The Australian Bureau of Statistics released Q2 inflation data on Wednesday, with both headline and core measures coming in largely in line with expectations.

This print supports growing expectations that the RBA will move to cut rates by 25 basis points at its upcoming August 12th meeting.

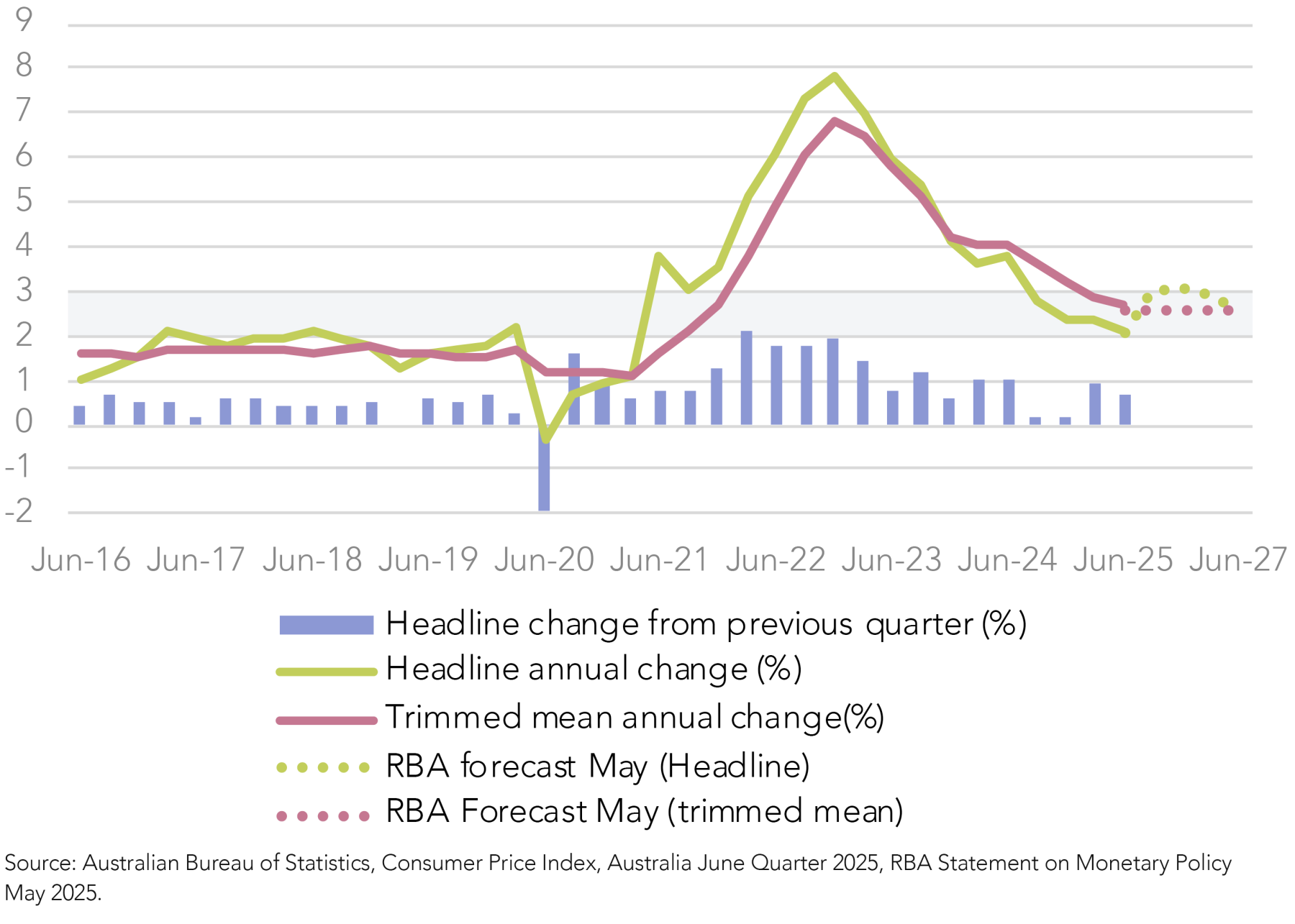

Headline CPI rose 0.7% quarter-on-quarter and 2.1% year-on-year, slightly below consensus estimates of 0.8% QoQ and 2.2% YoY. However, the 2.1% annual figure was in line with the RBA’s forecast published in its May statement on monetary policy. This marks the lowest level of headline inflation since Q1 2021.

