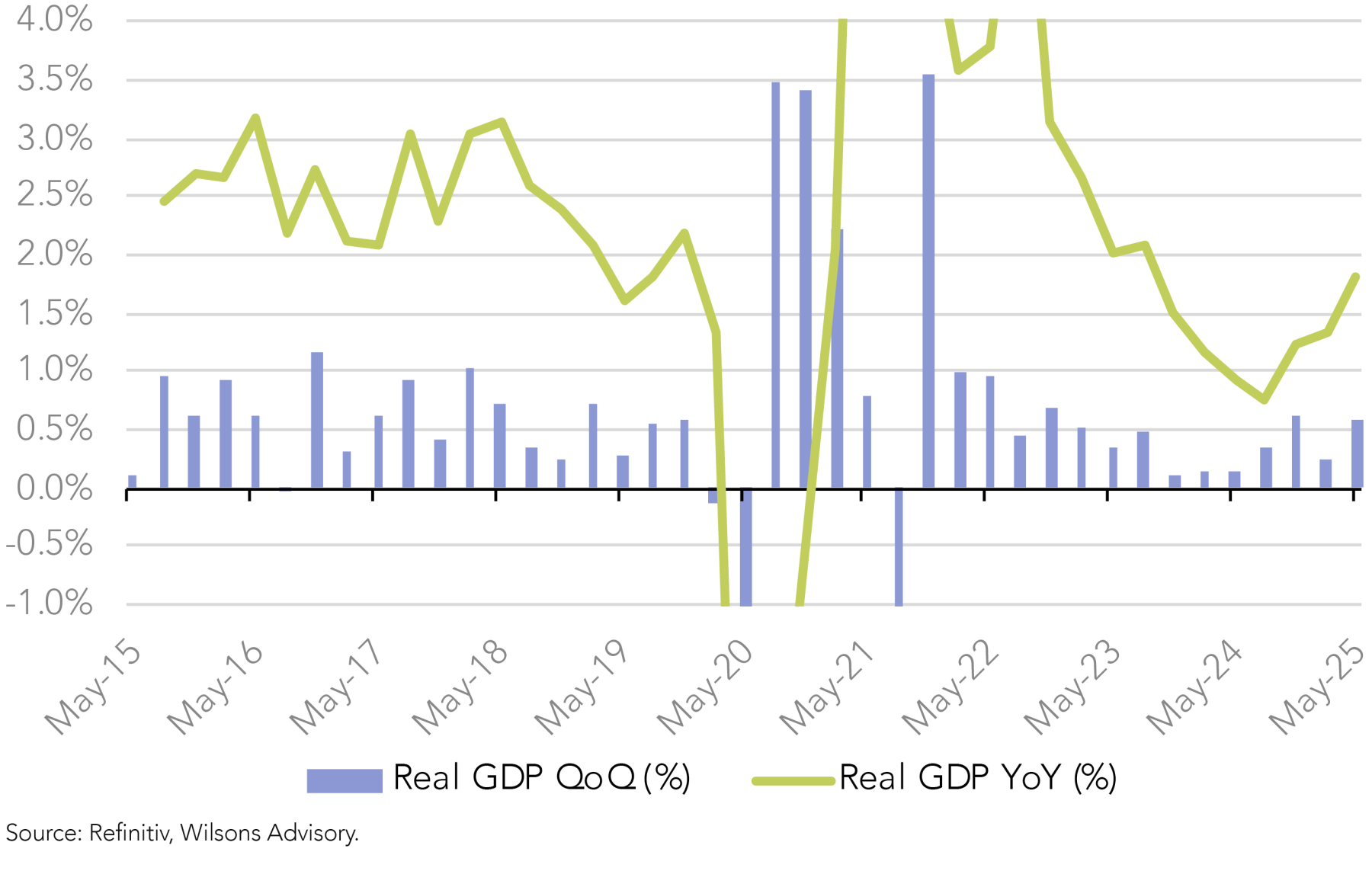

Australia’s real gross domestic product (GDP) grew by 0.6% in the June quarter and 1.8% year-on-year, according to the latest figures released by the Australian Bureau of Statistics (ABS) on Wednesday, 3 September.

