The Australian share market could be in for a mixed reporting season with respectable results tempered by cautious outlook statements, as threats to corporate profits accumulate at home and abroad.

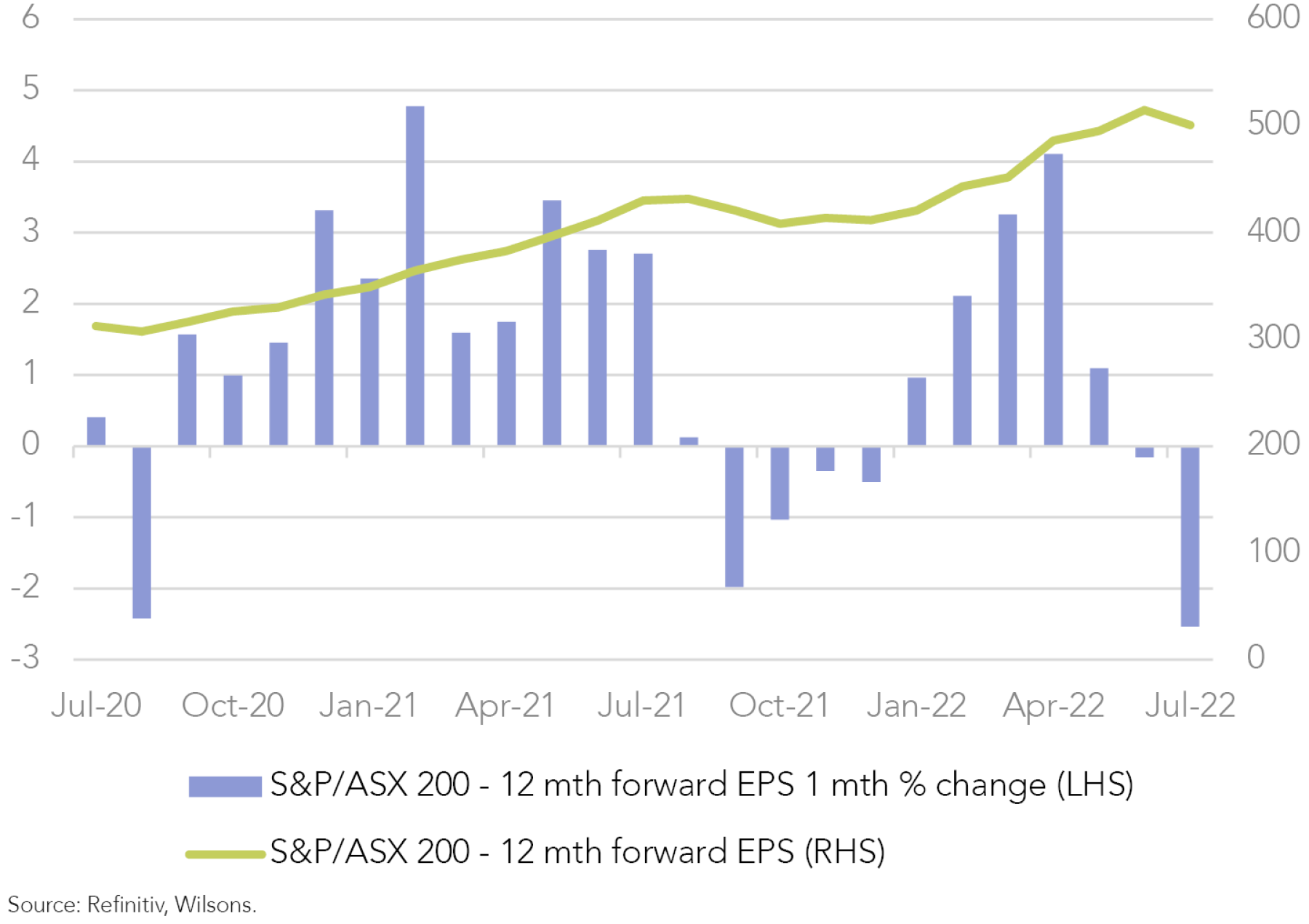

In spite of rising earnings estimates (on aggregate) over the past 6 months, the S&P/ASX 200 is down ~6% this year to date (price return) amid concerns about tighter monetary policy, the increased likelihood of a recession, supply-chain issues and geopolitical uncertainty.

