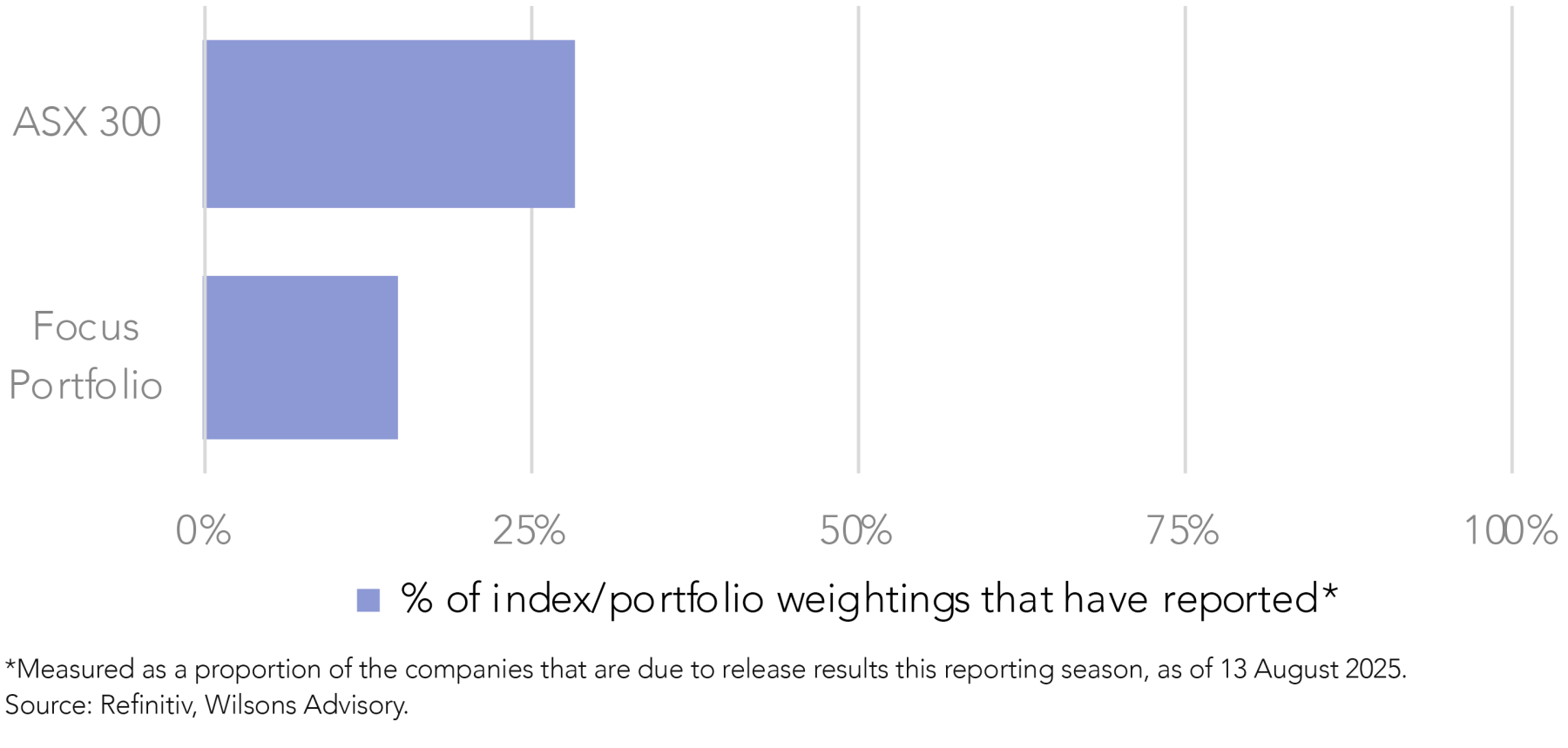

The August 2025 reporting season has now reached ‘quarter time’, with around 25% of the ASX 300 (by market capitalisation) having released results.

