It was announced in September that the XRG consortium, led by the Abu Dhabi National Oil Company, had withdrawn its indicative proposal to acquire Santos due to disagreements over deal terms.

The major sticking points included obligations for the consortium to secure regulatory approvals, likely extensions to the timeframe for deal completion, and expectations that the consortium provide reasonable commitments to the development and supply of domestic gas.

Notwithstanding the unsurprising share price weakness following the bid withdrawal, there are some clear positives to take away from this process. Firstly, the consortium maintains a positive view of the business and has respect for the management team. Secondly, the takeover approach itself highlights considerable value in Santos’ portfolio that remains underappreciated at its current share price, in our view. Thirdly, as ASX investors, we are pleased that Santos will remain publicly listed, maintaining a broad opportunity set in the local market – particularly given it is comfortably our preferred Energy sector exposure at this juncture.

The recent de-rate in Santos’ share price presents an attractive buying opportunity. For existing holders of Woodside, we see strong merit in a pair trade, selling Woodside and using the proceeds to buy Santos. Our strong preference towards Santos > Woodside is based on several key points:

- Attractive valuation

- De-risked near-term production growth profile and attractive free cash flow build

- Disciplined capital allocation

- Potential to unlock shareholder value

In this note, we provide an update on our current views towards the oil and gas sector and reiterate our investment thesis for Santos.

Balanced Near-term Risks Support A Neutral Energy Sector Exposure

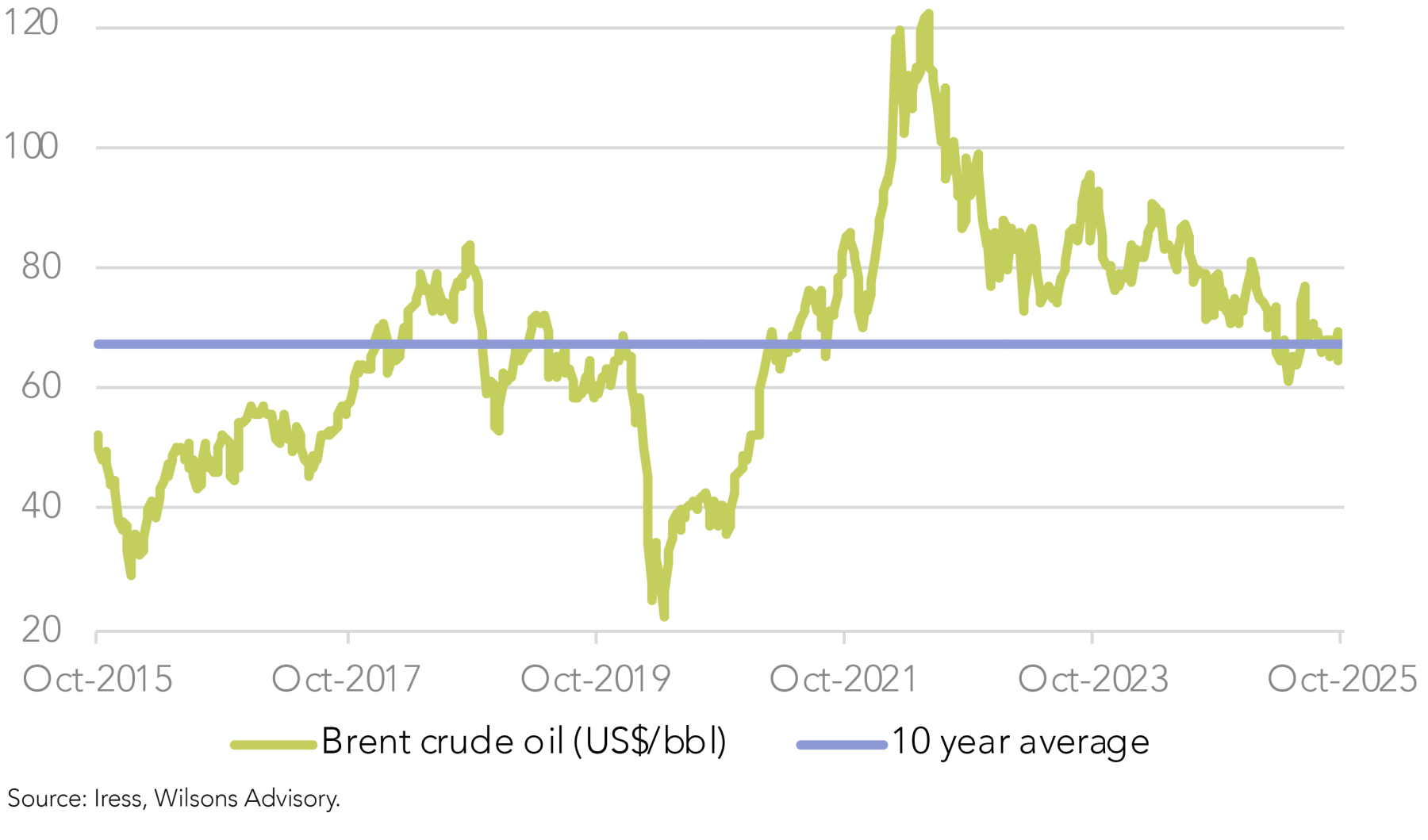

The Focus Portfolio has a neutral exposure to the Energy sector, with Santos as our sole position at a weighting of 3.5%. With Brent Crude oil currently trading at ~US$65/barrel, we view risks to the oil price (which the majority of LNG contracts are indexed to) as relatively balanced, with a range of forces to consider.