The figures surprised moderately to the upside, beating consensus expectations of ~0.4% - 0.5% growth for the quarter. The June quarter marked a rebound from a soft (weather impacted) Q1 result and returns to the growth rate delivered in the final quarter of 2024.

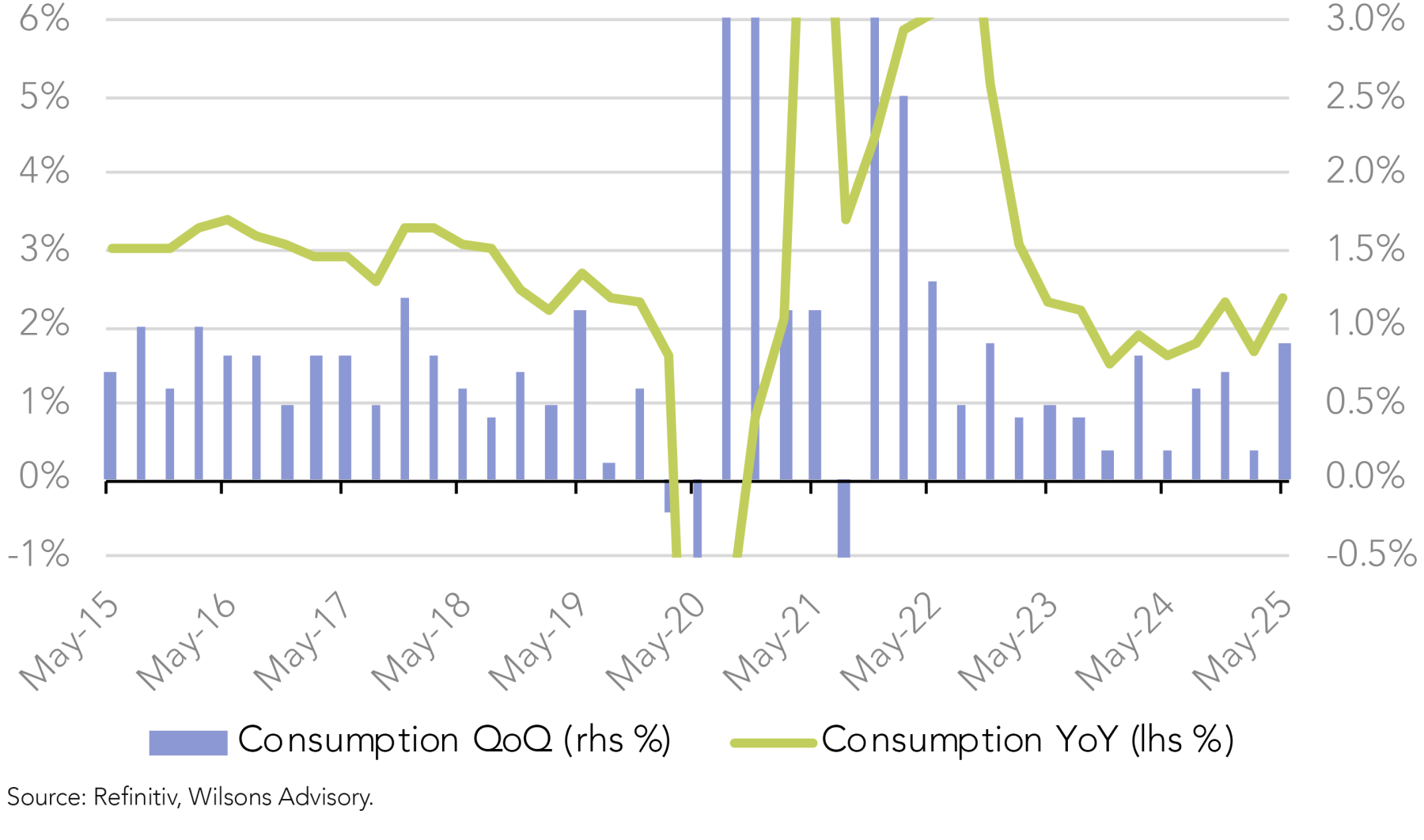

Australian Consumer Emerging From Hibernation

Most notably private demand improved in the quarter led by the household sector, with household consumption experiencing solid growth. This is consistent with trends seen in the recent Australian reporting season.

