The Australian economy continues to demonstrate underlying momentum, even though interest rates have been tightened by 175 basis points in the space of just 4 months.

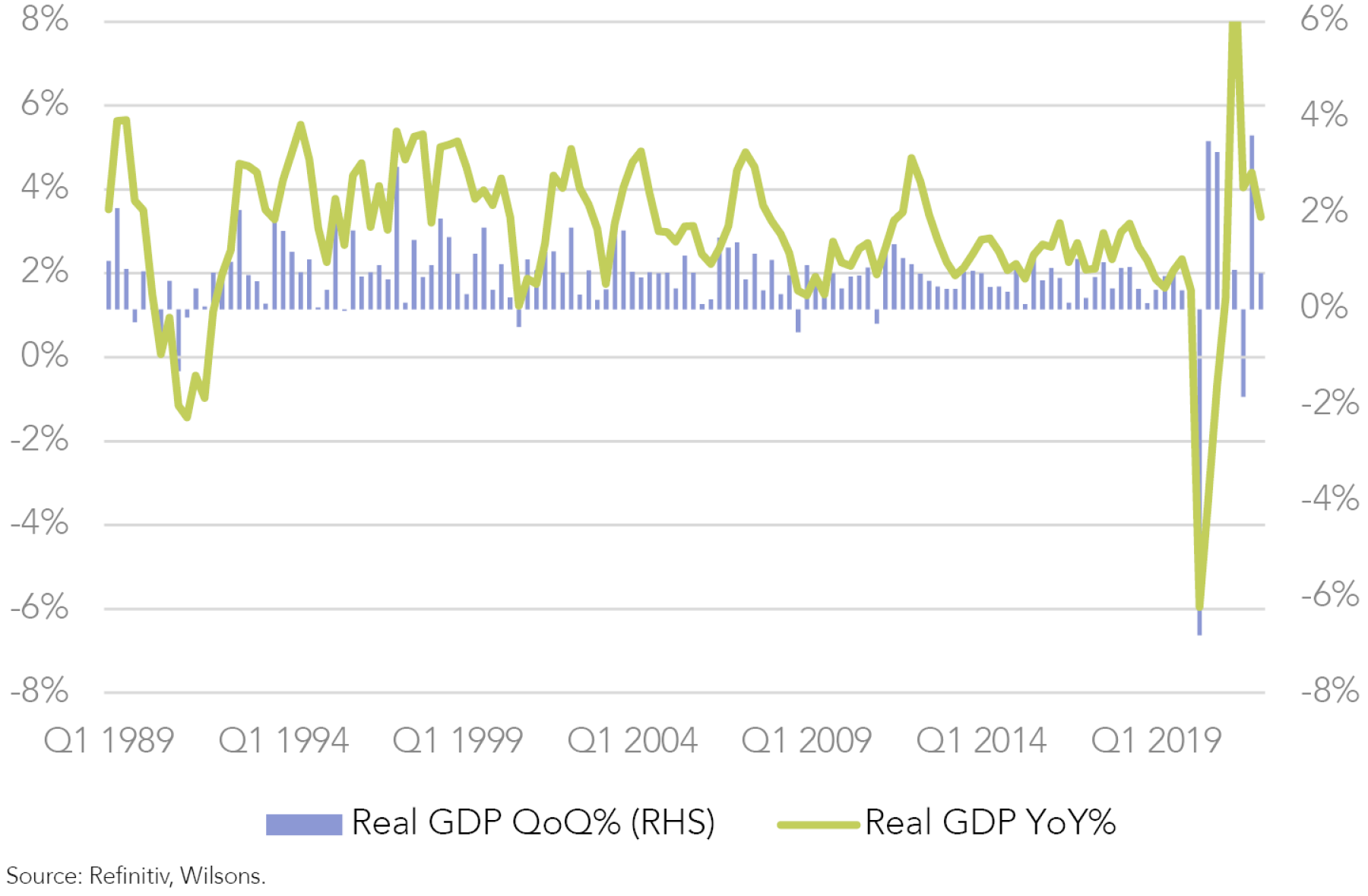

According to the national accounts, the economy grew by an above-trend 0.8% in the first quarter (3.3% YoY), despite the drag from another Omicron outbreak and the impact of flooding in New South Wales (NSW) and Queensland. More timely indicators of economic conditions (e.g., the NAB business survey) suggest the economy has continued to grow at an above-trend pace in the second quarter and through July in spite of the sharp rise in interest rates.

