Tensions between Israel, Iran, and the United States have escalated significantly in recent weeks and days, marking a potentially critical juncture in Middle Eastern and global geopolitics.

Israel launched a large-scale attack on Iran on June 13, targeting nuclear and energy infrastructure. This prompted swift retaliation from Iran.

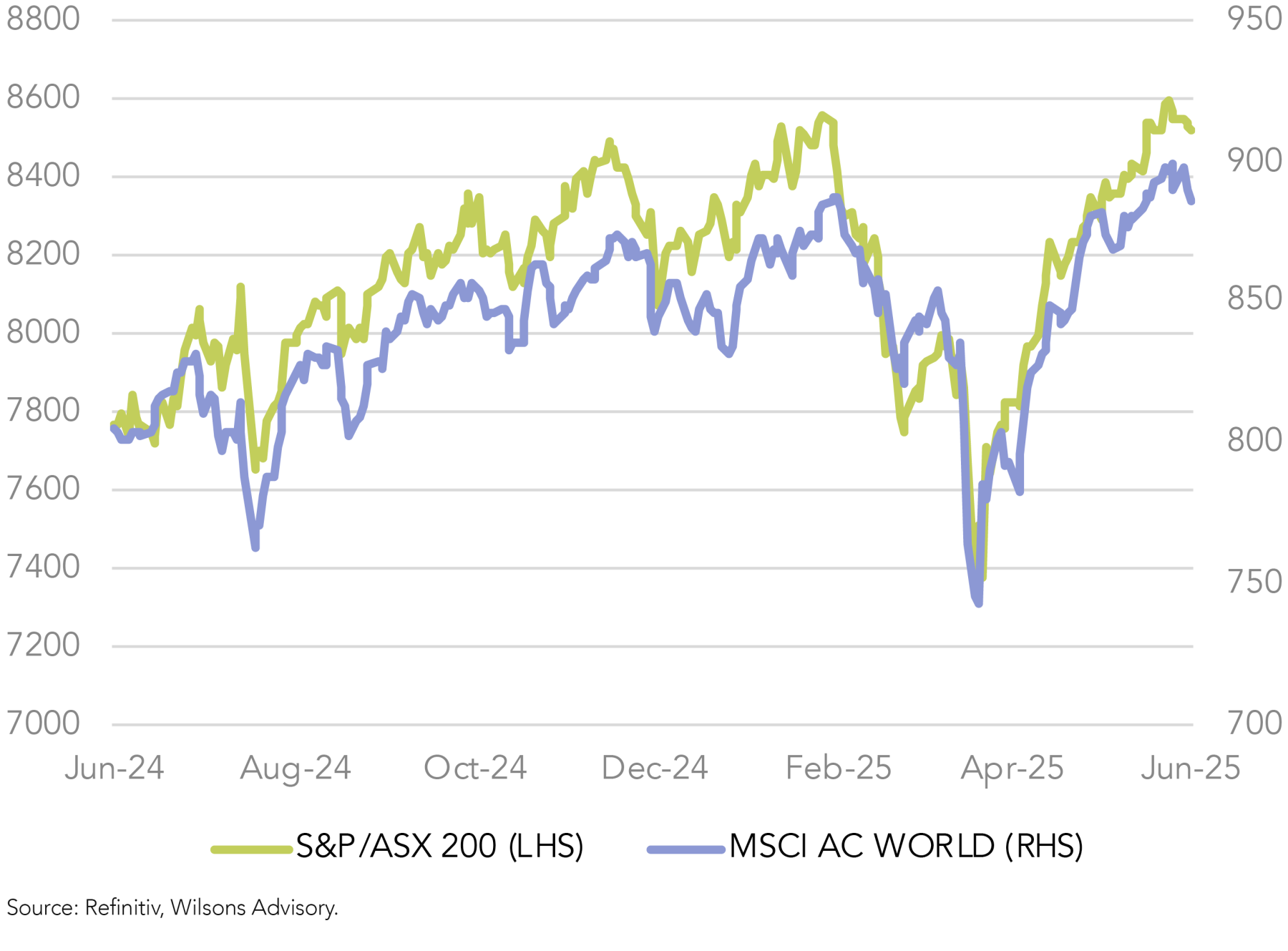

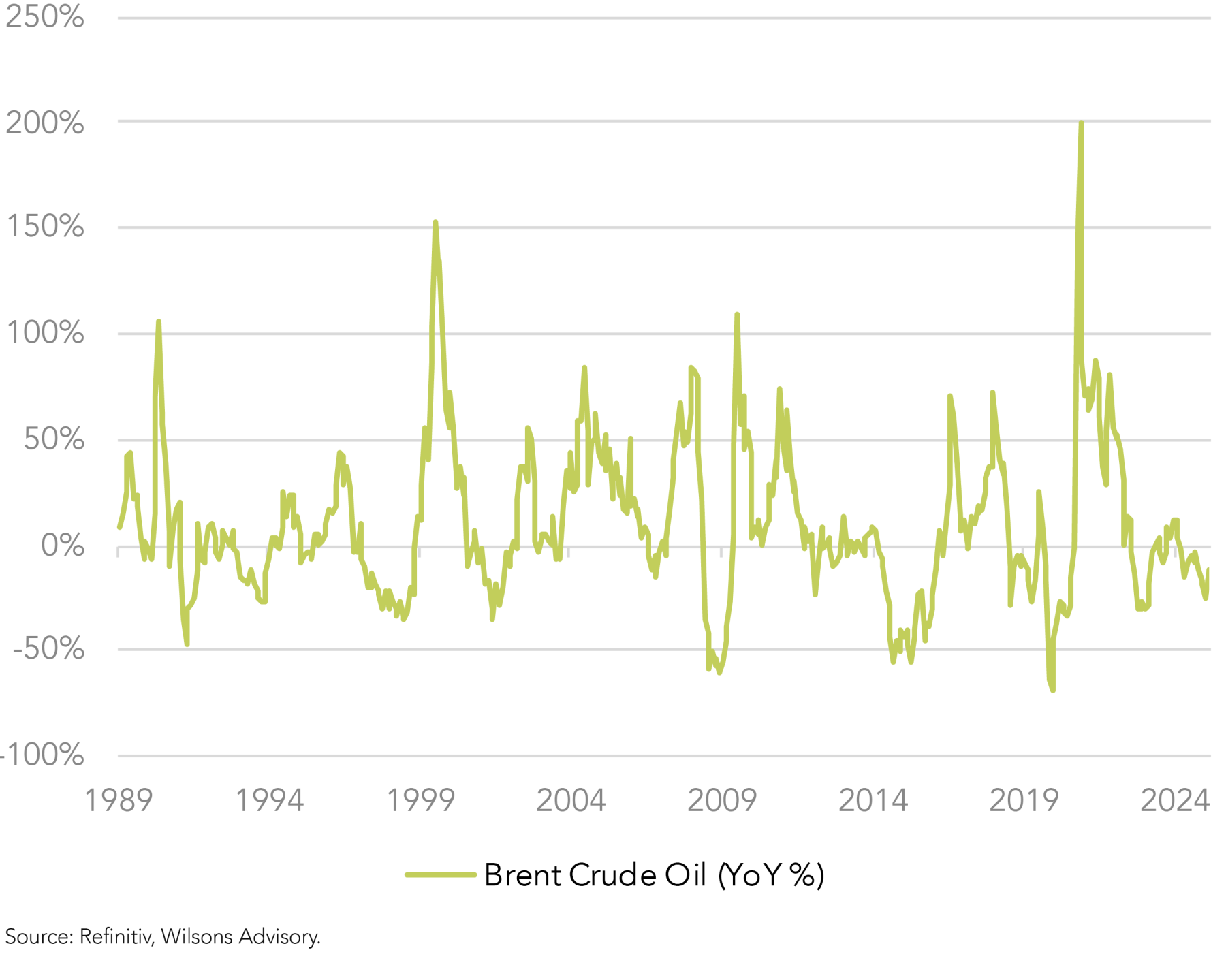

The conflict has caused a spike in risk aversion in global financial markets. Equities have pulled back, while oil prices have surged. Gold has also received some renewed buying. The impact so far on US bond yields and the US dollar has been relatively muted.