Household spending rose 0.9% in the June quarter, picking up from a 0.4% increase in March, driven largely by stronger discretionary spending. Discretionary categories were up 1.4%, compared to a 0.5% rise in essential spending.

The consumption growth improvement was supported by end of financial year sales and the proximity of Anzac Day to Easter, which boosted discretionary holiday spending. Consumption growth was also facilitated by strong disposable income growth and a decline in the savings ratio.

A day after the national accounts, the relatively new ABS nominal “Household Spending Indicator” (HSI) rose further to 5.1% y/y in July. This was slightly above consensus expectations (5.0% y/y), and the fastest since Nov-23.

The trend of the monthly HSI is consistent with a continued improvement in household consumption into the third quarter.

Public Spending Boom Eases a Little

Public demand was relatively soft overall, as a strong contribution from government spending (e.g. social payments to households) was offset by a decline in public sector investment (lower spend on health and transport projects). The 3.0% y/y public demand growth rate was the slowest in two years, but is still running well ahead of GDP growth in year-on-year terms.

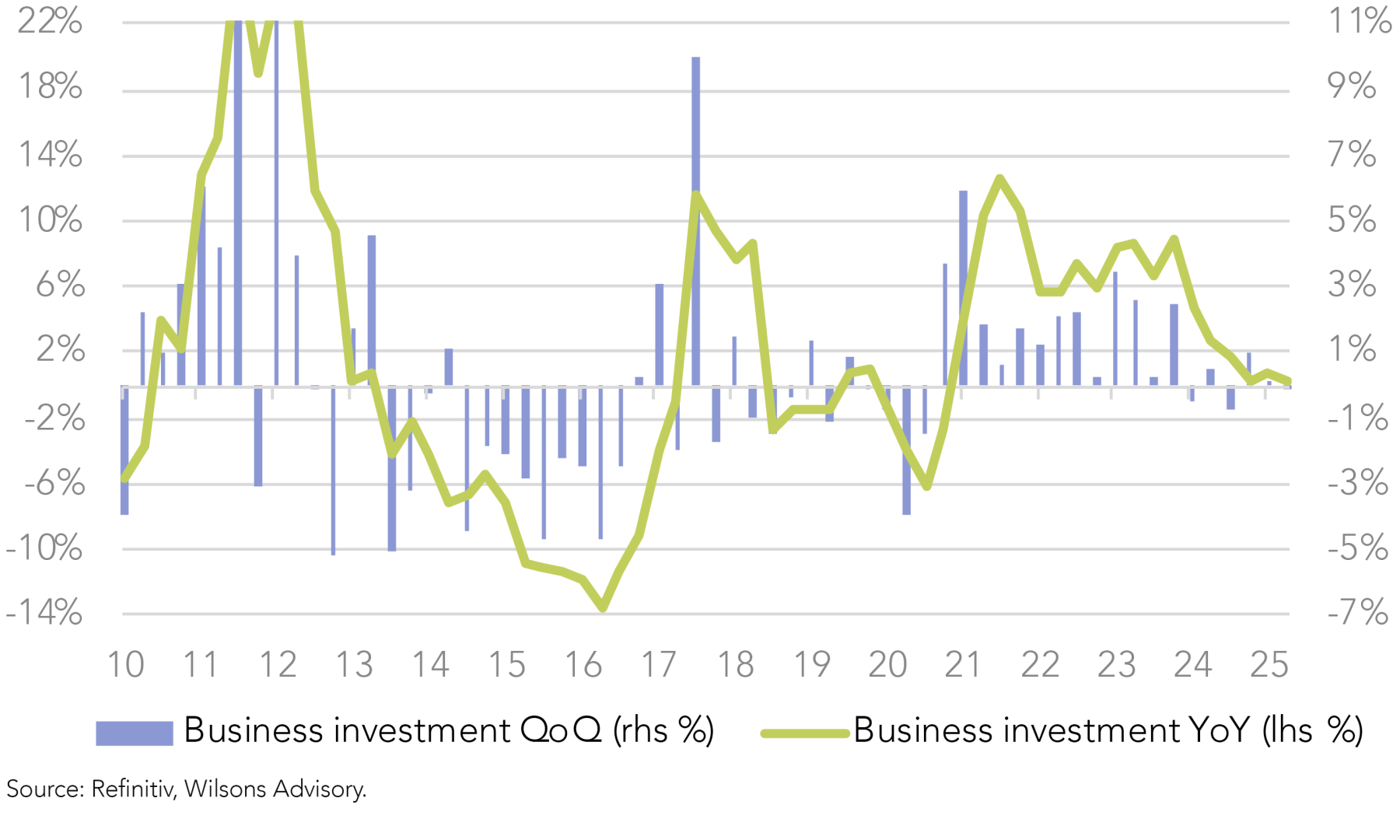

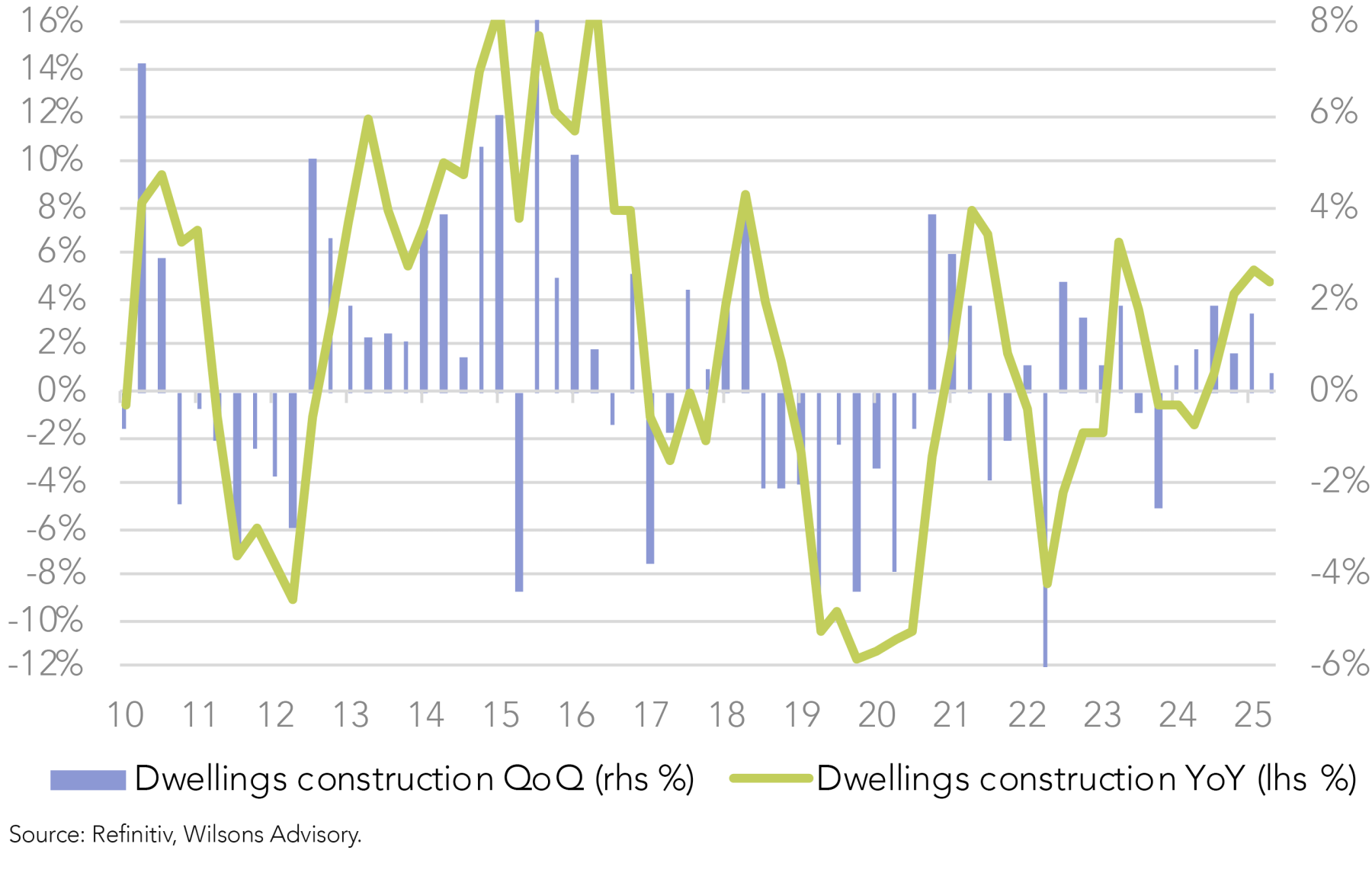

Private sector investment still lacklustre

Business investment remains relatively disappointing, falling -0.4% q/q, while the y/y pace slowed to 0.4%, the weakest since COVID. By industry, mining retraced (-1.3% q/q, -2.7% y/y); while non-mining was also weak (0.2% q/q, 1.0% y/y). Real dwelling investment slowed in the quarter, but is still rising solidly (0.4% q/q; 4.8% y/y), near the fastest annual growth since 2021.

