Consumer confidence has climbed to three-year highs, as easing cost-of-living pressures from lower inflation, interest rate relief and stronger disposable income growth have provided support to Australian households.

This provides a favourable backdrop for consumer discretionary businesses such as retailers, fast food chains, travel operators and consumer goods companies after years of headwinds. As a result, a top line recovery, easing input costs and operating leverage are set to underpin an upwards inflection in earnings across the sector.

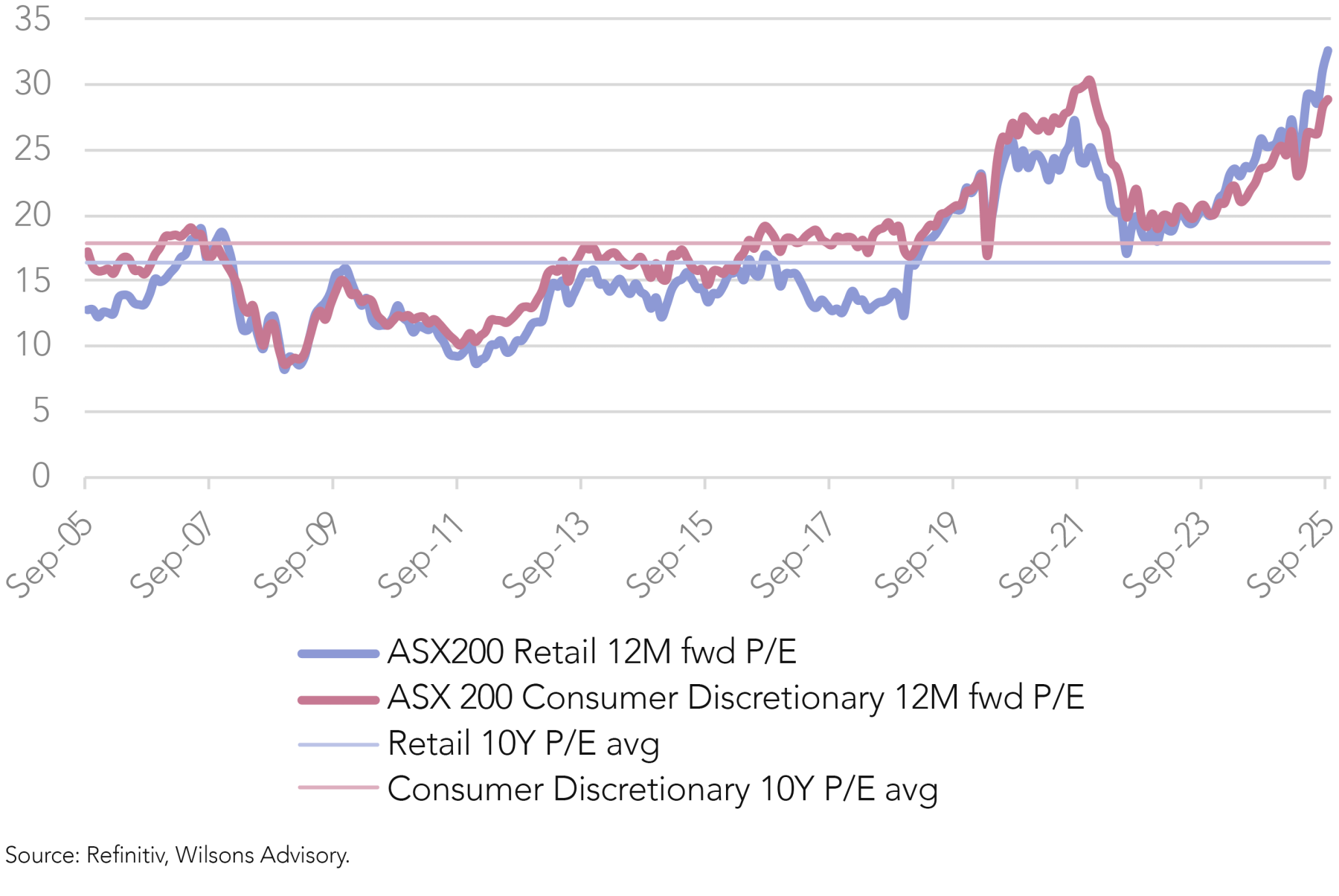

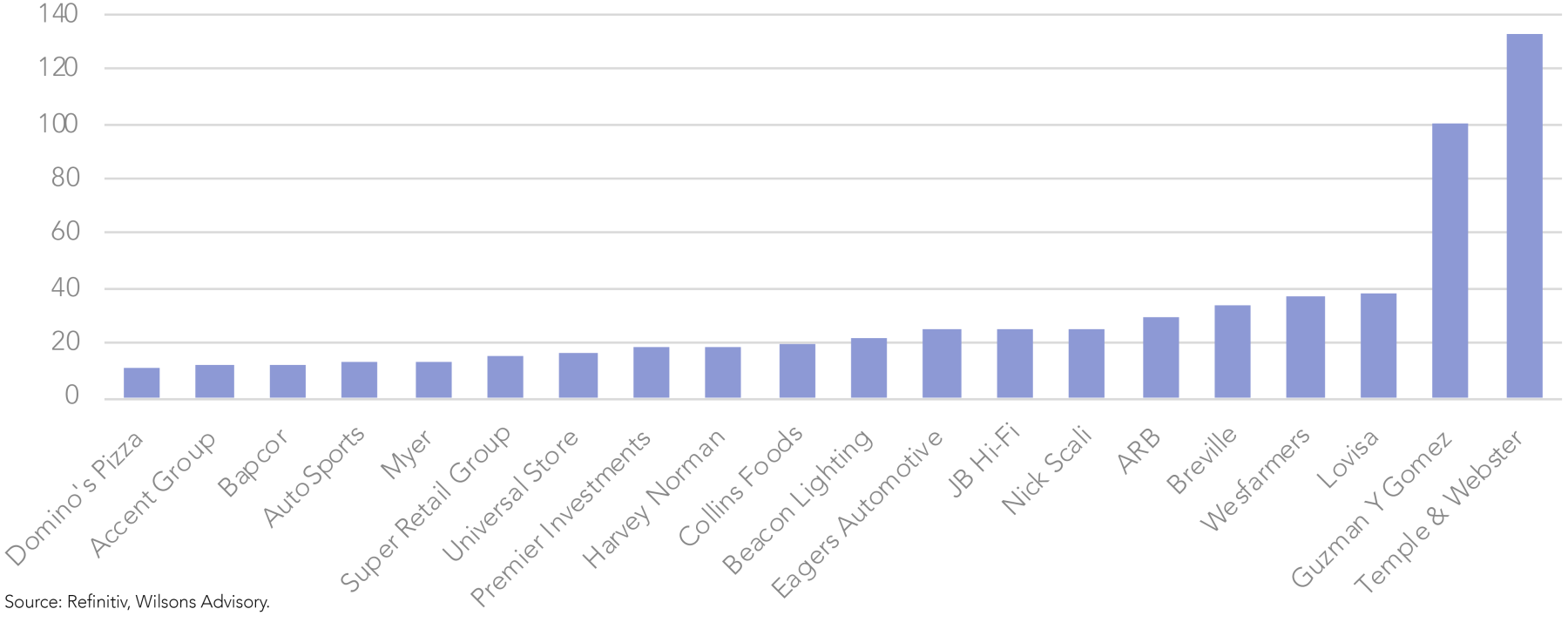

Despite these positive dynamics, current valuations are a challenge. Consumer Discretionary companies, particularly in Retail, have significantly re-rated and are trading at the highest point of at least the past two decades. Despite the sector-wide re-rate, we have identified a few key opportunities that balance out strong EPS growth while still offering a fair entry point.

