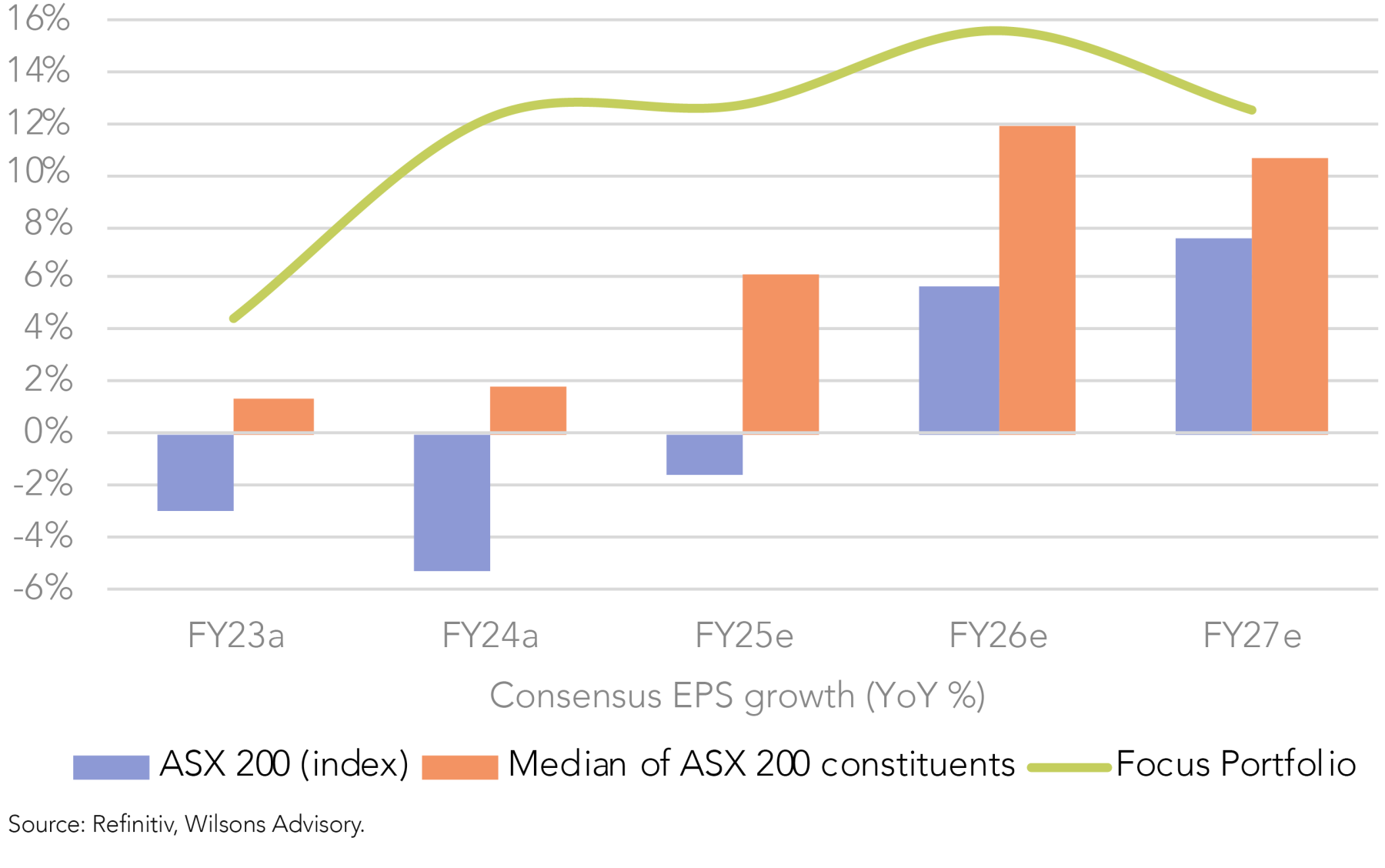

The ASX 200 is expected to deliver negative earnings growth for the third consecutive year in FY25, with the majority of full year results due in the upcoming August 2025 reporting season.

