The digital infrastructure sector remains in the early stages of its growth cycle, despite a significant ramp-up in data centre capacity in recent years.

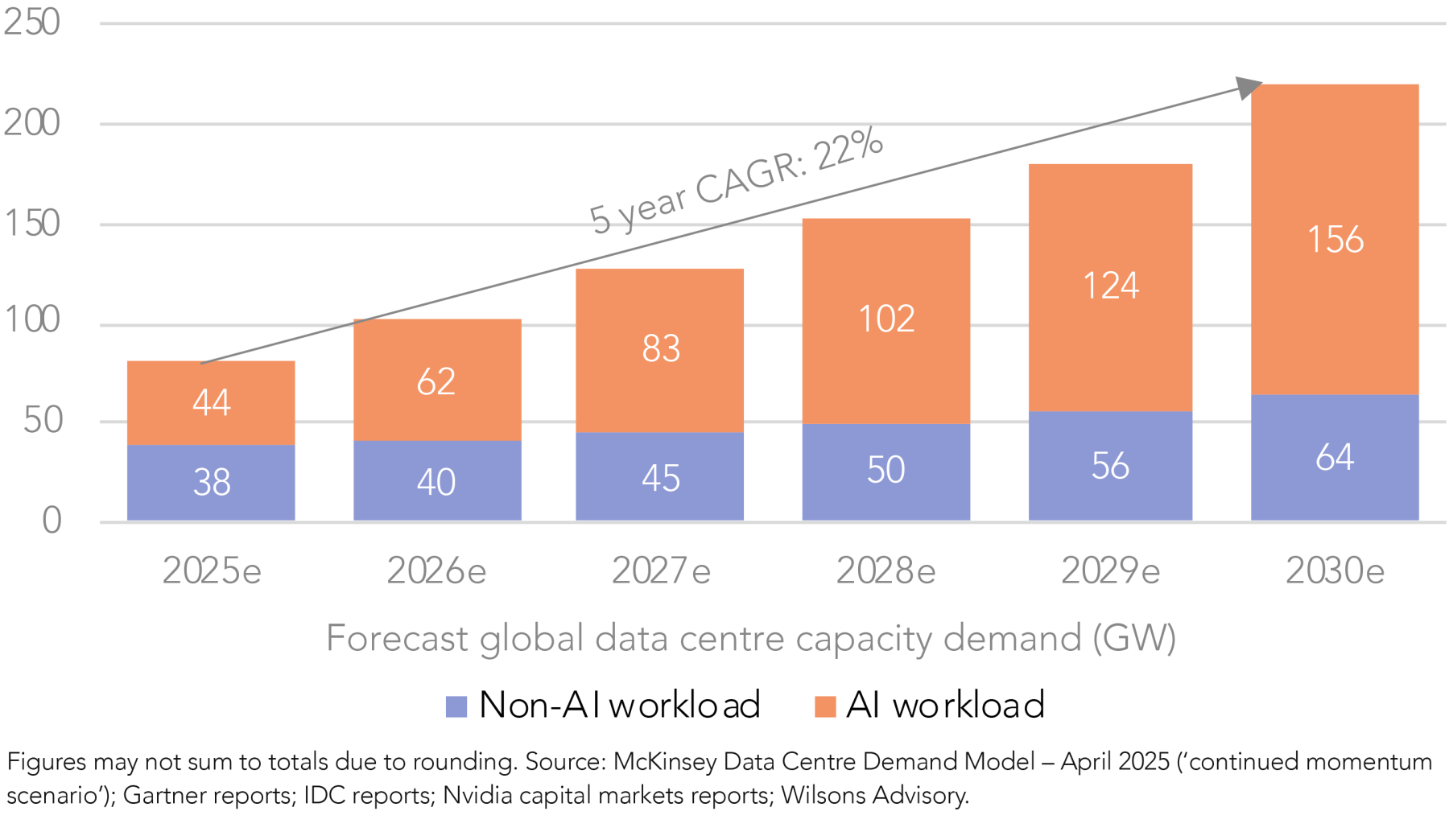

Data centre demand is expected to grow substantially over the next decade, driven by three major structural tailwinds: 1) the ongoing transition to the cloud, 2) rapid adoption of Generative Artificial Intelligence (GenAI), and 3) exponential growth in global data creation and consumption.

- Cloud computing –

enterprises continue to migrate from on-premise IT to cloud-based infrastructure to gain scalability, flexibility, and cost efficiency benefits. This ongoing transition is driving sustained demand growth for data centres, particularly from hyperscale cloud service providers (‘hyperscalers’) like AWS, Microsoft Azure, and Google Cloud. - GenAI –

the rise of AI – particularly large language models like OpenAI’s GPT-4 (used in ChatGPT) – requires immense compute power, which is fuelling demand for next-generation data centres. GenAI-related demand is still in its infancy, with incredible growth expected over the next decade as hyperscaler investment and user adoption grows. - Rising data generation –

