Bond yield movements have been attracting heightened attention recently, with competing narratives buffeting bond markets.

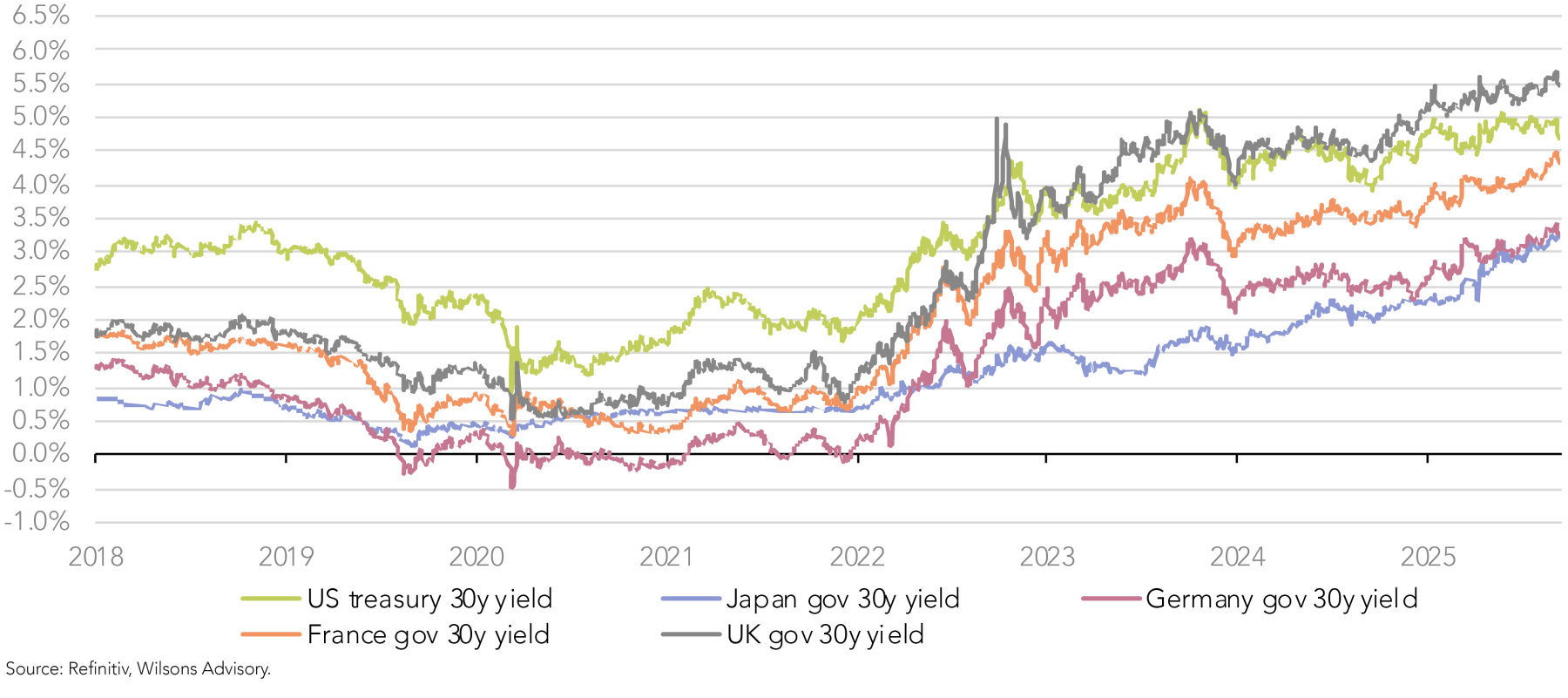

The very long end of yield curves (particularly 30-year yields) have been rising across the G7 as concerns around fiscal sustainability bubble to the surface again.

