US equity market performance and valuations look somewhat disconnected from the tariff damage that appears to be bearing down on the US economy.

Logic would suggest a series of trade deals are likely to be announced, but we have little visibility on where the tariff impost will settle, and how much of the recent consumer and business confidence decline will be “permanent.”

Deal or no deal?

At the time of writing, the US and the UK have just announced a limited bilateral trade deal that leaves in place Trump's 10% tariffs on the majority of British exports, modestly expands agricultural access for both countries, and lowers 27% U.S. duties on British car exports. 25% US tariffs on British steel and aluminium will also be lowered, but there were conflicting statements from the UK and the US on the exact agreement for these sectors. Market reaction in the US has initially been positive. However, to the extent that the US runs a trade surplus with the UK and the 10% base line tariff on most UK exports remains in place, we do not see this as a major breakthrough. Deals with the EU and ultimately China will be much more significant, and are likely to prove more difficult.

Staying Tactically Cautious Global Equities

As a result, we remain cautious on the US equity rally, and to some extent the recent Australian equity market bounce. At this juncture we prefer Australian fixed income and high-quality credit, alongside defensive alternatives such as gold.

Soft data sagging. Hard data still firm

US consumer confidence has collapsed, and business survey data (a mix of actual activity and confidence) has clearly weakened.

The US hard data, by contrast, is showing resilience so far. US non-farm payrolls - arguably the most closely watched hard data release, were strong again in April (released May 2). Other hard data points like durable goods orders, jobless claims, rail car loadings, and business lending are all holding up so far.

We think some of this is likely the calm before the storm. We expect to see a significant deterioration in US growth momentum over coming months.

Investors need to weigh up this likely deterioration in the hard data against the potential for significant announcements flagging trade breakthroughs. While this prospect of tariff de-escalation mitigates our caution to some extent, we still feel there is not much risk priced into US equities right now. We stay tactically cautious on global equities as a result.

The Global Economy: Down Then Up?

Apart from the potential to wind back Trump’s tariffs, we also expect Trump to pivot to a more growth-friendly agenda in the second half of this year. The Fed will also likely cut the cash rate several times, with July 30 the most likely kick-off in our view. The Fed faces a difficult growth-inflation trade-off, but we think it will ultimately act to support economic growth and look through the price level impact of tariffs, provided inflation expectations don’t further de-anchor. As a base case, we expect 100bp in cuts over the coming year starting at the end of July.

This pending fiscal and monetary stimulus acts to contain our caution on US equities somewhat. However, just how much damage is done to the real economy and animal spirits over the next few months is still a large enough uncertainty to keep us tactically cautious.

Our base case is still that US (and global) growth picks up next year, which should ultimately provide support for equities. However, markets will still need to address a significant slow down in the near-term, while the looming policy support that we expect, will take time to gain traction.

Apart from the US, China has so far not announced significant stimulus to counteract the looming tariff shock. We expect China will need to enact material stimulus in the order of ~1.5 to 2% of GDP, but they too appear hamstrung by the uncertainty around the magnitude of the ultimate growth headwind they are facing. Nevertheless, we do expect a significant stimulus is inevitable over the next few months. Once again, while this won’t prevent a significant near-term slowdown, China should see an improved growth outlook into 2026 as a central case, given the export drag they are facing.

For Europe, we expect Eurozone GDP growth to stay relatively tepid in 2025, with a likely growth rate of less than 1%. Growth should pick up across 2026 and 27, however, as monetary and fiscal policy gains traction.

While some tariff-related damage will weigh over coming months, policy is set to turn more supportive. We expect the ECB to cut the cash rate by 25bps to 2% in June, with another 25bps cut for July.

More importantly, we also expect a growing boost from stronger public spending in 2026 and 2027. Fiscal policy looks set to turn expansionary again in 2026. The fiscal outlook for Europe has changed meaningfully, with the approval of a large fiscal package in Germany (spending on defence and infrastructure worth c.20% of GDP over 10 years) and the announcement of the EU’s ReArm Europe/Readiness 2030 plan to boost defence spending. We expect the Eurozone fiscal stance to be neutral in 2025, and to become expansionary in 2026. We expect that additional defence and infrastructure spending will provide a decent boost to Eurozone GDP growth over the next few years.

Keeping some near-term caution

In summary, we are reluctant to chase the recent US equity market rebound, with the US economy expected to deteriorate over the next few months. We are more comfortable with the domestic economic and earnings outlook. However, a renewed pullback in US equities will likely also drag on the local market near-term.

Medium to longer-term, we are still attracted to the quality and growth prospects embedded in the US equity market, despite our concern around near-term complacency.

