The Australian dollar has experienced a notable rebound from its recent April lows, up 11% post ‘Liberation Day’, when risk-off sentiment and heightened volatility weighed heavily on markets.

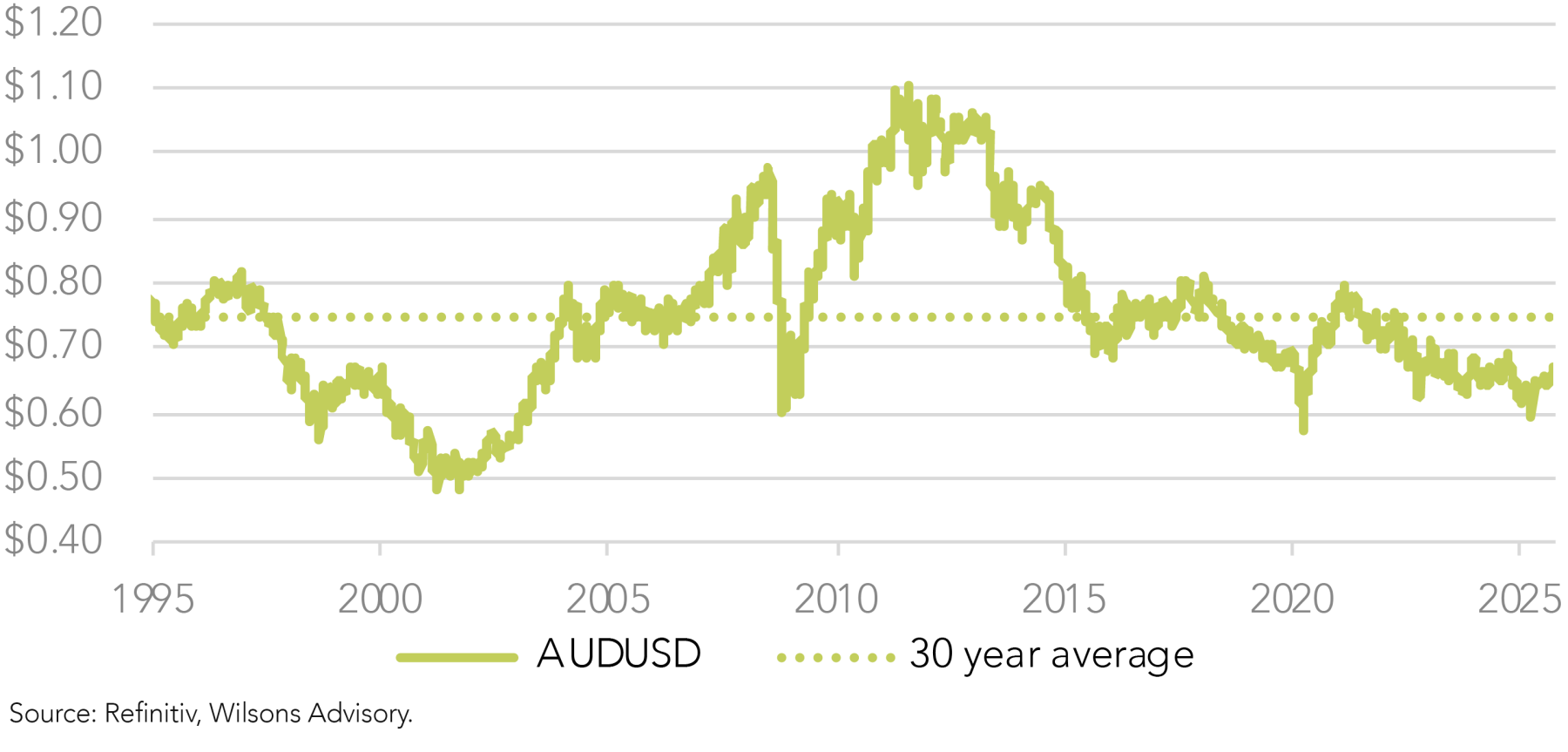

This continues the trend that has been playing out over the course of the year. From a low of US$0.62 in January, it has steadily regained ground in recent months. The Australian dollar has risen to up to US$0.66c at the time of writing, despite briefly falling to US$0.60 in the wake of April’s post-Liberation Day turmoil.

