Last week the RBA Policy Board defied market pricing and the great majority of economists’ predictions (including ourselves) by opting to keep the cash rate on hold at 3.85%.

This contrasted with the RBA's May 25 meeting, which cut the cash rate by -25bps, and was interpreted as somewhat dovish by revealing that the board had 'considered' a 50bps cut. The six-to-three split vote (disclosed for the first time) shows that it was a finely balanced decision.

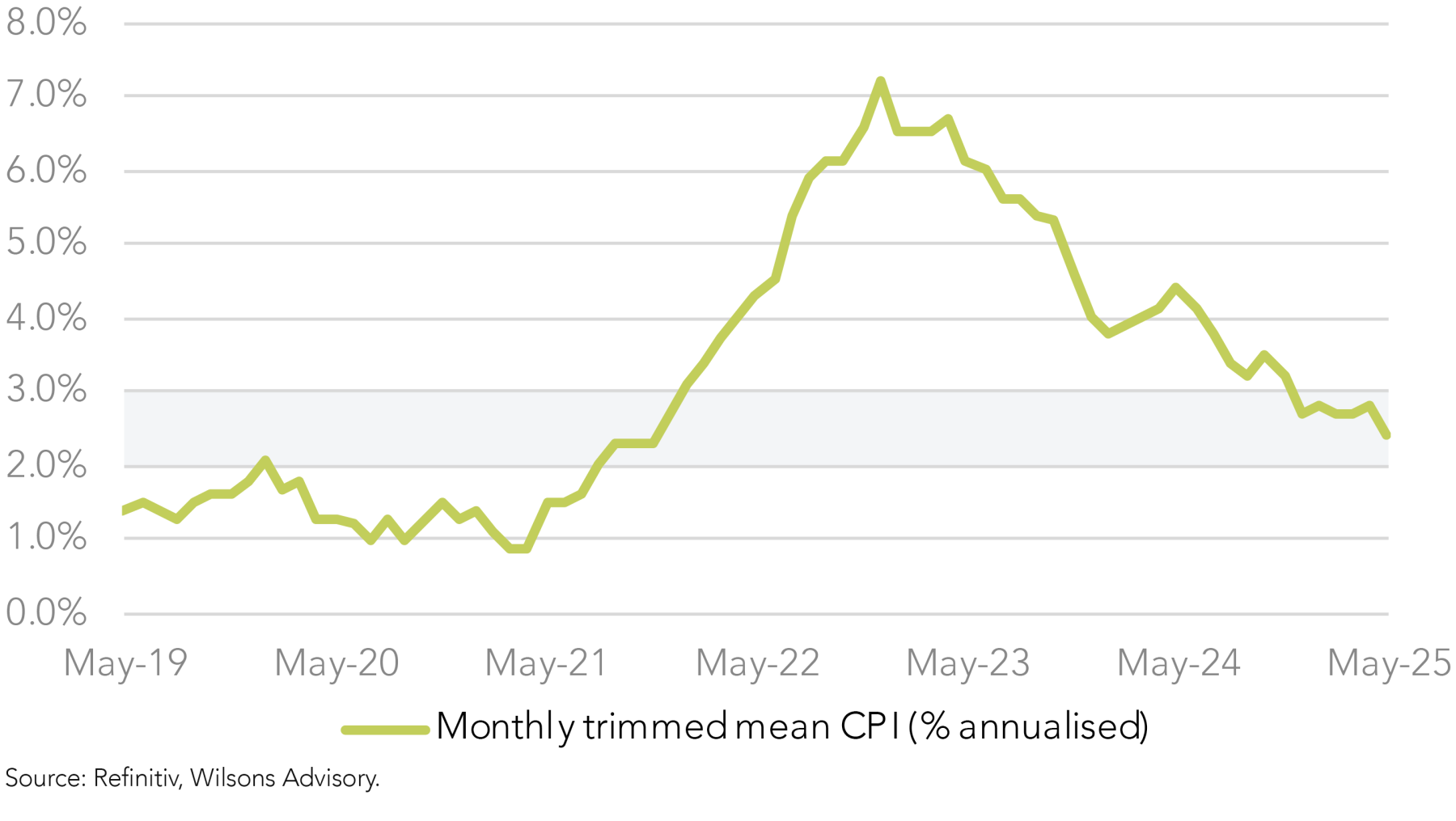

The board’s statement noted that “the board judged that it could wait for a little more information to confirm that inflation remains on track to reach 2.5 per cent on a sustainable basis.”

