The Australian economy finds itself at a pivotal juncture, and the Reserve Bank in a precarious position.

On one hand, inflation is inching up to be above the desired range, calling for a cautious approach to further policy easing. On the other, signs of weakening in the labour market are emerging, suggesting a need for policy stimulus. This leaves the RBA seemingly caught between a rock and a hard place ahead of the November board meeting, with its dual mandates of price stability and full employment calling for conflicting policy responses.

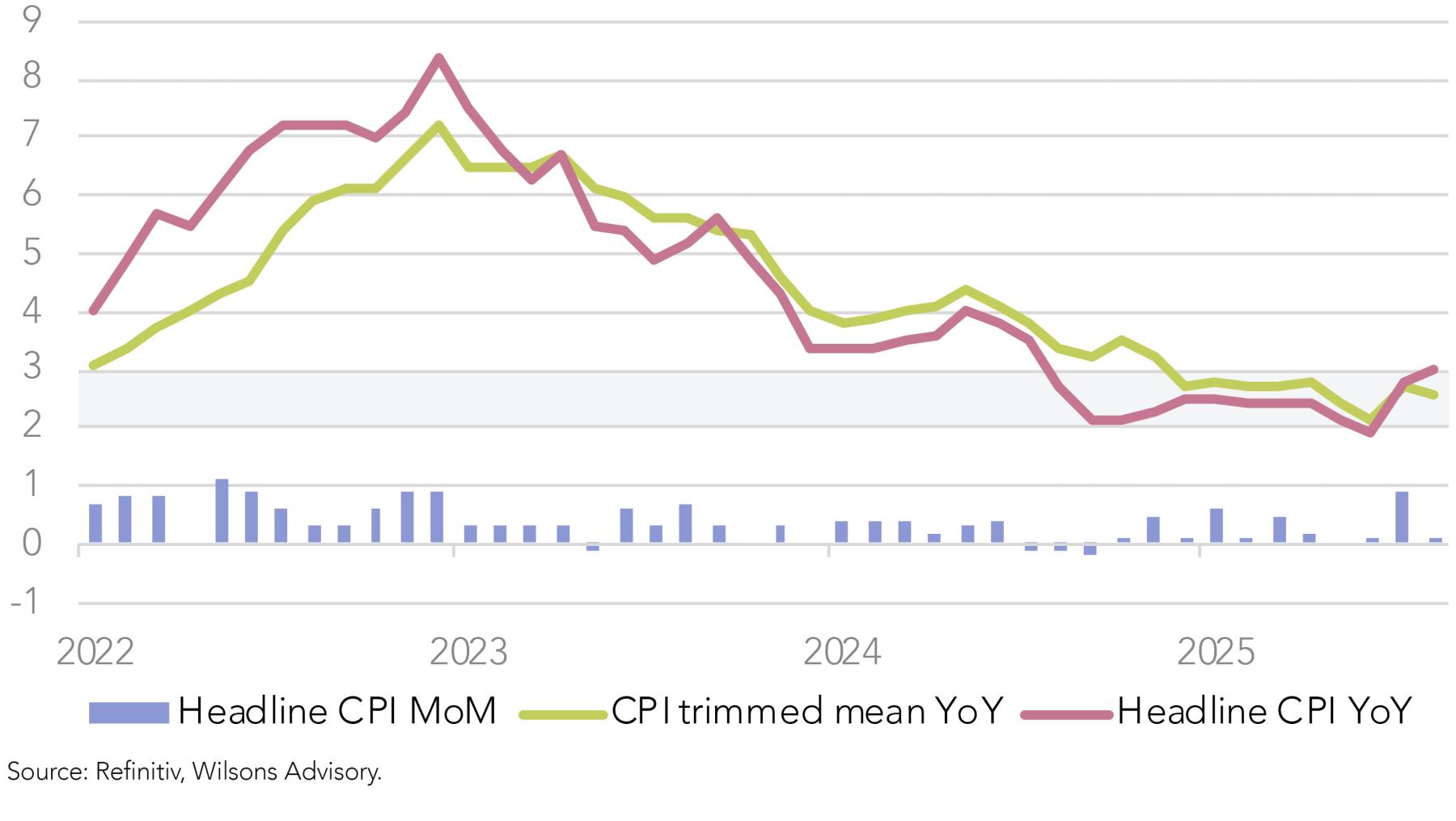

Monthly Inflation Points to Q3 CPI Heating Up

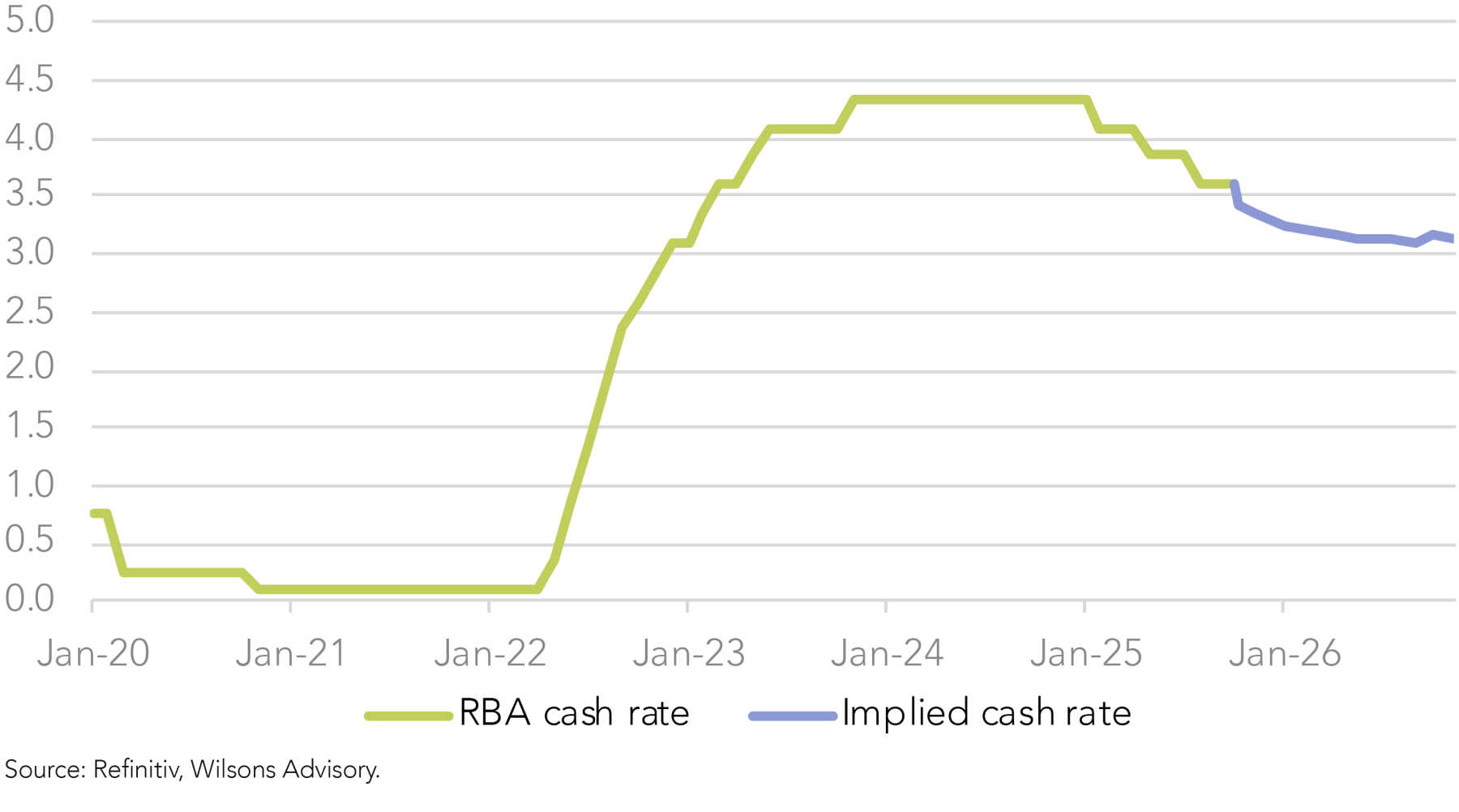

The journey to a soft landing has been long. However, the ‘higher for longer’ approach from the RBA has largely brought inflation under control. Trimmed mean CPI has been in the target band for much of 2025, allowing the RBA to cut rates three times this year. Monthly data nonetheless suggests that Q3 inflation may come in hotter than expected, above the RBA’s forecasts.