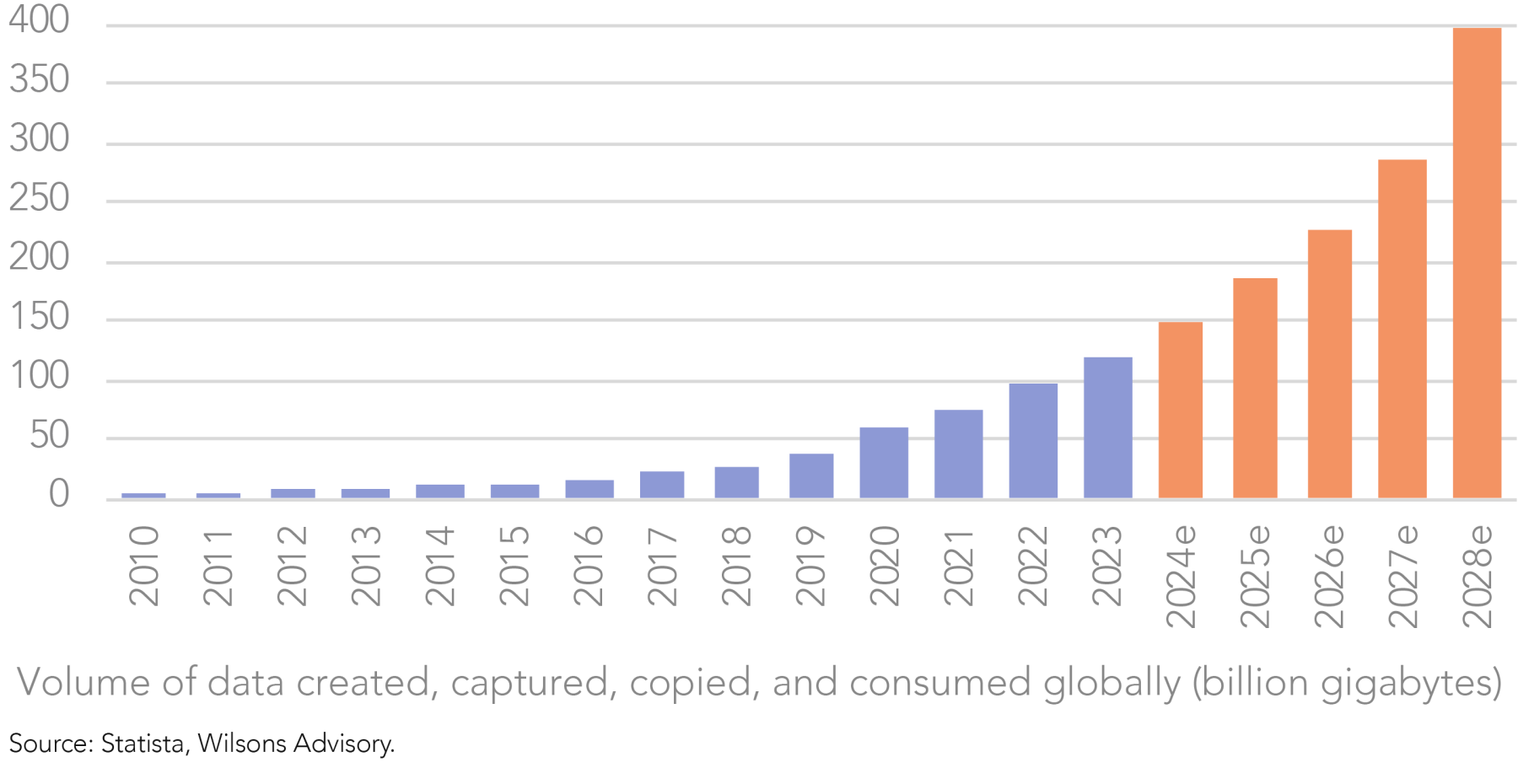

data creation is growing exponentially, driven by trends like video streaming (e.g. Netflix, YouTube), the proliferation of IoT devices (e.g. sensors, smart appliances, wearables), enterprise SaaS adoption (e.g. CRM, ERP), and edge computing (e.g. autonomous vehicles). This is driving growing demand for scalable, secure, and low-latency data centre infrastructure to store and process information efficiently.

