The price of gold has soared this year-to-date by 39%, with another surge over the past month of 5%.

This suggests gold may be overbought in the short-term. However, we continue to see physical gold (ETFs), as well as gold equities, as having a valuable place in investor portfolios over the medium-term. As such we retain our long-standing allocations.

Gold is often characterised as a store of value primarily against the long-run corrosive effects of inflation. Gold also has a proven track record as a portfolio hedge against a range of potential investment risks, including financial market volatility, geopolitical tensions, and currency weakness.

A Brief History of the Gold Price

Since it was unpegged from the US$ in 1971, physical gold has shown a long-run capacity to outperform both inflation and cash, despite not providing an underlying running yield.

Since 1971 gold’s per annum nominal return has been 8.4% (4.3% in real terms). While gold’s long-run performance has been very solid, we note there have been distinct bull and bear markets over the last 50 years.

After the US ended the fixed-link between the US dollar and gold in August 1971, gold moved into a decade-long upswing, as investors turned to gold for protection against both high inflation and significant geopolitical instability.

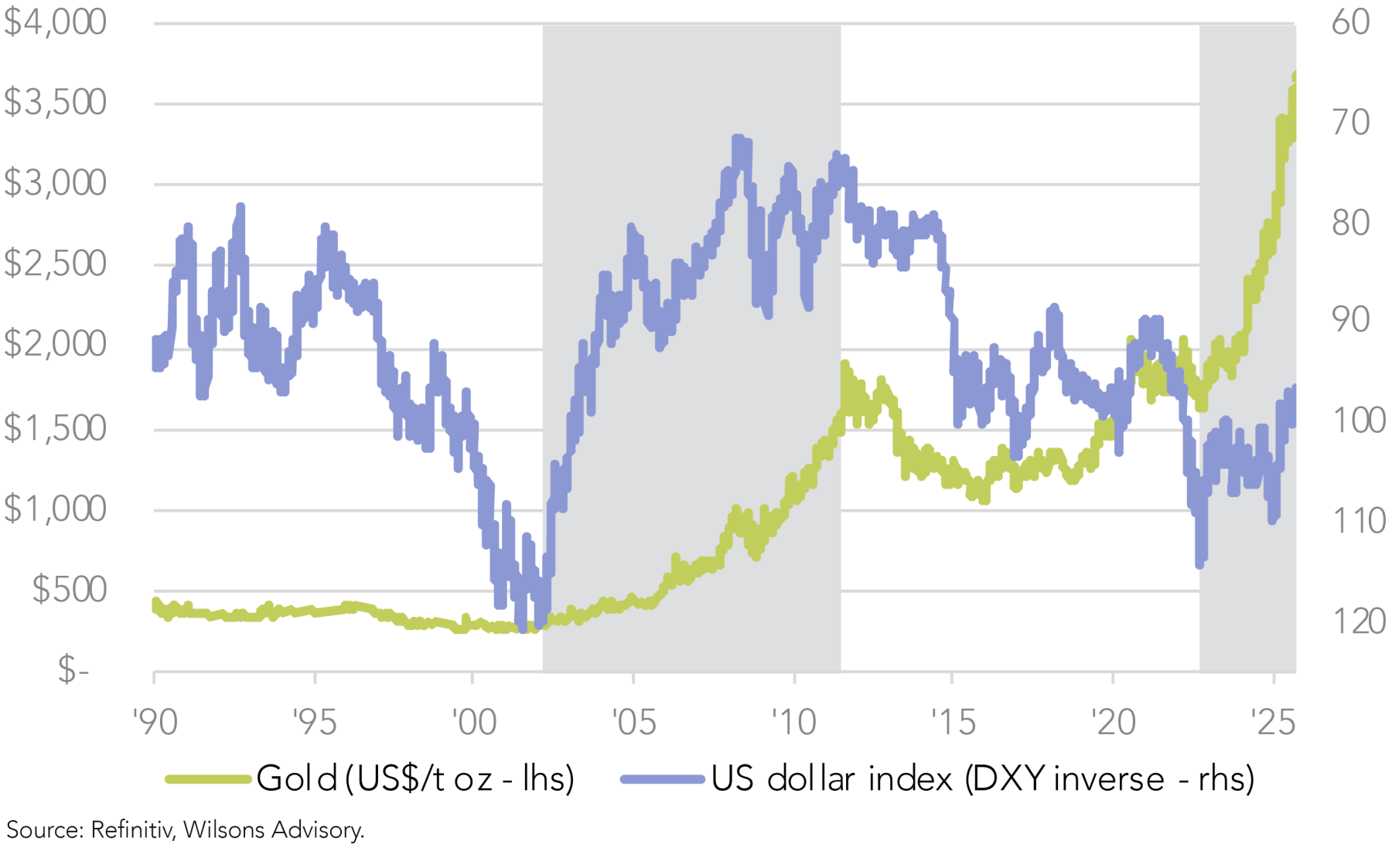

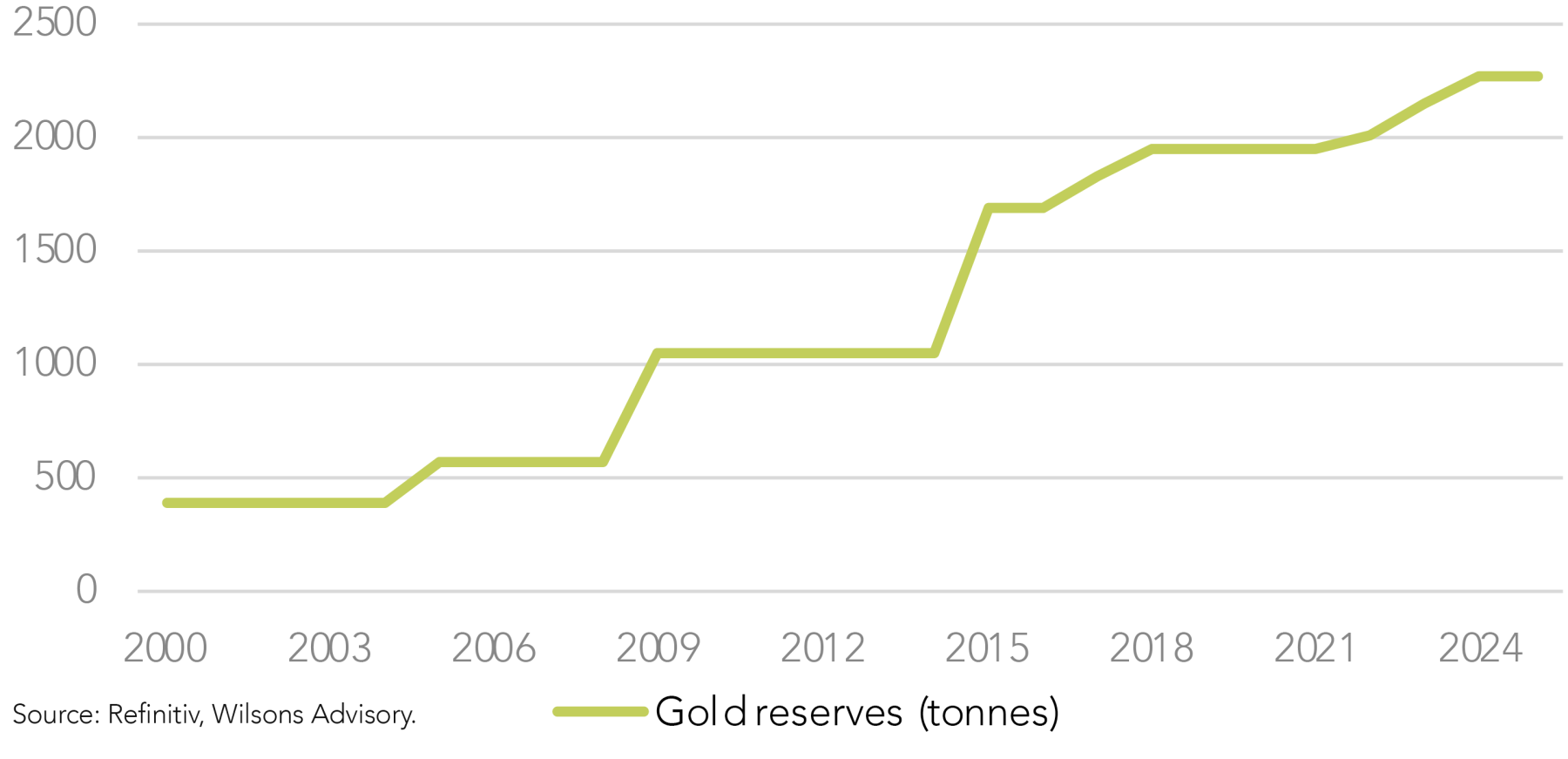

However, from 1980 until around 2000, gold moved into a secular downtrend as inflation was brought under control. The 2000’s saw gold enter another secular upswing coinciding with a number of performance drivers, namely US dollar weakness, the rapid expansion of the global money supply, a re-building of central bank gold reserves and large investor inflows into the gold ETF asset class.