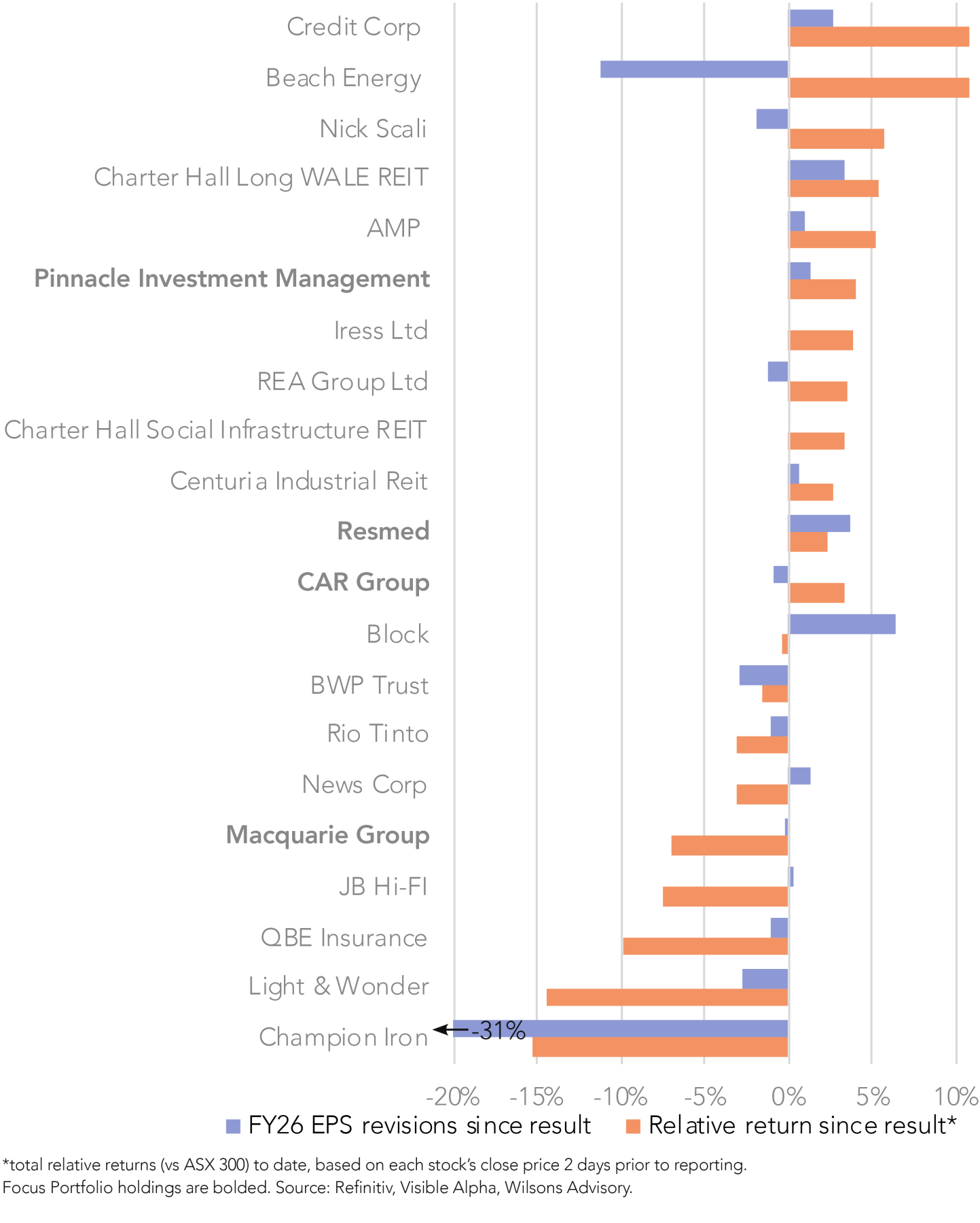

While it is still early in the reporting period, the mix of earnings upgrades and downgrades has been fairly even. For ASX 300 industrials (ex resources) that have reported so far, our analysis shows that FY26 consensus EPS revisions have averaged +0.5%.

Post-result share price moves have tracked broadly in line with the wider market on average. However, beneath the surface, the dispersion in returns has been wide: companies with upgrades to FY26 EPS estimates have outperformed the ASX 300 by +2.5% since reporting on average, while those with downgrades have lagged by -3.5%.

With valuations across the market still broadly full – the ASX 200 is trading on 19.3x forward earnings, around 17% above its five-year average – the bar for earnings delivery remains high. As reporting season progresses, we continue to expect consensus earnings misses, downgrades, or cautionary outlook statements to result in outsized share price weakness.

Key large cap results due this week include Commonwealth Bank, Computershare and Evolution Mining today; Westpac (quarterly), Telstra, Amcor, Origin Energy and Pro Medicus on Thursday; and ANZ (quarterly), Cochlear and Mirvac on Friday.

In this report, we provide an ‘around the grounds’ summary of notable results so far, from both the Focus Portfolio and the broader market, with a focus on Communication Services (CAR Group, REA Group), Financials (Pinnacle Investment Management, GQG Partners, Macquarie Group, QBE Insurance) and Consumer Discretionary (JB Hi-Fi).

Every Focus Portfolio result to date is also summarised in Figure 11.

Communication Services – Quality Shining Through

Australia’s largest online marketplaces, REA Group and CAR Group, have now released their FY25 financials. Both results highlight the strength of the online classifieds business model, with dominant market positions, best-in-class product suites, and significant pricing power continuing to support resilient earnings growth across varied macro conditions. Below, we provide a detailed review of our preferred exposure, CAR Group, followed by some observations on REA Group (not held).

