Last week’s “surprise” (90 day) reduction in US-China tariff rates suggests tariffs between the two economies are likely to settle at a significantly lower level than the recent consensus had assumed.

The “temporary” cut in US import tariffs to 30% from 145% means the average effective tariff rate charged on Chinese products is now well below ~50%-60%, which the consensus appeared to be assuming prior to last week’s announcement. As part of the deal, Chinese tariffs on the US have also been “temporarily” reduced to 10% from 125%.

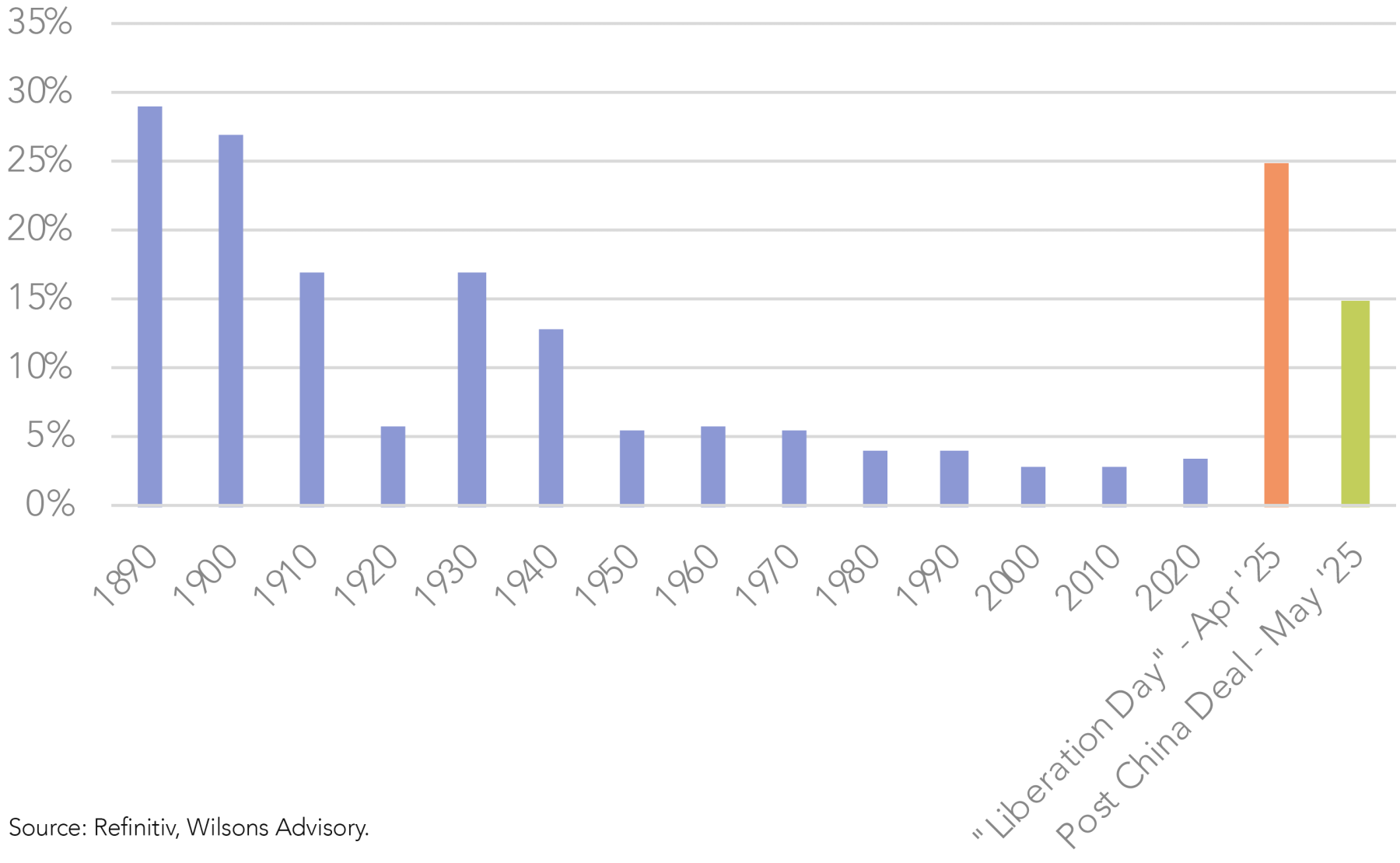

The US-China deal takes the US effective tariff rate on the world down from around 25% to around 15%. While this is a significant de-escalation, it is still well above the pre “Liberation Day” tariff rate of just under 3%.

“Relatively” more optimistic on the US and global economy

The US-China deal further confirms that US President Donald Trump has a relatively low pain tolerance in terms of adverse economic and financial market policy impacts, even in the short term. Initial talk of ignoring short-term pain for long-term gain (we were always dubious as to the potential gains) has quickly given way to a rapid and significant de-escalation.

