After five years of underperformance versus the broader market, a convergence of factors now supports a highly attractive risk/reward profile for investors in the Healthcare sector.

Given our quality/growth bias, we are naturally drawn to Healthcare, as the sector is home to a number of highly profitable, global market leaders benefiting from enduring structural tailwinds – including ageing populations, rising chronic disease prevalence, and ongoing innovation and product advancement.

Collectively, these factors have historically supported strong earnings growth and attractive returns on invested capital across market cycles. At this point in time, the Healthcare sector appears particularly well positioned to outperform over the medium-term, supported by three key dynamics:

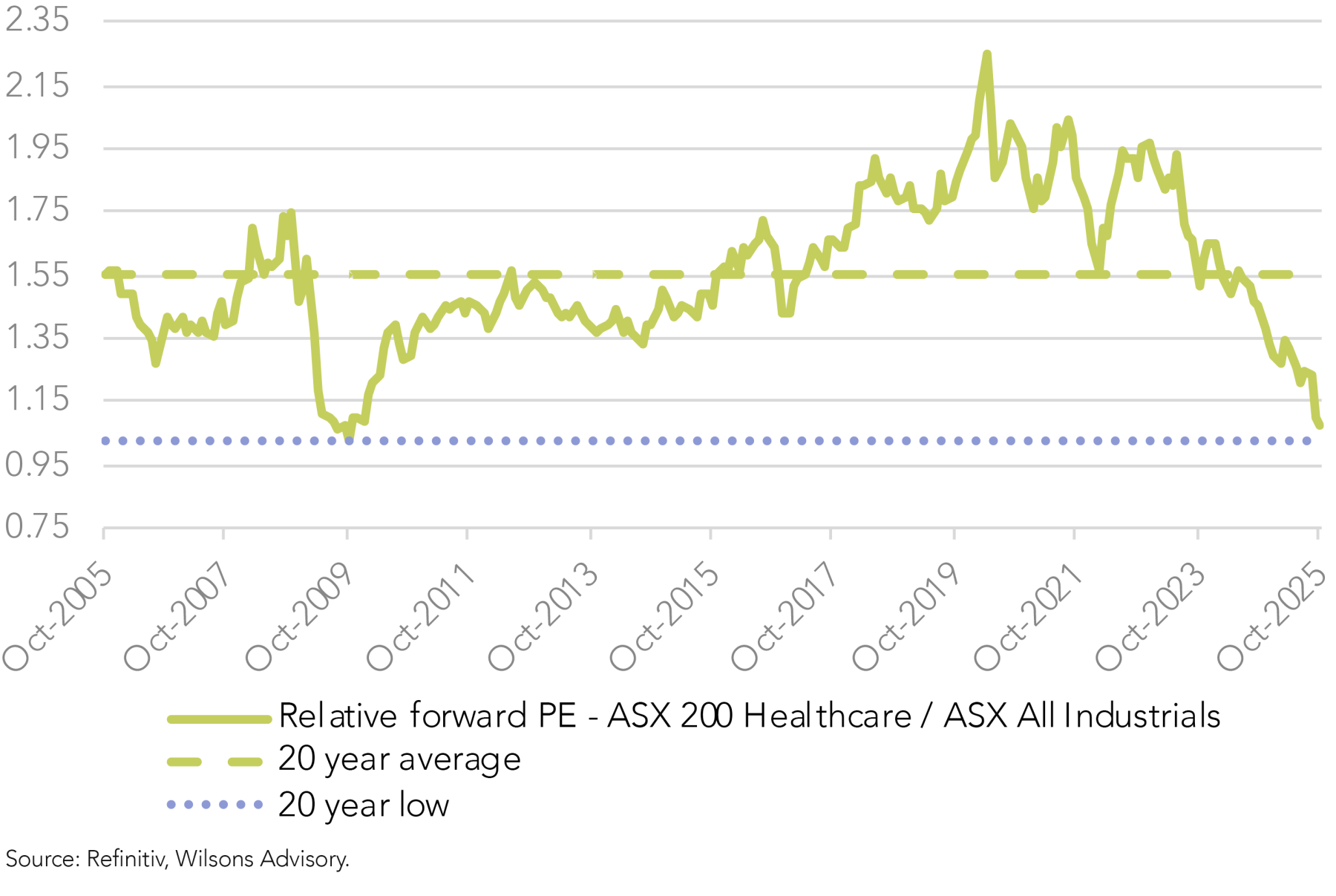

- Highly compelling relative valuation –

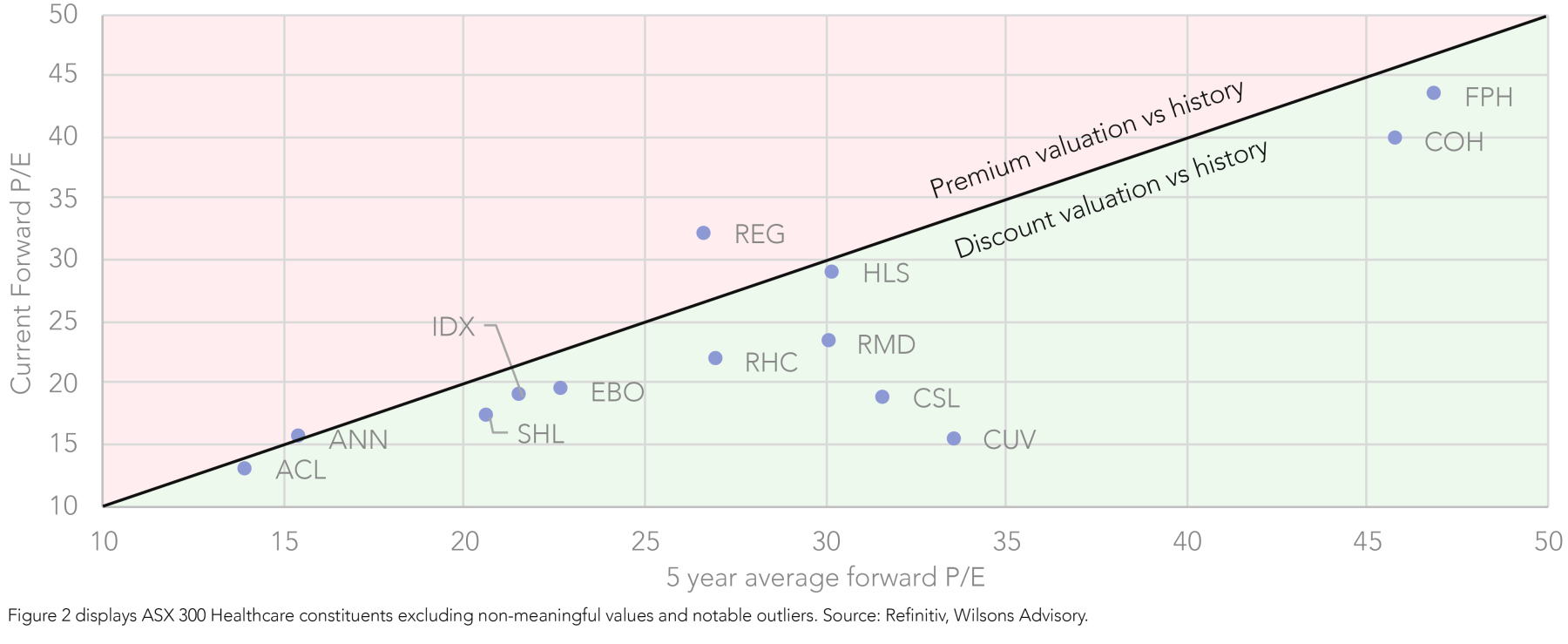

after meaningfully de-rating from its peak in 2020, the ASX 200 Healthcare sector now trades on a forward P/E multiple of 23.6x, equating to 1.2x the ASX 200 and 1.1x the ASX All Industrials. This is a material discount to the long-run average, with the sector’s relative valuation now close to 20-year lows against both benchmarks. Importantly, this is not solely a CSL-driven story; many other sector constituents trade below their respective historical averages. - Attractive, above-market earnings growth –