CAR Group – Cruising Ahead Despite Some Bumpy Roads

CAR Group (CAR) is held in the Focus Portfolio at a weight of 3%

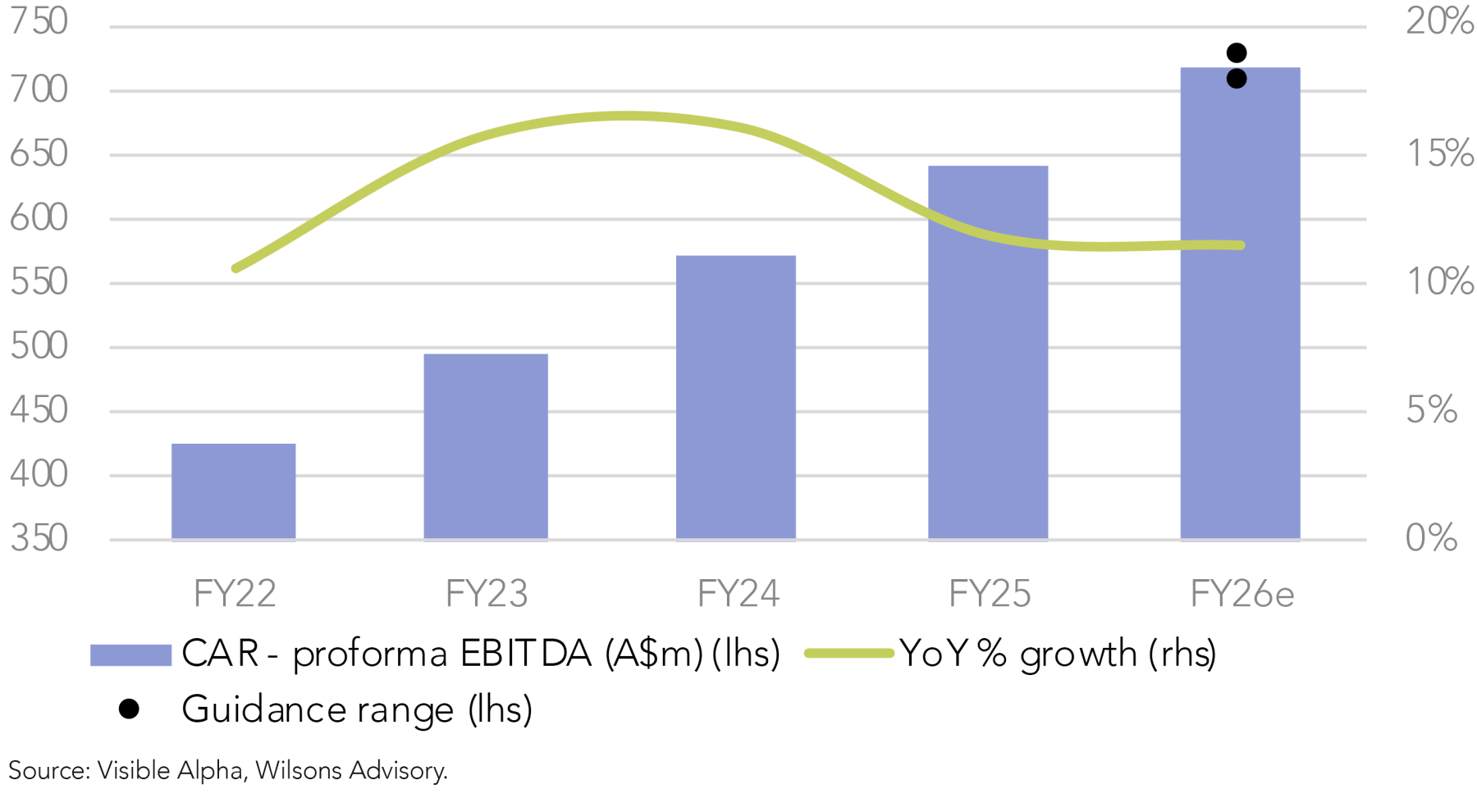

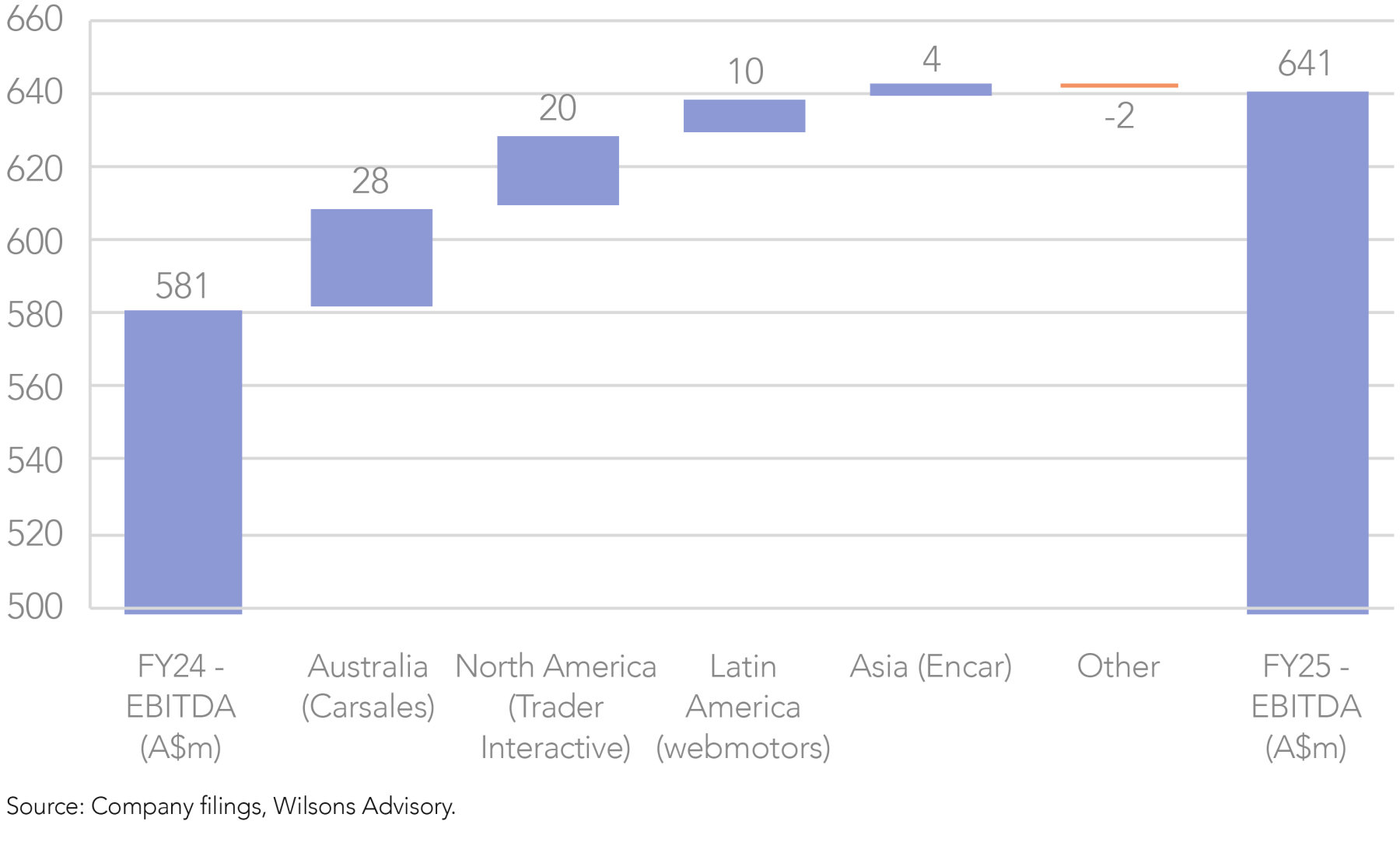

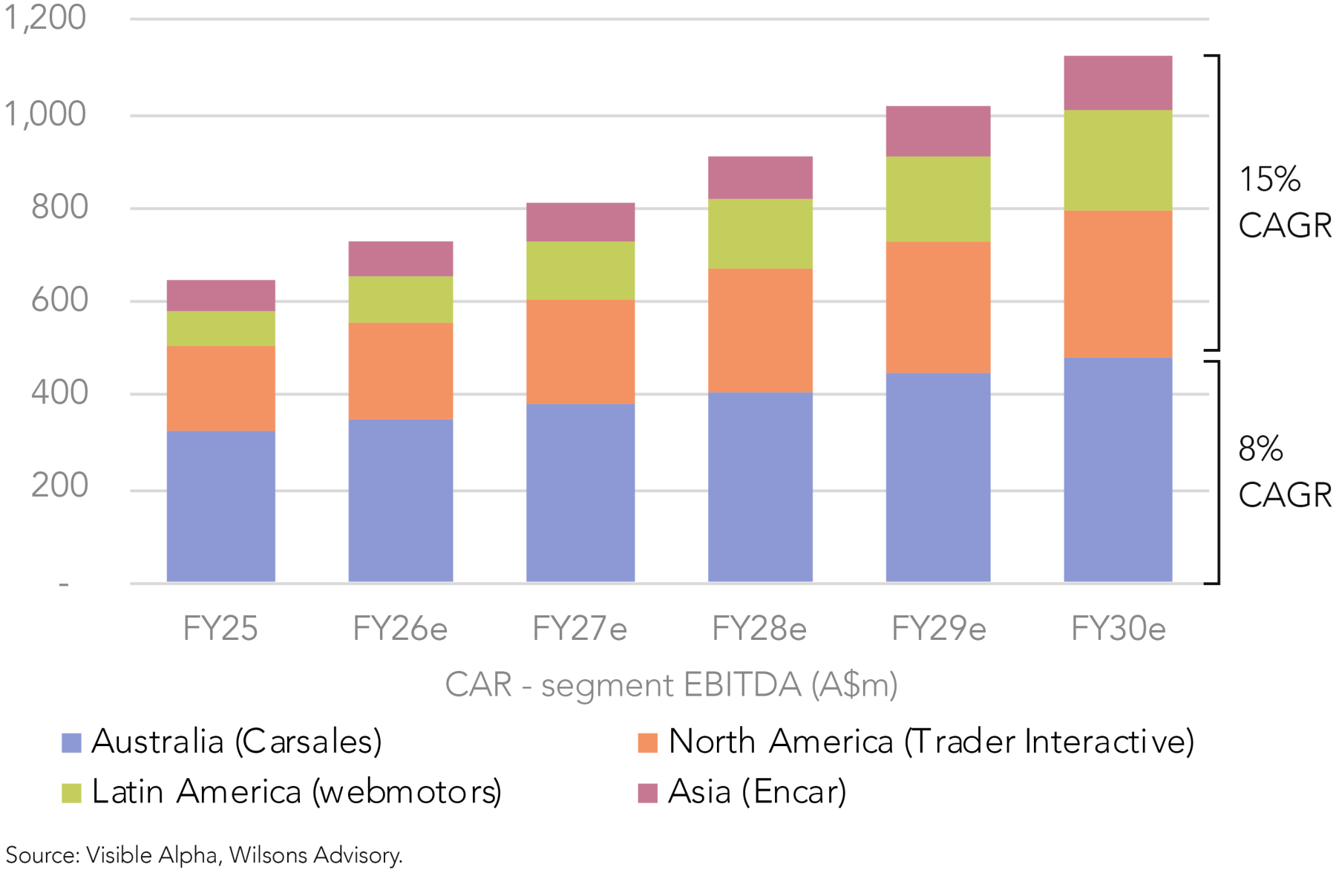

CAR delivered FY25 revenue of $1,144m (+12% YoY), which underpinned EBITDA of $641m (+12% YoY), in line with consensus expectations. Management guided to FY26 NPAT growth of 9-10% and EBITDA growth of 10-13%, slightly below consensus at the mid-point. The business also guided towards double-digit revenue growth across all international markets, while continued high single-digit growth is expected in Australia.

Trader Interactive – strong execution amidst cyclical pressures, with green shoots emerging...

CAR’s US business, Trader Interactive, was a highlight. In our reporting season preview (read here), we noted that we were ‘particularly interested in the outlook of the US segment where macro headwinds have been strongest’. Unsurprisingly, CAR pointed to a low-single-digit cyclical decline in the US recreational sectors (based on vehicle registrations).

However, despite these headwinds, TI delivered A$308 million in revenue (+11% YoY) and A$186 million in EBITDA (+12% YoY), both modestly ahead of consensus. This reflects TI’s brand strength and CAR’s ability to drive depth penetration and increase pricing to lift yield and sustain earnings growth in challenging market conditions.