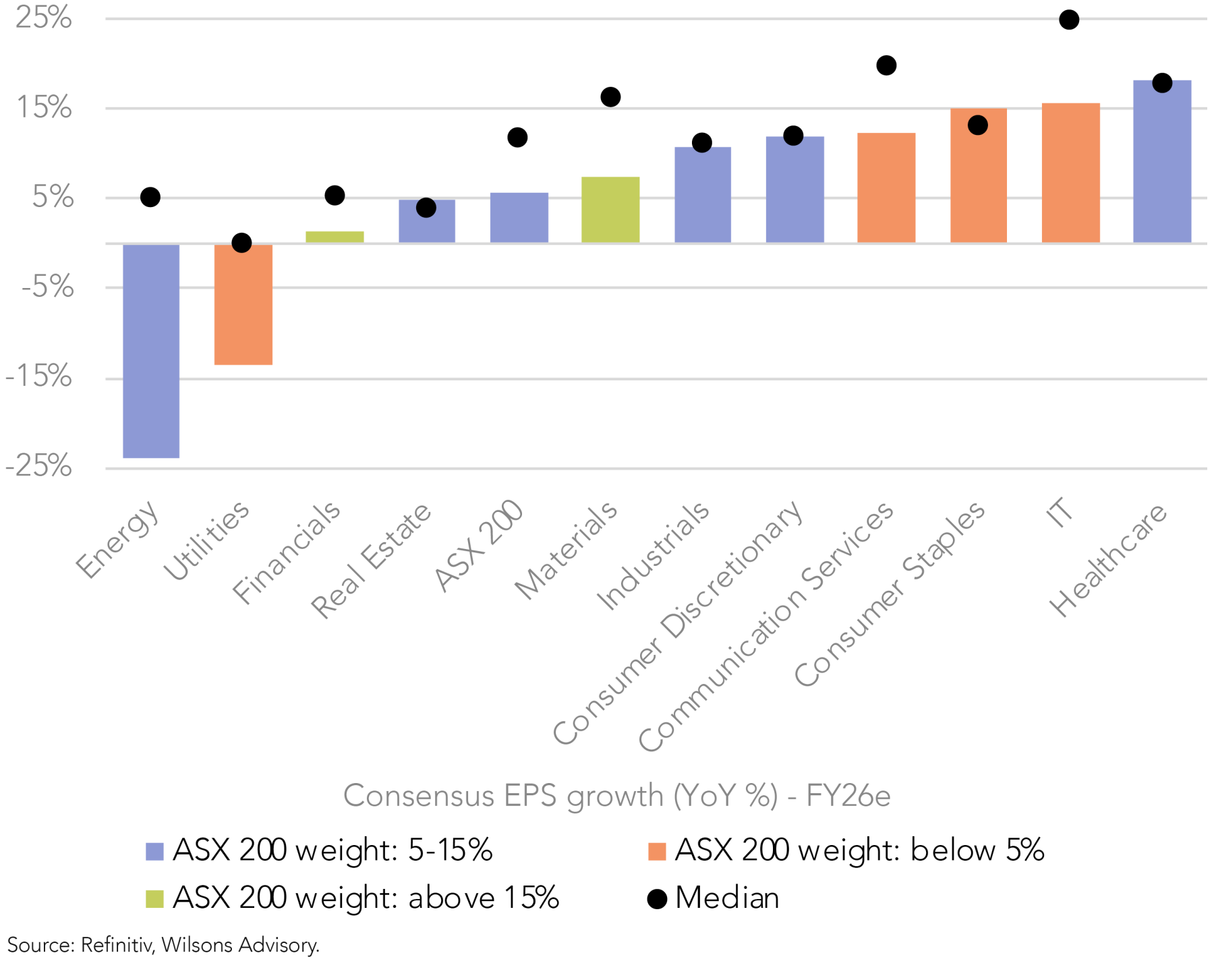

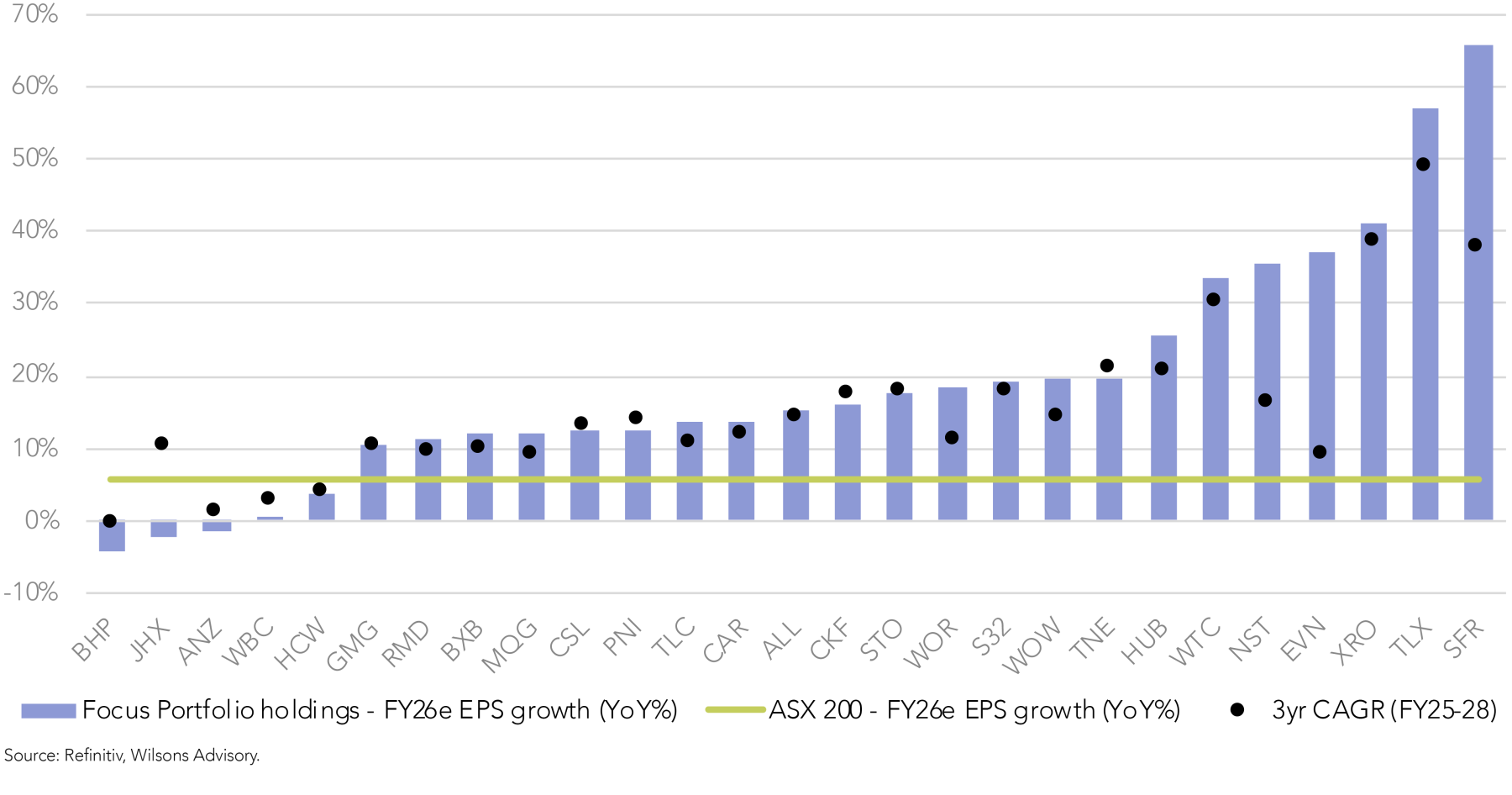

After a multi-year downgrade cycle, market earnings are forecast to return to growth in FY26, with consensus estimates pointing to EPS growth of +5.6% for the ASX 200, which should be underpinned by a broadly supportive domestic macro outlook.

