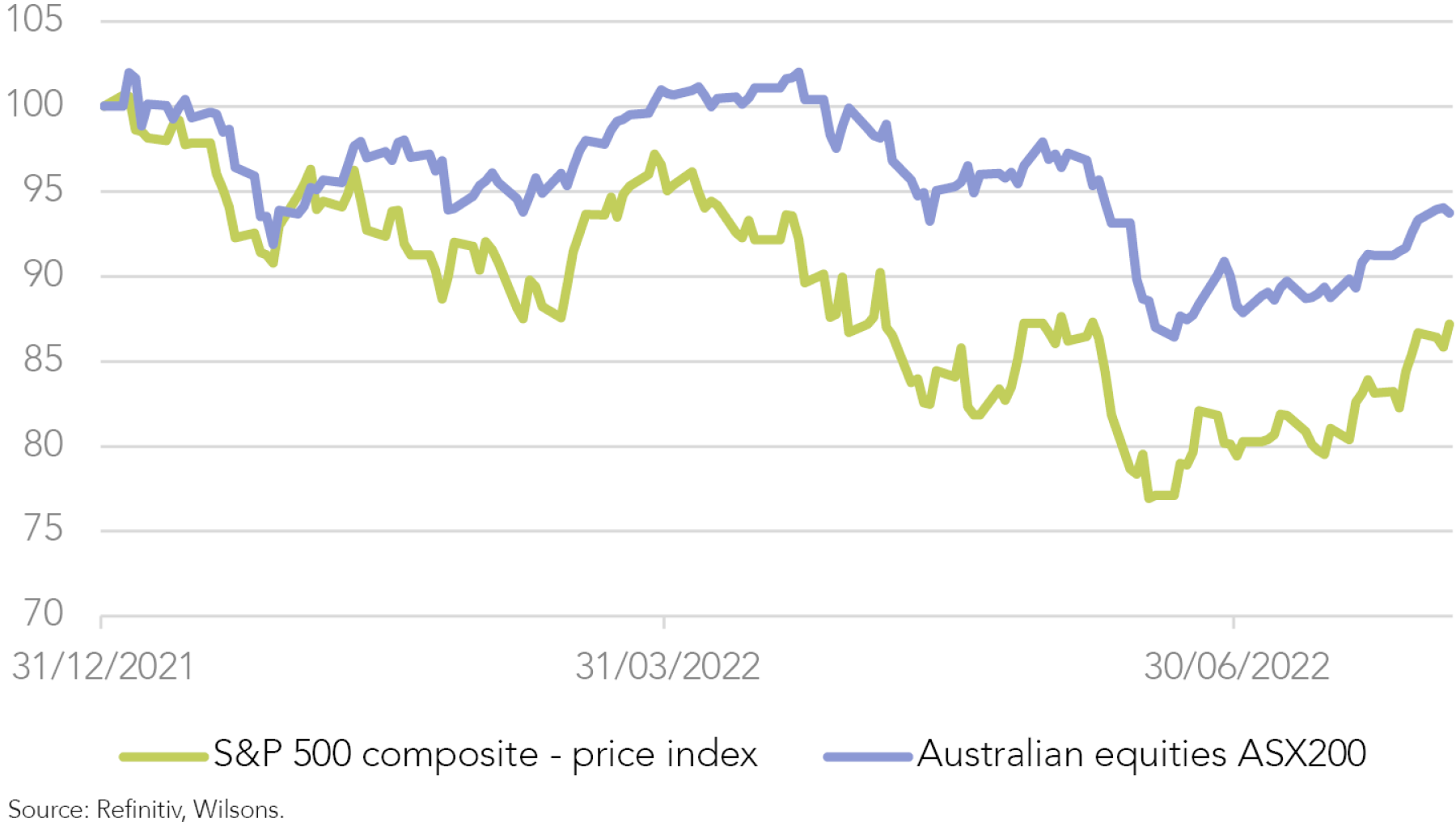

After a tough start to the year, global and Australian equities have staged a sharp bounce from their mid-June lows.

Following their fall of 23% between January and mid-June, US equities have led the way with a 13% bounce. Australia fell significantly less but has also staged a decent recovery at 9%.

Bear Market Bounce or Durable Bottom?

Investor views are mixed on whether this bounce represents a durable bottom for stocks, or whether stocks could re-test the June lows.