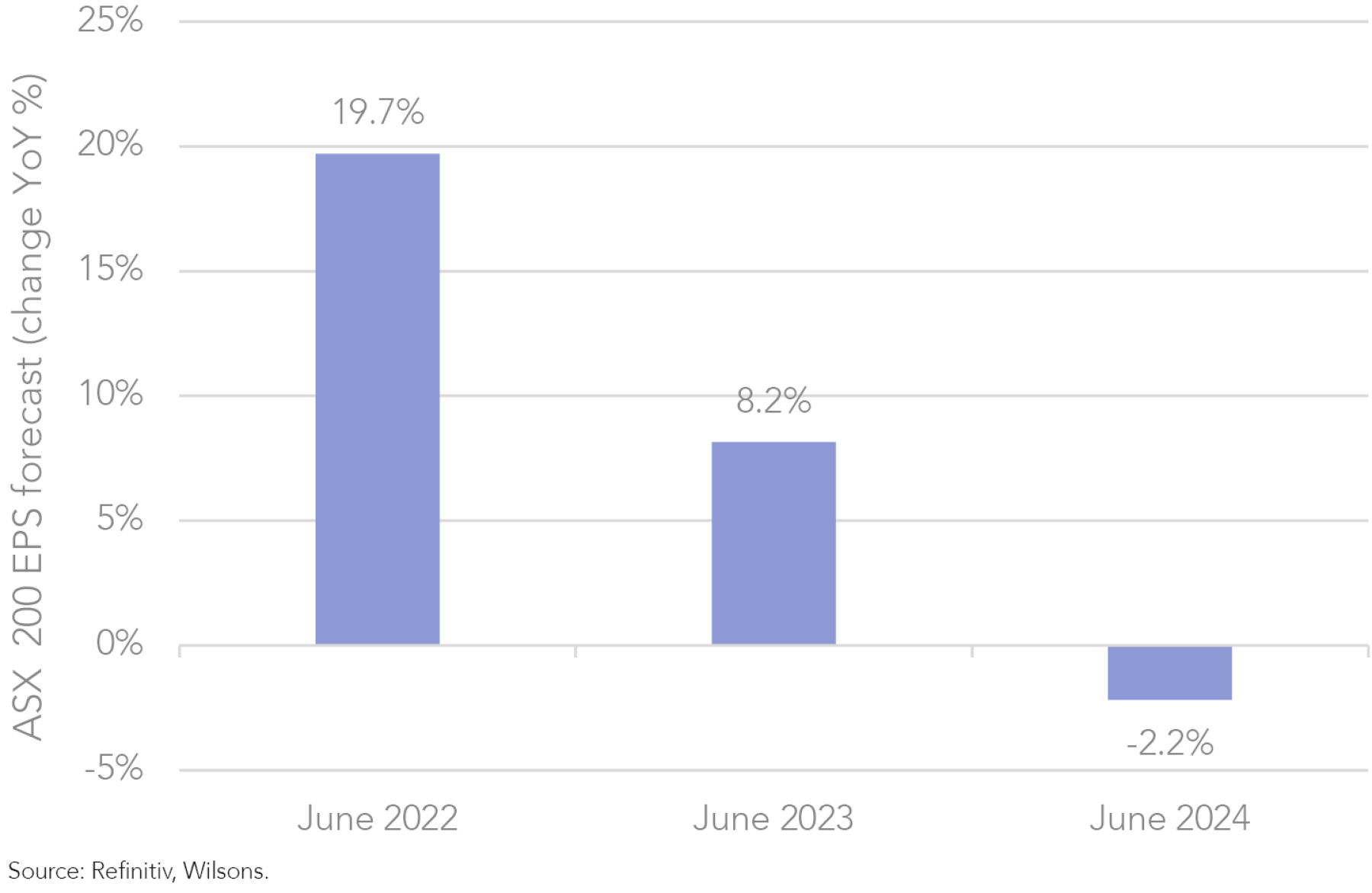

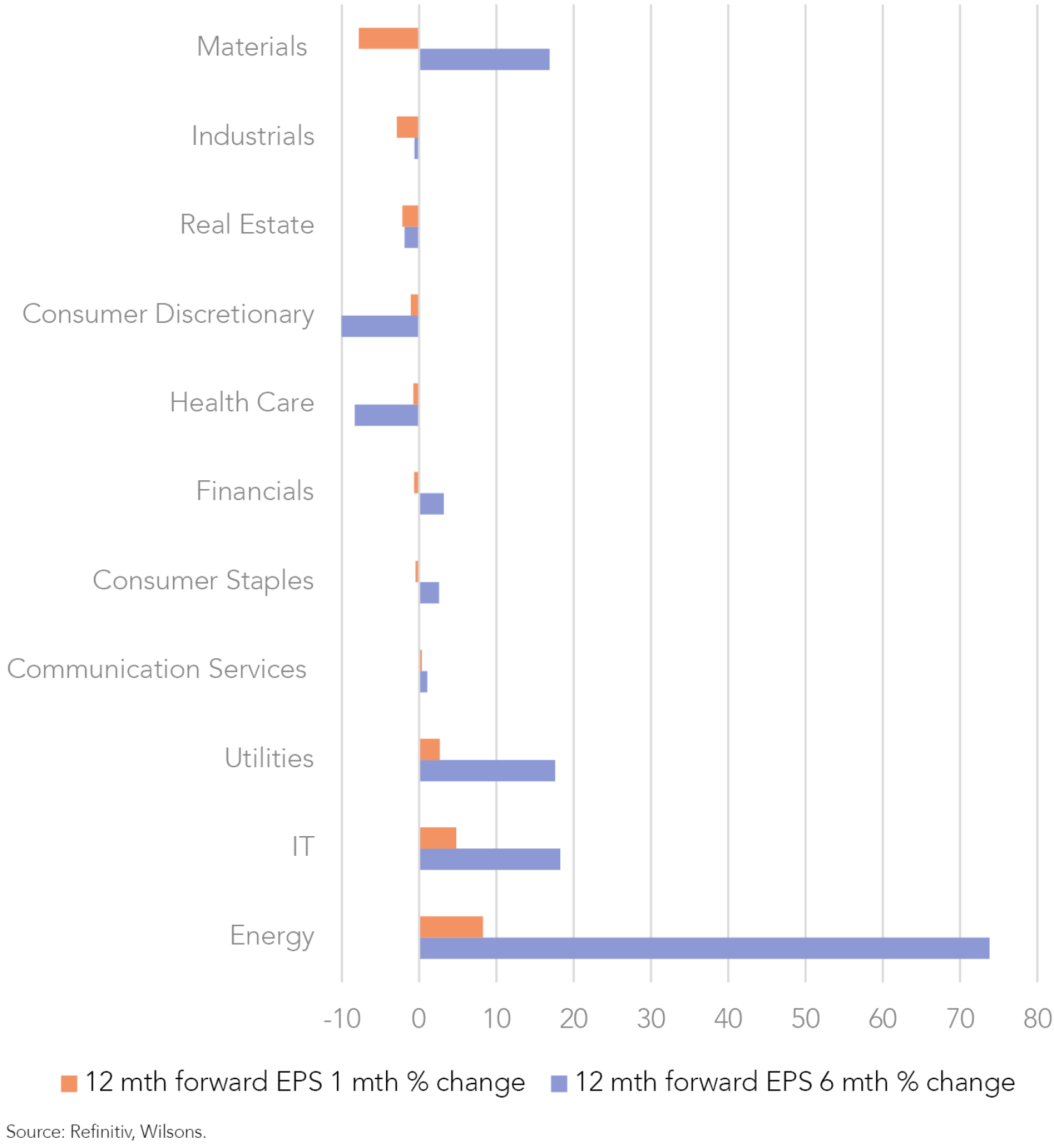

However, this has all been a valuation story so far, with only snippets of evidence that a slowdown in the global economy has had a significant impact on company earnings as of yet. The ASX 200 is expected to deliver ~20% earnings per share (EPS) growth for FY22, albeit this will be driven largely by an abnormally strong level of growth in the energy sector. Most other sectors are expected to report mid-single digit rates of growth.