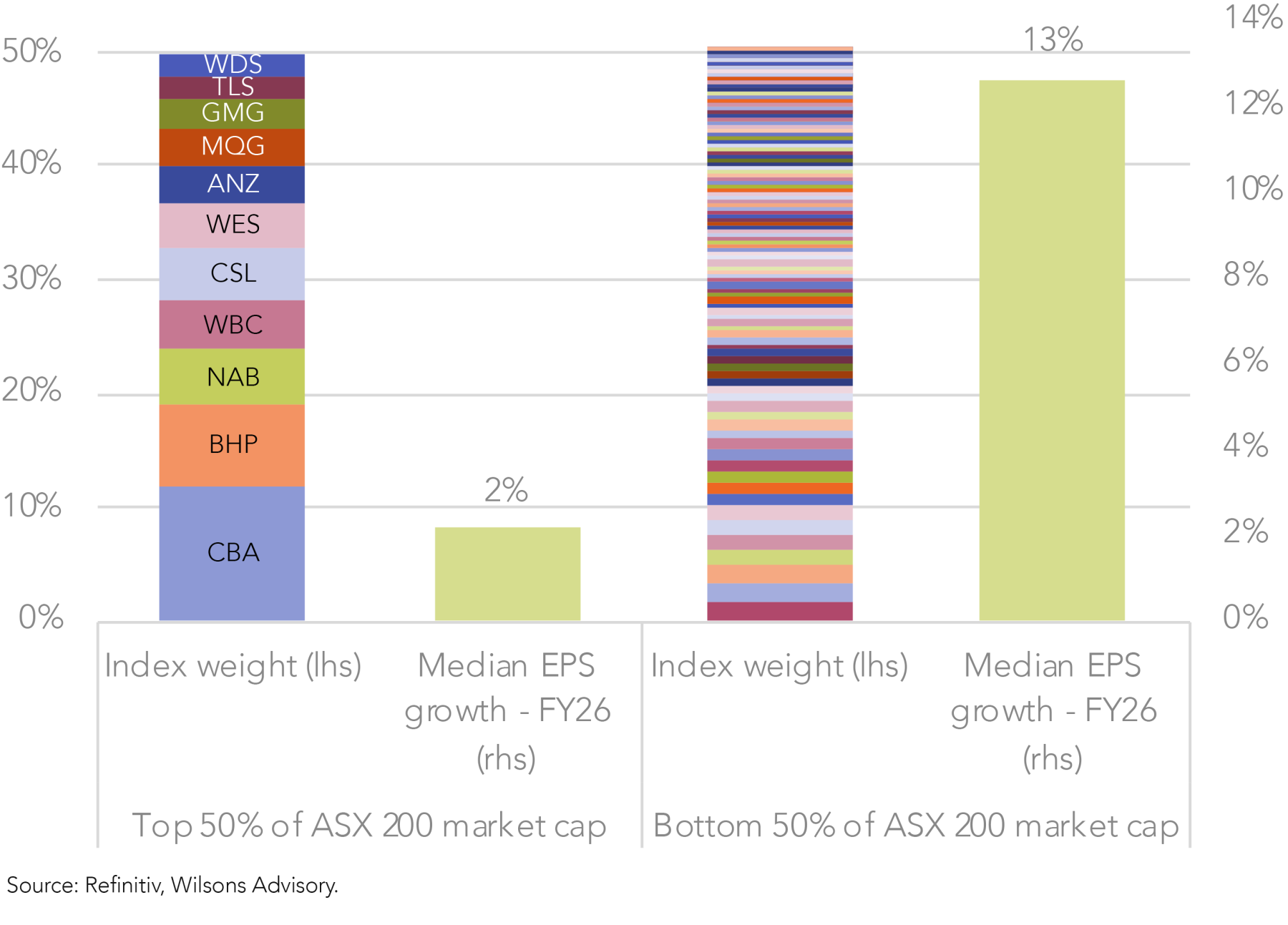

However, index-level estimates can obscure the underlying earnings trajectory of the average company due to the concentrated nature of the local market. Figure 3 demonstrates that ASX 200 index weightings are significantly skewed towards a small number of companies with limited EPS growth expected over the medium-term – including the big 4 banks (flat-to-low single-digit growth), BHP (low single-digit decline) and Woodside Energy (broadly flat).

That said, the ASX 200 has no shortage of companies with attractive EPS growth outside of the 'mega caps' for active investors (like ourselves) that are willing to deviate from the index. Interestingly, the median ASX 200 company is forecast to generate EPS growth of +12% in FY26 – well above the index’s headline growth of +5.6%.

Meanwhile, the Focus Portfolio is expected to deliver weighted average EPS growth of +15.5% in FY26, reflecting our active approach and our bias towards companies with above-market earnings growth.

In the remainder of this report, we examine the current stage of the ASX 200 earnings cycle and highlight key consensus earnings revision trends across the market.

Is the Downgrade Cycle Nearing an End?