Structural Growth Thematics Support Healthy Sector Fundamentals

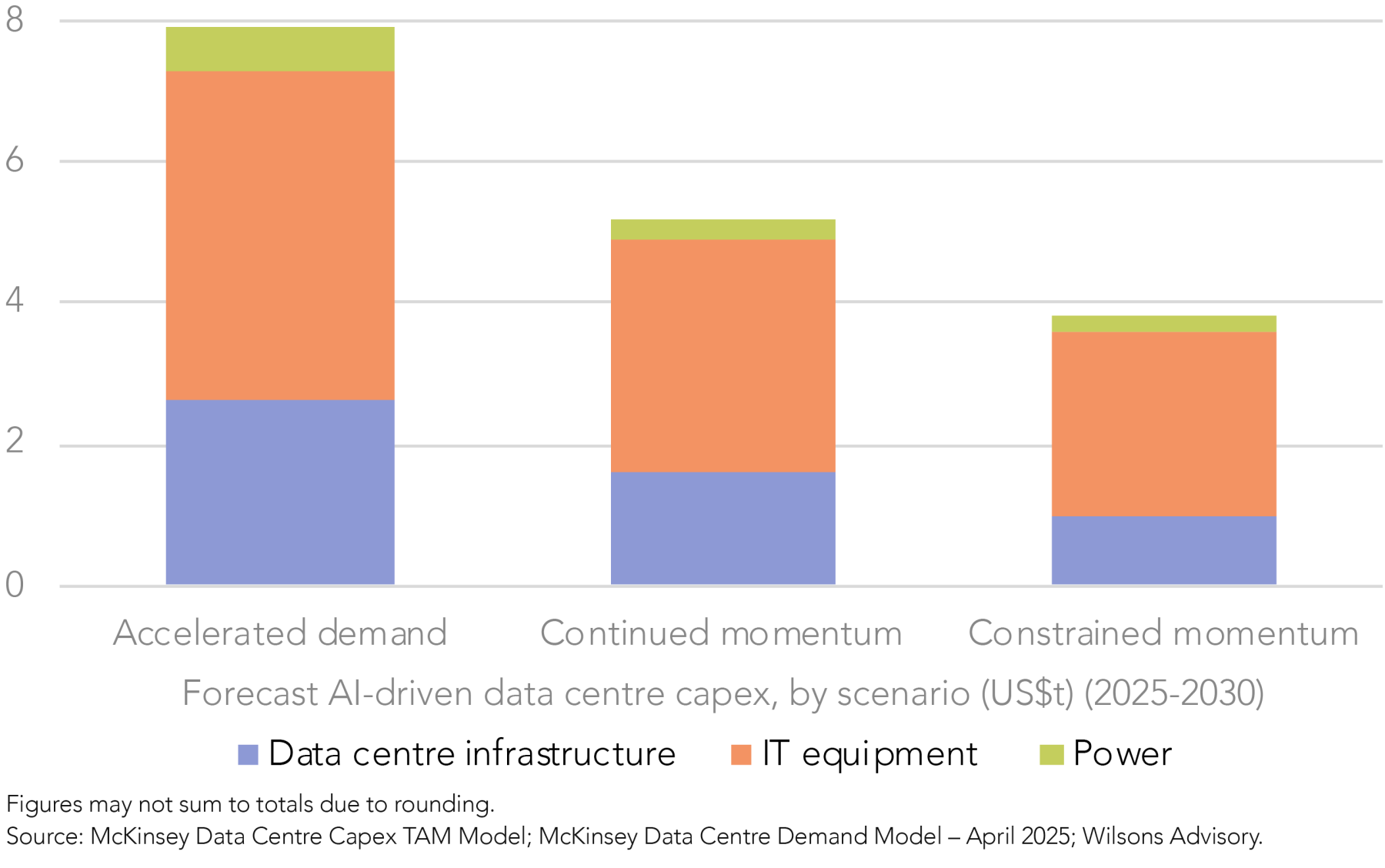

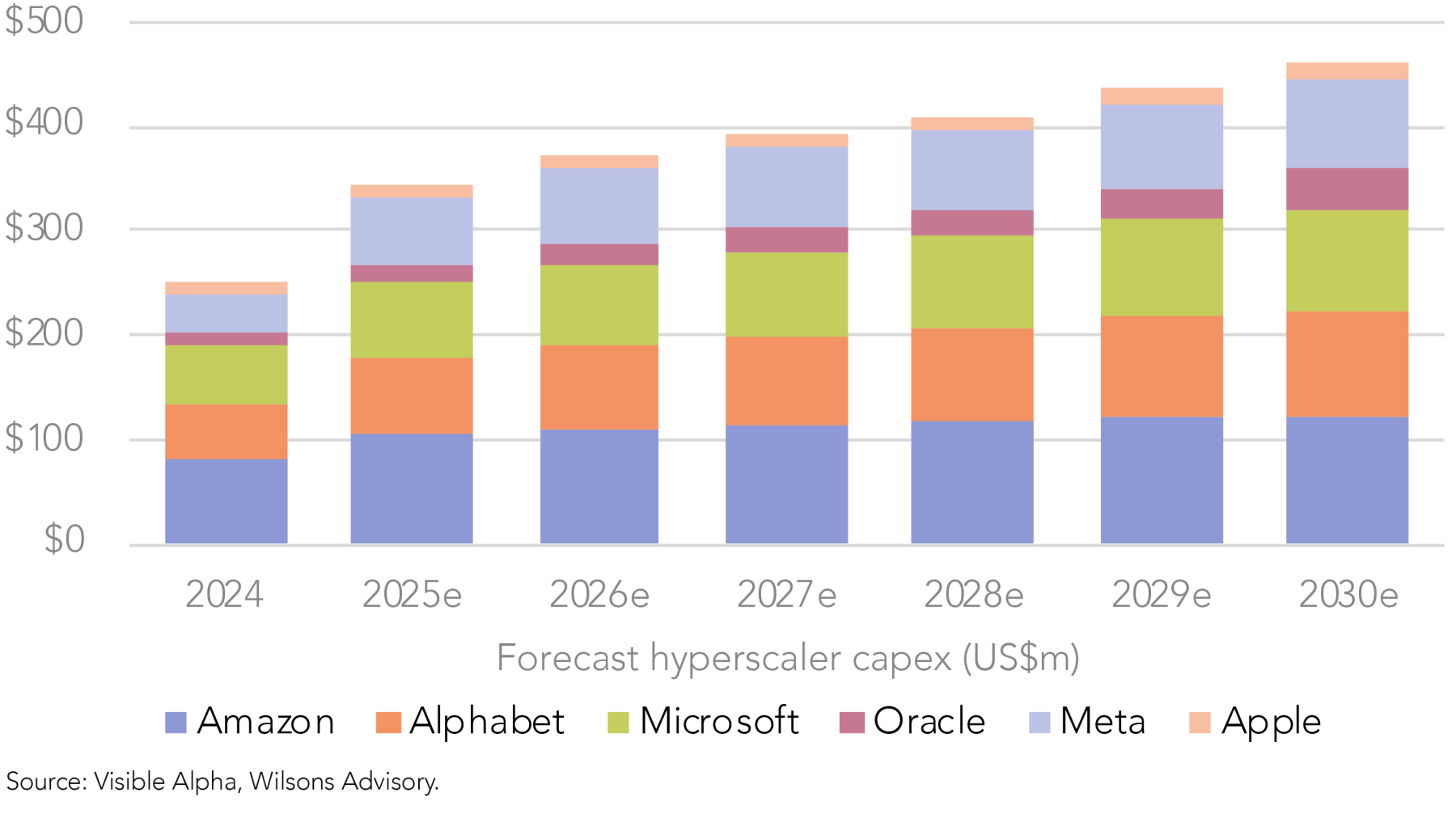

The aforementioned structural thematics are driving a surge in capital investment across the technology sector, particularly amongst hyperscalers, which are spending aggressively on data centre capacity as they build out their cloud and AI infrastructure footprints.

On the supply side, data centre developments face growing bottlenecks from a scarcity of access to power, land, and cooling capacity. This is a major impediment to new supply growth (particularly in urban infill locations) and underscores the value of existing tier-1 assets and well-located land/power banks with latent development potential.

Overall, the combination of strong demand growth and constrained supply points to a healthy fundamental outlook for the sector, with positive implications for data centre pricing/rental growth, occupancy/utilisation rates, and asset valuations over the medium and long-term.

Addressing the Recent Data Centre Sell Off

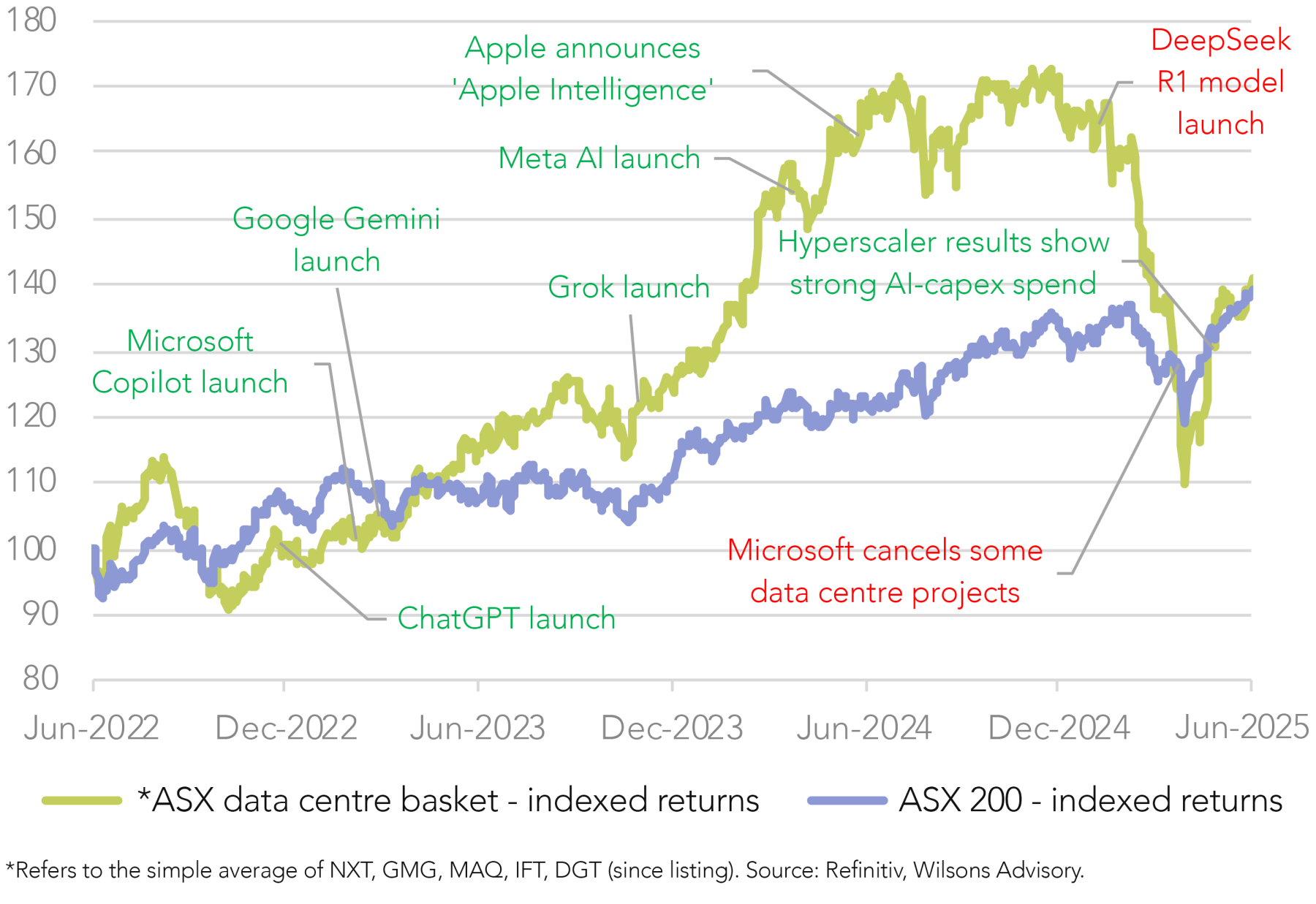

After a string of positive AI-related news flow since the launch of OpenAI’s ChatGPT in November 2022, share price momentum among AI beneficiaries – including chip makers and data centre owners/developers – swung negative early this calendar year.

