Gold has performed strongly this year, driven by a confluence of economic and geopolitical risks, including the rapidly evolving situation in the Middle East.

Notwithstanding the strength of the rally since mid-2023, we remain positive on the outlook for gold over the medium-term, which continues to be underpinned by several key demand drivers:

- Geopolitical risks,

with Russia’s war in Ukraine still ongoing, and the potential for escalation in the Middle East where the situation remains fluid, marked most recently by US military strikes on Iranian nuclear sites and subsequent expectations of a ceasefire between Israel and Iran. - Structural growth in central bank demand,

as major central banks – led by the likes of Poland, Turkey, India, and China – continue to diversify their reserves away from the US dollar. - Macro tail risks,

including US fiscal sustainability concerns, uncertainty around US trade negotiations (particularly between the US and China), and ‘stagflation’ tail risks.

Beyond our constructive top-down view, we also see the ASX gold mining sector as broadly attractive from a bottom-up perspective, with covid-era cost/production headwinds seemingly easing, balance sheets flush with cash, and sector profits inflecting upwards.

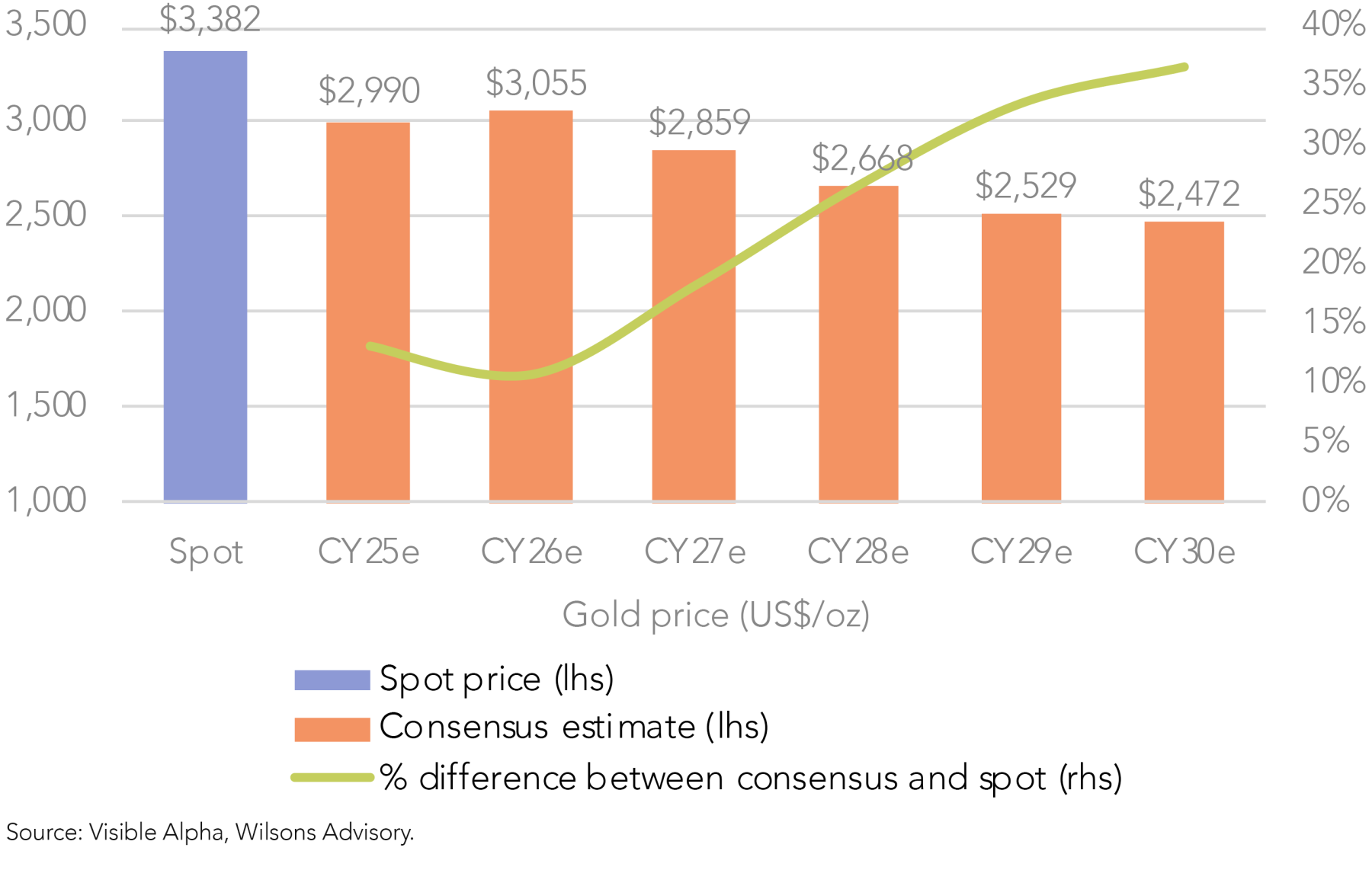

Moreover, the gold price now sits comfortably above medium and long-term consensus forecasts, providing meaningful scope for sector-wide earnings upgrades – assuming gold prices hold near current levels or continue to rise (see Figure 2).