Bearish sentiment and a build-up of negative positioning have played a role in the bounce (a classic contrarian signal) but there does seem to be a promising fundamental narrative behind the rally.

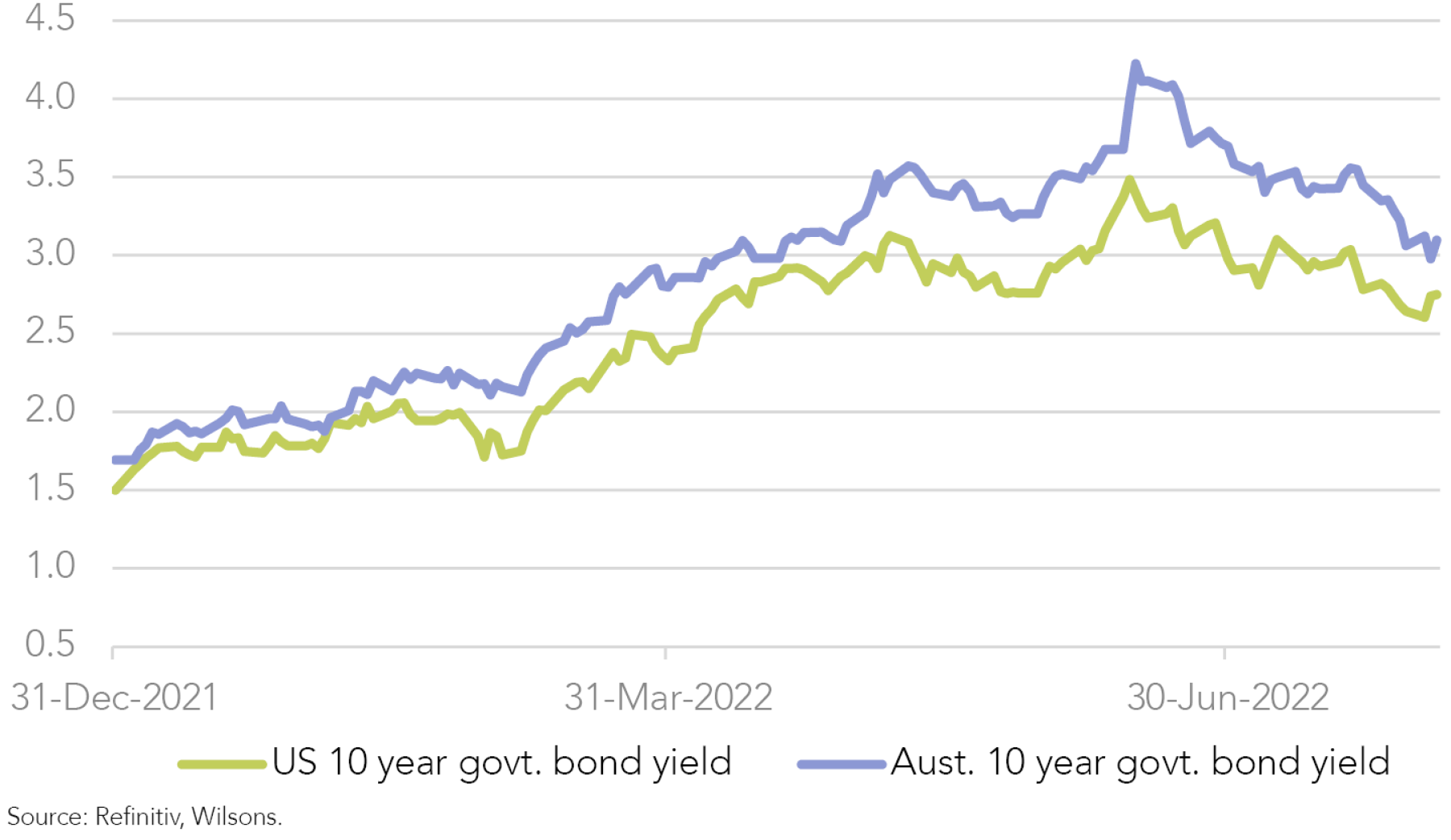

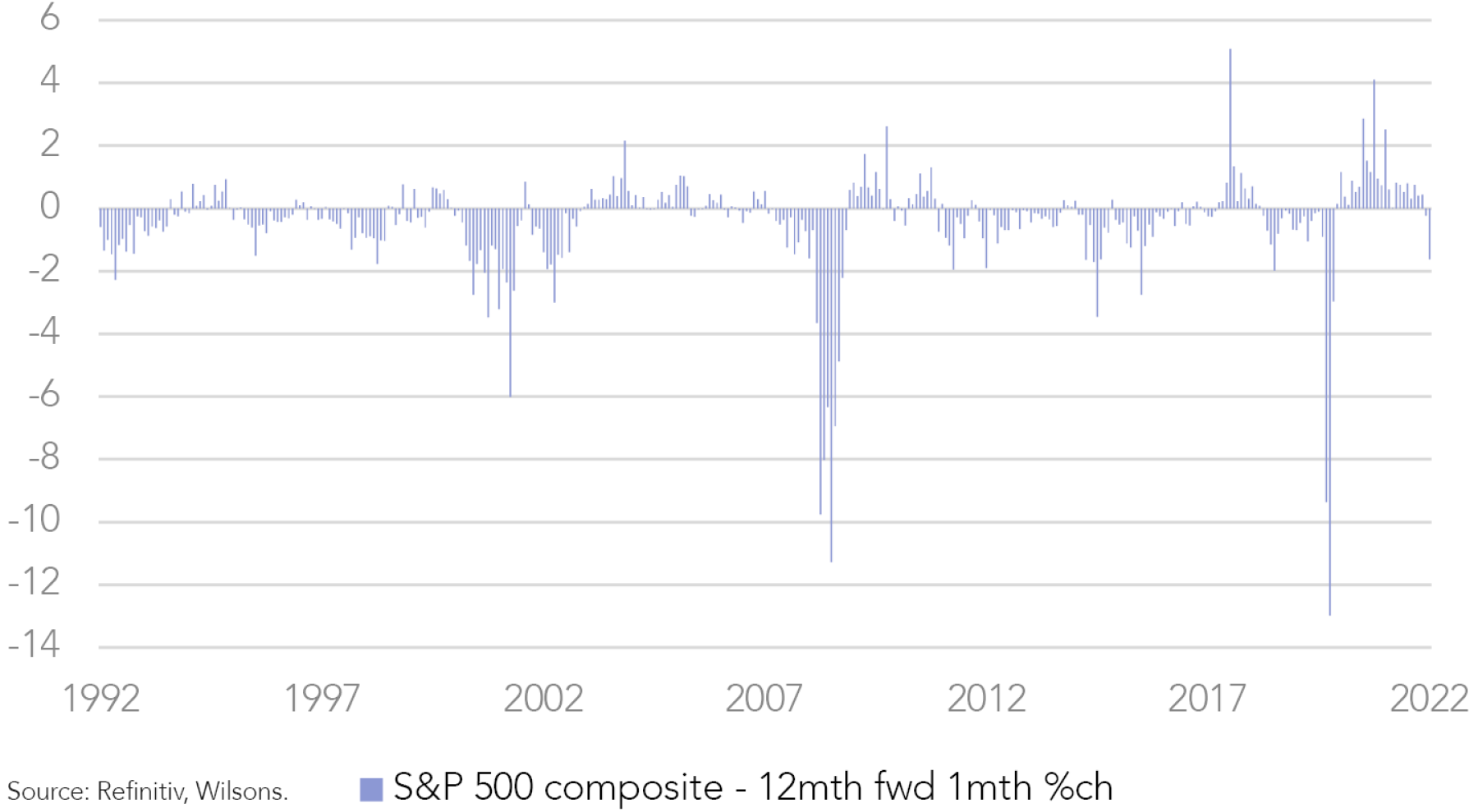

The correction in the first half of 2022 was driven by a trifecta of related concerns. A stubbornly high inflation pulse drove central banks to become increasingly hawkish through the first half of the year. This sent expectations for official cash rates climbing and long bond yields sharply higher. The shift in bond yields compressed equity valuations, particularly long-duration growth stocks in the first instance.

Economic growth concerns ultimately came to the forefront later in the selloff, with previously rampant physical commodity markets and commodity-exposed sectors correcting as fears of a global recession mounted.