Monthly data indicates that housing and food components continue to drive monthly inflation. Rents have been a significant contributor, rising 4.2% & 3.9% y/y in June and July respectively. We have, however, seen some moderation in recent periods. Food - in particular the “meals out of home” sub-component, have seen strong rises. Meals out and takeaway rose 3.3% in the 12 months to August - for the strongest annual rise recorded in the past year. An uptick in consumption has seemingly encouraged businesses to increase prices. Higher costs for labour (with the wage price index rising 3.4% y/y in June and March quarters) and ingredients have also contributed to price increases.

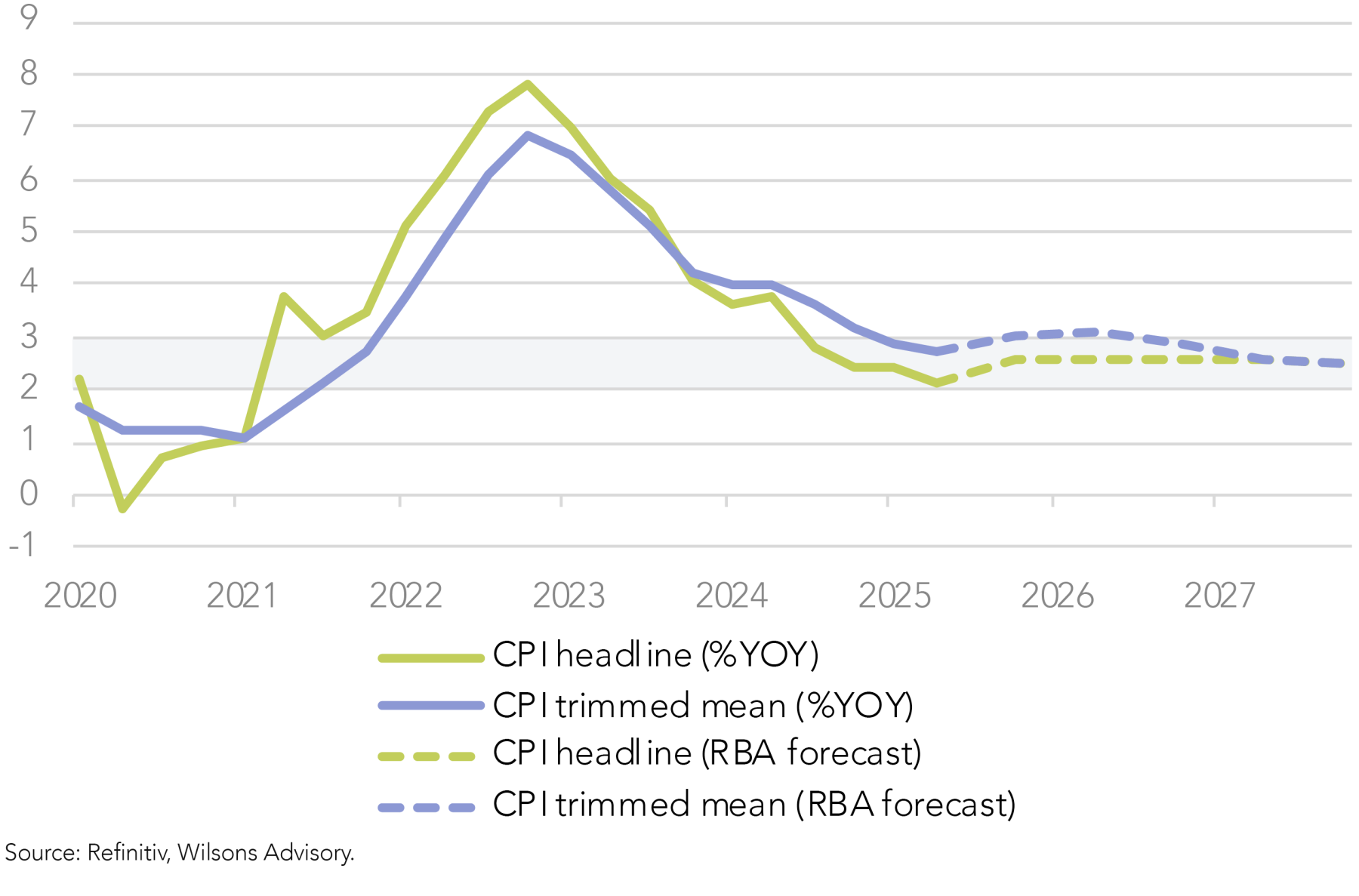

However, this is not entirely a surprise. The RBA’s August statement of monetary policy did forecast that inflation would rise through the end of 2025. The August forecast points to CPI rising to just above 3%, before returning to the mid-point of the target in 2027 - largely unchanged from the May statement. Volatility for headline CPI in the forecasts can be attributed to the unwinding of cost-of-living relief measures, such as electricity rebates.

