The second quarter has delivered a volatile ride, but ultimately positive returns for investors.

While performance has been strong, uncertainty remains elevated as we move into the second half of 2025, leading us to retain some caution in respect of near-term market prospects.

Executive Summary

- The US economy continues to slow but remains resilient, with labour markets holding up and recession risks diminishing as tariff pressures ease.

- Core inflation has stayed contained, though a temporary pick-up is expected in H2. This should not prevent the Fed from easing policy - it’s likely to begin cutting rates from September, with 100 bps of easing expected into early 2026.

- US equities are at risk of a set back near- term, but Fed easing and no US recession suggests a reasonable 12 month outlook.

- Australia’s economy should pick up pace, supported by falling inflation and expected RBA rate cuts starting in July.

- We remain overweight fixed interest, particularly Australian bonds, which offer attractive relative value and benefit from imminent rate cuts.

- We maintain a neutral stance on Australian equities, as falling rates support valuations but full pricing and near-term earnings risks limit upside.

- We retain an overweight to alternatives, particularly private credit, private equity, and real assets, which offer strong diversification and income.

Q2 began with President Trump’s “Liberation Day” tariff shock, which shook markets to their core, before Trump’s surprisingly rapid tariff de-escalation in mid-April set off a market rally that has carried through for much of the quarter.

June saw a pick up in geopolitical uncertainty as Israel and Iran became involved in tit-for-tat attacks, culminating in the US entering the fray by bombing Iranian uranium enrichment facilities. At the time of writing markets have calmed again, as a tentative ceasefire has been agreed. Equities have more than reversed their moderate pullback, while oil has retreated more than 10% in the past week.

A slowing but resilient U.S. Economy

Apart from Trump’s backtracking on tariffs, better than feared US macro data has helped equities and credit markets recover sharply after a rough start to the second quarter.

Despite fears that tariff-induced uncertainty would lead to a significant weakening, the US economy is so far proving relatively resilient.

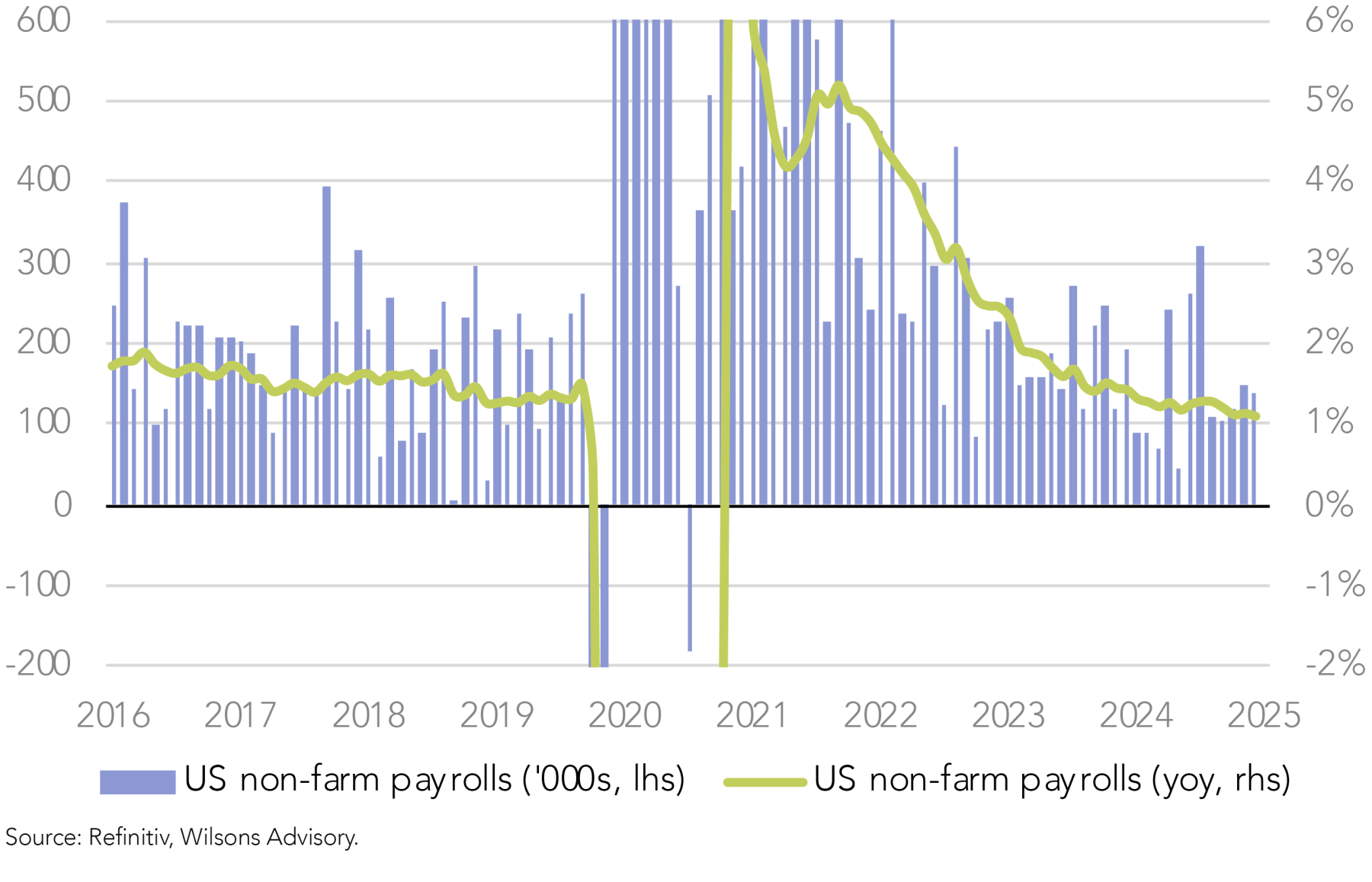

The closely followed non-farm payrolls data is indicating that the US labour market has continued to expand at a moderate pace in the second quarter. Unemployment remains low at 4.2%. This has alleviated fears that emerged in April, that the US economy might be about to slide into recession.