The attacks mark the second military confrontation between Iran and Israel in just over a year. In the previous episode, both sides showed restraint. This conflict, however, is looking more serious.

So far, the downdraft in stocks has been measured, consistent with the view that markets do not have a central case of a protracted and widening war with a damaging impact on the global oil supply.

US Threatens to Escalate the Conflict

However, with the US now threatening to become involved, tail risks appear to be rising and bear close watching. The Wall Street Journal reported in the middle of last week that President Trump and his team were considering options that included joining Israel in strikes against Iranian nuclear installations.

The US holds critical capabilities in terms of taking out Iran’s enrichment facilities buried deep underground. Specifically, a significant strategic blow to Iran's nuclear ambitions would require dropping bunker-busting bombs on the Fordow Fuel Enrichment Plant - the centre piece of Iran's nuclear program. Only the US has that capability. Trump has said he is considering such a strike, which would represent a major escalation for the United States.

President Trump was somewhat ambiguous in his comments on Wednesday the 18th on whether the US will join Israel's bombardment of Iranian nuclear and missile sites. "I may do it. I may not do it. I mean, nobody knows what I'm going to do,” Trump said to reporters outside the White House.

Offering some hope for negotiations, Trump in later remarks said Iranian officials wanted to come to Washington for a meeting and that "we may do that." He added, however, that, "it's a little late" for such talks.

On the 19th of June the White House said US President Donald Trump will make a decision within the next two weeks on whether to become involved in the conflict.

Iran appears to be exploring options for leverage, including veiled threats to hit the global oil market by restricting access to the Gulf through the Strait of Hormuz. This is the world's most important shipping lane for oil, through which 20% of global oil consumption and 25% of LNG flows daily. So the situation is delicately poised.

Middle Eastern Tensions Usually Fade (but not always)

