We remain underweight the two major supermarket brands in Australia - Woolworths (WOW) and Coles (COL).

Supermarkets’ earnings received a ‘sugar hit’ from food inflation in recent years, but there is a risk this tailwind is easing. Cost pressures and elevated valuations are additional reasons for our underweight.

Summary

- Investors pay a premium for the supermarkets with low earnings growth over the medium term.

- The ‘sugar hit’ to earnings from food inflation is starting to sour.

- Cost of doing business (CODB) is still increasing (wages, rent, electricity), meaning operating margins could come under pressure.

- Woolworths Group (WOW) valuation is elevated and at risk.

- Collins Foods is our preferred food disinflation exposure.

The Supermarkets Have a Benign Long-term Earnings Growth Outlook

Australia’s 2 dominant supermarkets, Woolworths (WOW) and Coles (COL), both have relatively uncompelling long-term earnings growth prospects. Earnings are expected to grow 6% and 7% for WOW and COL, respectively, over the next 5 years.

As mature businesses operating as an effective market duopoly, there are limited levers available for the supermarkets to deliver revenue growth that is structurally higher than gross domestic product (GDP) growth in the long run. In the past, this conundrum has motivated forays into new verticals with limited success, the most notable example being WOW’s failed Masters hardware franchise, which accumulated losses of $3.2bn in 7 years.

The market is also getting more competitive. Aldi has taken market share over the last decade. There is certainly a risk to WOW and COL that Aldi continues to take market share, impeding long-term store rollout and volume growth for the supermarkets.

Therefore, given the sector’s uncompelling long-term growth outlook, we are structurally cautious the supermarkets.

Cyclical Tailwinds Fading?