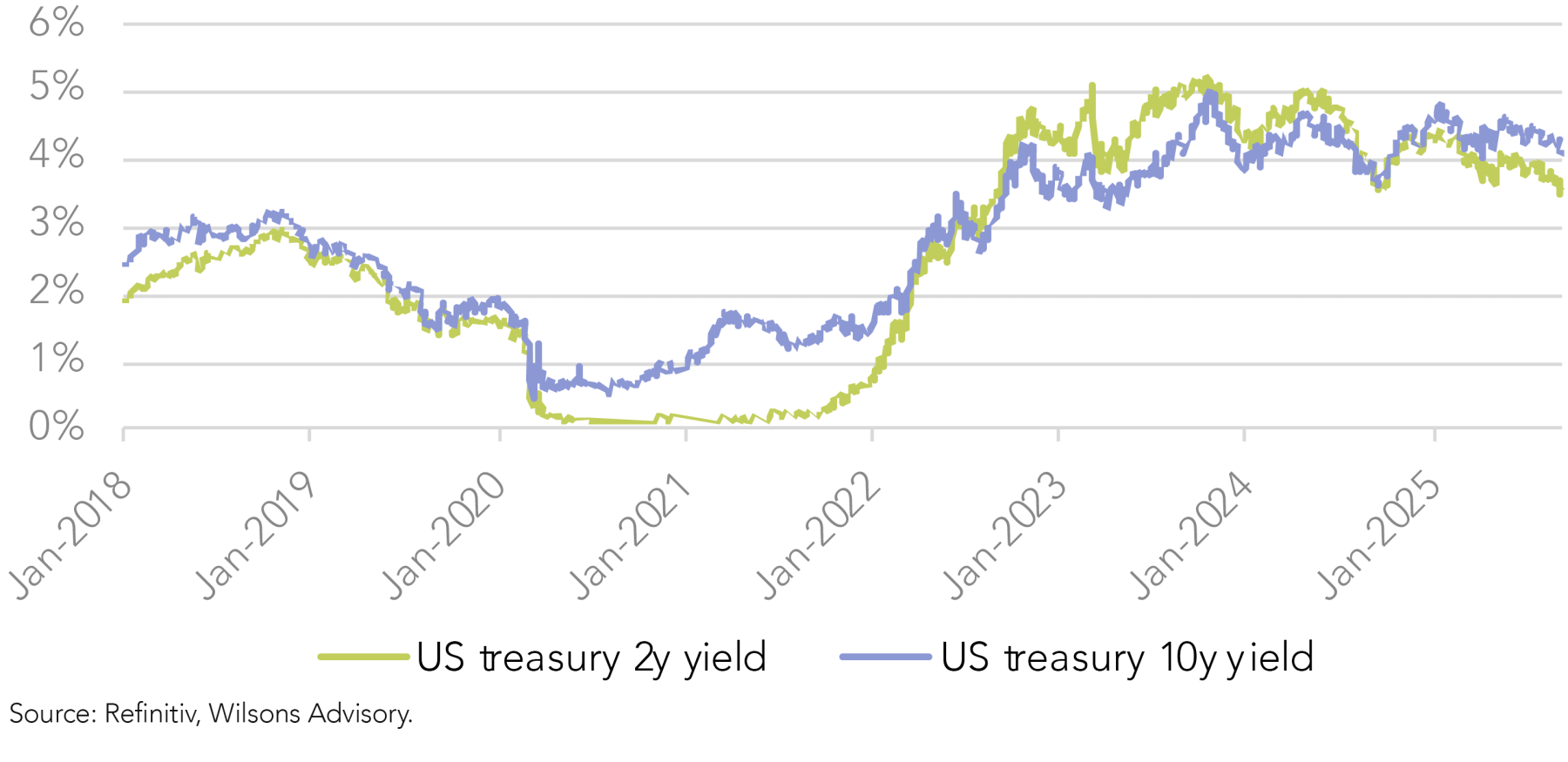

Just when this narrative was beginning to capture significant investor attention, signs of a weakening US economy (in labour market data in particular) has strengthened expectations for multiple Fed rate cuts in coming months. This has dragged yields lower across the curve. Benchmark US 2-year and 10-year yields have fallen significantly since early August, as two successive weak labour market prints have raised expectations for Fed rate cuts.

