The US exceptionalism theory posits that the United States is - from an economic standpoint - both different and “superior” in its economic, political, and cultural structures.

This has for some time been reflected in global capital flows, currency valuations, and equity market performance.

The debate over US exceptionalism, particularly from an economic and financial market perspective, has intensified in 2025, as global investors debate America's capacity for continued dominance, against a shifting geopolitical and macroeconomic landscape.

Structural proponents argue that the US continues to lead in innovation, productivity, and economic dynamism. They point to the country’s unique ability to attract capital, its entrepreneurial economy, its highly flexible labour markets and technology leadership as enduring strengths.

In contrast, sceptics highlight structural vulnerabilities - such as rising inequality, political polarization, an unsustainable government debt burden and a declining US dollar - as signs that US exceptionalism is waning.

Economic Foundations of US Exceptionalism

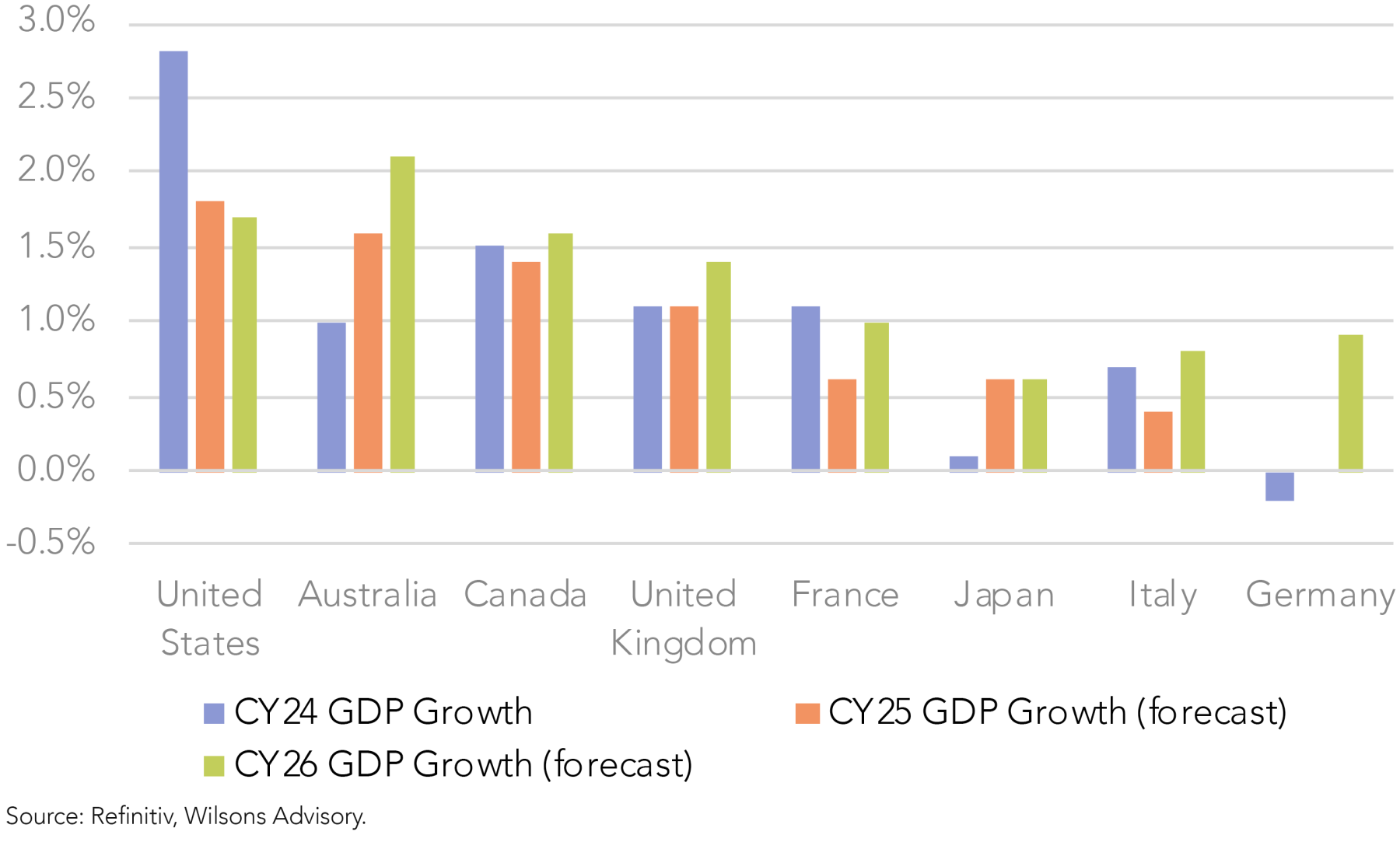

At the heart of the US exceptionalism narrative is the country's superior economic performance. The US has delivered superior economic growth relative to other G7 (developed) nations and in recent years it has also been stronger relative to Australia - a much smaller and historically faster growing economy.

This growth outperformance is largely attributed to superior productivity outcomes, but has also been supported by robust consumer spending, a strong labour market, and aggressive fiscal stimulus.

However, this growth leadership is not without its challenges. The US faces heightened policy uncertainty, particularly under President Trump’s second term, which has introduced significant new tariffs and immigration restrictions.

These policies, while potentially stimulative for domestic industries, also risk creating negative supply shocks and lifting inflationary pressures. These pressures will also likely act to constrain consumer spending.

The positive interpretation is that the US is undergoing some short term (cyclical) pain for some long-term gain, but exactly how much gain will be delivered from these trade and immigration policies is very much up for debate.

For example, will US trade policies spark a US corporate onshoring and foreign direct investment boom, or will persistent uncertainty hamper corporate investment within and into the US economy?

Our base case is that growth differentials do narrow in terms of growth outcomes for the next 12 months or so. However, we are not convinced that this will mark the end to superior US economic growth performance, particularly relative to Europe and Japan, when we consider their demographic and productivity headwinds.