This bull run paused between 2013 and 2018, before resuming in 2019. Once again, money supply acceleration, central bank reserve accumulation and ETF buying have supported gold’s gains over the past 5-6 years.

This has taken the gold price to new record highs, both in nominal and real terms. Indeed, gold is now well above its 1980 high in real terms.

What’s Been Driving the Gold Price Higher in Recent Years?

A range of factors have been pushing gold prices up recently, with a number of these drivers seemingly linked by a couple of overarching macro mega themes, namely, aggressive monetary and fiscal expansion, de-dollarisation and heightened geopolitical instability.

As discussed, a key causal driver of gold’s recent run appears to be central bank accumulation. After tailing off in the 1990’s central bank gold holdings have been rising strongly for some time now. Emerging central banks have been strong buyers since the early 2000’s. The pace of central bank gold accumulation has reaccelerated since the Russia/Ukraine War as many central banks sought to diversify away from the $US.

Arguably linked to this theme, at least in part, is the downtrend in the $US since 2022 which has also helped boost the gold price. The “de-dollarisation” theme appears to be a structural thematic likely to aid gold for some time to come. De-dollarisation represents the desire of not just central banks but many institutions and private investors to diversify holdings beyond US dollars. The rationale for de-dollarisation is multi-faceted, but revolves around the historical “reserve currency” role of the US dollar in the global financial system. When this “monopoly role” of the US dollar is juxtaposed against burgeoning US budget deficits and general US policy uncertainty, the desire for de-dollarisation is not surprising. De-dollarisation appears to have been a key driver of the rally in the gold price in recent years, and in particular the gain in the current year.

Gold is also seen as a hedge against geopolitical tensions which have been on the rise, particularly since 2022. Increasing political polarisation and rising signs of authoritarian leadership across both the developing and developed world is arguably supporting the case for gold as a tail risk hedge.