Food price inflation has provided a ‘sugar hit’ to earnings

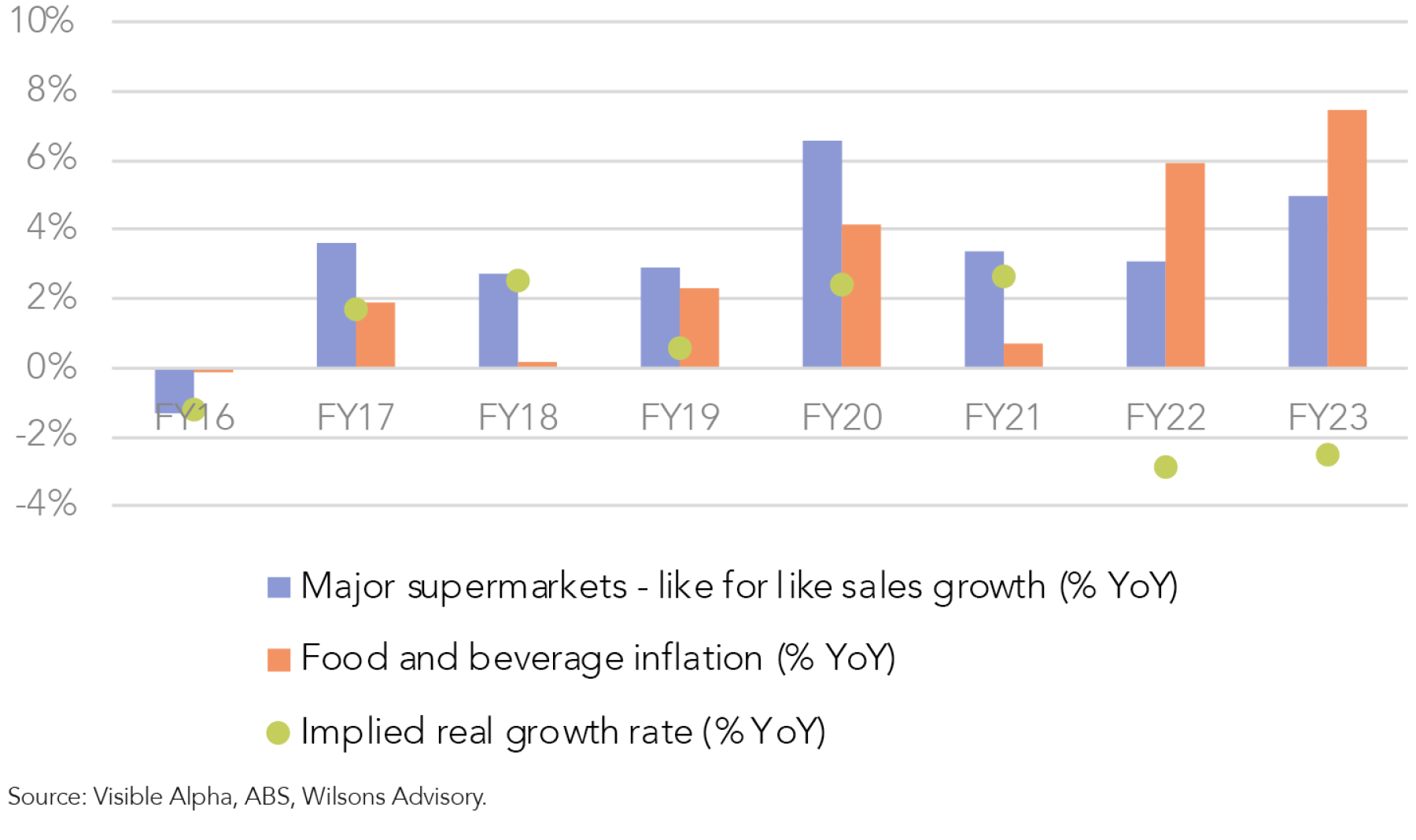

Supermarkets have historically benefited from periods of elevated food price inflation. Above-trend price growth provides a cyclical tailwind to the supermarket’s top line growth, and therefore to gross profits given their ability to pass on higher costs of goods sold (COGS) to consumers (as evidenced by their relatively stable gross margins over time).

This tailwind has been clear in FY22 and FY23 for both WOW and COL, as food prices accelerated at their fastest rate in more than 15 years, providing a significant boost to earnings. In fact, in the last 2 financial years, the sole driver of both WOW and COL’s positive like-for-like sales growth has been price inflation, with both companies’ Australian supermarkets posting negative ‘real growth’ (i.e. after adjusting for inflation) in these years.

