The Australian market has continued its strong price performance through the August reporting period, with the ASX200 index up +3%.

This takes the 12-month total return performance to 15%. A positive lead from global markets and another RBA rate cut earlier in August has added support to the local equity market rally.

Aggregate Earnings Still Treading Water

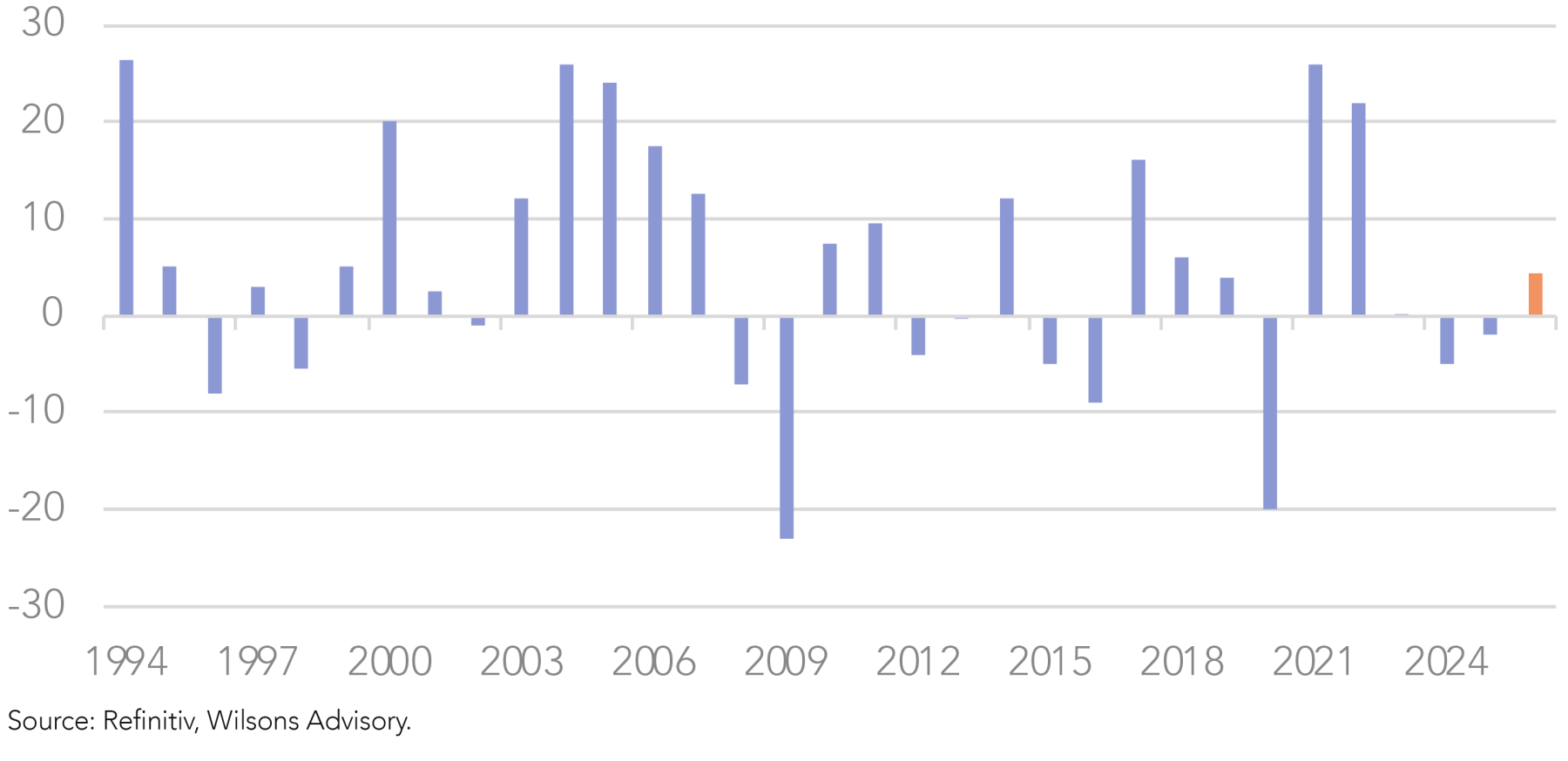

Market earnings growth for FY25 looks set to come in at a lacklustre -2%, for the third year of flat to negative earnings growth in a row. Investors seem to be taking heart from the fact that growth is expected to improve in FY26 to 4% (6% ex resources).

