Last week, we discussed the debate surrounding the outlook for growth versus value investment styles in equity portfolios.

We also highlighted “quality” as an important factor to consider both in the context of constructing growth or value orientated portfolios, and as a strategy in its own right.

This week, we explore a “quality” investment strategy in more depth.

Quality Has Strategic and Tactical Appeal

We see the “quality factor” as having strong long-term investment performance credentials and believe the outlook for quality is particularly attractive at the current juncture in the global business cycle. We expect global economic growth and earnings growth to slow significantly over the coming year. As a result, companies with high quality, resilient earnings streams should be increasingly sought after by the market.

Quality focussed investment strategies arguably receive less attention than growth and value investing, yet the quality factor has an impressive long-term track record. A quality tilt is also complementary to most other investment styles.

Defining Quality

Although there is no universally agreed upon definition of what constitutes a quality company, there are some fairly well accepted rules of thumb.

Quality businesses generally earn a high return on equity (ROE) or return on invested capital (ROIC). Quality growth companies can also typically re-invest back into their own business (using retained earnings) at a high marginal return on capital invested. It is this organic growth characteristic that gives quality growth companies a rising and very valuable earnings profile.

Quality companies typically have fairly defensive or resilient earnings streams. This is typically measured by low variability of earnings from year to year.

Quality companies typically have strong balance sheets with relatively modest gearing. Indeed, high quality mega caps such as Microsoft and Apple are literally sitting on billions of dollars of excess cash, which gives them considerable optionality.

The widely followed Quality Performance Index run by Morgan Stanley Capital International (MSCI) uses 3 characteristics - ROE, low variability in earnings per share (EPS), and low leverage - to construct a passive or quantitative quality index.

More active fundamental strategies may consider other quality inputs. Management quality is an important albeit more subjective consideration, which is typically highly prized by fundamentally based quality focussed investors.

Industry positioning is often an additional consideration. A high-quality business typically has an identifiable ‘moat’ or set of competitive advantages. These competitive strengths can include: superior product or service quality, a strong brand, superior scalability, distribution strength, or proprietary technology.

While this is not an exhaustive list of quality attributes (strong generation of free cash flow and high operating margins are frequently cited as additional quality attributes) the range of factors outlined above tend to describe quality companies fairly well.

| 12mth fwd PE | ROE (FY1) |

EPS CAGR % (FY1-FY3) |

|

| Apple | 24.3 | 157% | 6% |

| Microsoft | 25.5 | 40% | 17% |

| Alphabet (A&C class) | 19.9 | 26% | 16% |

| Amazon | 70.4 | 10% | 153% |

| Tesla | 55.1 | 34% | 26% |

| Nvidia | 30.7 | 40% | 18% |

| Meta | 13.7 | 26% | 14% |

| Nestle | 23.7 | 25% | 8% |

| Visa | 25.5 | 42% | 16% |

Source: MSCI, Refinitiv, Wilsons.

How Investors Use the Quality Factor

How the quality factor is utilised in investment processes tends to vary. Quality may be a consideration in a broader range of stock selection criteria, with valuation typically being pivotal. Quality can influence or dominate stock selection, depending on the exact investment strategy, be it quantitative or more fundamental.

Highly active strategies with a heavy emphasis on quality often exclude whole sectors (e.g., resources and financials) on the basis of quality thresholds, particularly in relation to earnings volatility.