Unemployment Pushing 50-year Lows

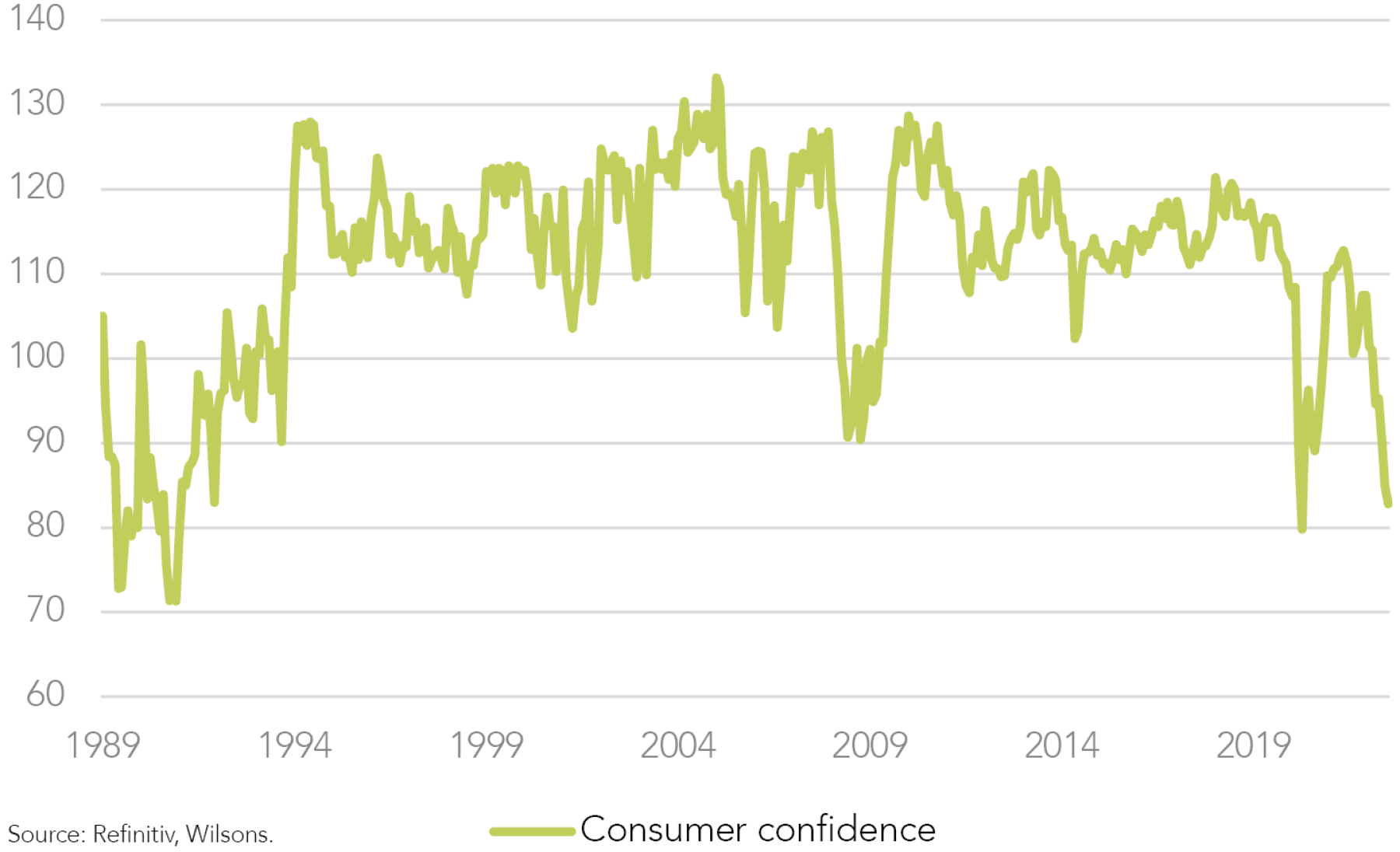

A notable feature of the economy at present is the tightness of the labour market. Unemployment has fallen to a 48-year low of 3.5%. Even more striking, the job vacancy rate to unemployment ratio is at an all-time high. Strong employment conditions are undoubtedly bolstering consumer spending, despite reported levels of consumer confidence being very low. With job vacancies at high levels, along with elevated job ads, we think the labour market is likely to stay strong over the rest of the year.

