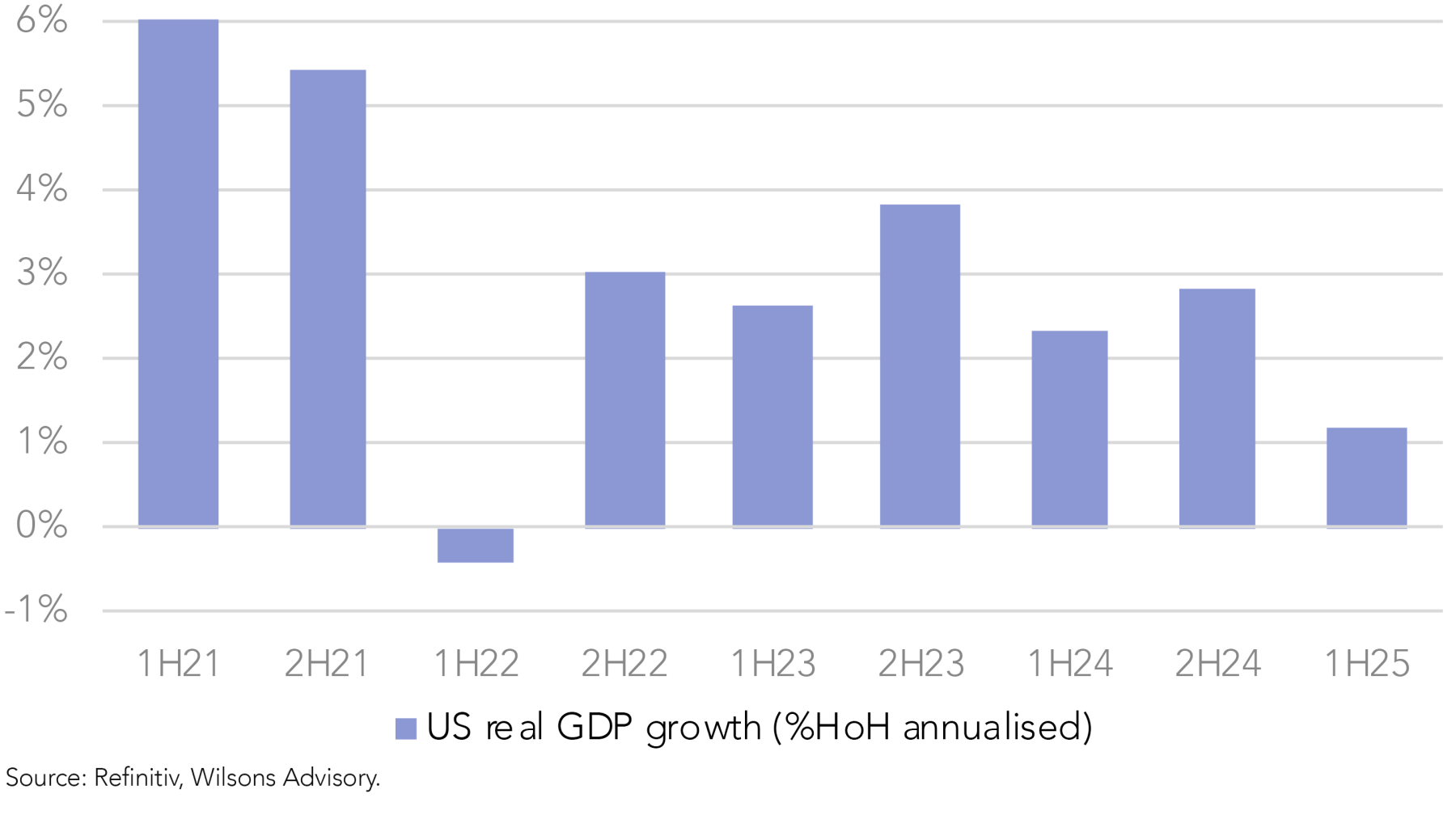

After an extended period of resilience, recent data releases suggest the US economy is losing momentum. Q2 GDP released earlier this month confirmed H1 growth of just 1.1% versus last year’s run rate of 2.6%.