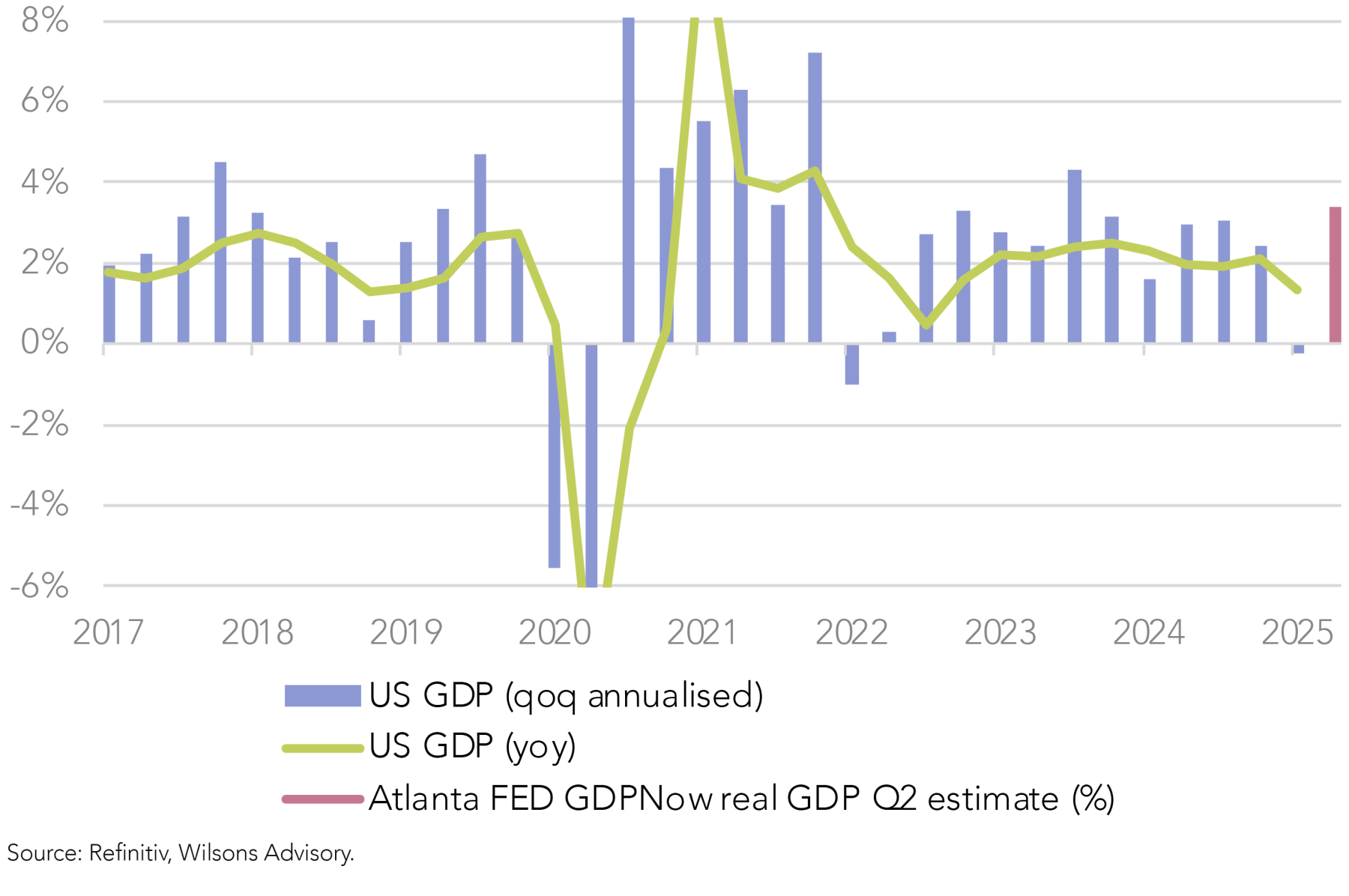

Indeed, the US economy has been surprisingly resilient for several years and delivered another year of “above trend” growth of ~2.5% in 2024. The underlying growth pulse has been difficult to gauge this year, given the distortions created by tariff-related import flows. Growth appears, however, to have averaged out at a trend-like 2% in the first half.

We continue to expect a further slowdown in the second half of this year. However, the probability of a slide into recession has been lowered significantly with the Trump administration’s backtracking on tariffs.

Real GDP growth is expected to slow to around 1.5% in the second half of 2025, with year-on-year growth likely dipping below 1% by the fourth quarter of the year. Jobs growth is expected to average a relatively tepid 100,000 per month in the second half of 2025. However, slower migration should keep unemployment from moving significantly higher.

| Asset Class | Tactical Tilt | Change | Wilsons View |

| Cash | Underweight -2% | no change | Underweight cash as fixed interest is likely to produce superior 12 month returns in both our central case and risk case (recession) view. |

| Fixed income (Domestic & Global) | Overweight +2% | no change | Australian bond yields look good value and should act as a hedge against a global slowdown. Floating rate credit is still offering attractive returns. |

| Equities - Domestic | Neutral | no change | Australian earnings growth should improve in FY26 as policy is eased. Valuations however look full. Small/mid caps preferred. |

| Equities - International | Underweight -1% | no change | Trump's tariffs suggest a slowing global and US economy near-term. US valuations look full. Fed easing and fiscal support should improve the CY26 growth outlook. |

| Alternatives | Overweight +1% | no change | A range of growth and defensive alternative strategies appeal at time of heightened uncertainty in listed assets. Gold appeals as a portfolio hedge against geopolitcal risk and as a beneficiary of both Fed easing & progressive central bank accumulation. |

*Our tactical tilts represent our view over the next 6 to 12 months though active tilts could be held for shorter or longer periods depending on both asset class performance and fundamental developments. Source: Refinitiv, Wilsons Advisory.

