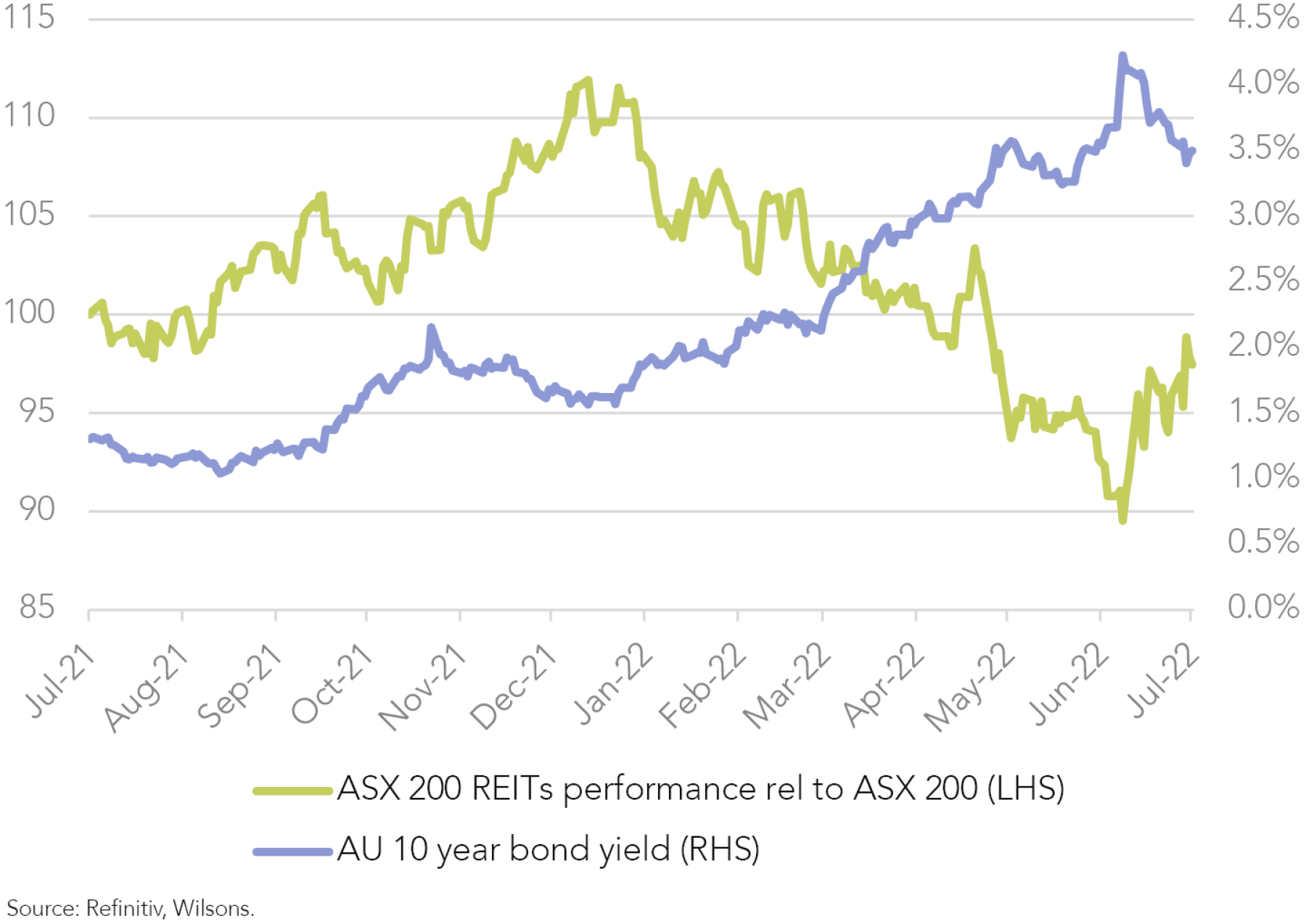

Since the beginning of the year, the real estate investment trust (REIT) sector has significantly underperformed in the broader market, mainly due to valuation concerns on rising bond yields.