The trimmed mean CPI - the RBA’s preferred underlying inflation measure, declined to 2.7% YoY from 2.9% in Q1. While the annual rate met RBA expectations, the 0.6% QoQ rise was 0.1 percentage point below consensus. Importantly, core inflation remains firmly within the RBA’s 2–3% target range. The RBA’s statement on monetary policy forecasts that the core measure should stabilise at around 2.6% for the forecast period. Consequently, we should see their attention turn towards addressing other key areas of the economy, namely weak GDP growth and the softening labour market.

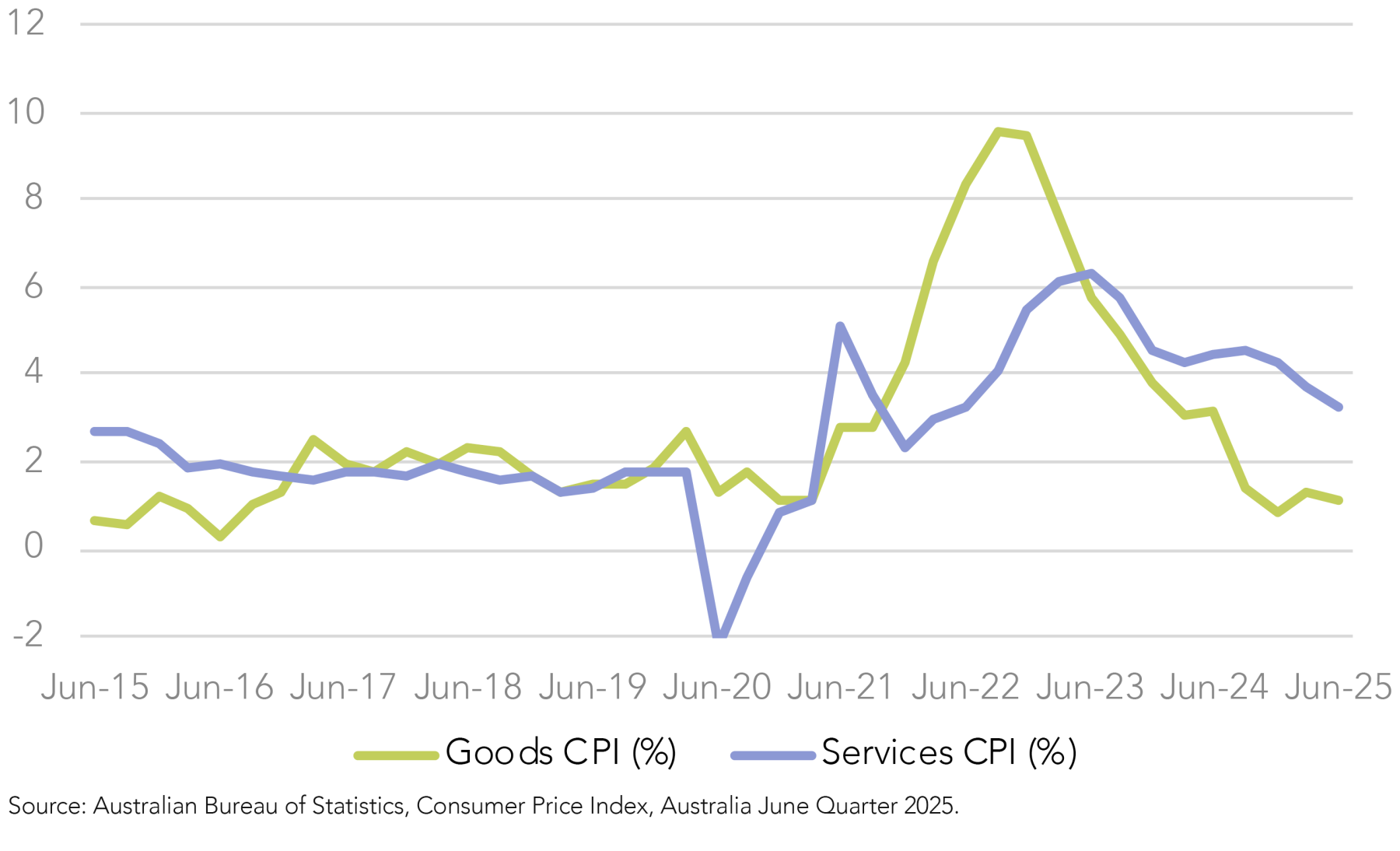

There continues to be a bifurcation in the inflation data between goods and services. Services inflation continues to remain elevated and sticky, although it has fallen to 3.3% YoY from 3.7% in the March quarter. Insurance premiums and rents have continued to ease in the June quarter, although they still remain elevated at 3.9% and 4.5% respectively.

Food and non-alcoholic beverages have held steady at 3%, with fruit and vegetables continuing to see a fall in price increases, down from 6.6% in March to 4.6% in June.

