The global equity market has delivered decent but volatile returns over recent years, with strong rallies punctuated by some sharp pullbacks due to a variety of concerns. One of the key sub-plots has been the performance of growth versus value investment styles. This remains a key point of debate.

The growth style has generally been in the ascendency in recent years, with multiple expansion aided by falling long-term interest rates in driving strong outperformance of growth stocks. However, growth stocks have experienced a sharp retracement over the past 6-9 months.

With interest rates rising, valuation multiples for the established (mostly US) mega cap growth stocks have contracted significantly, while the previously high-flying, loss-making “disruptor” stocks have been particularly harshly dealt with.

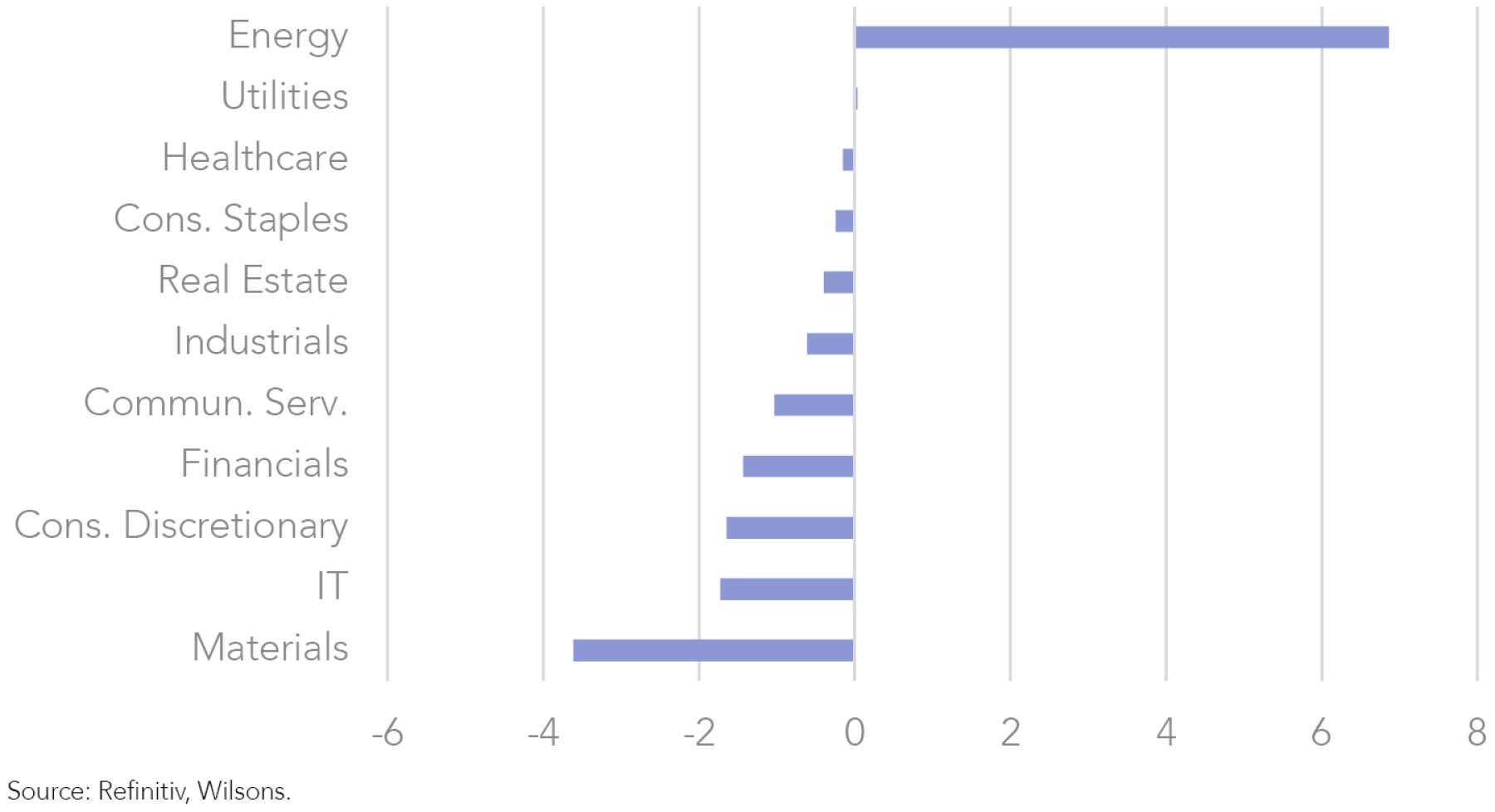

After a long period in the wilderness, in contrast, the value style of investing has proved relatively resilient, with the previously much maligned energy sector staging a particularly dramatic comeback. While value has made a reasonably strong revival, a weaker economic outlook has also begun to weigh on the more cyclical components of value trades recently.

