The US Federal Reserve left the policy rate on hold (4.25%-to-4.5%) at last week’s FOMC meeting, as was widely expected. The FOMC signalled it remains comfortable with waiting to assess the impact of recent and upcoming policy changes from the Trump administration.

While conventional policy was left unchanged, the FOMC announced a slowing to its balance sheet run off (the unwinding of its QE programme). Beginning on April 1, the Committee said it would slow the pace of decline of its Treasury securities holdings by reducing the monthly redemption cap of runoff from $25 billion to $5 billion.

While the Fed downplayed the QT shift, there was a passing reference to tightening in money market conditions. The Fed’s decision to slow its balance sheet reduction appeared to support market sentiment. U.S. Treasury yields eased, with the benchmark 10-year note down 4 basis points on the day to 4.24%. U.S. stock indices extended their gains slightly after the release of the Fed's policy statement and projections, with the S&P 500 closing just over 1% higher on the day.

Growth Down, Inflation Up Leaves FOMC Steady at Two More Cuts This Year

The median assumption for Fed policy rates (the dot plot) was unchanged through the forecast period. That left the median expectation for 2025 at 3.875%, (2 cuts this year). The long-run or terminal funds rate forecast remained at 3.0%. This is below current market pricing of around 3.5%.

Core PCE inflation was revised up to 2.8% (it was previously at 2.5%). 2026 and 2027 inflation estimates were unchanged.

GDP growth was marked down to 1.7% for this year (was 2.1%) and edged down to 1.8% for 2026 (was 2.0%).

These updated quarterly forecasts are the Fed's first collective attempt to account for the first weeks of the new Trump administration, and the initial rollout of what White House officials say will ultimately be global tariffs on many imported goods.

For now, the Fed sees tariff inflation as a one-off jump in prices, hindering progress toward the inflation target for 2025 but not beyond. As a consequence, the Fed’s bias for policy rates remains down.

Fed Not Buying Trump’s MAGA Hype

Trump has promised a coming economic "golden age" created by his push to impose tariffs, deport large numbers of immigrants and loosen regulations. By contrast, however, the Fed forecasts growth at 1.7% this year, and just 1.8% in both 2026 and 2027. This suggests the Fed is not exactly giving a ringing endorsement for Trump’s policy platform. However, while the Fed has downgraded its near-term growth outlook, its

short- and medium-term forecasts are not far from its long-standing estimate for “potential growth”.

Apart from the Fed’s quantitative projections, the written or qualitative FOMC meeting statement was not much changed, which likely provided some comfort to a nervous market.

The Fed suggested that economic activity continues to expand at a “solid” pace and labour market conditions remain “solid”. Weekly jobless claims released the day after the Fed’s statement support its assessment that the labour market is relatively stable.

Chair Powell's press conference highlighted, however, the heightened level of uncertainty around the economic outlook, but was careful to reinforce the view that policy was “well-positioned”.

Powell downplayed the weakening in the “soft data” (mostly confidence surveys) and said the “hard data” still looks to be in "good shape."

"We're not going to be in any hurry to move," Powell said at his press conference, noting that uncertainty is "unusually elevated".