Benign on the surface, chaotic underneath

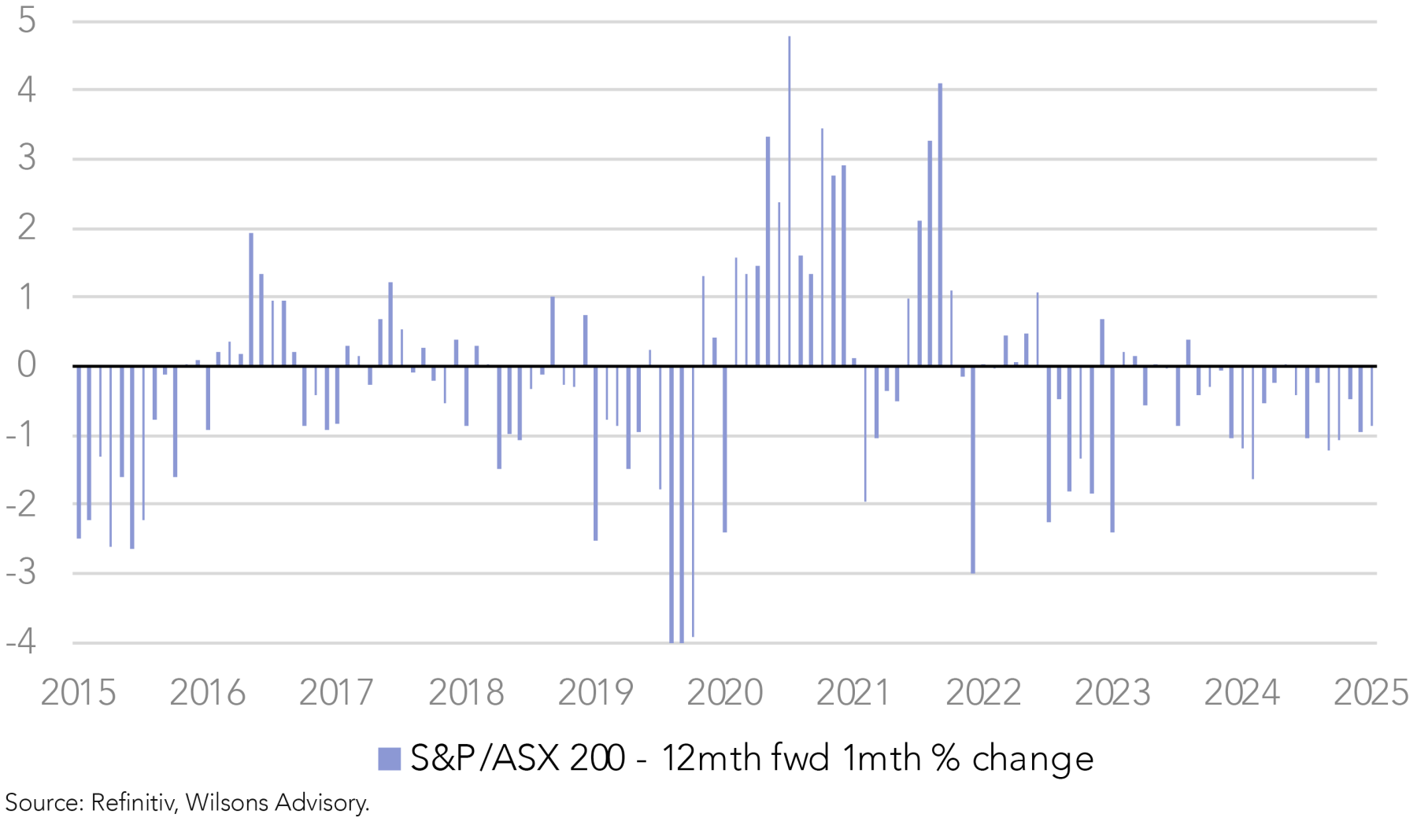

At the individual company level, results have been quite mixed, with very high levels of dispersion in terms of share-price reactions to results. However, while stock specific revisions and (particularly) share price reactions have been decidedly mixed, the aggregate market revision to FY26 has been relatively benign, with a -1% downgrade over the past month. Downgrades of this level are relatively normal for a typical reporting season.