Housing (which includes rents and utilities) components have continued to provide upward pressure on inflation. The RBA’s August statement shows housing inflation to be slightly stronger than anticipated in the May Statement.

Rents are expected to ease by a little less than expected in the May forecast, as near-term indicators of advertised rents suggest more strength in the rental market than previously assumed. These monthly indicators have suggested that Q3 CPI will be above expectations.

The extension of the Energy Bill Relief Fund is due to expire by the end of 2025, with the RBA forecast seeing trimmed mean inflation rising to just over three per cent through most of 2026. Headline inflation is forecast to remain around 2.6%, but will converge towards the underlying measure once the effects of this have passed. The RBA expects that headline and trimmed mean CPI will settle around the mid-point of the target band by 2027.

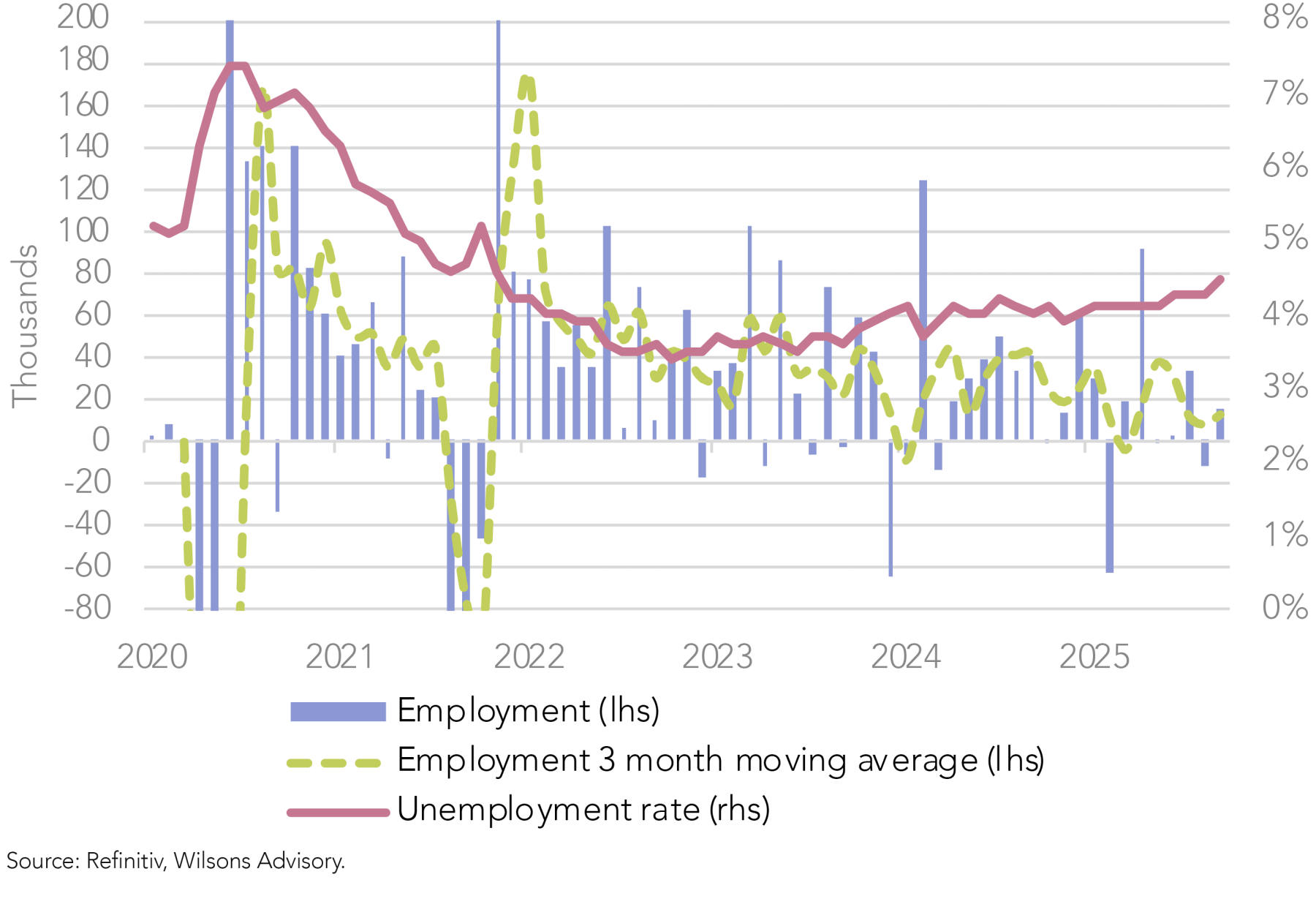

Jobs Down, Unemployment Up

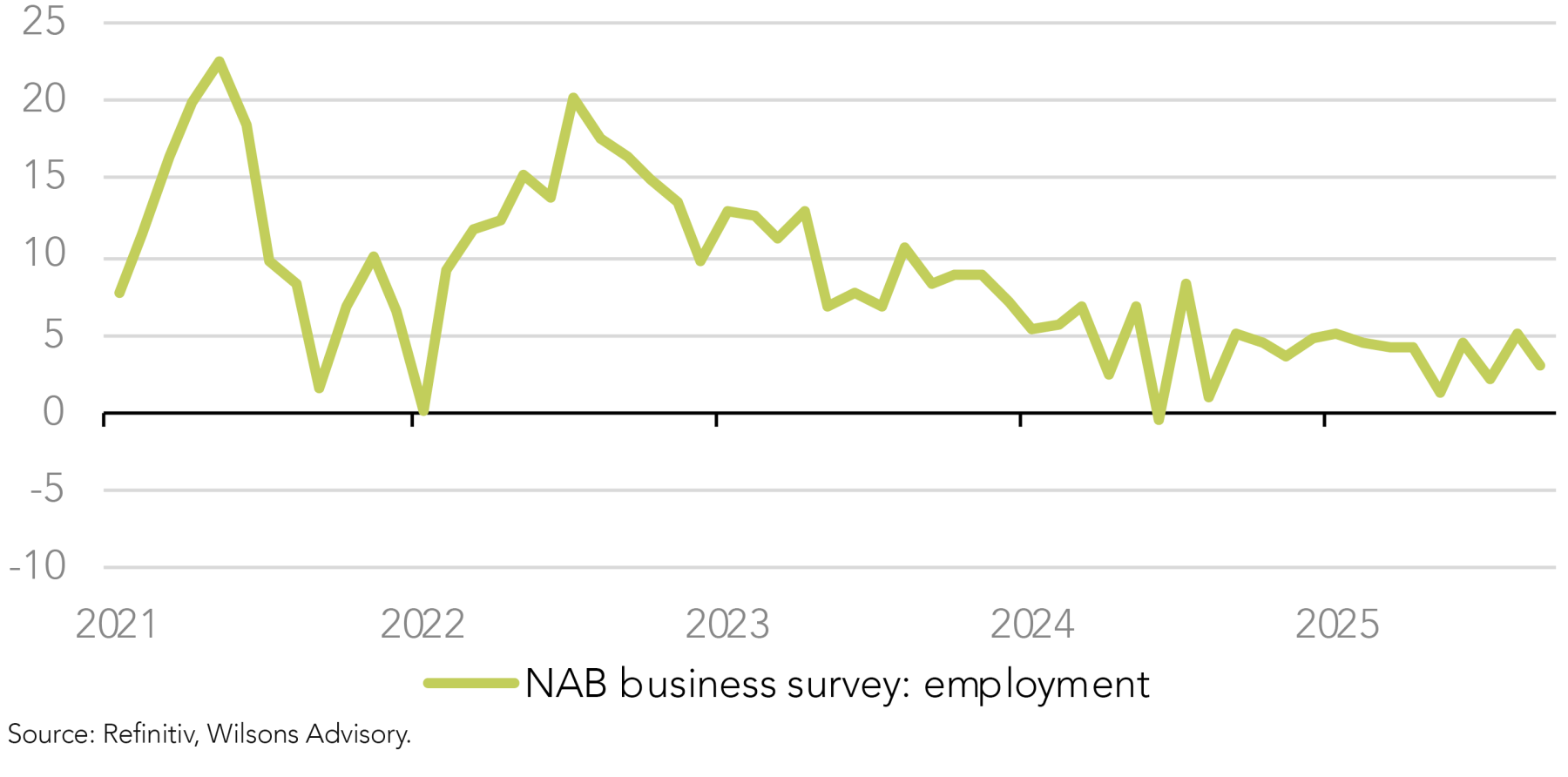

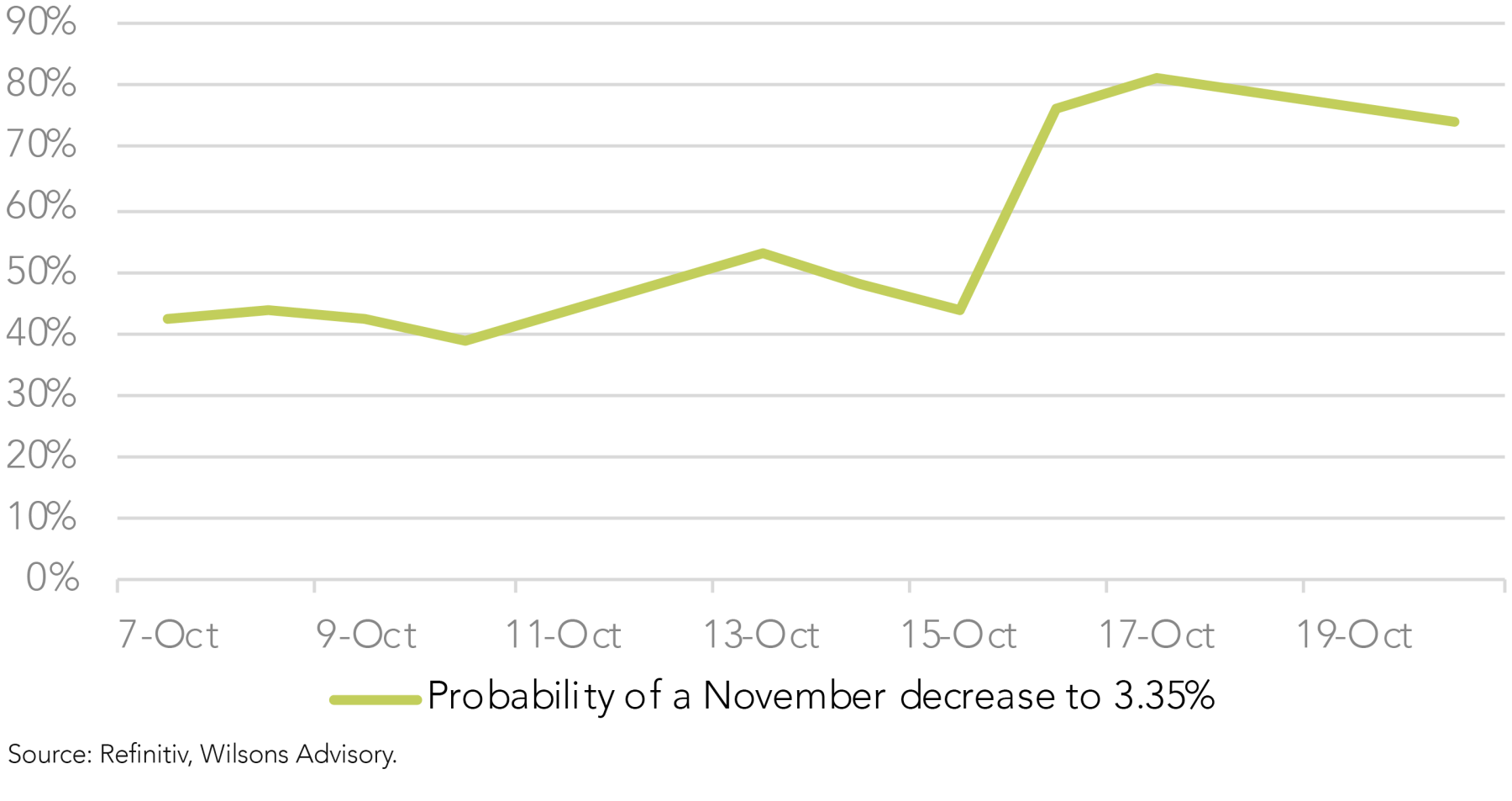