Thinking about Growth vs Value Performance Drivers

The growth style has a tendency to perform better when economic and earnings growth is subdued (or scarce). This tends to describe much of the post-GFC (global financial crisis) macro environment.

While it is not a hard and fast rule, value typically does better when the business cycle is strong. This environment tends to favour traditional value sectors such as energy, materials, financials and cyclical industrials.

These trends are also reflected in the relationship between value and growth performance and the interest rate environment. Growth typically does better when interest rates are moderate to low. Rates should ideally be falling or, at a minimum, stable. Growth stocks receive both a valuation boost from lower discount rates and a scarcity premium when profit growth is hard to come by.

The value style tends to do better when rates are trending upwards. A reflationary (but perhaps not stagflationary) environment seems to suit value better than a disinflationary or deflationary backdrop.

Neither style seems to do well when rates are moving up at a pace that significantly threatens a recession. Quality defensives (e.g. consumer staples, healthcare) tend to represent a safe place in such an environment, as we saw in the market’s sharp June correction.

Can Growth Stage a Sustained Comeback?

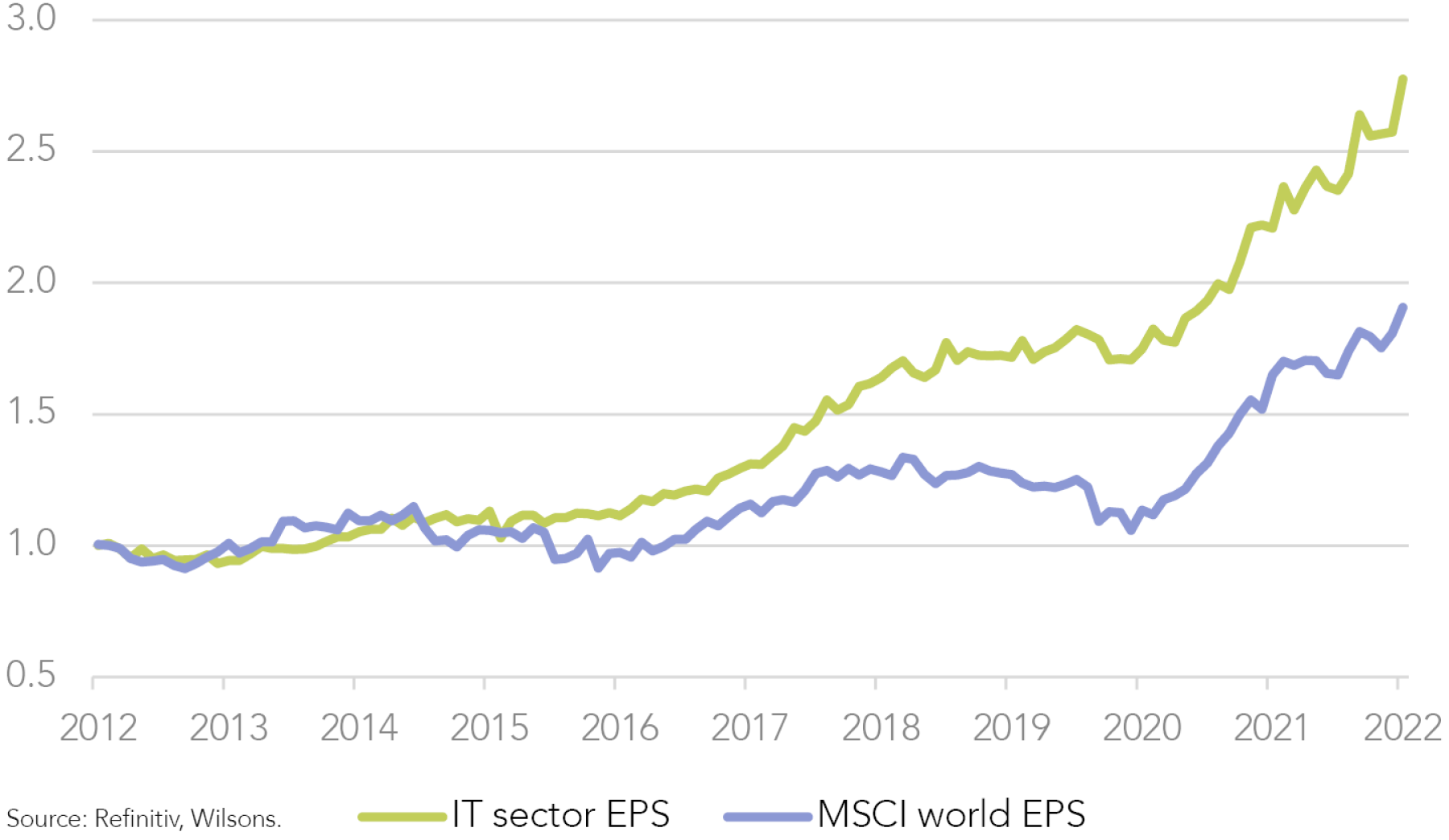

One point we would make is that the outperformance of growth over the past few years is not purely a function of multiple expansion. Growth outperformance has, at least in part, been grounded in superior earnings growth over successive years.

Valuation multiples did of course expand, although we see some degree of multiple expansion as rational given the decline in interest rates and the superior earnings growth delivered over a number of years by many large cap growth stocks.

Of course, the growth rally did end up taking on a substantial speculative element. The 2020/21 market rally saw huge share-price gains in many pre-earnings disruptors. Higher rates and tightening liquidity has helped squeeze a lot of this irrational exuberance out of the market.

Have Quality Growth Stocks Been Oversold, or Is there More Pain to Come?

The pullback in growth has been substantial, though not huge when weighted by market cap in the context of the big bull run in growth over the past 7 years or so.

Growth bears (i.e. value investors) suggest this is a sign the growth stock correction is not over, while growth stock bulls suggest the pullback in growth stocks is just a cyclical correction in a longer-term secular uptrend in the growth style.

All things remaining equal, slower growth should favour the growth style. The big proviso is that growth stocks need to deliver growth, which is not always assured given that the margin of safety in growth stock investing is typically slim.