Rate Cut Prospects Strengthen

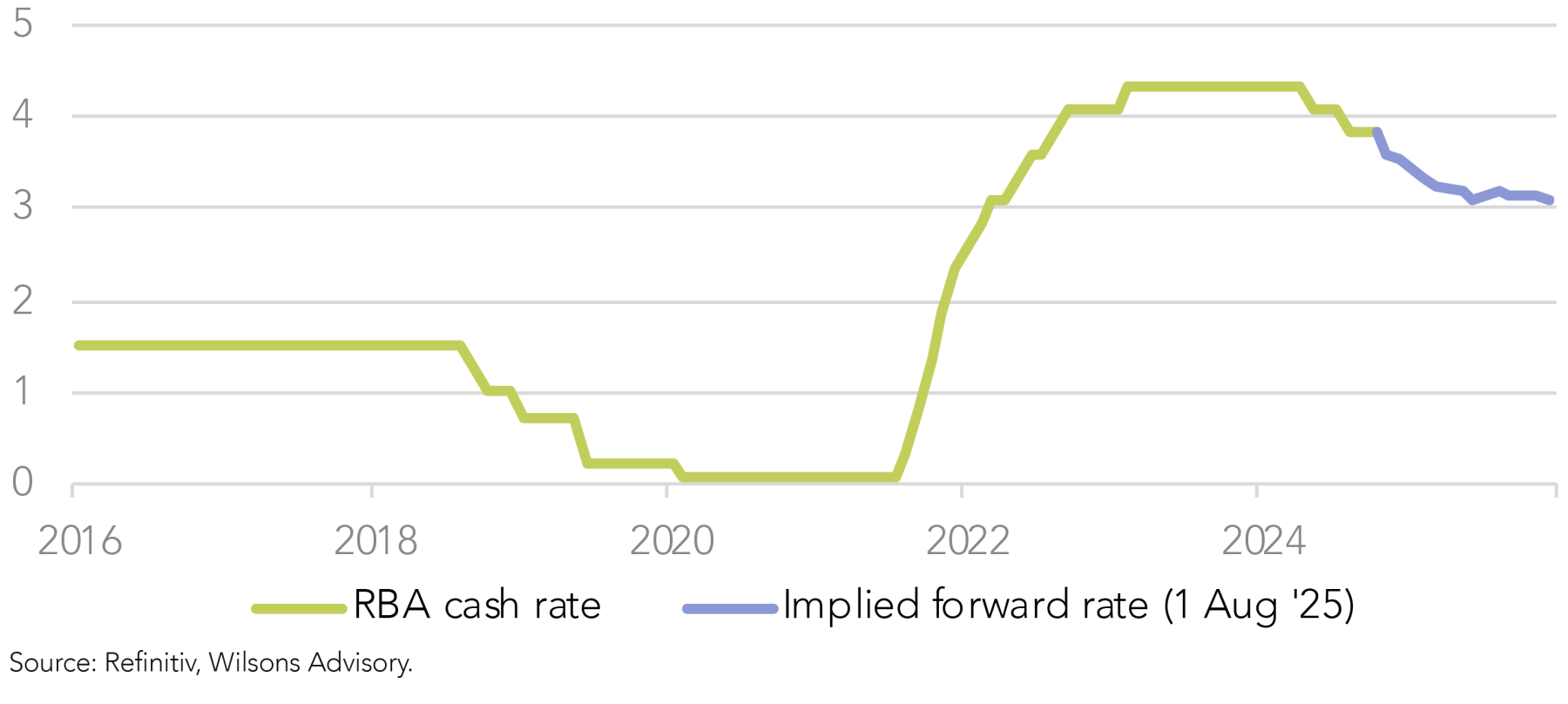

This softer-than-expected inflation report strengthens the case for an August interest rate cut. The money market has now fully priced in a cut for the August meeting—though it’s worth noting that markets were pricing for a similar outcome ahead of the July decision.

At the July meeting, the RBA surprised markets by holding the cash rate steady at 3.85%, with Governor Bullock highlighting the need for more confidence in the inflation trajectory. The monthly CPI series offers a more frequent but only partial snapshot of inflation, capturing approximately two-thirds of the items included in the full quarterly CPI basket.

The ABS announced that they will look to address this disconnect between monthly and quarterly CPI prints by publishing a full monthly CPI series, starting from November 26, with reference to October data. This new series will replace the current monthly CPI indicator. The scope of monthly price collection will be broadened, with comprehensive monthly inflation data across all expenditure classes.

The ABS will continue to publish the quarterly CPI, including the key trimmed mean measure, under its existing methodology for the next 18 months, with the next quarterly CPI due on 29th October ahead of the start of the more comprehensive monthly series. We expect enough evidence of ongoing disinflation in the third quarter data to see the RBA cut rates again at the November 4 meeting. Our expectation currently is for a final cut in early 2026, taking the terminal cash rate to 3.1%.