Productivity up a touch but still stuck in a rut

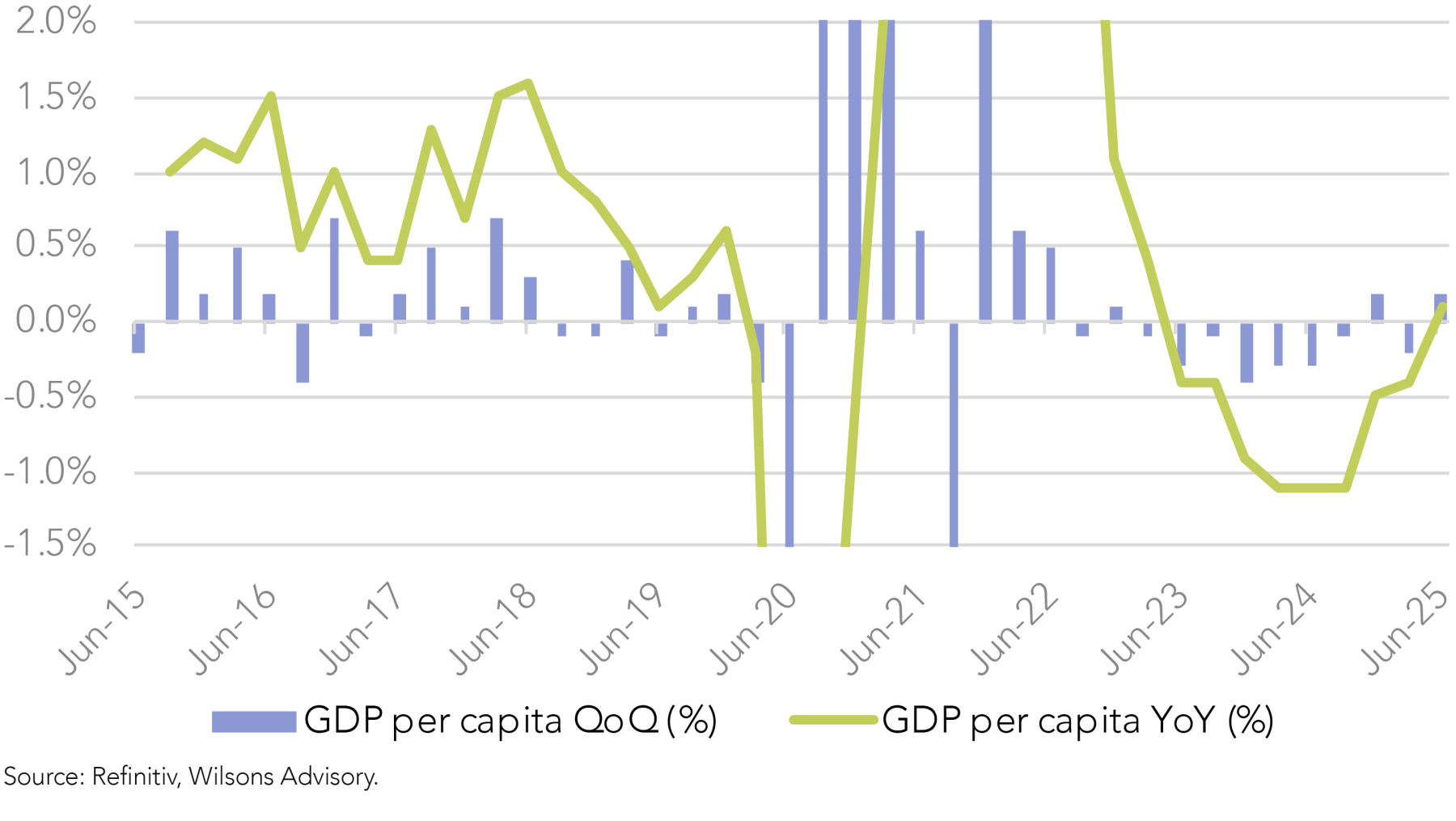

Productivity (i.e. GDP per hour worked) improved, but remains weak (0.3% q/q, 0.1% y/y) and is still basically flat since 2016! GDP per-capita also finally edged up 0.2% q/q, but is still up only 0.2% y/y, after contracting since Q2-22, representing the longest 'per capita recession' in history.