Waning Exceptionalism and the Impact on the US Dollar

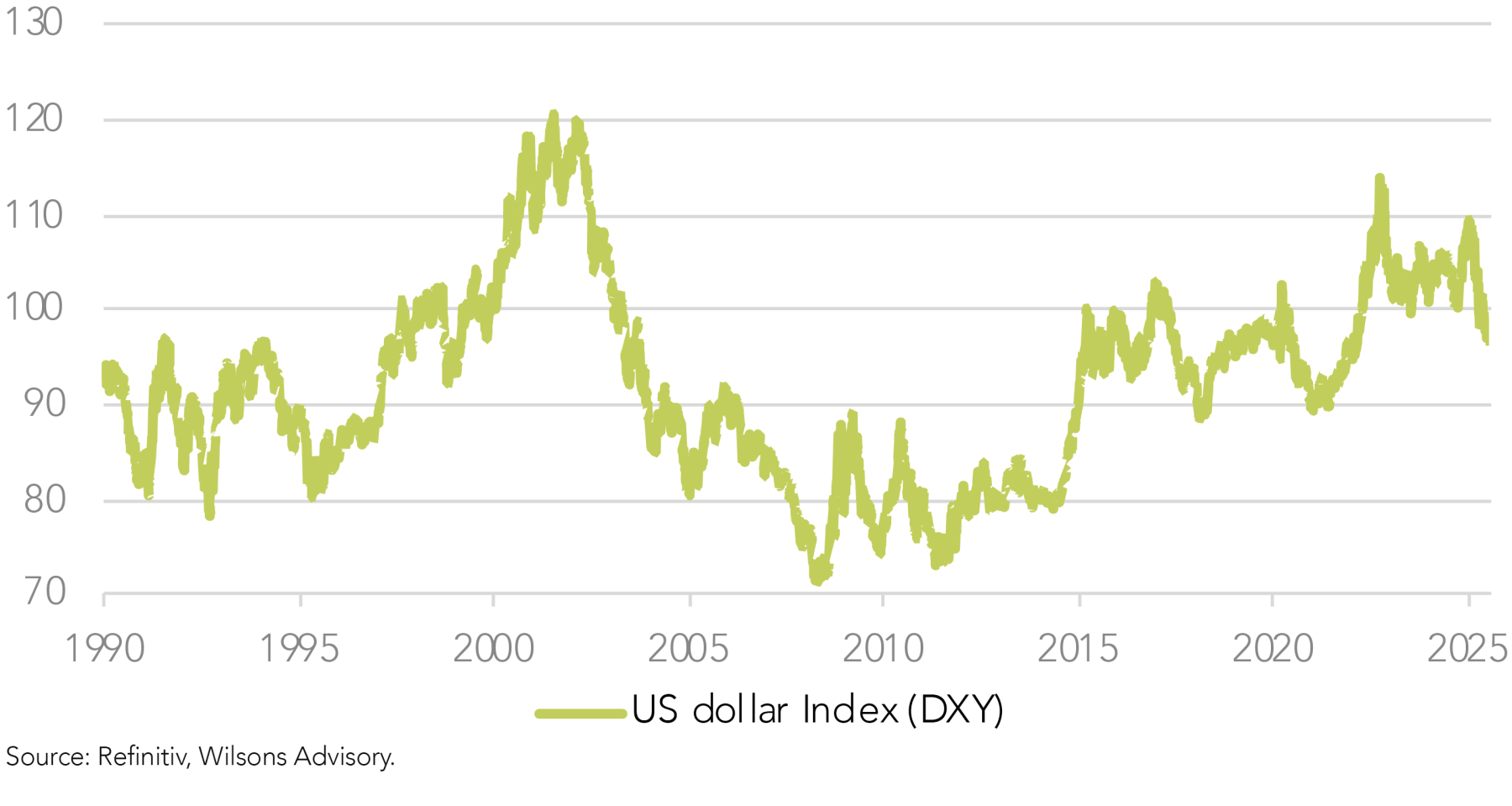

The US dollar has for some time been a key pillar of American exceptionalism, but has shown signs of vulnerability in 2025. After years of strength, the dollar reached a three-year low at the end of June.

This recent decline appears to be driven by several factors:

- Fiscal Deficits: Persistent and growing deficits have raised concerns about the long-term value and role of the dollar, prompting some central banks to diversify their reserves.

- US bond market jitters have been evidenced by a rising 10-year Treasury term premium. This suggests some growing investor unease about long-term fiscal sustainability, impacting both bond yields and the dollar.

- Policy Uncertainty: Unpredictable trade and immigration policies have also appeared to undermine investor confidence in the dollar, at least at the margin.

- Global Catch-Up: As other economies begin to recover and implement expansionary monetary and fiscal policies—such as Germany’s increased infrastructure spending—the relative attractiveness of the dollar has also diminished.

Despite these headwinds, the dollar is still not being seriously challenged as the default global reserve currency, and its decline has not yet triggered a wholesale shift away from US assets. However, the erosion of its dominance is arguably a signal that the foundations of US exceptionalism may be weakening.

US dollar - a baby bear?

We see it as likely that the US dollar unwind has further to go, particularly given that the US dollar still appears expensive against most of the major currency crosses, including the A$. However, we don’t see global economic conditions as likely to be as robust, as during the last genuine US$ bear market from 2002 to 2008, when the US$ basket index (DXY) fell from 120 to 70 (currently 98).

US Stock Market Dominance. Under Threat?