Global oil inventories are expected to build over the next 12 months, driven by accelerating non-OPEC supply (i.e. from the Permian Basin, Brazil, Canada, Guyana) alongside OPEC+ gradually unwinding its voluntary production cuts. Meanwhile, oil demand has been subdued amidst below-trend GDP growth, with analysts generally expecting global oil demand to be roughly flat in 2025 year-on-year.

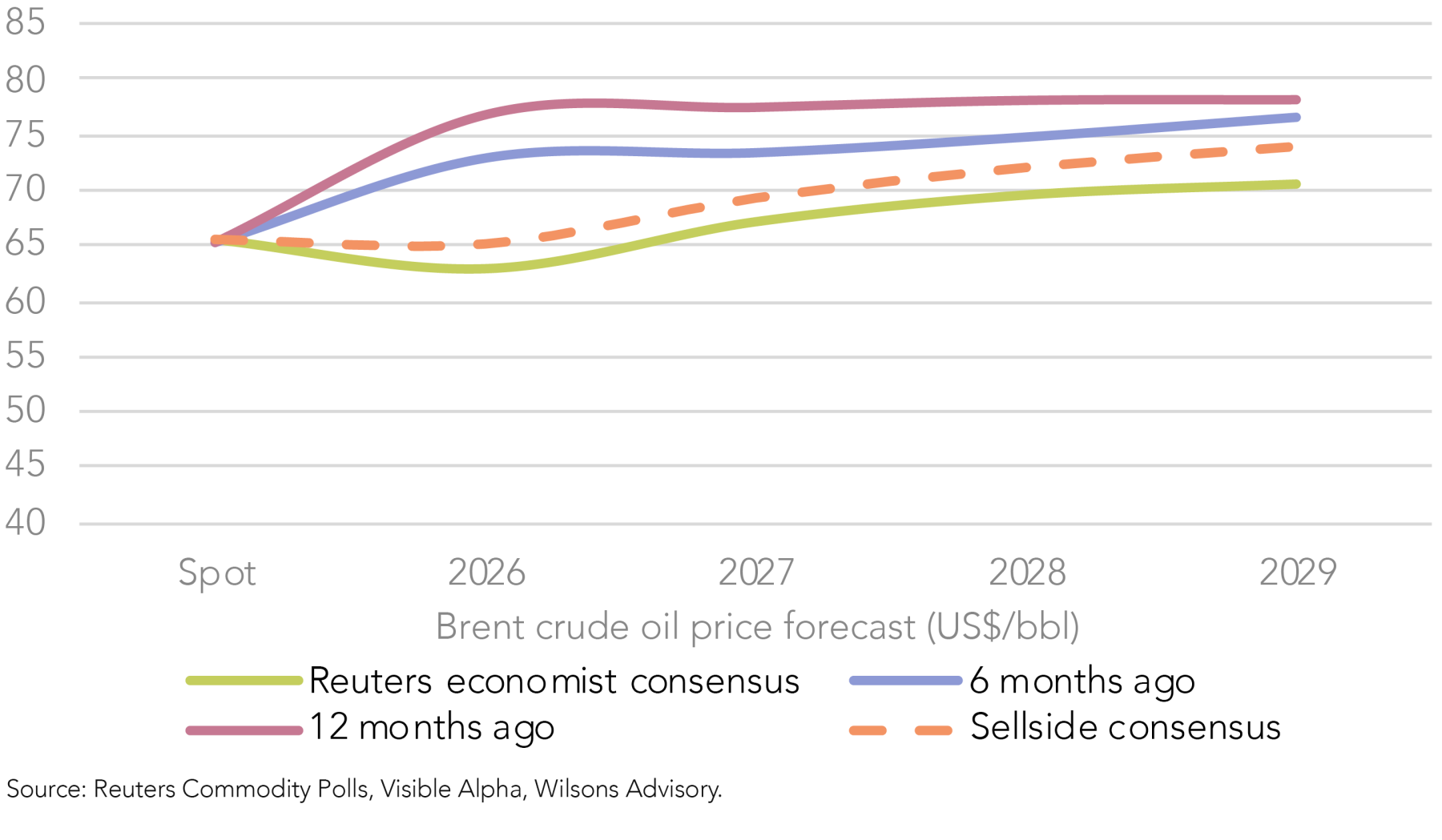

In combination, these factors are driving a growing oversupply in the global market, which has weighed on the spot oil price and analysts’ medium-term forecasts, which are displayed in Figure 2.