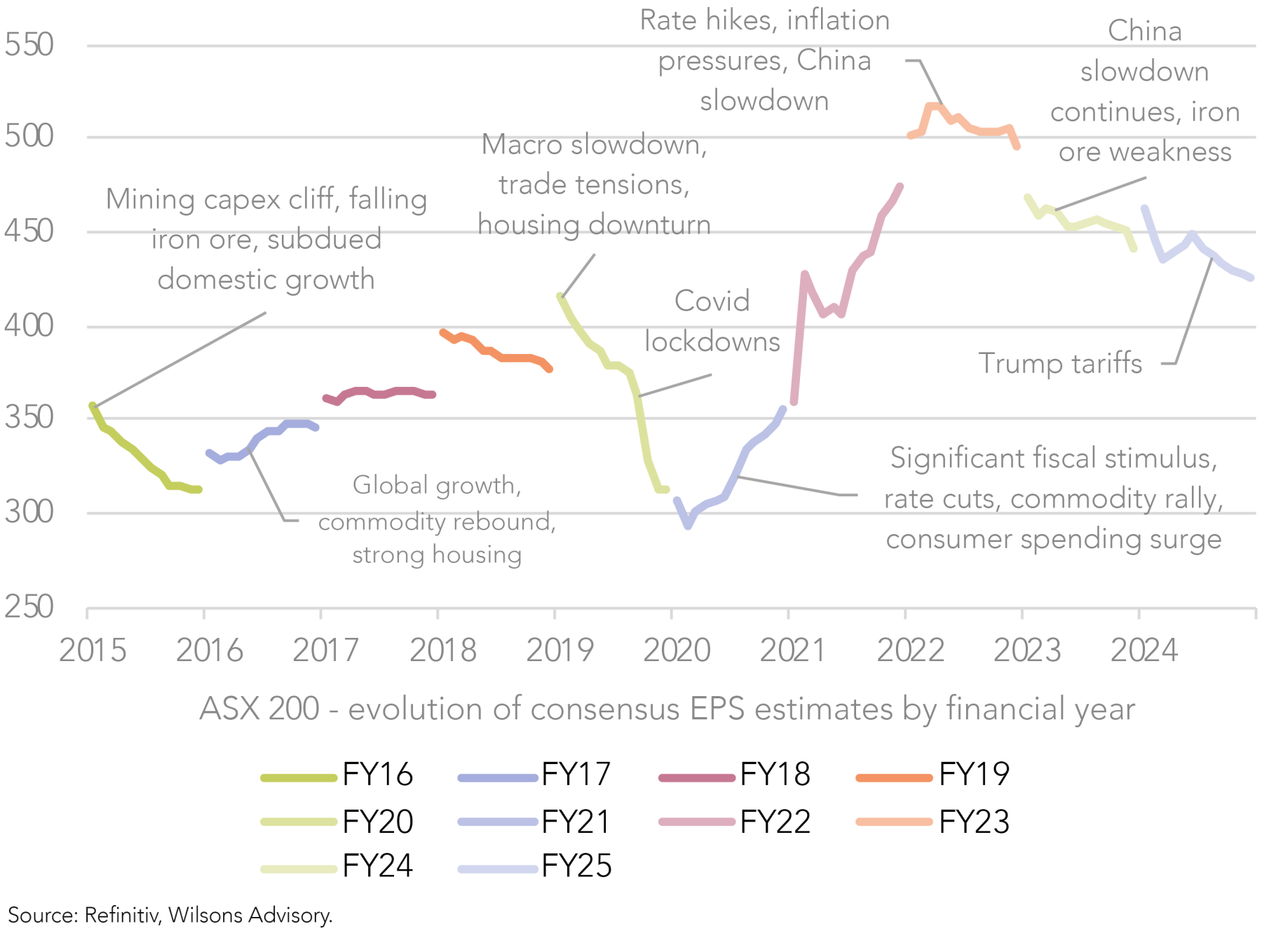

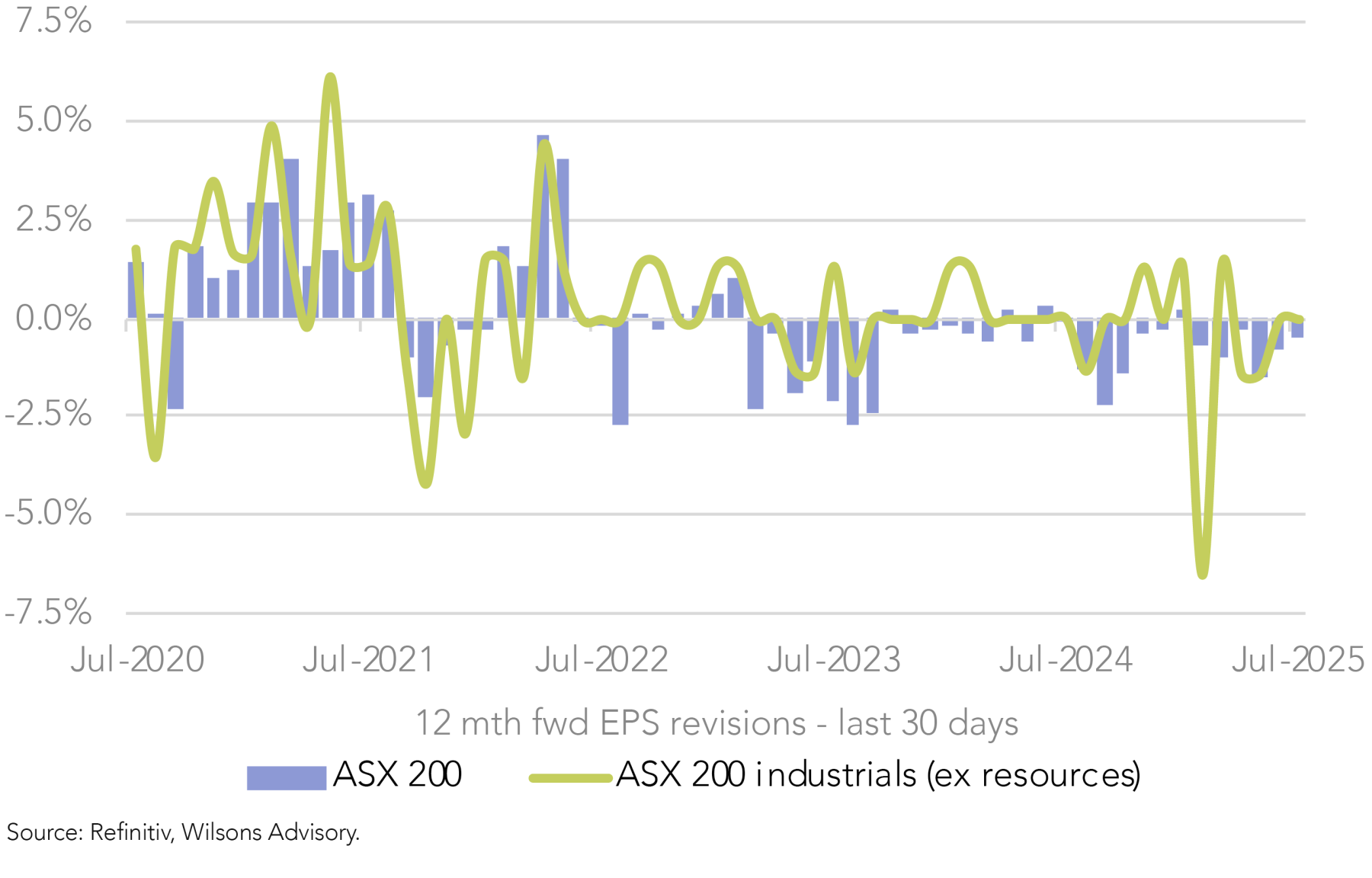

The ASX 200 has been in an earnings downgrade cycle since mid-2022 when the RBA started hiking rates. During this period, the market has also faced headwinds from elevated inflation (impacting both costs and customer demand), a slowdown in both the domestic and Chinese economies, and generally subdued commodity prices.

