Infrastructure (and ‘infrastructure-like’) companies have lagged the broader ASX 300 since late June, amidst the ongoing headwind from rising bond yields.

Despite the recent underperformance, the outlook for infrastructure remains positive, especially at this point in the economic cycle. There is currently an opportunity to invest in infrastructure stocks at attractive valuations.

Over the medium term, easing bond yields and the growing appeal of defensive earnings amidst a slowing economy should support strong relative performance for both infrastructure and ‘infrastructure-like’ companies, with our top picks being APA Group (APA) and The Lottery Corporation (TLC).

Infrastructure under Pressure amidst Macro Headwinds

Infrastructure (and ‘infrastructure-like’) companies have underperformed in the latest market correction, which has been driven in part by a combination of company specific factors, as well as macro headwinds, which include:

- Valuation pressures – the upward trajectory of bond yields has negatively impacted the valuation of ‘long-duration’ defensives like infrastructure.

- Costs of debt – infrastructure companies typically utilise a relatively high level of gearing given their tangible asset backing and predictable cash flows. While quality infrastructure managers actively hedge against interest rate risks and actively manage their debt maturity profiles, persistently elevated interest rates can nevertheless significantly impact their cost of debt and, therefore, free cash flows over the longer term.

- Market positioning – for much of this year, the market has been positioned for a relatively abrupt slowdown in economic activity, which has not yet occurred. Given the market’s defensive posture, the resilience in the global economy has resulted in cyclicals outperforming defensives like infrastructure in recent months.

Why Infrastructure?

Traditional infrastructure companies on the ASX 300 include the owners/operators of utilities like pipelines (e.g., APA Group), toll roads (e.g., Transurban), railways (e.g., Aurizon), airports (e.g., Auckland Airport), ports (e.g., Dalrymple Bay Infrastructure), and telco networks (e.g., Chorus).

Infrastructure investments are attractive for the following reasons:

- Defensive demand – infrastructure demand is generally resilient through the cycle as it involves the provision of ‘essential’ services to businesses and the community. Earnings are either regulated in nature, or underpinned by long-term contractual agreements. These factors together provide a degree of revenue predictability, which is particularly attractive amidst a slowing economic backdrop when market earnings growth is relatively scarce and uncertain.

- Inflation protection – infrastructure assets typically have either explicit or implicit cost pass-through mechanisms, which protect margins against inflationary pressures and enhance earnings predictability.

- Monopoly markets – most infrastructure assets exist in natural local monopolies that are free of competition, which underpins an attractive and sustainable return on capital for investors.

- Tangible, long-life assets – infrastructure companies typically either own, or have the right to operate, physical assets with economic lives usually spanning several decades. This provides investors with a degree of confidence over the long-term earnings outlook and can provide an implicit floor to equity valuations (absent stranded asset risks).

Given these defensive characteristics, infrastructure companies generally have low equity market betas, and have historically demonstrated resilient earnings during slowing or recessionary economic conditions and amidst earnings downgrade cycles. As such, infrastructure typically outperforms amidst softening economic/earnings cycles.

Infrastructure is Well-placed for a Slowing Economy

While recent performance has been disappointing, the outlook for infrastructure is strong at this point of the cycle.

In the coming months, we expect interest rates to shift from headwind to tailwind for both infrastructure and ‘infrastructure-like’ company valuations, which are likely to be supported by easing bond yields, and the increased appeal of defensive earnings amidst a slowing economy.

In combination, these factors should see high quality infrastructure and ‘infrastructure-like’ companies outperform over the medium-term, consistent with historical trends, making the recent pullback an attractive buying opportunity in our view.

Beyond Roads and Railways - Other ‘Infrastructure-like’ Exposures

After years of merger and acquisition (M&A) activity, the once abundant opportunity set of listed infrastructure opportunities on the ASX has diminished to just a handful of genuine pure play infrastructure companies. However, looking further afield, there are a number of high-quality ‘infrastructure-like’ companies that mirror many of the characteristics of traditional infrastructure, offering a similar risk/return profile. These companies can be divided into two main groups:

- Social infrastructure – landlords that own assets servicing the healthcare, education, early childhood, community support, community development, and emergency services sectors.

