Quality cyclicals do not have the same persistent growth characteristics as pure structural growth stocks.

However, quality cyclicals usually have a structural growth story embedded within the company that should drive superior earnings growth over the medium-term. This growth may be hampered by a downturn in the cycle simply because these stocks are more sensitive to economic conditions, but the structural growth drivers should outweigh the cyclicality over the medium to long-term.

In general, these companies are astute managers of capital deployment and cover their costs of capital at the bottom of the economic cycle, a characteristic we like when holding these stocks throughout the cycle.

The current market turbulence may represent a good opportunity to buy a quality cyclical at a reasonable price after they have experienced a tough period in the broader sell-off.

Macquarie Group (MQG) Fits the Bill

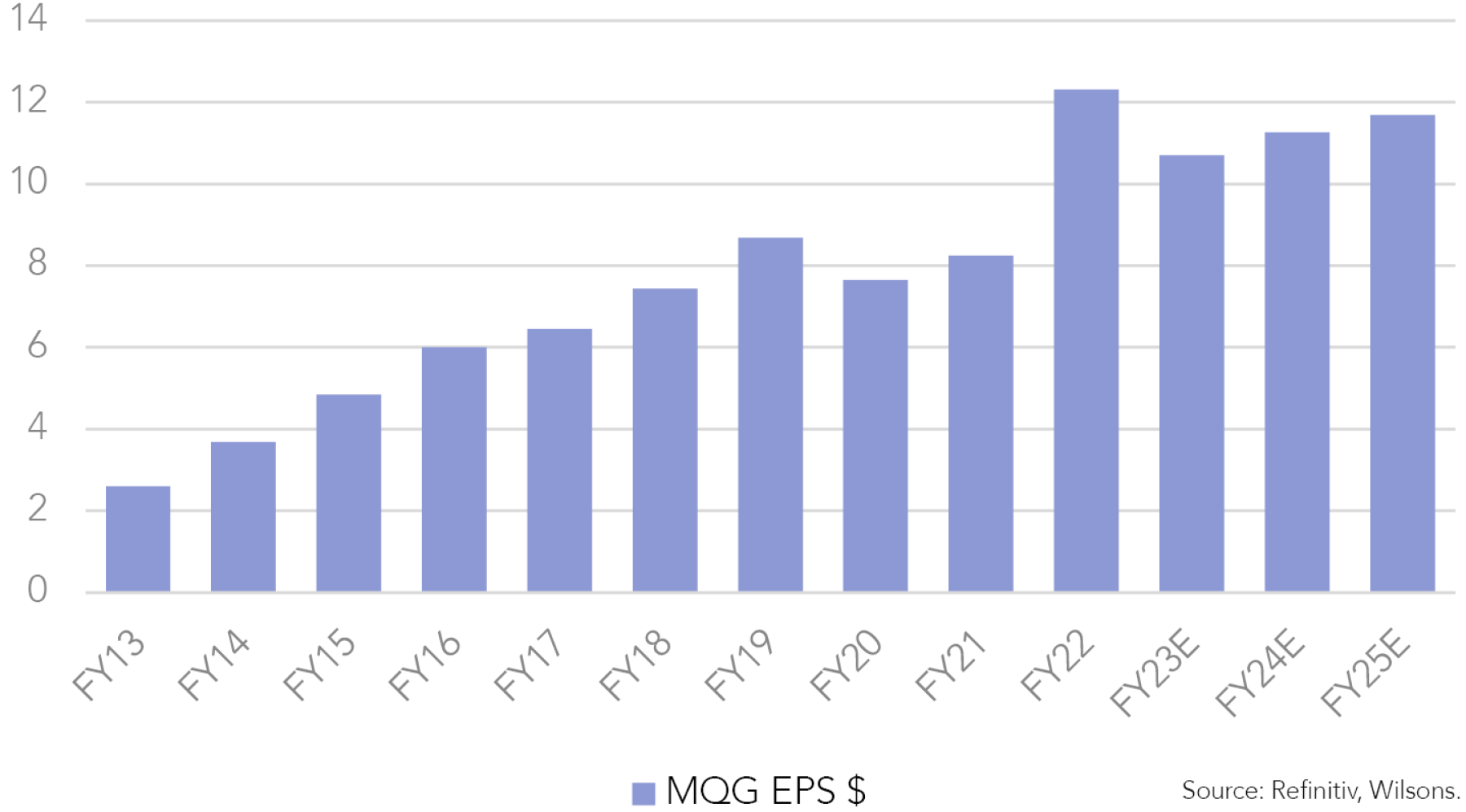

MQG is a quality business with the proven ability to position itself to take advantage of structural growth opportunities, resulting in compound earnings growth over the long-term. We think the medium- to long-term opportunity for the Group is significantly stronger than other large cap financials on the market.