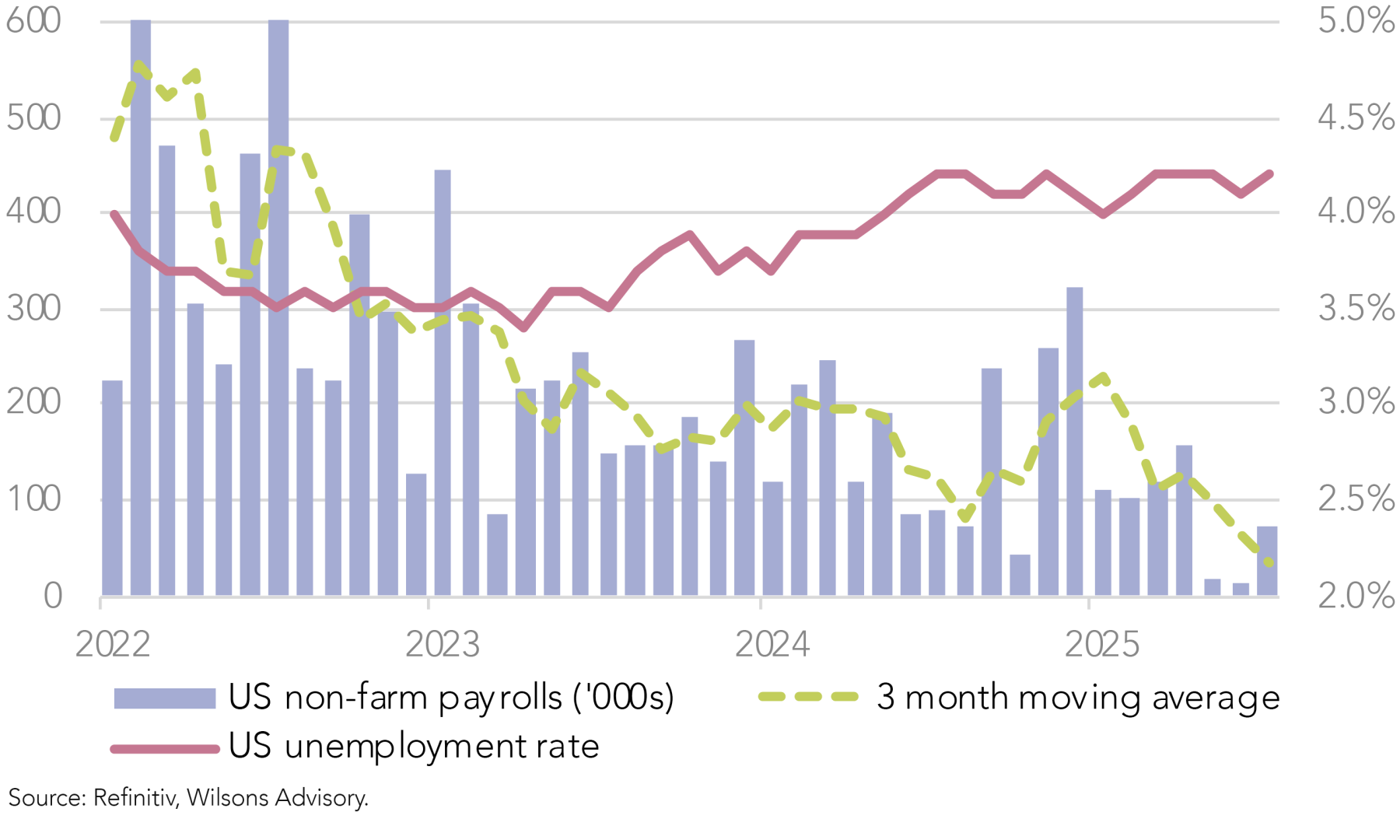

However, it was the recent (August 1) labour market report that produced the biggest surprise. July payrolls were on the soft side, at 73k new jobs versus expectations of 104k. More importantly, however, May and June saw large downward revisions of 125k and 133k respectively. While monthly revisions to recent months are quite normal, the magnitude of the July 2025 revision was exceptional, representing the largest such adjustment since 1978.