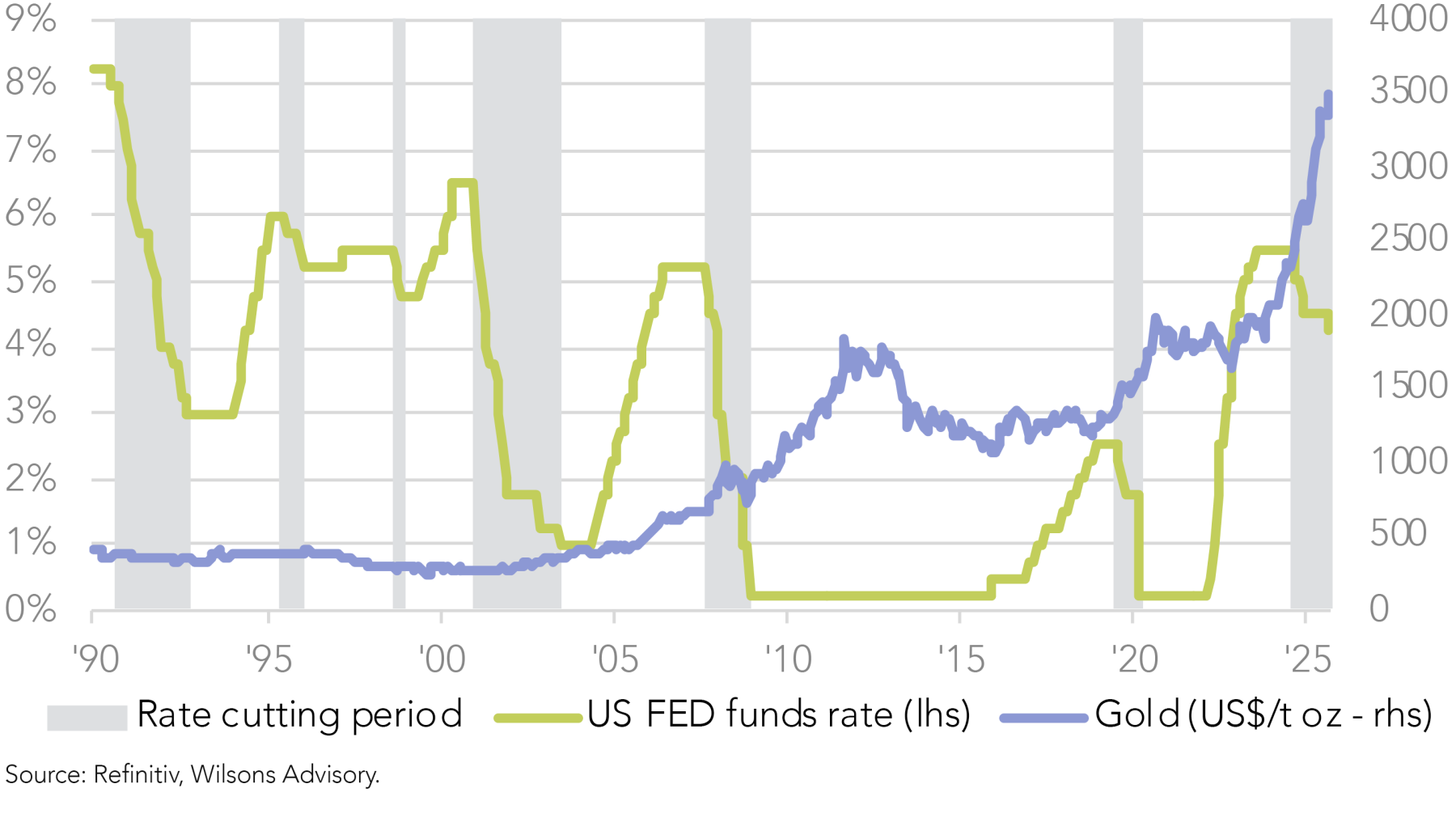

Finally, central bank rate cuts since 2023 are once again lowering the opportunity cost of holding gold. Increased expectations for a fresh run of Fed rate cuts have likely boosted gold’s performance over the last month or so.

These often-related factors have created a powerful tailwind for the gold price in recent years, and while gold may be overbought in the short-term, we see these drivers as likely to remain in place as a strong support for gold over the medium-term.

| Country | Gold Reserves (tonnes) | % of Total Reserves |

| United States | 8,134 | 78% |

| Germany | 3,352 | 70% |

| Italy | 2,452 | 66% |

| France | 2,437 | 65% |

| Russia | 2,333 | 25% |

| China | 2,280 | 6% |

| India | 876 | 8% |

| Switzerland | 1,040 | 6% |

| Japan | 846 | 3% |

| Turkey | 615 | 15% |

Source: Refinitiv, Wilsons Advisory.

Gold in a portfolio context

From a portfolio perspective, physical gold tends to have a low, and at times, negative correlation to other asset classes (especially equities), particularly in times of acute stress.

Gold’s low or negative correlation is potentially attractive from a diversification standpoint, helping to dampen overall portfolio volatility. Therefore, gold can potentially complement other portfolio “hedges” such as high-grade fixed interest.