In the media conference, the RBA Governor suggested that by the time of the August 12 meeting, the quarterly CPI (July 30), another monthly labour force release (July 17), and refreshed RBA forecasts would be available.

Rate Cut Pricing Tweaked, Bond Yields and A$ Lift

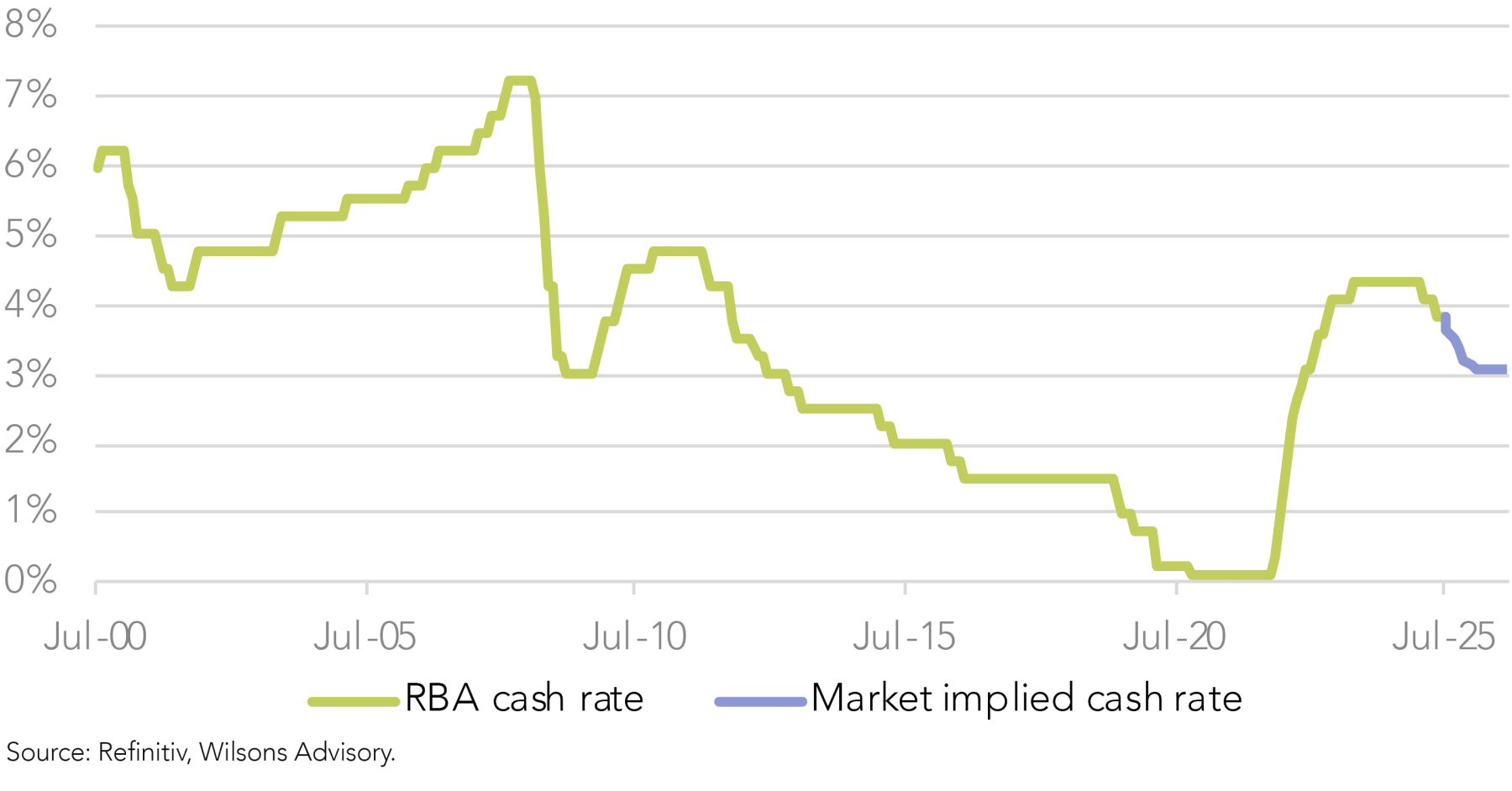

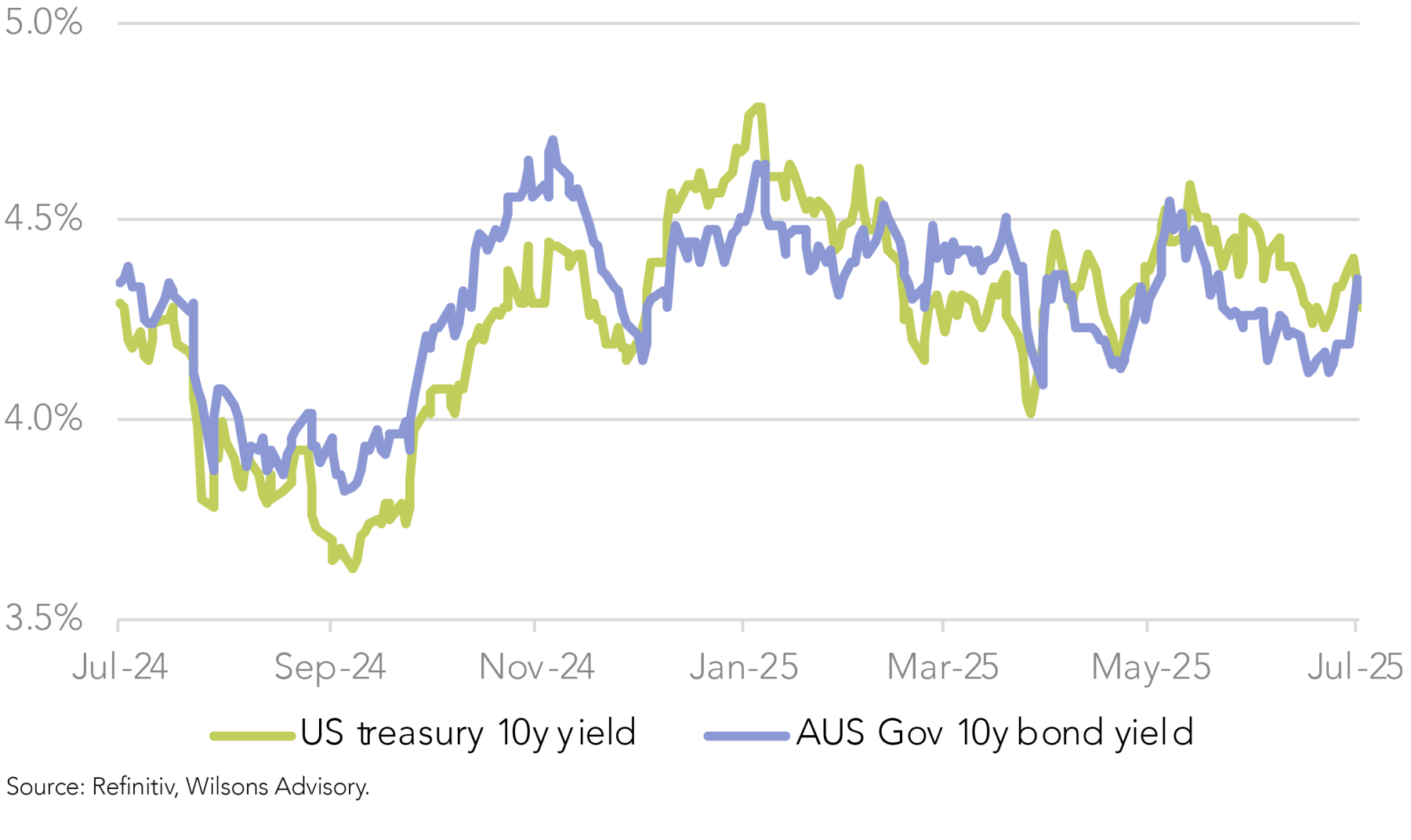

While the decision was a significant surprise, the reaction of the market was to push the expected July cut to the August meeting, which at the time of writing (July 11) is more than 90% priced. Three cuts are fully priced by March next year, which marks the expected bottom of the easing cycle at 3.1%. This is not a huge change from pre-meeting pricing, which was partially pricing the chance of a 4th cut. 10-year bond yields have pushed up post the meeting from 4.2% to 4.3%. The A$ has clearly strengthened post the meeting to sit at an 8-month high of 65.9c. Equities don’t appear to have been impacted significantly, with choppy, but ultimately flat performance since the announcement.

RBA shows little confidence in the monthly CPI series

While the most recent (monthly) underlying inflation data is well inside the RBA’s 2–3% target range and seemingly headed down, the post-meeting statement chose to highlight the 2.9% year-end rate for trimmed mean inflation as at the March quarter (the first quarter within the band for 12 quarters). This implies little confidence in the timelier monthly CPI series. Note, the monthly series was introduced in October 2022 and encompasses between 60% and 70% of the quarterly survey basket, depending on the month.