The two key pieces of news flow that have dampened confidence in the AI thematic have included: 1) DeepSeek’s R1 model, and 2) news of Microsoft scaling back its data centre developments. In our view, the market has overreacted to this news flow, with the long-term structural demand outlook for AI infrastructure remaining firmly intact.

1. The emergence of ‘highly efficient’ AI models

Chinese AI company DeepSeek released its new reasoning model, RI, in January, which was purported to be 95% more efficient than other leading GenAI models (e.g. ChatGPT). This stoked concerns that US tech companies may be significantly overspending on compute capacity, as they would be able to achieve equal performance at a significantly lower cost if they emulated DeepSeek, potentially driving less AI-related demand for data centres.

However, we are confident the outlook for data centre demand remains intact given:

- No one has successfully replicated DeepSeek’s purported efficiency gains.

- DeepSeek’s purported efficiency gains are solely related to training (i.e. the model being ‘built’) rather than inference (i.e. the model being used). While training is the current focus of AI spend, inference is growing much faster than training and will drive the majority of AI-related demand over the long-term (particularly in Australia). Currently ~20% of AI data centre usage is from inference (~80% from training), however, by the end of this decade inference is expected to account for ~80% of data centre usage.

- Efficiency gains often paradoxically drive greater (not less) consumption, which is known as the Jevons Paradox. If efficiency gains do meaningfully lower the cost of AI model delivery, lower capex requirements will allow more players to enter the market, driving greater end-demand. Microsoft CEO Satya Nadella recently stated that as ‘AI gets more efficient and accessible, we will see its use skyrocket, turning it into a commodity we just can't get enough of’.

Everything considered, efficiency improvements are to be expected from new and unoptimised technologies. Ultimately, the arrival of DeepSeek (assuming its disclosures are accurate) continues the contraction in costs and capex associated with AI model deployment. However, this will not diminish AI-related demand for data centres over the long-term, in our view.

2. Microsoft scaling back its data centre plans

News in March that Microsoft had cancelled up to 2GW of data centre projects exacerbated market fears that the hyperscalers may have ‘overspent’ on AI. However, it is common for hyperscalers to reassess their requirements, before ultimately committing more capital as the long-run trend has shown.

There are also company-specific reasons behind Microsoft’s move, including the company losing its designation as OpenAI’s exclusive provider of compute capacity. While this has lowered Microsoft’s capacity requirements over the near-term, there has been no net impact to system demand, as its competitor Oracle won the designation, and all of the cancelled contracts have been quickly taken up by other hyperscalers.

The latest US earnings season has also helped to allay concerns, with Microsoft confirming plans for capex to exceed US$80bn in FY25. Alphabet also reiterated its capex guidance of US$75bn, while Amazon plans to spend US$100bn. Meta recently raised its FY25 capex guidance from US$60-65bn to US$64-72bn, driven by data centre investments.

Overall, we are confident that the hyperscalers will continue to invest heavily into compute infrastructure (reflected in Figure 4) and that the long-term demand outlook for data centres remains very strong.

Investing in Digital Infrastructure on the ASX

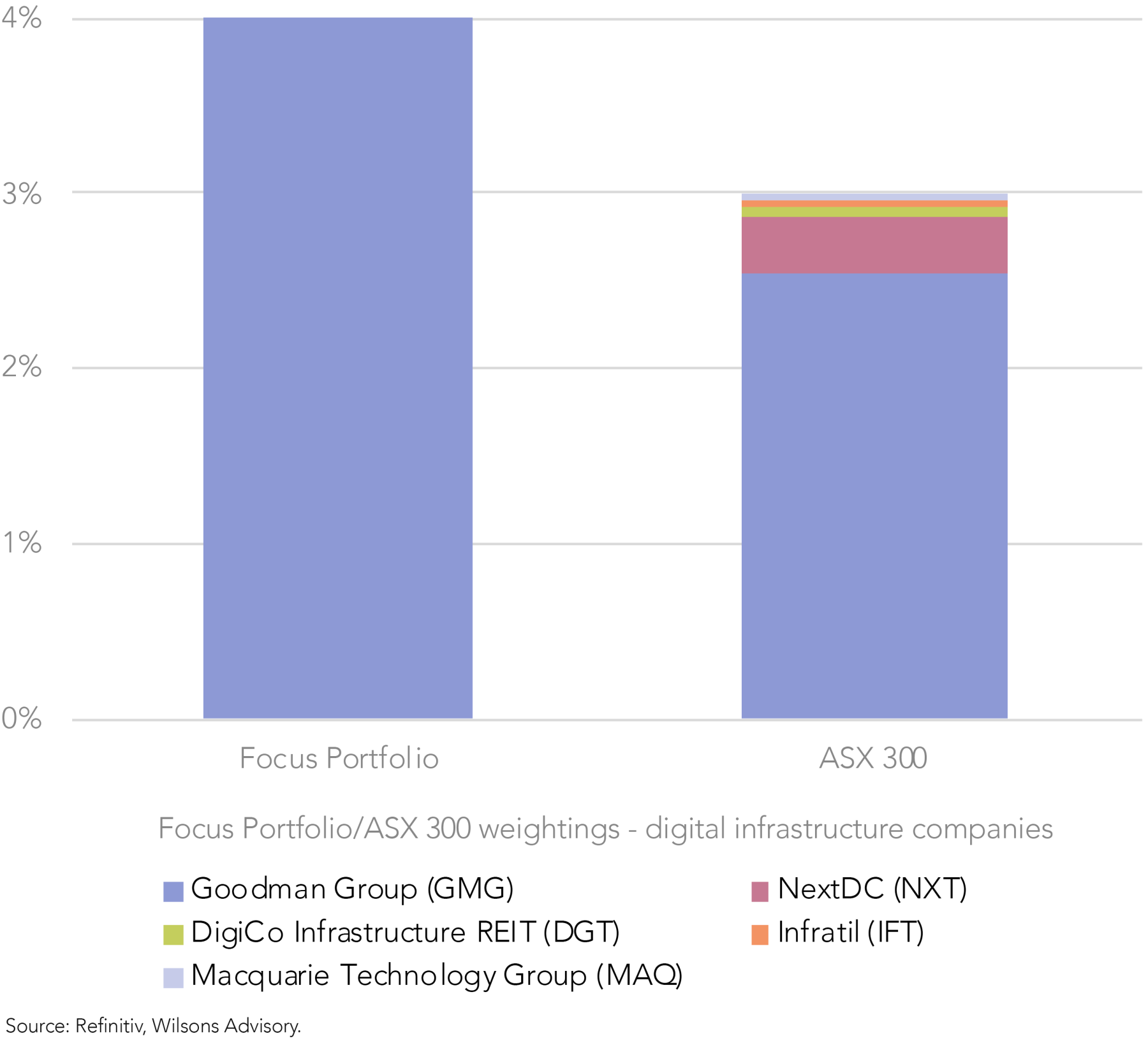

The Focus Portfolio has an overweight exposure to digital infrastructure, which is driven by our 4% weighting in Goodman Group (GMG).