More recently, the macro backdrop has become increasingly supportive of an acceleration in earnings growth: inflation is now contained, unemployment is relatively steady, the RBA has begun easing policy, Australia’s US tariff impost is negligible, domestic GDP growth is expected to accelerate (albeit modestly), and China is introducing stimulus measures to support its struggling economy. These factors underpin consensus expectations for a return to positive EPS growth in FY26.

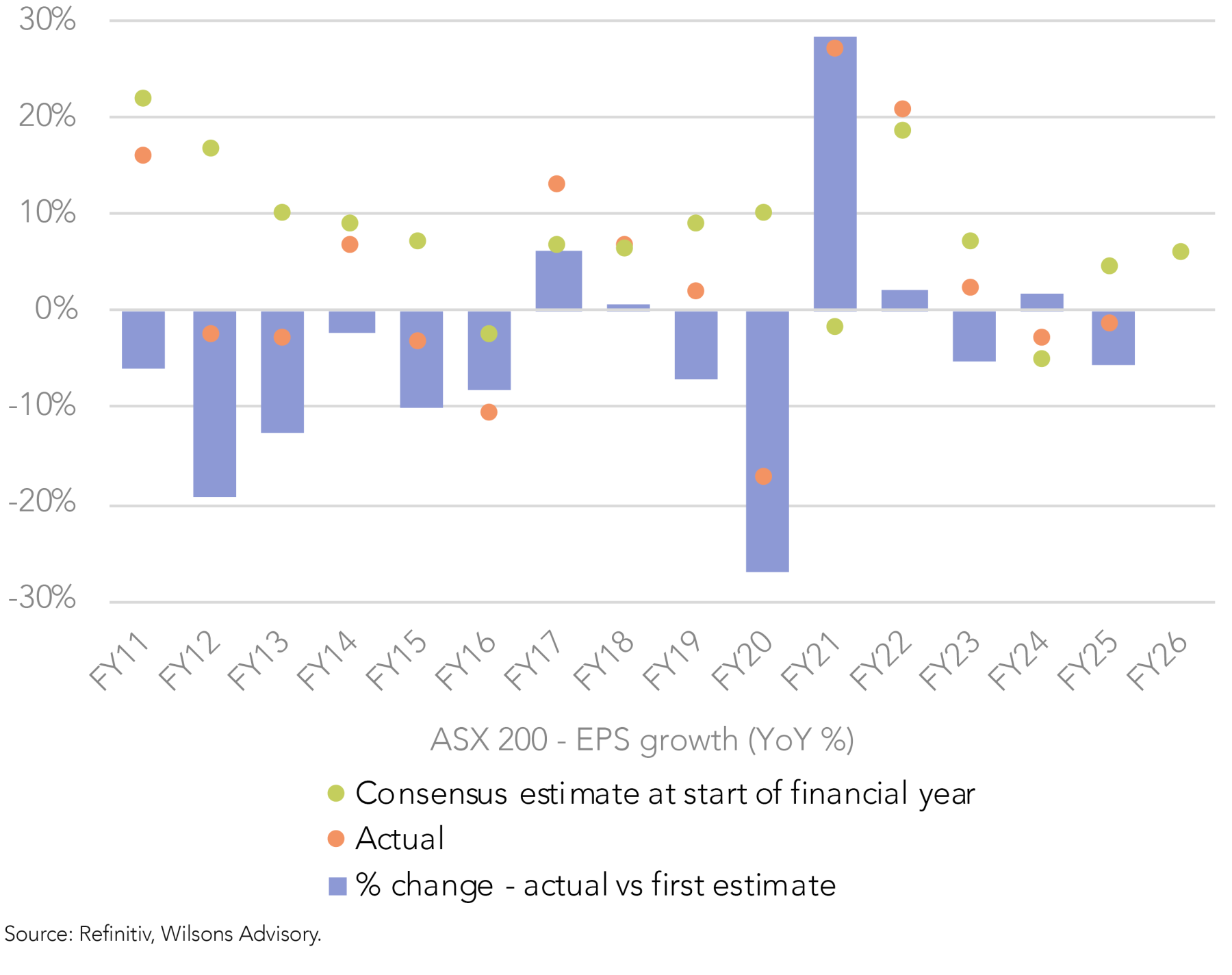

However, consensus estimates have been edging lower in recent months, with relatively broad-based EPS downgrades across most GICS sectors (see Figure 5). We also note that analysts typically overestimate earnings at the start of a financial year, with forecasts often revised lower as the year progresses (see Figure 6). This points to continued earnings risks ahead of the August 2025 reporting season.