These downward revisions revealed a labour market generating less than 20k in monthly jobs growth in both May and June, taking the three-month moving average of jobs growth to an anaemic 35k per month. This compares to the “pre-release” three-month moving average of 150k, which was quite close to the long run pace of job creation.

Indeed, just two days before the payrolls release, Fed chairman Powell cited a robust labour market as a key reason that the Fed was in no hurry to cut interest rates.

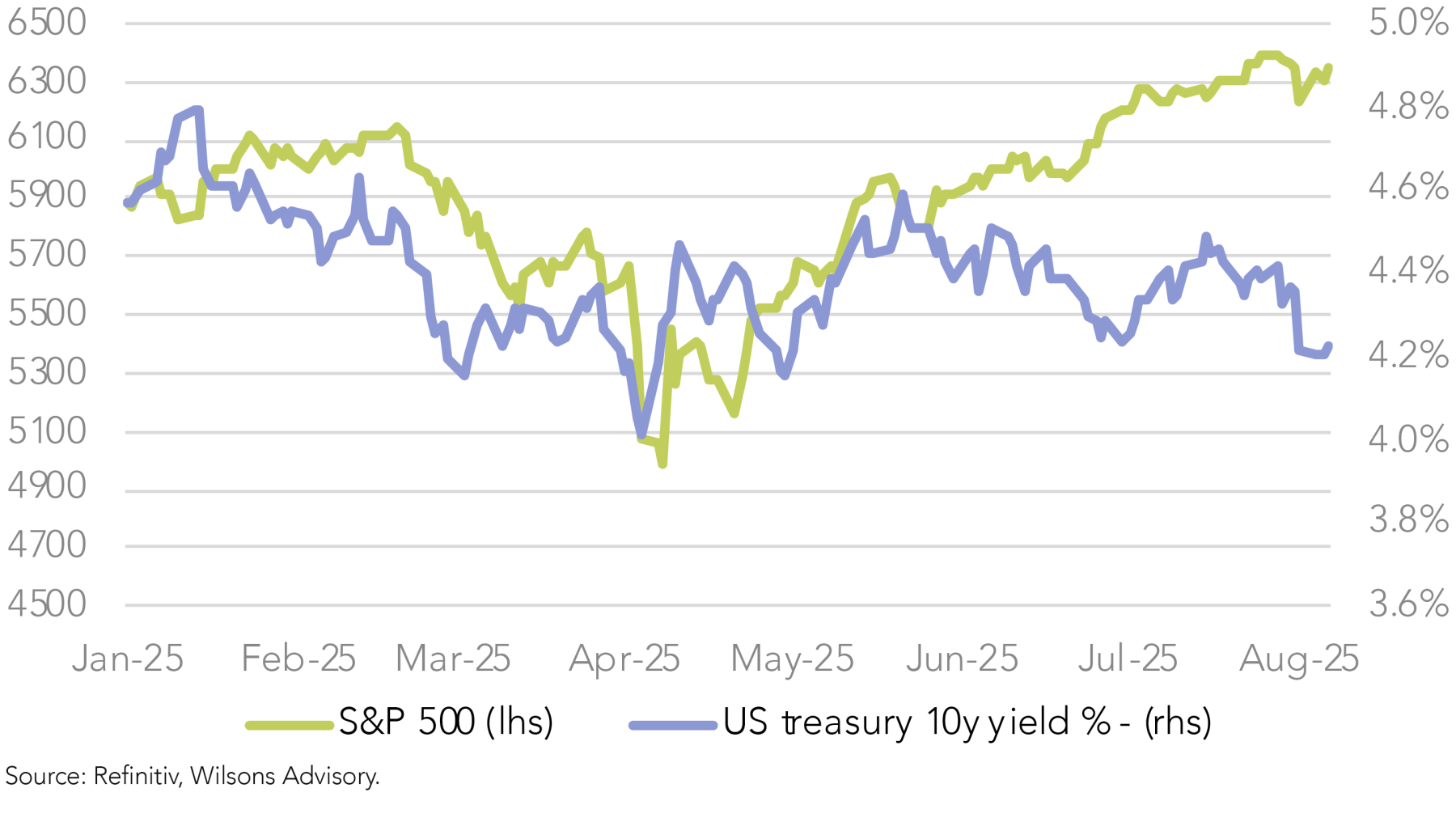

The reaction of the market to the weak labour market figures was dramatic, with 10-year bond yields falling 16 basis points and the two-year yield falling 27 basis points. Expectations for a Fed rate cut in September, which had dropped from a 65% probability to 45% post Powell’s “hawkish” policy press conference two days earlier, spiked to over 90% post the downward revision of the labour market data. US equities fell 1.6% on the day, although stocks have subsequently recovered much of this fall.

Trump Shoots the Slowdown Messenger

With such large revisions to the employment picture in recent months, the “credibility” of the data came under scrutiny and prompted President Trump to fire the head of the Bureau of Labor Statistics hours after its release. While Trump’s “shoot the messenger” approach is quite disconcerting, the market seems to be becoming desensitized to such outlandish actions, with equities managing to stage a sharp rebound early last week.