Weighing up valuations versus the cycle and flows

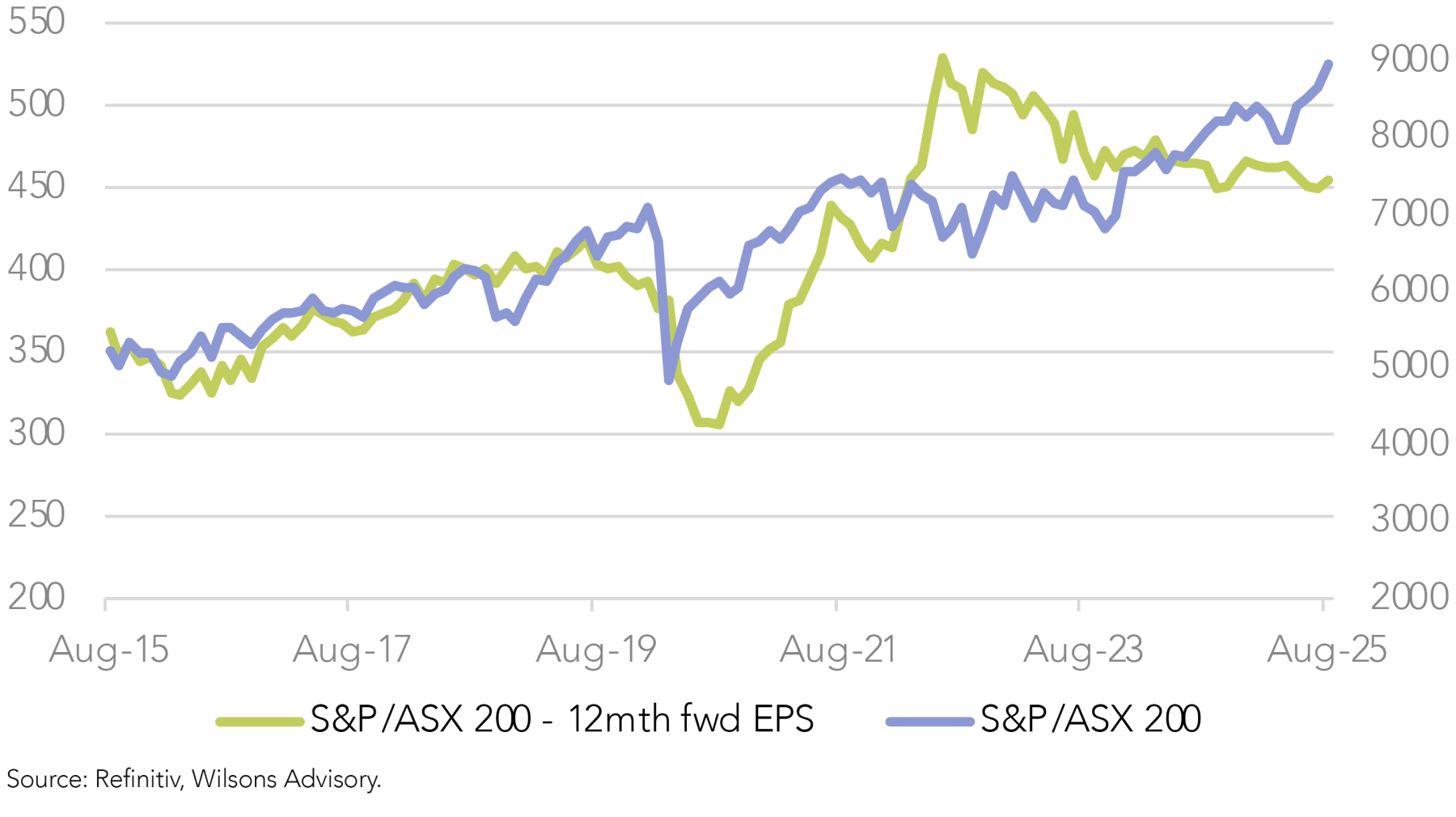

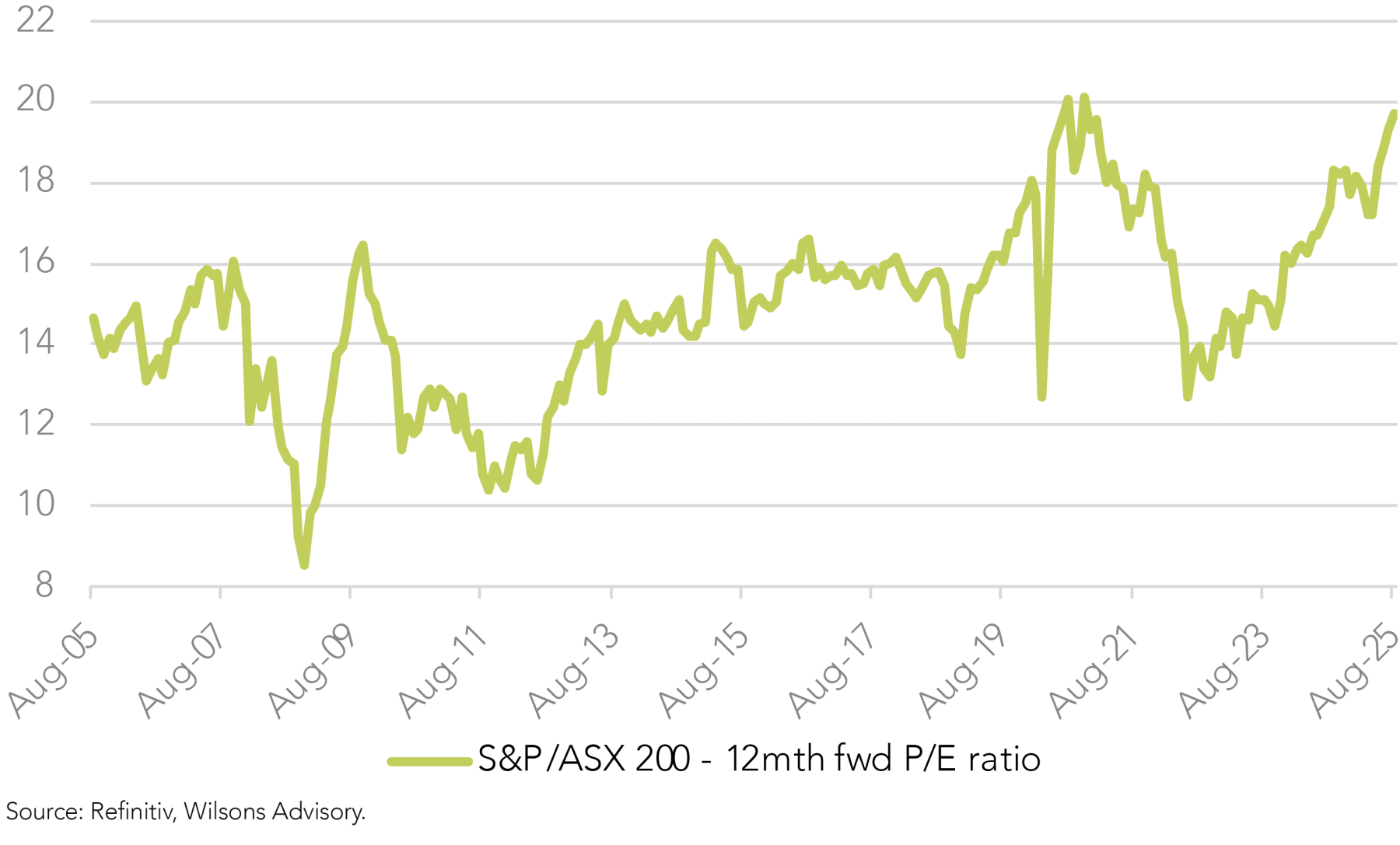

As we have been noting for some time, the market looks expensive at close to 20x 12 month forward expected earnings, having run well ahead of the lacklustre aggregate earnings trend for years.