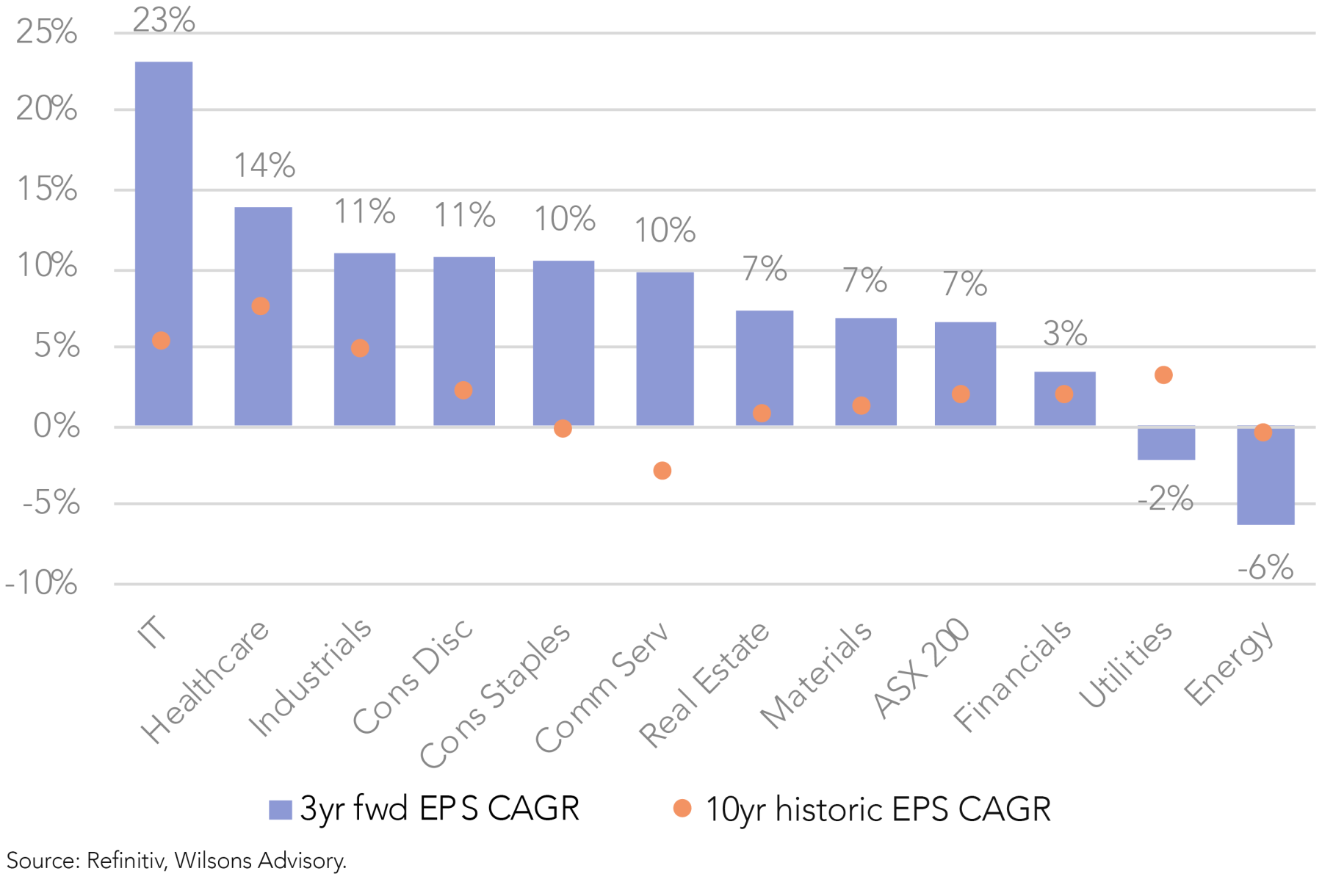

the sector is forecast to deliver a three-year EPS CAGR of 14% over FY25–28, double the ASX 200’s expected 7% growth. Notably, this growth is broad-based, with a median three-year EPS CAGR of 16% across sector constituents, highlighting the depth of the sector’s earnings growth. - Bottom-up drivers –

importantly, the sector’s outstanding valuation and growth appeal coincides with compelling bottom-up stock stories, including our preferred exposures ResMed and Telix Pharmaceuticals and Cochlear.

Given the attractive risk/reward at this juncture, the Focus Portfolio remains overweight the Healthcare sector. The remainder of this report provides updated insights on the sector from a bottom-up perspective, with a focus on ResMed, Telix Pharmaceuticals, CSL, and Cochlear.

| Company | Ticker | Portfolio weight | Active weight vs ASX 300 | Forward P/E | +- 5yr avg | Forward EV/EBITDA | +- 5yr avg | 3yr EPS CAGR (FY25-28) | 12 mth fwd EPS revisions - last 90 days |

| ResMed | RMD | 5.0% | 4.2% | 23.2 | -23% | 17.7 | -24% | 12% | 4.0% |

| Telix Pharmaceuticals | TLX | 3.0% | 2.8% | n.m. | n.m. | n.m. | n.m. | n.m. | n.m. |

| CSL | CSL | 4.0% | 0.3% | 18.8 | -41% | 13.7 | -36% | 11% | -1.5% |

| Cochlear | COH | - | -0.7% | 39.6 | -14% | 25.7 | -11% | 14% | -0.3% |

| Sigma Healthcare | SIG | - | -0.6% | 44.2 | n.m. | 30.1 | n.m. | 17% | -3.6% |

| Pro Medicus | PME | - | -0.6% | 175.7 | 46% | 119.9 | 47% | 32% | -4.5% |

| Sonic Healthcare | SHL | - | -0.4% | 17.1 | -18% | 7.6 | -24% | 12% | -6.5% |

| Fisher & Paykel | FPH | - | -0.2% | 43.2 | -8% | 26.3 | -7% | 16% | 0.3% |

| Ramsay Health Care | RHC | - | -0.2% | 21.8 | -20% | 8.4 | -24% | 14% | -13.7% |

| EBOS Group | EBO | - | -0.0% | 19.3 | -15% | 10.3 | -22% | 5% | -22.6% |

| Focus Portfolio | 12.0% | 3.9% |

Figure 4 displays the 10 largest ASX 200 Healthcare companies (based on index weights). Source: Refinitiv, Wilsons Advisory.

ResMed – Sleeping Easy

ResMed (RMD) is held in the Focus Portfolio at a 5% weight, making it the portfolio’s highest conviction position within the Healthcare sector, which is underpinned by three key factors.

1. Robust CPAP fundamentals support healthy top-line growth

CPAP fundamentals remain strong, underpinned by resilient patient demand, structural tailwinds supporting patient flow, the sector’s status as a ‘tariff safe haven’, and the continued absence of key competitor Philips from the US market. Given this backdrop, consensus forecasts for a 3 year revenue CAGR of 8% over FY25–28 are well supported, if not conservative. We expect continued top-line strength driven by:

- Demand generation initiatives: ResMed’s investments in direct-to-consumer engagement and education targeting GLP-1 prescribers aim to raise sleep apnea awareness and reinforce CPAP as the ‘gold standard’ treatment, supporting growing market penetration.

