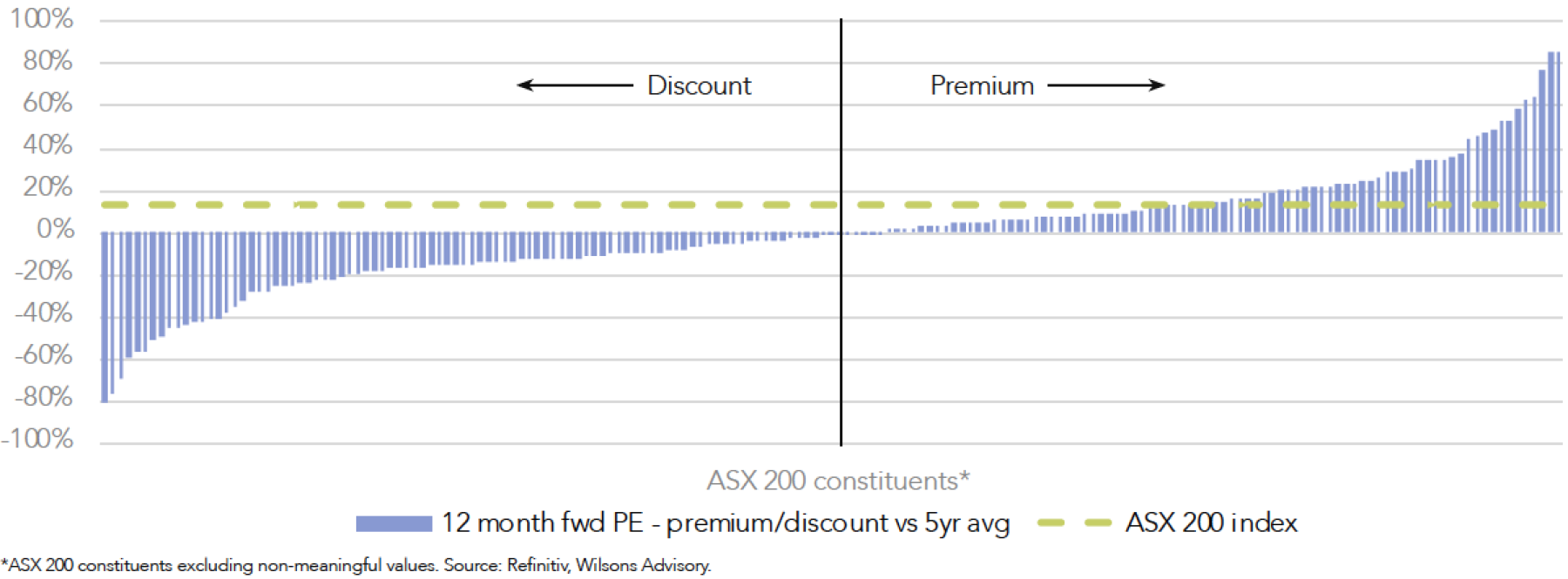

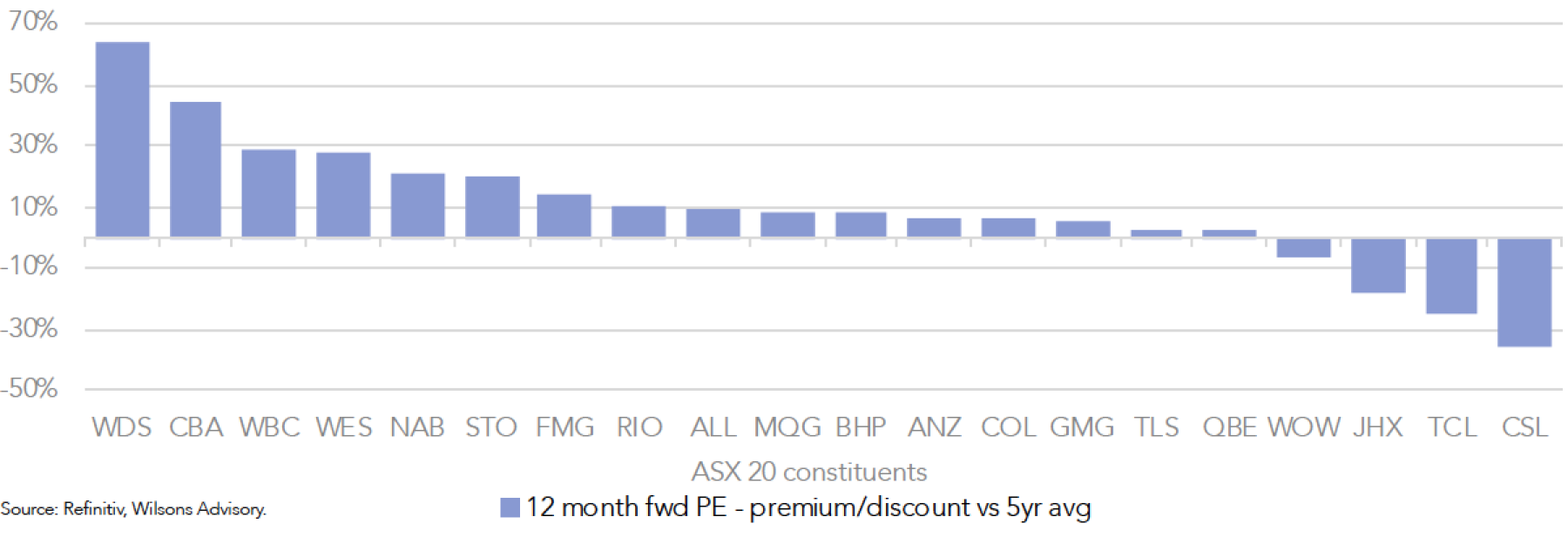

The sharp recovery of the ASX 200 from its April lows has pushed the local market’s headline valuation to relatively full levels, with the index currently trading on a forward PE multiple of ~18.6x – above its five-year average of ~16.6x.

However, given the level of concentration within the local index (with valuations being driven disproportionately by ‘expensive’ sectors like the banks), the dispersion of valuations within the index remains relatively wide, with ~54% of ASX 200 constituents trading at a discount to their five-year average PE multiples.This suggests there is no shortage of attractive value within the local market at the individual company level, which underscores the importance of remaining active in the current environment.

In this vein, this report identifies two compelling ‘pairs trades’ in companies that offer highly attractive value relative to peers in their respective sectors (ResMed, Woolworths). We also analyse the recent A$30bn takeover proposal for Santos, which is the Focus Portfolio’s sole exposure within the Energy sector.

Key action points include:

- Energy: retain exposure to Santos

- Medical Devices: sell Cochlear, buy ResMed

- Consumer: sell Wesfarmers, buy Woolworths

Energy Sector M&A: A$30bn Takeover Offer for Santos

Santos (STO) is held in the Focus Portfolio at a weight of 3.5% and is our sole exposure within the Energy sector

Santos has received a non-binding indicative proposal from a consortium led by XRG, a subsidiary of the Abu Dhabi National Oil Company (ADNOC), to acquire the company in an all-cash offer. This is a vote of confidence in the fundamentals of the LNG market and is a pleasing affirmation of our conviction in Santos specifically.

Proposal summary

The ADNOC consortium has offered A$30bn for the business, which (if successful) would make it the second largest acquisition in ASX history and the local market’s largest ever cash deal.