There are five companies on the ASX 300 exposed to the digital infrastructure thematic, including two pureplay data centre companies: NextDC (NXT) and DigiCo Infrastructure REIT (DGT). Each company has a unique investment proposition with a distinct risk/return profile, which is briefly described in Figure 7.

With DGT recently listing on the ASX and attracting significant investor attention, this is the focus of the remainder of this report. We also briefly reiterate our constructive view towards our preferred exposure digital infrastructure exposure, GMG, at the end of the report.

| Company | Ticker | Index | Valuation (12 mth fwd) | Earnings growth (3yr CAGR, CY25-28) | Capital intensity | Investment proposition | |||

| P/E | EV/EBITDA | Dividend yield | EBITDA growth | EPS growth^ | Capex / sales | ||||

| Pureplay | |||||||||

| NextDC | NXT | ASX 100 | nm | 38.0 | - | 30% | nm | 290% | NXT builds, owns and operates co-location facilities for enterprise and hyperscale customers. NXT has 13 fully operational data centres and 5 in development. Despite having 190MW of built capacity and 70MW in progress, the company is still early in its growth cycle, with ~1.3GW of planned capacity. This will require substantial capex (and equity funding) required to support growth in its built and contracted capacity. |

| DigiCo Infrastructure REIT | DGT | ASX 200 | 41.5 | 26.2 | 5.4%* | 34% | 22% | 62% | DGT is a pure play data centre owner/developer with a portfolio of 13 assets which includes a mix of stabilised income generating assets and a pipeline of developments, including the expansion of its flagship asset SYD1. DGT currently has 76MW in built capacity and a 160MW of development pipeline. See more below. |

| Diversified | |||||||||

| Goodman Group | GMG | ASX 20 | 25.6 | 25.4 | 0.9% | 14% | 12% | 39% | GMG owns, develops and manages logistical warehouses and data centres. GMG has delivered 500MW of built capacity and has a total power bank of 5GW, with 500MW of projects (~10% of its power bank) set to commence over the next 12 months. The development pipeline will drive the majority of its future earnings growth. Developments are typically 'internally funded' from retained earnings its capital partnerships, and a modest amount of leverage. |

| Macquarie Technology Group | MAQ | ASX 200 | 46.4 | 14.3 | - | 17% | 1% | 48% | MAQ is diversified across cloud services, government (cybersecurity, secure hosting), telecom and data centres. It is increasingly pivoting towards data centres, with 5 data centres which represent roughly ~1/3 of its EBITDA. Its data centre business is focused on growing its capacity, with ~25MW of built capacity and ~45 MW in progress. |

| Infratil | IFT | ASX 300 | nm | 15.2 | 2.1% | 17% | -1% | 15% | IFT has investments across renewable energy, data centres, transport and healthcare, with data centres making up approximately 30% of EBITDA. IFT owns a 49.75% stake in CDC Data Centres, which is also in a growth stage despite already having a large built capacity of 300MW, with ~390 MW in progress and a further ~1.2GW in planned capacity. It also has a 53% stake in UK data centre company Kao Data, which has ~75MW in built capacity, ~58MW in progress and ~40MW of planned capacity. |

*FY25 prospectus guidance implies DPS of 20cps (annualised yield). ^refers to FFO for GMG and DGT (preferred underlying earnings measure for property companies).

Source: Refinitiv, Visible Alpha, Wilsons Advisory.