Looking forward, CAR guided towards double-digit revenue growth for TI in FY26, which broadly aligns with consensus (+10.6%). Management also pointed to a ‘recent uptick’ in transaction volumes and early ‘signs of improvement’, suggesting cyclical headwinds may be easing. This presents potential upside risks to consensus should these trends continue.

Thesis firmly intact – quality compounder with a long runway for growth

Overall, this result reinforces some of the key appeals of CAR – a strong and continually expanding product suite, a high degree of pricing power (with positive yield growth offsetting mixed listings trends), and consistent double-digit earnings growth despite varied macro conditions.

We also remain attracted to CAR for its market leadership, geographical diversification, and numerous growth levers, including its robust pipeline of depth and value-add products that should continue to lift its yield and take-rates over the medium-term.

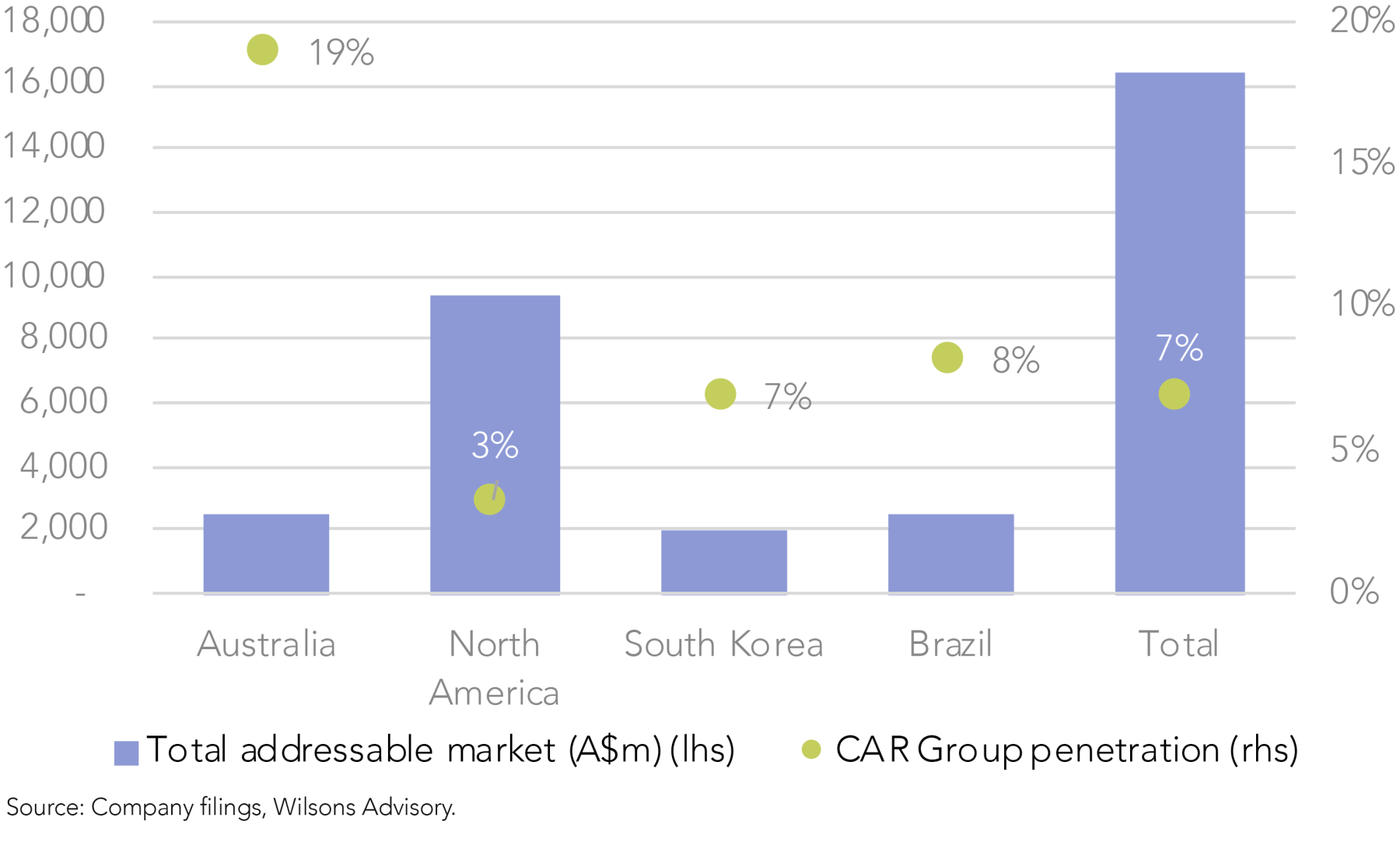

Taking a longer-term view, CAR’s runway for growth is substantial, particularly in its less mature international segments where penetration remains low.