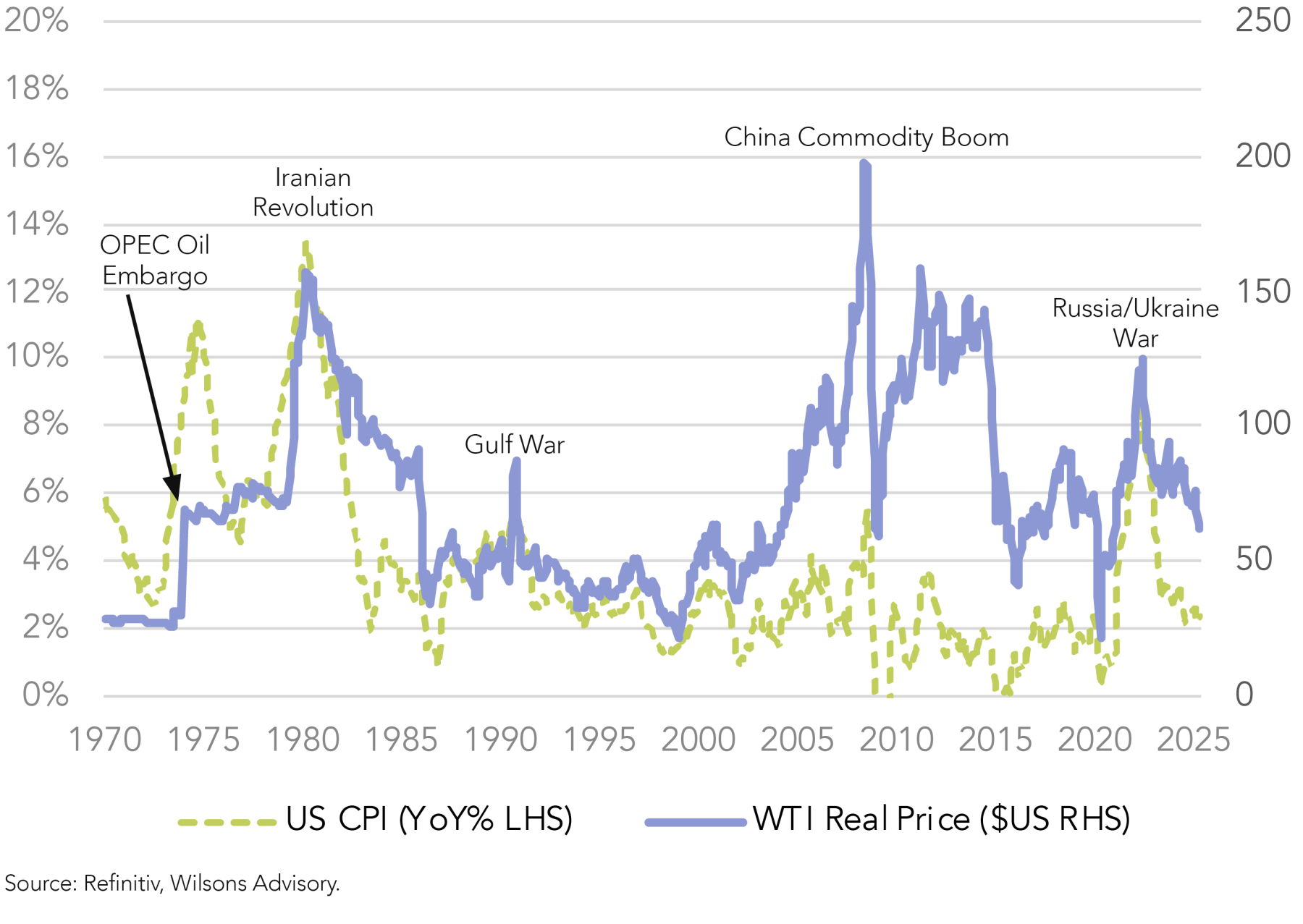

While Middle Eastern tensions have tended to fade without major impact in recent years, conflicts in the early 1970s and early 1980s caused oil prices to surge and subsequently led to major inflationary shocks. In addition, the Russian invasion of Ukraine in 2022 caused a large spike in oil and gas prices that fed into global inflation. So tail risks around the Israel/Iran conflict are not insignificant, given the potential implications for the oil market.

Whether it proves to be truly inflationary will be a function of the magnitude and duration of the oil price rise, with a decision by the US to escalate or de-escalate likely the key. President Trump has been vocal in his desire for lower oil prices, but the US administration may perceive it has a window to significantly impair Iran’s nuclear capabilities.

A Tense Two Weeks

In summary, potential US involvement in Israel’s military campaign against Iran, is raising near-term risks to oil supply and global financial market stability. Iran may retaliate by targeting regional oil production and/or transport routes, especially if the US launches direct strikes.

A US assault would aim to dismantle Iran’s nuclear program, not the regime itself, but the regime’s capacity to disrupt oil flows remains the critical risk. Closure of the Strait of Hormuz is a significant risk unless the US can effectively preempt Iranian moves, which remains uncertain.

While Iran may attempt to revive negotiations given the two-week window, the US administration may perceive it has a chance to significantly impair Iran’s nuclear capabilities and aim to play hardball with Iran. Consequently, it is difficult to back an outcome with certainty. We see the current delicate state of play as another reason to have some tactical caution around equities after a strong run-up, and continue to hold gold as a portfolio hedge.

| 2025 | 2026 | 2027 | |

| Real GDP | |||

| June | 1.4 | 1.6 | 1.8 |

| March | 1.7 | 1.8 | 1.8 |

| Unemployment | |||

| June | 4.5 | 4.5 | 4.4 |

| March | 4.4 | 4.3 | 4.3 |

| Core Inflation (PCE) | |||

| June | 3.1 | 2.4 | 2.1 |

| March | 2.7 | 2.2 | 2 |

| Fed Funds Rate | |||

| June | 3.9 | 3.6 | 3.4 |

| March | 3.9 | 3.4 | 3.1 |

Source: Refinitiv, Wilsons Advisory.