Labour market weakening & cost of living pressures persist

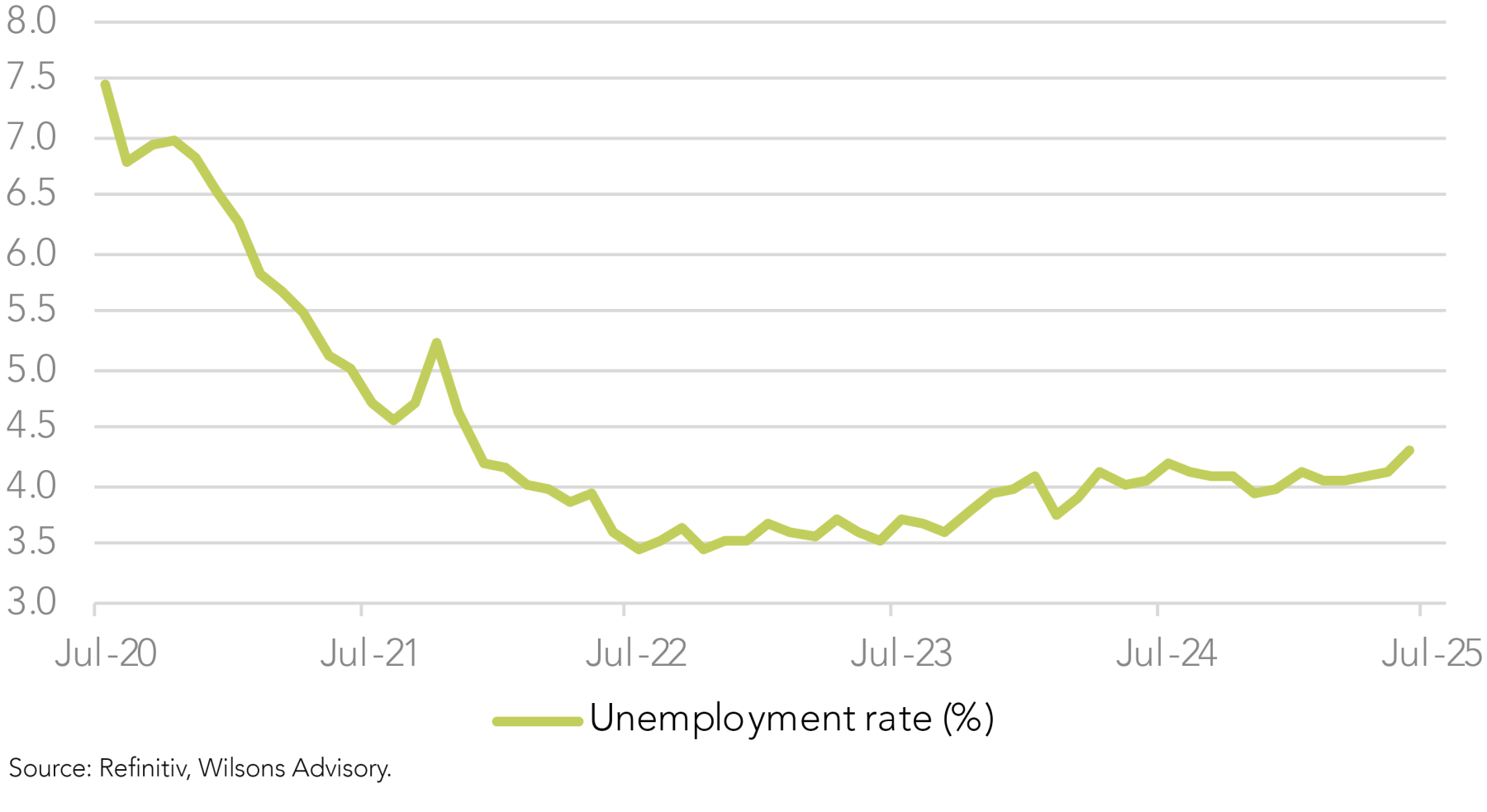

Labour market data released earlier in July adds further weight to the case for easing. Unemployment rose unexpectedly to 4.3%, up from 4.1% where it had held steady for much of the past year. With inflation now in the target band, the RBA is likely to shift its focus to the other side of its dual mandate - supporting the labour market.