Pleasingly, incoming CEO William Elliot has emphasised that management under his leadership will be ‘one of continuity,’ with the group’s disciplined approach to capital allocation and overarching growth strategy remaining largely unchanged.

At a forward PE of 33x (+5% vs 5yr avg) and an EV/EBITDA of 20x (-3% vs 5yr avg), CAR continues to offer attractive value for a reliable earnings compounder, with consensus forecasting an EPS CAGR of 12% over the next three years (FY25–28).

REA Group (REA) – Pricing Power on Show

Not held.

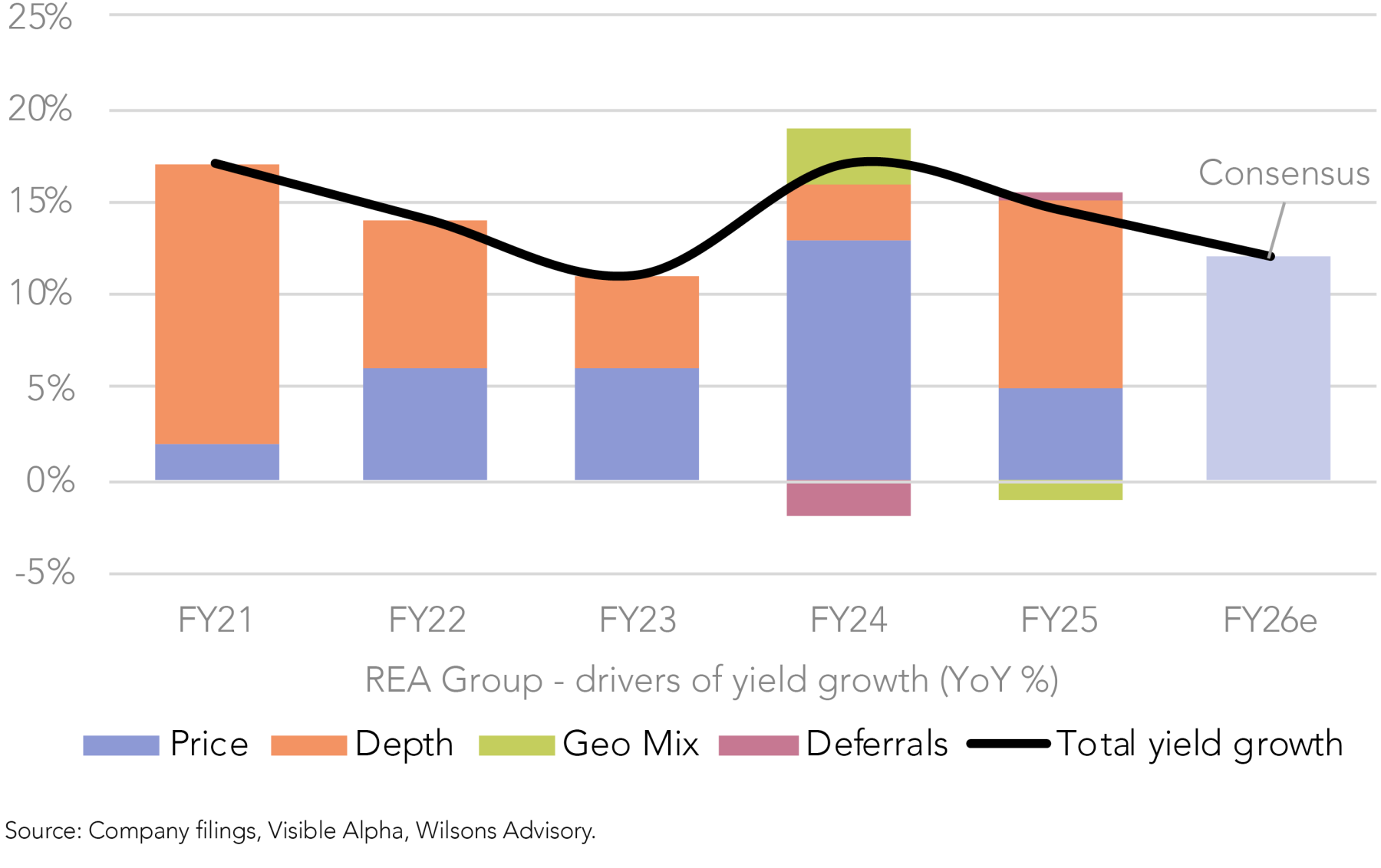

REA Group delivered FY25 revenue of $1,673m (+15% YoY), translating to NPAT of $563m (+23% YoY), broadly in line with consensus. The highlight was the dividend, with DPS of $2.48, which beat expectations by 6%. Overall, the result reflects REA’s high degree of pricing power (buy yield +14% YoY) and significant operating leverage – given the business delivered robust earnings growth despite a subdued listings environment, with volumes rising just +0.7% YoY.

The business also provided a constructive outlook for FY26, guiding towards double-digit yield growth (driven by pricing and AMAX penetration), flat volumes (factoring in two rate cuts), and positive operating jaws (with yield expansion to outpace cost growth). Together, these factors underpin consensus revenue growth of 11% and NPAT growth of 18% in FY26. There may be potential upside risks to FY26e consensus from a stronger-than-expected housing cycle post rate cuts. We note that buyer demand is already strong (May enquiry levels are at three-year highs) and auction clearance rates are improving.

REA is one of the highest quality businesses on the ASX. However, in the near-term investors must weigh several potential headwinds: (1) a relatively full valuation, with REA trading on a forward P/E of 47x versus its five-year average of 45x; (2) management uncertainty, with CEO Owen Wilson set to retire after a decade at the helm and his successor to be announced within the next month; (3) the ACCC investigation into whether REA has imposed unreasonable listing fees; and (4) the prospect of greater competitive pressure from DHG’s new owner, CoStar.

Financials – A Mixed Bag

Pinnacle Investment (PNI) – Life Cycle underpins significant FUM growth

Pinnacle was added to the Focus Portfolio at a weight of 2% in July.

