Last week I had the pleasure of presenting on asset allocation at the Portfolio Construction Forum in Sydney. The session looked at three alternative scenarios (neutral, bear and bull) and how an investors’ asset allocation should be positioned on balance. What was interesting was how the audience of 600 delegates voted for each scenario. At 42 percent, 36 percent and 23 percent respectively for each of the neutral, bear and bull case, fat tail risk seems to be the order of the day. In other words, with a reasonable probability, just about any scenario is likely.

No sooner had the ink dried on this conclusion than the surprise escalation in the trade war occurred. Just hours before Federal Reserve Chair Jay Powell was due to take the stage at the Jackson Hole Economic Symposium, China announced its retaliation to the plan by the United States, announced earlier this month, to increase tariffs on more of its imports from China. The Trump twitter tirade that followed had the biggest impact on the market, coming so far out of left-field.

It really is a fat-tailed world after all. How should investors be positioned?

Markets like normal

What is normal?

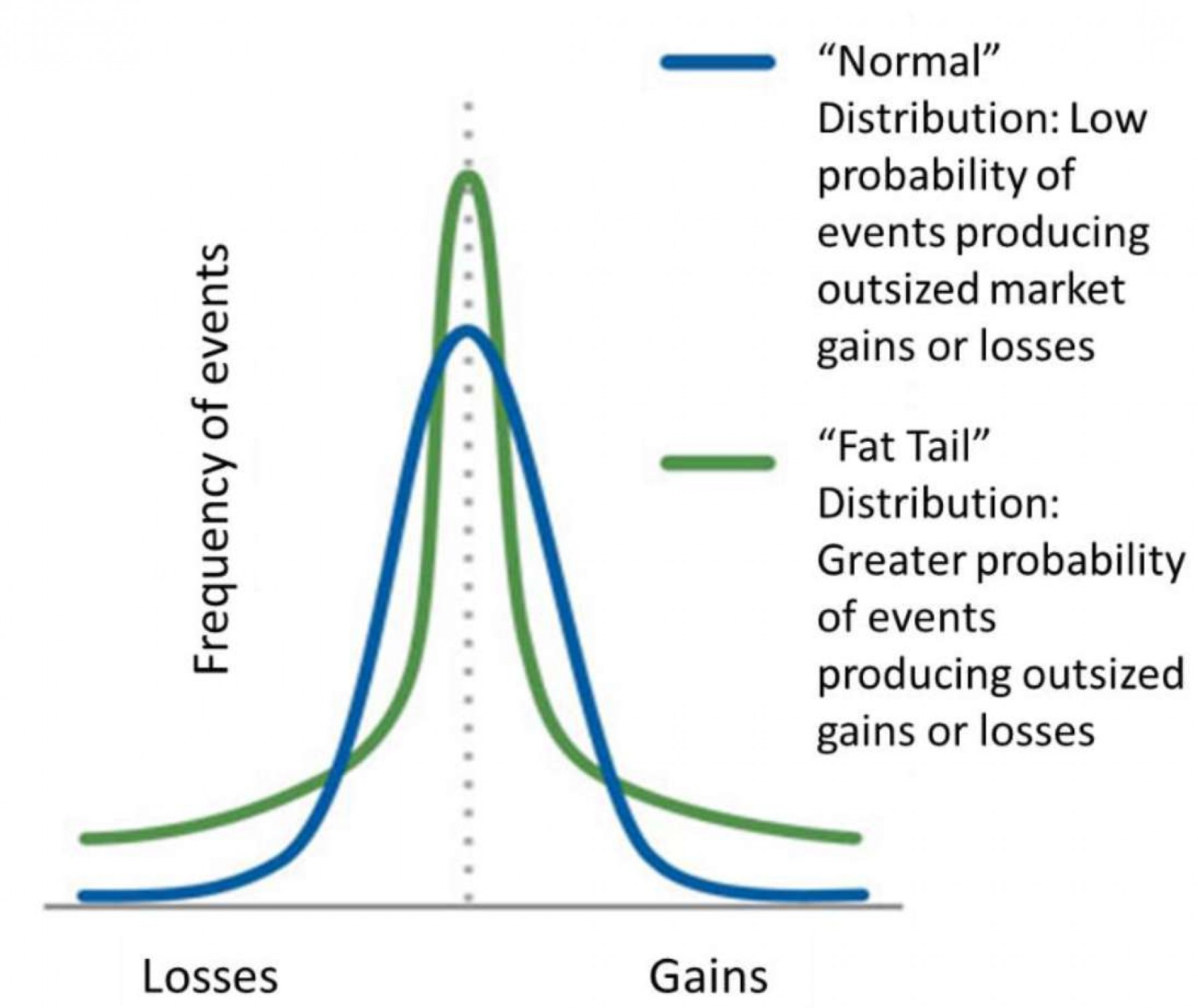

Normal is when the likelihood of the base case occurring is around 95 percent and the probability of an extreme bull or bear scenario is assigned around a 2.5 percent probability of each occurring. In other words, the tails around a normal distribution are typically thin.

Fat tails occur when the probability of extreme outcomes rises, causing the tails on the curve to be elevated or “fattened” (see chart 1.)

When we move away from normal, uncertainty rises.

There are a number of possible fat tail events that have the potential to cause significant uncertainty. These include, but are not limited to: the US-China trade dispute, Brexit, the US-Europe trade dispute and geopolitical risk in Italy, Hong Kong, the Middle East, and of course North Korea where the foreign minister there has recently said “we are ready for both dialogue and confrontation.”

None of these events are considered base case but in a world where Donald Trump can become President of the United States and the UK willingly elects to exit the European Union, their likelihood of occurring should not be understated.

Chart 1. Fat-tailed distributions

Source: Wilsons Advisory