This environment warrants caution towards companies already in earnings downgrade cycles or those with meaningful downside risks to consensus estimates. Accordingly, the remainder of this report explores key consensus downgrade and upgrade trends across the ASX 100, with a focus on implications for the Focus Portfolio.

Key Downgrades – Cyclicals Weigh

The largest consensus downgrades over the last twelve months on the ASX 100 have been concentrated in cyclical sectors (particularly resources), including:

- Lithium – miners continue to be challenged by a persistent oversupply, which has severely impacted the sector’s profitability and solvency (i.e. Mineral Resources), with several Australian assets operating at a loss at spot prices. We remain cautious on the sector, with zero portfolio exposure, given the lack of clear near-term catalysts for a lithium price recovery.

- Energy – weaker oil prices have underpinned significant downgrades for the oil and gas sector, particularly index heavyweight Woodside Energy. The outlook for oil demand remains subdued, while OPEC+ continues to add supply to the market, which has driven an ongoing oversupply, weighing on prices. Meanwhile, thermal coal prices are down ~30% since late 2024 due to a global supply glut, which has driven downgrades for Whitehaven Coal. Overall, we are comfortable remaining neutral energy, with our sole exposure being to Santos, which is currently subject to a takeover bid.

- Diversified Mining – South32 (held) has seen downgrades primarily due to revisions to key FY26e commodity price assumptions (last 3 months: Alumina -8.5%, Aluminium -4.8%, Nickel -4.2%, Copper -1.1%, Manganese +1.8%). That said, South32’s delivery has been broadly in line with its guidance, its recent sale of Cerro Matoso (Nickel) for ~US$100m has simplified its portfolio, and we remain structurally positive towards its basket of commodities (particularly Aluminium).

- Building Materials – ongoing softness in housing market activity in both the US and Australia has been a key driver of earnings downgrades for names like Reece (plumbing supplies) and Focus Portfolio holding James Hardie (housing sidings). For James Hardie, EPS downgrades have also been partly driven by near-term dilution from the AZEK acquisition. However, its valuation is compelling and we continue to expect a cyclical recovery in housing activity – supported by interest rate cuts – to underpin a return to positive EPS growth over the medium-term.

Other major downgrades on the ASX 100 have been largely idiosyncratic in nature: IDP Education is being severely impacted by student immigration reforms; Ramsay Healthcare’s hospitals are still facing significant cost pressures; Seek faces a tough macro with subdued job ads; and Flight Centre’s corporate/leisure sales have been impacted by tougher US trade/entry policies.

| Name | Ticker | Sector | FY26e EPS growth | FY26e - consensus EPS revisions | Total return - last 12 months | Focus Portfolio holding | ||

| 3mths | 6mths | 12mths | ||||||

| Pilbara Minerals | PLS | Lithium | nm | -70% | -79% | -91% | -50% | |

| IGO | IGO | Lithium | nm | -63% | -71% | -89% | -25% | |

| Whitehaven Coal | WHC | Energy | -22% | -63% | -69% | -81% | -31% | |

| Mineral Resources | MIN | Lithium | nm | -34% | -62% | -74% | -57% | |

| IDP Education | IEL | Education Services | 0% | -48% | -56% | -61% | -71% | |

| Woodside Energy | WDS | Energy | -37% | -25% | -35% | -44% | -11% | |

| Lynas Rare Earths | LYC | Rare Earths | >100% | -12% | -30% | -42% | 26% | |

| LendLease | LLC | Property | -39% | -5% | -16% | -40% | -1% | |

| Ramsay Health Care | RHC | Hospitals | 25% | 0% | -8% | -38% | -15% | |

| South32 | S32 | Diversified Mining | 19% | -21% | -22% | -36% | -16% | x |

| Seek | SEK | Online Classifieds | 34% | 0% | -1% | -32% | 22% | |

| Orora | ORA | Packaging | 31% | -6% | -14% | -28% | 6% | |

| Reece | REH | Building Materials | 7% | -9% | -20% | -27% | -39% | |

| Ampol | ALD | Energy | 40% | -5% | -15% | -27% | -21% | |

| Fortescue | FMG | Iron Ore | -15% | -6% | -8% | -26% | -21% | |

| Reliance Worldwide | RWC | Building Materials | -3% | -17% | -23% | -26% | -1% | |

| Atlas Arteria | ALX | Infrastructure | 30% | -2% | -19% | -23% | 10% | |

| Flight Centre Travel | FLT | Travel | 20% | -11% | -14% | -22% | -37% | |

| James Hardie | JHX | Building Materials | -2% | -7% | -15% | -21% | -11% | x |

| Santos | STO | Energy | 18% | -15% | -20% | -19% | 1% | x |

Figure 7 shows the 20 largest consensus downgrades to FY26e EPS forecasts across the ASX 100 over the last 12 months, excluding non-meaningful values and notable outliers. Source: Refinitiv, Wilsons Advisory.