We tend to believe the REIT sector’s underperformance should be coming to an end given that:

- Bond yields have started to stabilise.

- Market focus will shift to the defensive aspects of REITs.

- Valuations are generally supportive.

At this stage of the cycle, we remain neutral on the REITs sector. While underperformance due to bond yields may be over, structural issues within some sectors, such as office and retail REITs, may be further exacerbated by an economic slowdown. Our preference is to invest in sectors with structural tailwinds and defensive earnings, such as logistics and healthcare REITs.

Bond yield proxies to benefit from lower yields

The Australian 10-year bond yield has increased from 1.7% to 3.5%, after reaching a high of 4.2% at the end of June, as the market becomes more concerned about inflation and the Reserve Bank of Australia’s (RBA) attempts to tame it. The Australian listed property sector is still perceived (probably quite rightly) as a bond proxy. So, as bond yields go higher the sector tends to underperform.

We believe that the bond yield has largely stabilised and the risk is now to the downside for yields as investors contemplate recession risk (or at least a decent slowdown) and an easing of inflation pressures. As bond yields fall, this would likely be a tailwind for REIT valuations.

Market focus shifts to rental growth and defensive cash flow

The return of inflation may paradoxically prove to be of benefit to REIT investors, if rents can continue to outpace financing and labour costs. This would result in greater top-line revenue, which may in turn be reflected in higher cash flows.

Even though we believe inflation will start to fade this year, and that bond yields will fall with it, it is still worthwhile to invest in companies that can pass increased costs on to their customers.

In order for this dynamic to hold, we believe investors should be exposed to in-demand, fast-growing sectors, such as distribution warehouses, data centres, and life science facilities. Despite rising interest rates, these specialty sectors will likely exhibit the most significant pricing power, which will still give them an attractive growth profile relative to traditional sectors like office and retail. We believe the logistics sector offers the best prospects for rental growth, consistent with consensus expectations.

As the market gets more concerned about the economic outlook, we think the defensive nature of some REITs will begin to shine through and should start to outweigh the concerns on valuation.

Valuations generally supportive

Despite rising interest rates, underlying fundamentals for most property sub-sectors remain solid, as do current demand and pricing.

While asset prices remain resilient, many REITs are currently trading at significant discounts to net asset value (NAV). It is likely that NAVs could be downgraded retrospectively and that cap rate expansion will remain a focus for FY23. However, most REITs screen as relatively cheap vs their previous 10-year discounts to NAV and probably present an opportunity for investors.