- ‘Infrastructure-like’ companies – can be defined as (a) companies that own infrastructure assets embedded within a broader operating group, and (b) companies that have many characteristics that mirror the features of infrastructure – such as predictable demand profiles, inflation protected cash flows, and monopoly positions.

| Ticker | Name | EV/EBITDA (NTM) | Dividend yield (NTM) | Beta | % from 52 week high | Infrastructure characteristics | Focus Portfolio holding |

| Traditional infrastructure | |||||||

| DBI | Dalrymple Bay Infrastructure | 10.9 | 7.8% | 0.11 | -5% | DBI has a concession arrangement to operate the world's largest metallurgical coal export terminal, the Dalrymple Bay Terminal in QLD until 2051 at least. DBI's long-term contracts with users are 100% take-or-pay in nature and carry no throughput risk, meaning revenues aren't impacted by unexpected fluctuations in volumes, which underpins a high degree of earnings visibility. | |

| ALX | Atlas Arteria | 55.8 | 7.2% | 0.4 | -27% | ALX has long-dated concessions over a portfolio of toll roads in Europe and the US. The tolls under these concession contracts are structured to escalate annually with a mix of CPI and fixed escalators. Toll road demand is relatively predictable year to year - driven largely by macro factors, which combined with annual price escalators, provides a high degree of long-term earnings predictability. | |

| CNU | Chorus | 9.3 | 6.6% | 0.46 | -17% | Chorus is New Zealand's largest telecommunications infrastructure company. The company builds and maintains a a network of fibre and copper cables, local telephone exchanges, and cabinets. Access to this infrastructure is contracted to telco's, with revenues being regulated in nature based on a 'maximum allowable revenue' which underpins a relatively high degree of earnings predictability. | |

| APA | APA Group | 11.2 | 7.2% | 0.53 | -30% | APA is a monopoly pipeline infrastructure owner. Pipeline demand is resilient through the cycle and APA's contract structure provides a high degree of earnings visibility. Contracts are long-dated, and ~87% are take-or-pay (users pay for access irrespective of their usage) or regulated (based on a predetermined return on capital) in nature, which has underpinned predictable and uninterrupted dividend growth for 20 years. Read Opportunities Amidst the Volatility | x |

| AZJ | Aurizon Holdings | 6.9 | 5.7% | 0.61 | -14% | Aurizon's integrated business model provides a defensive stream of earnings from its regulated track infrastructure (Central Queensland Coal Network) which provides a high degree of earnings predictability, while its rail haulage business is more cyclical given it is largely leveraged to the export of bulk commodities via its contracts with resource companies. | |

| AIA | Auckland International Airport | 19.2 | 1.9% | 0.59 | -18% | AIA owns and operates the Auckland International Airport. AIA generates a combination of regulated and unregulated earnings. Regulated (i.e. infrastructure-based) earnings include its airfield income and passenger service charges, where pricing is based on a predetermined return on capital, providing a degree of revenue predictability - albeit air travel volumes can be somewhat cyclical in nature. AIA also conducts unregulated activities across its retail precinct, hotels and, car parking assets, which offers a lower degree of earnings visibility. | |

| TCL | Transurban | 21.5 | 5.3% | 0.71 | -21% | Transurban has long-term concessions (averaging ~30 years) to operate the majority of Australia's toll roads (i.e. 18 of 21). The toll pricing structure includes a mix of CPI-linked and fixed escalations. Toll road demand volatility is generally low, and generally driven by macro factors (e.g. GDP growth). In combination, these factors provide a high degree of long-term earnings predictability. | |

| "Infrastructure-like" | |||||||

| TLC | Lottery Corporation | 14.5 | 3.9% | 0.2 | -16% | TLC has many of the characteristics of traditional ‘infrastructure’; including a predictable demand profile, a degree of inflation protection through its ability to raise ticket prices, its low sustaining capex requirements and high free cash flow margins, and its effective monopoly over Australian lotteries (ex WA). | x |

| TLS | Telstra Group | 7.3 | 4.8% | 0.41 | -15% | ~1/4 of EBITDA is derived directly from its infrastructure assets, which earn mostly contracted/recurring, CPI-linked revenues; including InfraCo's 30 year agreement with the NBN to provide access to its pits, ducts, and exchanges, which is worth ~$1bn p.a. Moreover, TLS's mobile business, which generates ~1/2 of TLS's EBITDA, is 'infrastructure-like' in nature, given its a) dominant position in a domestic telco oligopoly , b) its proven degree of pricing power in the currently rational competitive environment, and c) the defensiveness of demand for mobile connectivity. Read Unbundling Telstra’s Hidden Value | x |