This recovery has been underpinned by several economic and structural factors, most notably the development of broad-based weakness in the US dollar. This has marked a significant turnaround from the US dollar strength narrative that was playing out through late ‘24 and early ‘25. Favourable interest rate differentials, resilient commodity export prices and longer-term valuation anchors have all assisted gains to the Australian dollar.

Australian dollar strength is a US dollar weakness story

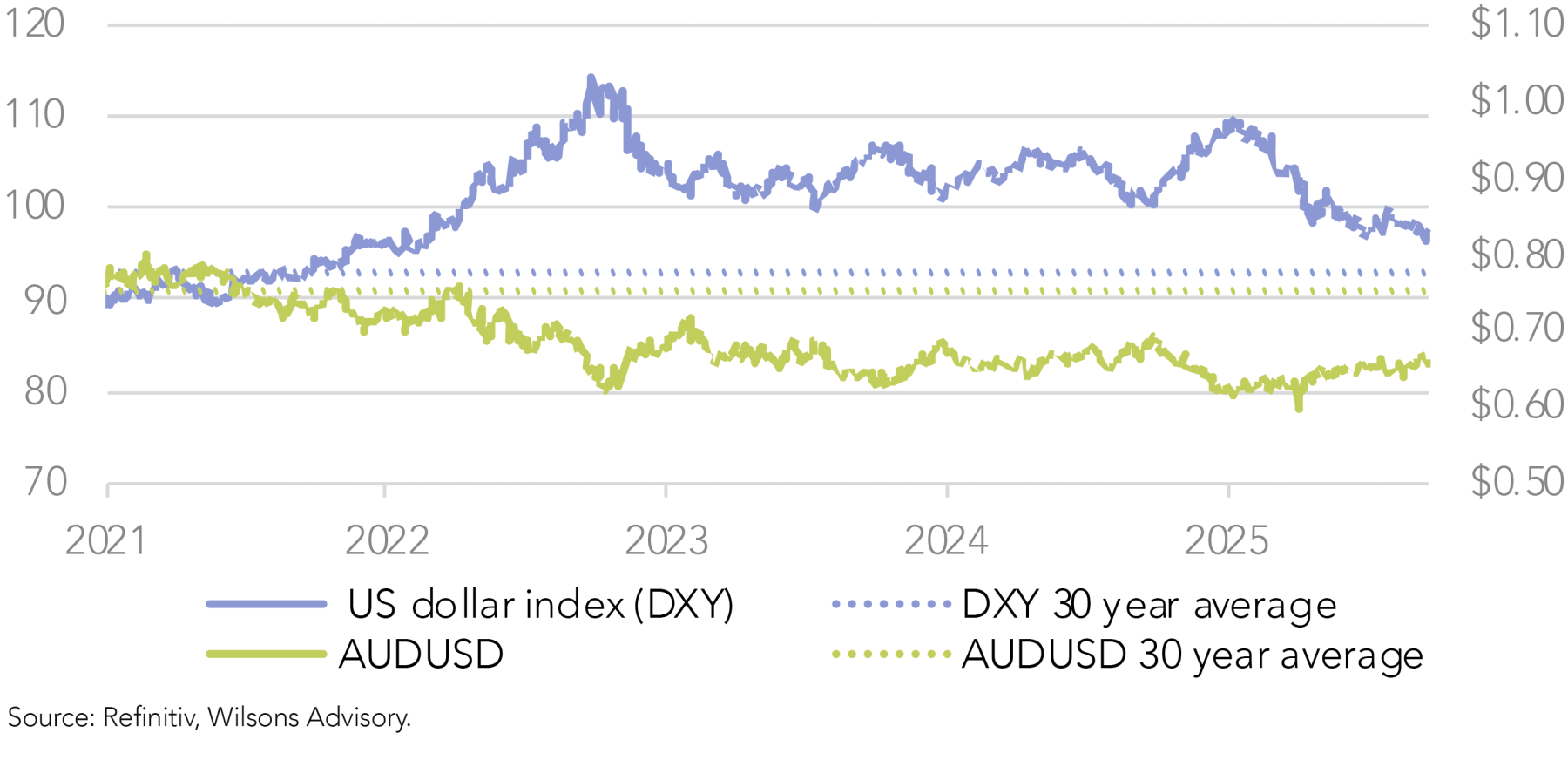

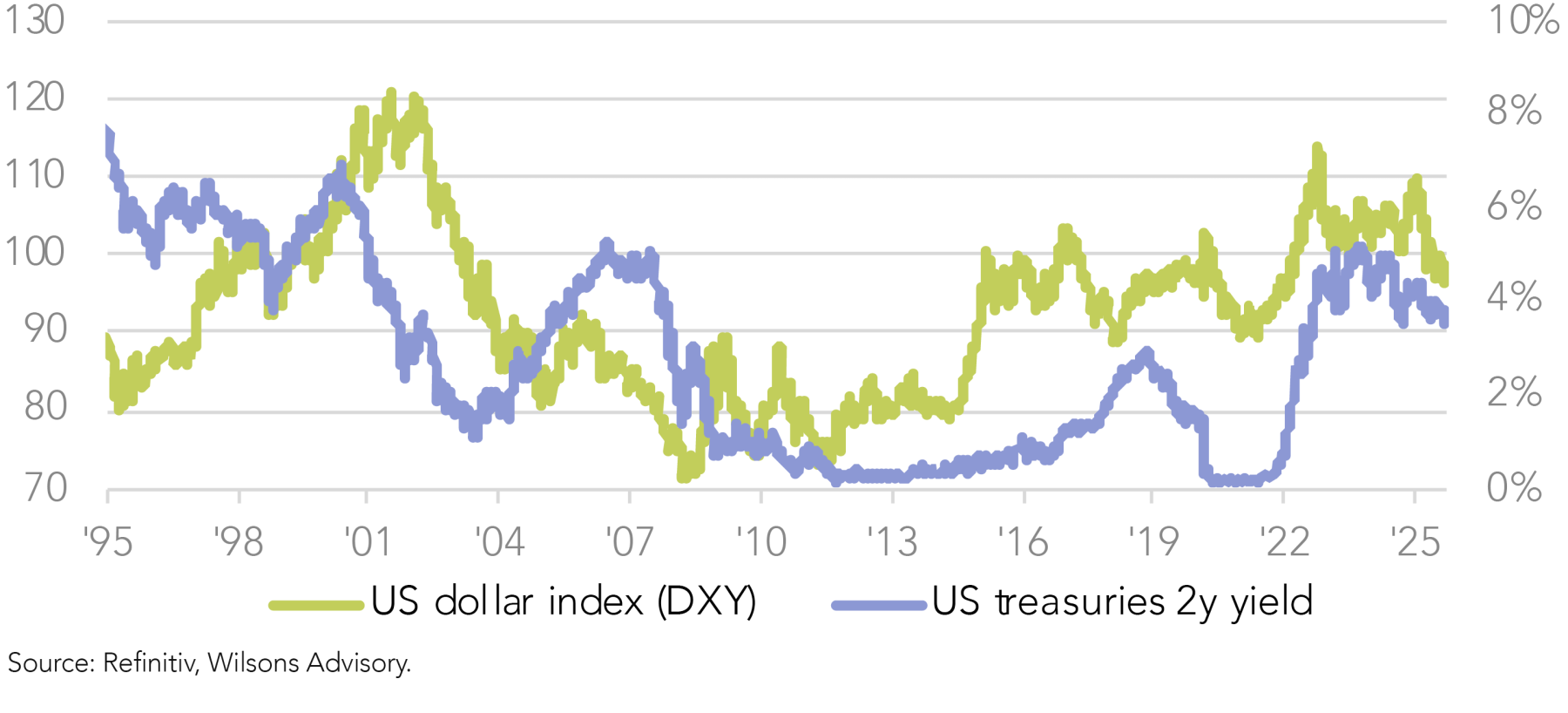

Since its January peak, the US Dollar Index (DXY) has fallen by around 12%. Despite a brief interruption from April’s risk-off episode, where the US dollar bounced higher, its underlying momentum has been weak through the year. The Australian dollar has been a beneficiary of this dynamic, rising approximately 7% since January.