Risks Persist for Office and Retail

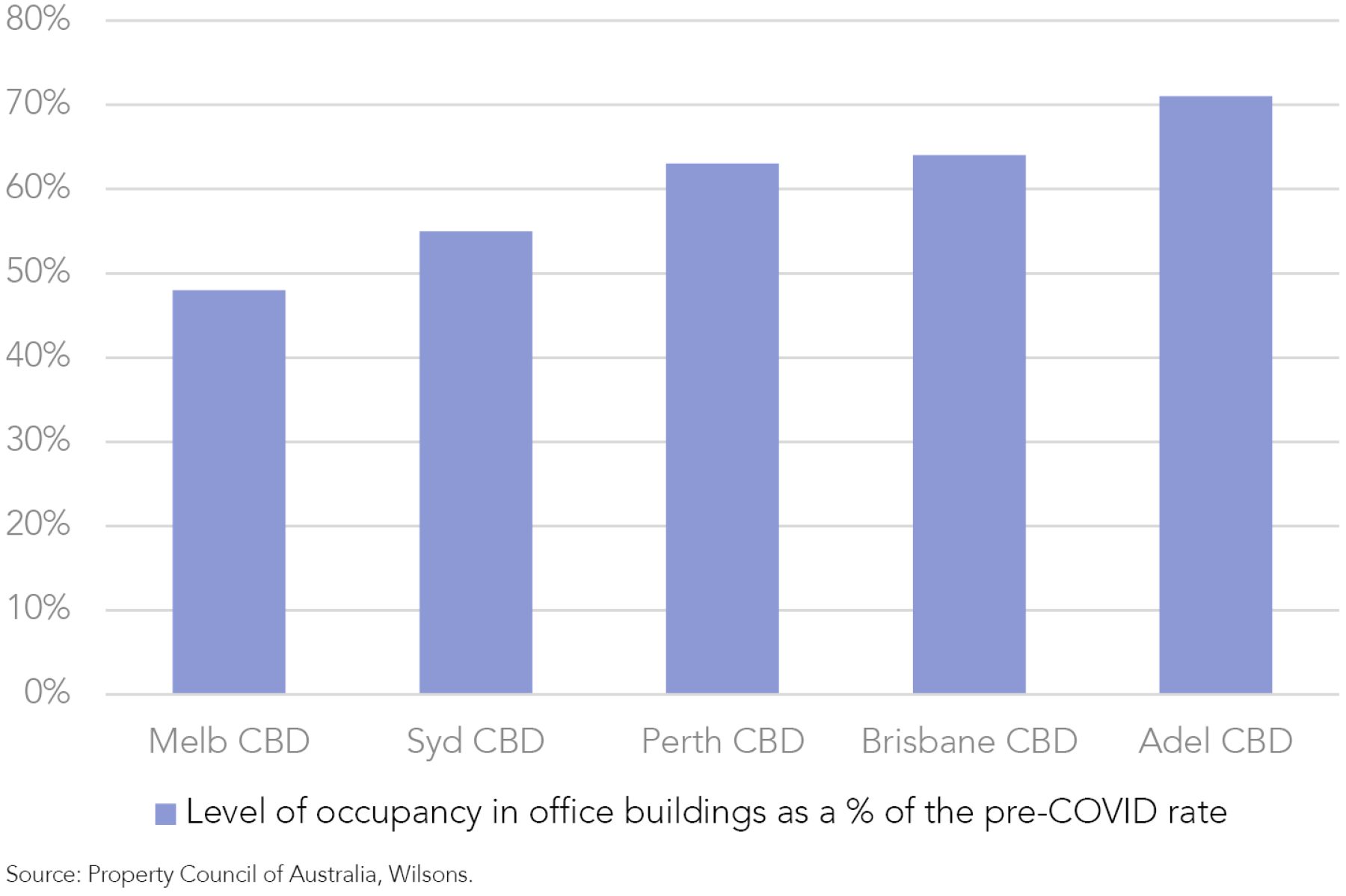

Despite the significant discounts to net tangible assets (NTA) in these sectors, we remain concerned about structural challenges for office and retail REITs.

Office occupancy is still low compared to pre-COVID levels (Sydney and Melbourne at 55% and 48%, respectively). Occupancy may never reach pre-COVID levels, and this could lead to balance sheet downgrades for some office REITs. A slowdown in economic growth is another risk for office REITs. In the next 12 months, businesses may refrain from upgrading office space because of the impending slowdown, postponing upgrades until at least FY24.

The recovery of retail REITs appears to be further along than that of office REITs, with Vicinity Centres (VCX) reporting positive momentum in foot traffic, sales, and rent collections in May. However, online remains a headwind for retail REITs, with even more households shopping online after the pandemic. Meanwhile, an economic slowdown could derail a recovery in foot traffic and rent collections over the next 12 months. Consequently, we do not have exposure to this sector in the Focus List.