Management’s ability to deploy capital into opportunities has the potential to underpin future years of growth. We think investors will continue to support this approach, given MQG’s track record.

How can MQG achieve long-term earnings growth?

- Increasing assets under management – market pays more for annuity-style businesses.

- Alternatives growth – increasing its share in a global shift towards alternative assets.

- Clean energy – a structural growth thematic with a unique opportunity for MQG.

- Further commodity volatility should benefit MQG's trading business.

- A quality bank under the bonnet.

We anticipate some near-term volatility in earnings over FY23. Still, we are encouraged by MQG's long-term growth profile and its track record of consistently delivering strong returns while also delivering earnings upgrades.

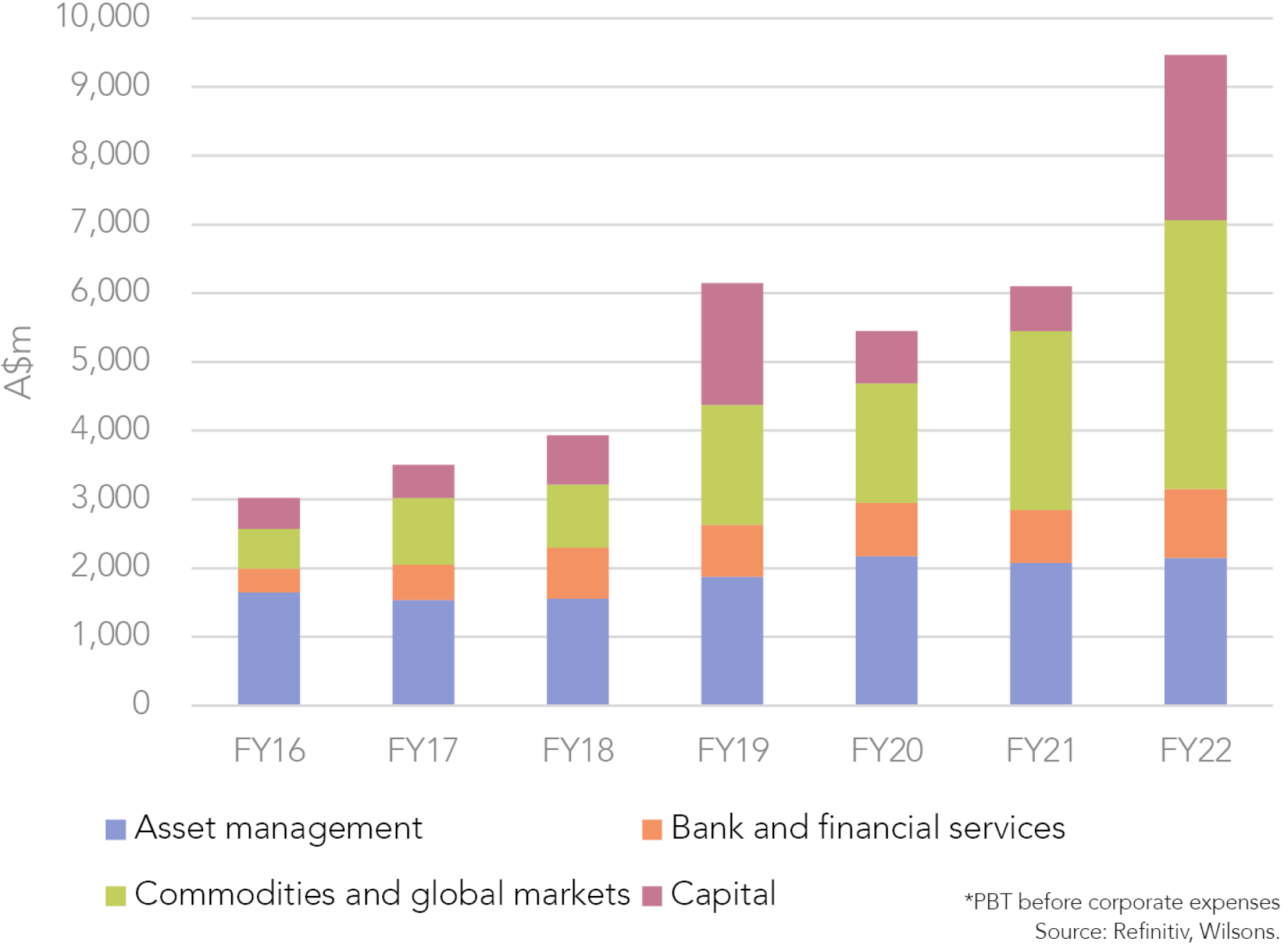

Continuing to Shift to Annuity Style Earnings

MQG has progressively increased its assets management business over the past decade and we do not expect this to stop over the next.

The asset management segment is an annuity style part of the business. Growing earnings in this segment should make the share price more resilient during downturns, as MQG generates a base fee on the assets it manages.

As we have discussed previously, investors prefer annuity style businesses than those at the mercy of the cycle. As this part of MQG's business grows, investors should pay more for the stock, leading to a rerate.

Macquarie Asset Management (MAM) is a capital-light franchise with a high return on equity (ROE) in alternative asset management, including a strong green energy footprint. Waddell & Reed in the US and AMP Capitals' public investments are examples of further inorganic growth that will support the expansion of the MAM business. More M&A in this sector should be earnings accretive for MQG.

We believe that MQG can continue to grow assets under management over the next decade in the high single digits per annum, providing a higher proportion of earnings from the this business on average over the cycle.