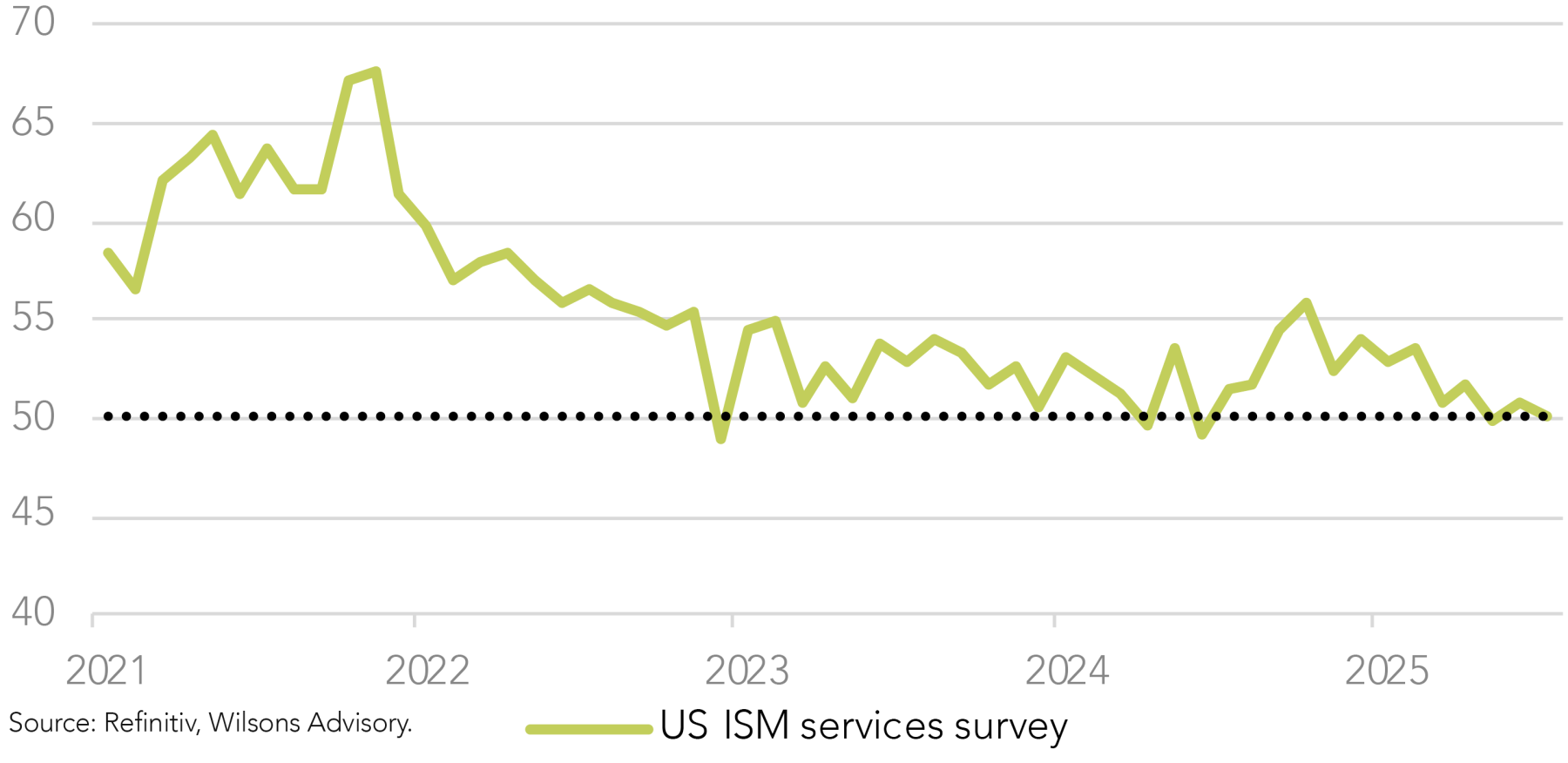

Following on from last week’s shock labour market print, the ISM service sector business conditions survey also reinforced the message of a slowing US economy, falling from 50.8 to 50.1. Indeed, the employment sub-index came in at a very weak 46.4 (i.e. a contracting labour market).

In terms of the official data, the unemployment rate, which the Fed is arguably more focused on than non-farm payrolls, ticked up to 4.25% from 4.12%. This is not a huge deterioration and still a very low level of unemployment, but the stalling in job creation is often a recessionary precursor and would likely worry the Fed.

Why are equities remaining relatively resilient into what is seemingly an economy threatening to stall under the weight of uncertainty created by Trump’s tariff policy and general policy unpredictability?

Equities taking their cue from a resilient earnings season

A key reason behind the resilience in equity markets is that in contrast to the economic data, the current Q2 earning season has been, once again, better than expected. In aggregate, US earnings continue to show resilience, although the tech sector is doing a lot of the heavy lifting.

We are now ~80% of the way through the Q2 reporting season and over 80% of companies have reported a positive EPS surprise. Year-on-year earnings growth for the second quarter is now averaging ~10% compared to a 5% estimate at June 30. This is in line with the growth rate seen in recent quarters and very impressive in a longer-term historical context.

Perhaps indicative of the evidence of slowdown within the economic data is that earnings results are showing something of a two-tiered market, with the tech sector mostly very strong (led by the mega caps) while other areas are less robust. This includes many areas linked to consumer spending. Indeed, while tech sector earnings growth is close to 20%, ex-tech growth is more mundane, averaging in the low single digits. So while the AI narrative appears on a firm footing, consumer and tariff exposed sectors appear more fragile.

Given the size of the tech sector, its ongoing strength has been enough to keep the market buoyant - though the narrowing of performance is somewhat cautionary.