Australia’s (Global) Inflation Problem

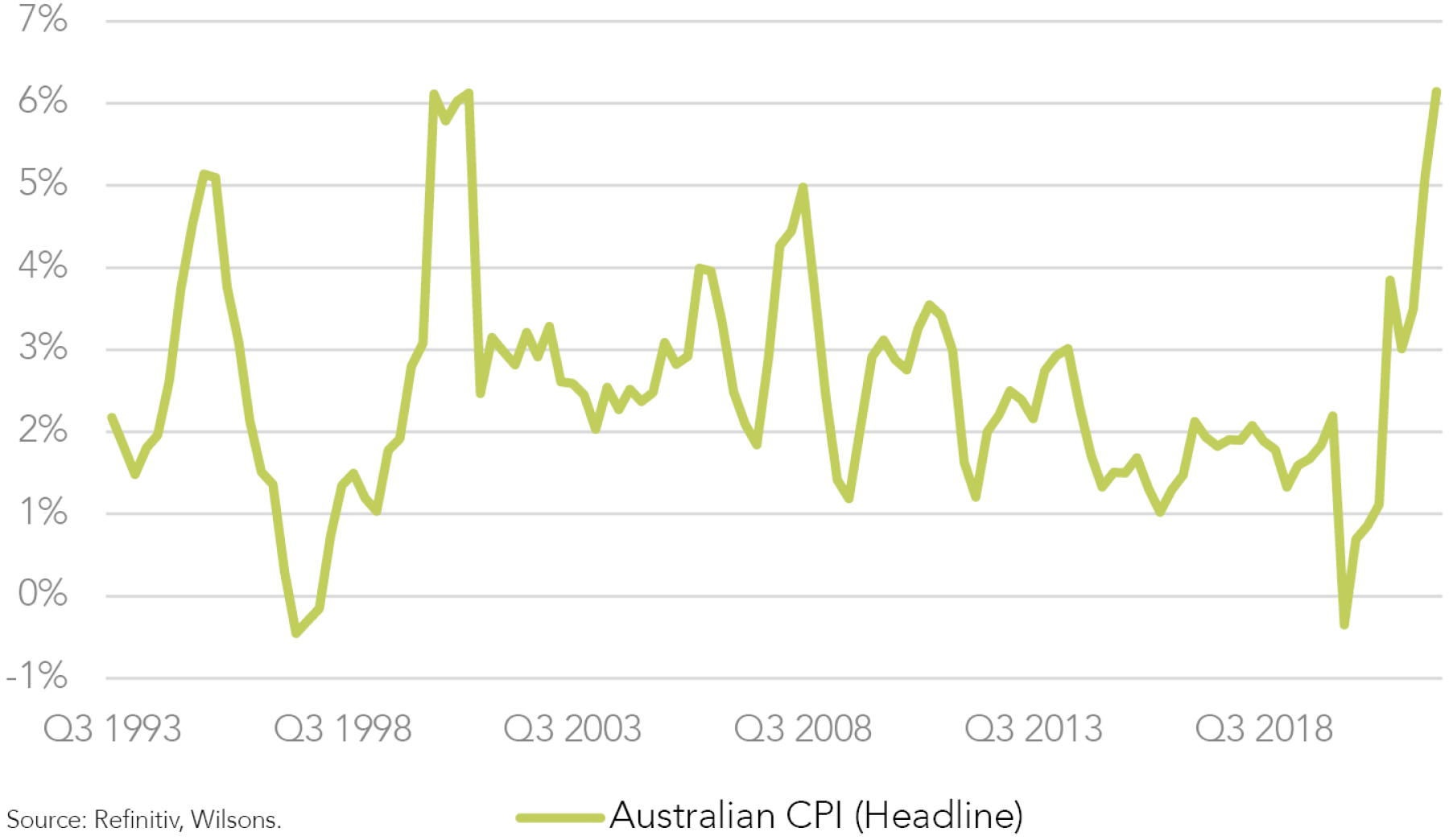

Alongside a tight labour market, Australia is also experiencing an elevated inflation rate, albeit one that is currently well below the prevailing rate in the US and Europe. Headline consumer price index (CPI) increased by 1.7 %(sa) in the June quarter and by 6.1% over the year. Fuel and fruit and vegetable prices (flood related) were the strongest contributors, though the inflation pulse is fairly broad in terms of the factors driving it. Around three quarters of the CPI basket grew faster than 3% in the June quarter.