DigiCo Infrastructure REIT – Emerging Global Data Centre Developer

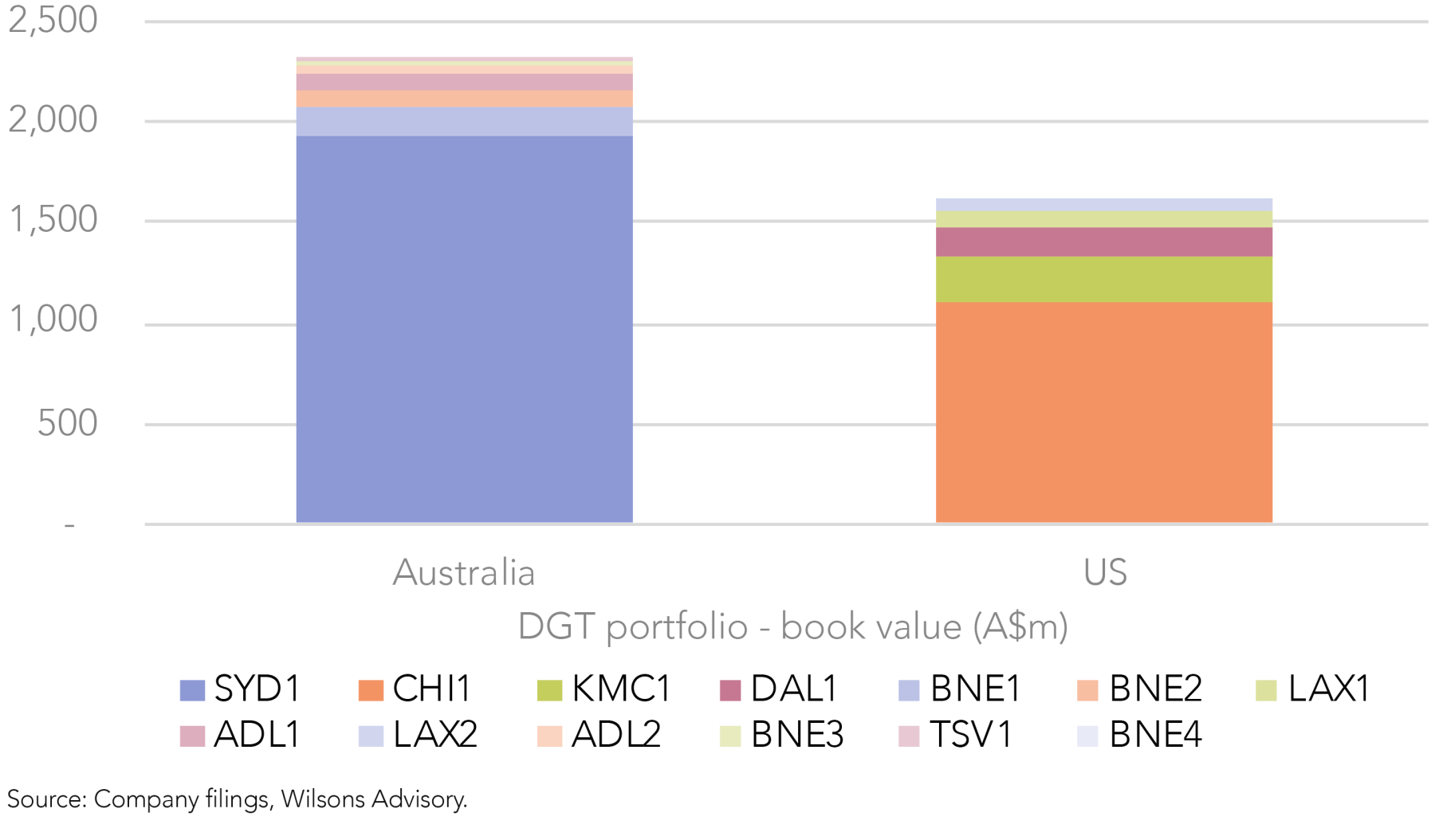

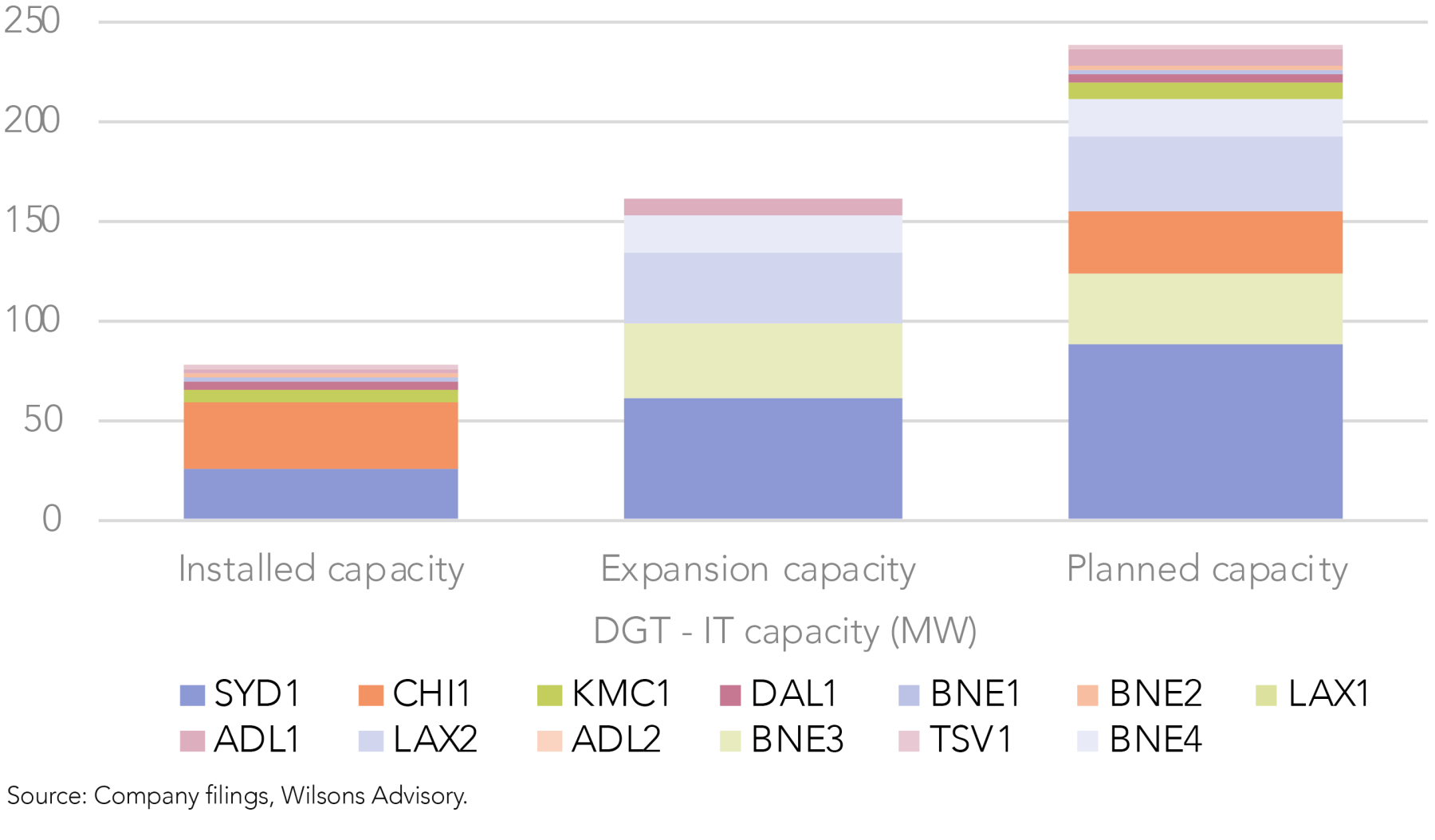

DigiCo Infrastructure REIT (‘DigiCo’) (DGT) is an ASX 200 A-REIT, which was listed in December 2024. The A-REIT owns, operates and develops data centres in Australia and the US, with key assets being in strategic tier-1 locations near large population centres. DGT’s ~$4bn portfolio spans 13 assets comprising 76MW of installed capacity and a 162MW development pipeline.

DGT has a broad investment mandate across the risk/return spectrum, including stabilised assets (40-50% target portfolio weighting), value-add assets (40-50%) and greenfield development opportunities (10-20%). DGT’s collection of stabilised assets and its capital partnering strategies should provide the flexibility to self-fund a meaningful proportion of its pipeline. In our view, DGT’s unique proposition provides a sound balance of near-term cash flows/income and longer-term growth.

No changes in underlying fundamentals

Despite its disappointing share price performance since listing, DGT reaffirmed its FY25 prospectus forecasts in February, which is for Pro-Forma Annualised Adjusted FY25 EBITDA of $97m. Upon completion of CHI1 (phased, 100% finalised by July 2026), which is a fully funded ‘turnkey’ asset, Pro-Forma Adjusted EBITDA is expected to increase to $163m. DGT has also highlighted that there has been no changes in its operating fundamentals, while pointing to positive integration momentum leading to an uptick in leasing velocity.