Adding complexity to the story, geopolitical tensions, trade policies and the potential for further sanctions on Russian and Iranian supply present swing factors that could alter market balances over the near-term.

Remaining structurally positive oil and gas

Taking a longer-term view, we remain structurally positive towards oil and gas, which is underpinned by our positive outlook for oil and gas demand over the next decade (particularly LNG as a transition fuel). Robust demand will be driven by the economic development of Asia, which will offset softer demand in OECD countries.

On the supply side, US shale production is expected to plateau over the medium-term, which should allow OPEC+ to lift its production market share and exercise greater pricing power over time. Together, this supports a long-term oil price of US$70-75/barrel, which would underpin attractive free cash flows for the ASX oil and gas majors over the long-term.

Santos – Go with the Cash Flow

Notwithstanding our balanced near-term outlook for the oil market, Santos stands out as an attractive bottom-up investment opportunity even without making bullish assumptions regarding the oil price.

Our preference for Santos is based on four key considerations, which are explored below.

1. Attractive valuation

Santos offers attractive value, trading on a forward EV/EBITDA of 4.7x and an implied Brent oil price of US$49.7/bbl (24% below spot), compared to Woodside at 5.2x and US$58.5/bbl respectively. This is despite Santos having a materially stronger production/earnings growth outlook. We believe downside risk to Santos’ valuation is mitigated by Barossa recently reaching first gas, and Pikka coming online in early 2026, which together will deliver a step change in free cash flows over the near/medium-term.

| Name | Ticker | 12 mth fwd EV/EBITDA | +/- vs 10yr avg | 12 mth fwd dividend yield | Implied oil price (US$/bbl) | 3 year production CAGR (2025-2028) | 3 year EPS CAGR (2025-2028) |

| Santos | STO | 4.7x | -6% | 5.60% | $49.70 | 6.9% | 16% |

| Woodside | WDS | 5.2x | 10% | 4.50% | $58.50 | -0.5% | 1% |

Source: Visible Alpha, Wilsons Advisory.