Inflation is now the highest it has been since the early 1990s, and is expected to rise even further through the balance of the year. The Reserve Bank of Australia (RBA) has significantly upgraded its forecast for peak inflation to reach 7.75% by Q422.

We think the peak may end up being a bit lower than RBA forecasts, though inflation with a 7 handle is likely. Australia looks to be lagging the inflation cycle playing out overseas, in part due to government controls in some key categories, e.g., fuel excise and childcare.

The RBA is expecting only a gradual decline in inflation in CY23, with expectations that the rate will still be 4.25% by the end of 2023. With evidence that inflation is now peaking in the US, we think the balance of risk is that inflation declines a bit more quickly than the RBA is currently forecasting, but it is likely to stay well above the Bank’s 2-3% target over the coming year. This is likely to keep the RBA in a somewhat hawkish mood.

After its uber-dovish rhetoric last year, the RBA has swung into line with the chorus of global central bankers scrambling to tighten policy. The RBA finally lifted the cash rate from 0.1% to 0.35% in early May, and has followed this up with 3 quick-fire hikes of 50 basis points, taking the cash rate to 1.85%.

Economy Resilient to Rate Hikes (so far) but House Prices Were Quick to Soften

While the economy is so far holding up well, the RBA estimates the neutral cash rate is 2.5%, so policy is prima facie still in easy mode. A stiffer test will come as the RBA hits neutral and potentially moves above neutral later in the year.