Macro liquidity, market illiquidity

Next month will likely see a raft of major central banks cutting interest rates further. The European Central Bank (ECB) meets on September 12 and the US Federal Reserve meets on September 15. Both are expected to ease monetary policy and, in the case of the ECB, reveal its thoughts around unconventional policy options.

The combination of unconventional monetary policies together with the rise in passive investment strategies and the post financial crisis regulations that reduce the market making capacity of investment banks has resulted in what American economist Nouriel Roubini called an environment of “macro liquidity and market illiquidity.”

The major central banks around the world have made it very clear – they will do whatever it takes to support and extend the economic cycle. This creates an environment of macro liquidity that has the effect of suppressing market volatility and compressing risk premiums. The forced crowding of positions that are not necessarily supported by the underlying fundamentals is tantamount to a coiled spring that can unwind quickly. The impact on market pricing is made worse by the absence on market liquidity.

While macro liquidity has reduced market volatility, market illiquidity makes for an unstable equilibrium. Investors shouldn’t, therefore, confuse lack of volatility with stability.

Portfolio positioning

In this environment, where the probability of the extreme event (positive and negative) has increased to the point of being almost as likely as the neutral scenario, how should investors be positioned?

1. Invest in low or minimum volatility strategies. These are funds that take positions in sectors or companies that have a more muted relationship with the overall equity market. An example in our portfolios of this kind of strategy is the Alliance Bernstein Min Vol Fund.

2. Maintain portfolio diversity. This means having an allocation to bonds as well as to equities and alternative assets. Bonds have become less attractively valued in recent months but the relationship to equities is such that if equities sell-off, bonds will act as a cushion.

3. Stay liquid. This doesn’t necessarily mean increasing your allocation to cash. It does mean making sure your allocation to smaller markets or asset classes that are less widely traded is appropriately sized for your needs.