Key Upgrades – Gold and Healthcare Dominate

The most notable upgrades on the ASX 100 have been concentrated in three key sectors:

- Gold – despite mixed production/cost delivery from large producers such as Newmont (not held) and Northern Star (held), the sector has seen broad-based upgrades, driven by the ongoing appreciation in the gold price (and upward revisions to analysts’ gold price assumptions). Consensus gold price estimates have yet to reflect structurally higher gold prices in our view, presenting further upside risk to medium-term earnings estimates. Evolution Mining and Northern Star remain our preferred exposures within the sector.

- Banks – while CBA (not held) is only expected to deliver low-single digit EPS growth over the medium-term, it has earned consensus upgrades every quarter in the last 12 months, which has been a key driver of the bank’s continued outperformance. Notwithstanding CBA’s quality and track record of delivery, we continue to view it as significantly overvalued on a forward price-to-book of 4x, and expect it to underperform over the medium-term.

- Healthcare – outside of index heavyweight CSL (held), which has underwhelmed against expectations (driving downgrades at the index level), the healthcare sector features several companies delivering consistent upgrades. Standouts include: Telix Pharmaceuticals (held), which continues to gain share in the US PSMA imaging market; and ResMed (held), which is benefiting from a continuation of robust CPAP demand alongside emerging tailwinds, including GLP-1 referral pathways, new generation wearables, and growing adoption of at-home sleep testing.

| Name | Ticker | Sector | FY26e EPS growth | FY26e - consensus EPS revisions | Total return - last 12 months | Focus Portfolio holding | ||

| 3mths | 6mths | 12mths | ||||||

| Telix Pharmaceuticals | TLX | Healthcare | 57% | 3% | 53% | 95% | 31% | x |

| Evolution Mining | EVN | Gold | 37% | 11% | 56% | 84% | 120% | x |

| Perseus Mining | PRU | Gold | 3% | 6% | 15% | 80% | 49% | |

| Sigma Healthcare | SIG | Healthcare | >100% | 12% | 50% | 59% | 135% | |

| Newmont | NEM | Gold | -1% | 13% | 42% | 27% | 43% | |

| Northern Star Resources | NST | Gold | 36% | -14% | 8% | 26% | 48% | x |

| Pinnacle Investment Management | PNI | Div Fins | 13% | -2% | 1% | 25% | 53% | x |

| Pro Medicus | PME | Healthcare | 40% | 0% | 6% | 19% | 136% | |

| Bank of Queensland | BOQ | Banks | 7% | 6% | 6% | 18% | 38% | |

| JB Hi-Fi | JBH | Retail | 7% | 0% | 5% | 17% | 84% | |

| Qantas Airways | QAN | Aviation | 12% | 3% | 5% | 16% | 79% | |

| Medibank Private | MPL | Insurance | 7% | 1% | 5% | 9% | 43% | |

| ResMed | RMD | Healthcare | 11% | 2% | 3% | 9% | 39% | x |

| Light & Wonder | LNW | Gaming | 20% | -6% | 4% | 7% | -3% | |

| Qube | QUB | Industrials | 11% | 0% | 2% | 7% | 19% | |

| Amcor | AMC | Packaging | 16% | 4% | 4% | 6% | 9% | |

| AGL Energy | AGL | Utilities | 0% | 0% | 1% | 6% | 0% | |

| Commonwealth Bank | CBA | Banks | 2% | 0% | 2% | 6% | 45% | |

| Steadfast | SDF | Insurance | 7% | 0% | -1% | 6% | 0% | |

| HUB24 | HUB | Div Fins | 26% | -1% | 2% | 6% | 98% | x |

Figure 8 shows the 20 largest consensus upgrades to FY26e EPS forecasts across the ASX 100 over the last 12 months, excluding non-meaningful values and notable outliers. Source: Refinitiv, Wilsons Advisory.

Focus Portfolio – Retaining a Growth Bias

The Focus Portfolio remains skewed towards high-quality businesses with strong medium-term earnings growth prospects. The majority of holdings are expected to deliver double-digit EPS growth in FY26 and beyond – well ahead of the ASX 200’s level of growth.

From a bottom-up perspective, we remain confident in the ability of our core holdings to meet or exceed consensus expectations over time. Recent notable upgrades have come from Telix Pharmaceuticals, Evolution Mining, Pinnacle Investment Management, ResMed, HUB24, and TechnologyOne.

Written by

Greg Burke, Equity Strategist

Greg is an Equity Strategist in the Investment Strategy team at Wilsons Advisory. He is the lead portfolio manager of the Wilsons Advisory Australian Equity Focus Portfolio and is responsible for the ongoing management of the Global Equity Opportunities List.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.