| KLS | Kelsian Group | 8.1 | 3.7% | 0.8 | -21% | Transport services operator with long-term 'infrastructure-like' contracts with governments, where KLS is paid fixed fees to operate bus routes. Contract terms include cost pass throughs (i.e. fuel, wages) and have no leverage to passenger volumes (i.e. no 'farebox risk'). This structure provides a high degree of earnings visibility. | |

| Social infrastructure | |||||||

| HCW | Healthco Healthcare and Wellness Reit | nm | 5.5% | 0.81 | -19% | Australia's largest diversified healthcare REIT. HCW owns a portfolio of private hospitals, medical centres, childcare assets, life science facilities, and aged care facilities, which are leased to high quality, 'blue chip' tenants. The demand for these 'social infrastructure' assets is defensive in nature and is supported by strong structural tailwinds. A high degree of earnings predictability is supported by long-dated contracts (weighted average lease expiry ~12 years), its majority CPI-linked leases, and ~99% portfolio occupancy. | x |

Data as of 23/10/2023. Source: Refinitiv, Wilsons Advisory.

How the Focus Portfolio is Positioned

The Focus Portfolio holds a mix of traditional infrastructure, social infrastructure, and ‘infrastructure-like’ companies, which in our view are all well-placed to outperform over the medium term.

The Lottery Corporation - High Quality Defensive Trading at a Discount

The Lottery Corporation (TLC) is our preferred ‘infrastructure-like’ investment. The company has many of the characteristics of traditional infrastructure, including a predictable demand profile, a degree of inflation protection through its ability to raise ticket prices, its low sustaining capex requirements and high free cash flow margins, and its effective monopoly over Australian lotteries.

Lottery turnover is typically resilient through economic slowdowns

Despite being a discretionary expenditure item, lottery turnover has historically been highly resilient through past economic cycles, notwithstanding short-term fluctuations due to jackpot variability. The predictability of lottery turnover on a medium-term basis has helped TLC generate consistent ‘infrastructure-like’ earnings growth over time.