Preference to Defensive Earnings Profiles with Structural Tailwinds

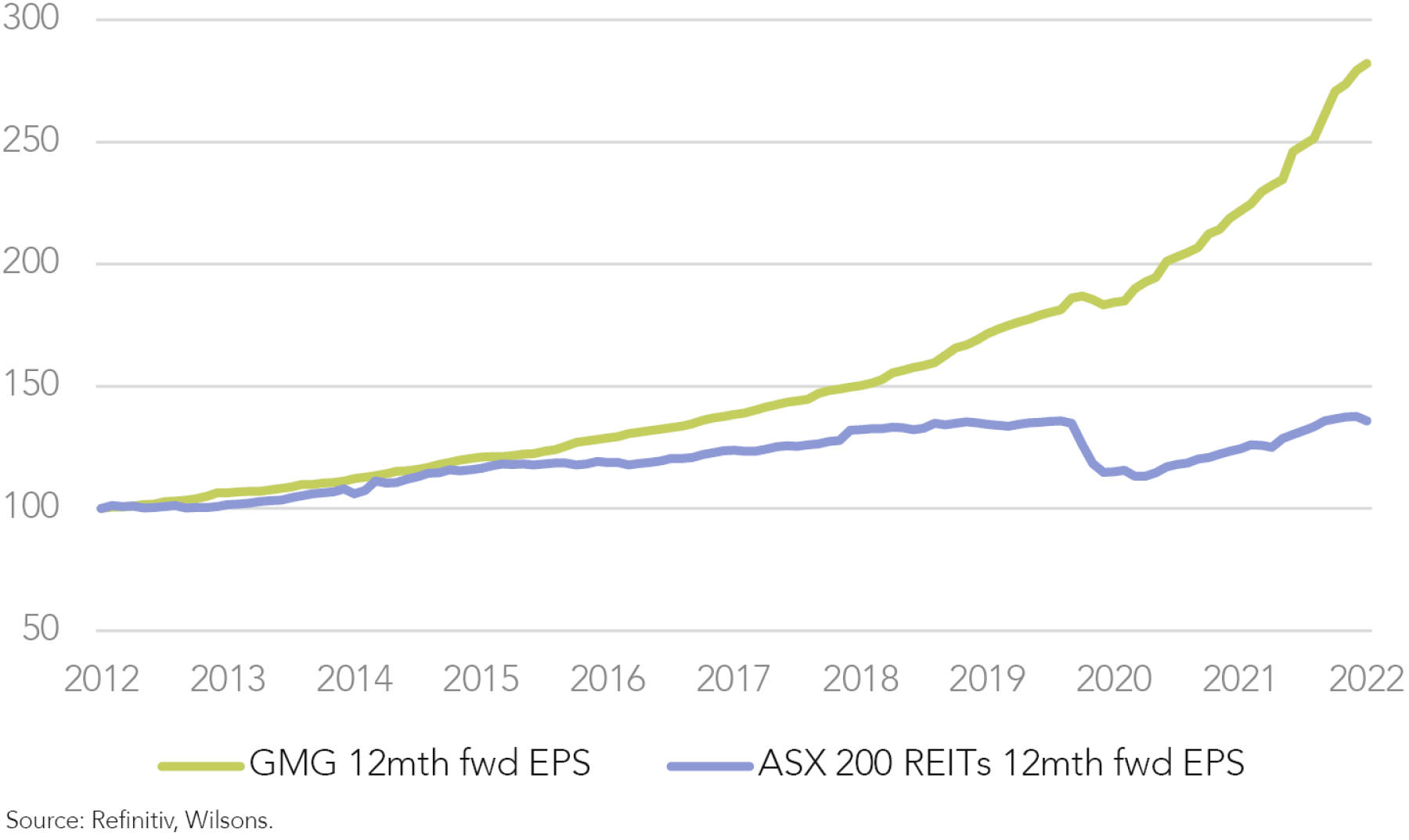

Given the growing shift to e-commerce and the focus on supply-chain resilience, we expect the favourable tailwinds for industrial/logistics assets to remain in place over the medium-term. REITs like Goodman Group (GMG) should benefit from structural growth over the next 12 months, which ought to make their earnings less cyclical than other REITs on the market.