We believe that Australian equities are more than likely entering an earnings downgrade cycle, and the reporting season this month may be one of the key catalysts to kick off further downward revisions led by risks relating to margin degradation. In July, aggregate ASX 200 EPS forecasts were dragged lower by downgrades in the heavily weighted materials sector after a period of upgrades driven by buoyant commodity prices.

Australian companies may exhibit cost pressures in their FY22 results, since this has become more prevalent in the past half year.

It typically takes some time for higher interest rates to trickle down into the economy. Risks associated with higher rates (e.g. an economic slowdown) may not appear in the actual FY22 results, but may appear in forward guidance, August trading updates, or management outlook commentary.

What We are Watching

Costs pressures

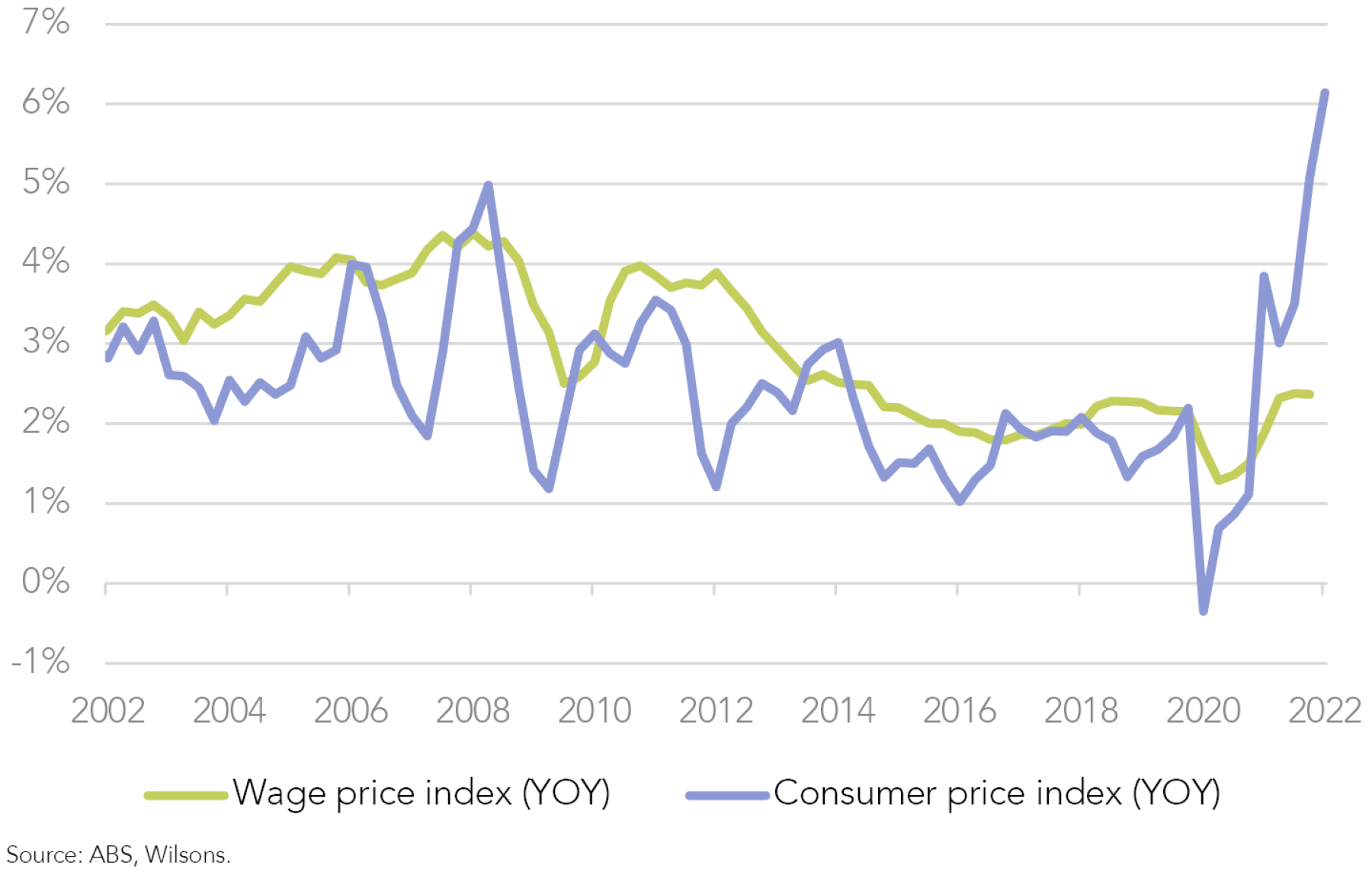

Inflation (and its impact on central bank policy) has been a key focus of markets since the beginning of the year. However, we are starting to see traces of cost pressure flow through into recent US companies’ profits and these may present themselves in the Australian 2H22 results.

We have already seen the impact of higher costs on US companies in quarterly earnings reports. Coca-Cola, Amazon and McDonald’s all reported higher costs (which were being passed on to customers in higher prices). For Walmart, a stalwart of US retail, the reported cost increases came with a profit warning that led to analyst downgrades. The stock fell almost 9% on the day of reporting.

Therefore, higher costs have not yet become an issue for companies that can pass these costs onto customers. However, for retailers like Walmart, whose business model is built on maintaining low prices, we have already started to see an immediate hit to profits.

Consumer goods companies will have to balance passing on higher costs to customers while sustaining demand as cash-strapped consumers consider alternatives. For this reason, we believe the current dynamic of passing costs to consumers cannot continue forever, and companies implementing this strategy may have to change tact by the end of this calendar year.

The other key factor for companies is labour costs. Wages in Australia have started to increase over the past 12 months and for many Australian stocks, this is a large cost line. Wages may not yet be the most talked about FY22 cost this reporting season for the broader market, but it will certainly be a key factor management will be considering in forward guidance. However, we might see evidence of labour cost pressures in sectors like technology or mining, where there are current labour/skill shortages.

Sectors where costs could be an issue:

- Resources (labour costs)

- Banks (labour costs)

- Select industrials (labour and material costs)

- Technology (labour costs)

- Consumer discretionary (material and labour costs, goods retailers are our biggest concern)