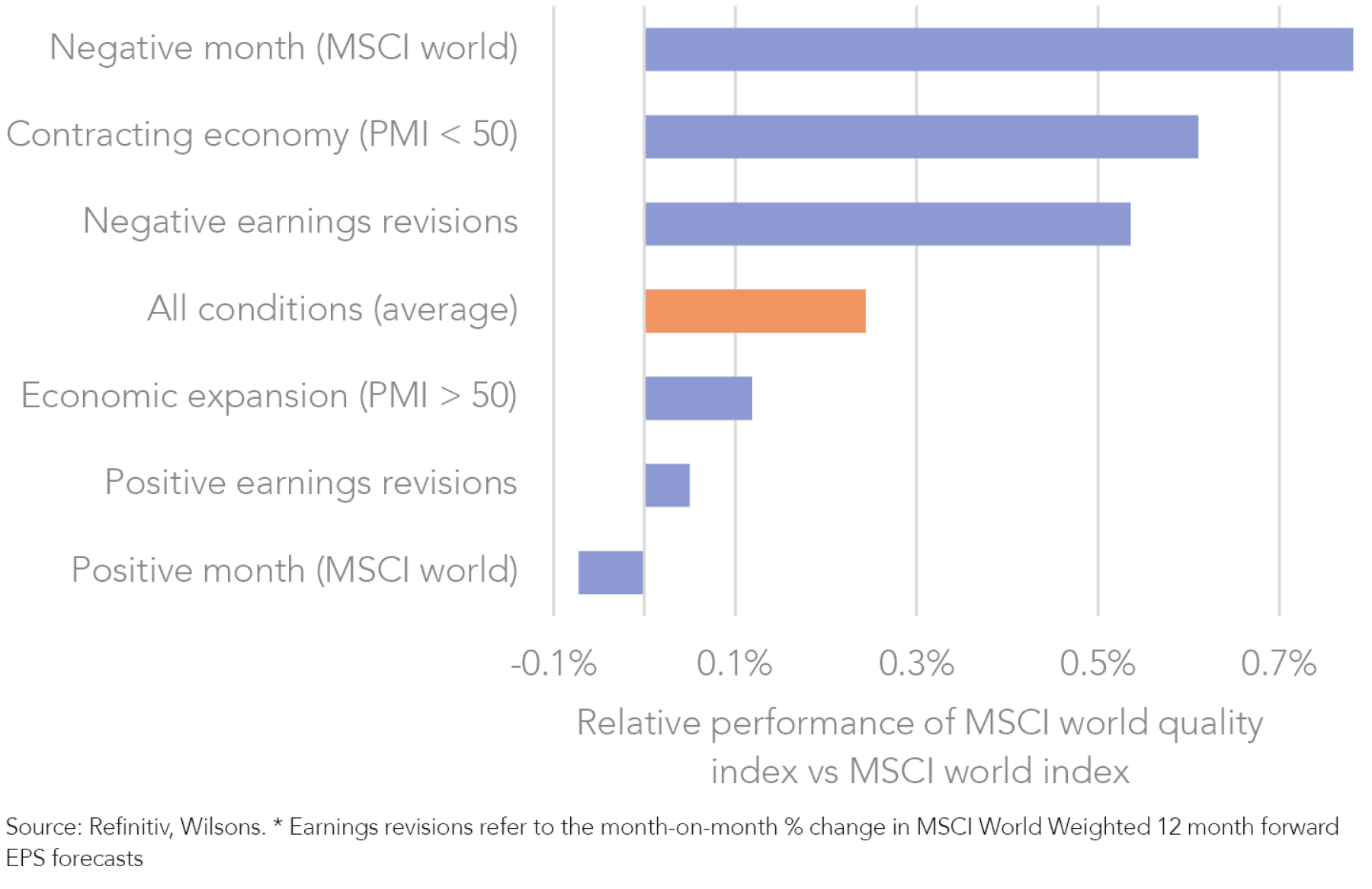

Looking at passive quant-based indices over a long period of time suggests quality titled portfolios perform well over the long run. As discussed, they also tend to do particularly well in times of moderate to low economic growth. Quality often performs better in drawdown phases or bear markets, albeit outperformance is not confined to bear markets.

It is this risk asymmetry, with decent performance in rising markets but superior performance in falling or sluggish markets, that gives quality its outperformance trend over the long-term. From this perspective, there is a large body of academic evidence suggesting that low volatility, high quality portfolios outperform high volatility, low quality portfolios. This perhaps flies in the face of traditional portfolio theory, which holds that higher risk portfolios will generate higher returns in the long run.

Re-thinking Risk and Return

The apparent existence of a long-term global premium for quality suggests quality could represent a ‘free lunch’ for investors. Of course, these are long-term tendencies, not ironclad outcomes for every year. Over the past 2 years, quality has actually underperformed.

We see 2 key drivers behind the underperformance of quality. Firstly, the growth stock rally entered a speculative phase last year with many high-growth (pre-earnings) stocks being bid up aggressively. More recently, a big first quarter commodity rally, led by energy in particular, saw quality indices lag again.

As both the high-growth and commodity rallies have faded, quality has begun to show signs of outperformance. With earnings slower and downgrades increasing, resilient high-quality companies look set to outperform in our view.

Investors can access quality through deliberate quality focussed strategies or through growth and value managers with a material quality component to their investment process. We tend to favour equity managers with quality either at the forefront or well incorporated into their investment processes, across both international and Australian equities.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.