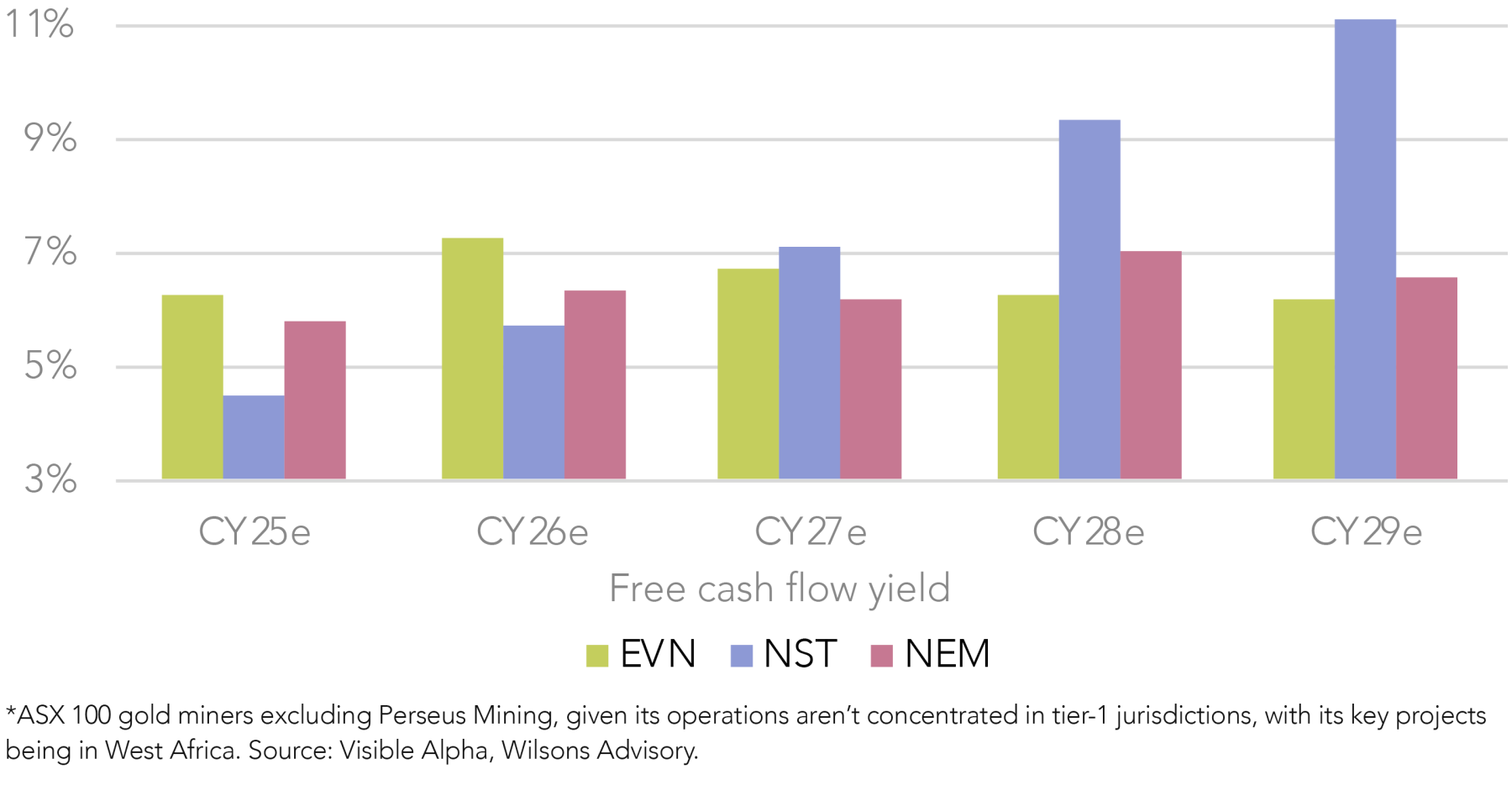

In this context, valuations across the ASX 100 gold sector remain attractive, as they are yet to reflect structurally higher gold prices. While the average forward consensus free cash flow yield of ~6% is in line with the ten-year average, this could ultimately rise into the high-single-digit range – meaningfully above the historical average – if consensus gold