Alternatives, Infrastructure and Energy Transition Tailwinds

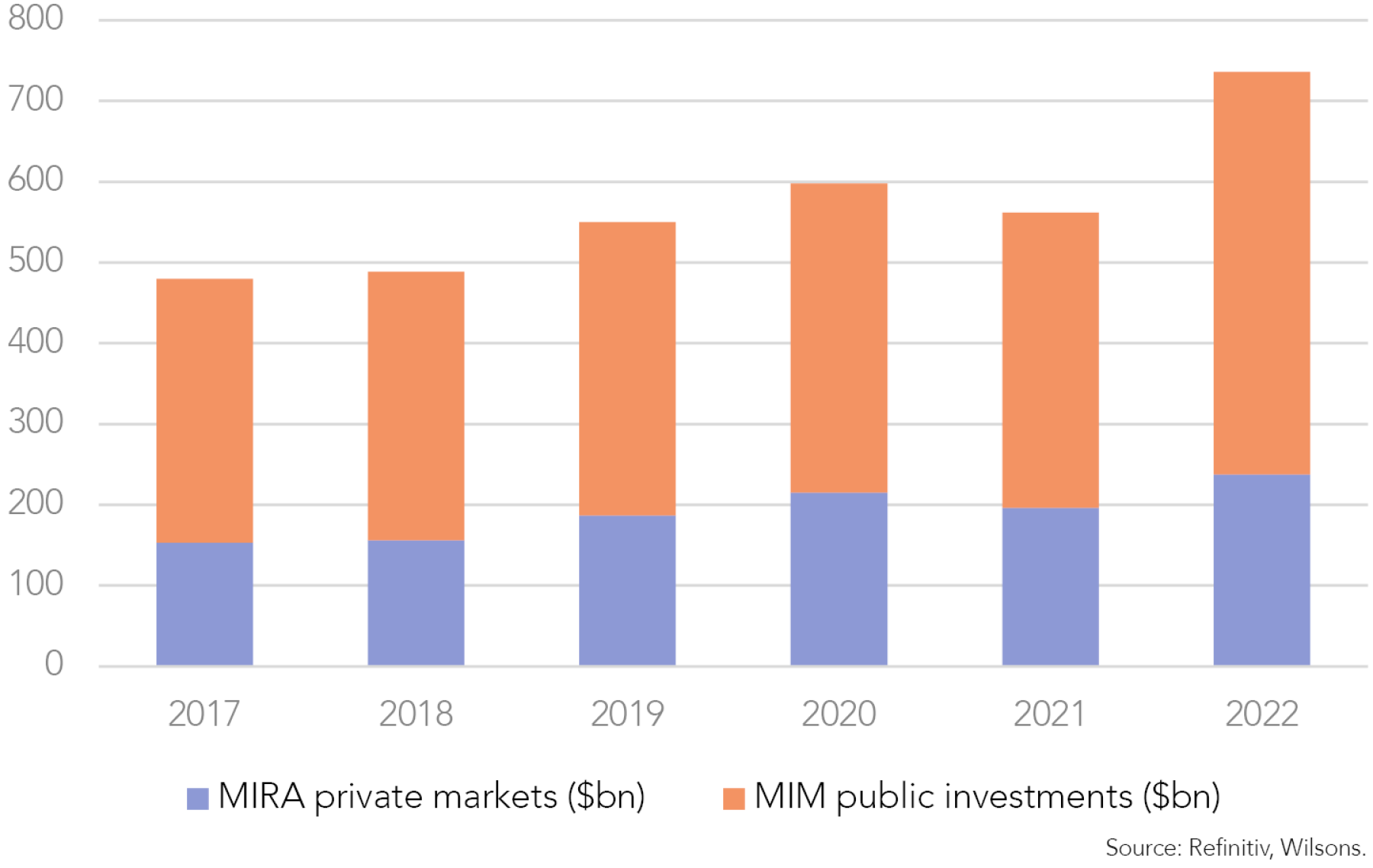

The growing prominence of alternative investments — most of which are private, as opposed to publicly listed stocks and bonds — reflects changes that have been underway in financial markets for decades.

As one of the world's leading global players in alternatives, Macquarie has capitalised on this trend. MQG continues to be a top choice for investors looking at long-term growth opportunities in alternative assets such as renewable energy and infrastructure.

MQG is one of the largest infrastructure managers globally (IPE Real Assets Jun/Jul 21) and is now the manager of 153 infrastructure assets across the world with deep sector expertise across all asset classes, including roads, airports, rail, ports, telecommunications, utilities, green energy and digital infrastructure.

The company increased its infrastructure AUM from A$87bn in 2011 to A$203bn by the end of 2021. This also generates synergies into providing advice on infrastructure transactions for the Macquarie Capital business.

The global infrastructure opportunity for MQG is not over. Oxford Economics estimates the world will need US$75tr of infrastructure investment by the end of 2040, of which 54% will come from Asia. MQG is well-positioned to take advantage of this opportunity.

Green energy is another area of differentiation between MQG and its peers. MQG and Brookfield, its key competitor in this space, have the first-mover advantage in green energy. Decarbonisation is a major macro trend that will continue to drive investment trends over the next two decades. In our opinion, MQG is well-positioned to take advantage of this opportunity and is one of the few ASX stocks exposed to this macrotrend.