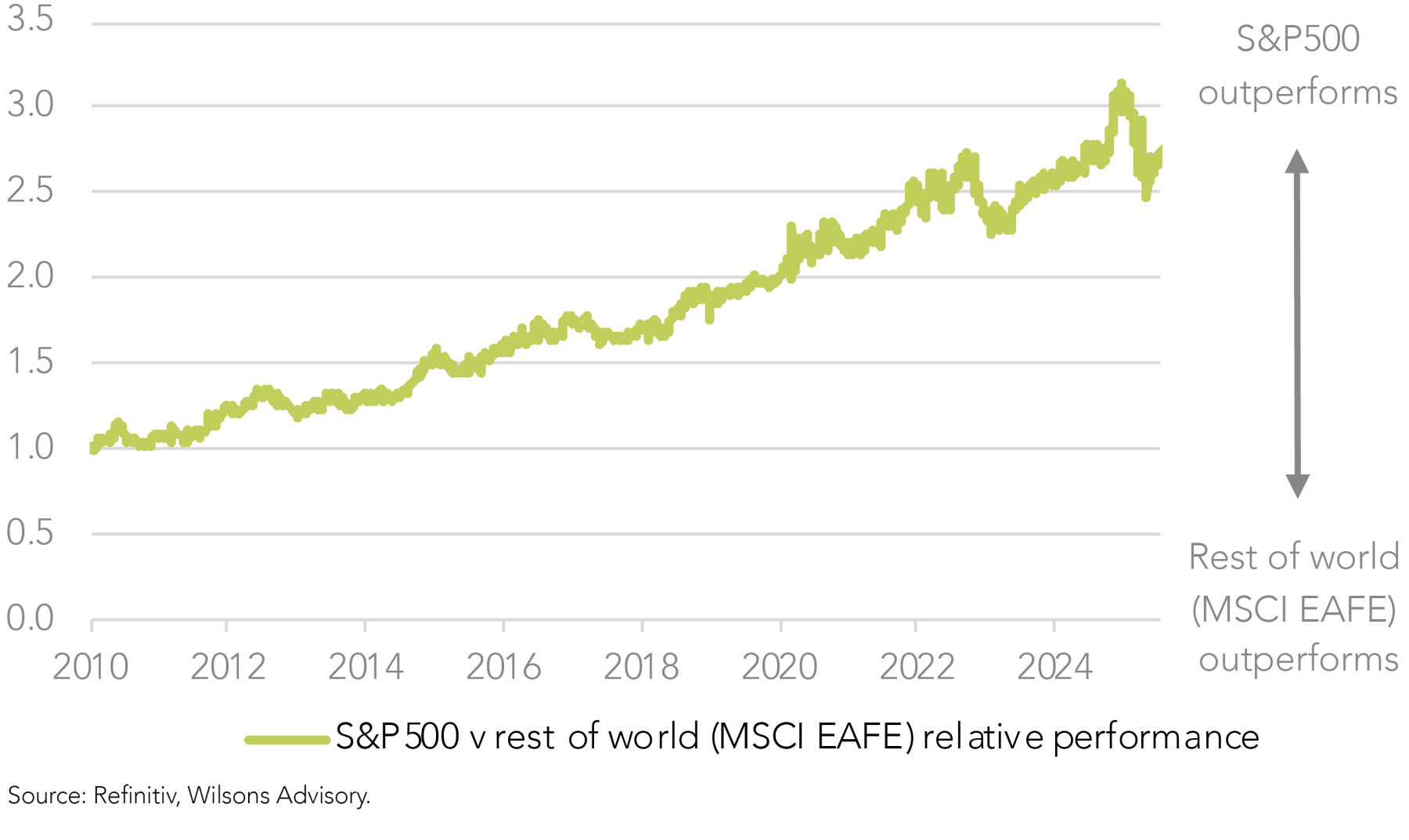

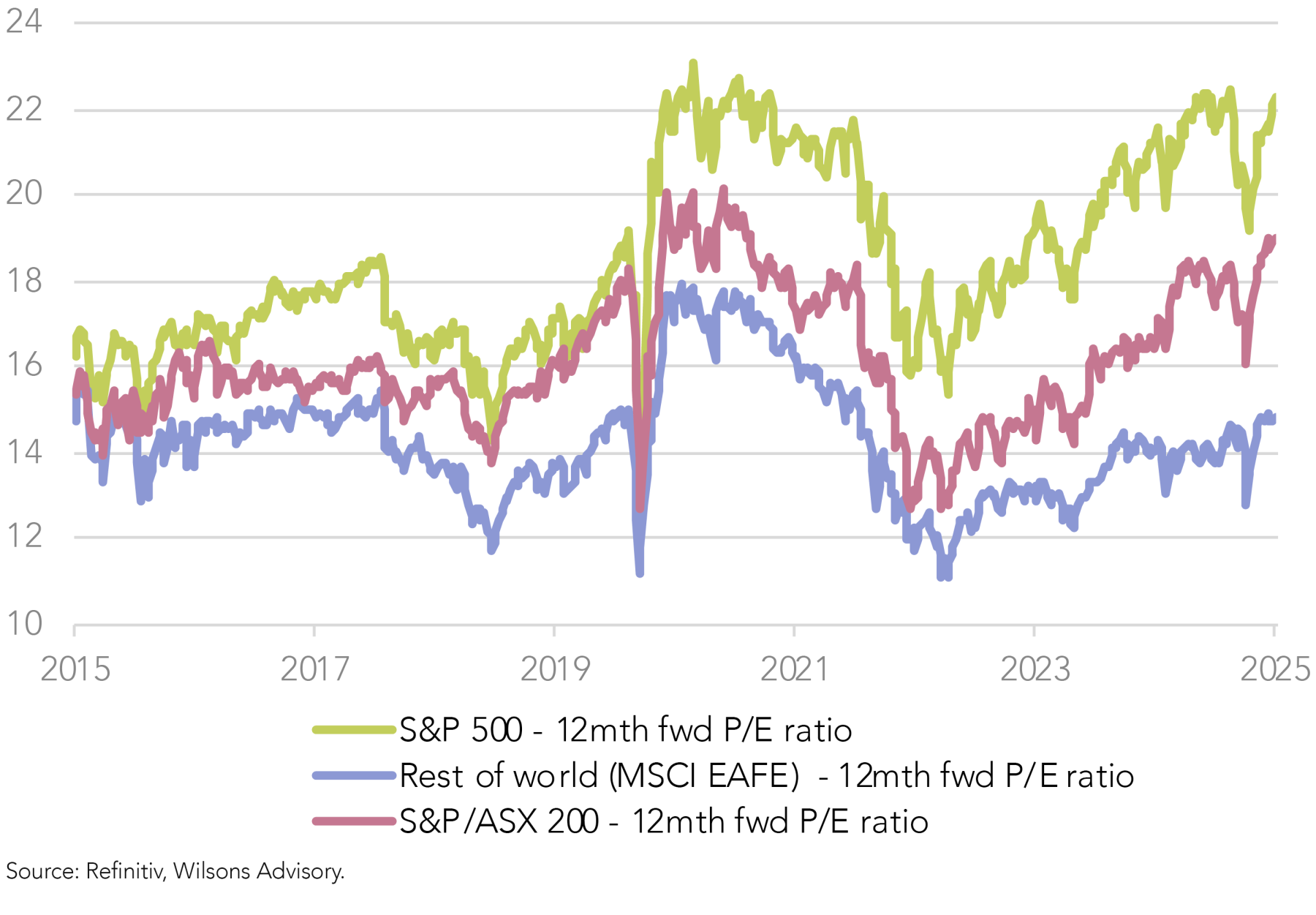

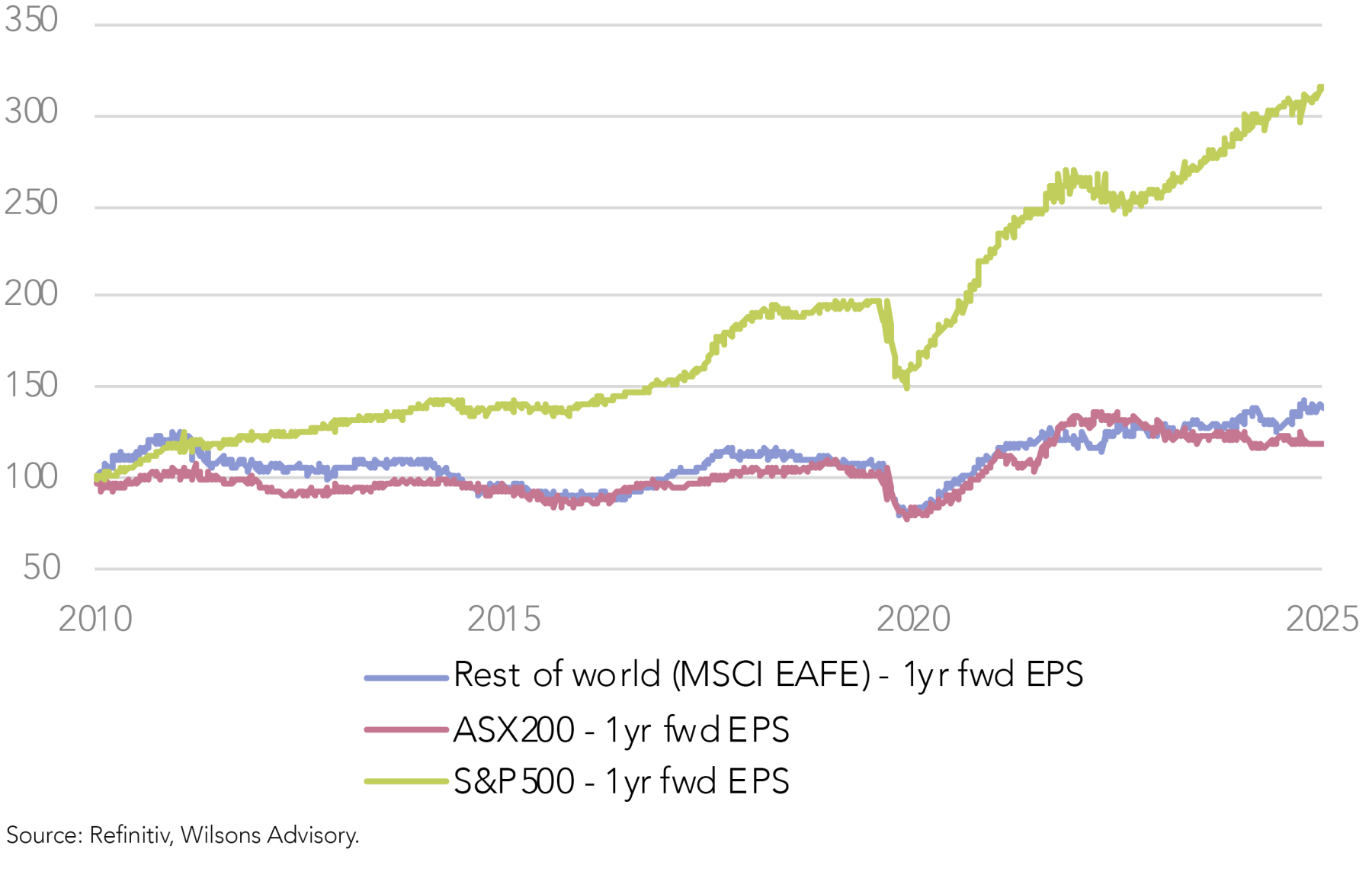

The US equity market has historically been a key driver of the US exceptionalism narrative. The S&P 500 has significantly outperformed global peers for an extended period, driven by superior earnings growth, which in turn has largely been driven by technology innovation and tech industry dominance.

However, 2025 has brought a more mixed picture. While the S&P 500 posted a 7% gain in the first half of the year, it underperformed the 18% delivered by the rest of the world (in US$ terms). Currency effects played a major role here, as the strengthening (10% based on the DXY index) of the many key currencies against the dollar reduced returns for international investors holding US assets. This dynamic has led some to question whether US equities can continue to deliver superior returns against a waning US$ backdrop.