In the current environment, we believe the Healthco Healthcare and Wellness REIT (HCW) presents an opportunity for investors due to its defensive earnings, its current discount to NTA and the ongoing structural tailwinds in healthcare.

Goodman Group a core holding in the Focus List

GMG is a truly global integrated property company. The group owns, develops and manages industrial property and business space globally, with its key operating regions being Australia and New Zealand, Asia, Continental Europe, United Kingdom and the Americas. Over time, management has demonstrated a strong track record of deploying capital with a high rate of return.

GMG is well placed to benefit from the long-term tailwinds of the digital economy, as continued growth in e-commerce drives strong demand for modern, well-located, urban infill logistics sites. Supply of such sites is relatively scarce and barriers to entry are high. The widespread supply chain disruptions caused by COVID have also underscored the value of having strategically located logistics sites, encouraging businesses to shore up their supply chains and further bolstering tenant demand for high quality industrial assets.

The positive sector backdrop should continue to underpin strong occupancy levels and rents across Goodman’s investment portfolio over the medium- to long-term, while also driving growth in its development WIP (work in progress) book (currently ~$13.4 billion) and in its assets under management (currently ~$68.2 billion).

The group has ample balance sheet capacity with gearing at 7.2% (18.7% look-through) and available liquidity of $2.1 billion, while most of its capital investments are internally funded with retained earnings being largely re-deployed into the business.

In recent years, GMG have grown their funds-management operations – a move that proved prescient. COVID-19 highlighted the reliability of their earnings under significant market stress. As a recognised leader in real estate asset management, the growth in funds-management earnings should continue. The market will normally pay a higher price for annuity style earnings, and given that a shift towards this style of earnings has been key to GMG rerating over the last decade, we think this can continue over the next decade as well.

We expect the business to sustain mid-double-digit earnings per share (EPS) growth over the medium-term, consistent with its 5-year historic EPS compound annual growth rate (CAGR) being ~14%. This would likely lead to earnings upgrades for the company (consensus is expecting 12.5% CAGR over FY22-FY24).