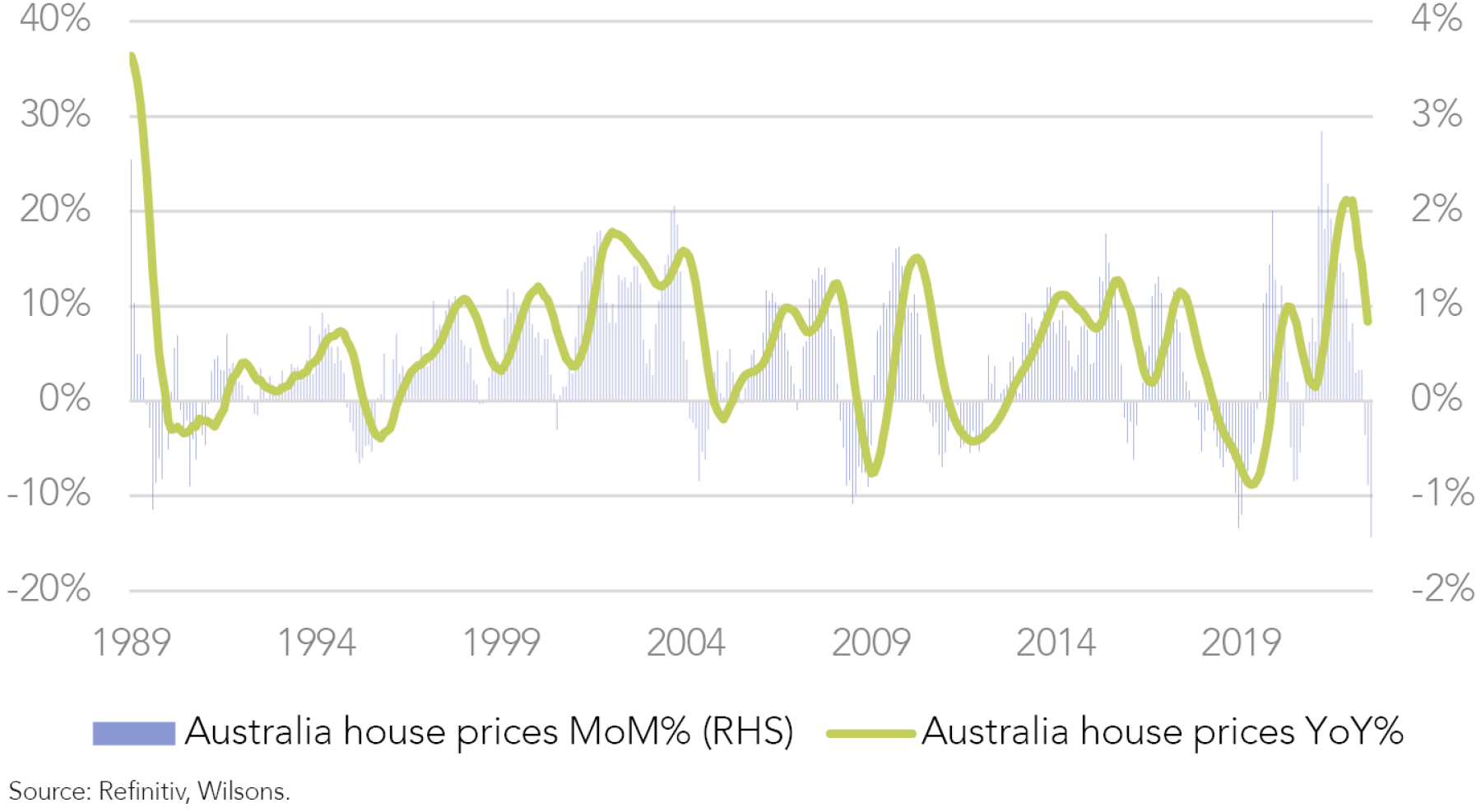

While domestic demand and labour market conditions remain robust, house prices are perhaps the canary in the coal mine. National house prices have fallen for 3 consecutive months, while Sydney and Melbourne prices have declined 4 months in a row. The National series is 3% off the peak but is still up 8% YoY, having risen 25% from 2 years ago. So, home buyers/owners (apart from very recent buyers) are still feeling happy, although we expect higher rates to continue to push prices lower over the coming year (with a double-digit peak to trough fall), with the potential for negative wealth effects.