2. De-risked near-term production growth profile and attractive free cash flow build

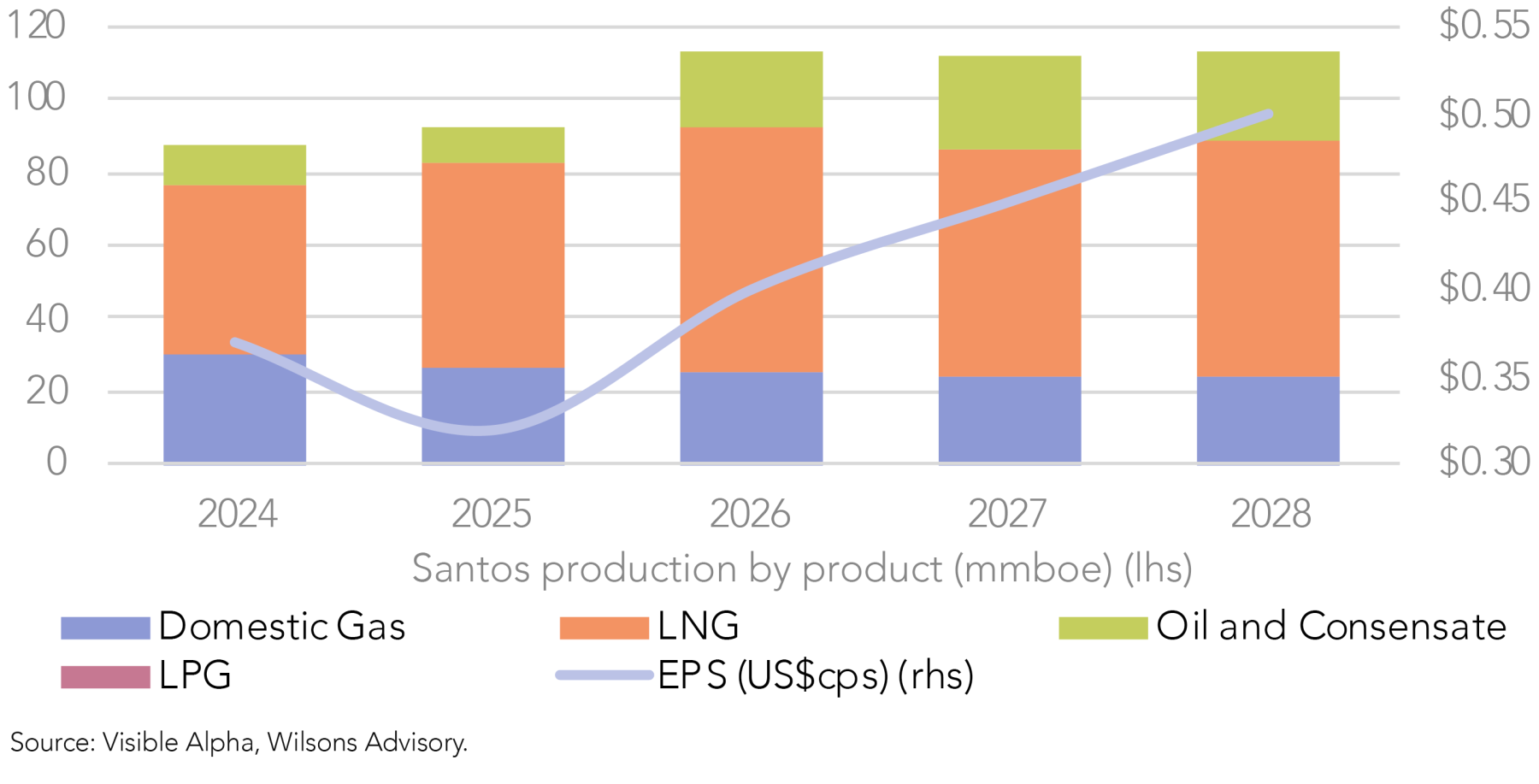

Santos’ growth pipeline is being delivered admirably well. Its largest project, Barossa (Northern Australia, LNG) is currently in ramp up after reaching first gas last month. Pikka Phase 1 (Alaska, Oil) is also largely de-risked, with the project ~95% complete.

Pikka’s first oil has been brought forward to 1Q26 (previously 1H26), with full ramp up expected in 2Q26. Santos says these two projects will underpin a ~30% increase in production by 2027, driving a meaningful step change in free cash flows from 2026.