- GLP-1 tailwinds: ResMed’s analysis of 1.6m patients shows those prescribed GLP-1s are 11% more likely to initiate CPAP therapy – likely driven in part by sleep test referrals – and demonstrate higher, more consistent mask resupply rates.

- New generation wearables: FDA-cleared devices with sleep monitoring capabilities – like the Samsung Galaxy Watch and Apple Watch (Series 9+) – are driving greater sleep apnea awareness and helping patients move through ResMed's sleep care ‘funnel’ more efficiently.

2. Gross margin expansion upside

ResMed’s FY26 gross margin guidance of 61-63% was well ahead of prior consensus of 60.2% and above FY25a of 60.0%. This has supported significant upgrades since its result in late July.

Looking forward, we expect margin expansion to continue to be driven primarily by procurement, manufacturing, and logistics efficiencies, with the company now seemingly back to ‘business as usual’ from a cost optimisation standpoint after disruptions in recent years from:

- Covid (requiring emergency ventilator scale-up)

- Inventory scaling related to Philips’ market absence

- Supply chain issues (which delayed the AS11 launch)

Beyond operational improvements, we also see ongoing support from favourable product mix shifts – including growth in higher-margin mask and device (AS11) sales. We see scope for gross margins to reach 65% over the medium term, which could underpin further upgrades to consensus margin assumptions (currently peaking at 62.5%) and, in turn, EPS forecasts.

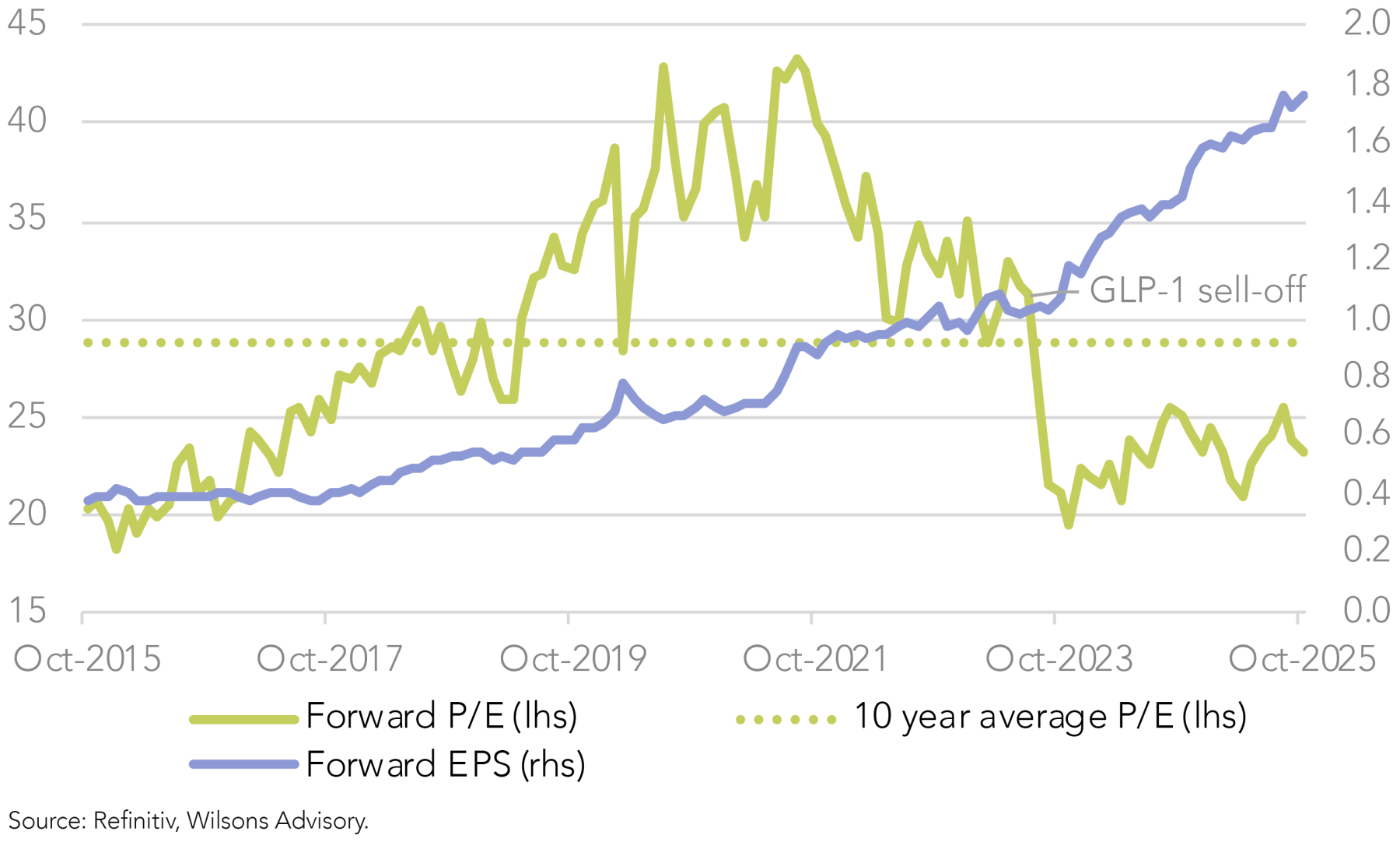

3. ResMed still offers attractive value

Despite ResMed’s share price trading at effectively double its ‘GLP-1 sell-off’ low, its valuation remains undemanding, given the rally has been predominately driven by EPS growth rather than multiple expansion. With the company trading on a forward PE of 23x – meaningfully below its long-term average and pre-GLP1 levels – and offering double-digit consensus EPS growth over the medium-term (with scope for upgrades), ResMed continues to offer attractive growth at a reasonable price.