Spending slowdown

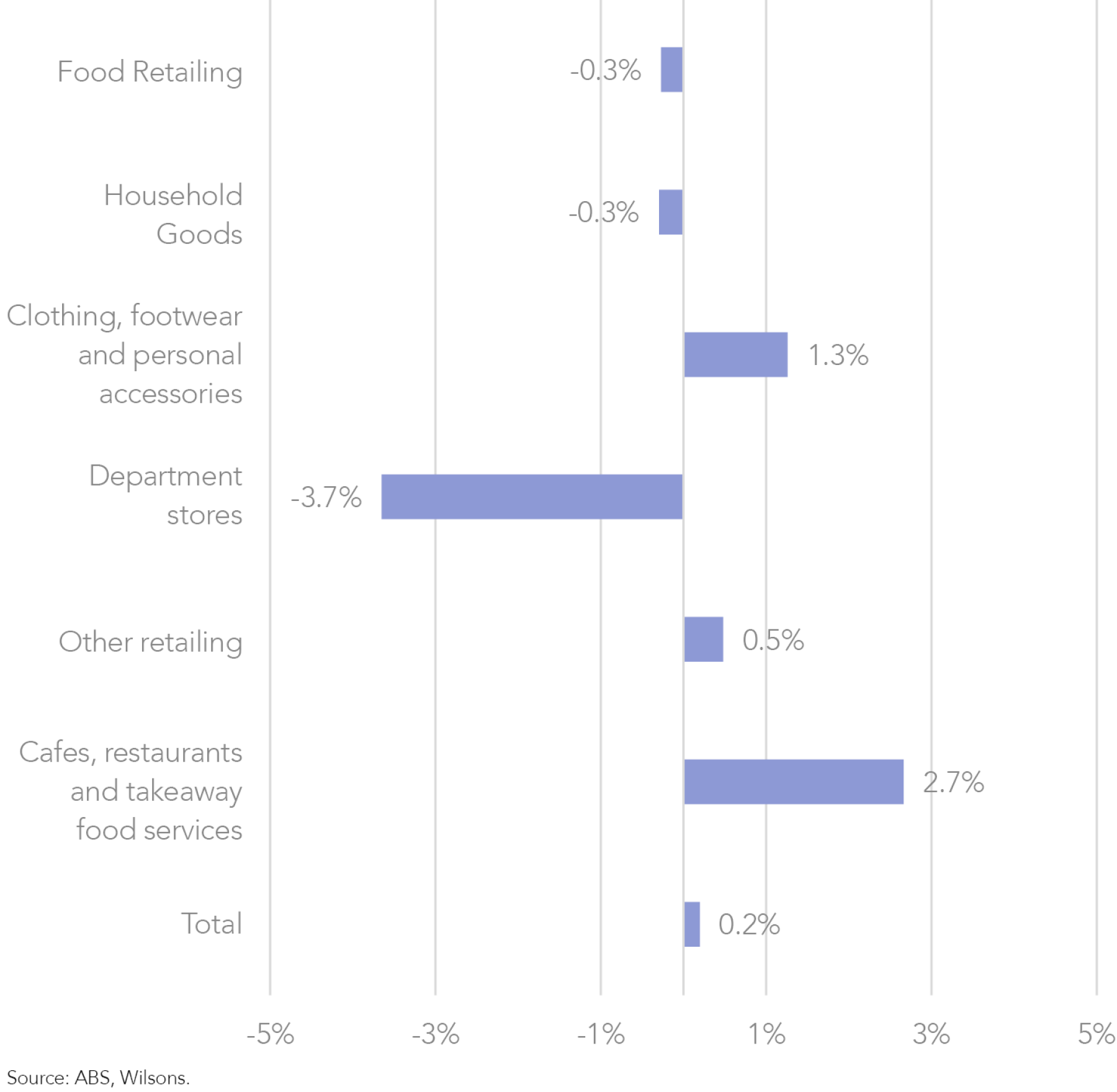

We expect consumption to slow as interest rates increase. There is a risk that more households will be under pressure to pay their bills and put food on the table if mortgage repayments and consumer prices rise. Households with lower incomes will be less likely to spend money on clothes and electronics.

We think this is unlikely to hit the FY22 performance for the likes of JB Hi-Fi (JBH) or Harvey Norman (HVN), but we believe that forward guidance and trading updates may start to show a decline in sales or higher discounting for the post-FY period. This would likely be a concern for investors.

We think investors are better placed in consumer services than consumer goods. Consumer services should be less impacted by rising rates than retailers. The consumer services sector has more defensive products, such as gaming and fast food. We also believe that a normalisation of spending habits from goods to services (e.g. electronics to travel), will provide a tailwind for services over the next 12 months and this should become more evident in trading updates.

Share prices may not move as significantly in response to downgrades in this reporting season as we saw in February. The market has seemingly priced in downgrades already. Over the next 6 months, earnings may play catch up with share prices that have already fallen significantly over the past 6 months.

Dividend surprises

Dividends in certain sectors may be the key upside surprise for investors this reporting season. We believe this can be driven by two factors, elevated commodity prices and US dollar strength.

Companies with global earnings represent almost 30% of the ASX 200 by market cap. As a result, the current strength of the US dollar may provide positive earnings surprises and therefore dividend surprises this reporting season, with analysts yet to upgrade earnings numbers due to house FX assumptions.

Elevated commodity prices could be another key driver of higher than average payout ratios for resource stocks. For example, we believe that Santos (STO) or Woodside (WDS) might be able to boost interim results due to a strong cycle, which should allow STO to increase its payout ratio and increase dividends as it generates supernormal levels of cash.