Inflation and Monetary Policy

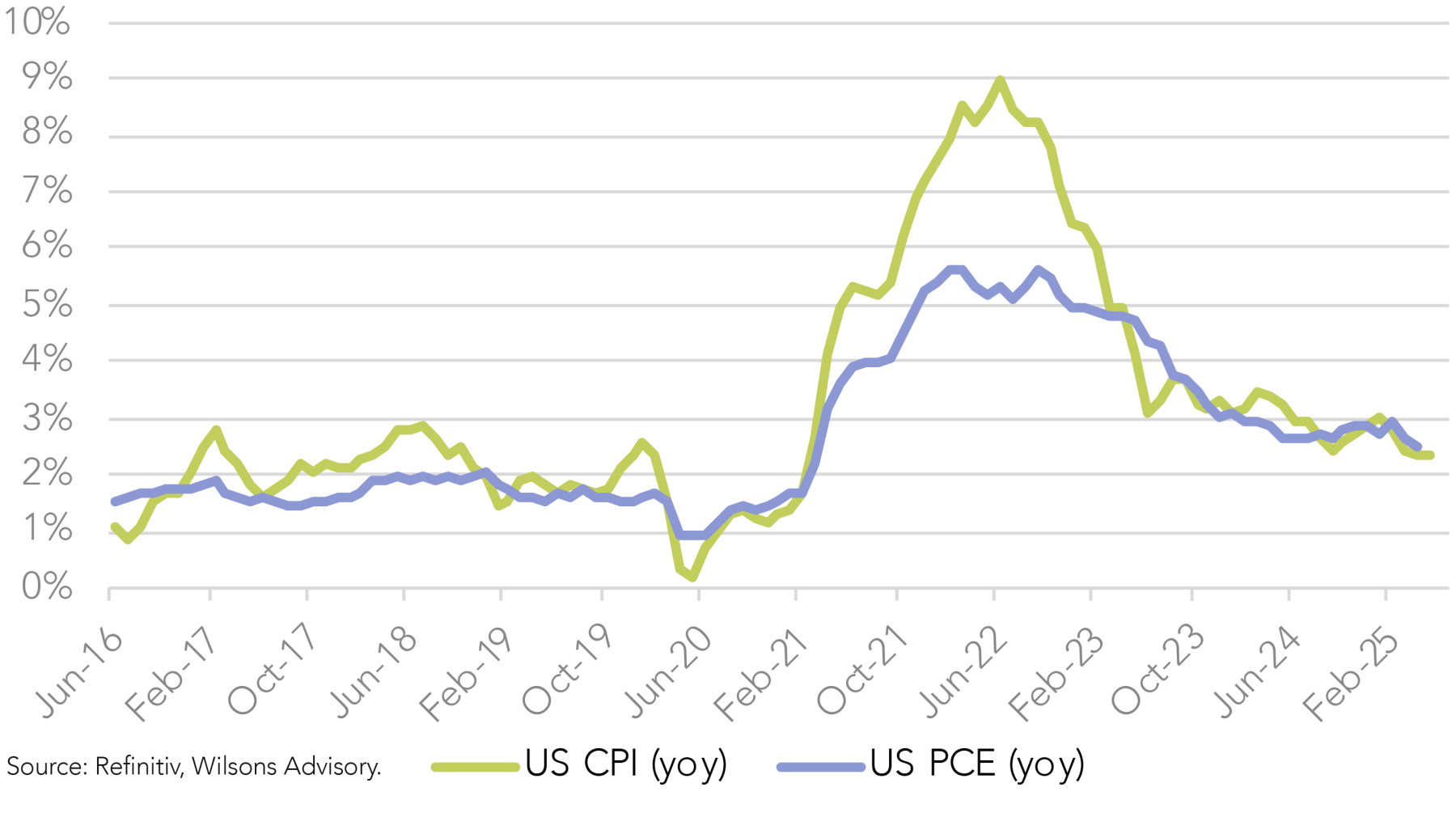

At the same time as the US economy’s growth pulse has defied the recent pick up in uncertainty, inflation is yet to show definitive signs of picking up from the impact of tariffs. April and May readings have both proved benign.

We do expect that inflation will pick up in the second half of the year. With core inflation projected to reaccelerate to just over 3% by year-end, the Federal Reserve is maintaining a cautious stance. Markets anticipate, however, at least two rate cuts in the second half of 2025, given the prospect of cooling growth and only a temporary pick-up in inflation.