US Fed Happy to Sit on the Sidelines for Now

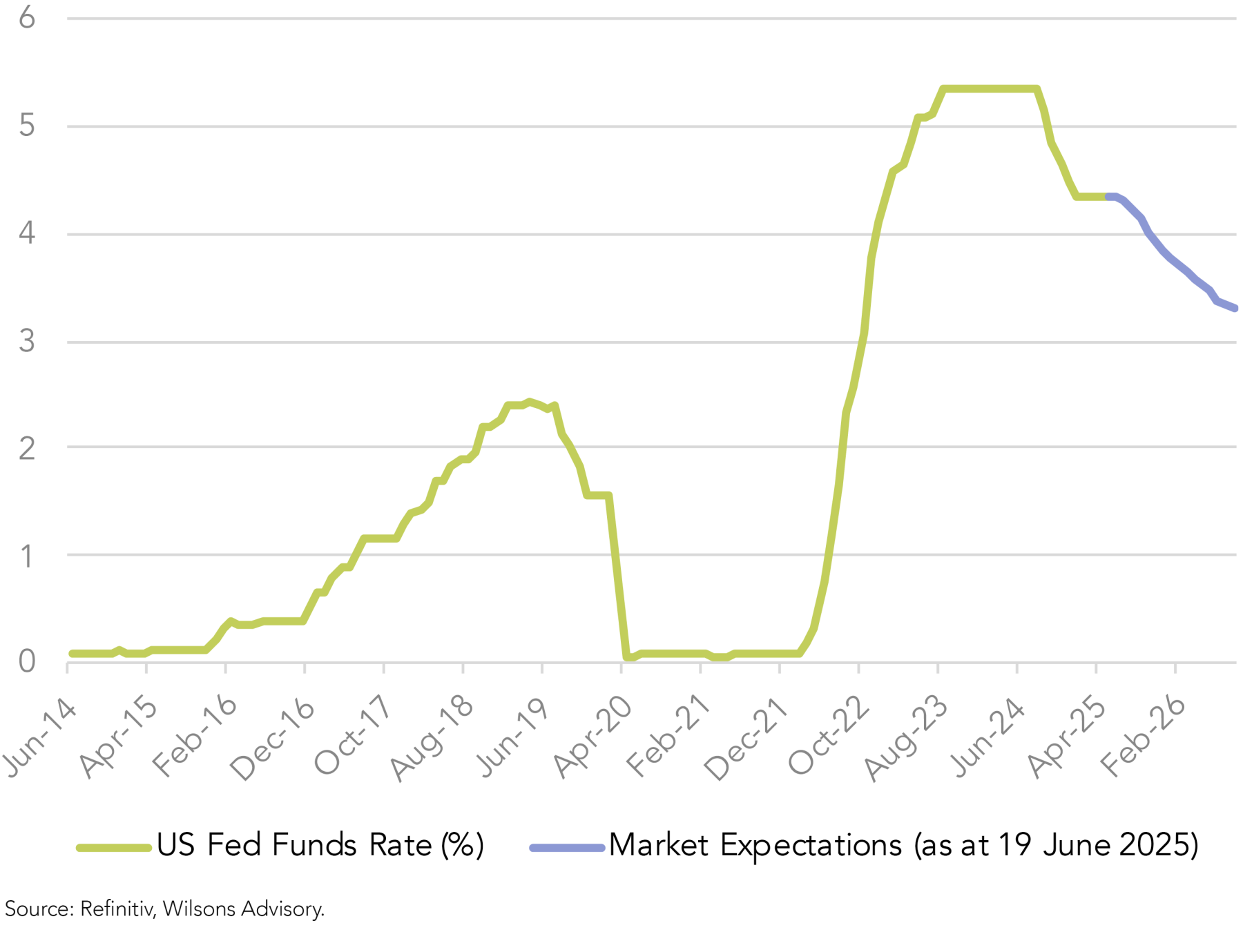

From a domestic policy perspective, the US FOMC left rates unchanged at their meeting last week, but the Fed did shift their economic projections at the margin.

The Fed revised its forecast for headline and core inflation higher this year and next, while nudging its forecast for GDP growth lower.

The median assumption of appropriate policy (the "dot plot") for 2025 was left unrevised at ~3.9%. However, 2026 was revised up 25bp to ~3.6%, and up 25bp to ~3.4% at the end of 2027.

At his press conference Powell downplayed the significance of the dot plot, saying it lacked “great conviction,” which suggests the Fed is not firmly committed to any specific rate path.

Chair Powell reiterated the outlook is highly uncertain, but with the economy solid and the labour market doing well in his view, the FOMC believes it has the luxury of waiting.

"Because the economy is still solid, we can take the time to actually see what's going to happen," said Chair Powell.

He believes policy is well-positioned to respond to risks that may be realized. "The current stance of monetary policy leaves us well positioned to respond in a timely way to potential economic developments."

Powell suggested any adjustments to forecasts would depend heavily on tariff policy and its impact. He downplayed the notion that broader fiscal policy would have much impact.

While Powell did not directly critique fiscal policy decisions, he did highlight how tariffs are complicating the Fed’s ability to forecast and respond appropriately. This suggests the Fed will lean towards being reactive rather than proactive.

Powell's Term as Fed Chair Due to End May 2026

Chair Powell’s patient stance and reserved comments come as U.S. President Donald Trump continues to snipe from the sidelines. “So we have a stupid person, frankly, at the Fed” said President Trump post the Feds on-hold decision.

Trump has also recently said that he could soon nominate Jerome Powell's successor, with nearly a year left before the Federal Reserve chair's term ends. This could further increase uncertainty for markets.