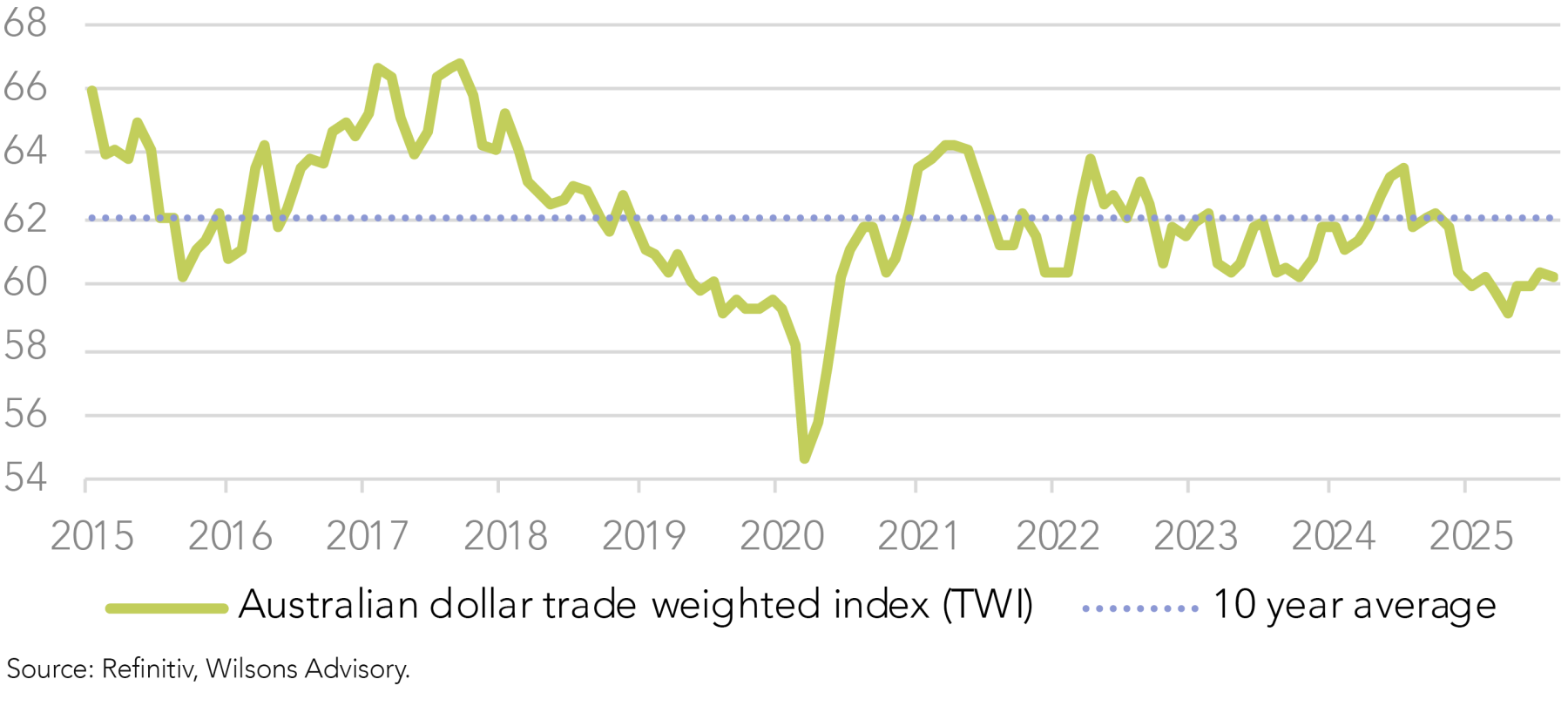

The weakness in the DXY has been broad-based, with the euro gaining 14% against the greenback, and the pound rising 8% since January. While the Australian dollar performance has lagged key majors such as the euro, pound, and yen since January (down -6%, -1%, and flat respectively), its relative strength has improved more recently, with the Australian Trade Weighted Currency (TWI) basket rising 2% from April. Against the US dollar specifically, the Australian dollar has appreciated 11% since its April lows, reflecting both cyclical tailwinds and structural support.