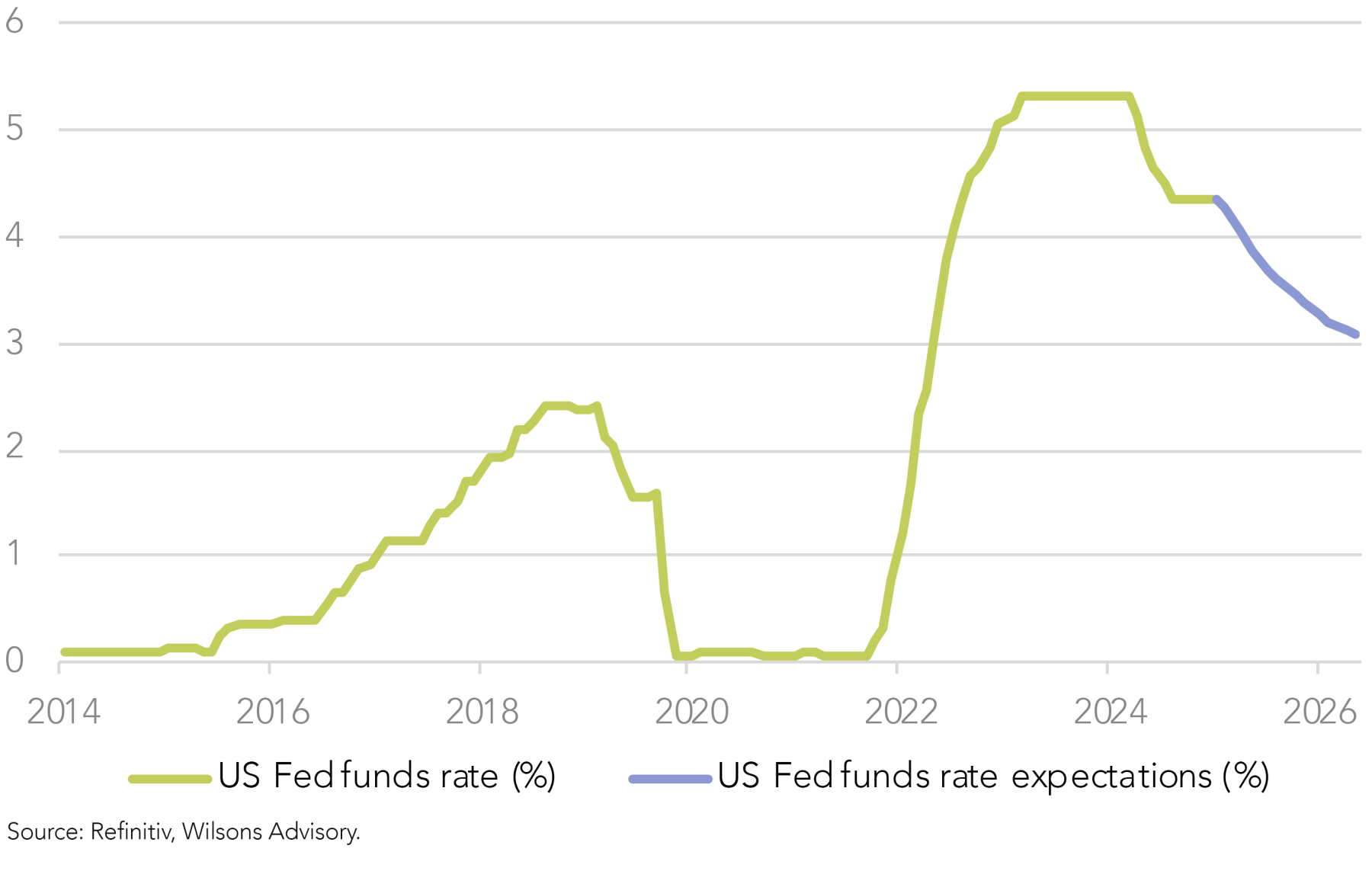

Core inflation is forecast to ease back to ~2.5% in 2026. This is still above the Fed’s 2% target, but is unlikely to stop the Fed from cutting interest rates given the “one-off” nature of the inflation pick up. We expect monetary policy easing to restart in September, with probably 100 basis points of easing to come between then and early 2026. This is likely to help GDP growth recover to a trend-like pace in 2026 (~2%).

As we will discuss in more detail in our asset market section - this is a reasonably supportive backdrop for both stocks and bonds on a 12-month view, despite our short-term concerns for US equities and longer-term tail risks relating to the US bond market.

Europe’s Fiscal Pivot

Outside the US, the Euro area outlook remains moderately positive, with GDP expected to grow by 1.0% in 2025 and ~1.5% in 2026, supported by recovering consumption and fiscal expansion in Germany. However, tariffs and policy uncertainty will continue to weigh on exports and investment. Encouragingly, Europe is showing signs of a long-awaited fiscal pivot. Germany’s stimulus package, focused on manufacturing and defence, is expected to add some impetus to GDP into 2026. This marks a significant shift from austerity to proactive fiscal support, partly in response to geopolitical pressures and US. trade policy.

China’s economy is expected to grow 4.5% in 2025, down from 5.0% in 2024, as moderate consumer demand, sluggish investment and trade tensions weigh on momentum. China is responding to external pressures with targeted stimulus - particularly in infrastructure and technology. China’s growth is undergoing a gradual deceleration with shifting drivers, most notably the shift away from property as a growth engine, but overall growth remains well above developed world levels.

In summary, the global growth cycle is undergoing a slowdown that should at least stretch through the second half of the year. However, global growth should pick in 2026, in response to broad-based monetary easing and moderate but broadening fiscal stimulus.

Global fixed interest and equity market implications

As discussed, US rate cuts are still likely (September cut) despite a near-term tariff induced pick-up in US inflation. We expect the Federal Reserve to maintain a patient approach, with the Federal Funds rate projected to sit at ~3.85% (current 4.35%) by the end of 2025, before declining to ~3.35% in 2026.

Fiscal policy is likely to be mildly expansionary over the coming year, but we don’t see the deficit expanding significantly once the revenue impact of tariffs is considered. A stubbornly large deficit (~6.5% of GDP) will likely keep some term premium in long bond yields, but we don’t see the bond market as becoming unhinged. Potential capital relief for US banks in respect of treasury holdings may also provide some support at the margin.