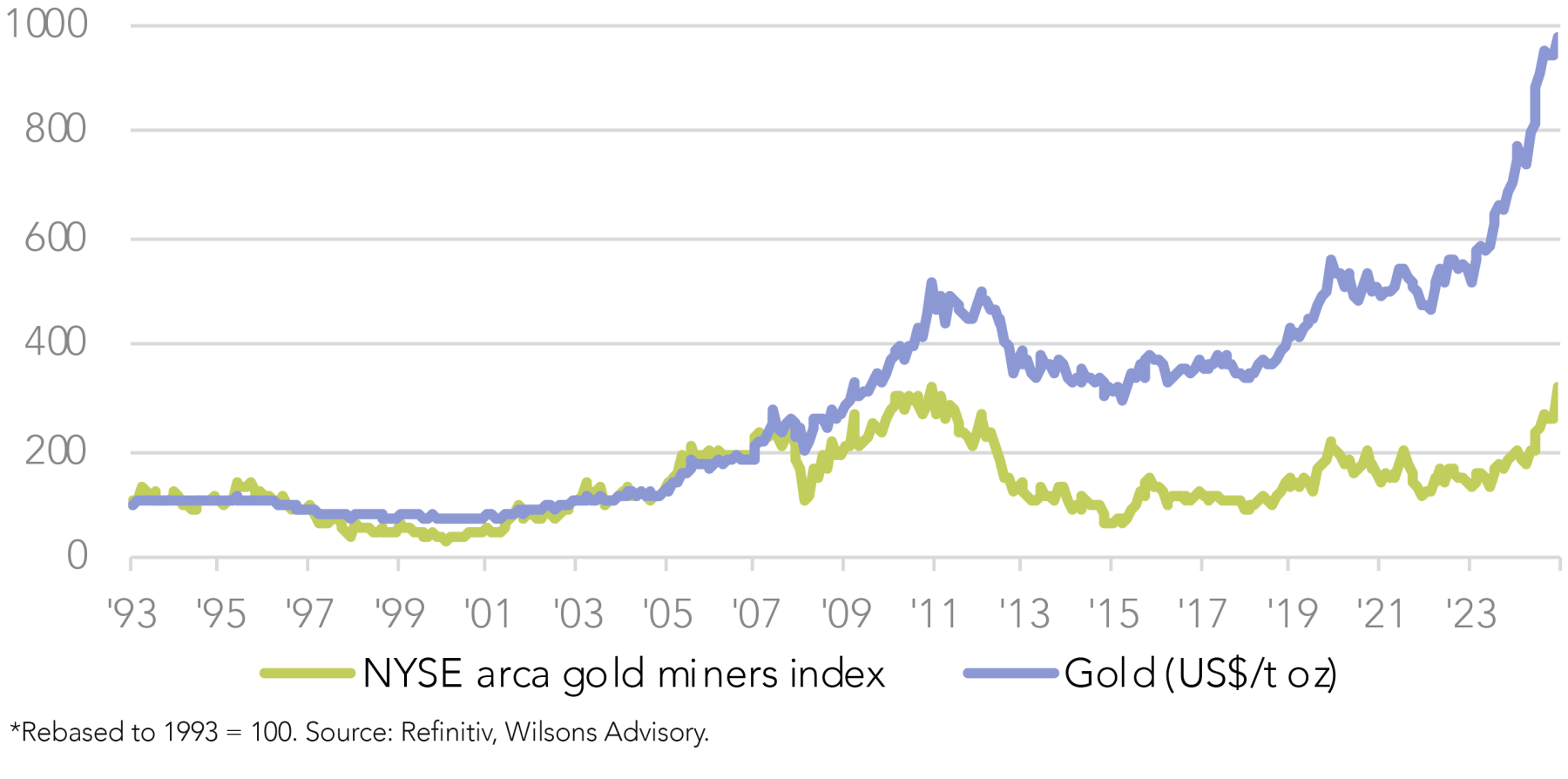

Gold is a relatively liquid asset class, so we place it within the liquid alternatives (defensive) segment of diversified portfolios. Physical gold holdings (we use ETFs) can, of course, be complemented with an additional allocation to Australian and global gold equities (or gold

equity funds).

Gold Versus Bitcoin – Chalk and Cheese

In recent years cryptocurrencies, Bitcoin in particular, have been likened to gold. One similarity often cited is their perceived ability to protect investors from currency debasement because neither gold nor Bitcoin are tied to a specific country’s currency. This has led many investors to dub Bitcoin the new gold or “digital gold”. However, we would highlight several key differences between gold and Bitcoin that bring into question the notion that Bitcoin is a substitute for gold in investor portfolios.

Historically, gold has served as an effective hedge against heightened volatility, geopolitical turmoil, and significant “risk-off” events resulting in equity market drawdowns. In contrast, while Bitcoin has been in a strong uptrend for much of the last 10 years, it has tended to behave like a high beta risk asset during significant phases of market volatility (indeed the 10 year equity beta of bitcoin is 1.83). As a result, we view Bitcoin as a highly speculative risk asset with a different potential place in investor portfolios relative to gold.

| Start Date | S&P 500 Corrections | Bitcoin (US$) | Gold US$/t oz | Gold A$/t oz |

| Jul-15 | -14% | 37% | 13% | 17% |

| Jan-18 | -10% | -36% | -1% | 4% |

| Oct-18 | -20% | -41% | 5% | 6% |

| Feb-20 | -34% | -32% | -5% | 7% |

| Jan-22 | -25% | -58% | -8% | 5% |

| Feb-25 | -19% | -22% | 2% | 9% |

Source: Refinitiv, Wilsons Advisory.

Long Term Lustre Remains

After rising 39% year-to-date, gold is arguably overbought in technical terms and may be due for a short-term pullback.

However, in our view the medium-term picture remains positive for both gold and gold equities. The US dollar is likely to fall further in the medium-term as de-dollarisation led by ongoing central bank gold accumulation continues. Global interest rates look set to fall further keeping the opportunity cost of holding gold down. There is also the latent tail risk of a public debt crisis at some point in coming the years, albeit timing this “event” is near impossible. Finally, geopolitical tensions are more likely to escalate than de-escalate in coming years in our view. As a result, demand for gold is likely to remain strong.

In summary we continue to see a role for gold and gold equities in investors’ portfolios as a hedge against a range of imbalances and tail risks embedded in the global system.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.