Telix Pharmaceuticals – Down But Not Out

Telix Pharmaceuticals (TLX) is held in the Focus Portfolio at a 3% weight and has been a portfolio constituent for over five years with an effective entry price of ~$1.40 per share.

The stock is down 32% this calendar year-to-date, driven by a series of negative surprises, most recently its second Complete Response Letter (CRL) (an FDA communique that identifies issues to be resolved before approval) in six months – this time for its kidney cancer diagnostic, ZIRCAIX.

Importantly, this delay is not related to the efficacy or safety of the drug itself, but rather to manufacturing and supply chain deficiencies identified by the FDA. The timing and complexity of the ‘way back’ for ZIRCAIX is uncertain – our research team has delayed its assumed commercialisation by 12 months to FY26.

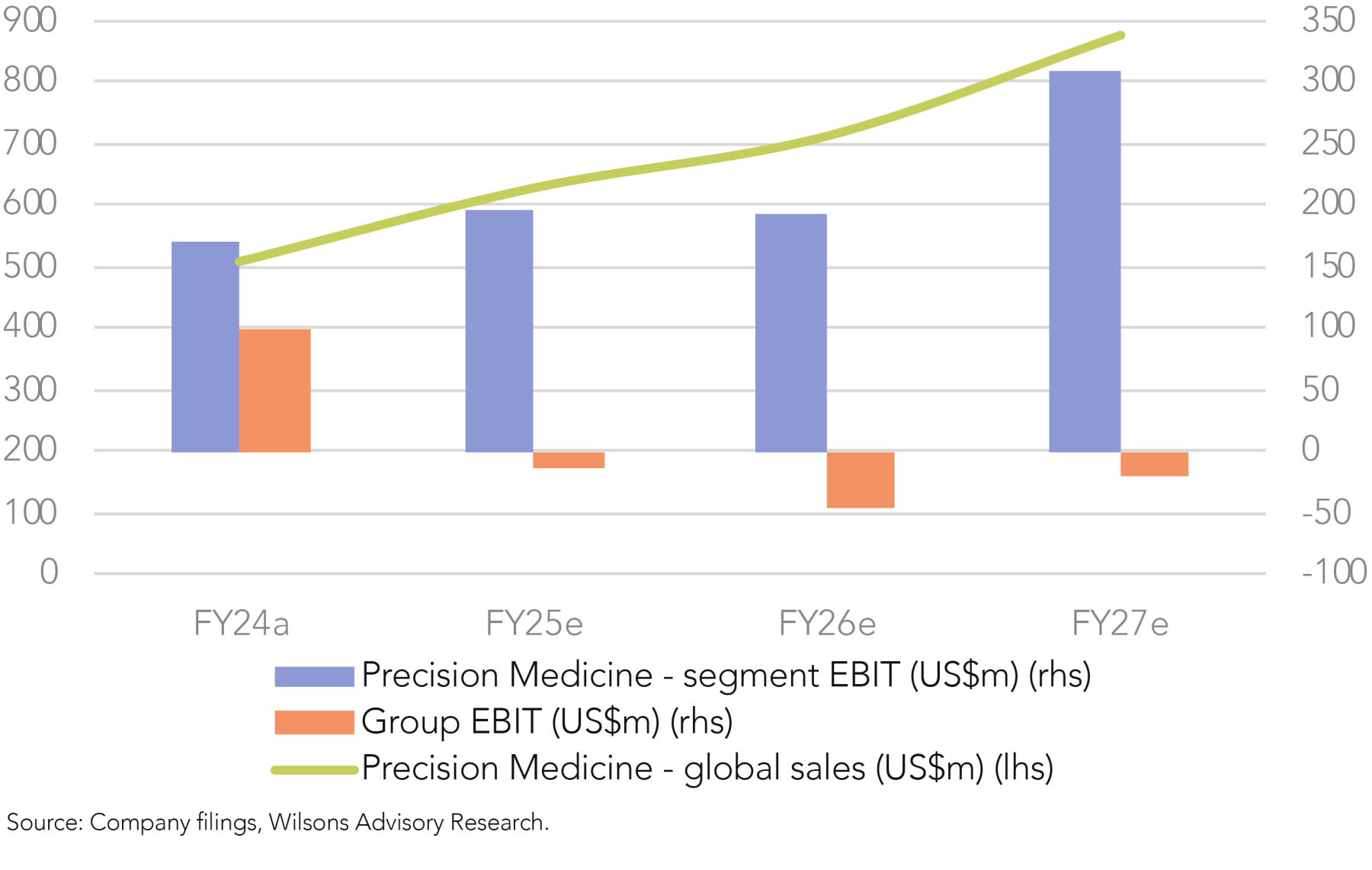

Separately, ahead of its 1H25 result in August, Telix provided FY25 OPEX guidance which was meaningfully ahead of prior market expectations, reflecting increased investments into its infrastructure and R&D at the expense of near/medium-term earnings. Management has signalled its intent to continue reinvesting its Precision Medicine profits into the business over the next three years as it builds towards becoming a fully-integrated, self-funded, global radiopharmaceuticals business.