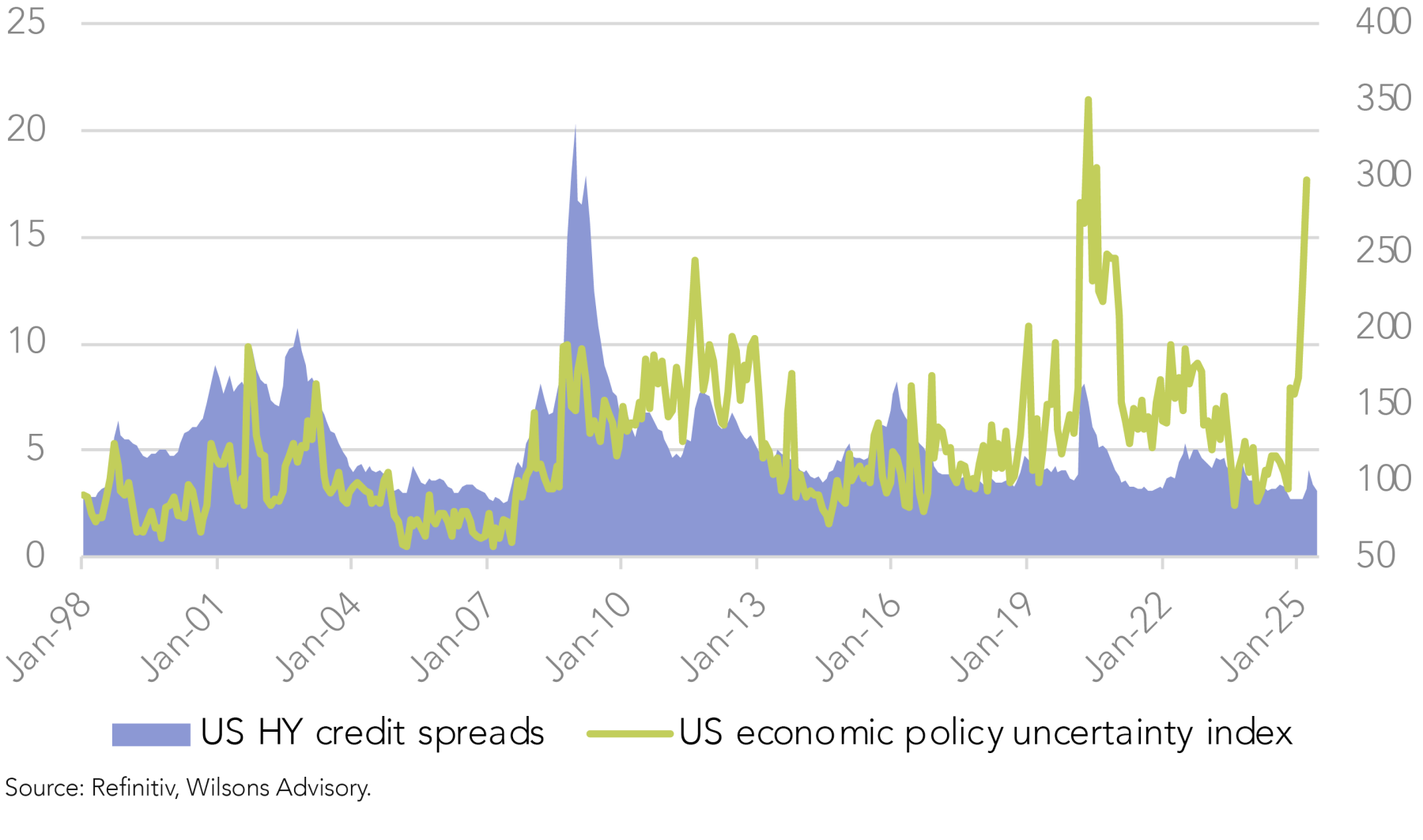

We expect US bond yields to track slightly down, as the economy slows and the Fed cuts rates multiple times over the next 6 to 12 months. Credit spreads seem somewhat disconnected from the high-level economic policy uncertainty index and subsequently look a little complacent. However, a relatively brief and shallow slowdown in US and global growth suggests that any widening in credit spreads will be relatively contained.