Hedge Your Bets – Sell America Becomes Hedge America

The US dollar’s decline is not an isolated development, but rather part of a wider recalibration in global capital flows and investor positioning. As discussed in last week’s note many economies are seeking to diversify their reserve holdings and reduce dependence on the US dollar by increasing allocations to gold and other major currencies, like the euro, yen, and renminbi.

Read Gold’s Golden Run

This de-dollarisation structural shift has provided support for a range of currencies, including the Australian dollar.

This year has also seen an uplift in foreign investors increasing their hedging on portfolios. The ‘Sell America’ trade post-Liberation Day has evolved into ‘Hedge America’.

This trend, interestingly, is playing out even as US equity indices set new record highs seemingly every week. As a consequence, while ongoing investor appetite for US equities remains strong, there has also been an increasing desire among foreign investors to reduce exposure to the declining US Dollar, which has been eroding real returns. This increase in hedging has further weighed on the $US, which in turn has contributed to its downward slide this year.

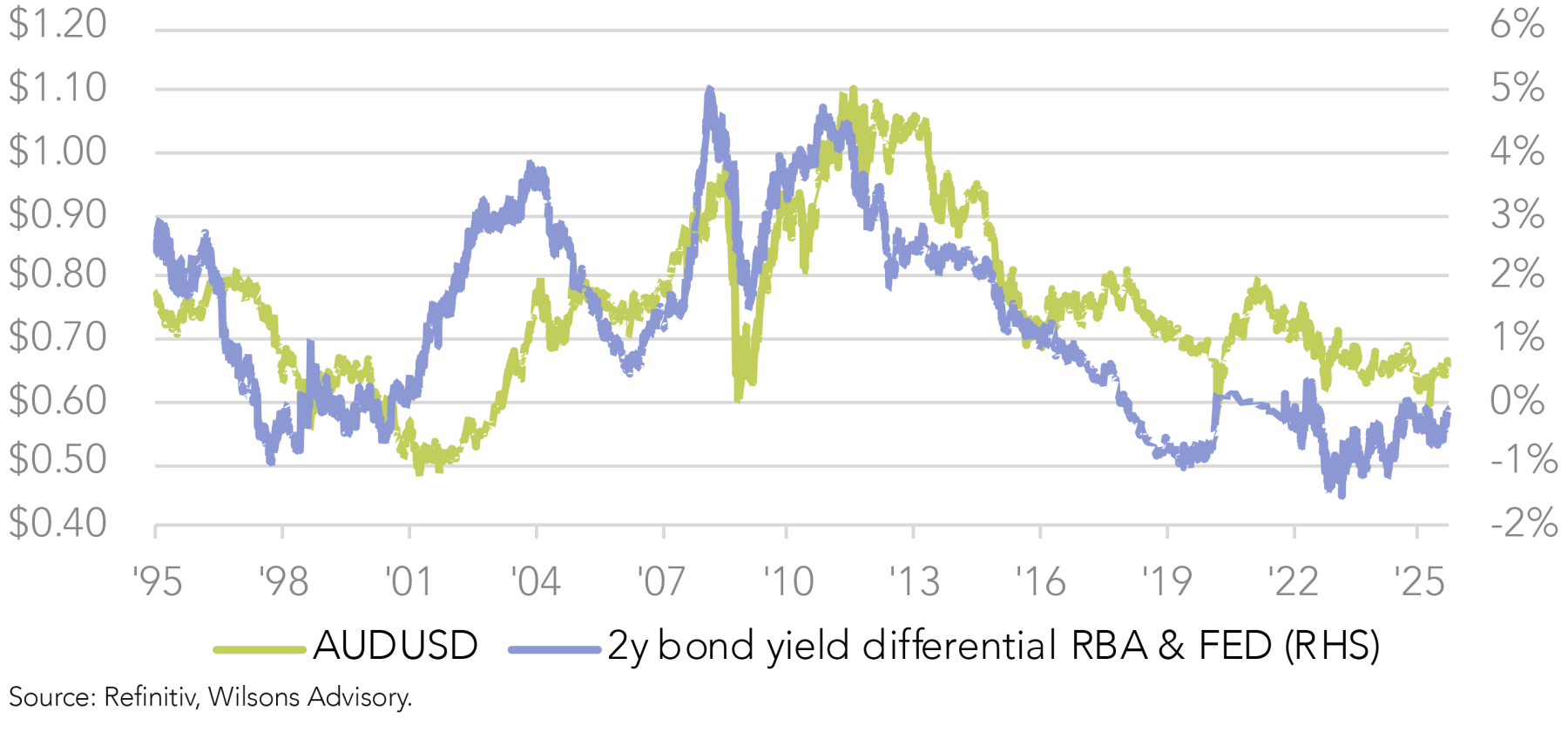

Interest rate differentials drive foreign flows

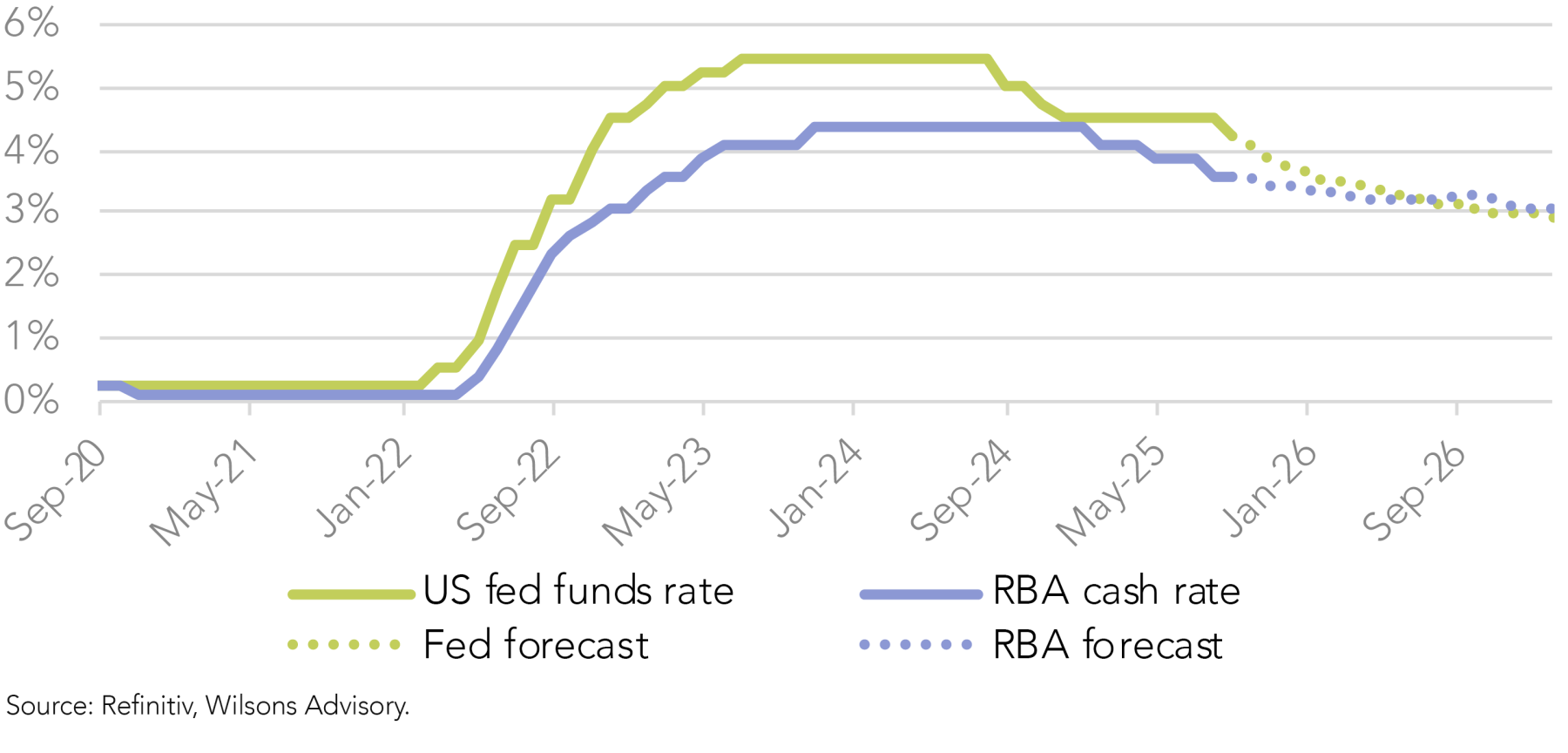

Another key driver of the Australian dollar’s recent strength has been the evolution of interest rate differentials between Australia and the United States. Expectations for multiple Federal Reserve rate cuts have built substantially over recent months, leading to a meaningful repricing of the Fed funds terminal rate. Importantly, at 2.9%, the implied terminal Fed funds rate now sits below that of the RBA’s projected terminal cash rate of 3.1%. Expectations of higher cash rates have helped support foreign capital inflows to Australian assets, as investors look for more favourable rates, boosting demand for the Australian dollar and contributing to the upward trend.

Bond market pricing reinforces this relative dynamic. Both Australian 2-year and 10-year government bond yields are trading near to or above their US equivalents. While expectations for RBA easing remain modest, the recalibration of the Fed’s policy trajectory has created a more favourable backdrop for the Australian dollar.