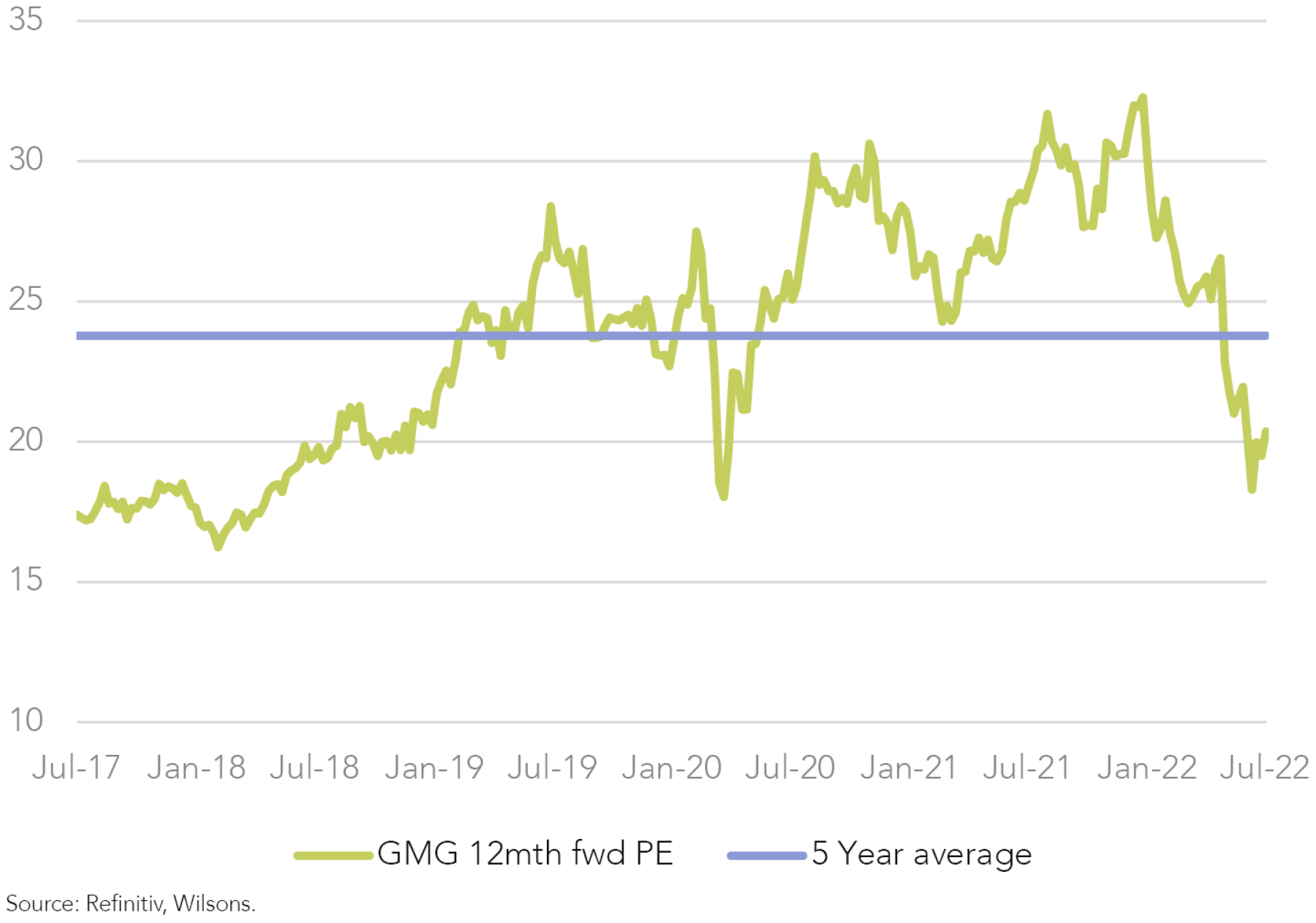

In our view, GMG’s valuation is currently attractive with the group trading at a forward price-to-earnings multiple of ~20.6x, which is favorable in the context of management’s guided +23% EPS growth for FY22 and a mid-double-digit EPS growth expected over the medium-term.

Vital signs remain positive - Healthco Healthcare Wellness REIT

Healthco Healthcare Wellness (HCW) owns a diversified portfolio of real estate assets in the Australian healthcare and wellness sector, including private hospitals, aged-care centres, primary care and wellness facilities, childcare centres, and life sciences / research centres. HCW maintains a defensive earnings profile through the cycle given tenant demand is consistent and non-discretionary in nature, and mostly government-supported.