Global Equities – Short Term Caution but 12-Month Outlook Looks Decent

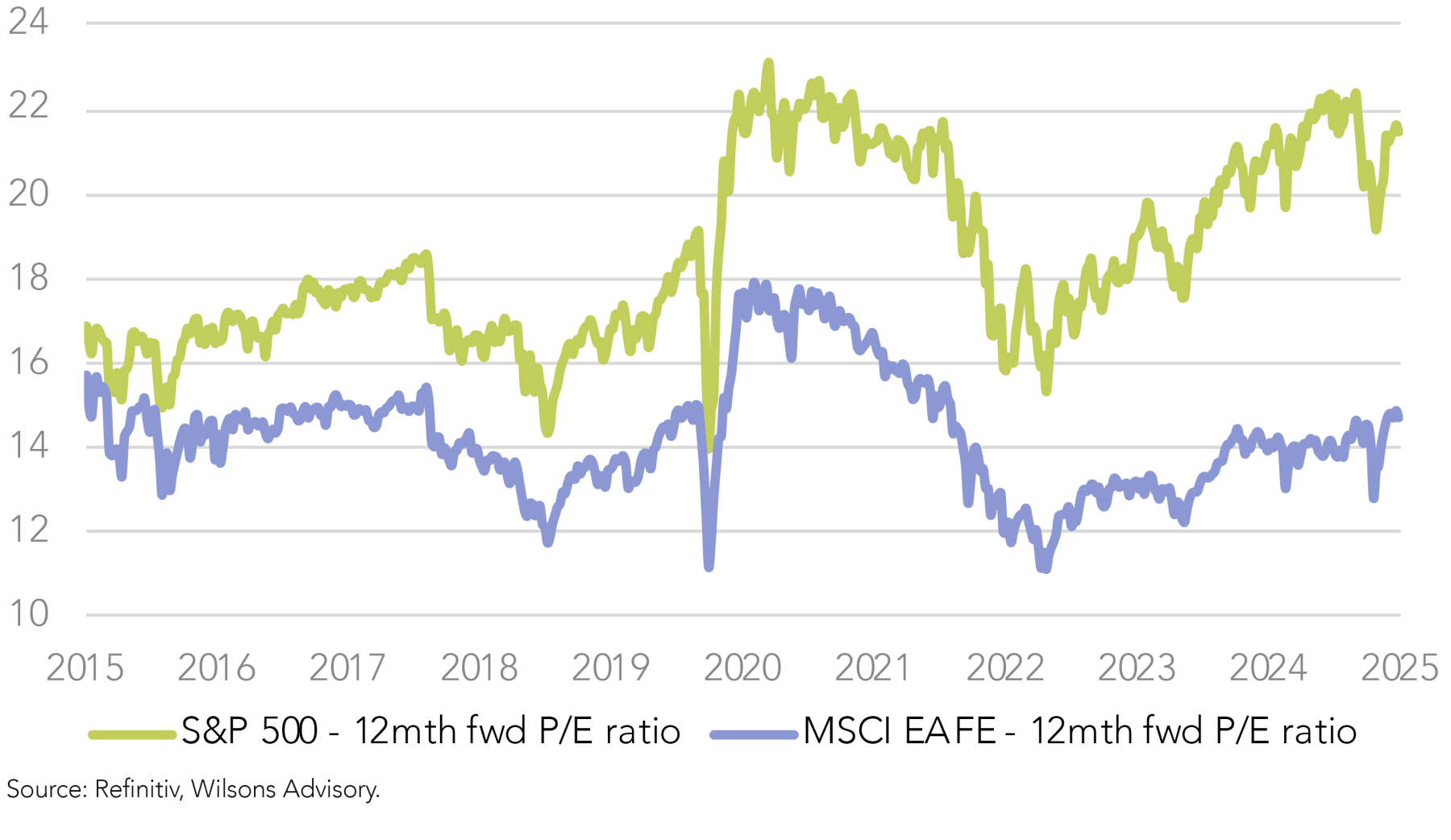

The prospect of lower short-end and long-term interest rates and somewhat stronger economic growth in 2026 still point to a reasonable 12-month backdrop for US equities, despite full valuations and near-term risks to economic and earnings growth.

The US equity market may need to consolidate, as it absorbs a near-term mix of slower growth and higher inflation. Although tariff levels are currently lower than initially feared, it seems likely that supply chain disruptions and higher costs will act as a drag on output and margins. Downward revisions of corporate earnings has already started but still looks to be at risk.

The US stock market continues to be “exceptional” on the basis of its long-term growth prospects. Recent underperformance may extend into the second half, however, as the economy slows and earnings are rebased. Investors will likely be best served by a more globally diversified portfolio over the balance of 2025.

Australian Macro Outlook

At its May 2025 Statement on Monetary Policy, the Reserve Bank of Australia (RBA) forecast a gradual recovery in economic activity from still subdued levels of growth prevailing at the end of Q1 2025 (1.3%). This growth pick-up should be supported by improving household consumption and ongoing strong public demand. However, the RBA noted that the recovery has recently been more subdued than previously anticipated, due to global economic headwinds, policy uncertainty, and weaker domestic consumption momentum. A subdued consumption pick-up in particular is predominantly behind rising market expectations for a July 8th rate cut.