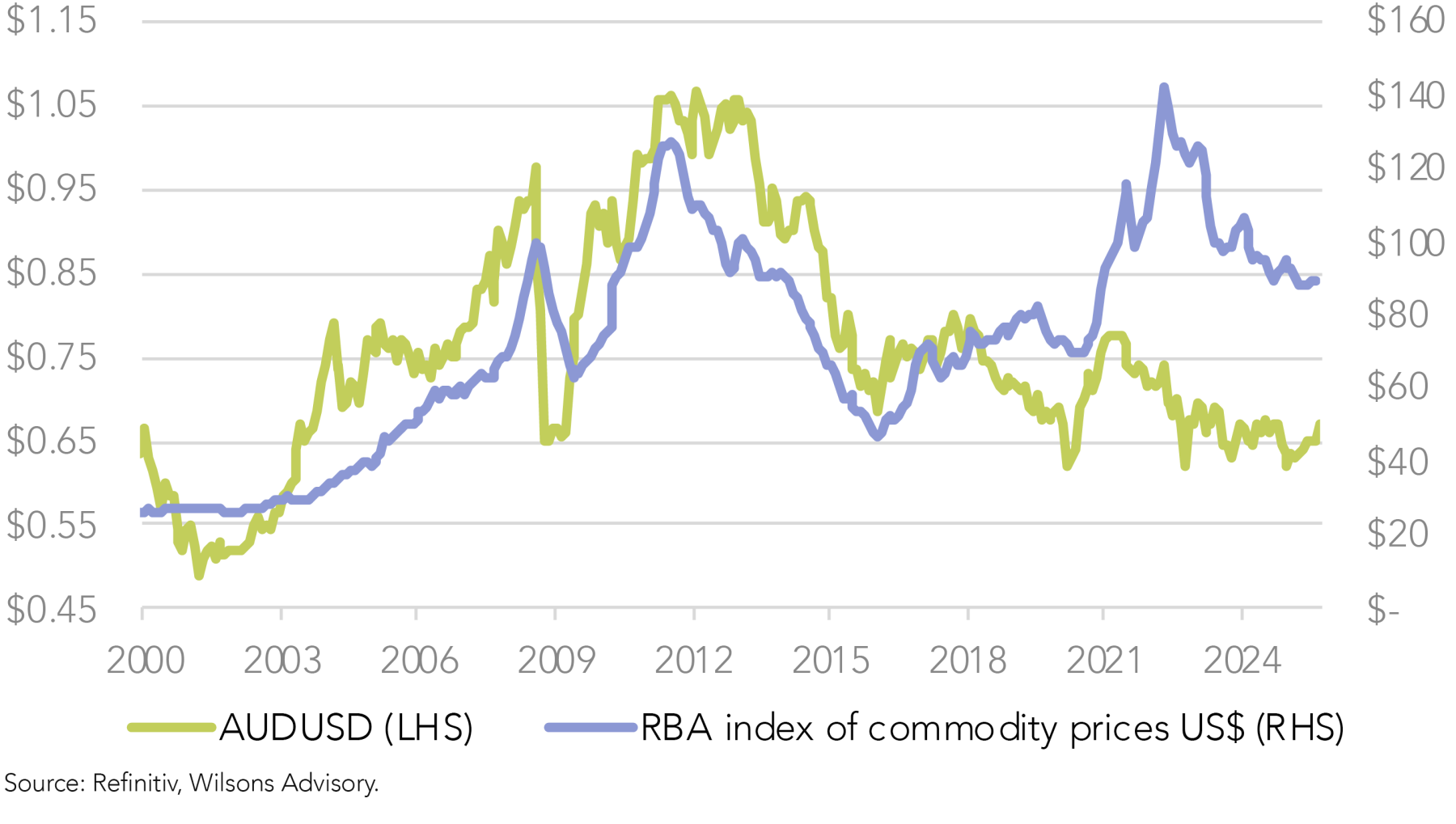

Commodity Export Support

The resilience of Australia’s key commodity exports has also played a supportive role in the currency’s recovery. Prices for iron ore and other critical exports have edged higher in recent months, providing a steady source of inflows. Given the structural importance of commodity revenues, this remains a crucial underpinning of medium-term Australian dollar strength. Given Australia’s dependence on China as the largest buyer of iron ore, China’s economic trajectory remains a key driver of commodity demand. A renewed slowdown in Chinese demand or commodity prices would be a key risk to the Australian dollar.

Long-Term Valuation Anchors

From a long-term perspective the Australian dollar continues to look cheap. The Australian dollar/US dollar does appear to have a long-term mean reverting trend, despite its ability to depart from this equilibrium for extended periods. Looking at purchasing power parity (PPP), according to which exchange rates should equalise the price of a basket of goods and services across countries, if over time Australian prices and costs rise relative to the US, then the value of the Australian dollar should fall to maintain its real purchasing power. The opposite is true, if Australian prices fall versus the US dollar. Consistent with this, the Australian dollar tends to move in line with relative price differentials over the long-term. Right now, the Australian dollar looks cheap at around US$0.66 compared to fair value around US$0.70 - 0.72 on a PPP basis, according to OECD estimates. This is also not too far from the Australian dollar simple long-term average level (US$~0.75). As such, the currency appears modestly undervalued on a structural basis. This provides further scope for appreciation, should cyclical tailwinds persist.

Portfolio Implications