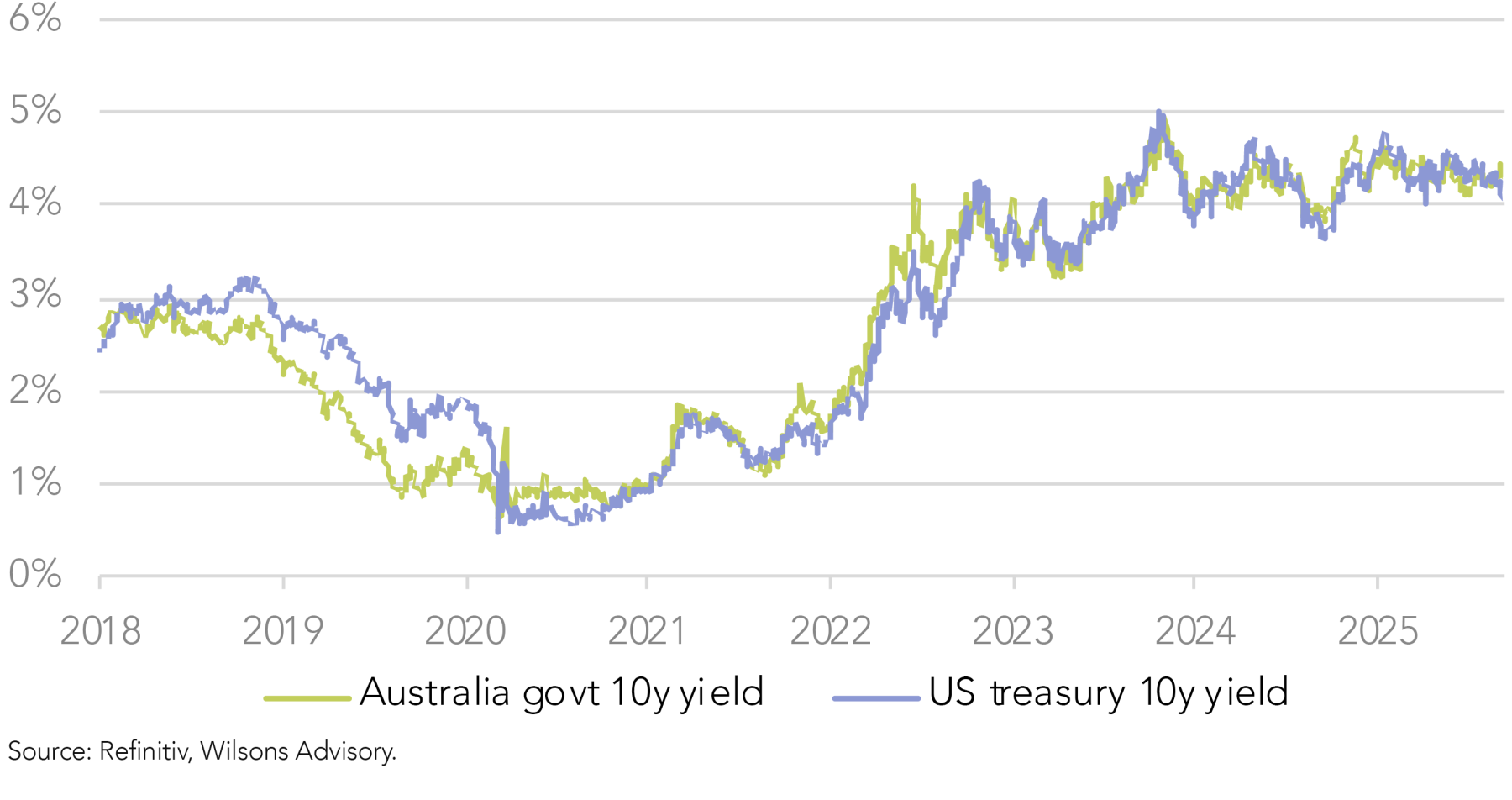

The Australian bond market has also been buffeted by these global forces, as well as seen some domestically induced bond yield volatility. The recent better-than-expected GDP print in early September drove a brief spike in local bond yields.