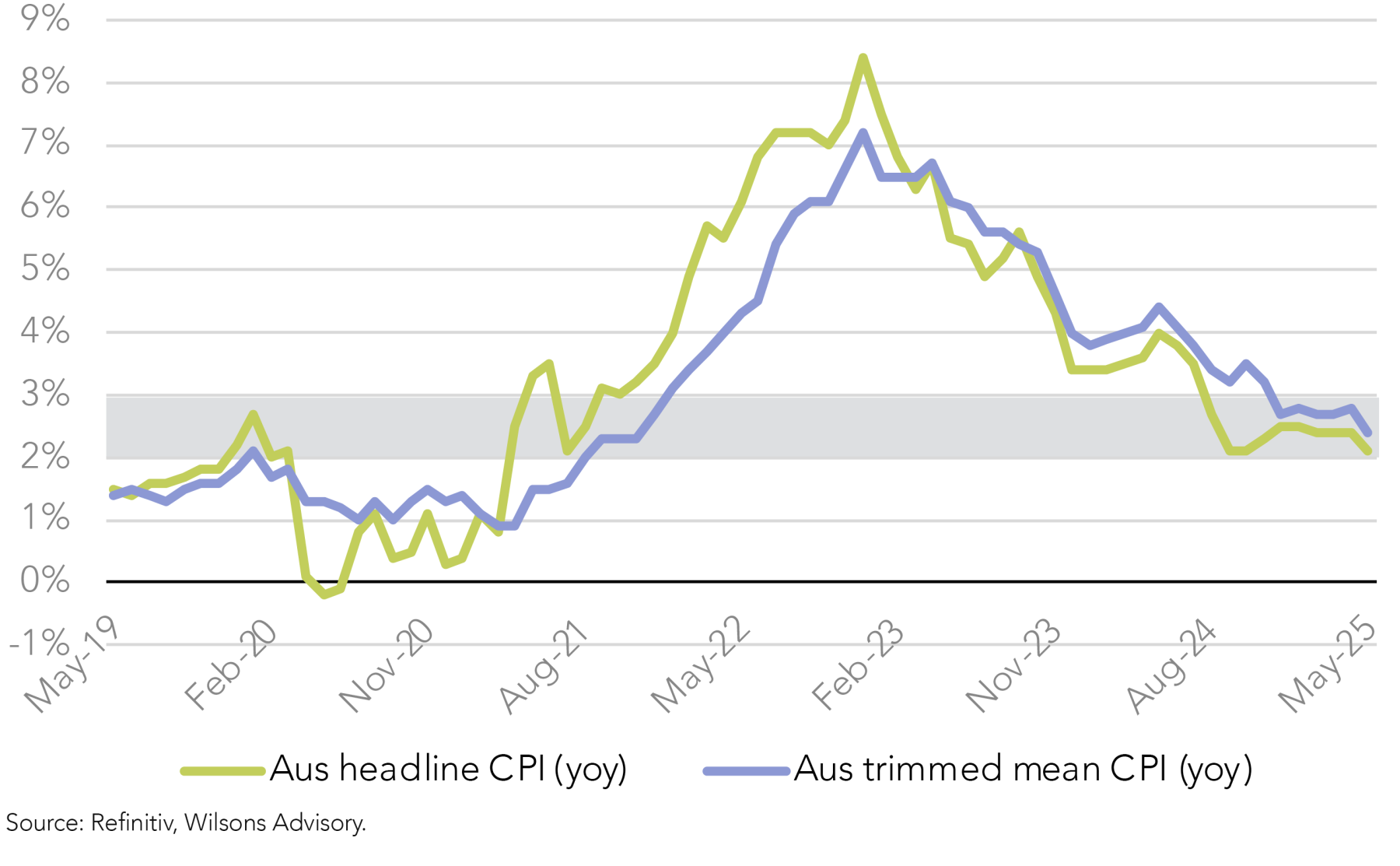

Easing inflation indicators are also pushing the market to a sooner-rather-than-later rate cut scenario. The trimmed mean CPI indicator eased to 2.4% y/y in May, the slowest since November 2021, after 2.8% y/y in April.

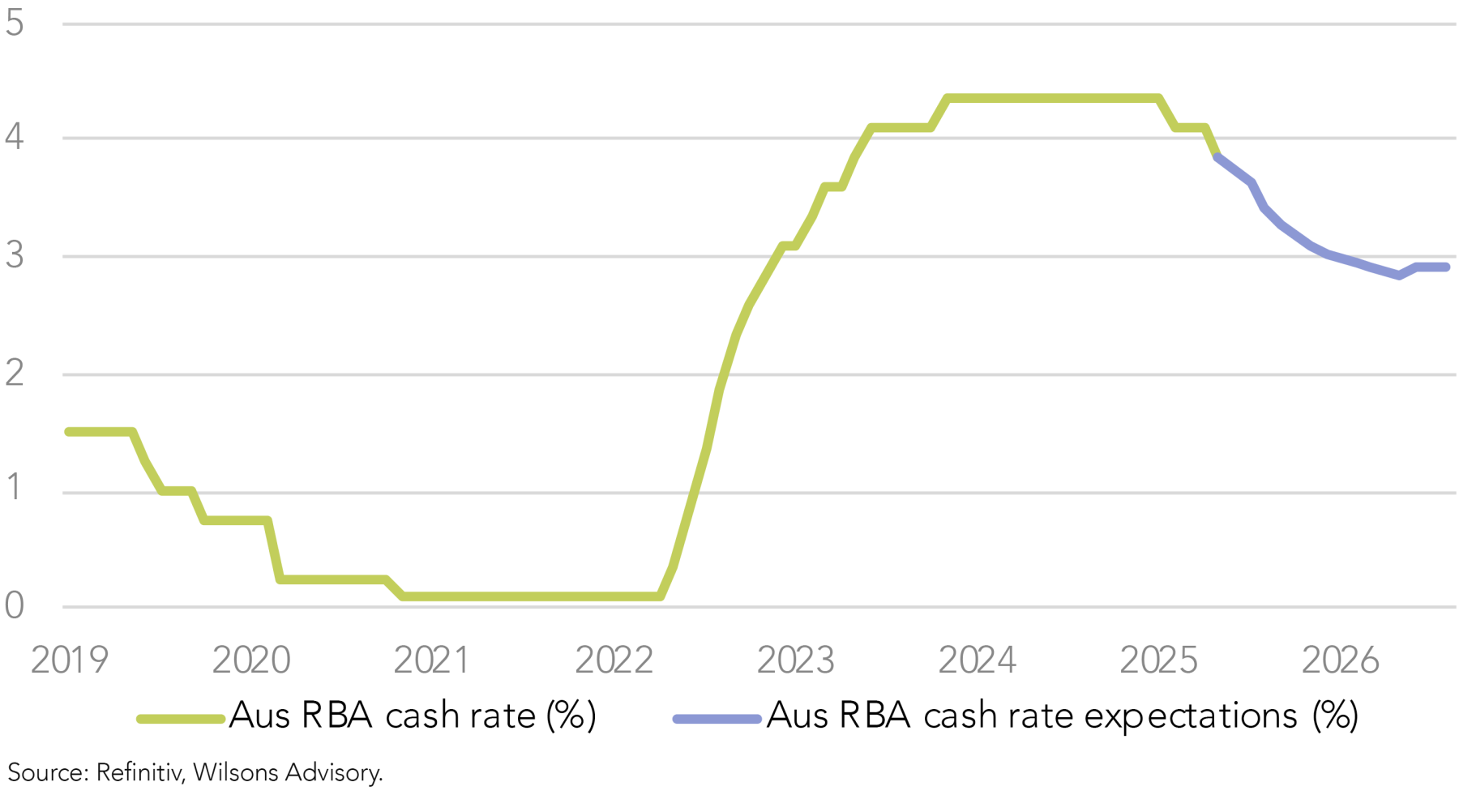

The monthly CPI data would seem to provide enough reason to fall in behind the markets July cut view. The RBA has expressed a preference for waiting for the quarterly data, however. When combined with recent disappointing consumption, we expect the RBA to cut in early July followed by two more cuts before year end.