Trump has been regularly voicing his displeasure with Powell and the Fed for not lowering interest rates since the president began his second term in January.

While Trump has backed off from comments earlier this year that he might fire Powell, he said earlier this month that a decision on the next Fed chair could be coming soon.

The potential for a "shadow" Fed chair who offers potentially clashing views with the sitting central bank leader on monetary policy could contribute to market confusion. In addition, any choice deemed as being a Trump insider would alarm markets, given the broad sentiment that an independent Fed is critical to its ability to function properly.

The Fed Chair is only one of 18 members on the central bank's monetary policymaking committee and a key part of the role is to build consensus on the committee.

Widely discussed candidates are Fed Governor Christopher Waller; White House economic adviser Kevin Hassett; former Fed Governor Kevin Warsh; Judy Shelton - a former Trump pick for the Fed board whose nomination was withdrawn under President Joe Biden; and current Treasury Secretary Scott Bessent.

One mitigating factor is that a Fed Chair would need to be confirmed by the US Senate, a process that could take months from the time of Trump's announcement. So, for now, Chairman Powell will remain the loudest voice on US monetary policy, despite President Trump’s periodic sniping from the sidelines.

Trump Making Life Difficult for the Fed but More Cuts Still Likely

The market continues to see the September 17 meeting as a probable re-start of the Fed’s easing cycle, with two cuts this year and two next year. This is a little more dovish than the Fed’s dot plot, but as discussed, the Fed does not have strong conviction given the unusual amount of uncertainty around geopolitics and tariff policy. However, the likelihood that rates are more likely to come down than go up over the coming year, alongside a base case of no recession, keeps us constructive on US and Australian equities on a 12-month view, despite some near-term caution.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.