Recent labour market data released in mid-October surprised to the downside, prompting a sharp and rapid response from the market to re-price the chance of a November rate cut. Unemployment rose sharply to 4.5% (from 4.2%), with jobs numbers coming in softer than expected from both the September and the revised August and July numbers. This continues the three-month moving average trend showing a softening in the labour market. The three-month average came in at only 12k jobs, well below the average over the last year of closer to ~25k. The y/y in September moderated further to only 1.3% - the slowest since late 2021 and notably now below the long-run average of ~2%.

While employment numbers continue to fall, we have also seen a rise in the unemployment rate. The sharp rise to 4.5% certainly surprised the market, however it is also important to note that the labour market is still looking exceptionally tight in relation to historical levels. Data from the RBA and market strategists estimates that the Non-Accelerating Inflation Rate of Unemployment (NAIRU) is at 4.5 – 5%. As such, market economists and the RBA did expect unemployment to rise in the coming periods, although not at the rapid pace seen in the latest print. The monthly employment survey is subject to volatility month-to-month however, due to the sampling pool of survey respondents.

Australian GDP Growth Continues to Pick Up

Interestingly, the softening in the labour market is playing out as the economy begins to pick up. We have seen a rise in GDP in recent periods, with data showing that the Australian economy grew by 0.6% q/q in Q2 2025, and 1.8%y/y - above consensus expectations. Much of the quarterly growth was driven by household consumption (+0.9% q/q) and improved mining output (+2.3% q/q). The monthly household spending indicator echoes these findings. Monthly spending has increased 5.3% y/y & 5.0% y/y in July and August respectively. This is a marked uptick over the same period last year of 3.1% y/y in August ’24.

Despite the moderate growth pickup, investment remains weak, productivity is flat, and business capex remains lacklustre. From a policy stance perspective, the growth backdrop provides mixed signals: the economy is improving, but not firing on all cylinders, and the soft labour market suggests the recovery lacks broad-based momentum - at least at this stage of the recovery cycle.

Policy Dilemma for the RBA

The RBA finds itself in an uncomfortable position. On one side, inflation running above expectations calls for a cautious approach to further easing, in order to avoid undermining their mandate for price-stability. On the other, a deteriorating labour market leans toward monetary easing to support employment. With inflation risks persisting, the central bank may opt to hold rates rather than cut pre-emptively, despite markets increasingly expecting a reduction.

The RBA has recently conveyed a somewhat hawkish tone, signalling that while it is judging whether further easing is needed, it remains cautious in the face of inflation uncertainty. The upcoming quarterly CPI print - due 29th October - is likely the key decision point. An above-consensus trimmed mean of 0.9% q/q will likely lead the RBA to hold the current cash rate at 3.60% until the February meeting. At this point they will have additional employment and quarterly inflation prints to better inform the board on economic trends.