With rates moving lower, growth is expected to pick up to 2.1% by December 2025. Growth is expected to stabilize at around 2.2% through 2026. This is a subdued pick-up by historical standards and in part reflects ongoing lacklustre productivity growth.

Australian fixed interest and equities

The prospect of three interest rate cuts before the end of the year should be supportive for both domestic fixed interest and the domestic equity market. Assuming a relatively benign near-term lead from the US bond market, we expect the Australian long-term bond yield to ease back below 4% over the balance of this year as the cash rate moves to 3.1% (current 3.85%). We remain overweight fixed income. We continue to prefer Australian fixed interest over US/global fixed interest, with Australia’s stronger fiscal position and more immediate relief from a July cash rate cut.

Lower cash rates will crimp the return from floating rate funds over the coming year. We predict, however, that cash rates will bottom at around the 3% level and expect domestic credit conditions to stay benign, as the economic momentum improves at the margin. As such, we are still comfortable with a mix of fixed and floating exposure.

Lower interest rates across both the long- and short-end should also support the domestic equity market, while a pick-up in economic growth over the year should improve prospects for earnings growth. This interest rate and macro backdrop should be supportive of equities moving moderately higher over the coming year - albeit full market valuation crimps our return expectations somewhat. We retain a neutral allocation to Australian equities.

Alternative Assets – Still Offering Attractive Diversification

We continue to maintain an overweight to alternatives for a combination of diversification and return enhancement benefits. Private credit and private equity, alongside real assets such as property & infrastructure, still offer good sources of diversification, income, and total return. We continue to tilt our allocations in private equity (mid-market) and private credit toward domestic allocations based on benign domestic conditions.

Gold rose to new highs in Q2, as risk assets came under pressure. As risk aversion has receded gold has consolidated over the last couple of months. Central bank buying (led by China), heightened US policy uncertainty, and US dollar weakness are likely to be the key drivers of further gains in the gold price over the medium term. While growing investor bullishness toward gold hints at the potential for a pullback or consolidation, we continue to see the medium to longer-term outlook for gold as favourable.

| Long Term Expected Returns | 12 Month Expected Returns | |

| Domestic Equity | 8.0% | 6-9% |

| Int'l Equity | 8.5% | 5-10% |

| Fixed Interest | 4.5% | 5-8% |

| Cash | 3.2% | 3.5% |

| Alternatives | 6.0% | 6-9% |

Long term expected returns are 5 to 10 year passive expected returns based on both historical performance and current pricing/yields. 12 month expected (passive) returns are shown as a range due to the inherent volatility of financial market returns. Performance and risk projections are subject to market influences and contingent upon matters outside the control of Wilsons Advisory and Stockbroking Limited and therefore projections may not be an accurate indicator of future performance and/or risk.

Source: Refinitiv, Wilsons Advisory.

| Asset class | High Growth | Growth | Balanced | Moderate | Defensive | ||||||||||

| TAA | B’mark | Tilt | TAA | B’mark | Tilt | TAA | B’mark | Tilt | TAA | B’mark | Tilt | TAA | B’mark | Tilt | |

| Cash | 0% | 2% | -2% | 0% | 2% | -2% | 3% | 5% | -2% | 8% | 10% | -2% | 18% | 20% | -2% |

| Fixed Interest | 6% | 4% | 2% | 14% | 12% | 2% | 24% | 22% | 2% | 34% | 32% | 2% | 49% | 47% | 2% |

| Equities - Domestic | 40% | 40% | 0% | 37% | 37% | 0% | 30% | 30% | 0% | 24% | 24% | 0% | 12% | 12% | 0% |

| Equities - International | 38% | 39% | -1% | 35% | 36% | -1% | 29% | 30% | -1% | 22% | 23% | -1% | 11% | 12% | -1% |

| Equities Total | 78% | 79% | -1% | 72% | 73% | -1% | 59% | 60% | -1% | 46% | 47% | -1% | 23% | 24% | -1% |

| Alternatives | 16% | 15% | 1% | 14% | 13% | 1% | 14% | 13% | 1% | 12% | 11% | 1% | 10% | 9% | 1% |

| • Growth | 11.5% | 11.0% | 0.5% | 8.5% | 8.0% | 0.5% | 8.5% | 8.0% | 0.5% | 6.5% | 6.0% | 0.5% | 5.5% | 5.0% | 0.5% |

| • Defensive | 4.5% | 4.0% | 0.5% | 5.5% | 5.0% | 0.5% | 5.5% | 5.0% | 0.5% | 5.5% | 5.0% | 0.5% | 4.5% | 4.0% | 0.5% |

| Growth Assets | 90% | 90% | -1% | 81% | 81% | -1% | 68% | 68% | -1% | 53% | 53% | -1% | 29% | 29% | -1% |

| Defensive Assets | 11% | 10% | 1% | 20% | 19% | 1% | 33% | 32% | 1% | 48% | 47% | 1% | 72% | 71% | 1% |

| Cash + Fixed Interest + Equities + Alternatives | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | |||||

Source: Refinitiv, Wilsons Advisory.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.