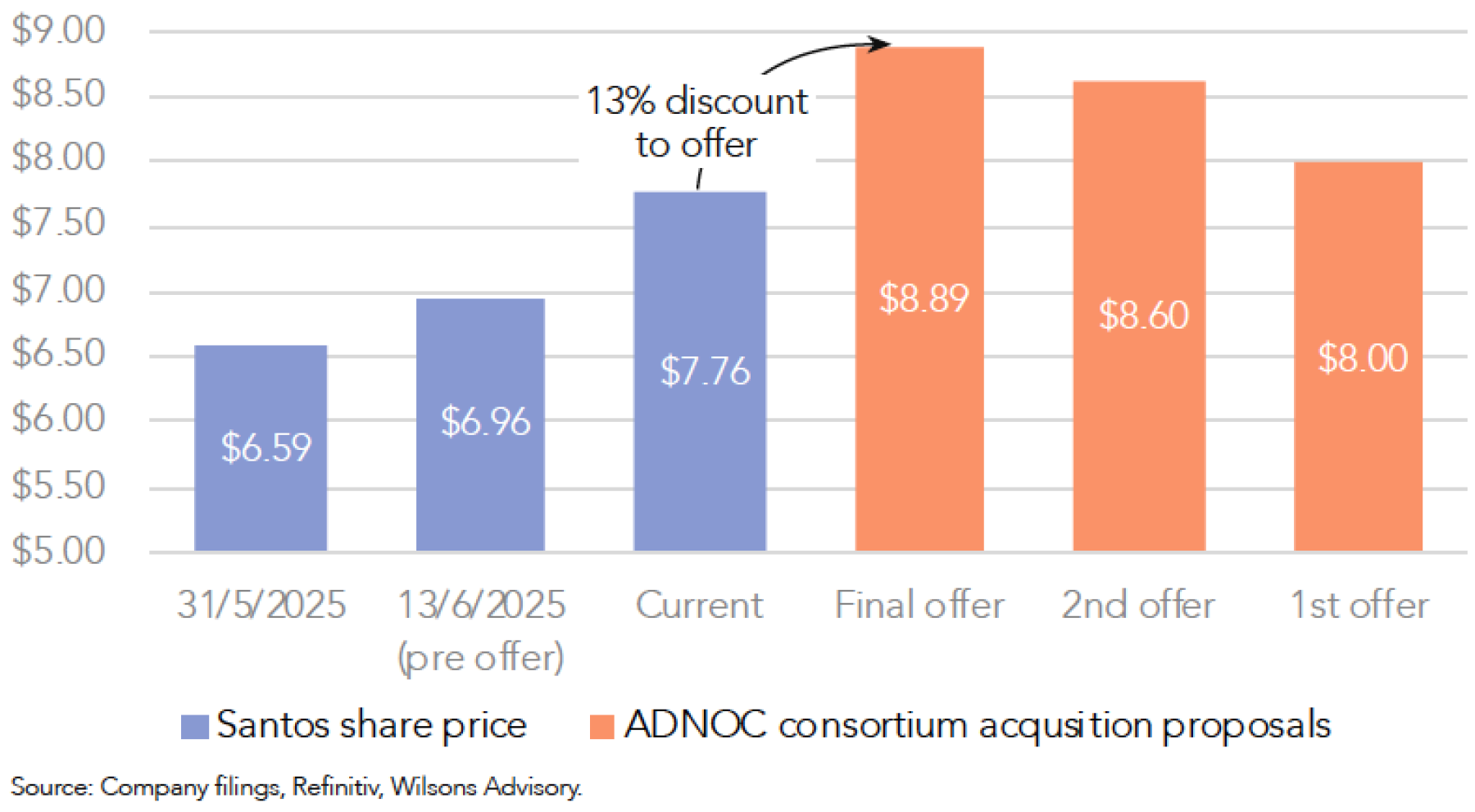

The proposal is worth A$8.89 per share, which represents a 28% premium to Santos’ prior close, a 34% premium to the 1-month VWAP, and a 44% premium to the 3-month VWAP.

This proposal follows two prior confidential proposals, worth A$8.00 and A$8.60 respectively, and has been expressed as the ADNOC consortium’s ‘final non-binding indicative offer’ for Santos.