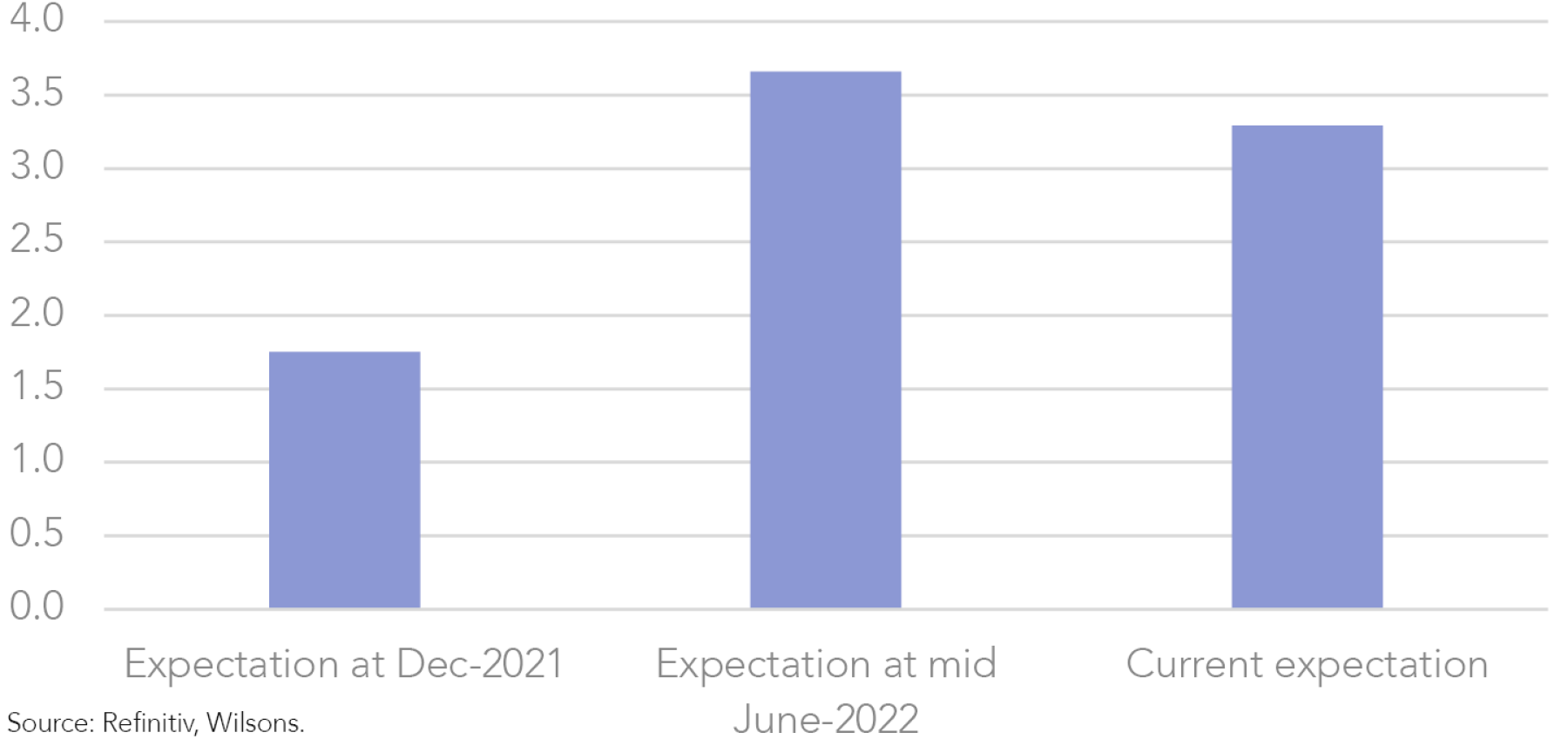

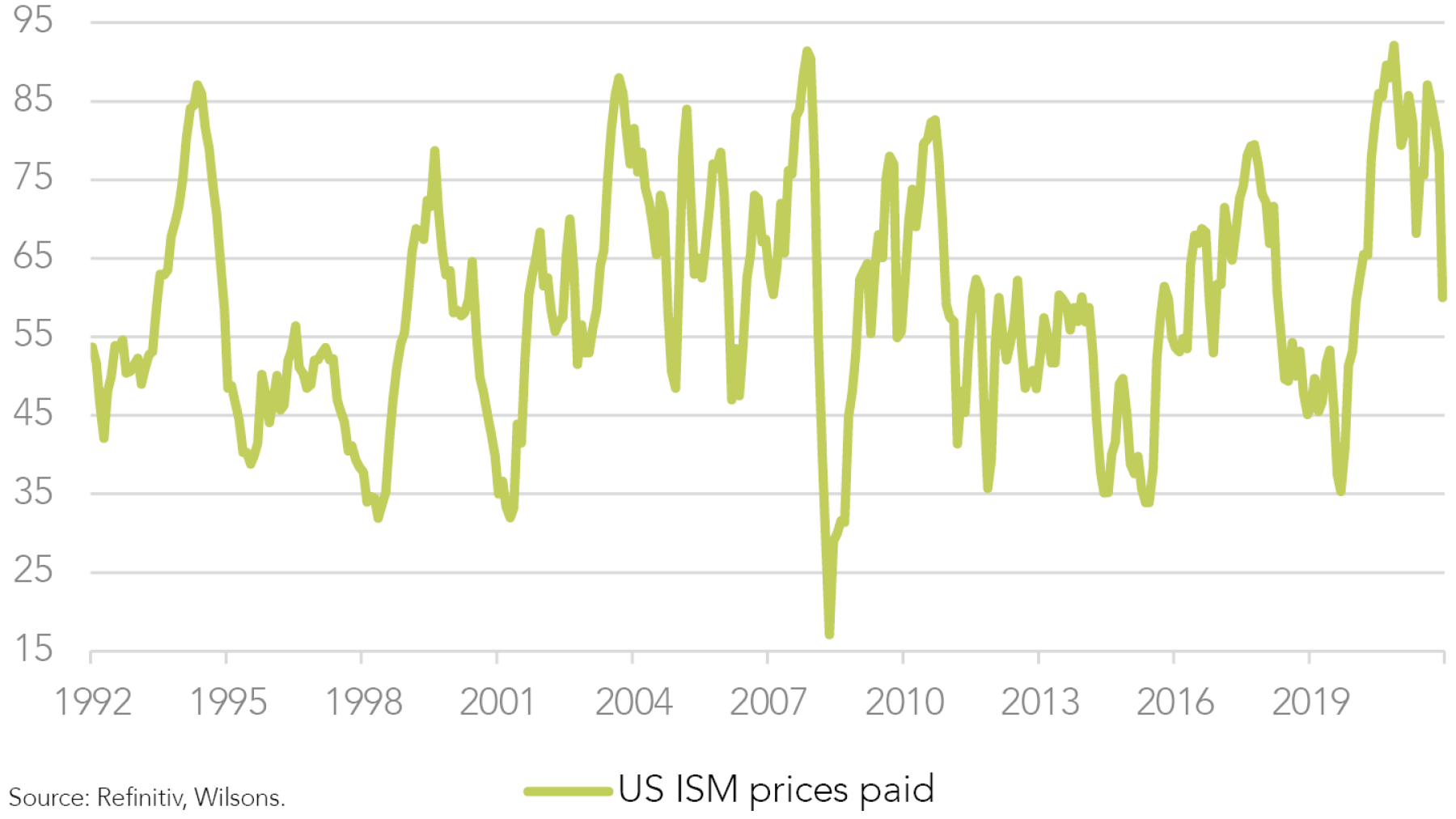

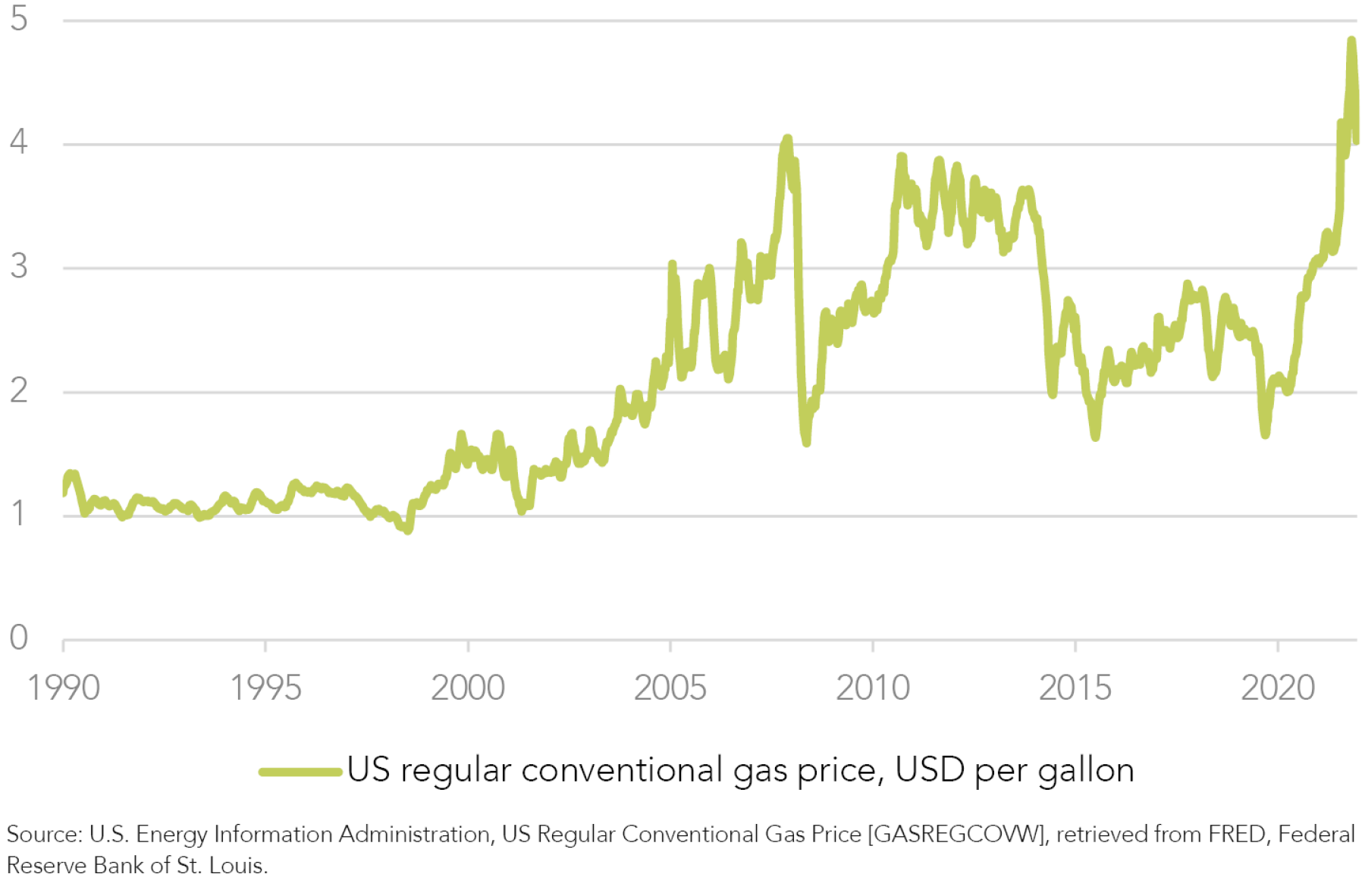

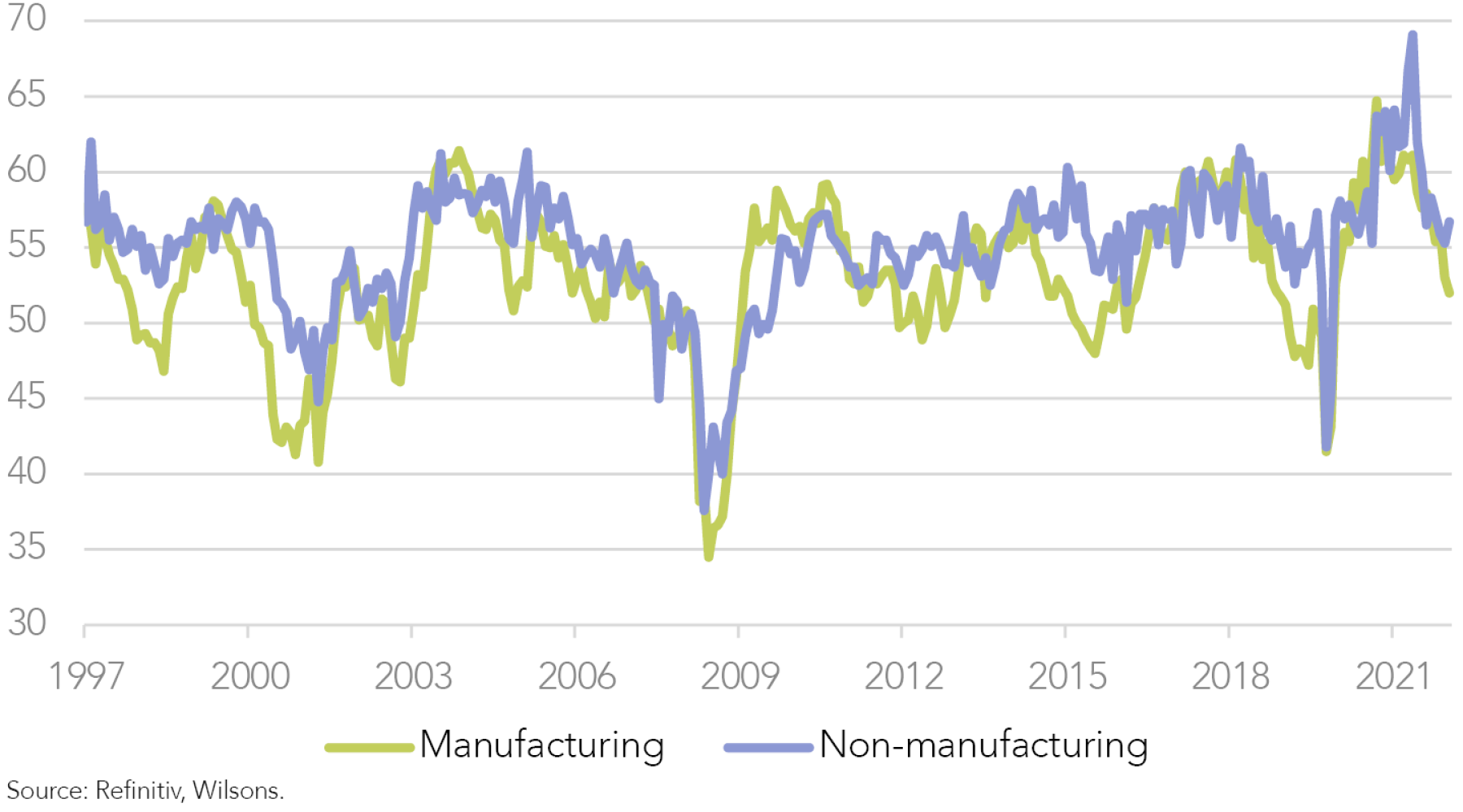

The narrative shifted again towards the end of June as stocks and bonds began to reverse course. Bond yields began to fall and official cash rate expectations began to be wound back on evidence of both slowing growth and a peaking in a variety of leading indicators of inflation (commodity prices, Purchasing Managers Index (PMI) input cost data, freight rates).