Volatility Hedge

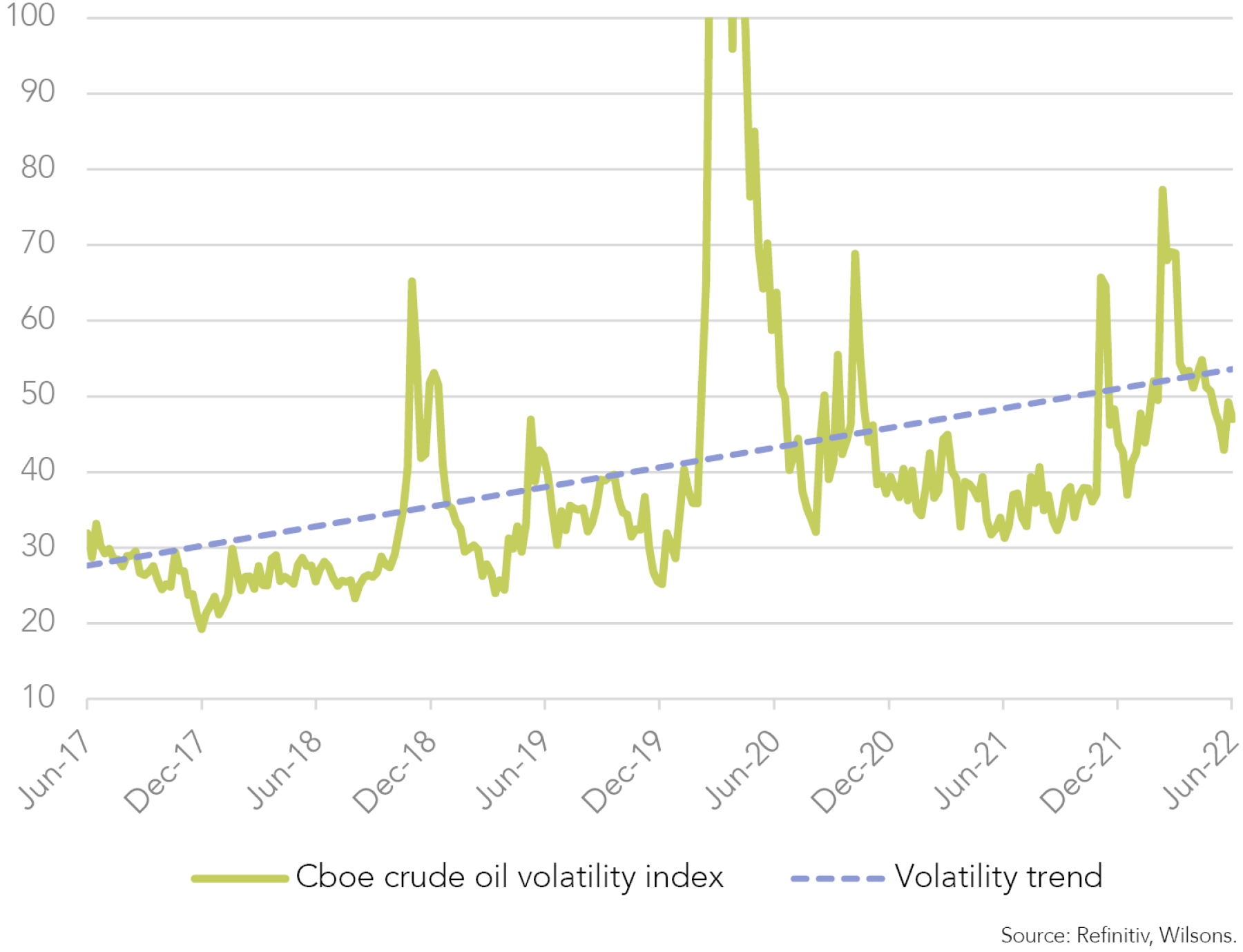

The commodities and global markets (CGM) business has become a global business over the past decade.

Macquarie maintains a strong geographical presence in the US. As the US market is more fragmented, Macquarie has grown this business inorganically through acquisitions, leading to higher earnings.

In the past five years, the CGM business has also benefited from volatile and dislocated energy prices, creating a number of hedging and trading opportunities.

Its trading business also stands to benefit from recent market volatility (against the backdrop of the ongoing conflict in Ukraine). MQG should continue to benefit if commodity prices remain volatile, which we believe is a distinct possibility.

Quality Growing Bank Under the Bonnet

Macquarie is one of the fastest-growing mortgage lending businesses in the Australian market.

We have been impressed by the growth rate of Macquarie's lending business. The bank is taking market share both for owner-occupied mortgages as well as investor mortgages. The home loan portfolio at March 2022 was $A89.5bn, up 24% from March 2021, and represents approximately 4% of the Australian market.

Although this growth is off a lower base, the Group is growing its home loans and investor mortgages faster than the big 4 banks.

If it continues to grow at its current pace, it is very possible that the banking segment could capture over 10% of Australia’s household lending by the end of the decade.

Still a Cyclical Element to MQG and Hard to Cycle FY22 Result

MQG had a very strong FY22 result and will likely find it difficult to cycle this level of earnings in FY23. As we have discussed, there is a cyclical element to MQG earnings that will be negatively impacted by a slowdown in the global economy.

However, with the underlying structural stories, we think MQG is a stock we would want to hold over the medium-term and believe it can still generate above-market earnings growth over this timeframe.

Near-term Earnings Look Soft but Could Surprise the Market

Looking at growth from FY23 to FY25 the market is expecting growth of 4.5%, after falling from the exceptionally strong FY22 result. However, MQG has a great ability to positively surprise the market.