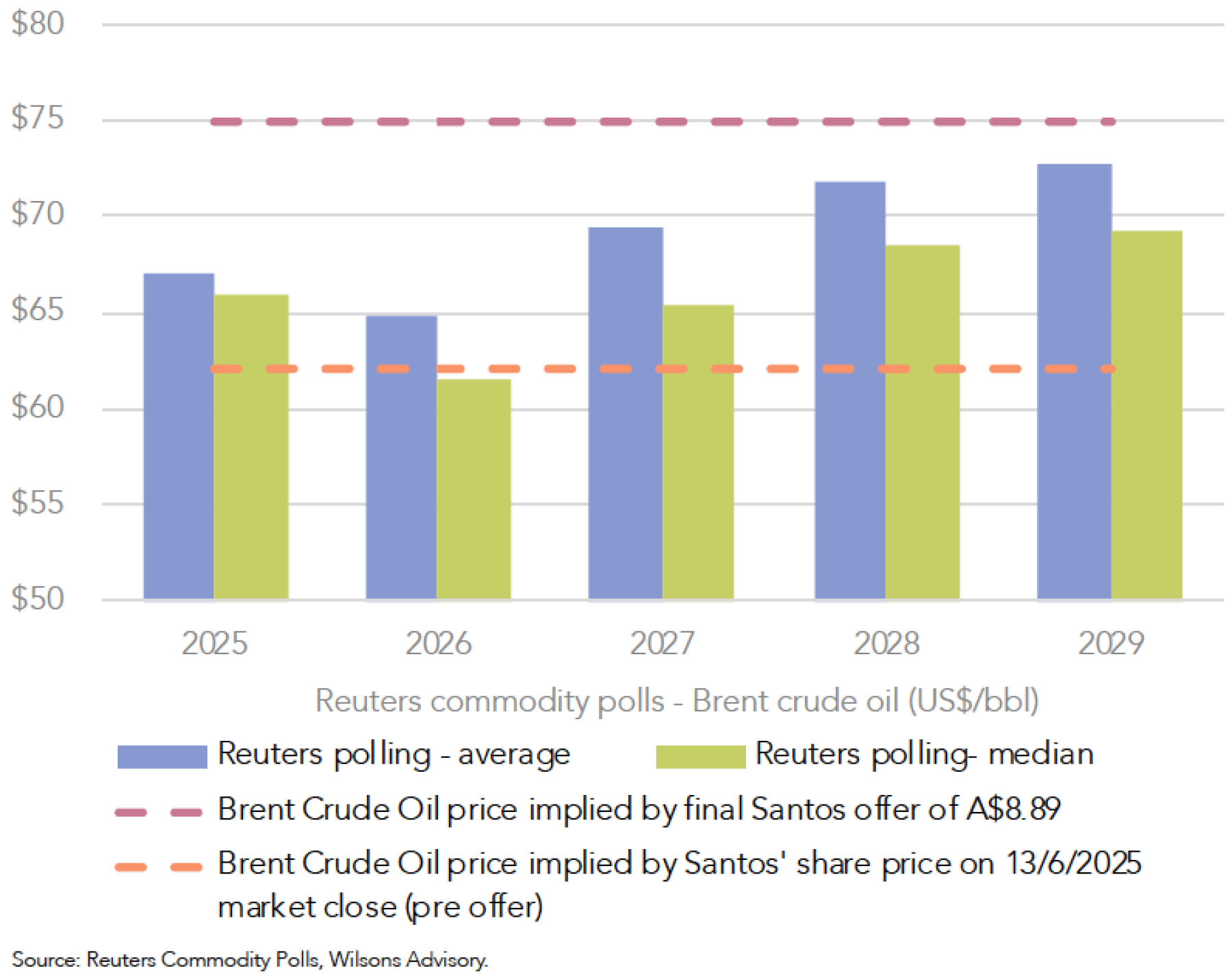

The final offer represents fair value for Santos, in our view. We estimate the final consideration of A$8.89 for Santos implies a Brent oil price US$75/bbl, which is above medium-term consensus forecasts for the oil price (see Figure 4) and broadly aligns with our long-term outlook for the oil price.

Not yet a ‘done deal'…

The Santos Board intends to unanimously recommend that shareholders vote in favour of the proposal, subject to agreeing on a binding SIA and in the absence of a superior proposal.

However, the deal remains uncertain as it faces several significant hurdles including:

- Completion of confirmatory due diligence by the ADNOC consortium

- Negotiation and execution of an agreed binding Scheme Implementation Arrangement (SIA)

- Approval from the Foreign Investment Review Board (FIRB), Jim Chalmers (as Federal Treasurer) and ASIC, as well as several regulatory bodies in PNG and the US.

The most significant of these hurdles will be receiving FIRB, and ultimately Treasurer, approval. With Santos being a major player in the domestic gas market and an owner of critical energy infrastructure (e.g. the Moomba Gas Plant, Darwin LNG facility), the sale of the entirety of the business to a foreign state-owned enterprise will lead to a degree of scrutiny regarding national interest and energy security concerns.

Domestic gas concessions could pave the way for Treasurer approval

The FIRB will conduct a rigorous review process that will require ADNOC to address national interest concerns, provide clear operational plans, and demonstrate commitment to Australia's energy security.

Encouragingly, ADNOC has already committed to keeping Santos’ headquarters in Adelaide, retaining its brand, as well as investing in expanding and accelerating the development of Australia’s gas capacity. Another lever may include spinning off Santos’ domestic assets to a local suitor.

The takeover presents an opportunity for the Federal Government to extract favourable domestic gas concessions from ADNOC (e.g. supply guarantees, firm commitments to grow domestic gas capacity) at a time that energy affordability is a key voter concern, and the domestic gas market faces long-term supply risks.

There is precedent for the FIRB granting conditional approvals for large energy/infrastructure acquisitions from foreign buyers in cases where strong commitments were provided on Australian jobs, governance, and a continuity of domestic supply.

Everything considered, while the Santos takeover faces meaningful hurdles, we believe these can be navigated and see a viable path towards approval. We assess the probability of deal success/failure as reasonably evenly balanced.

Maintaining exposure to Santos

Notwithstanding the near-term uncertainty associated with the takeover – which is reflected in Santos’ share price remaining ~13% below the offer price, implying a ~40% probability of deal success – we have retained our existing weighting of 3.5% to Santos in the Focus Portfolio.