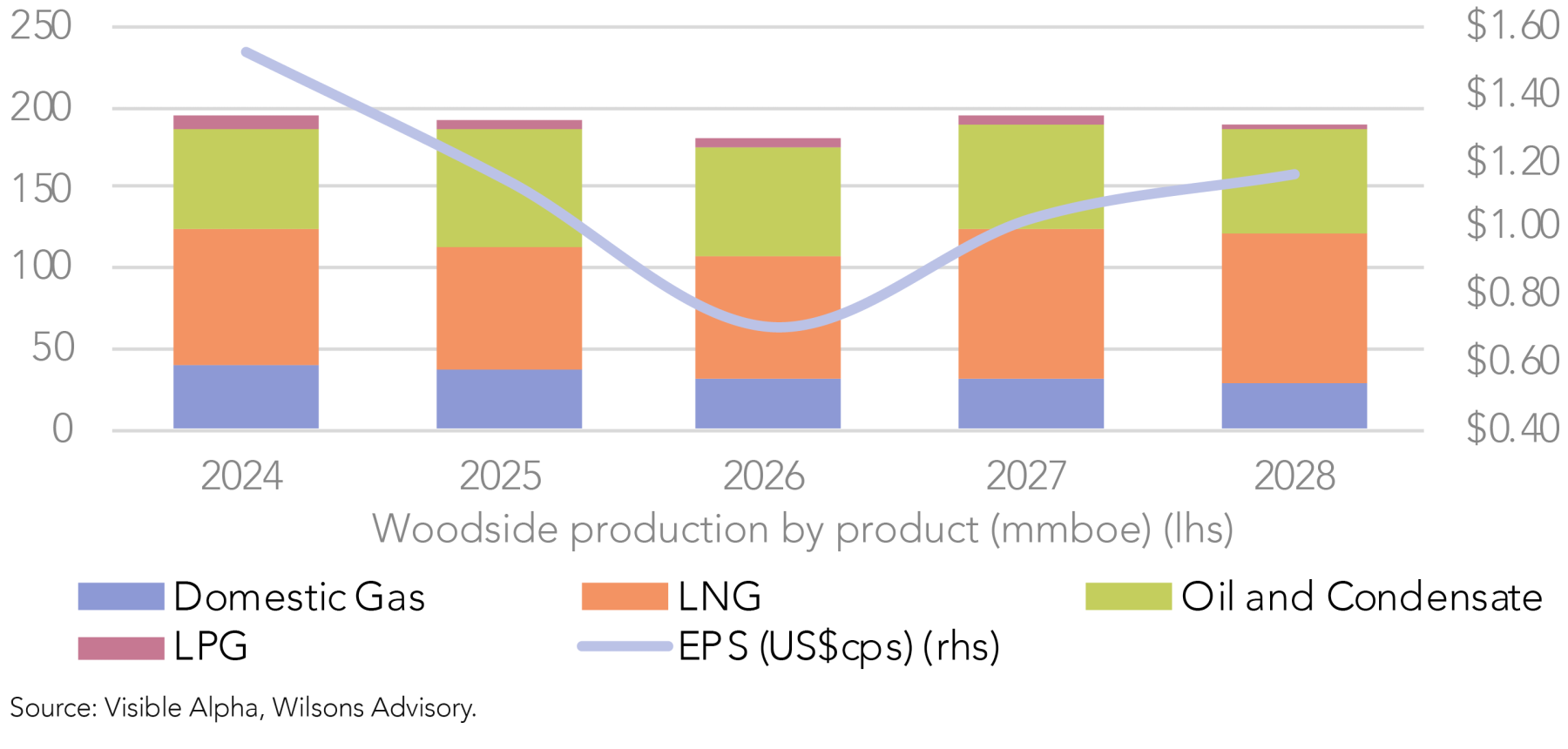

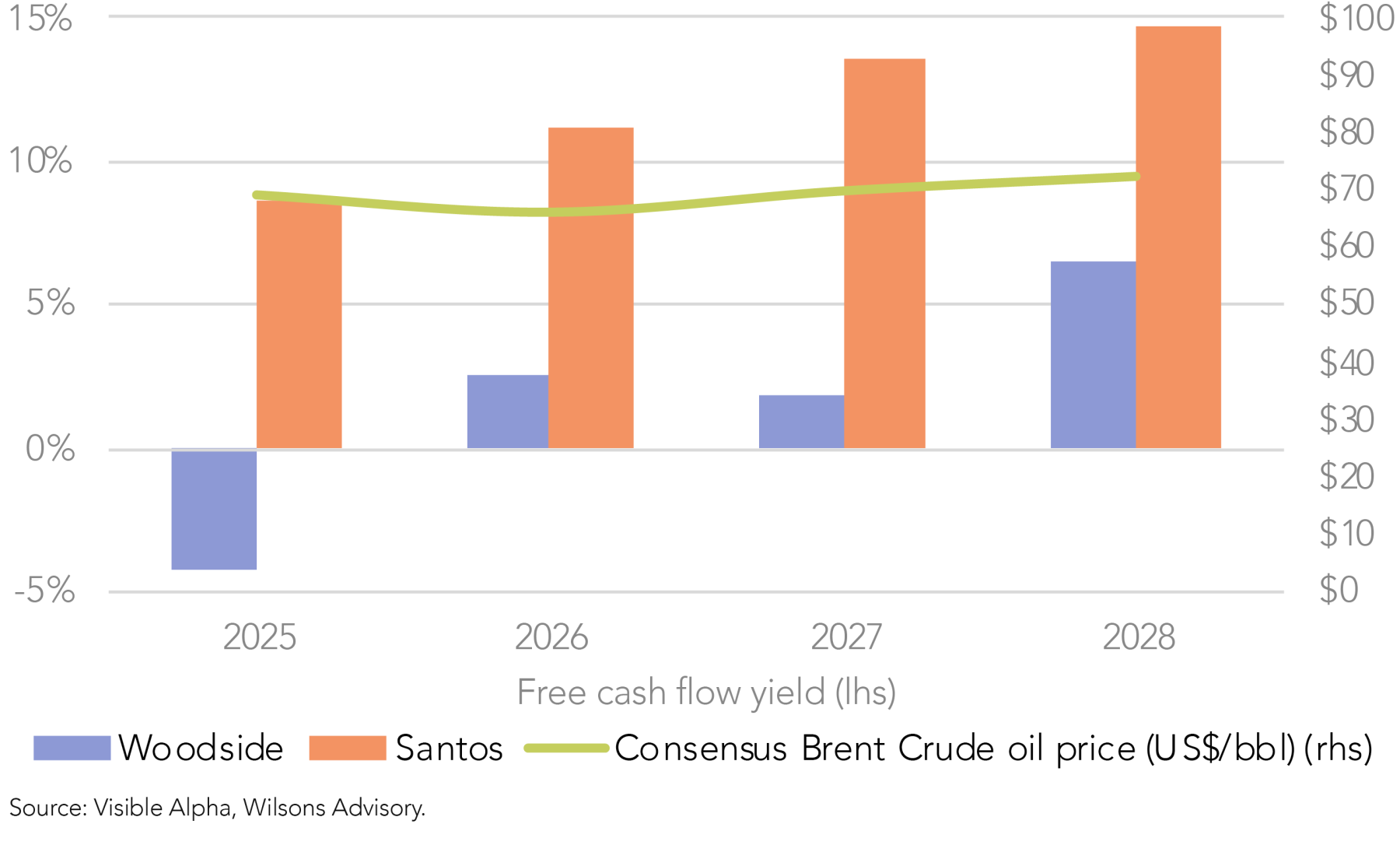

In contrast, despite a heavy CAPEX profile, Woodside is not expected to deliver any production growth over the medium-term. Near-term production growth from Scarborough-Pluto Train 2 (WA, LNG) – with first gas expected in 2026 – will only be enough to offset declining output from maturing assets. Woodside’s largest growth project, Louisiana LNG (USA, LNG), is relatively early stage, and is not expected to come online until 2029. It will also require significant CAPEX over the coming years.