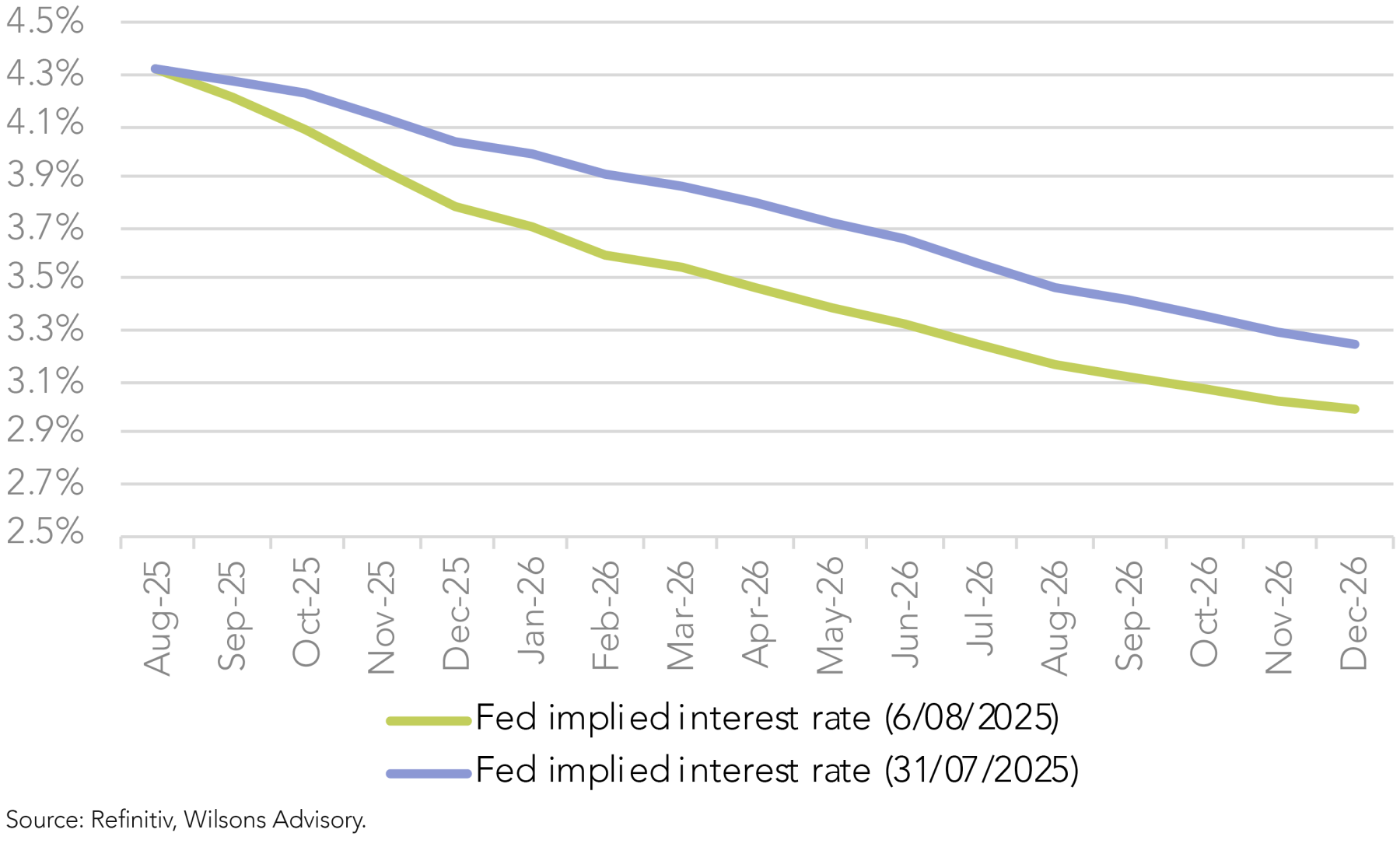

The Fed Put Back in Play?

Arguably another reason the US market is shaking off bad economic news is that the market sees a rising probability that the Fed will cut rates at its next meeting (September 17) before implementing several follow-up cuts. The complication for the Fed is that inflation is likely to be in the early stages of a multi-month pick up, off the back of tariff-induced goods price rises.

So far, the evidence of inflation pass-through has been very minor, but we would expect more evidence of accelerating prices in this week’s August 12 CPI print. There are two CPI prints (and one labour market print) due between now and the next Fed meeting on 17 September. Tariff-driven inflation is likely to be a theme for CPI prints for several months.

We see US CPI annualising close to 4% through the second half of this year, up from the current ~2.5% level.