The RBA appears to be looking for confirmation from the more comprehensive Q2 inflation series to become comfortable that inflation is set to sustainably settle near 2.5%.

In the post-meeting media conference, Governor Bullock emphasised that the decision was more a question of timing, rather than direction. It seems a majority of Board members (six to three) opted to wait for more information, principally the Q2 CPI release.

The tone of the media conference did suggest that a rate cut is still likely for August, provided the trimmed mean inflation rate for June quarter does not surprise to the upside.

We expect -25bps cuts in August, November, and now February, taking the cash rate to a “terminal” rate of 3.1%. This terminal rate is in line with our pre-meeting view, but with the cutting profile pushed into early next year following July’s on-hold decision.

The fact that the economy looks close to full employment - indeed unemployment at 4.1% is below “full employment” based on the RBA’s 4.5% best estimate for the NAIRU - provides some insight as to why the RBA is in no hurry to cut. This is in line with the RBA’s apparent pivot back towards its dual mandate of targeting both price stability and full employment.

However, while the labour market is seemingly robust, we still see the need for the RBA to lower rates, with consumption so far having recovered more slowly than expected earlier and broader GDP growth tracking below most estimates of trend growth for six consecutive quarters (see figure 8).

While the unemployment rate remains low, we note that the public sector has done much of the heavy lifting and persistent sub-par growth across the economy poses a threat to the ongoing resilience of the labour market.

All eyes on the July 30 quarterly CPI

RBA Governor Bullock was asked during the press conference on the trigger to cut rates at the next meeting in August, specifically based on the quarterly CPI print for Q2-25. Bullock noted,

"The June quarter underlying forecast is 0.6 (q/q) … and it may be at the margin ... a little bit higher than that. I'm not going to put a number on what the trigger is to cut or not. “

Our assessment is the RBA Governor is giving the RBA a little bit of scope to be able to still cut the cash rate in Aug-25 by -25bps - even if the outcome for trimmed mean CPI in Q2-25 is slightly higher than the RBA's forecast (2.6% y/y). Hence, it now seems more likely that a 2.8% y/y print would probably be required to stop the RBA from cutting in August.

While the RBA may tolerate a little bit of upside surprise, it does put the onus on the Q2 CPI to print relatively benign.