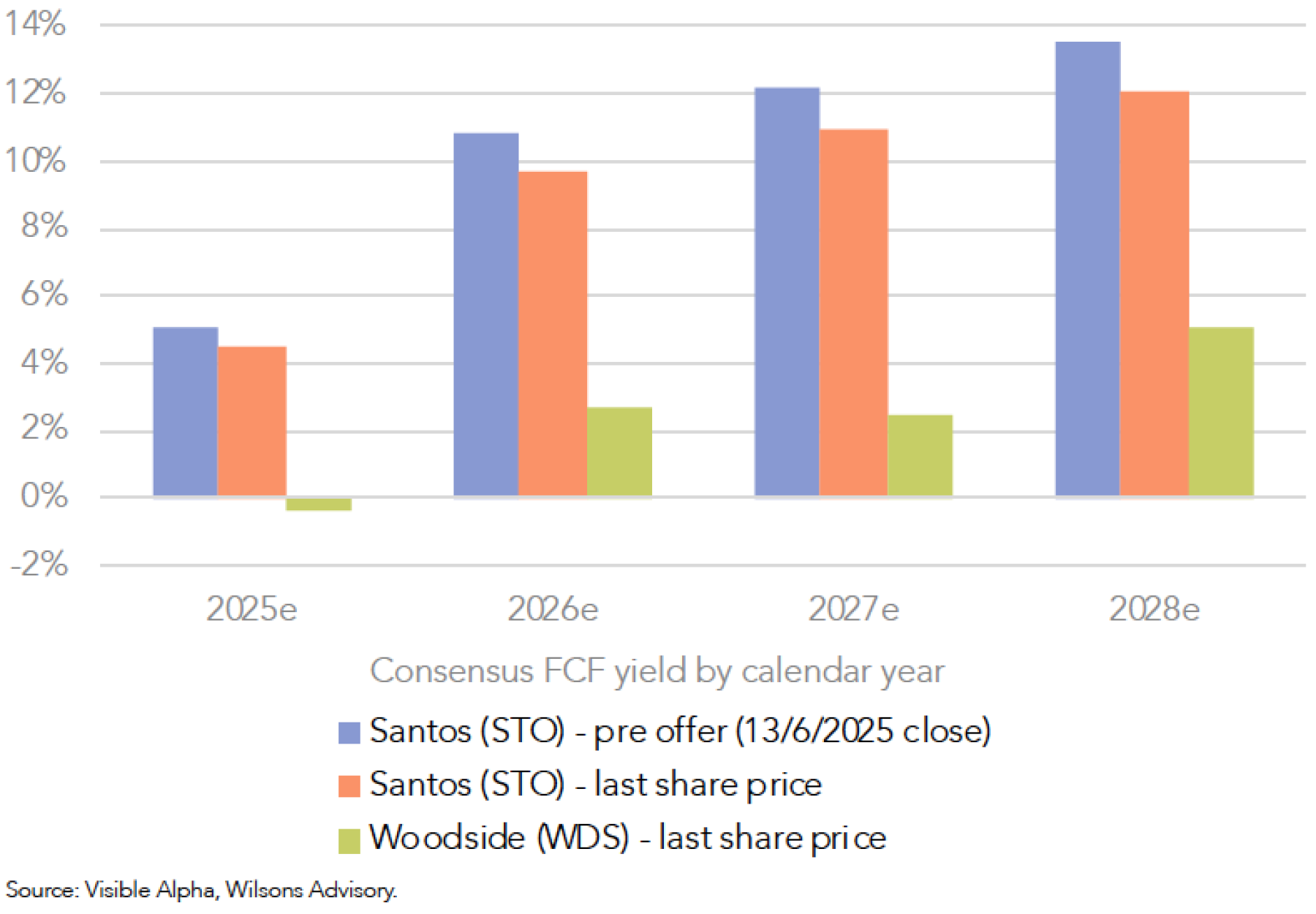

Looking through the near-term transaction uncertainties, when taking a medium-term fundamental view, Santos comfortably remains our preferred large cap oil and gas exposure (over Woodside).

Our preference towards Santos is based on 1) its more attractive (and now largely de-risked) production growth profile, 2) its far superior free cash flow yield over the medium-term (even following the rally in its share price), and 3) its more disciplined approach to capital allocation.

We do not recommend rotating capital from Santos into Woodside at this juncture.