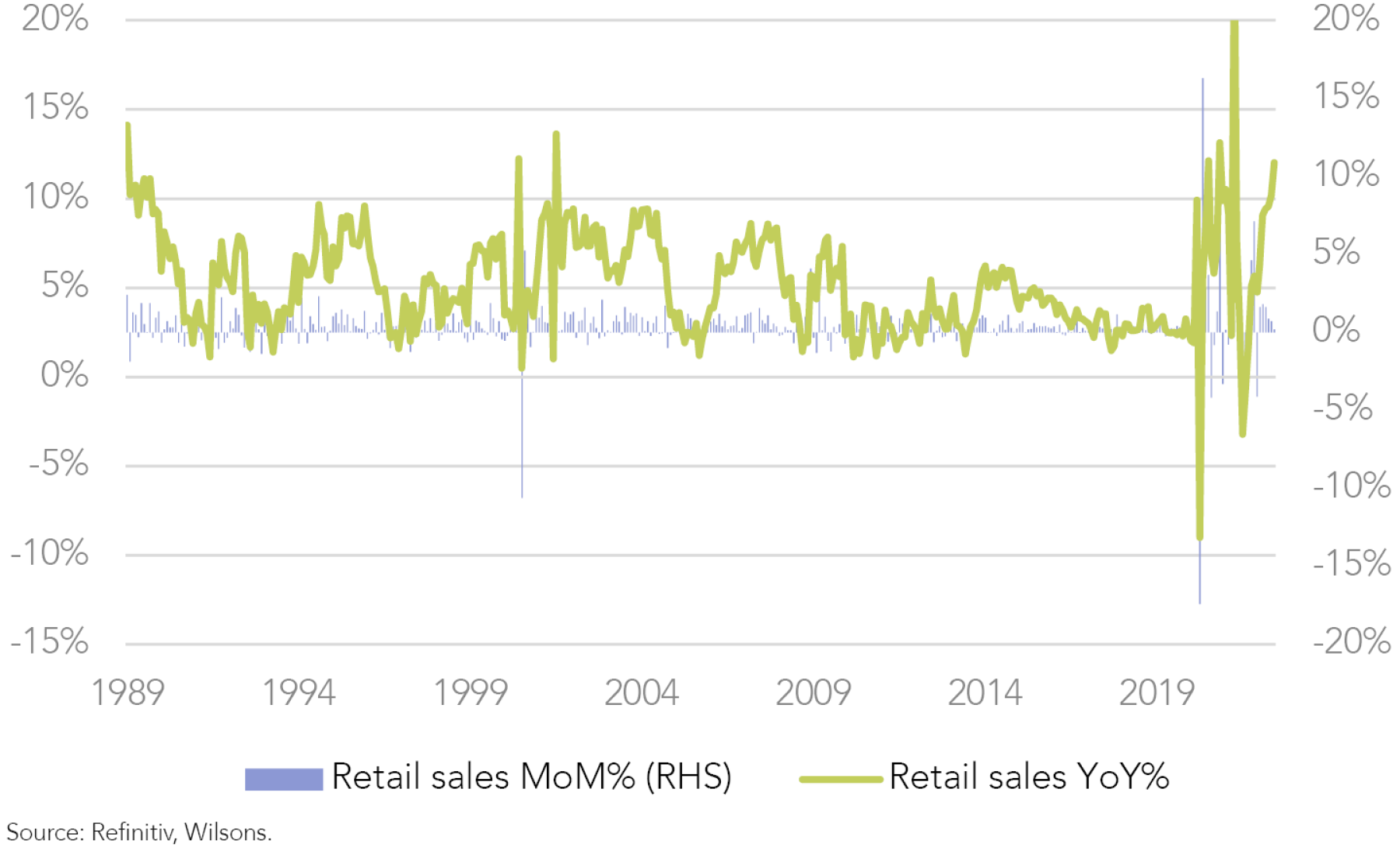

Higher rates and lower house prices alongside a continued high cost of living (inflation) should combine to slow consumer spending in CY23. Wage growth appears to be picking up with the economy essentially at full employment. Wages look set to pick up to around 3-4 % growth. This is well below the current (or expected) rate of inflation, so real purchasing power is (and will continue to be) crimped.

Households Have Debt and Cash

On the positive side, the household savings ratio is still very high and many mortgage holders are several months ahead on their repayments, but the marginal buyer of the past 12 months bears watching for signs of stress.

We believe a peak cash rate of around 3% is likely to cause a significant amount of slowing in consumer spending in CY23. A 3% cash rate peak is still below the futures market expectations (3.6% peak), although these expectations have moderated significantly over the past 2 months, in line with global trends.

While consumer spending should slow significantly over the coming year, other areas of the economy should continue to contribute to growth. Consequently, the outlook for business investment remains reasonably positive.

A large pipeline of residential and non-residential projects should sustain construction activity for at least the next year. The pipeline of private non-residential construction work yet to be done is also quite large, despite the recent decline in new approvals. Demand for new detached dwellings should soften further due to the decline in established housing prices, and because high construction costs reduce the incentive to build new dwellings, even if there remains a pipeline of work to complete. Prospects for higher density residential projects are better, as rental vacancy rates in Sydney and Melbourne have declined and as population growth recovers following the reopening of the international border.