While Trump's rhetoric around rebuilding the US manufacturing sector and reducing the trade balance will likely continue. Recent actions signal a realisation that the rapid hike in tariffs would be much more costly and disruptive than he and his key advisors envisaged. As a result, they appear to be pivoting to a more moderate and pragmatic tariff policy. This is good news for the US and global economy, at least relative to what we were facing just a few weeks ago.

The US-China tariff deal will provide businesses with an opportunity to avoid punitively high tariffs for at least 90 days, and hopefully permanently.

This reduces the risk of goods shortages and supply chain disruptions that threatened to significantly weigh on the US economy.

In addition, the growing evidence of the Trump administration’s increasingly pragmatic approach to tariffs could encourage firms in the US to retain staff, lessening the risk of a significant softening in the labour market, which had the potential to trigger a growth recession.

This also lowers the risk of a significant secondary sell-off in the US stock-market, based on a slumping earnings outlook for the US corporate sector.

Investors Suffering from Stockholm Syndrome?

The share market is reacting positively to the "relative" positive surprise after the negative shock of Liberation Day in early April. While the market is factoring in a relative improvement in the economic and earnings backdrop, it is arguably not factoring in the prospect that the near-term absolute picture caused by Trump’s policy chaos is not that great. This keeps us cautious at the margin.

While the tariff de-escalation reduces the probability of a recession and secondary share market slump, uncertainty remains unusually high, and is unlikely to fall back anytime soon.

Looking ahead, a key issue for markets is to monitor the degree to which confidence is restored among consumers, corporates, and foreign investors. Is it set to rebound quickly, or is it going to take several quarters, or possibly several years?

Moreover, even with the recent tariff “breakthroughs,” current tariffs remain significant. Prominent forecasters expect US inflation to rise from existing levels by roughly 1% between now and the end of the year. While last weeks April CPI print continued to look benign, there will inevitably be lags between the implementation of the tariffs and their pass-through into the CPI. We expect stronger monthly increases in the ~40 to 50bp range over the next 3 to 6 months. This is likely to keep the Fed somewhat reactive on rate cuts, rather than pre-emptive.

From this perspective, the interest rate markets have scaled back Fed rate cut expectations to just two cuts this year. This is likely due to a combination of the tariff de-escalation (i.e. less recession risk) as well as ongoing resilient “hard data”. This has also seen long bond yields rise, given the persistent (risk) premia in the long end of the curve since Trump took the Presidency. Building evidence of an economic slowdown in coming months may see the pricing of further rate cuts reemerge. We did see bond yields drop on Thursday night, as April retail sales came in quite soft. However, the market will remain wary of the Fed facing a difficult balancing act, in terms of its dual mandate of containing inflation but supporting growth.

As we highlighted last week, the US market rebound has pushed valuations back up to levels which don’t appear to embody much margin for error in terms of earnings.

While the chance of a big slump in earnings has receded, the risks to CY25 estimates (+10% growth) is still on downside, as the economy slows and tariffs weigh on the cost base of many businesses.

This prospect keeps us somewhat cautious on the US market’s return potential over the balance of the year. We have reduced our global equity underweighting from -3% to -1% based on reduced tail risk, but stay underweight due to full valuations and moderate downside risk to earnings. We stay neutral on Australian equities.

We are cognisant that the Trump administration is likely to pivot to a more growth-orientated policy later in the year. A significant budget bill centred on tax cuts is before congress currently. A skittish bond market, and Republican hawks, will likely constrain the amount of stimulus. However, we would expect at least some moderate fiscal stimulus in the new financial year (begins October 1). A pivot to financial and business sector de-regulation also has the potential to buoy market sentiment. The potential for an economic pick-up in 2026, on a combination of moderate Fed cuts and moderate fiscal stimulus, tempers our cautious earnings view somewhat. However, it may prove a difficult balancing act, with equities fully priced and the bond market skittish with respect to the inflation outlook and the US fiscal position.

| Asset Class | Tactical Tilt | Change | Wilsons View |

| Cash | Underweight -2% | 0% | Underweight cash as fixed interest is likely to produce superior 12 month returns in both our central case and risk case (recession) view. |

| Fixed income (Domestic & Global) | Overweight +2% | -1% | Australian bond yields look good value and should act as a hedge against a signficant global slowdown and benefit from RBA easing. Floating rate credit is still offering attractive returns. |

| Equities - Domestic | Neutral | no change | Australian earnings growth should improve in FY26 as policy is eased. Valuations are still not compelling. Small/mid caps preferred. |

| Equities - International | Underweight -1% | 2% | Trumps aggressive tariff plan has been wound back which reduces recession risk but uncertainty and tariffs still pose risks for the US economy. US valuations look full. |

| Alternatives | Overweight +1% | -1% | A range of growth and defensive alternative strategies appeal at time of heightened uncertainty in listed assets. Gold appeals as a portfolio hedge against geopolitcal risk and as a beneficiary of progressive central bank accumulation. |

*Our tactical tilts represent our view over the next 6 to 12 months though active tilts could be held for shorter or longer periods depending on both asset class performance and fundamental developments. Source: Refinitiv, Wilsons Advisory.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.