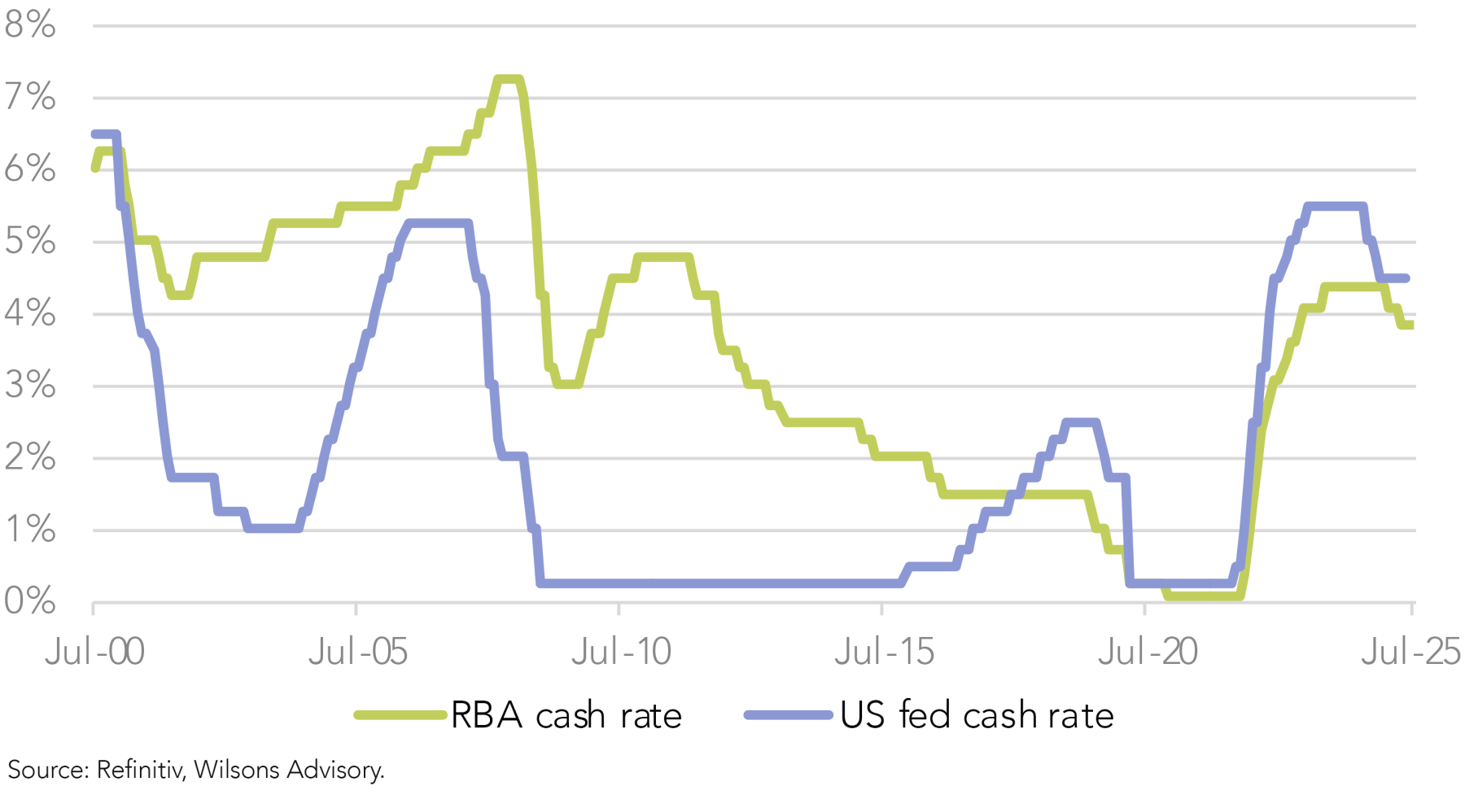

Monetary Backdrop Still Looks Supportive for Equities and Bonds

The prospect of three RBA cuts over the next eight months remains a supportive backdrop for the local stock market, despite the risk of a short-term (global) set back. Domestic fixed interest should also perform well against a backdrop of multiple RBA cuts. The move up in bond yields last week from 4.2% to 4.3% is overdone in our view, considering the cash rate is still expected to fall to 3.1%. Of course, global factors will also be important in influencing the direction of both asset classes. We see near-term risks of a setback in global equities, but maintain a constructive 12-month backdrop as central banks ease rates globally and global growth recovers from its current slowdown phase as we move through 2026.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.