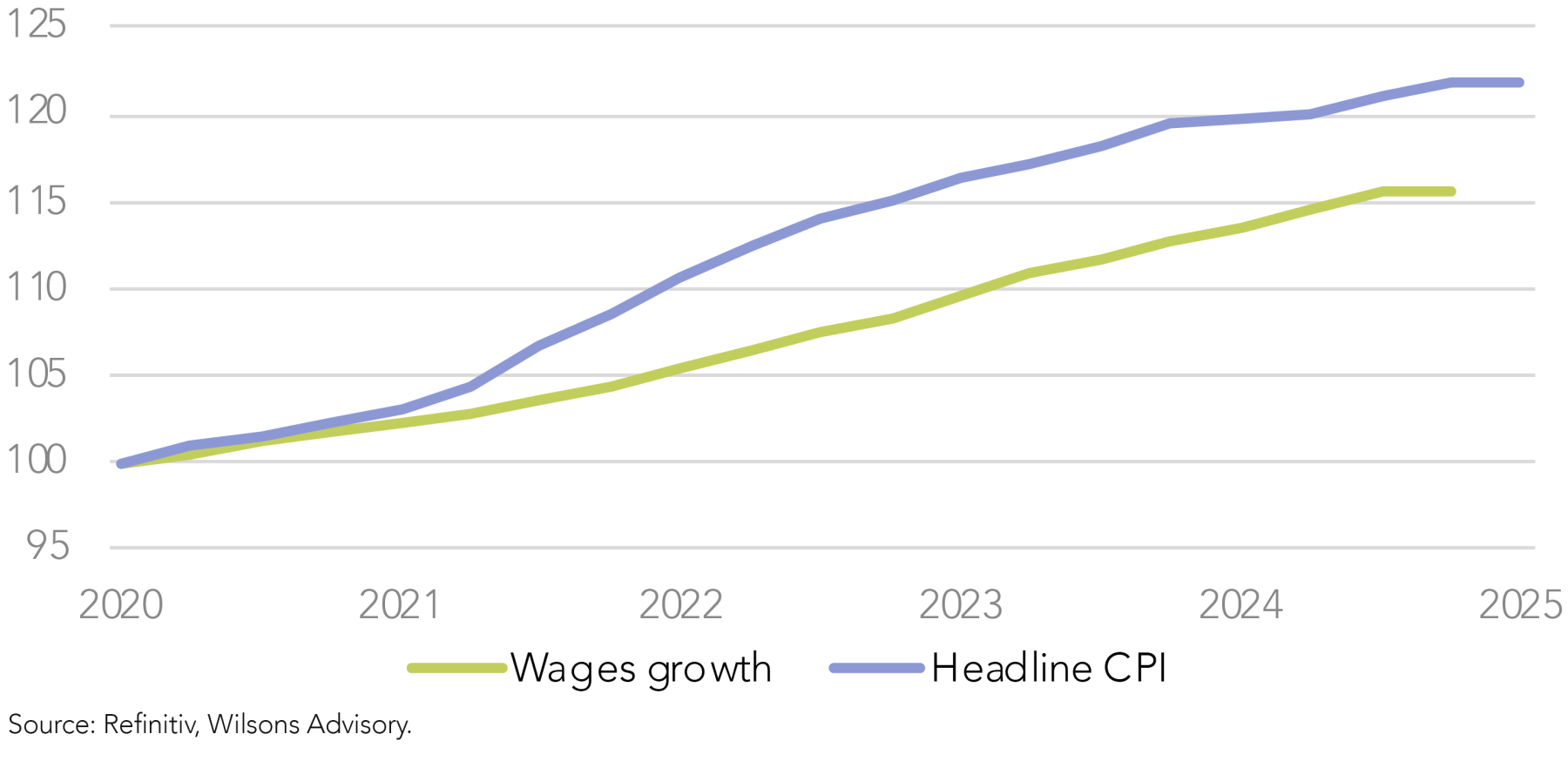

Despite falling inflation, the burden of the cost-of-living crisis remains acute. Although real wages have begun to improve, the cumulative impact of high inflation over recent years means that many households are still feeling the pressure.

Sustained real wage growth will be necessary in the months ahead to offset the prolonged stagnation experienced during the last four years of high inflation. Encouragingly, the real wages gap has begun to narrow, albeit only marginally.