Monopoly licences provide ‘infrastructure-like’ earnings visibility

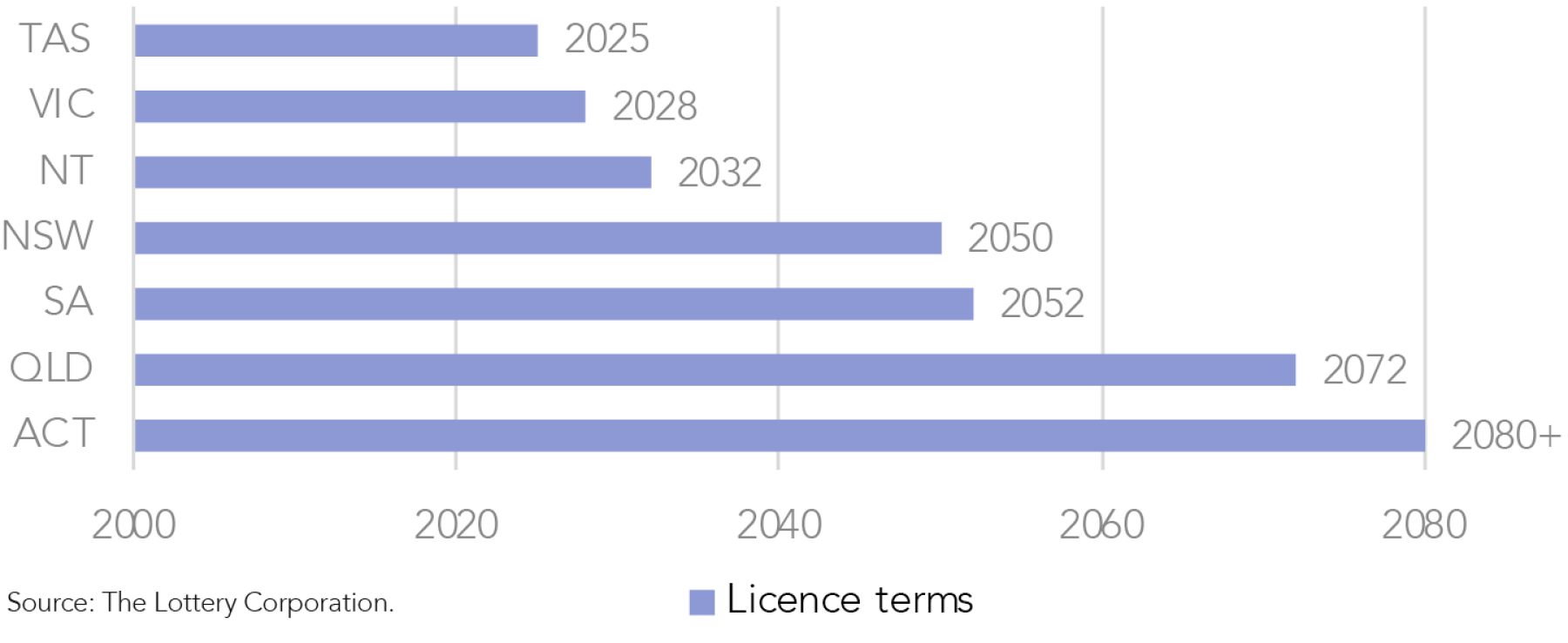

TLC’s earnings are highly predictable over the medium term, given both the defensiveness of lottery sales and the company’s long-dated exclusive licenses in every state and territory excluding WA, which have a weighted average term of >25 years, and are in some ways similar to the ‘concession agreements’ traditional infrastructure companies are awarded over assets (except, of course, TLC does not operate tangible assets).

The digital transition will push margins structurally higher

While steady lottery turnover growth, coupled with occasional price increases, together offers ‘GDP plus’ growth for TLC shareholders, over the long term we expect the company to benefit from a structural uplift in its margins driven by the transition of lottery sales from the retail channel (i.e. via newsagents) towards online channels (i.e. via thelott.com)

Digital lottery sales enjoy significantly (~3x) higher earnings before interest, taxes, depreciation and amortization (EBITDA) margins than the retail channel, largely because this channel incurs lower fees. In the fullness of time, we expect TLC’s digital penetration to grow from ~40% currently to closer to 100% (think of the rapid shift from DVD rentals to on-demand streaming in the last decade), which will drive significant margin expansion for what is an already very profitable business.

Forward consensus estimates for TLC’s digital penetration are relatively conservative (implying ~50% digital penetration in ~10 years’ time), which is likely to result in upgrades over the medium-term, in our view.

Lottery market update – near-term outlook is improving

While lottery turnover is predictable over the medium and long term, within shorter time frames there is a degree of unpredictability around the ‘jackpot cycle’ trajectory that invariably ‘smoothes’ itself out over time. TLC’s FY23 full year result was a slight miss to (arguably stale) consensus earnings estimates due to a weak jackpot cycle in 2H23, which has likely weighed on the stock in recent months.

Pleasingly, following ticket price increases to Powerball in late FY23, annualised FY24 national lottery sales are currently tracking ~$200m, or ~3.4% above last year’s ticket sales (based on Wilsons Research estimates), which should help alleviate market concerns around TLC’s FY24 earnings. In any case, it is important to look through the inherent short-term unpredictability associated with lotteries as ‘games of chance’, and to remain cognisant of the medium- and long-term resilience of lotteries.