Earnings downside from food disinflation

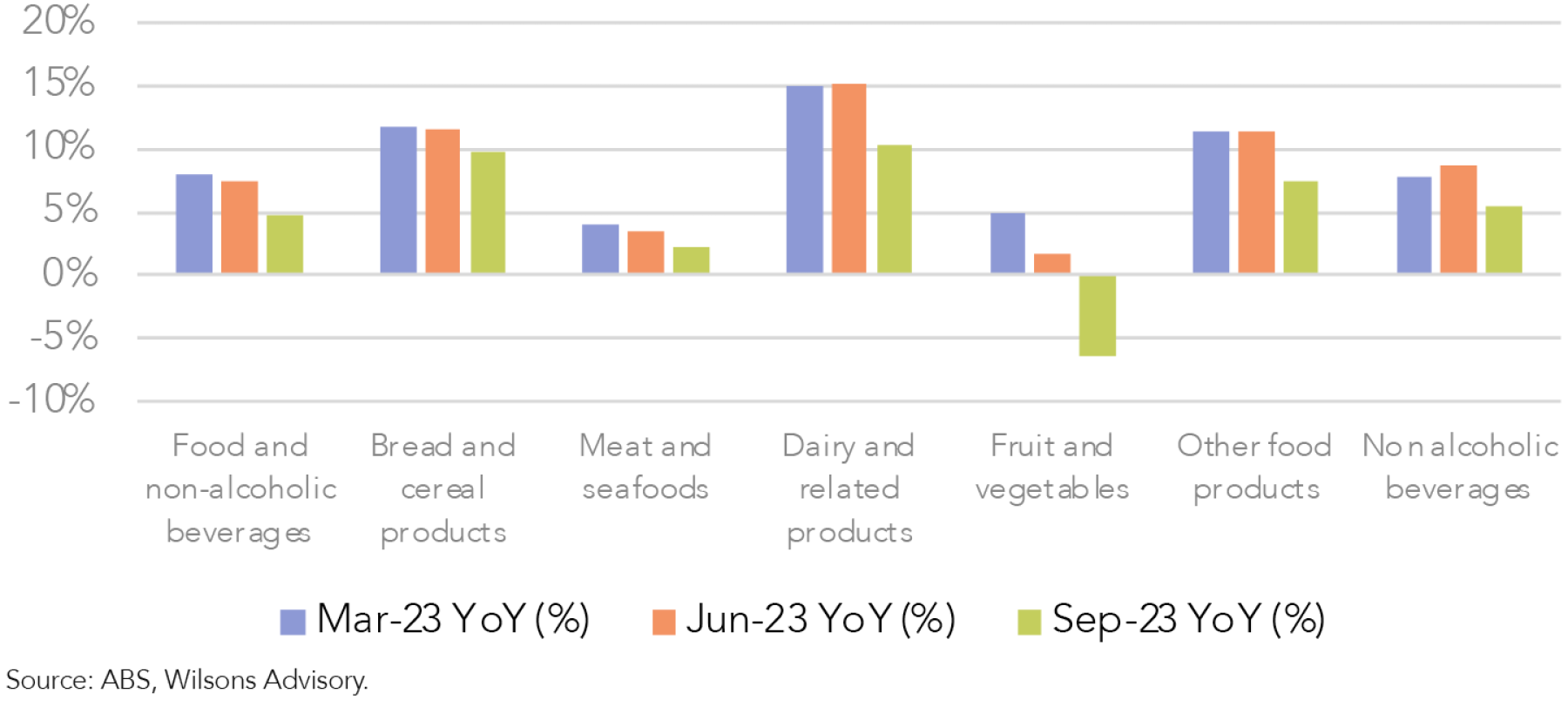

Food price inflation is now falling after peaking in Q4 of 2022, and deflation is now evident within a range of categories (e.g. fruit and veg), which means the ‘sugar hit’ to the supermarket’s revenues is quickly fading.

Leading indicators point to further disinflation (and deflation) in the prices of supermarket goods. The UN Food and Agriculture Organization (FAO) Food Price Index, which tracks the global prices of a basket of food commodities (e.g. cereals, sugar), has been declining since late 2022. Industry data from the Australian Bureau of Agricultural and Resource Economics has demonstrated significant deflation in the prices of a large number of domestic agricultural commodities (e.g. wheat, beef, canola) and futures markets also point to further softening in the prices of various soft commodities.

Soft commodity prices have a directional relationship with the eventual retail prices of both fresh and non-perishable (i.e. FMCG) food products, which therefore suggests supermarket prices are likely to ease further in the next 12-18 months, as lower raw material / input costs work their way through the supply chain.

A disinflationary or deflationary environment will make it increasingly difficult for the supermarkets to deliver above-market revenue growth without a material lift in basket sizes / real growth, which we view as unlikely over the medium term considering the already challenged consumer backdrop amidst cost of living pressures and added (trade down) competition from Aldi.