Woodside plans to sell down 20-30% of this asset, which will be necessary to reduce its high level of gearing. However, progress has been slower than anticipated, and market/consensus expectations are high. If Woodside disappoints on the Louisiana LNG sell down process, consensus dividends may be at risk.

Considering Woodside’s high CAPEX burden and lack of near-term production growth, the business has an uncompelling free cash flow outlook out to 2028.

3. Disciplined capital allocation

In November 2024, Santos updated its capital allocation framework, which demonstrated its intention to prioritise shareholder returns over investing surplus cash flows into capital-hungry growth projects.

Under the framework, Santos will return at least 60% of all-in free cash flows to shareholders from 2026, up from 40% previously, and will return 100% of cash flows once its gearing falls below its 15-25% target, expected in 2029.

Therefore, after a period of heavy capital investment, Santos’ latest framework gives us confidence that its growing free cash flows will largely be returned to shareholders via distributions, rather than deployed into major growth investments (i.e. M&A).

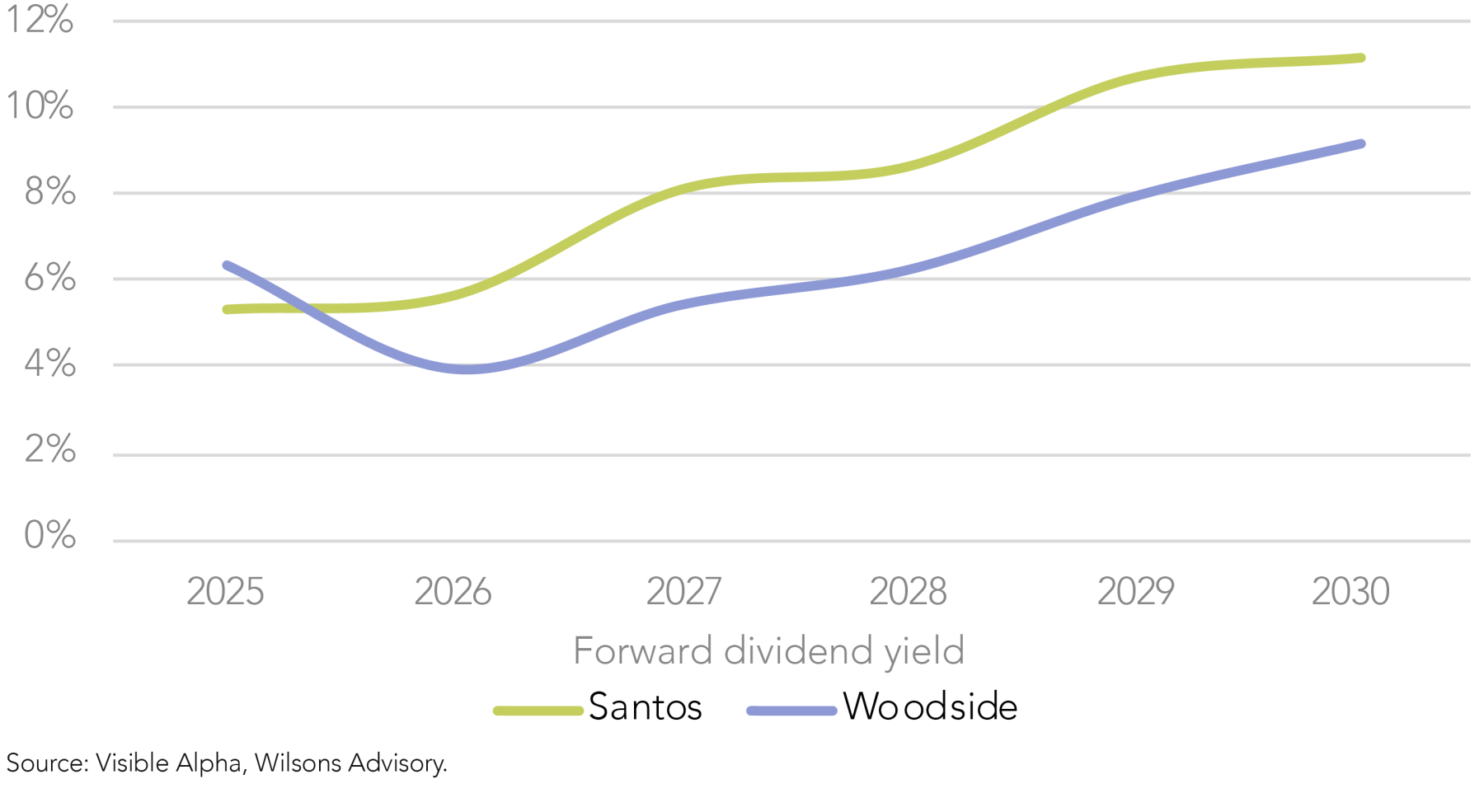

We expect Santos to be disciplined in its goal of maximising shareholder value. In light of this, consensus expects Santos’ dividends to grow by ~23% between FY26-28.