Medical Devices: Sell Cochlear, Buy ResMed

ResMed (RMD) is held in the Focus Portfolio at a weight of 4%

ResMed is our highest conviction healthcare position and is the largest active weight within the sector in the Focus Portfolio, while Cochlear (COH) is a meaningful portfolio underweight (not held).

Both are high quality businesses, as dominant global leaders in their respective niches (sleep/hearing devices) with high returns on invested capital, formidable balance sheets (with net cash positions), strong track records of innovation, and exposure to significant industry tailwinds.

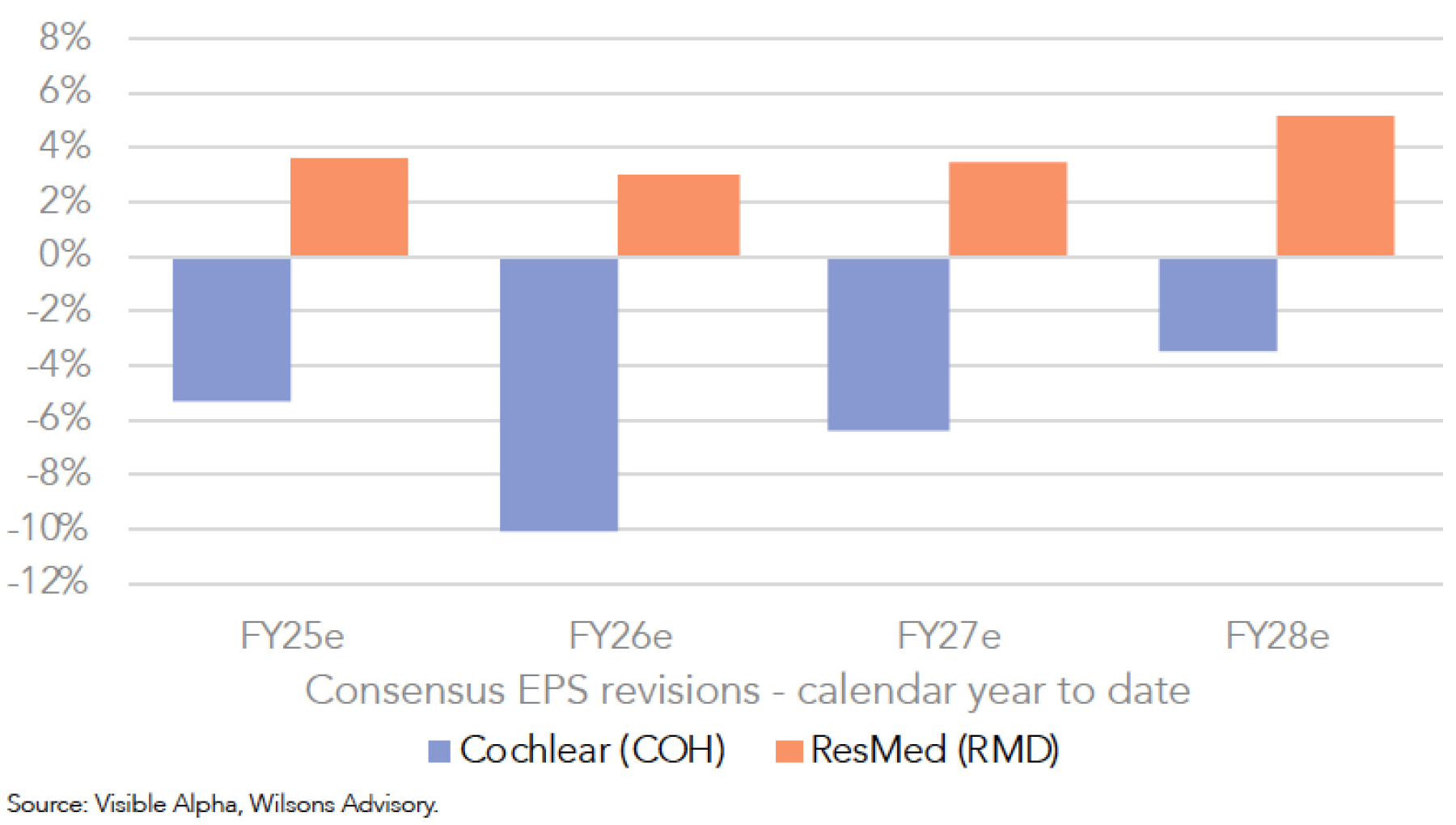

Cochlear and ResMed both are expected to deliver low-teens EPS growth over the FY26/27. However, ResMed has demonstrated positive consensus earnings momentum, while Cochlear is in an earnings downgrade cycle.