Risk management as important as return management

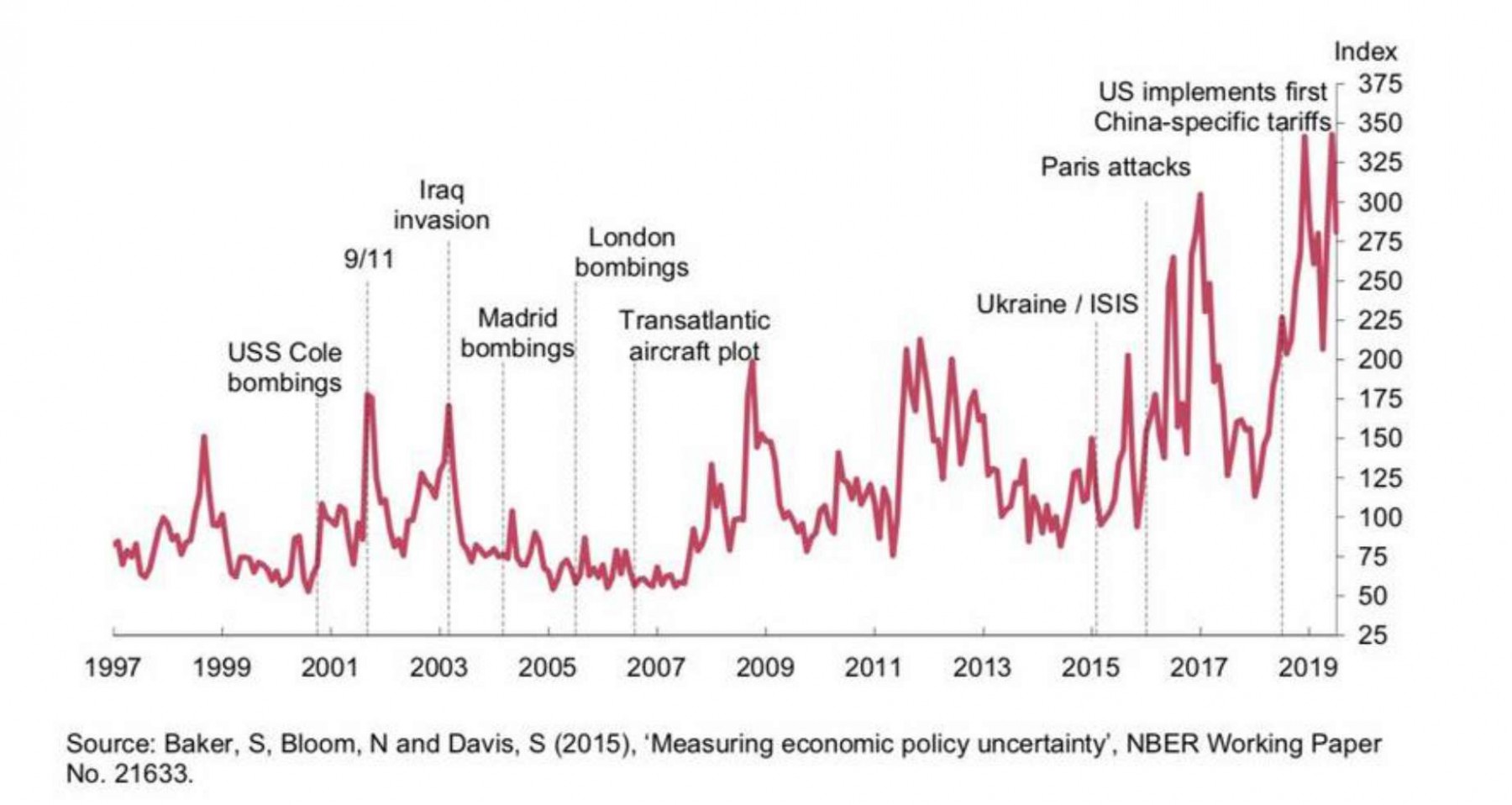

Uncertainty is always and everywhere a market reality. The chart below illustrates the history of events that have peppered the last couple of decades. The level of uncertainty has increased over the last few years. Heightened levels of uncertainty that characterise a fat-tailed world weigh on business investment and hence future growth and earnings potential. The equity market is beginning to come around to this realisation, that growth is likely to be weaker in the future than it is today.

Chart 2. Global economic policy uncertainty has reached record highs

Source: Wilsons Advisory

Late-cycle investing can be volatile, especially when the chance of an extreme event occurring is not insignificant. For this reason, more than at any other time in this cycle, risk management is as important, if not more so, than return management.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.