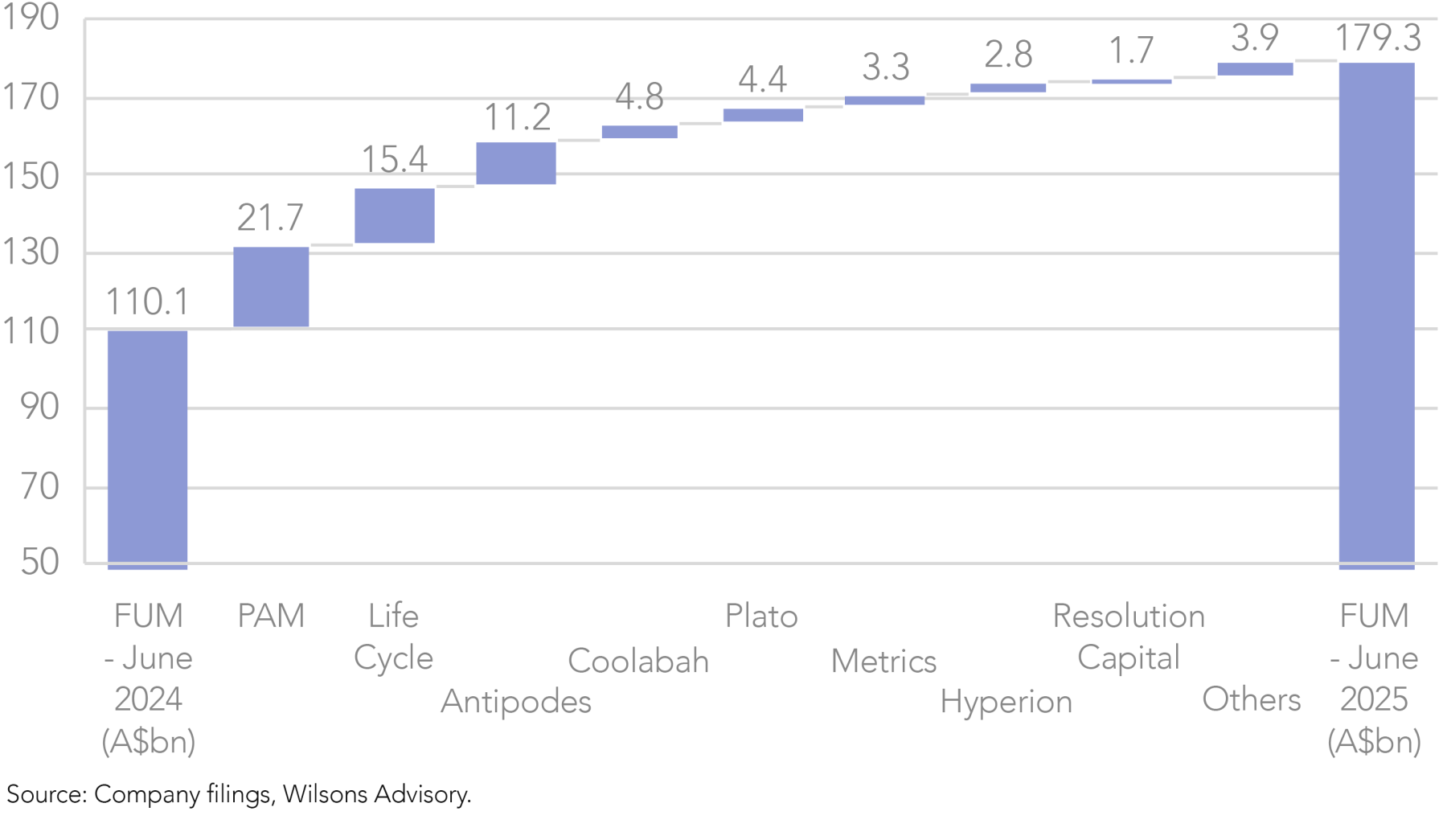

The company delivered a positive FY25 result, with NPAT growing +49% to $117m, in line with our expectations. This was underpinned by stronger than expected inflows (Q4 $10.2bn) and FUM growth (+63% YoY) across the stable of affiliates. Life Cycle was by far the standout affiliate, where FUM grew to $15.4bn in just 9 months, effectively doubling consensus expectations of $7.8bn.

Looking forward, Pinnacle is set up for another stellar year in FY26 given: a healthy outlook for inflows (supported by Life Cycle and Metrics); a positive outlook for performance fees, with Five V’s maiden performance fee contribution due by December and several affiliates (e.g. Hyperion, Plato, Firetrail) at or near their high watermarks; and the likelihood of improved profitability at Metrics (less one-off costs, improved performance fees) and Antipodes (Maple Brown Abbott cost-out).

Accordingly, we retain a high level of conviction in Pinnacle and continue to expect ongoing FUM expansion – driven by net inflows, market appreciation, and fund outperformance – to support significant earnings growth over time. Trading at a forward PE of 32x, the stock offers attractive value given the strong outlook for FY26 and consensus expectations of mid-teens EPS growth over the medium-term.

GQG Partners (GQG) – outflows highlight single manager risk

Not held.

GQG has yet to release its interim result, but last week provided a July 2025 FUM update ahead of reporting on 22 August. FUM fell 3.4% MoM to $166.6bn, driven by net outflows of $1.4bn – its largest monthly outflow since IPO. Management also cautioned that underperformance across all strategies could remain an ongoing headwind for flows.

This weakness in GQG’s flows stands in stark contrast to Pinnacle’s strength, while also highlighting a key attribute that differentiates Pinnacle from its peers: as a multi-affiliate manager, the company offers highly diversified exposure across a stable of 18 managers covering a broad range of asset classes. This model allows weakness in one affiliate (based on fund performance and/or flows) to be offset by strength in others, supporting a higher level of earnings quality for Pinnacle, in our view.

Macquarie (MQG) – staying neutral after soft quarterly update

Macquarie is held in the Focus Portfolio at a weight of 3%.

The company provided a 1Q26 update in late July, which was qualitatively soft, with net profit contribution down versus the pcp (we estimate approximately -10%), driven by weakness in MAM and CGM. Following the update, we remain cautious around near-term consensus risks, as the street is forecasting NPAT growth of +20% in 1H26 despite NPAT declining YoY in Q1, meaning MQG will need to deliver a very strong Q2 to meet consensus.