In addition, despite the softer tone to economic data, the US reporting season has been better than feared, alleviating concerns that corporate earnings were about to hit a wall.

The combination of easing interest rate pressures and a decent earnings season has helped fuel the US-led global equity rally.

Time will tell whether the market’s renewed optimism proves warranted. While we continue to see a viable path to decent 12-month returns, uncertainty remains unusually elevated.

There has been some commentary that stocks are not cheap enough for the recent low to represent a genuine bottom. We agree that global stocks are far from cheap if we are headed for a genuine recession, but if the growth slowdown proves mild, equity valuations look reasonable. Although stocks are clearly cheaper than pre-Covid levels, they don’t look to represent the compelling value typically found at major market lows.

Inflation Outcomes likely Hold the Key

We believe Inflation outcomes over the balance of the year will be central to the performance of equities. With the next Fed meeting not due until late September, the market and the Fed will have 2 fresh US inflation prints to digest. We see a reasonably good chance that a downtrend in inflation will begin to unfold in the official data. This may not necessarily stop the Fed from tightening further, though it could moderate market interest rate expectations and prompt incrementally more dovish guidance from the Fed.

A clear downswing in inflation pressures and a Fed pivot is not a done deal, of course. Growth outcomes will also be important to confirm that the US economy is slowing but not collapsing. Recession risk is still elevated, even if recent data suggest the US is not in recession at present. Indeed, some of the recent indicators suggest a decent degree of resilience.