Still, the structural advantages of the US - including deep capital markets, a culture of innovation, and strong corporate governance - remain intact. The rise of AI should support premium valuations and superior long-term growth in the US tech sector.

As a result, the US stock market may deliver a less exceptional performance in the near term, particularly when assessed in common currency terms. However, we doubt its propensity to deliver higher earnings growth than the rest of the world over the long-term is coming to an end.

Is US exceptionalism sustainable?

In summary, the current debate centres on whether US exceptionalism is a structural feature of the global economic and financial market landscape, or a transitory phenomenon that has reached its pinnacle.

US exceptionalism may persist in certain sectors, particularly technology but its broad-based dominance is currently being contested.

We see the dominance of the US dollar as definitely being tested at present. While there is no one serious rival to the US$ as a global reserve currency, investors are looking to at least diversify into other currencies, as well as currency alternatives such as gold and bitcoin. We continue to hold an allocation to physical gold and hold a partial currency hedge on global equity portfolios.

From an equity perspective, portfolio allocations are beginning to reflect a more multipolar world. However, we believe that the US stock market does remain exceptional in terms of the dominant position of many of its major companies, notwithstanding some performance drag from a weaker currency.

For investors, this means navigating a landscape where US assets are still attractive on a long-term basis, but where the US is no longer the only game in town.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.