However, domestic bond yields have also been wound back over the last week or two, in line with the global bond yield shift.

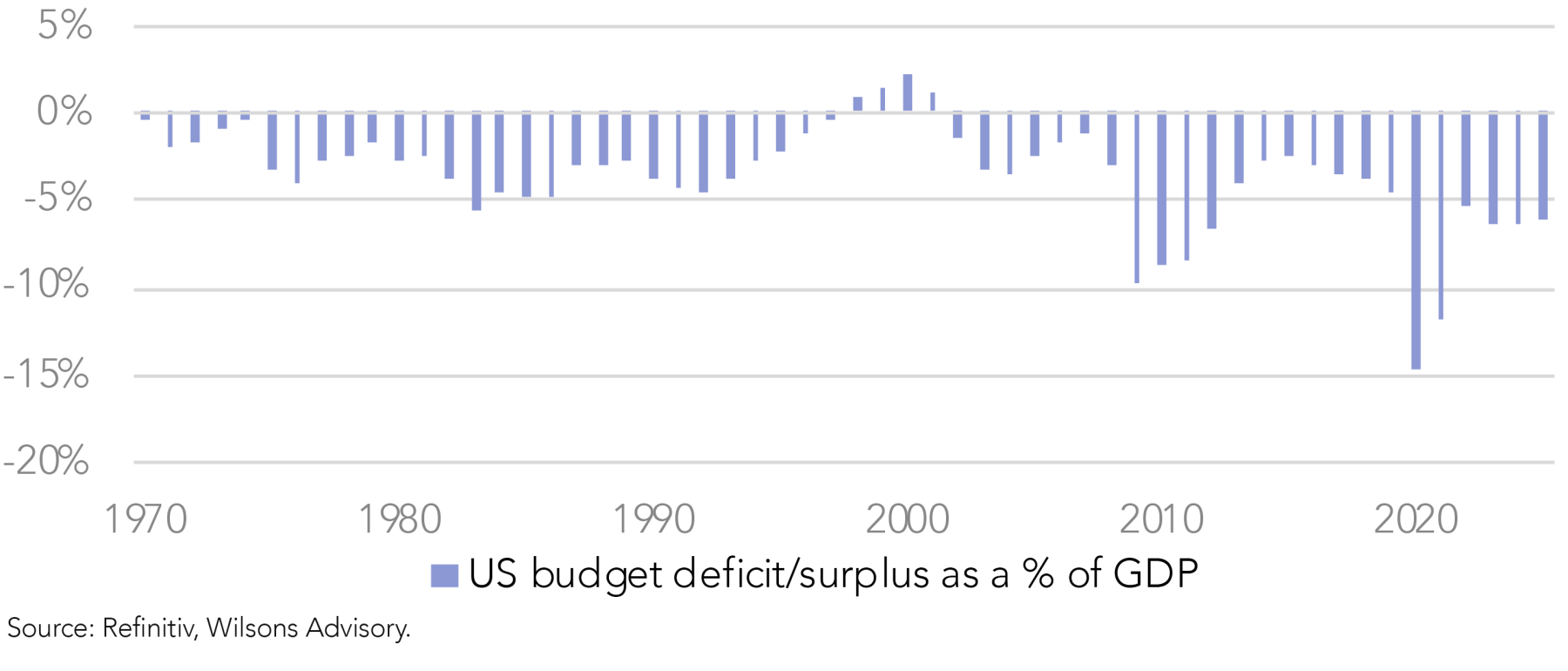

Bond markets appear to be caught between the “bond-bearish” narrative of excessive budget deficits across many major economies and the “bond-bullish” narrative of slower economic growth and lower policy rates.

The Fed’s Inflation versus Labour Market Dilemma

The past week delivered some new information on the US inflation and labour market backdrop. US headline CPI rose 0.4% in August, the biggest gain since January, after increasing 0.2% in July. In the 12 months through August CPI advanced 2.9%, for the largest increase since January, after rising 2.7% in July. The headline figures were slightly higher than expected. Economists had forecast consumer prices would rise 0.3% in August and increase 2.9% on a year-over-year basis.