Downgrades vs Upgrades

Last week, Cochlear lowered its FY25 NPAT guidance by 6%, from $410-430m to $390-400m, driven by lower services sales, negative mix shifts (growth in lower margin markets), and share losses in some countries. This is the second downgrade to Cochlear’s FY25 outlook in just four months.

On the other hand, ResMed has consistently met/beat consensus estimates in its recent reports, which has driven upgrades. The business remains well placed to achieve double-digit earnings growth, driven by a continuation of healthy CPAP demand growth and further margin expansion.

There is scope for ResMed to receive further consensus upgrades over the medium-term in our view. Industry fundamentals remain healthy and new sleep apnea demand tailwinds are emerging, which supports a positive outlook for patient starts (i.e. GLP-1 referrals, home sleep testing, new generation wearables).

ResMed offers growth at a reasonable price

Considering the tailwinds supporting ResMed and the headwinds impacting Cochlear – and broadly similar fundamental metrics for both (see Figure 7) – the valuation gap between the two companies is excessive. Cochlear trades on a forward PE multiple of ~41x, which is a 60% premium to ResMed at ~23x. Therefore, we believe now is an opportune time to sell Cochlear and buy ResMed.

| Company | ResMed (RMD) | Cochlear (COH) |

|

Sector |

CPAP devices |

Hearing devices |

|

Industry position |

#1 |

#1 |

|

P/E |

23.5x |

40.9x |

|

+/- vs 5yr avg |

-24.6% |

-13.3% |

|

+/- vs 10yr avg |

-17.9% |

-1.1% |

|

EPS CAGR (FY26-28) |

10.9% |

13.3% |

|

PEG ratio |

2.1x |

3.1x |

|

Dividend yield |

1.0% |

1.7% |

|

Return on Invested Capital |

28.0% |

26.0% |

|

EPS revisions - last 90 days |

1.5% |

-2.2% |

|

Net debt (cash) / EBITDA |

-0.6x |

-0.5x |

All figures are based on consensus 12-month forward estimates unless otherwise stated. Source: Refinitiv, Wilsons Advisory.