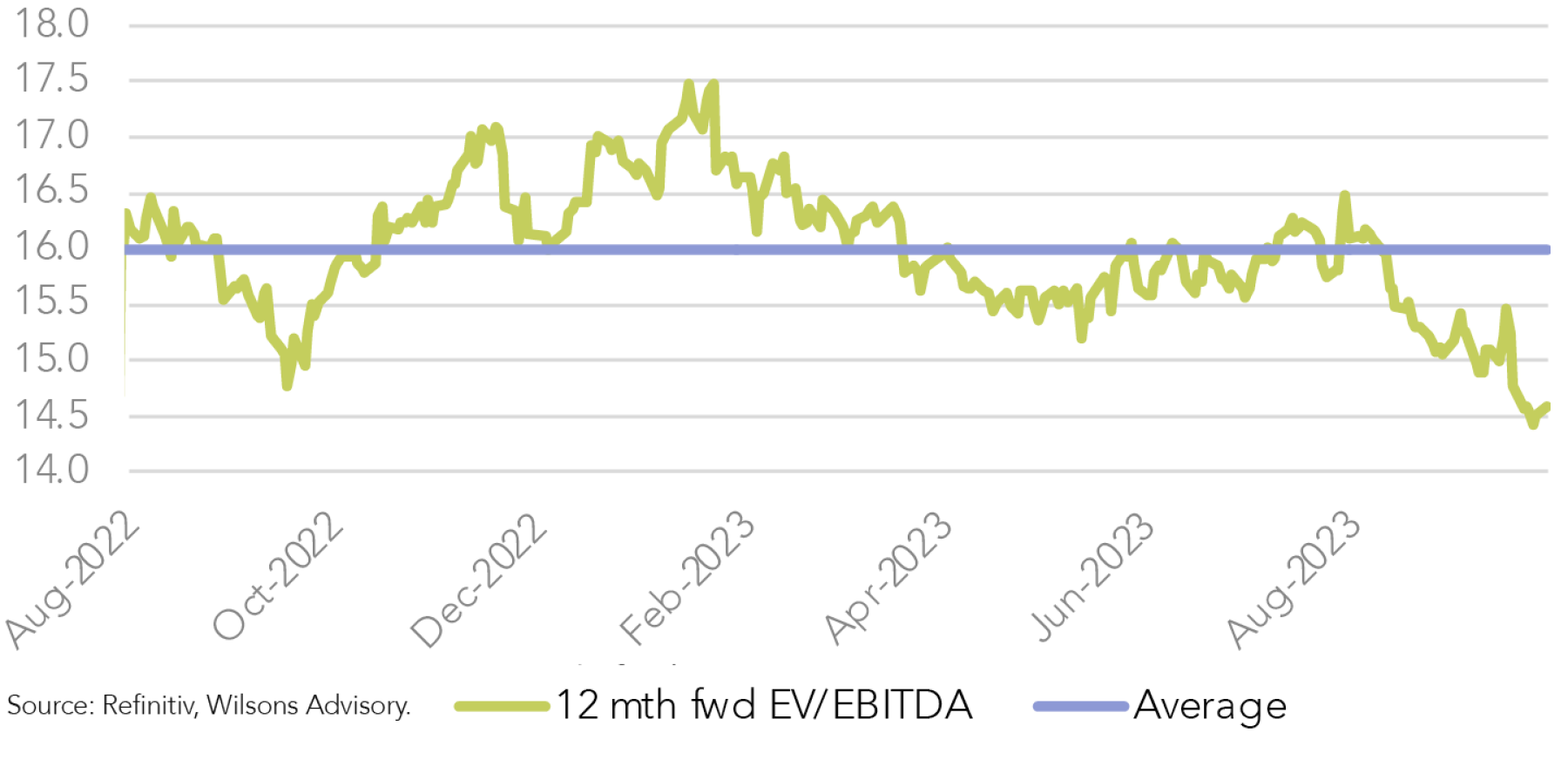

Valuation de-rate presents an attractive buying opportunity

TLC’s valuation has de-rated largely due to investor short-termism around recent jackpot activity, in spite of the medium and long-term fundamentals remaining strong. Given its highly defensive, ‘infrastructure-like’ earnings, the company is well placed to outperform over the medium term amidst what is likely to be a slowing economic and earnings backdrop.

In our view, a ‘mid to high teens’ EV/EBITDA multiple is plausible for TLC given its attractive ‘infrastructure-like’ characteristics. Simplistically, putting TLC’s FY25 consensus EBITDA of $838m on a multiple of 16-17x implies an equity value per share of $5.1-$5.5, which represents material upside to the current share price - before even considering upside risks to consensus earnings estimates.

Therefore, the recent pullback in TLC’s share price is an attractive buying opportunity.

Written by

Rob Crookston, Equity Strategist

Rob is an experienced research analyst with a background in both equity strategy and macroeconomics. He has a strong knowledge of equity strategy, asset allocation, and financial and econometric modelling.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.