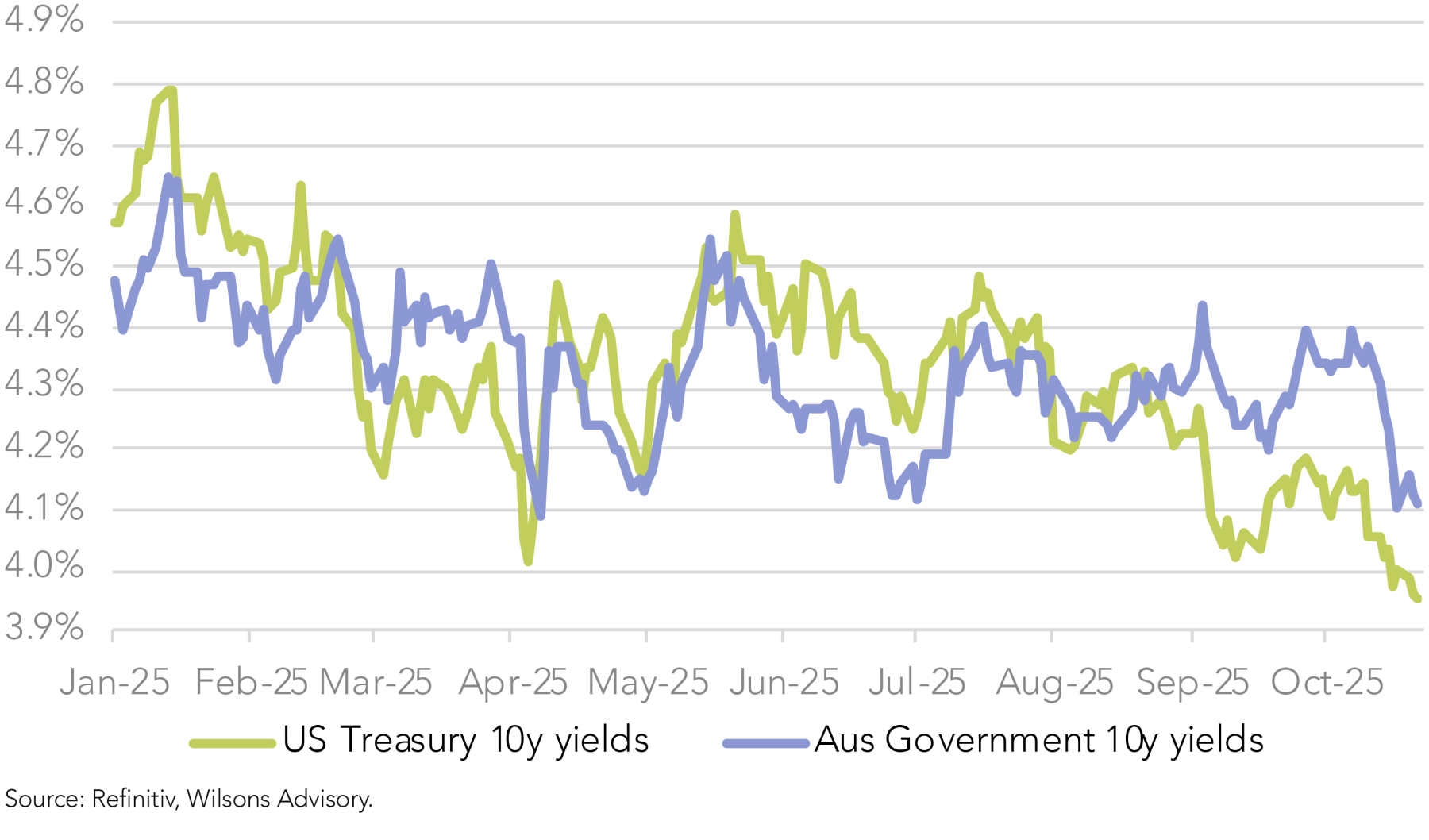

Markets have responded swiftly to the weak labour data. Yields on 10yr government bonds fell by ~20 basis points following the labour print, and implied yields in the money market have increased the chance of a November rate cut to over 70%. The market has also priced in the chance of an additional cut in 2026, bringing the terminal rate to 3.1% - a figure which had previously been wound back in recent months.

Outlook and Data to Watch

Looking ahead, the inflation outlook remains clouded by structural cost pressures (housing, utilities) and the unwinding of relief measures. The RBA expects headline inflation of around 3% through much of 2026, before returning to mid-target around 2027. Underlying inflation (trimmed mean) remains the more reliable gauge of inflation momentum. On the labour-market side, the risk is that weaker employment could feed into lower consumption, and risk a contraction in business investment. This is particularly the case if global growth softens.

For the upcoming RBA meeting, we see Q3 inflation data as the key point to watch. A hotter than consensus read will likely put the RBA on hold. However, a read that’s in line with forecasts may prompt the RBA to ease again to support the labour market.

We maintain our view that we can expect one more cut in this easing cycle to bring the terminal cash rate to 3.35%. Whether this is delivered in November or February will be highly dependent on the results of the quarterly CPI print due next week. Further softening in the labour market and moderating inflation will increase the chance of an additional 25 basis point cut in 2026.

We expect the likelihood of at least one more rate cut should help the Australian economy continue its growth recovery over the coming year, and help keep any rise in unemployment relatively contained. This should provide a constructive backdrop for domestic equities and fixed interest - all things being equal. While this is our base case, the current backdrop of rising inflation and a softening labour market is creating an increasingly tough challenge for the RBA.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.