Excluding the volatile food and energy components, the CPI rose 0.35% (a touch above expectations) after a similar gain in July. In the 12 months through August, the core CPI inflation lifted 3.1%, matching July's rise.

The rise in core CPI inflation was relatively broad. Core goods prices increased 0.3%, with tariff-exposed products like new motor vehicles, motor vehicle parts and apparel all costing more. The increase in new vehicle prices was the largest in a number of months and could signal the start of tariff pass-through in this category. In services, healthcare costs fell as a recent sharp rise in dental services reversed, helping keep services inflation steady.

We suspect the broadening cost burden from tariffs will keep the monthly pace of goods inflation elevated through early next year, but the spill over into services inflation should be limited by the weakness in the jobs market. It is possible that foreign exporters and US importers are still absorbing a larger share of the cost of tariffs rather than passing it on to consumers. Given that most tariff pauses ended in early August, we expect firms to continue to adjust pricing, pushing inflation higher in coming months.

On the same day as the CPI release, the labour market's ongoing softening was underscored by a separate report from the US Labor Department, showing initial claims for state unemployment benefits jumped 27,000 to a seasonally adjusted 263,000 for the week ended September 6. This is the highest level since October 2021, albeit bad weather in Texas likely had some impact.

The interaction of rising inflation and softening employment creates a tricky policy trade-off for the Fed. Cutting rates too quickly risks embedding tariff-driven inflation, while delaying cuts risks amplifying unemployment. We agree with the market’s pricing that the Fed will attempt to look through tariff driven inflation pressures at least in the near term, and cut rates to protect the labour market.