While we support this long-term strategic focus, it leaves the business as broadly ‘breakeven’ for now, making revenue performance and pipeline progress the key share price drivers over the medium-term, rather than EPS.

GOZELLIX reimbursements steady the ship

On 1 October, GOZELLIX was granted transitional pass-through (TPT) status. As a second-generation version of ILLUCCIX, it offers extended shelf life (~6 hours vs. ~2 hours), enabling broader geographical distribution. Under TPT, eligible Medicare patients will no longer face the 20% co-payment, supporting broader uptake.

GOZELLIX (and Telix’s two-product PSMA strategy) provides several advantages. Firstly, its enhanced distribution range could expand Telix’s addressable market by reaching patients previously outside ILLUCCIX’s delivery window. Secondly, GOZELLIX should command a premium price, while ILLUCCIX remains positioned as a competitive or ‘fighting’ brand in lower ASP (average selling price) segments.

Together, this dual-product approach should enable incremental gross margin gains from both higher average pricing and reduced dispensing costs.

Where to from here?

Telix’s recent Q3 update was encouraging, with FY25 revenue guidance upgraded to US$800-820m (from US$770-800m), suggesting strong momentum of the GOZELLIX launch following TPT approval.

The GOZELLIX approval and positive Q3 update are the first steps in Telix’s turnaround story. There are several other material upcoming catalysts that are likely to drive the stock over the near-term, including:

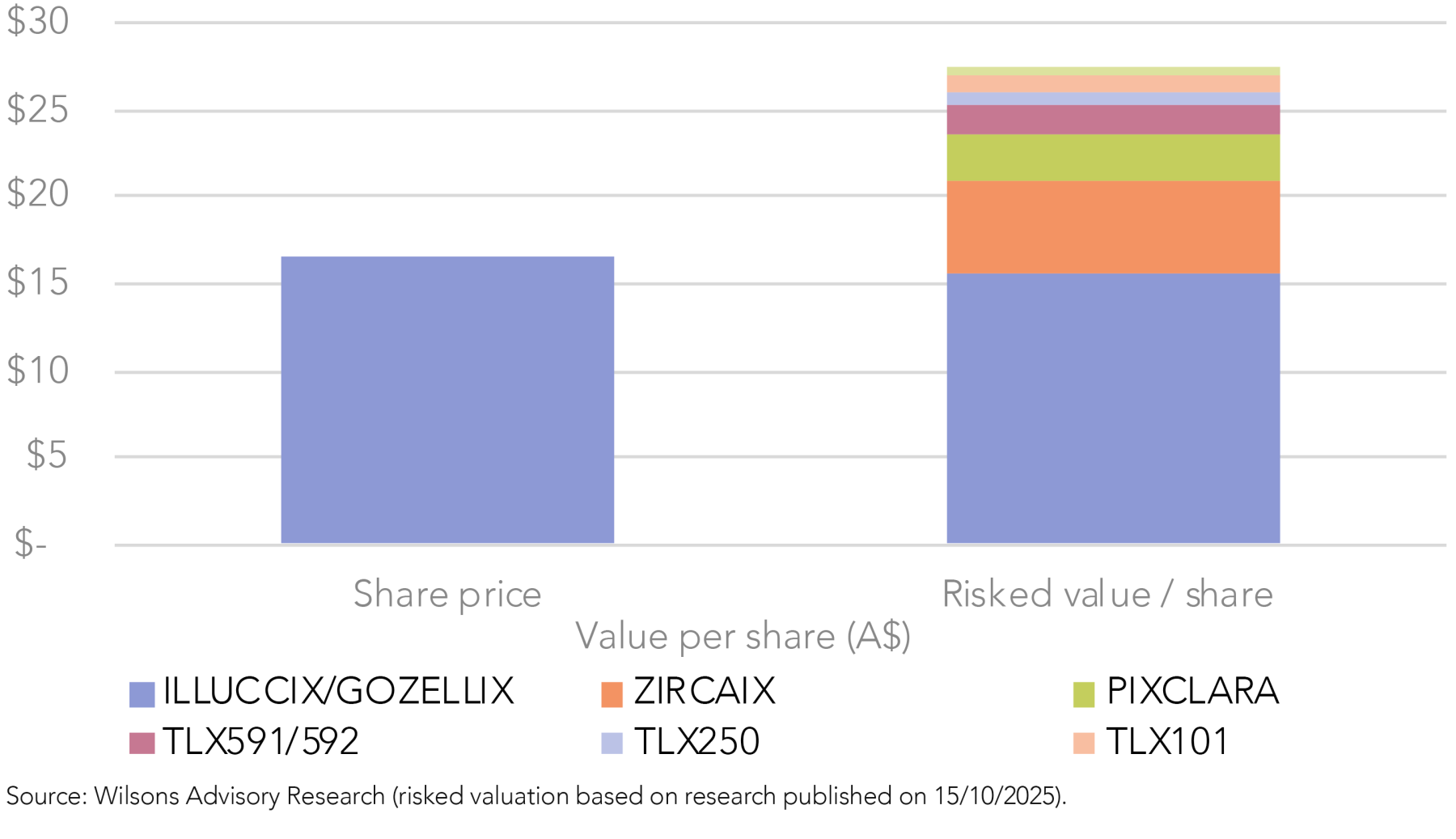

- TLX591 (prostate cancer therapeutic) Phase 3 trial data expected ‘before Christmas’ – this readout will be focused on safety and dosimetry (measuring radiation exposure). Should the results be broadly positive, we believe a generous de-risk of the asset is warranted. Our research team has an un-risked value of $8.23/share for TLX591/592.

- PIXCLARA (brain cancer diagnostic) resubmission expected in 4Q25 – following its CRL in April, Telix has aligned with the FDA for a NDA (new drug application) resubmission path and is on-track to resubmit in 4Q25. Our research team has an un-risked value of $3.10/share for PIXCLARA.

- ZIRCAIX (kidney cancer diagnostic) FDA Type A meeting requested, submission timeline uncertain – after ZIRCAIX’s CRL (discussed above), Telix has requested a Type A meeting (the highest priority meeting) with the FDA to get its development back on track. Management is confident it has a sufficient amount of clinical data to support comparability of clinical and commercial products without the need for additional clinical trials.

Overall, despite recent setbacks, we remain positive on Telix as an emerging leader in radiopharmaceuticals. It has meaningful long-term upside from its extensive diagnostic and therapeutic pipeline, which we expect to be fully self-funded by the cash generated from its commercial Precision Medicine assets, including ILLUCCIX. As pipeline assets are progressively de-risked, and commercial assets scale, we anticipate attractive shareholder returns.

CSL – Compelling Valuation but Unconvinced on Execution

CSL (CSL) is held in the Focus Portfolio at a weight of 4% (neutral exposure vs the ASX 300).

CSL disappointed the market during the August 2025 reporting season, with modest FY26 EPS downgrades driven by further delays to its gross margin recovery despite its productivity initiatives. Weak immunoglobulin (IG) sales (flat in 2H) and rising competition from novel biologics have also raised concerns about the sustainability of Behring’s growth trajectory. The result also revealed that CSL's focus has shifted toward cost savings rather than growth, with a >US$500m cost-out program likely to reduce R&D investment and constrain long-term pipeline potential.

Our level of conviction in CSL has fallen since its result, given our thesis was underpinned by our belief in Behring’s gross margin recovery and more broadly the strength of Behring as the growth engine of the group. Both are now in question, and consecutive results have missed expectations, eroding our confidence in the company’s medium-term outlook.

That said, CSL appears attractively valued after de-rating to a forward P/E of 19x, well below its five and ten year averages of 32x and 34x, respectively. This is compelling considering to a three-year consensus EPS CAGR of 12%, which is well above the level of growth offered by the market (at 7%) and other large caps trading on much higher multiples (i.e. WES trades on 35x and offers single digit EPS growth). However, given our degree of caution around consensus estimates, we need to see better execution to become comfortable moving from our current neutral stance.

Cochlear – Nexa to Turn Up the Volume Growth

Cochlear (COH) is not held in the Focus Portfolio.

Cochlear is a global leader in implantable hearing solutions, specialising in Cochlear Implants (CI) that restore hearing for people with severe to profound hearing loss. While not currently held in the Focus Portfolio, we continue to monitor it closely as a high-quality global franchise with an increasingly plausible valuation following three successive earnings downgrades.

Nucleus Nexa resets its product cycle for a long runway of growth

The recent FDA approval and launch of Nucleus Nexa marks Cochlear’s first new CI system in over two decades – a major milestone in its next phase of growth.

Nexa’s upgradeable firmware positions Cochlear at the forefront of implant innovation, enabling ongoing improvements in sound processing, connectivity, and battery life without the need for hardware replacement. Its Smart Sync feature allows users to adjust settings via an app rather than clinic visits, improving convenience, engagement, and appeal among younger users. Early patient and clinician feedback has been positive.

We expect the rollout of Nexa to support further market share gains and lift CI unit growth from ~10% toward the mid-teens, driving an upward inflection in earnings over the medium-term, while recurring firmware enhancements will extend the commercial life of the Nexa platform and lengthen Cochlear’s growth runway.