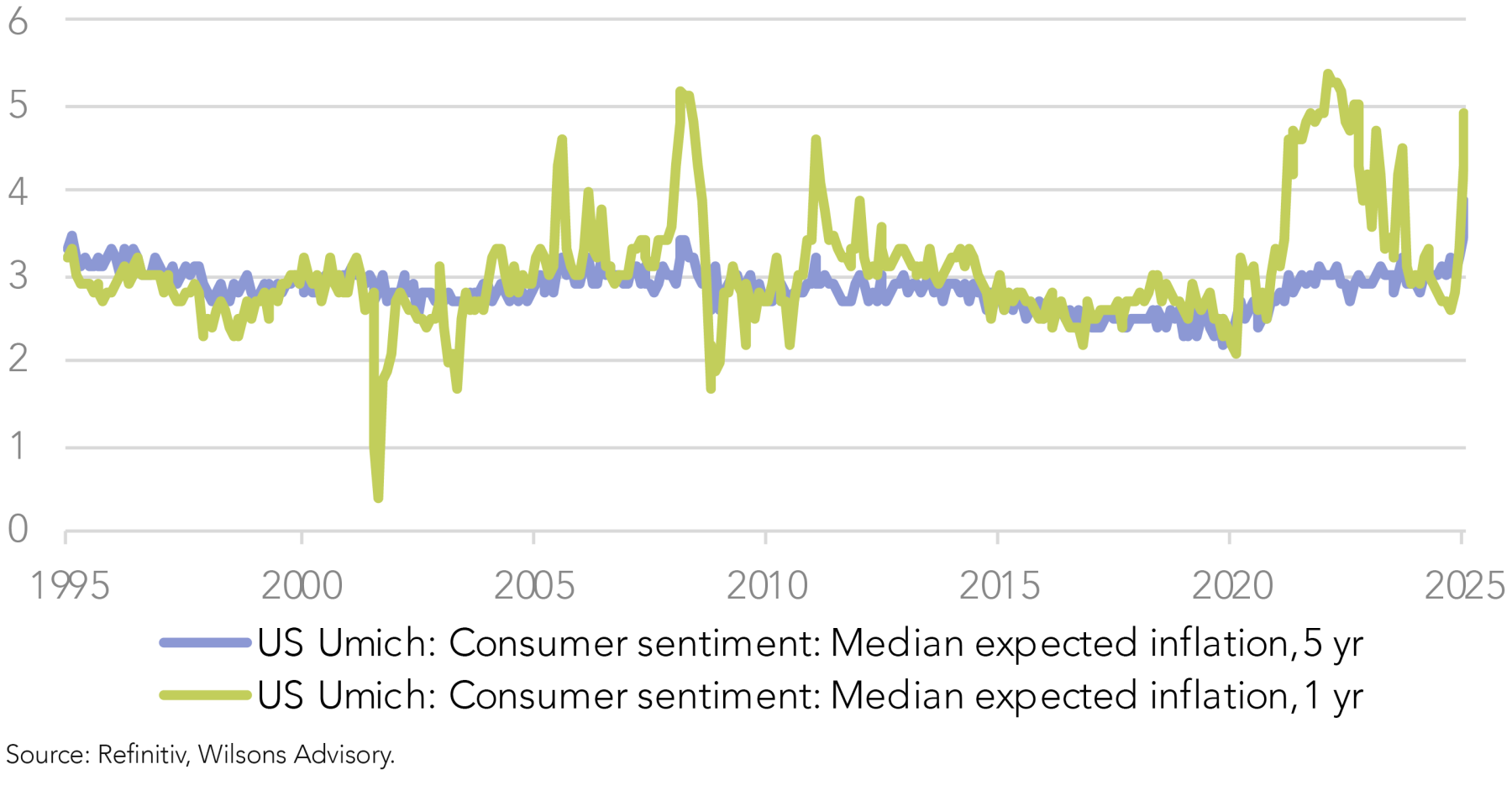

While not mentioning Trump or tariffs in its policy statement, the Fed's projections for higher inflation this year coincide with the unveiling of Trump’s tariff plans. Powell said tariffs certainly were a factor in those higher projections, but it was too early to know if the effects would be persistent enough to draw a policy response.

"There may be a delay in further progress over the course of this year," Powell said, referring to the central bank's 2% inflation target.

It appears, however, that the Fed for now is looking through the price shift involved in Trump’s tariffs, treating them as a one-off change (in its 2025 projection) rather than a persistent source of price pressures.

Investment View: Looking Through the Noise

An overdue cyclical slowing in the US economy, alongside a raft of new policy announcements from the Trump administration, has led to some weakening in US activity and confidence indicators. However, weakness remains more marked in soft relative to hard data - at least for the time being. Signs of a growth slowdown, alongside heightened policy uncertainty, has led to concern over the US economic outlook and prompted a ~10% fall in the US share market. The market has lifted a few percentage points off these levels in the past week, however, helped in part by the Fed’s relatively calm and composed assessment of the economy.

The Fed’s growth downgrade acknowledges both the softer recent data trend and the elevated levels of uncertainty, although its forecast implies a mild slowdown to trend-like growth, rather than a growth slump.

It does seem likely that tariff uncertainty and Elon Musk’s DOGE cutbacks to the size of the Federal public sector will weigh on near-term economic growth. However, we - like the Fed - remain in the slowdown, not the recession camp. Personal income tax cuts are highly likely to be extended, along with a potential reduction in the corporate tax rate, while the Fed is expected to edge the policy rate lower later in the year. Trump’s deregulation agenda is also likely to gain momentum as we move through the year. US growth should benefit from these moves later in 2025 and into 2026.

Our base case is for slower but moderate US growth over the next 12 months, with ex US growth and domestic growth likely doing a little better. This still seems a reasonable backdrop for investment returns over the next 12 months.

More volatility in US shares is likely in the near-term, as the US policy upheaval is going to remain front and centre for now. April 2 shapes as a key date for investors, with the Trump administration due to release its “universal” or “reciprocal” tariff plan. It is difficult to gauge the consensus on the shape of this plan, if indeed there is a consensus at all. However, the market now seems braced for a reasonably significant announcement. Whether it will prove better or worse than feared is extremely hard to gauge. We remain neutrally positioned in equities. At this uncertain juncture, we are particularly attracted to relatively defensive “alternative” investments with “equity-like” returns, such as asset-backed private credit, as well as real assets.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.