Consumer: Sell Wesfarmers, Buy Woolworths

Woolworths (WOW) is held in the Focus Portfolio at a weight of 4%

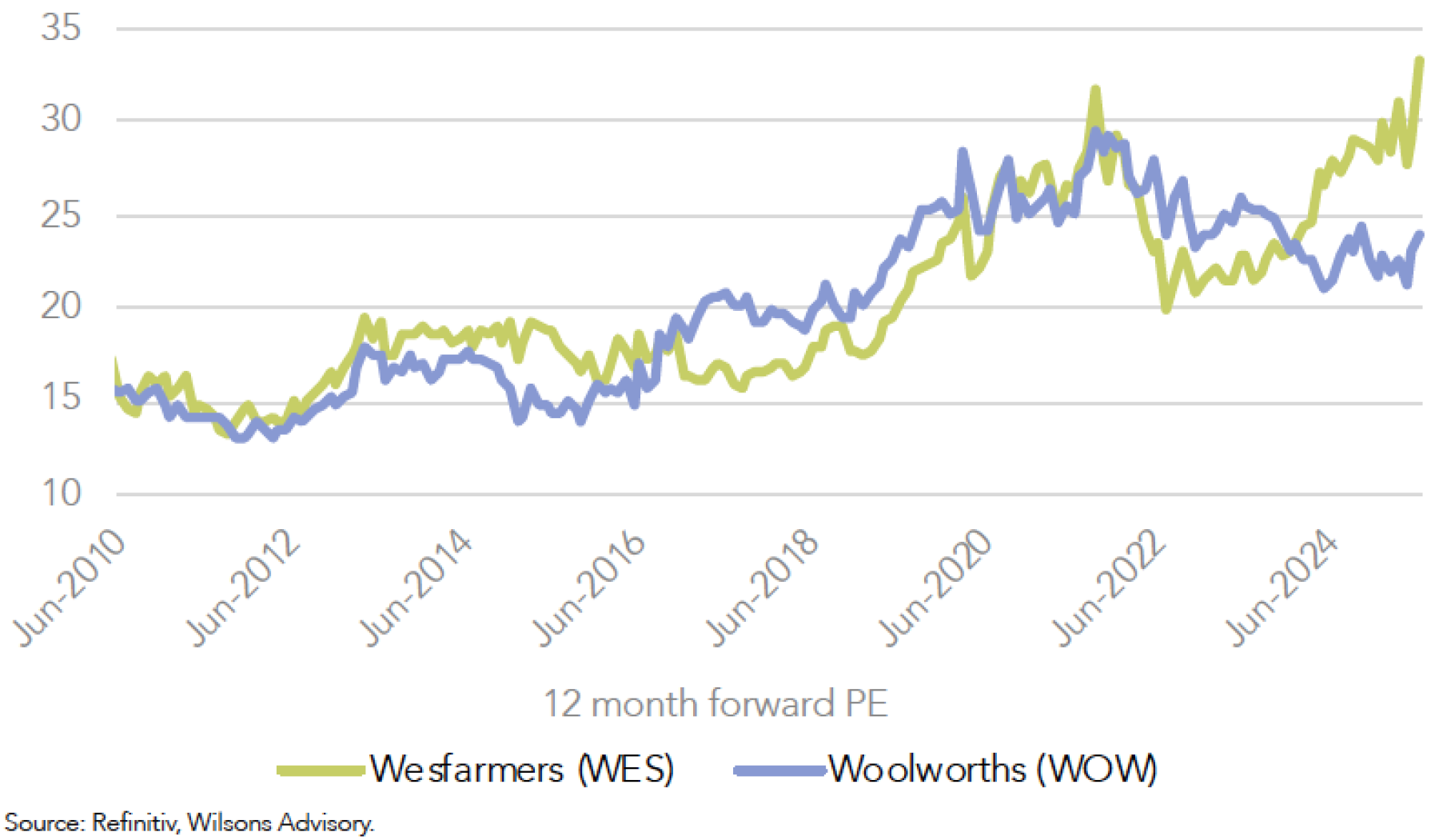

Woolworths offers highly attractive value relative to Wesfarmers (WES).

While these businesses are positioned at different ends of the consumer space (Staples vs Discretionary), Woolworths and Wesfarmers share much in common:

- Market leaders – both Woolworths (i.e. Woolworths, Big W) and Wesfarmers (i.e. Bunnings, Kmart, Officeworks) operate retail businesses that are dominant market leaders within their respective sectors.

- Oligopolies – both businesses operate in oligopolist industries with limited competition among a few large players, which typically underpins highly attractive returns on capital.

- Domestic consumer focus – both businesses are primarily exposed to the Australian consumer and will benefit from a relatively supportive domestic macro backdrop over the medium-term, including (in all likelihood) several RBA rate cuts this year.

- Resilient demand profile – both companies have historically demonstrated relatively resilient top-line growth through the cycle. However, Woolworths’ underlying demand is more non-discretionary in nature, which provides greater stability in tougher macro conditions.

Therefore, given the similarities between the two businesses, they should trade at broadly similar valuations in our view. Hence, notwithstanding the quality of Wesfarmers, we view its ~40% valuation premium to Woolworths’ as excessive, at a forward PE of ~33x compared to Woolworths at ~23x.

Woolworths’ valuation discount is particularly compelling considering it screens more favourably on almost all key fundamental measures, including 1) earnings growth, 2) return on invested capital, and 3) recent consensus earnings revisions, which is illustrated in Figure 9.

Therefore, we believe now is an opportune time to sell Wesfarmers and buy Woolworths.

| Company | Woolworths (WOW) | Wesfarmers (WES) |

|

Sector |

Consumer Staples |

Consumer Discretionary |

|

Industry position |

#1 |

#1 |

|

P/E |

23.3x |

32.9x |

|

+/- vs 5yr avg |

-6.4% |

27.9% |

|

+/- vs 10yr avg |

3.9% |

48.8% |

|

EPS CAGR (FY26-28) |

16.0% |

9.5% |

|

PEG ratio |

1.5x |

3.5x |

|

Dividend yield |

3.2% |

2.7% |

|

Return on Invested Capital |

24.7% |

20.0% |

|

EPS revisions - last 90 days |

-0.7% |

-1.3% |

|

Net debt (cash) / EBITDA |

1.6x |

1.0x |

All figures are based on consensus 12-month forward estimates unless otherwise stated. Source: Refinitiv, Wilsons Advisory.

Written by

Greg Burke, Equity Strategist

Greg is an Equity Strategist in the Investment Strategy team at Wilsons Advisory. He is the lead portfolio manager of the Wilsons Advisory Australian Equity Focus Portfolio and is responsible for the ongoing management of the Global Equity Opportunities List.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.