While this valuation level in isolation suggests caution, interest rates are falling (both domestically and globally) and the earnings cycle finally looks set to improve, aided by ongoing domestic and global policy easing.

This keeps us at neutral on the Australian equity market for now, despite seemingly very full aggregate valuations. While a great deal is priced in at the stock level, a catalyst for a market-wide correction is more likely to come from global than from domestic factors, in our view, given relatively benign domestic conditions.

What’s Been Happening Below the Surface?

There have been a number of interesting rotational performance trends in recent months.

Resources trying for a comeback

The Resource sector is no longer dragging on market performance, having now outperformed the All Industrials since late June. This appears to be due to improving sentiment toward the Chinese economy, even though recent data has not been particularly strong. The key iron ore price has edged up in recent months, while the gold price has also edged higher again. The market is likely looking to require some more concrete evidence of incremental policy support in China over coming months to sustain the rally.

All Industrials still pushing higher

While the All Industrials portion of the market has been lagging the All Resources in recent months, it is still pushing higher in absolute terms. This suggests solid net flows into the market, rather than just a rotation within the market.

Bank index marks time but no genuine correction as yet

With the Resource sector rebounding, Banks have been underperforming since late June, but once again the sector has not really retreated significantly in absolute terms, although the uptrend is showing signs of running out of steam. Market heavyweight CBA has pulled back, however, which has led to strong rotation into the rest of the Big Four Banks. This has likely been pushed along by some weak results among some key industrial large caps e.g. CSL and WOW.

Small and mid caps starting to make their run

In line with our expectations, there has been a clear trend in recent months for both mid caps (50 to 100) and small caps (100 to 300) to outperform the top 50. This broadening of performance is a relatively healthy development in our view. This is likely due to a combination of factors: a rotation back to these segments from underweight institutional investors; relatively better stock specific results compared to the big caps, and finally optimism around improved earnings prospects in response to RBA rate cuts.

From this perspective, profit results in August are suggesting some improvement in macro conditions is beginning to take hold, although it is still tentative. More specifically, consumer stocks on average have had a good reporting season, which has helped the small cap index.

Recent improvements in monthly household spending indicators and business surveys do seem to be translating into improving company outlooks. We have seen a number of domestic consumer stocks move higher, on results which showed favourable trading updates and an improvement in the willingness of consumers to spend. The Australian property sector is also showing some green shoots, particularly in relation to an improving domestic housing cycle.

While many of the domestic results have been encouraging, it was interesting that one of the clearest themes was weakness from a number of US facing companies, in particular those that are housing related. This tended to be masked in the US reporting due to the dominance of the Tech/AI theme at the large cap end of the market.

Market Flow Goes With the Mo

The market is showing a clear willingness to back price and earnings momentum and has shown little patience for faltering turnaround stories. This highlights the increasing dominance of quantitative strategies, in our view. We do worry about the market’s propensity to respond to low single-digit upgrades with double-digit share price gains. This dominance of momentum could reverse at some point, but will likely take some sort of global macro catalyst.

Full valuations but cycle and liquidity supportive

Australian equity market investors generally remain in a bullish mindset despite some significant stock specific setbacks.

With global equities still buoyant, the local economy seemingly is beginning to improve and liquidity is looking supportive as interest rates fall, so the Australian market seems well underpinned.

Valuations are stretched, but this is not in itself enough reason to be underweight. We see full valuations as constraining medium-term upside, suggesting latent vulnerability to any adverse global macro shock (most likely either upside inflation or downside growth surprise). We stick with our neutral view of the Australian equity market, with a preference for mid and small caps.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.