| Indicator | YoY % change |

| Selected world indicator prices | |

| Wheat – US no. 2 hard red winter wheat, fob Gulf | -33% |

| Corn – US no. 2 yellow corn, fob Gulf | -33% |

| Canola – Rapeseed, Canada, fob Vancouver | -21% |

| Sugar – Intercontinental Exchange, nearby futures, no.11 contract | 47% |

| Selected Australian grain export prices | |

| Milling Wheat – APW, Port Adelaide, SA | -22% |

| Feed Wheat – ASW, Port Adelaide, SA | -18% |

| Canola – Kwinana, WA | -28% |

| Selected domestic livestock indicator prices | |

| Beef – Eastern Young Cattle Indicator | -64% |

| Lamb – National Trade Lamb Indicator | -36% |

| Pig – Eastern Seaboard (60.1–75 kg), average of buyers & sellers | 0% |

| Global Dairy Trade (GDT) weighted average prices | |

| Dairy – Whole milk powder | -13% |

| Dairy – Cheddar cheese | -15% |

Source: Australian Department of Agriculture, Fisheries and Forestry – Weekly Commodity Price Update as of 9 November 2023; Wilsons Advisory.

Operating Margins Could Be under Pressure as CODB Likely to Remain Elevated

While COGS are likely to ease over the medium term, the supermarket’s ‘cost of doing business’ (CODB) has risen materially and is likely to remain ‘higher for longer’ in our view.

Wages – Employee benefits are by far the largest expense item for supermarkets. Following the Fair Work Commission’s 5.75% increase to the minimum wage, effective 1 July 2023, employee benefits expenses are poised to structurally increase in FY24 and are likely to remain elevated over the medium term. Wages account for a significant portion (+50%) of opex and are therefore a significant driver of cost growth.

Rent – Supermarket occupancy costs are rising in line with periodic rental escalators, which are typically based on long-term leases with a mix of annual CPI/fixed/turnover-based rent reviews.

Energy – Electricity and gas costs have risen ~15% this year, according to CPI data in September. We expect electricity and gas costs to remain structurally elevated over the long term, consistent with our ‘higher-for-longer’ outlook for energy markets.

Negative Jaws Closing

The combination of a weaker revenue growth outlook, combined with structurally elevated operating costs, could result in ‘negative jaws,’ with expenses outpacing revenue growth. This augurs poorly for supermarket operating margins over the medium term, where risks are skewed to the downside (vs consensus) in our view.

Disinflation/Deflation Could Trigger Valuations to De-rate

There are downside risks to the supermarket valuation multiples as we transition to a lower inflation regime.

Analysis of WOW’s valuation over the past 3 decades shows that its PE multiple has, on average, re-rated higher in periods of elevated food price inflation, which reflects the cyclical tailwinds prevalent in this environment. Conversely, when transitioning to a ‘normal’ or deflationary price regime, the company’s PE multiple has on average de-rated significantly lower to reflect a more cyclically challenging environment. As a consequence, WOW has struggled to outperform in periods of falling food price inflation.

Therefore, considering food inflation is likely to keep decelerating, while both WOW and COL’s PE multiples remain elevated at above average levels, in our view there is further downside to both company’s valuation multiples (and relative performance vs the market) over the medium term.

Where We See Better Value in the Consumer Space – Collins Foods (CKF)

Unlike the supermarkets, Collins Foods’ (CKF) margins have been hit by higher inflation (chicken, wheat, canola oil prices). A fall in food inflation should benefit CKF’s margins over the next 12-24 months, as costs fall and prices stay elevated.

CKF provides resilience in the face of a slowdown; even with rising prices in the past 12 months, demand has remained steady for CKF, highlighting the resilience of CKF’s demand profile. Other factors supporting our positive view on CKF are:

Structural growth – CKF is still rolling out restaurants in Australia and the Netherlands, and this will be a key driver of growth over the medium term.

Valuation attractive – Trading on a PE of ~18x (below its 10-year average of ~20x) with expected annual earnings growth of 23% over the next 3 years, CKF’s valuation looks attractive, in our view.

Written by

Rob Crookston, Equity Strategist

Rob is an experienced research analyst with a background in both equity strategy and macroeconomics. He has a strong knowledge of equity strategy, asset allocation, and financial and econometric modelling.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.