Equities Rally on Dovish Shift

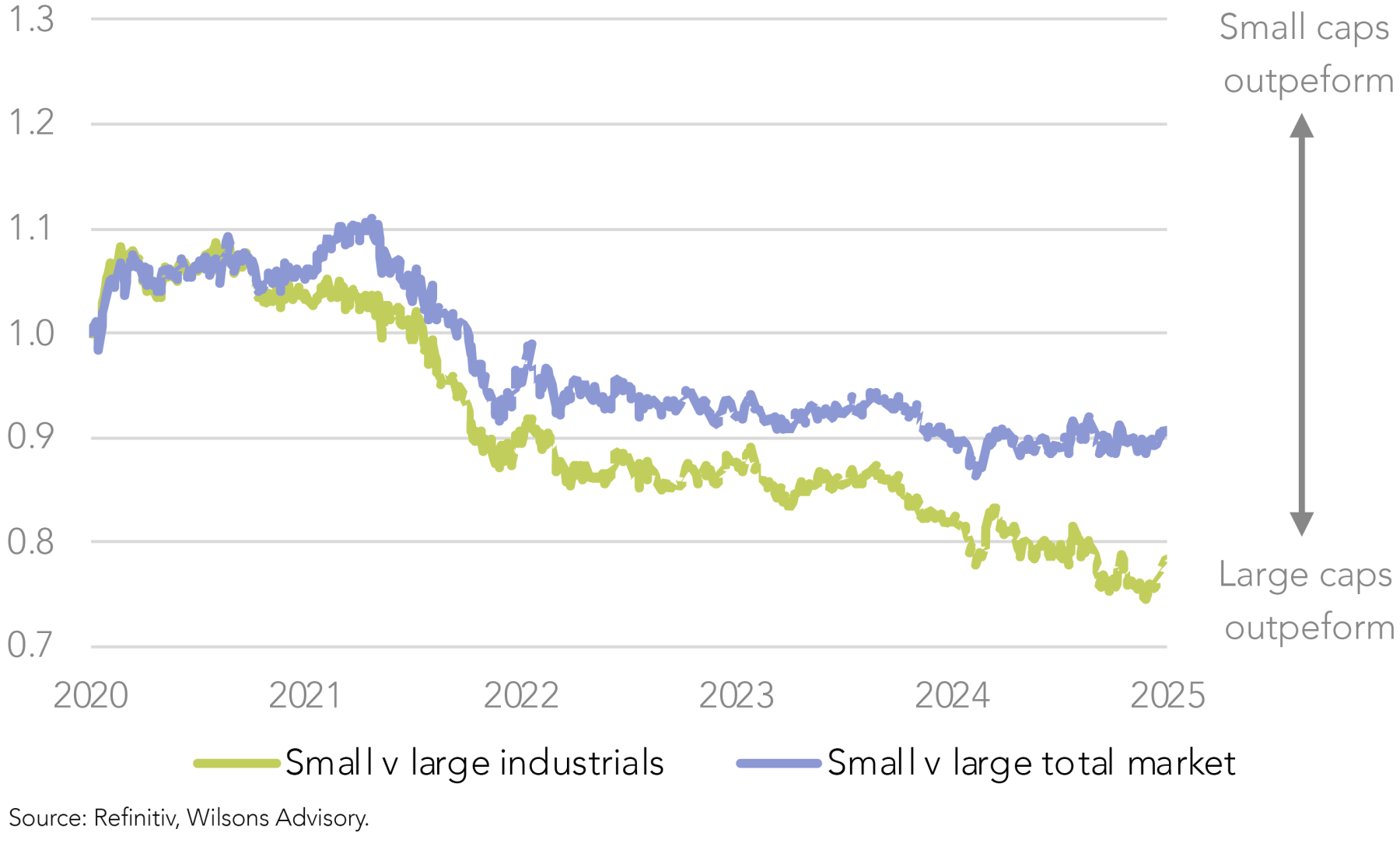

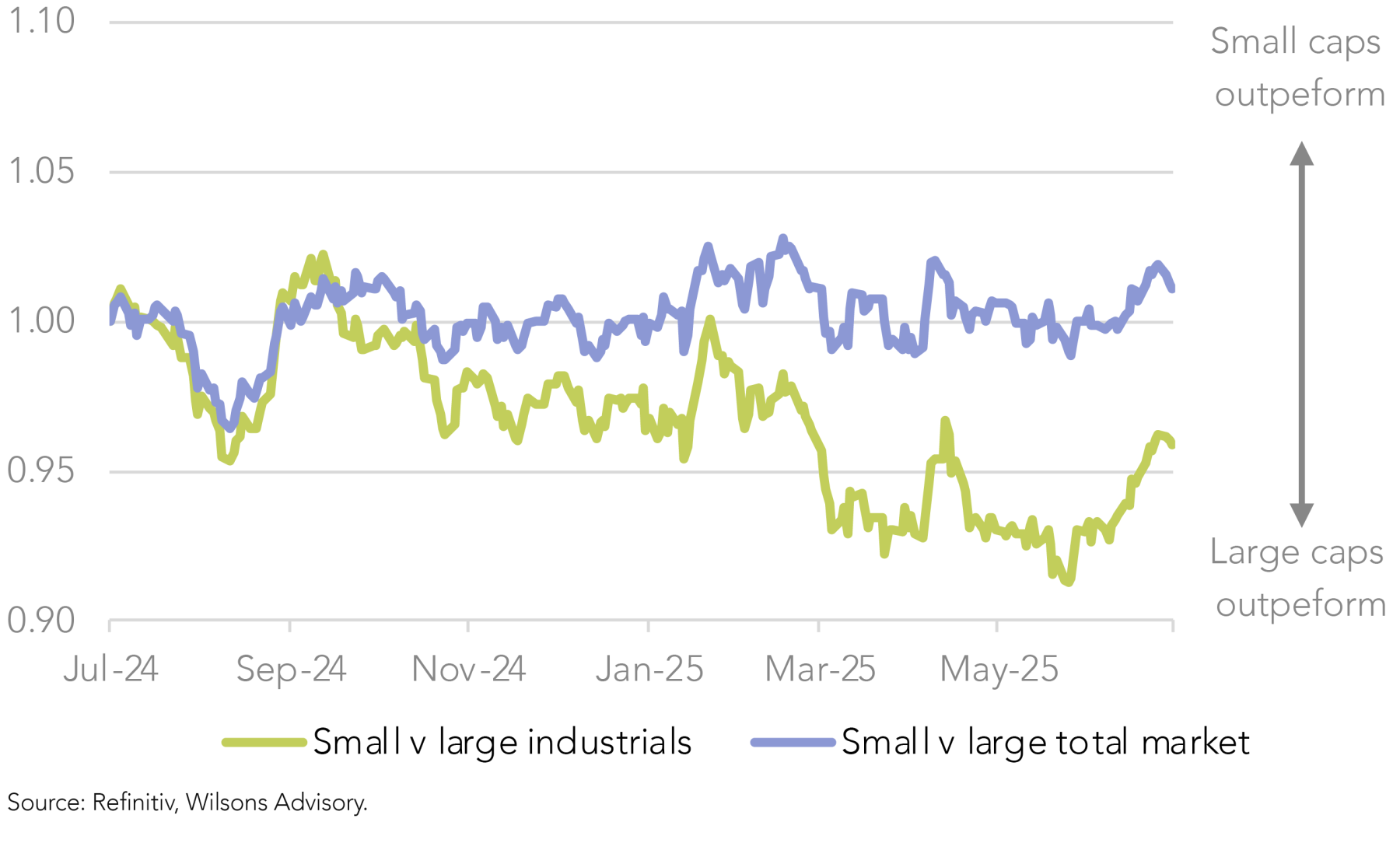

Markets responded positively to the release with broad-based gains. The ASX200 gained 0.7% across the session. One trend that has started to play out this year is the relative outperformance of small caps against large caps. This may mark the early stages of a more sustained rotation.

The relative performance gap between large and small caps has been widening for the past five years. Active small cap managers have long said that a rotation to small caps is due, so we may be starting to see this trend play out. Indeed, the ASX Small Ords has outperformed the ASX 200 over the past 12 months. However, when resources are stripped out to focus on industrials, the trend reverses. This indicates that smaller rate-sensitive companies are yet to fully realise the tailwinds