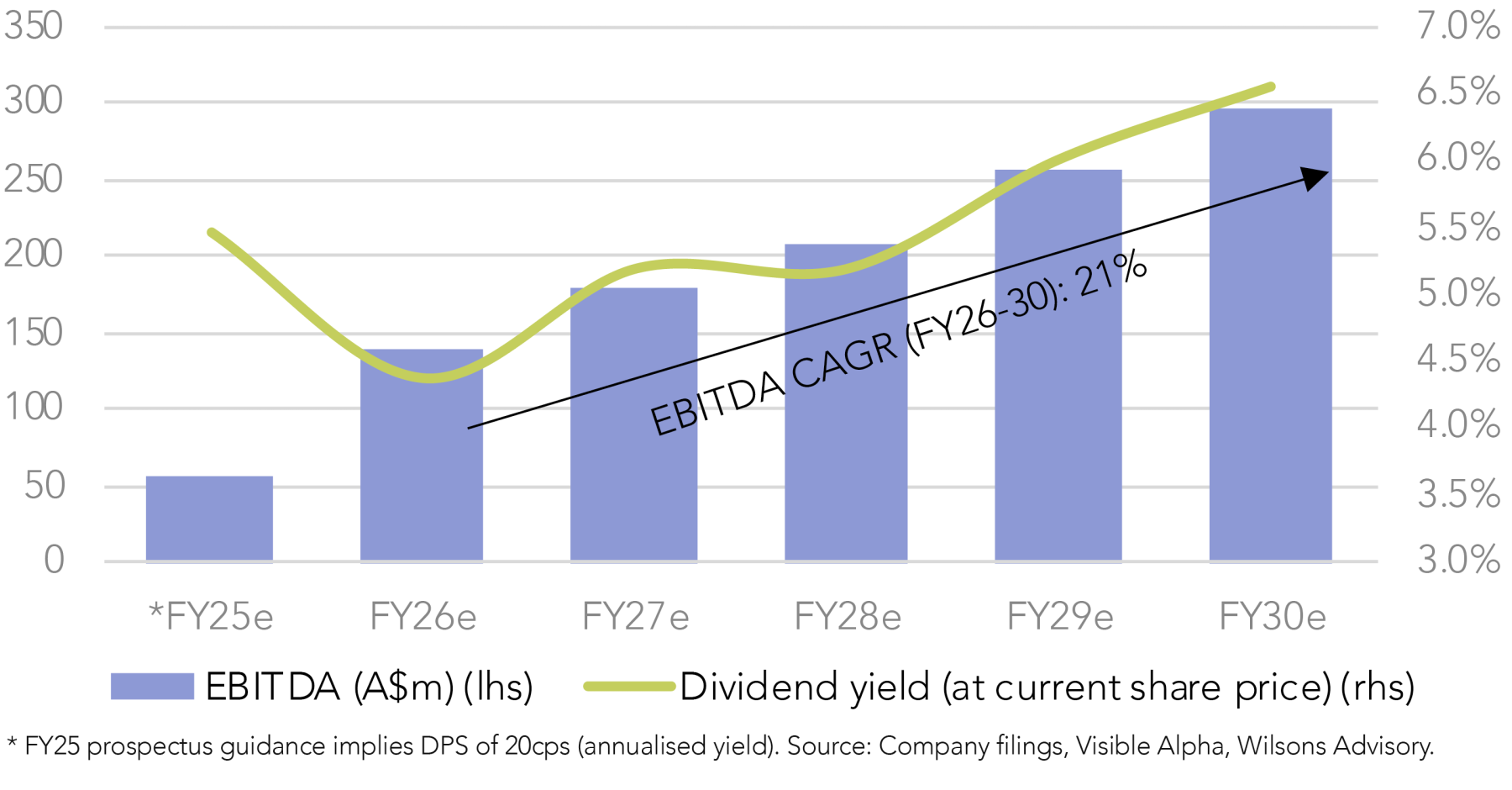

Attractive double-digit EBITDA growth outlook

DGT is well placed to deliver stable and growing cash flows and distributions over the medium and long-term, which will be underpinned by three key drivers:

- Contracted rental growth –

DGT’s stabilised ‘rent collector’ assets including CHI1, DAL1, KMC1 (~40-50% of portfolio) provide a strong foundation for the group. Average contracted rental escalations of +3%, in conjunction with 15-year triple net leases and high contracted utilisation, together drive stable, low-single digit rental growth from these assets. - Value-add opportunities –

9MW (or 12%) of DGT’s total built capacity is currently uncontracted across its Australian operating platform (SYD1, QLD & SA assets). Most notably, DGT’s flagship asset, SYD1, is underutilised (at 76%), which creates a meaningful leasing opportunity over the near/medium-term. The asset also has a 62MW expansion opportunity, which will be phased over 5 years and targets a yield on cost of 12%+. - Greenfield developments –

DGT has significant greenfield development capacity, which should be accretive to earnings over the longer-term. DGT’s two key development sites are LAX1 and LAX2, which together are expected to deliver 72MW of capacity over the long-term. These assets target a yield on cost of 10%+ and a levered project IRR of 15-30%. LAX1 is expected to commence construction in 2H25 with completion targeted in 2028.

Catalysts on the horizon

There are a number of catalysts that we expect to drive the DGT share price over the next 6-12 months, which include:

- SYD1 HCF certification –

DGT has applied for the certification of SYD1 under the Hosting Certification Framework, which is a form of security clearance the asset didn’t previously have due to its prior Chinese ownership. HCF approval is on track for ‘mid-2025’, which will be key to securing customer demand (particularly from government tenants). - SYD1 expansion & leasing –

after HCF approval, DGT is expected to resume leasing activities at SYD1 given its spare existing capacity (76% utilisation). DGT is currently tendering for 10MW+ of new potential contract capacity, likely resulting in contract announcements over the near-term. In addition, DGT also has a 9MW expansion build underway, which it says will deliver ‘well in excess’ of its 12%+ yield on cost target. - Capital partnering –

DGT is targeting capital partnering opportunities for SYD1 in 2H25, once the asset is ‘de-risked’ with HCF certification and positive leasing momentum. A partial selldown of SYD1 will unlock capital for accelerated growth and demonstrate the underlying value of the asset (which could be re-valued higher after the above de-risking points).