Taking these factors together, our base case is for a stronger Australian dollar over the next 12 months, assuming a broadly benign global environment over the next year. We expect multiple Fed rate cuts to materialise, reinforcing US dollar weakness, Ongoing de-dollarisation and diversification of reserves will support non-US dollar currencies. We expect the interest rate differential premium for Australian bond yields above US yields to continue to offer a relative advantage and to provide Australian dollar uplift. Resilient export demand continues to drive Australian dollar gains, as the currency moves towards its long-term average and fair value estimate in line with PPP. On this basis, we expect the Australian dollar to move higher over the coming year, with a fair value estimate in the US$0.70 - 0.73 range.

In light of this broadly constructive backdrop for the Australian dollar, we are modestly increasing our hedging from 20% to 35%. This positioning reflects confidence in the medium-term drivers of Australian dollar appreciation while also being cognisant of potential risks.

Chief among these is the potential for a renewed “risk-off” environment. The April drawdown demonstrated how quickly capital can retreat from risk-sensitive currencies, such as the Australian dollar when global uncertainty spikes. A repeat of such conditions could see the Australian dollar retrace recent gains. We will also be watching for if the Fed delays or scales back the extent of expected rate cuts, which could boost the US dollar.

China’s growth trajectory remains a crucial determinant of commodity demand. As such, a renewed downturn in commodity demand or prices from China, particularly for iron ore, would undermine one of the Australian dollar’s key structural supports.

While our base case remains supportive, we do remain alert for the inherent risks. We believe that the currency remains modestly undervalued and is positioned well for further gains over the coming year.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.