Australia the Lucky (Commodity) Economy yet again

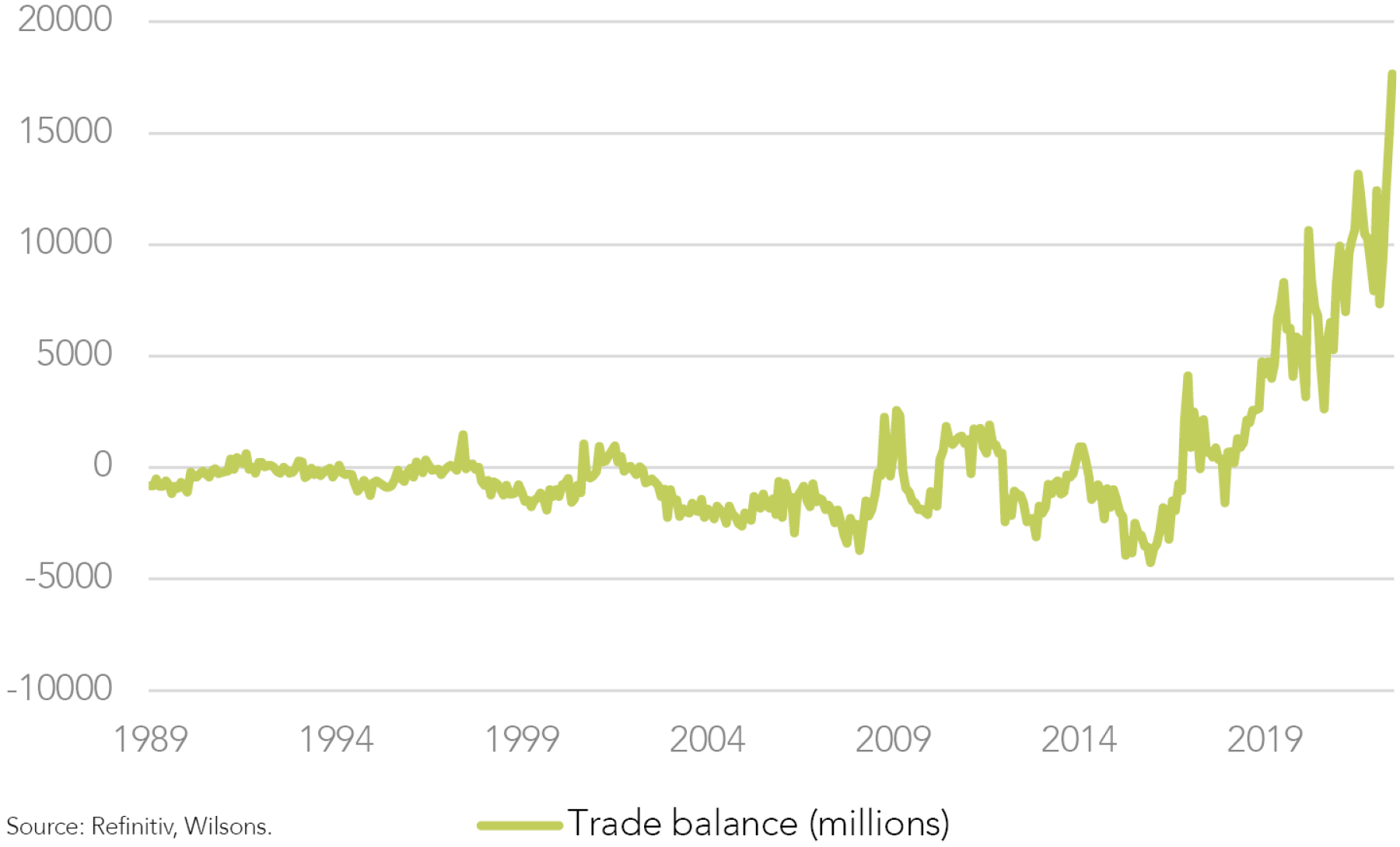

Resource sector investment is expected to increase over coming years after running at moderate levels for several years now. Elevated commodity prices and recent strong growth in profits for Australia’s main commodities should encourage at least a moderate lift in investment. The near-term outlook for the terms of trade has been boosted by high global energy prices, particularly liquefied natural gas (LNG) and thermal coal, reflecting ongoing disruptions in energy markets due to Russia’s invasion of Ukraine. The terms of trade reached a record high level in the June quarter. Commodity prices are projected to decline over the next year or 2, but to remain high nonetheless. The trade balance is currently at record levels, which is supporting growth, although it should moderate with the expected decline in commodity prices.

Public investment is still likely to grow solidly. The large pipeline of public engineering work should support a high level of public capital expenditure for several years. In contrast to investment, public consumption growth should ease as the deficit is gradually reined in, though we do not expect fiscal tightening to be overly dramatic.

Resilient for Now but a Tougher Grind in 2023

Overall, the Australian economy should grow solidly over the balance 2022, as household consumption is supported by a strong labour market and residual savings. GDP growth is likely to slow significantly in 2023 (under 2%) to below most estimates of trend growth (~2.5%). The slowing is likely to be broadly based, with slower growth in household consumption, weaker dwelling investment as housing prices decline, a stabilisation of public demand at high levels after recent rapid growth, and slower growth in exports.

Employment should grow strongly during 2022 before moderating as growth in activity slows next year. Unemployment may edge a touch lower in the near-term before stabilising at very low levels, where it will stay well into 2023, before ultimately edging up toward the back end of 2023 and into 2024. However, it is hard to see a significant rise in unemployment over the next 2 years. While growth is likely to be below trend in 2023, the tight labour market suggests recession risks are fairly low, even with elevated house prices and high household gearing.

A cash rate peak of 3% or a touch lower looks likely in our view. The RBA is likely to hit its peak cash rate by year end, with potential for modest easing later in 2023 as growth slows below trend, unemployment starts to edge up from very low levels, and inflation comes back toward the upper end of the target band. Australia’s economic resilience should continue for a while yet, but growth will likely be lacklustre next year. In saying that, a hard landing anytime soon looks unlikely in our view.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.