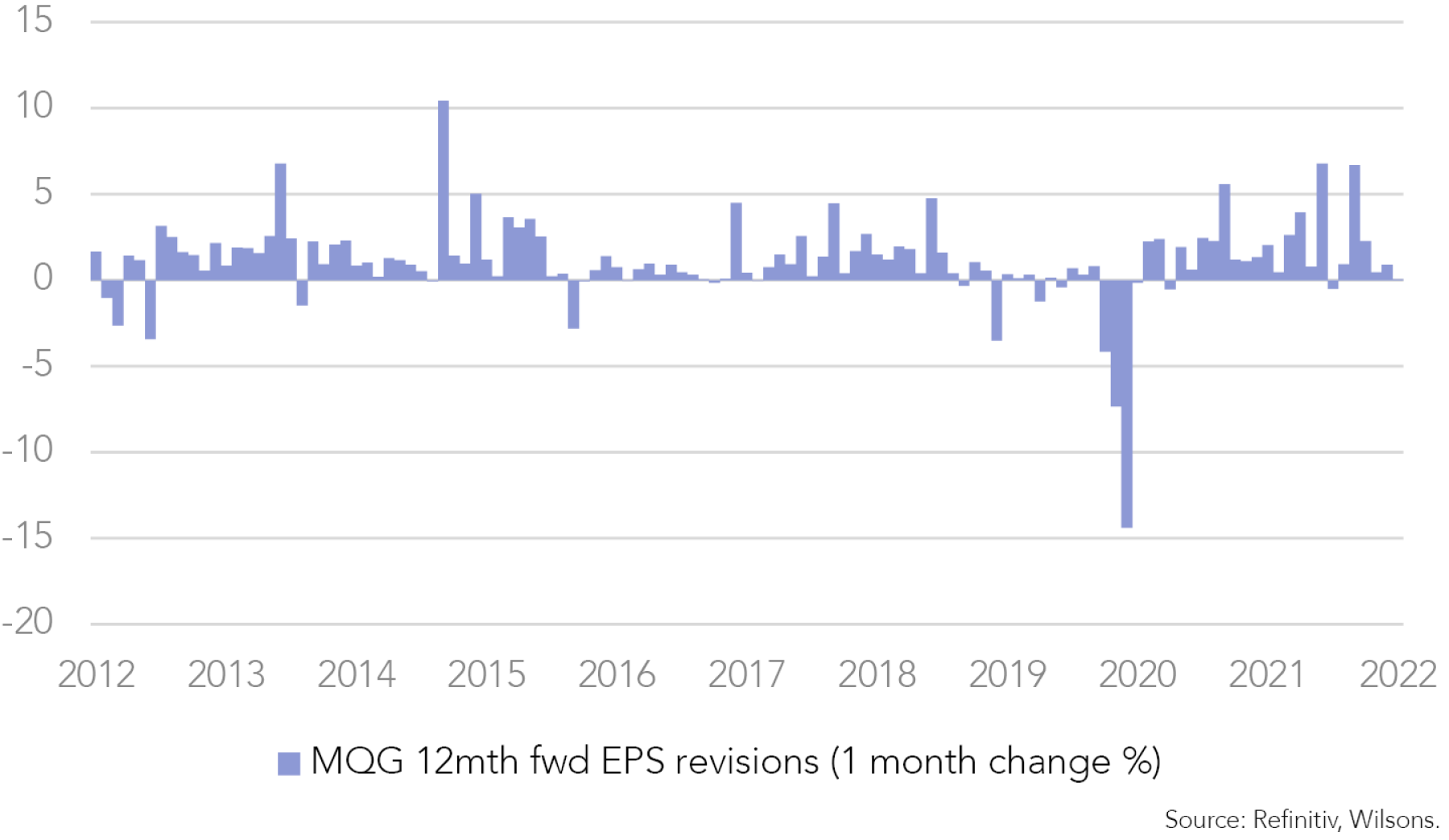

Earnings revisions have generally been positive for MQG over the last 10 years. The ability to deliver earnings upgrades is another reason to hold the stock. Analysts have generally found it challenging to forecast earnings and MQG tend to under-promise and over-deliver.