| Company | Ticker | Date | Event | Detail |

| ANZ | ANZ | 21/07/2022 | 1Q23 Update | Recent trading update showed modest underlying NIM improvements (+ 6 BPS QoQ), while costs continue to be tightly managed and momentum remains strong in lending. Collective provisions remained flat. Higher rates are expected to be supportive of Q4 margins. ANZ also announced it will acquire Suncorp Bank from Suncorp Group Limited (ASX: SUN) for a purchase price of $4.9 billion. The deal is expected to be EPS neutral pre-synergies in FY23 on a pro forma basis, with low single-digit accretion expected when including full run-rate synergies. |

| Macquarie Group | MQG | 28/07/2022 | 1Q23 Update | No explicit guidance has been issued for FY23 at this stage. Macquarie's recent trading update indicated its 1QFY23 profit was up over the quarter, although conditions had softened over the quarter. |

| Pinnacle Investment Management Group | PNI | 3/08/2022 | FY22 Results | Our analysts expect PNI to report normalised NPAT of $77.5m (+ 16% YoY) and normalised EPS of 39.8 CPS (+9% YoY). PNI recently provided an update on performance fees, which exceeded our expectations and are expected to be $57m. However, the result is expected to be weighed down by a higher cost profile and negative impacts to FUM arising from volatile markets. |

| NAB | NAB | 9/08/2022 | 3Q23 Trading Update | Key issues: NIMs, bad debts, credit growth, updates on costs (though the business has abandoned its explicit cost reduction target of $7.7 billion by FY23-25). |

| Telstra | TLS | 11/08/2022 | FY22 Results | Earnings should reflect lower NBN headwinds and a more rational pricing environment is expected to benefit ARPUs. We expect underlying EBITDA to meet FY22 guidance of $7.0-7.3b and the FY23 ambition of $7.5-8.0bn should be reiterated. Look for updates on strategic initiatives, including InfraCo fixed monetisation and cost outs. |

| IAG | IAG | 12/08/2022 | FY22 Results | Earnings should be uneventful. IAG has already provided preliminary results. NPAT is expected to be $347m, slightly below consensus, driven by gross written premium (GRP) growth of 5.7%. Result will be negatively impacted by higher net peril costs (~$1.1b) and reserve strengthening. Expect the business to reaffirm FY23 guidance for GRP growth in the mid to high single digits range and for insurance margins of 14-16%. |

| Healthco Healthcare and Wellness REIT | HCW | 12/08/2022 | FY22 Results | We expect HCW to achieve its FFO and DPU guidance of 5 CPS and 7.4 CPS. Look for updates on real estate market valuations and acquisition pipeline. |

| Westpac | WBC | 15/08/2022 | 3Q23 Trading Update | Trading update: expect progress on cost-out programme. Costs have been guided to be 0-2% lower in 2HFY22 despite inflationary pressures. Look for updates on bad debts and NIMs. |

| Seek | SEK | 16/08/2022 | FY22 Results | Positive operating conditions should support robust earnings. We expect EBITDA to report towards the top end of the guidance range of $490-515m (last upgraded +15% in Feb 2022), given record job ad volumes in Australia amidst a tight labour market. This may remind the market that SEK is earning supernormal profits at present. |

| BHP Group | BHP | 16/08/2022 | FY22 Results | Earnings should be uneventful. BHP recently reaffirmed that it achieved full year production guidance for iron ore and energy coal, as well as revised guidance for copper and metallurgical coal. WA Iron Ore unit cost guidance is expected to be achieved. Look for updates on unit cost/ production volume guidance, labour shortages, COVID absenteeism. |

| James Hardie | JHX | 16/08/2022 | 1Q23 Trading Update | FY23 full year guidance is for adjusted net income of US$740-820m, a 26% YoY increase at the mid-point. Look for updates on this guidance, with a focus on cost pressures, price increases, and the demand outlook amidst a softer US housing market. |

| Goodman Group | GMG | 16/08/2022 | FY22 Results | GMG management forecasts operating EPS of +23% YoY and full year distributions of 30 CPS. We see upside to guidance. Look for updates on development activity, WIP book, and logistics market valuations. |

| Santos | STO | 17/08/2022 | 1H22 Results | Consensus expects 1H22 EBITDA of $3.0b (vs $2.8b in 2H21). Expect top line to benefit from robust energy prices. Look for updates on merger integration synergies, asset sales, dividend payout ratio and future capital commitments. We think STO needs to prioritise short term free cash flow (FCF) over medium term production growth. |

| CSL | CSL | 17/08/2022 | FY22 Results | Our analysts expect CSL to deliver normalised NPAT of US$2,189m (versus guidance of US$2, 150-$2,250m). Look for updates on COVID related cost pressures, updates on R&D pipeline and collection trends. |