Accordingly, we are comfortable retaining a 3% weighting in MQG (neutral vs ASX 300) at this juncture. While we are attracted to MQG’s exposure to long-term secular thematics (i.e. decarbonisation), we are looking for improved momentum in asset sales across MAM and MacCap (particularly in green assets) to gain greater conviction over the near/medium-term.

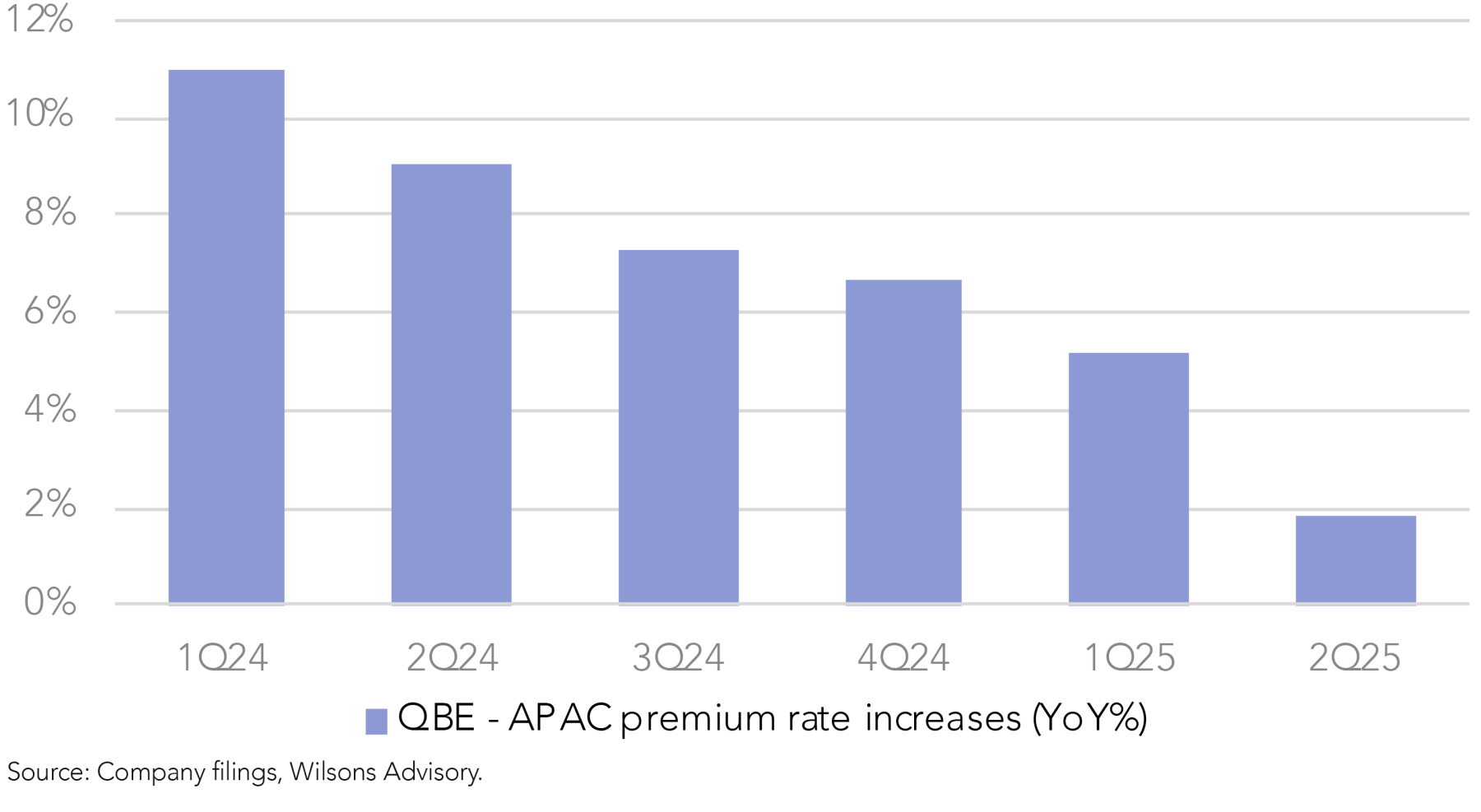

QBE Insurance (QBE) – premium cycle slowing rapidly

Not held.

QBE’s 1H25 result was a solid beat, with insurance profit of $1,157m, which was +12% ahead of consensus forecasts.

However, the stock fell sharply (alongside the other listed general insurers) as investor confidence was likely shaken by reserve releases, management’s acknowledgment of downward pressure on the combined operating ratio (COR) and rapidly slowing premium rate increases.

Overall, QBE's result reinforces our view that premium tailwinds are rapidly fading, which we expect to weigh on earnings growth across the insurance sector over the medium-term. Accordingly, we remain comfortable having zero exposure to the sector.

Consumer Discretionary

JB Hi-Fi (JBH) – consumer momentum priced in

Not held.