Valuation Looks Reasonable

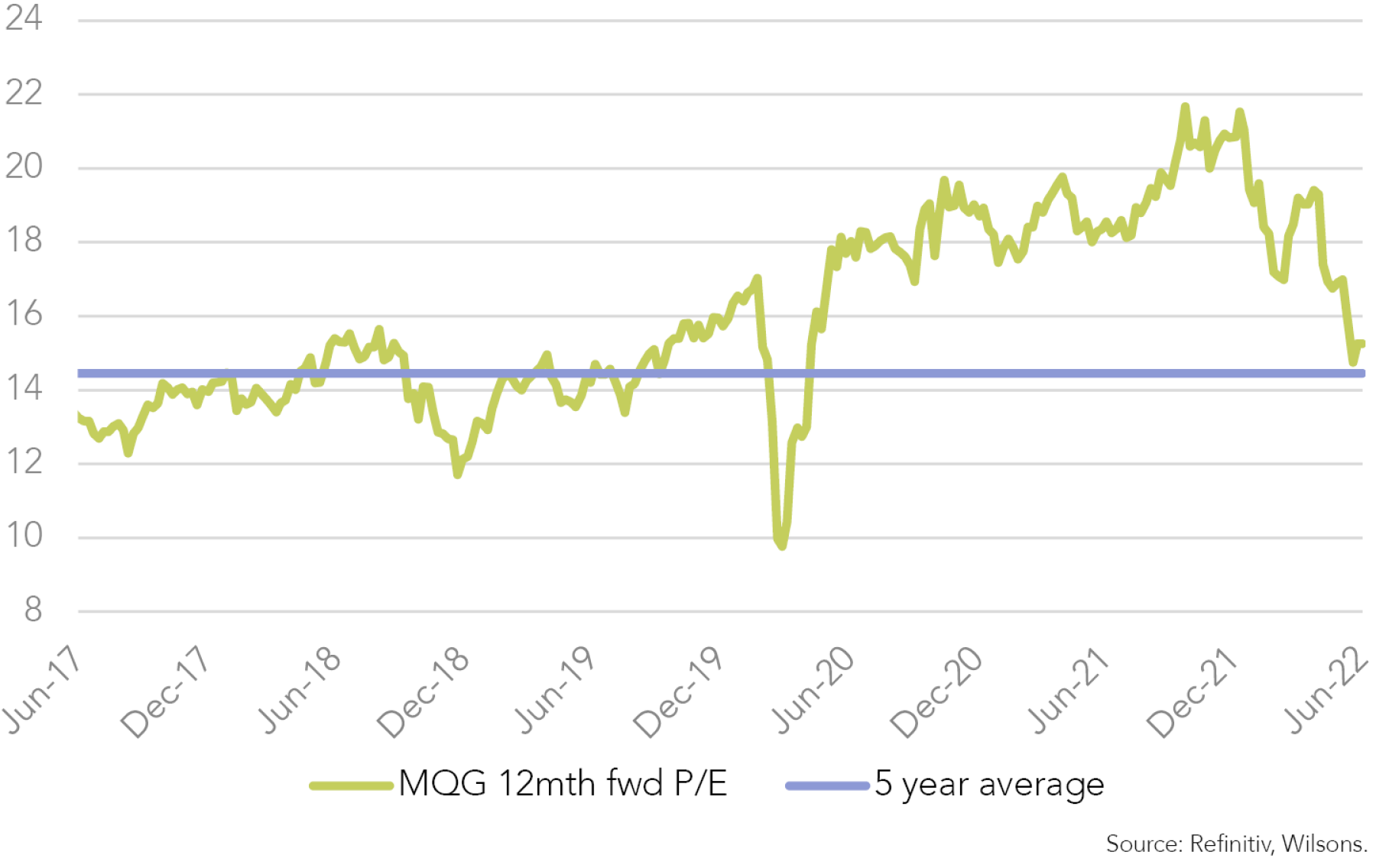

MQG currently trades on a PE multiple of 15x (1 year forward earnings), lower than it has been trading on post 2020 and close to its 5-year historical average.

We think this valuation looks reasonable due to the strong long-term earnings growth potential for MQG and unique leverage to the energy transition.

We believe that after the price fall of ~20% since the beginning of the year, there is an opportunity now to buy a quality cyclical at a discounted price.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.