price assumptions are ultimately revised higher (in line with our expectations).

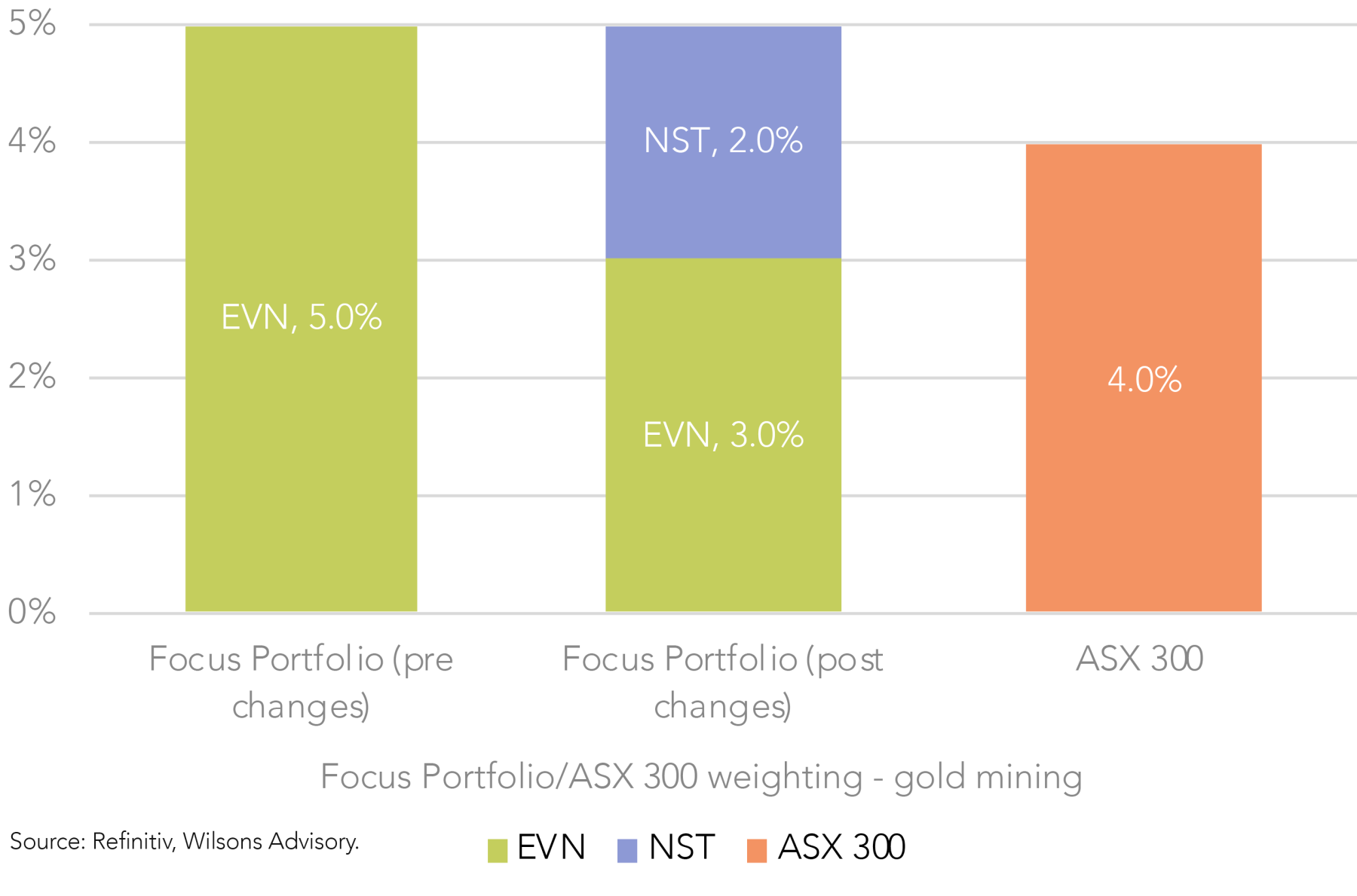

In the remainder of this report, we discuss recent changes to the Focus Portfolio’s positioning in the gold sector. Our overweight exposure to the sector remains unchanged, however, we have trimmed our weighting in Evolution Mining and added Northern Star Resources to the portfolio.