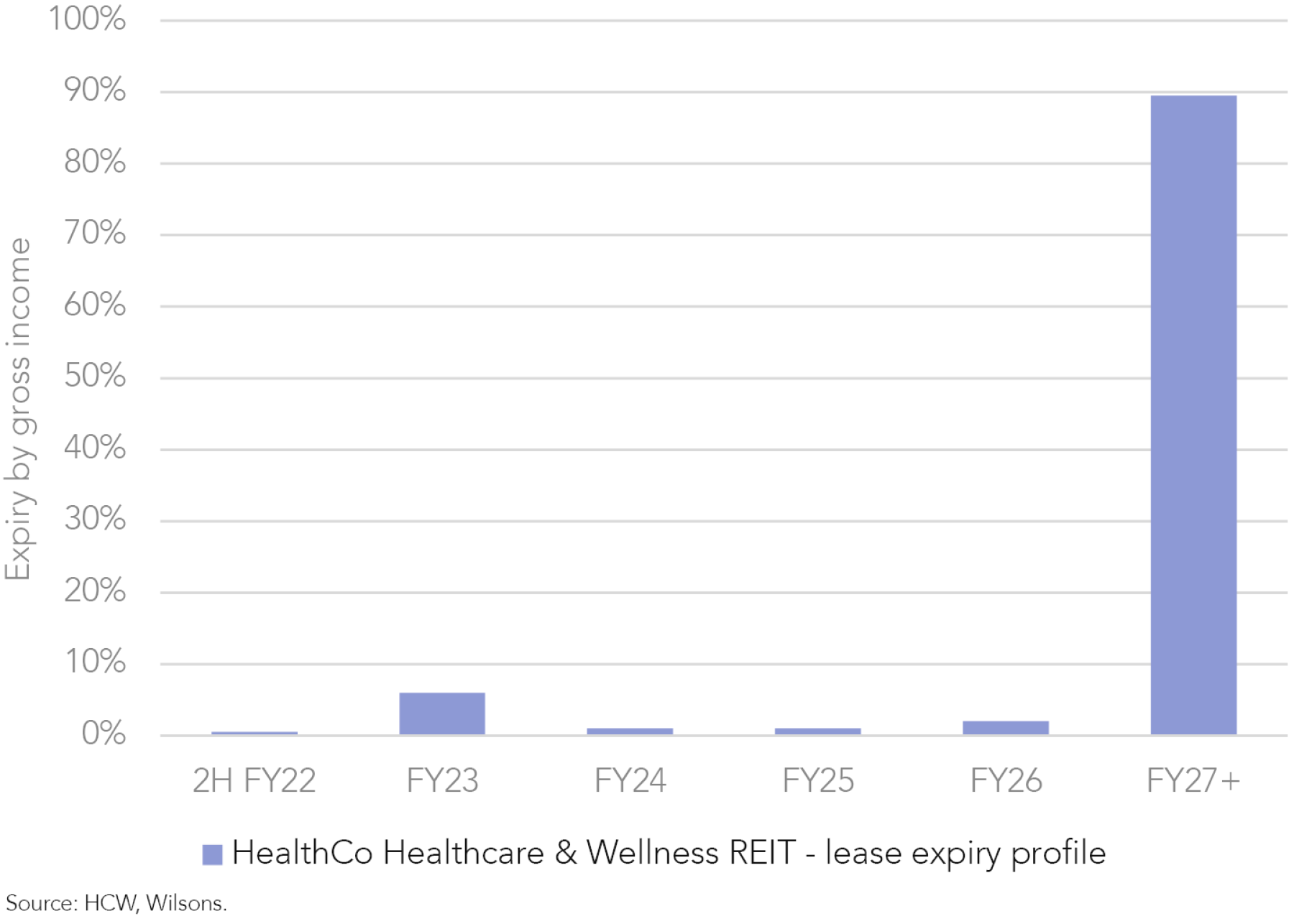

Secure and predictable cash flows are underpinned by the REIT’s long-dated leases (Weighted Average Lease expiry of ~10 years), which have fixed rental escalators of 3% across 70% of the portfolio, while the balance is linked to the consumer price index (CPI), providing explicit inflation protection. Tenants are predominately on double or triple net leases, meaning they are responsible for most or all of the ongoing property expenses, which gives HCW unitholders a high degree of earnings visibility.