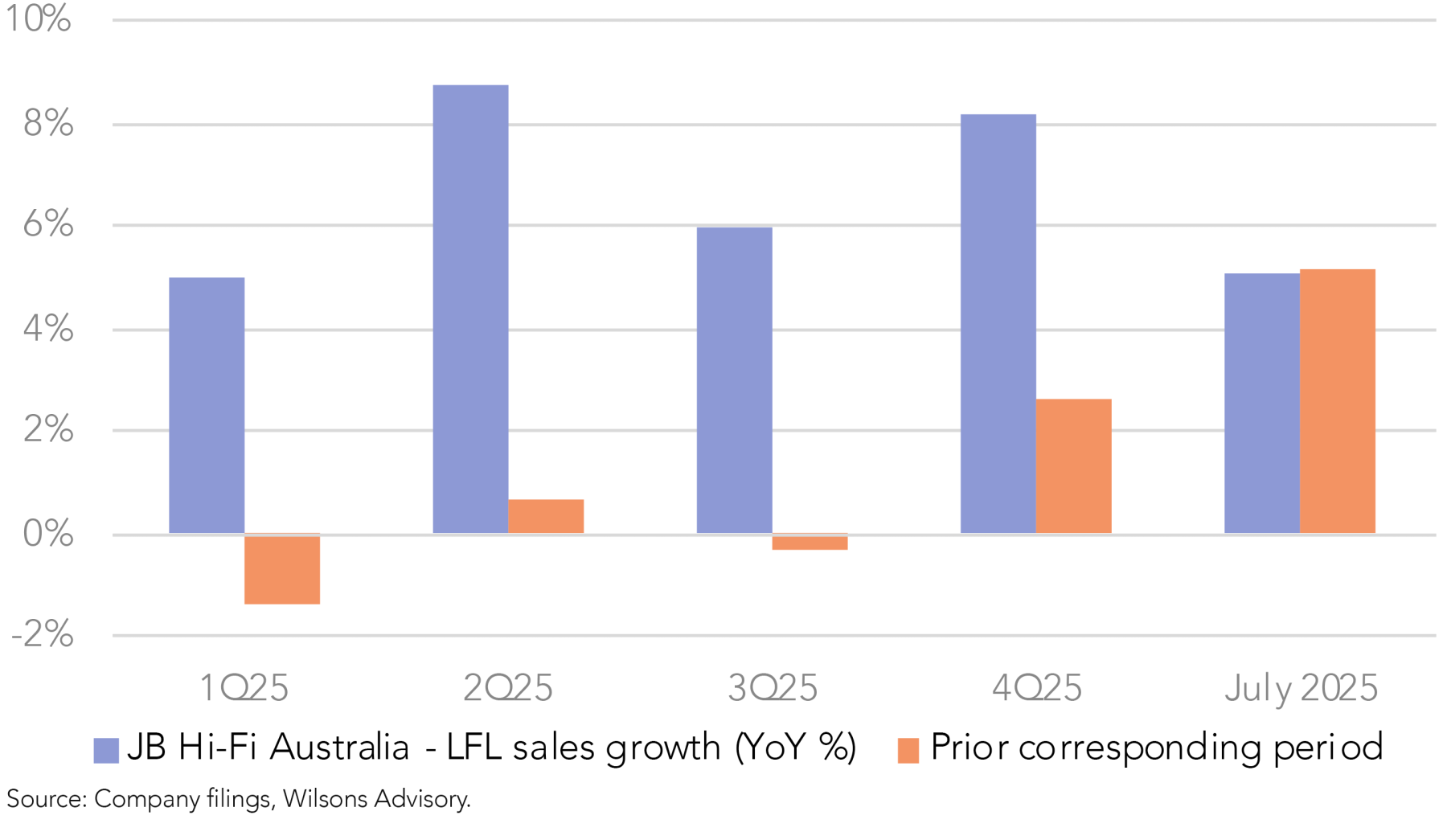

JB Hi-Fi reported NPAT of $462m (+5.4% YoY), which was in line with consensus expectations. However, the result was overshadowed by the surprise announcement that CEO Terry Smart will step down in October, to be succeeded by current COO Nick Wells. Share price weakness was also likely a reflection of JBH's demanding valuation, which had set a high bar for this reporting season.

JBH’s July trading update showed sales momentum continuing into FY26, providing a broadly positive read on the health of the domestic consumer and on companies with material exposure (e.g., Collins Foods, The Lottery Corp, Woolworths). That said, part of this momentum likely reflects company-specific factors including strong execution and market share gains.

Overall, while the consumer outlook is improving, supported by the prospect of several rate cuts in FY26, we continue to view JBH – along with other large retail names such as Wesfarmers – as fully valued. JBH now trades on 23.1x forward earnings, nearly a 50% premium to its five-year average of 15.7x.

| Company Name | Ticker | Release date | Period | ISG view | Result summary |

| Macquarie Group | MQG | 24-Jul | 1Q FY26 | Negative | Macquarie’s 1Q26 update was qualitatively soft, with net profit contribution down versus the pcp (we estimate approximately -10%), driven by weakness in MAM and CGM. Following the update, we remain cautious around near-term consensus risks, with the street forecasting NPAT growth of +20% in 1H26 despite NPAT declining YoY in Q1, meaning MQG will need to deliver a very strong Q2 to meet consensus. While we are attracted to MQG’s exposure to long-term secular thematics (i.e. decarbonisation), we are looking for improved momentum in asset sales across MAM and MacCap (particularly in green assets) to gain greater conviction over the near/medium-term. |

| ResMed | RMD | 1-Aug | FY25 | Positive | ResMed’s FY25 result delivered on our expectations: sleep revenue growth lifted from 9% in Q3 to 10% in Q4, while gross margins expanded 230bps YoY to 61.4% in Q4, well ahead of consensus forecasts of 60.0%. This underpinned EBIT growth of +19% (to US$454m), which was 5% above consensus, and EPS growth of +23% (to US$2.55), coming in 2% ahead of consensus. After 2–5% upgrades to consensus EPS over FY26–28, ResMed is expected to deliver 15% EPS growth in FY26 (vs 12% pre-result) and an 11% EPS CAGR over the next three years – with further upgrade potential remaining, particularly on gross margins. |

| Pinnacle Investment Management | PNI | 5-Aug | FY25 | Positive | Pinnacle posted a positive FY25 result, with NPAT +49% to $117m meeting our expectations, underpinned by strong inflows (Q4 $10.2bn) and FUM growth (+63% YoY) across the stable of affiliates. Life Cycle was by far the standout affiliate, where FUM grew to $15.4bn in just 9 months, effectively doubling consensus expectations of $7.8bn. Looking forward, Pinnacle is setup for another stellar year in FY26 given the healthy outlook for inflows (supported by Life Cycle and Metrics) and a positive performance fee outlook. Five V’s maiden performance fee contribution is due by December and several affiliates (Hyperion, Plato, Firetrail) at or near their high watermarks. |

| CAR Group | CAR | 11-Aug | FY25 | Positive | CAR delivered a credible FY25 result, with revenue of $1,144m (+12% YoY), which underpinned EBITDA of $641m (+12% YoY), in line with consensus. Management also guided to FY26 NPAT growth of 9-10% and EBITDA growth of 10-13%, slightly below consensus at the mid-point. Double-digit revenue growth is expected across all international markets, while high single-digit growth is expected in Australia. Despite cyclical pressures in the US RV market, Trader Interactive delivered A$308 million in revenue (+11% YoY) and A$186 million in EBITDA (+12% YoY), both modestly ahead of consensus, while management encouragingly pointed to ‘early ‘signs of improvement’ in the US, suggesting cyclical headwinds may be easing. |

Source: Refinitiv, Visible Alpha, Wilsons Advisory.

Portfolio Results Due in the Next Week:

- Wednesday 13 August (today): Evolution Mining (FY25)

- Thursday 14 August: Westpac (3Q25)

- Friday 15 August: ANZ (3Q25), HealthCo Healthcare and Wellness REIT (FY25)

- Tuesday 19 August: BHP (FY25), CSL (FY25), HUB24 (FY25)

Written by

Greg Burke, Equity Strategist

Greg is an Equity Strategist in the Investment Strategy team at Wilsons Advisory. He is the lead portfolio manager of the Wilsons Advisory Australian Equity Focus Portfolio and is responsible for the ongoing management of the Global Equity Opportunities List.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.