This approach contrasts with Woodside, which has pursued several large acquisitions with questionable IRRs, capital requirements, and strategic rationales.

For example, Woodside’s $2.35 billion acquisition of the OCI Clean Ammonia Project is a major departure from its core operations and is likely to have a materially lower IRR than its traditional oil and gas assets. Meanwhile, Woodside’s largest growth project, Louisiana LNG, will require an estimated US$13bn of CAPEX to get it off the ground by 2029.

4. Potential to unlock shareholder value

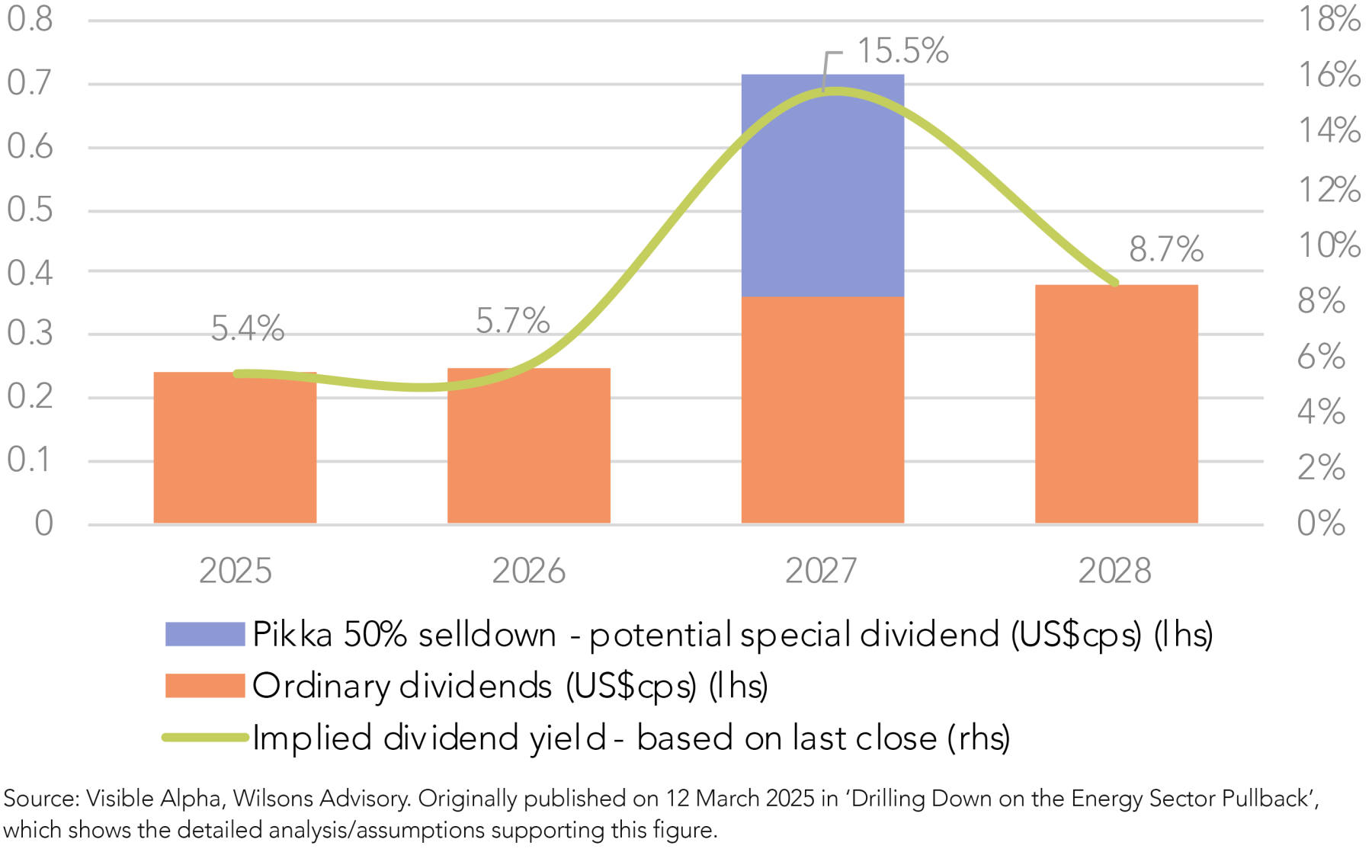

Santos has the potential to unlock value and fund capital returns through targeted asset selldowns. We believe a selldown of Pikka post commissioning (due 1Q26) is high potential, particularly given the Trump Administration’s supportive policy backdrop for Alaskan oil. Assuming Santos sells down half of its stake in Pikka, we estimate this could liberate ~US$1.15bn of cash, which we expect would be used to fund capital returns to shareholders (see Figure 8).