| Cleanaway Waste Management Ltd | CWY | 19/08/2022 | FY22 Results | The FY22 result is expected to be impacted by a number of one-off costs, including New Chum Landfill flood damage of $30-40m and $6m of flood damage at other sites. An additional $10m of EBITDA impact is expected in FY23. Market expects FY22 EBITDA of $572m (+7% YoY). Look for updates on cost pass throughs (labour, fuel and general CPI) and Suez acquisition synergies. |

| Lottery Corporation | TLC | 24/08/2022 | FY22 Results | First result post demerger of TAH/TLC. Consensus expectations are for EBITDA of $694m in FY22 (+ 14% YoY vs $611m in FY21). May get more detail on demerged company. |

| Tabcorp Holdings | TAH | 24/08/2022 | FY22 Results | First result post the demerger of TAH/TLC. Market expects EBITDA of $368m in FY22 (-21% YoY vs $464 in FY21), which will reflect impacts of venue closures and sport/racing disruptions to wagering and gaming services revenue in CY2021. |

| Seven Group Holdings | SVW | 24/08/2022 | FY22 Results | Management has provided guidance for FY22 EBIT to be up to 8-10% on FY21 pro-forma EBIT from continuing operations, excluding property. We believe there could be upside surprise here. |

| News Corp | NWS | 25/08/2022 | 4Q22 Trading Update | Consensus expects full year EBITDA of ~US$1.67b (+31% YoY). Performance of digital real estate services will be key. Look for updates on simplification strategy and potential 'value unlocking' events such as asset divestments (e.g. Foxtel), capital management initiatives, online sports betting venture, and the outlook for ad market and property listings. |

| Judo Capital Holdings | JDO | 25/08/2022 | FY22 Results | Maiden full year result. Consensus expectations are for NPAT of $9.37m, underpinned by net interest income of $172m. Look for updates on NIMs, loan book, bad debts, and the outlook for SMEs. Market reacted positively to recent update in May. Loan book was marginally higher than prospectus for June 22. |

| Qantas Airways | QAN | 25/08/2022 | FY22 Results | QAN forecasts a significant full year EBIT loss for FY22, reflecting the worst of the Delta and Omicron impacts to travel and tourism, as well as significant restart costs. However, the business has guided it is on track to deliver 2HFY22 underlying EBITDA of $450m to $550m. Look for guidance around the expected timing of a return to underlying profit. |

| Allkem | AKE | 25/08/2022 | FY22 Results | Earnings should be uneventful. AKE's recent Q421 update highlighted Mt Caitlin production of 193.6k dry metric tonnes (spodumene concentrate) with ~56% recovery in line with guidance. FY22 full year cash cost of US$401/tonne also met FY22 guidance . Key issues include lithium pricing / demand, as well as costs. Cash cost guidance for FY23 is higher than FY22, at US$700-800 per tonne, due to development costs, lower volumes, lower ore grades, COVID impacts and labour shortages. |

| Telix Pharmaceuticals | TLX | 26/08/2022 | 1H22 Results | After Telix's ILLUCCIX delivered a pleasing commercial debut in the USA, Wilsons analysts recently increased our full year FY22 revenue forecast by +28% to $85.9m, with revenue of $24.4m expected in 1HFY22. Look for further updates on commercial performance in the US market. |

| Northern Star Resources | NST | 29/08/2022 | FY22 Results | Consensus expectations are for NPAT of $342m. Top line growth is expected to be offset by margin pressures. Key issues: cost inflation, production delays, labour shortages, energy costs and weather impacts. |

| OZ Minerals | OZL | 29/08/2022 | 1H22 Results | In June OZL updated its guidance, forecasting lower copper production (120-135k tonnes down from 127-149k previously) and higher costs (AISC of 160-180 US c/lb up from 135-155 US c/lb) due to staffing shortages, COVID absenteeism and adverse weather. Look for further updates on costs and production guidance. |

| Woodside Energy Group | WDS | 30/08/2022 | 1H22 Results | Expect top line to benefit from robust energy prices. Look for updates on merger integration synergies, with US$400m p.a. of synergies guided. |

Note: XRO and ALL are not expected to provide updates this reporting season.

Source: Wilsons.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.