No Bond Vigilantes in Foxholes

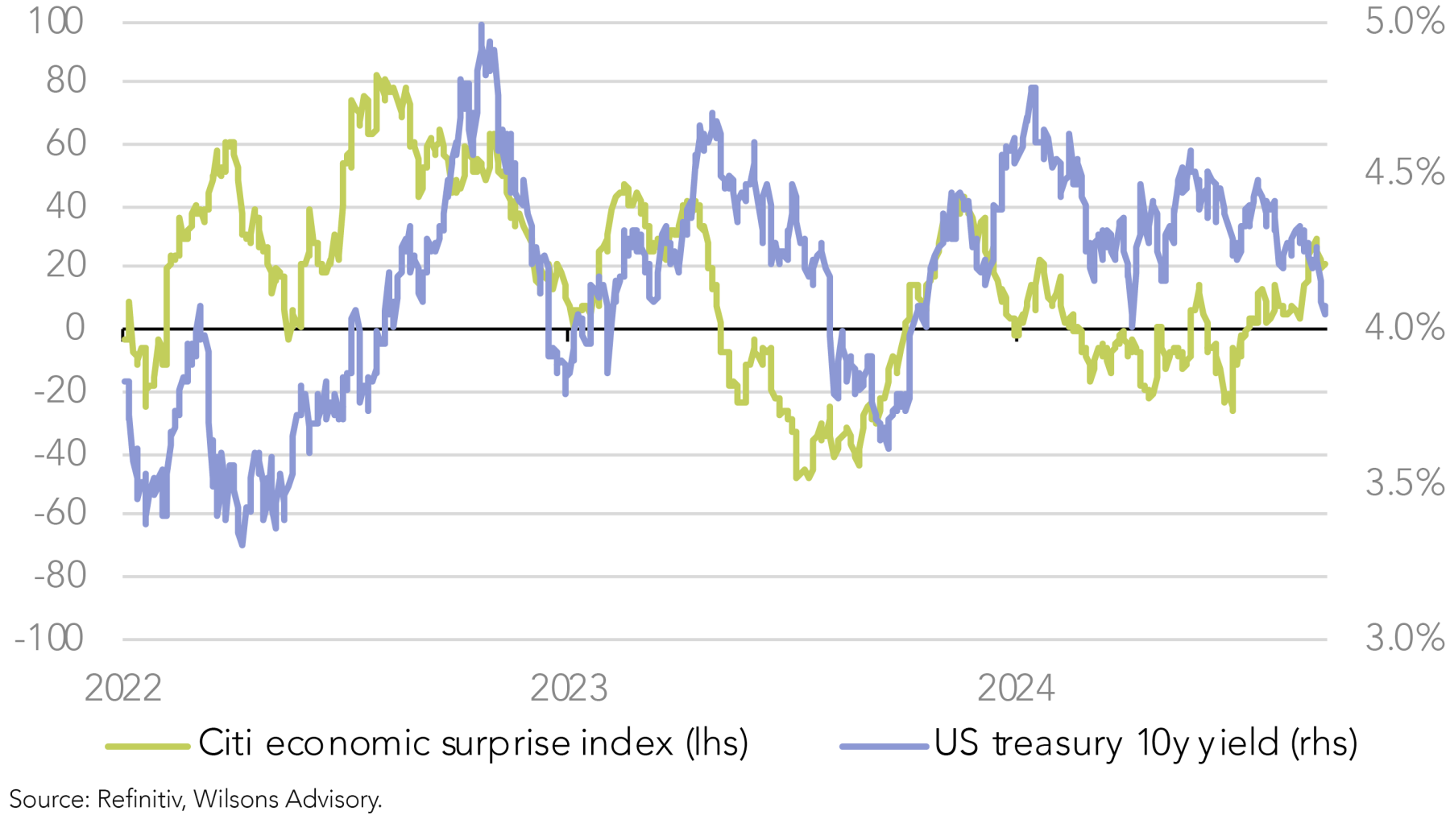

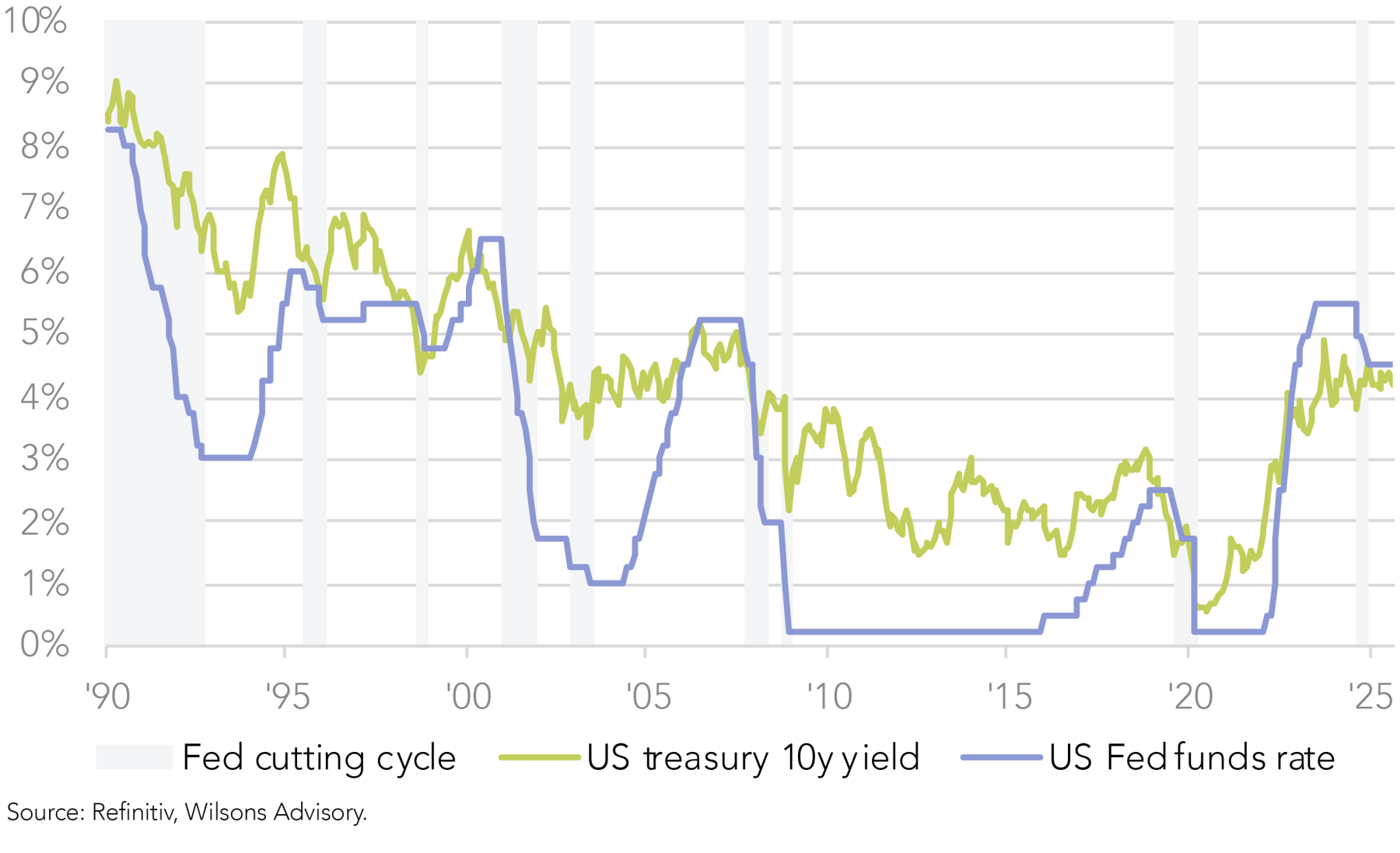

From this perspective, we believe the economic slowdown and monetary policy (easing) cycle will continue to dominate near-term and likely continue to drag bond yields lower into year end. We note the relatively strong historical linkage between the US economic surprise index and the short-term direction of 10-year yields. Perceptions of economic momentum continue to be very important for movements in bond yields, despite the persistence of large fiscal deficits. We also note the tendency of bond yields to fall as the central bank is cutting. Alongside the mathematical impact of cash rate expectations influencing yields further along the curve, a multi-cut easing cycle once again highlights the impact of a sustained soft period for the economy dragging bond yields lower.

It is interesting that in this current easing cycle, beginning with the Fed’s first rate cut in September 2024, US bond yields are actually higher so far. It could be argued that a rising (fiscal deficit) term premium in US yields has dominated this time around. We do note that yields did rally aggressively in the three months leading into the first cut in September last year. However, it does appear that concerns around fiscal sustainability have increased the term premia embedded in the US yield curve this cycle. From our perspective, this does suggest that any drop in bond yields in coming months could prove relatively fragile.