Diversifying our Gold Positioning

Consistent with our positive view on the sector, the Focus Portfolio remains overweight gold mining.

That said, we have diversified the Focus Portfolio’s positioning within the gold mining sector by trimming our exposure to Evolution Mining (EVN) from 5% to 3% and adding Northern Star Resources (NST) at a weight of 2%.

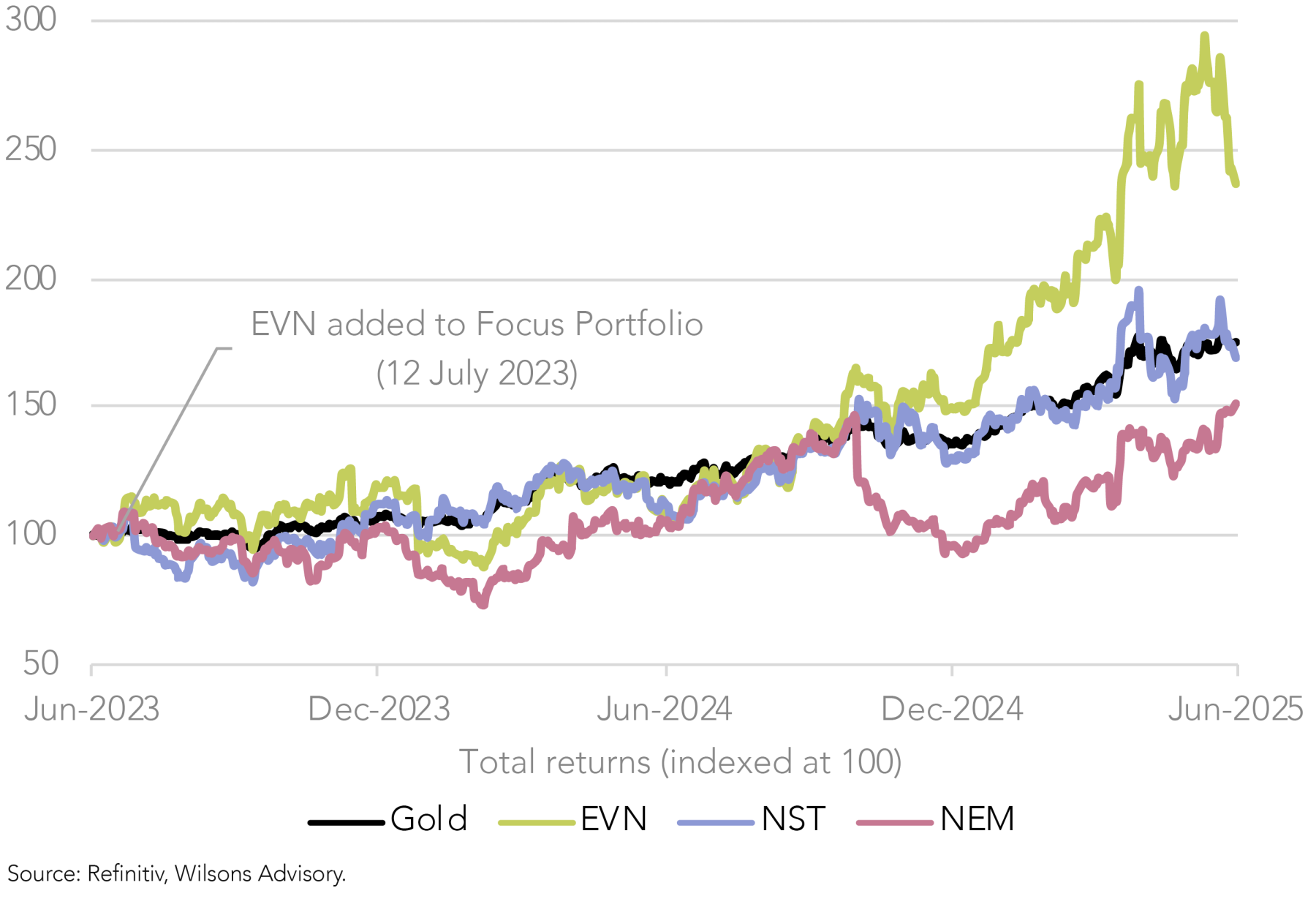

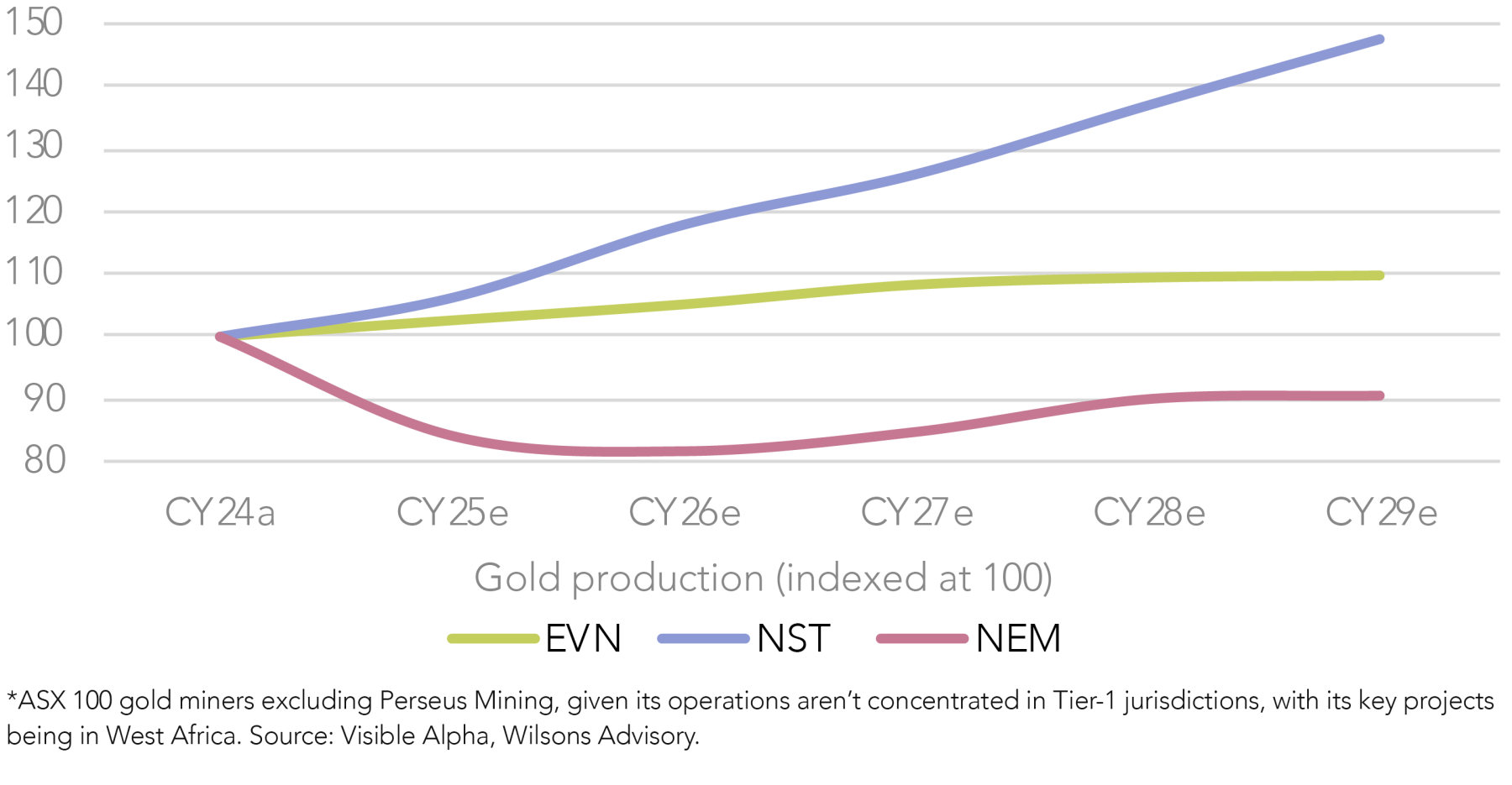

While we remain positive towards EVN – given its superior operational delivery and attractive free cash flow profile over CY25/26 – we are taking this opportunity to lighten our exposure considering its significant share price outperformance, which has brought its valuation closer to fair value. We also note our investment thesis is closer to being realised, with production growth expected to plateau after FY27.