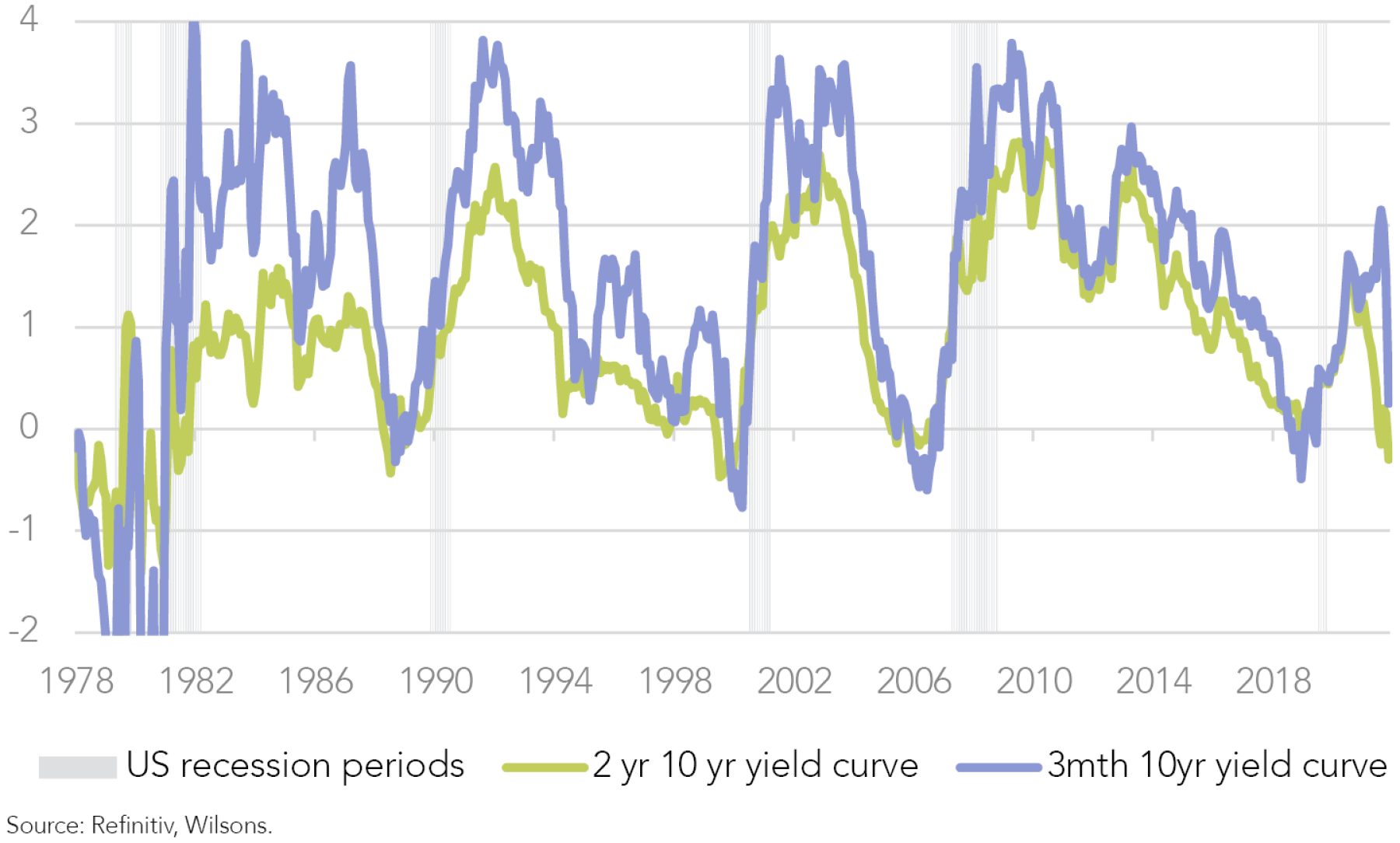

Signs of a future US recession such as inverted yield curve are certainly worth noting, but this is a very unusual cycle with strength of the labour market a unique feature. In our view, this makes it hard for the US to experience a classic recession (with rising unemployment) anytime soon. Australian economic conditions are still decent but a stiffer test will likely come later in the year as cash rates (currently 1.85%) push up to a more neutral level (2.5% in the RBA’s view) or potentially a bit beyond.

Outside the US and Australia, tail risks from weak conditions in Europe and China are still considerable, though our central case is that conditions remain “orderly”, and so sentiment towards the US is still likely to dominate in coming months.

Not Bearish but still Cautious

Stocks have run hard and may mark time in the near-term but the potential for lower inflation could be supportive of higher markets over coming months. We retain a relatively neutral stance in equity positioning, particularly given the pace of the recent rally. We expect more slowing and a tougher path for corporate earnings, so quality stocks with resilient earnings streams should dominate equity portfolios.

The fixed interest rally has been almost as dramatic as the selloff. US long end yields are starting to look a touch expensive on a long-term view, though a weakening economic cycle should support US bond yields around current levels. Australian bonds have rallied hard over the last month or 2 and long-term yields at just over 3% now look fair value in our view.

-

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.