Indeed, a renewed growth re-acceleration next year combined with continued fiscal largesse in both the US and other G7 economies (i.e. Japan, France and the UK) could see renewed pressure on bond yields, particularly at the long end of yield curves.

By global standards, Australia has a relatively better fiscal position, so bond market tail risks are relatively lower, although Australia is unlikely to be immune from global bond market volatility.

In line with our US bond market view, we see the pull from lower policy rates both in the US and domestically as likely to drag domestic bond yields lower in coming months. However, as with the US, better growth next year could see some upward pressure re-emerge at some stage next year.

Domestic 10-year yields do still appear to have plenty of “term premium” relative to a terminal cash rate next year of 3.1% (based on the consensus view of two more cuts). As a result, our bias is to expect moderately lower 10-year yields on a three-to-six-month view. This would deliver some moderate capital gains to investors over and above the current solid running yield.

Staying Overweight Fixed Interest but Hedging with Gold

We retain our moderate overweight to fixed interest, with valuations and the cycle both looking supportive. This should also support equity markets, although a lot of optimism is already seemingly priced into both US and Australian equities.

Ongoing global fiscal largesse is a tail risk to monitor and could bubble up again next year, particularly if economic growth and inflation re-accelerate. We continue to hold an allocation to physical gold as a tail risk hedge against G7 fiscal irresponsibility.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.