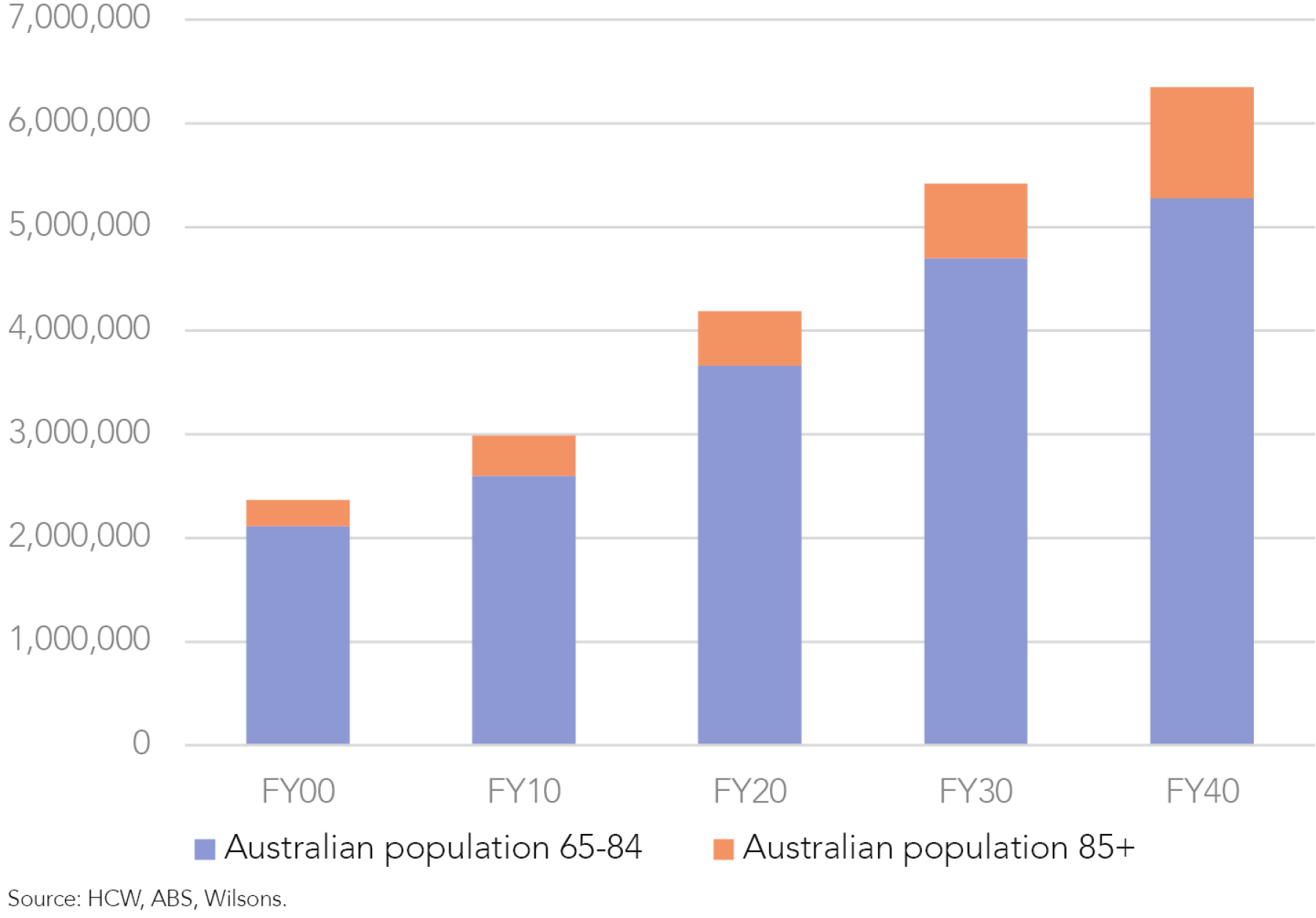

In the long-term, HCW is poised to benefit from structural ‘megatrends’ such as an ageing population and a heightened government focus on the resilience of the healthcare system post COVID, which will collectively support growing healthcare expenditure per capita over time. In addition to organic growth, the REIT has a large runway for growth through accretive acquisitions and developments, which it is well placed to fund given its balance sheet’s net cash position.

From a valuation perspective, after the recent pull-back in its share price driven by rising bond yields, HCW currently trades at a compelling ~25% discount to its $647 million portfolio valuation and NTA per unit of $2.02 (as of 30 June 2022), and offers a forward dividend yield of 5.6%.

| Company Name | Forecast Multiple 12mth fwd PE |

Price to NTA | Dividend Yield % 12mth fwd |

EPS CAGR % FY22-FY24 |

DPS CAGR % FY22-FY24 |

| Healthco Healthcare and Wellness REIT | 18.5 | 73% | 5.60% | 35% | 10% |

Source: Refinitiv, Wilsons.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.