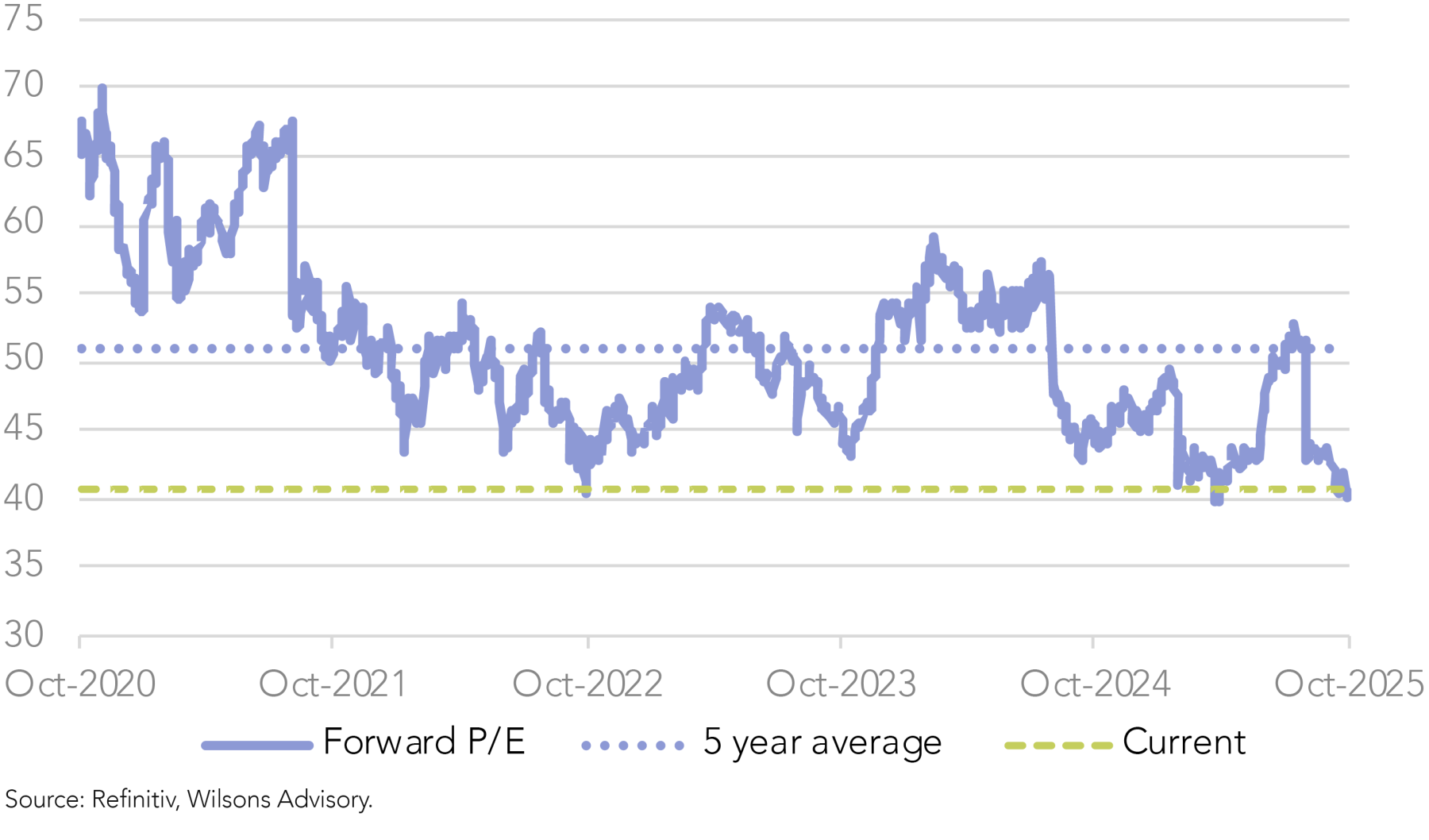

Compelling story but near-term risks remain

Cochlear’s traditionally ‘expensive’ valuation multiple has historically been a barrier to inclusion in the Focus Portfolio, given our bias towards growth at a reasonable price. However, on 40x forward earnings, the stock now trades at a meaningful discount to its five-year average multiple of 51x.

Cochlear holds several key investor appeals, including:

- A dominant, quasi-monopoly position in the global CI market, supporting a high ROIC

- Structural tailwinds from ageing populations (driving greater prevalence of hearing loss and growth in CI demand) and the trend towards earlier implantation, as evidence builds linking early hearing intervention to reduced cognitive decline (expanding the CI addressable market)

- The commencement of a new product cycle with Nucleus Nexa.

While the risk/reward profile has improved, we remain cautious in the near-term. Cochlear’s Services segment remains in an earnings downgrade cycle (albeit arguably due to cycling the 'early success' of the N8 sound processor launch), and consensus doesn’t adequately reflect management’s guidance for a 2H-skewed recovery driven by the launch of the KANSO-3 sound processor and the Nexa system rollout, as well as the surge of new patients (from FY21-22) reaching eligibility for upgrades. This raises the risk of a further (timing related) downgrade at the 1H26 result.

Nonetheless, for investors willing to look through potential near-term share price volatility and take a medium-term view, Cochlear appears to offer a reasonable entry point considering its medium-term growth trajectory.

Written by

Greg Burke, Equity Strategist

Greg is an Equity Strategist in the Investment Strategy team at Wilsons Advisory. He is the lead portfolio manager of the Wilsons Advisory Australian Equity Focus Portfolio and is responsible for the ongoing management of the Global Equity Opportunities List.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.