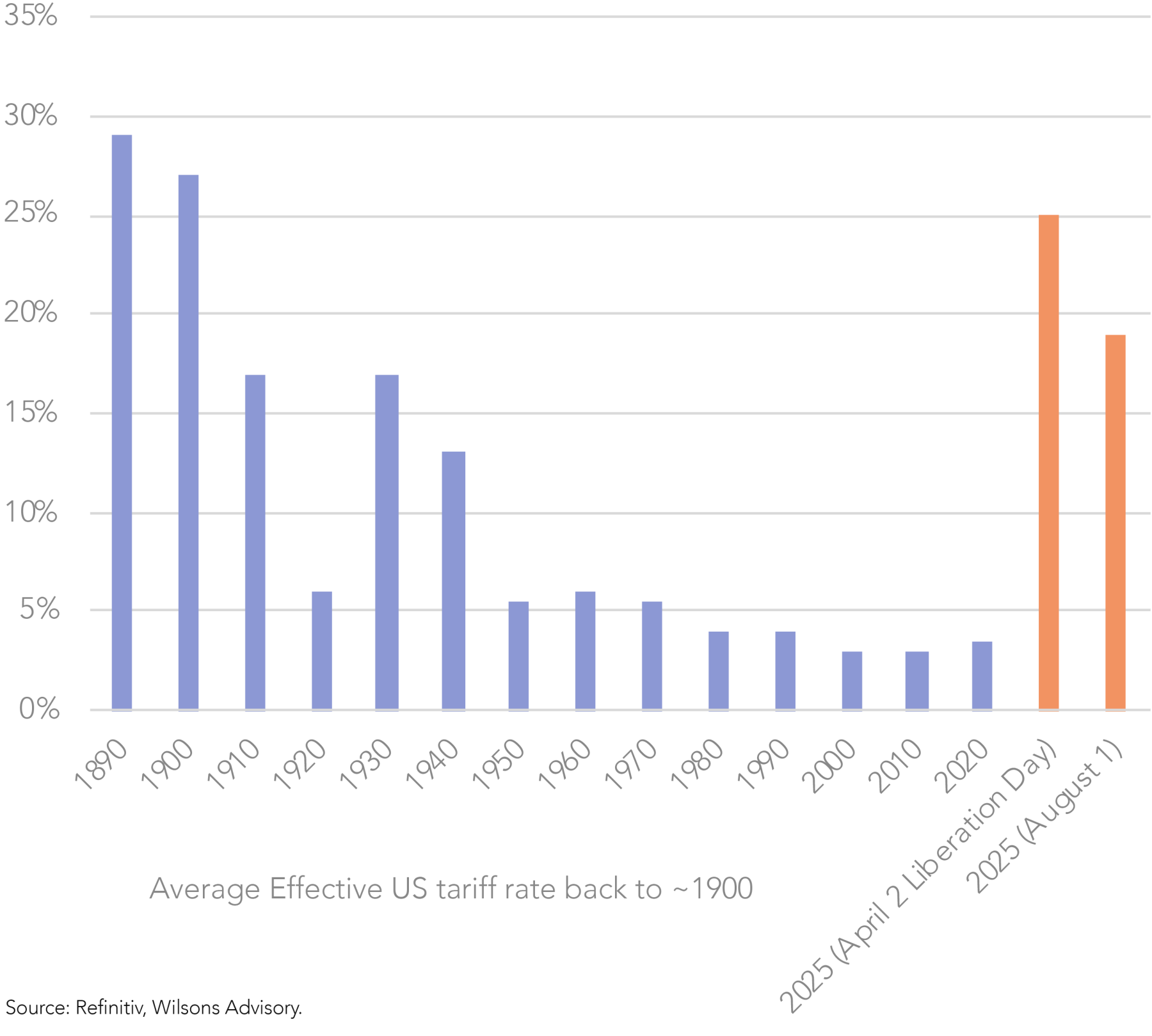

From a tariff perspective, last week President Trump announced an updated list of reciprocal tariffs, with the overall effective tariff rate now expected to land at a significant 19%. This is down from the 25% on Liberation Day, but up from only ~3% at the start of this year. The US equity market has largely shrugged off the recent “bad news” on tariffs. Powell himself noted that tariff effects on inflation might be seen as short-lived "one-time base effects". However, with worsening jobs data and signs of a spending slowdown, the potential impact of tariffs on both consumer spending and the CPI ultimately may prove hard to ignore.

We anticipate that the uptick in CPI from tariffs will not stop the Fed from easing policy, assuming the labour market continues to show softness. However a backdrop of stalling growth and rising inflation suggests an uncomfortable period for a currently buoyant equity market.

As a result, we see the near-term risk-return trade-off for stocks as not particularly favourable. Looking further ahead, the tariff-driven inflation spike should have run its course by year end and the prospect of multiple Fed rate cuts should help the US economy regain its footing in 2026. As a result, we see the 6-to-12-month outlook as decent. Longer term the US market should remain supported by significant structural technology sector tailwinds, so our caution is tactical rather than strategic.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.