Economy Improving but Not Firing on All Cylinders

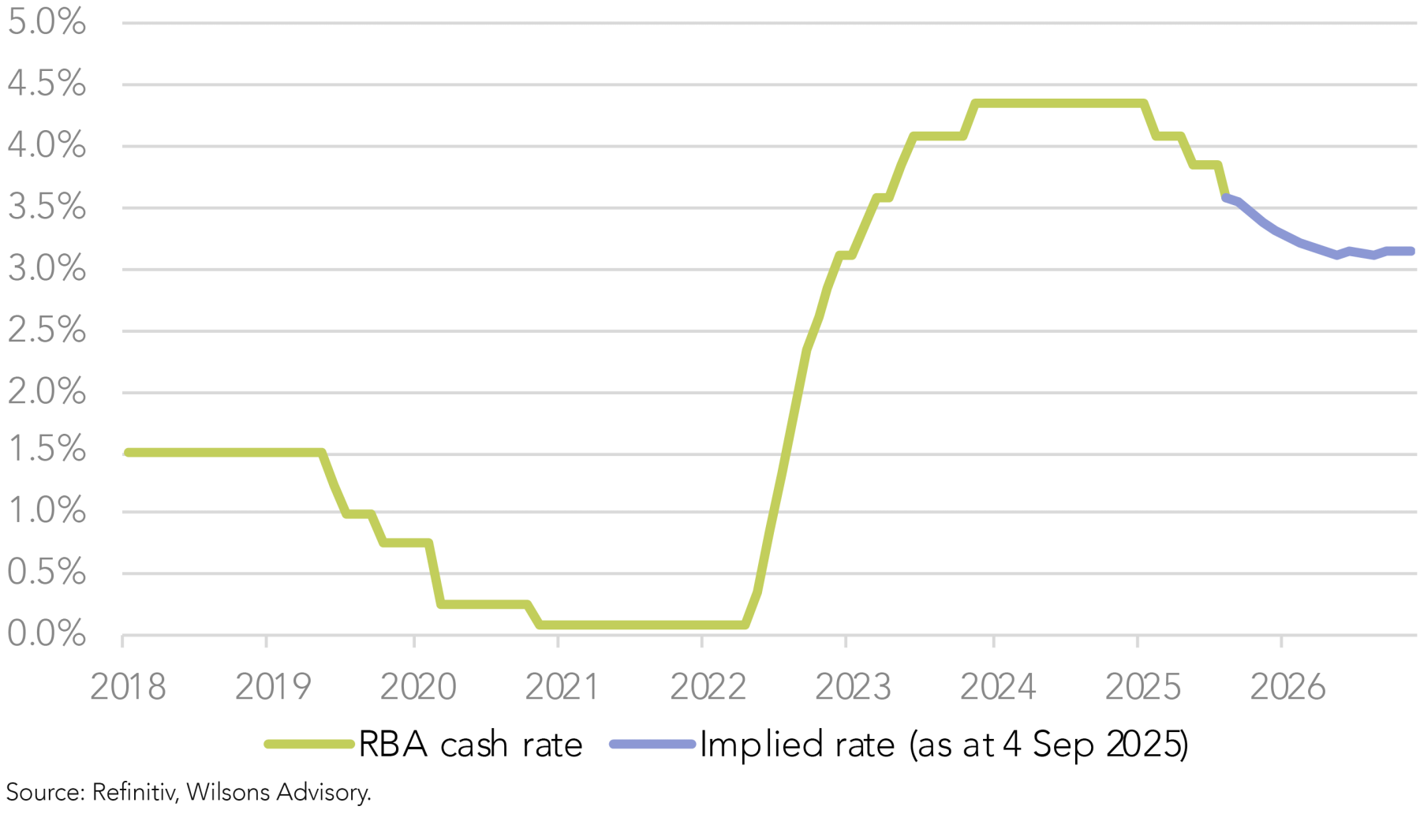

Overall, real GDP in Q2-25 supported our view that a modest recovery is underway. Importantly, the drivers of growth are changing, with RBA rate cuts supporting a 'handover' to private demand. Looking ahead, we expect GDP to remain supported by 1) the cashflow boost from RBA easing, & 2) rising household wealth, which is supporting consumption.

Good news is bad news for stocks and bonds?

We still expect the RBA to hold rates at their September meeting; but cut -25bps in early November-25. Our base case remains for a final cut around February/March 2026, taking the cash rate to a trough of 3.1%, although this cut is looking a bit less certain.

This is not dissimilar to market pricing, though the somewhat stronger-than- expected GDP print and the recent higher than expected monthly CPI has seen the market move from fully pricing two more cuts to a less than fully priced second cut i.e. ~43 of 50bps. In short, two more cuts is still our central case, but the risk of just one more cut appears greater than the chance of three more cuts at this juncture.

Long bond yields rose last week (and stocks fell), in part because of the stronger than expected GDP print, but also due to renewed global pressures on the long end of bond curves, as fiscal concerns bubbled up again. We see our own fiscal position as “relatively” benign and continue to see domestic fixed interest as relatively attractive, given the spread of longer-term maturities to the expected terminal cash rate. An improving economy aided by lower rates also supports the case for an ongoing tilt to small caps.

Economy responding to lower rates but what’s beyond the sugar hit?

The growth transition from the public sector to the private sector appears underway, as consumption recovers with help from lower interest rates. However, the role of the business sector and productivity, as drivers of economic growth, is still underwhelming. These drivers need to kick into gear to reinvigorate GDP and private sector employment growth on a sustainable basis.

Outside of lower interest rates, there is clearly a role for the government to enact meaningful economic reform to drive productivity and reinvigorate private sector investment. However, this remains a somewhat vague aspiration at this juncture.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.