from reduced headline rates. Small industrials have picked up some outperformance over the past month. However, further rate cuts will be needed to support this trend.

Implications for Fixed Income

Bond markets also reacted positively to the news, with Australian 10-year bond yields falling by seven basis points to 4.26% over the day. Shorter dated treasuries also saw a decline in yields with 3-year treasuries falling seven basis points to 3.36%.

A potential easing cycle presents a mixed outlook for fixed income markets. Floating rate securities, which have benefitted from the recent high rate environment, will face declining yields as base rates fall. Nevertheless, current yield levels remain attractive, particularly for more conservative income-focused portfolios.

Conversely, fixed rate instruments stand to benefit from falling rates as bond prices typically rally in easing cycles. We feel the current environment warrants selectively adding duration to portfolios, to benefit from potential bond price capital appreciation in addition to running yield.

Outlook for Alternatives

The outlook for alternative assets should also improve in a lower rate environment. While private credit returns may moderate from recent elevated levels, reduced default risk should bolster portfolio stability and returns over the medium term.

Private equity stands to gain from lower borrowing costs, which can facilitate expansion and enhanced growth prospects for underlying portfolio companies. As financial conditions ease, the asset class may see renewed interest from investors seeking long-term growth exposures. Finally property should also benefit from the valuation and cash flow impacts of lower interest rates.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.