Taking a medium/long-term view, NST has become increasingly attractive among the ASX 100 gold majors, underpinned by a strong production growth outlook, which supports a sector-leading free cash flow yield from CY27 onward. Our investment thesis for NST is detailed below.

Our Approach to the Gold Sector

When investing in the gold sector, we have a preference towards miners with:

- High-grade, low-cost assets

- Scaled, producing miners operating in Tier-1 jurisdictions (which drives a preference for Australian and North American assets)

- Production growth, which allows for earnings growth that is not reliant on an appreciation in the gold price

- Inflecting free cash flow yields, which can be underpinned by production growth, non-core asset sales and/or an easing capex burden

- Balance sheet strength, with future capex and/or M&A plans being well-funded (lowering the risk of future equity raises)

| Name | Ticker | Key geographies | Gold production (koz) | All-in sustaining costs (US$/oz) | 3yr production CAGR* | P/E | EV/EBITDA | FCF yield | Gross dividend yield^ | Net debt (cash) / EBITDA |

| Newmont Corp | NEM | Global | 5,446 | 1,639 | 2.2% | 12.19 | 6.43 | 6.1% | 1.79% | 0.08x |

| Northern Star Resources | NST | Australia, Alaska | 1,838 | 1,339 | 8.8% | 13.44 | 6.52 | 5.1% | 2.80% | (0.17x) |

| Evolution Mining | EVN | Australia, Canada | 752 | 1,019 | 2.2% | 12.77 | 6.62 | 7.3% | 4.27% | 0.23x |

| Perseus Mining | PRU | West Africa | 432 | 1,415 | 9.6% | 9.76 | 4.15 | 0.6% | 2.70% | (-1.12x) |

All figures are based on consensus 12-month forward estimates unless otherwise stated. *CY26-28. ^EVN’s dividends are fully franked, while NEM, NST, and PRU have unfranked dividends. Source: Refinitiv, Visible Alpha, Wilsons Advisory.

Following the North(ern) Star

Northern Star Resources has been added to the Focus Portfolio at a weight of 2%

Northern Star Resources (NST) is a major Australian gold producer with operations in the Tier-1 jurisdictions of Western Australia and Alaska. The company operates across four key production and development hubs – Kalgoorlie, Yandal, Pogo, and Hemi.

While NST’s operational delivery has been mixed over the last 12 months – with its FY25 production/cost guidance downgraded at its March quarterly – looking past the immediate challenges, the company’s medium and long-term outlook remains highly attractive.

Our investment thesis for NST can be summarised in three key points:

1. De Grey Mining acquisition – more growth at lower unit costs

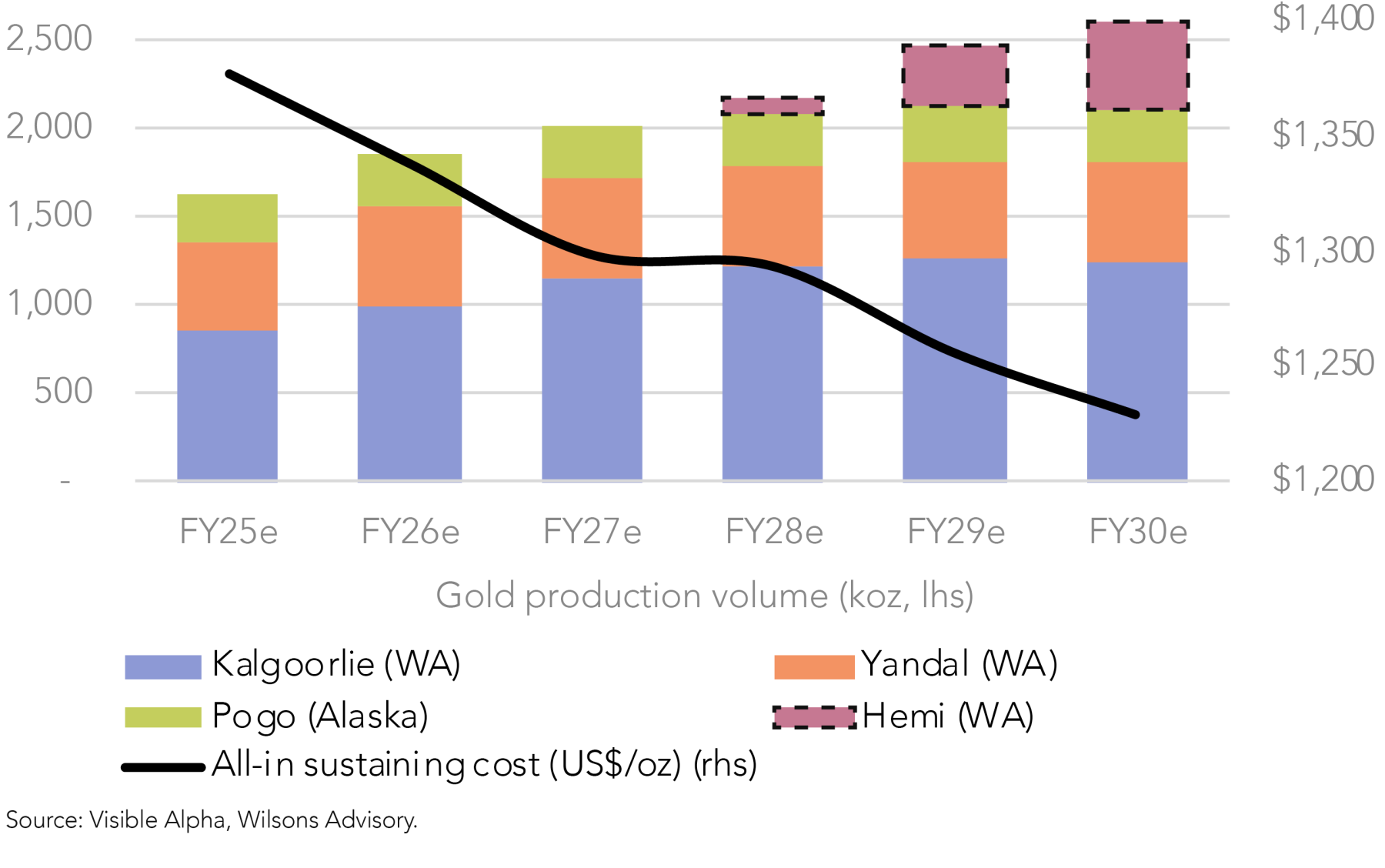

The acquisition of De Grey Mining, completed in May 2025, has strengthened NST’s production growth profile. The Tier-1 Hemi deposit is expected to deliver steady-state production of 530koz p.a. in the first ten years of its mine life, with final permitting and approvals expected in December 2025 and consensus expectations for first gold in 1Q FY28.

Hemi is expected to be in the bottom quartile of the global cost curve, with a life-of-mine average all-in sustaining cost (AISC) of ~US$860/oz (at spot FX), which is meaningfully below NST’s FY24a AISC of ~US$1,240/oz. This low-cost profile is underpinned by relatively high grades for an open pit operation (~1.3g/t) and an optimised development plan, including a purpose-built plant and supporting infrastructure.

As a result, the acquisition is expected to materially lower NST’s unit costs over time and to be accretive to quality, earnings, and NPV from first production.