The past 6-9 months have seen some cracks appearing on the earnings front for the growth style, although earnings for the growth mega caps have still held together reasonably well. Another consideration on the earnings front is that the Covid pandemic accentuated the outperformance of growth via not just the steep fall in interest rates but also by driving unusual demand patterns (e.g. an acceleration in online shopping), which boosted the earnings of many established (e.g., Amazon, Netflix) and newcomer (e.g., Peloton) growth companies. Some of these Covid tailwinds have now started to unwind, and we expect this unwinding to continue.

The US reporting season will be an important milestone. The market will be weighing up earnings resilience versus latent cyclicality, that is, the ability to pass on cost pressures as well as the potential headwind from revenues pulled forward into the Covid earnings boom. So far, results look better than feared – which has sparked a fresh rally in growth stocks – even though it is still early days.

Diversified with a Quality Growth Tilt

In summary, the growth style is showing signs of life again in recent weeks, yet the highly speculative growth phase we saw in 2021 is unlikely to return. In our view, if growth does reassert itself, it is likely to be a less dramatic, “quality growth” revival.

For value, the business cycle slowdown currently playing out presents a headwind in at least the near-term. Cost pressure is also a consideration, particularly for many seemingly cheap but lower quality stocks. On the positive side, we still think there are large parts of the global equity market with undemanding valuations, even though they may face economic headwinds in the near-term. Low multiples in themselves will not guarantee the outperformance of any given stock or sector. This is particularly the case at present against a backdrop of slower growth and higher cost bases. Of course, value investing is a long-term pursuit, and it is still quite plausible that a well-chosen, value-based portfolio will do well over a 3-5-year period, particularly given the market's obsession with high growth areas over the last decade or so.

It may be the case that the market settles into a groove where the outperformance of the growth or value style is less marked than it has been in recent years. This has been the case in previous periods in history, implying that stock selection could trump investment style.

To the extent that growth can regain its footing, quality growth is likely to be the way to go. We think it makes sense to invest in quality-focused portfolios that can weather a slower business cycle and cope with cost pressures. We retain exposure to all 3 investment styles – growth, value and quality – although our current style preference is quality. We will talk more about the quality factor in the coming weeks.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.