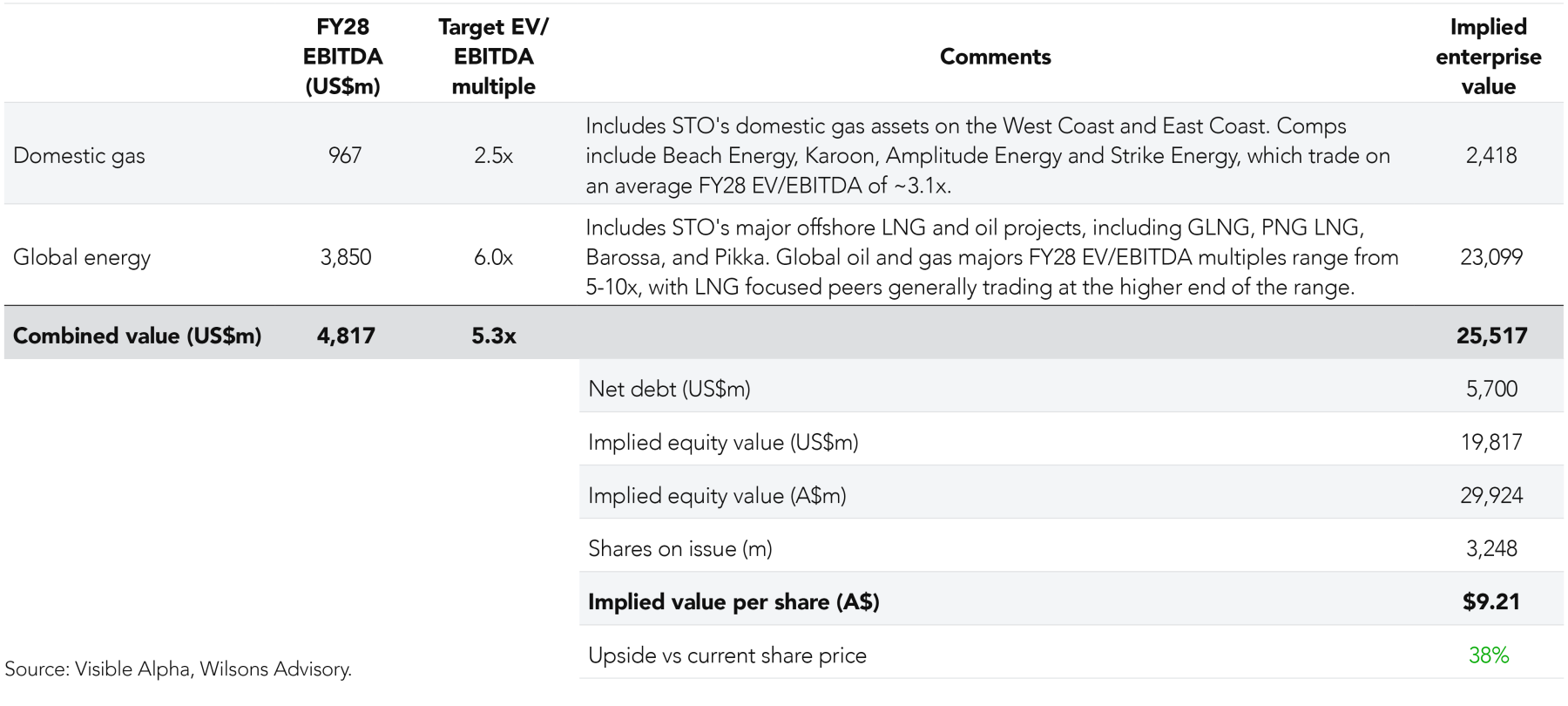

Separately, while less likely, a demerger of the group into two separate businesses – one focused on offshore oil and LNG assets and one focused on domestic gas – could unlock meaningful value for shareholders in our view.

We believe that Santos’ high quality global energy assets – which are primarily LNG projects – are undervalued by the market in its current structure. By separating Santos’ prized LNG assets into a concentrated business without domestic gas market exposure, the group could open itself up to greater interest from global energy players seeking to grow their LNG portfolios.

Meanwhile, Santos’ domestic gas operations could find appeal among domestic-focused energy producers. These include the likes of Hancock Prospecting, which has demonstrated its motivation in securing domestic gas supply for its operations, as well as producers like Beach Energy, which is looking to cement itself as a leading domestic gas supplier.

To assess how value accretive a demerger of Santos’ assets could be, we have conducted a sum-of-the-parts analysis of the group in Figure 9.

Written by

Greg Burke, Equity Strategist

Greg is an Equity Strategist in the Investment Strategy team at Wilsons Advisory. He is the lead portfolio manager of the Wilsons Advisory Australian Equity Focus Portfolio and is responsible for the ongoing management of the Global Equity Opportunities List.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.

-thumb.jpg)