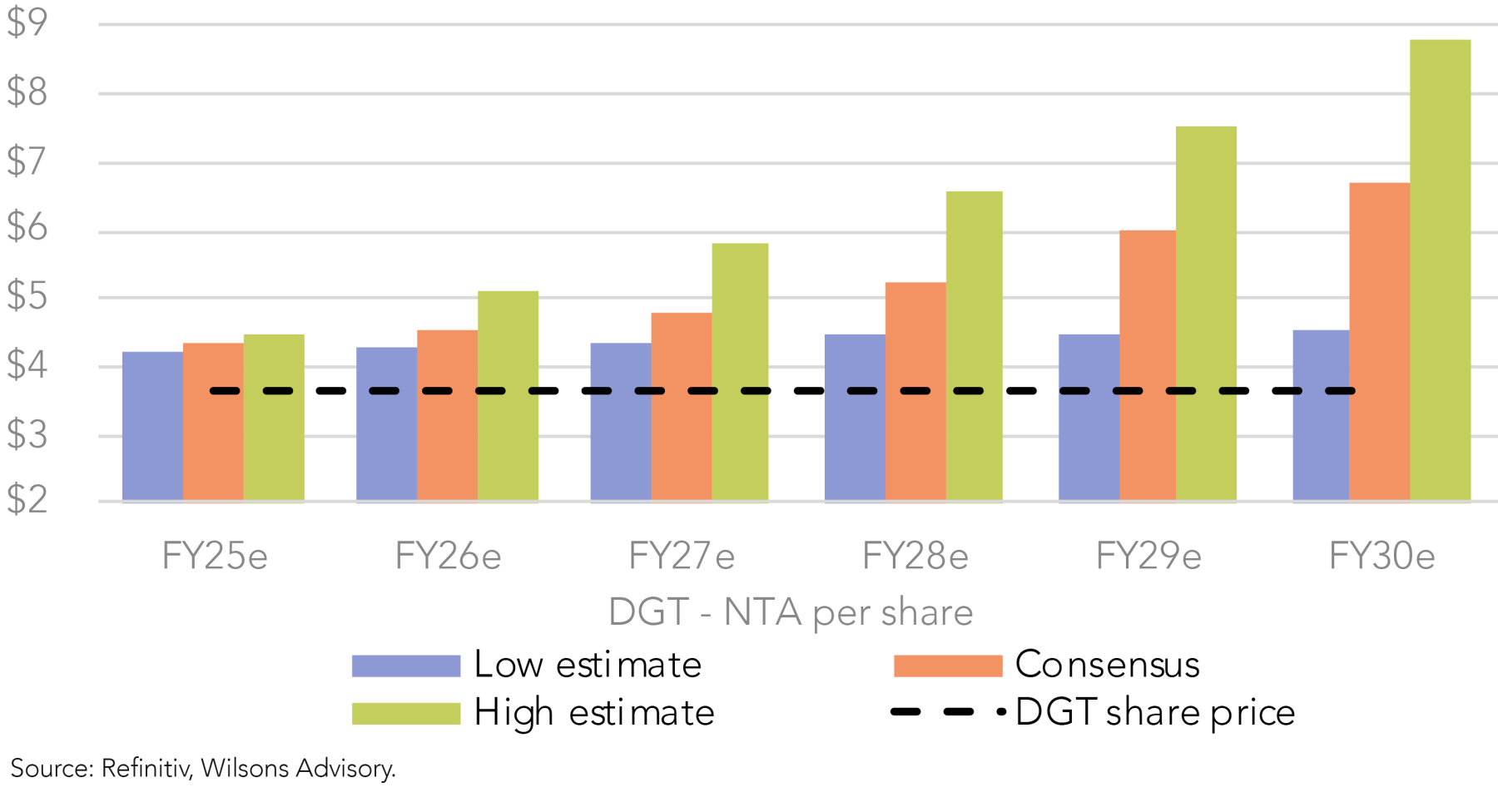

Valuation upside

DGT currently trades at a discount to NTA. Its NTA backing is also expected to grow over time as its accretive development pipeline is de-risked (see Figure 11). This provides meaningful potential upside to DGT’s current share price.

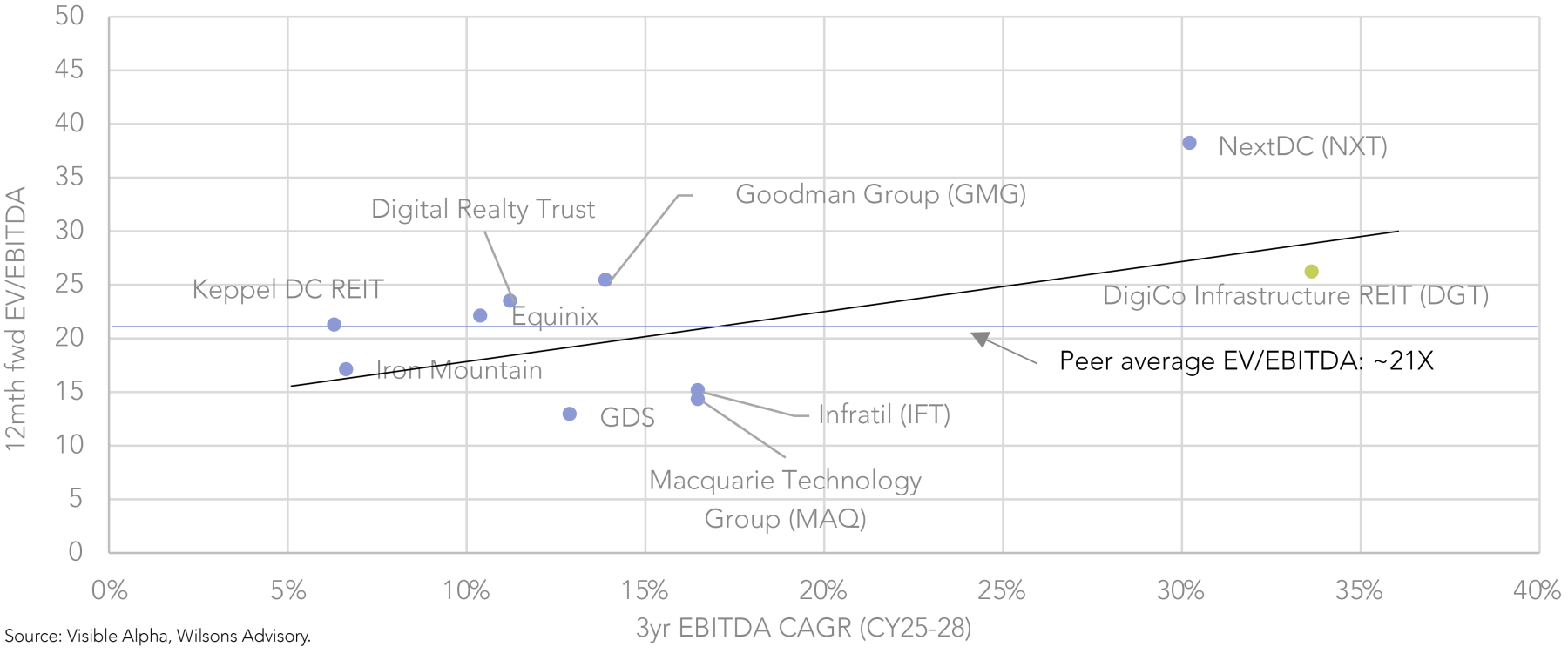

On a 12-month forward EV/EBITDA basis, DGT trades slightly above its peer average, at 26x compared to a range of ~15-40x (average 21x). However, DGT’s multiple reduces materially over the medium-term given strong EBITDA growth (3yr CAGR 34%).

On a multiple to growth relativity (using EV/EBITDA to 3yr EBITDA growth), DGT is valued attractively, towards the bottom-end of the peer group, at ~1.1x (vs average of ~1.8x), which reflects its above-sector level of EBITDA growth.

Goodman Group – Our Preferred Data Centre Exposure

Goodman Group is a leading global property owner, manager and developer. The group has historically focused on logistical warehouses, but is now pivoting towards digital infrastructure, which now accounts for >50% of its development book.

Notwithstanding the investment appeals of DigiCo, from a Focus Portfolio context GMG is our preferred exposure to the digital infrastructure thematic.

This is due to GMG's significant global scale (and market liquidity), its exceptionally strong balance sheet (and financial conservatism), and its long track record of development execution through cycles (lessening execution risk).

With GMG trading at a forward PE multiple of ~26x, the company offers attractive value for a high-quality operator that should deliver low-teens EPS growth over the medium/long-term.

The three key points to our investment thesis for GMG are:

- Data centre pivot is earnings accretive –

with development margins being higher for data centres than logistical warehouses, progress on GMG’s data centre pipeline will be earnings accretive over time (see Figure 13). - Attractive development pipeline –

GMG’s large existing land and power banks (5GW) are a key differentiator and will support ~$100bn of data centre developments over the next decade. GMG has provided good visibility into eight major projects (~0.5GW) that are due to commence by ‘mid 2026’ and will underpin its earnings growth over the medium-term. - Internally funded platform –

GMG is confident in its ability to self-fund its future data centre developments from a combination of existing liquidity, retained earnings, equity sell-downs (of ~50-70%) to capital partners, and a modest amount of leverage.

Key catalysts over the next 6-12 months will include 1) development starts (driving further work-in progress/ development yield increases), 2) hyperscaler commitments, and 3) capital partnerships (sell-downs).

Read: Rejigging our Structural Growth Exposures

Written by

Greg Burke, Equity Strategist

Greg is an Equity Strategist in the Investment Strategy team at Wilsons Advisory. He is the lead portfolio manager of the Wilsons Advisory Australian Equity Focus Portfolio and is responsible for the ongoing management of the Global Equity Opportunities List.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.