We don’t see the Trump Presidency as negating the medium-to-longer attractions of the US equity market, particularly if Trump does significantly moderate his high tariff policies and pivot to a more growth focused agenda. However, with investors clearly looking to diversify away from the US, we don’t see the US market as being as dominant as it has been over the last 5 to 10 years.

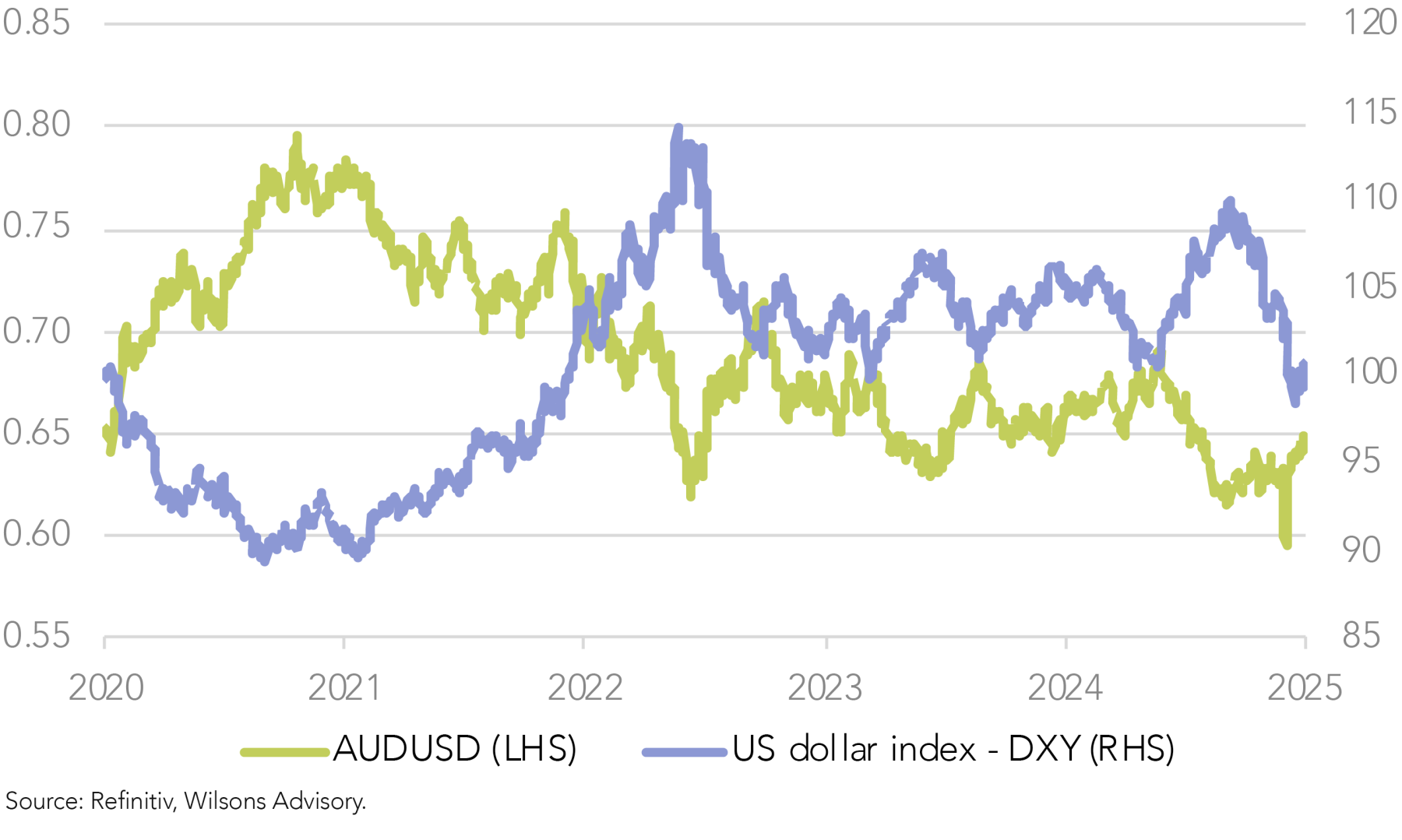

We do think the US dollar will have trouble regaining the dominance of recent years, as investors look to diversify out of US assets and the US fiscal deficit remains relatively intractable. Gold is likely to continue to be a beneficiary of structural US dollar weakness.

We are happy to be buying Australian fixed income as a beneficiary of rising global growth concerns over the near-term, and as official rates move lower over the balance of the year.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.