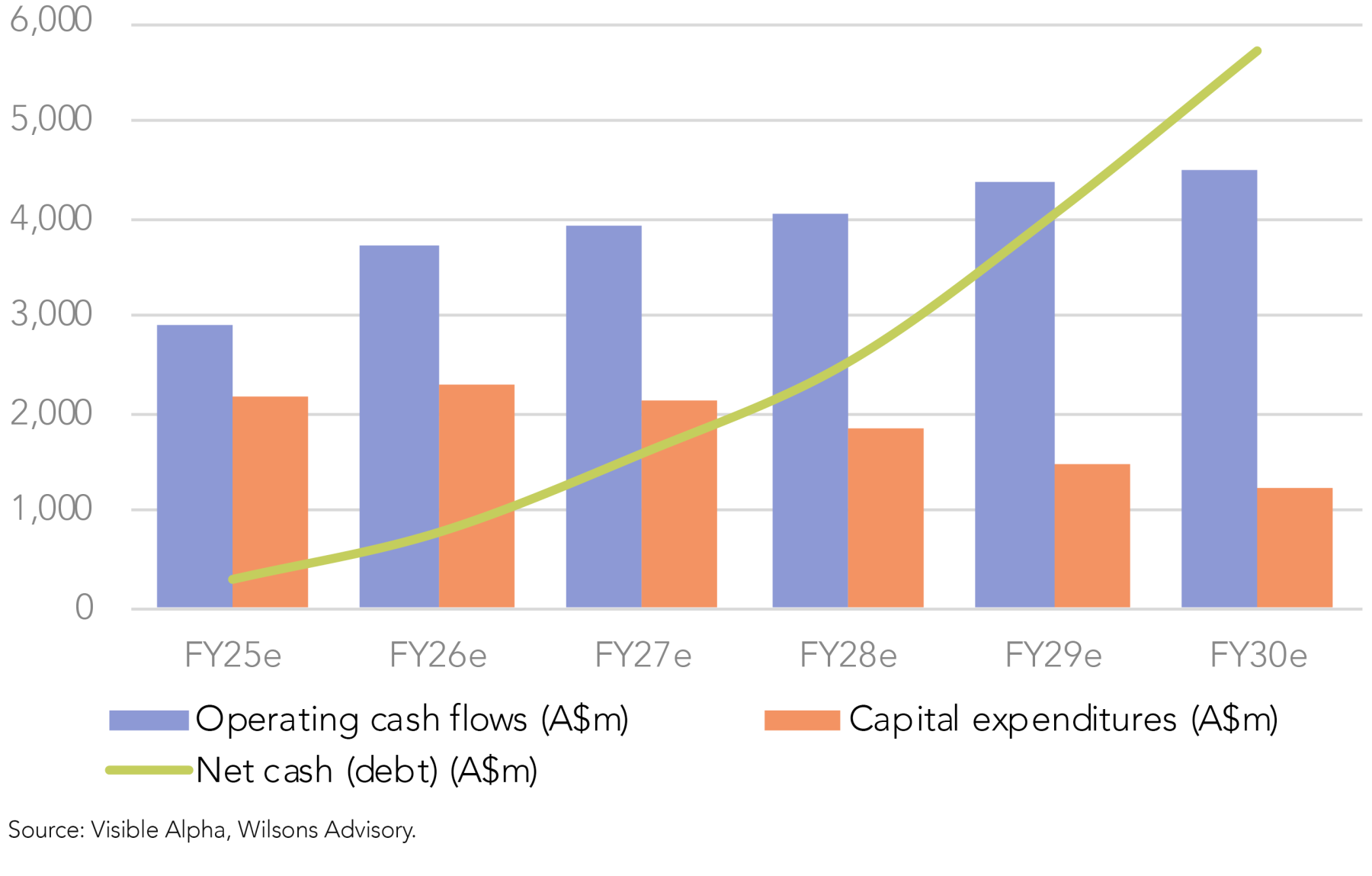

With the acquisition being funded entirely via scrip, NST’s balance sheet remains strong, with ~A$180m of net cash (as of the March quarter), supporting the internal funding of growth projects and preserving flexibility for future M&A or shareholder returns.

2. Strong production growth outlook

In addition to the acquired Hemi project, NST is advancing organic growth within its disciplined capital framework. NST began expanding its Kalgoorlie Consolidated Gold Mines (KCGM) mill in FY24, with its capacity ramp-up expected to start in FY27 and reach steady-state by FY29. This expansion will increase KCGM’s production capacity from 650koz p.a. to 900koz p.a.

The A$1.5bn of growth capex required for the project will be funded from existing cash reserves, forecast cash

flow and previously issued debt. The project was initially projected to generate an IRR of 19% and have a payback period of 4.6 years, based on a gold price of A$2,600/oz (~US$1,690/oz at spot fx).

However, with the gold price currently at ~US$3,380/oz and consensus forecasts also well above the original assumption, the project’s IRR is expected to be substantially higher, with a shorter payback period.

In combination, the Hemi project and the KCGM mill expansion will lift NST’s overall annual production capacity by ~900koz, from ~1,600koz p.a. to ~2,500koz p.a. These projects are set to underpin high single-digit production growth p.a. over the medium-term, which compares favourably to NST’s key ASX 100 peers (see Figures 5 and 8).

3. Attractive free cash flow build

Strong production growth, coupled with a declining capex profile after CY27, is expected to drive a highly attractive free cash flow yield from CY27 onward. Consensus forecasts currently point to a double-digit yield by the end of this decade (before factoring in potential upgrades to consensus gold price assumptions). On this basis, when taking a medium-term view, NST is valued highly attractively compared to the other ASX gold majors (see Figure 9).

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.