Discretionary Earnings Momentum is Inflecting Upwards

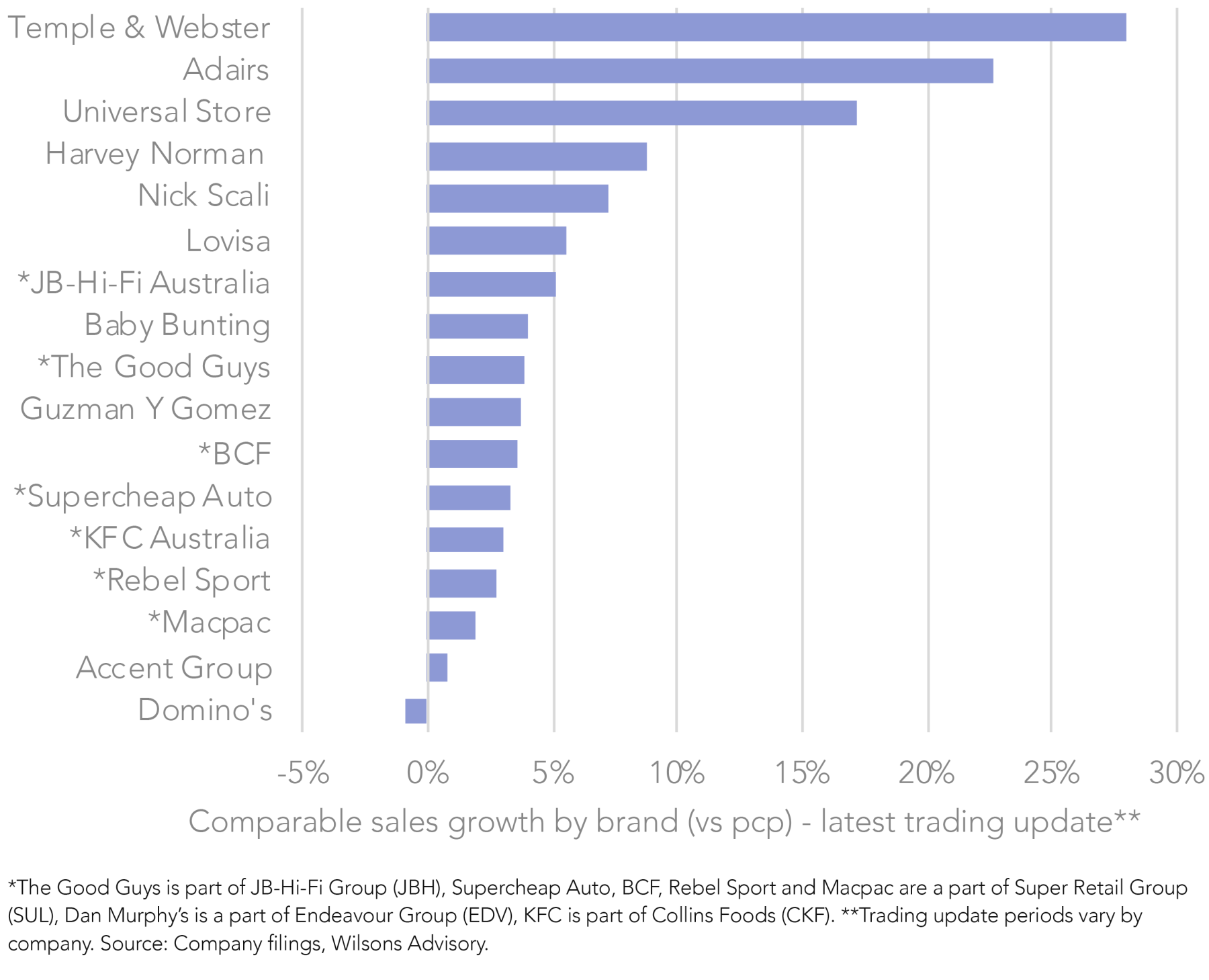

We saw a clear improvement in consumer spending throughout the August 2025 reporting season, with the latest trading updates from across the Consumer Discretionary sector showing accelerating sales momentum. In these early FY26 trading updates, median comparable same store sales growth sits at ~4%.

Encouragingly, momentum has been broad-based, spanning everything from Apparel & Accessories (Universal Store, Lovisa), Electronics (JB Hi-Fi), big-ticket items like Furniture & House Goods (Temple & Webster, Harvey Norman, Adairs, Nick Scali) and Autos & Accessories (Eagers, Autosports Group). Card spending data released by CommBank also shows a marked increase in discretionary spending across all age cohorts under the age of 65 between April and June 2025 (compared to the pcp), which indicates interest rate cuts are translating to stronger consumption among mortgage holders.

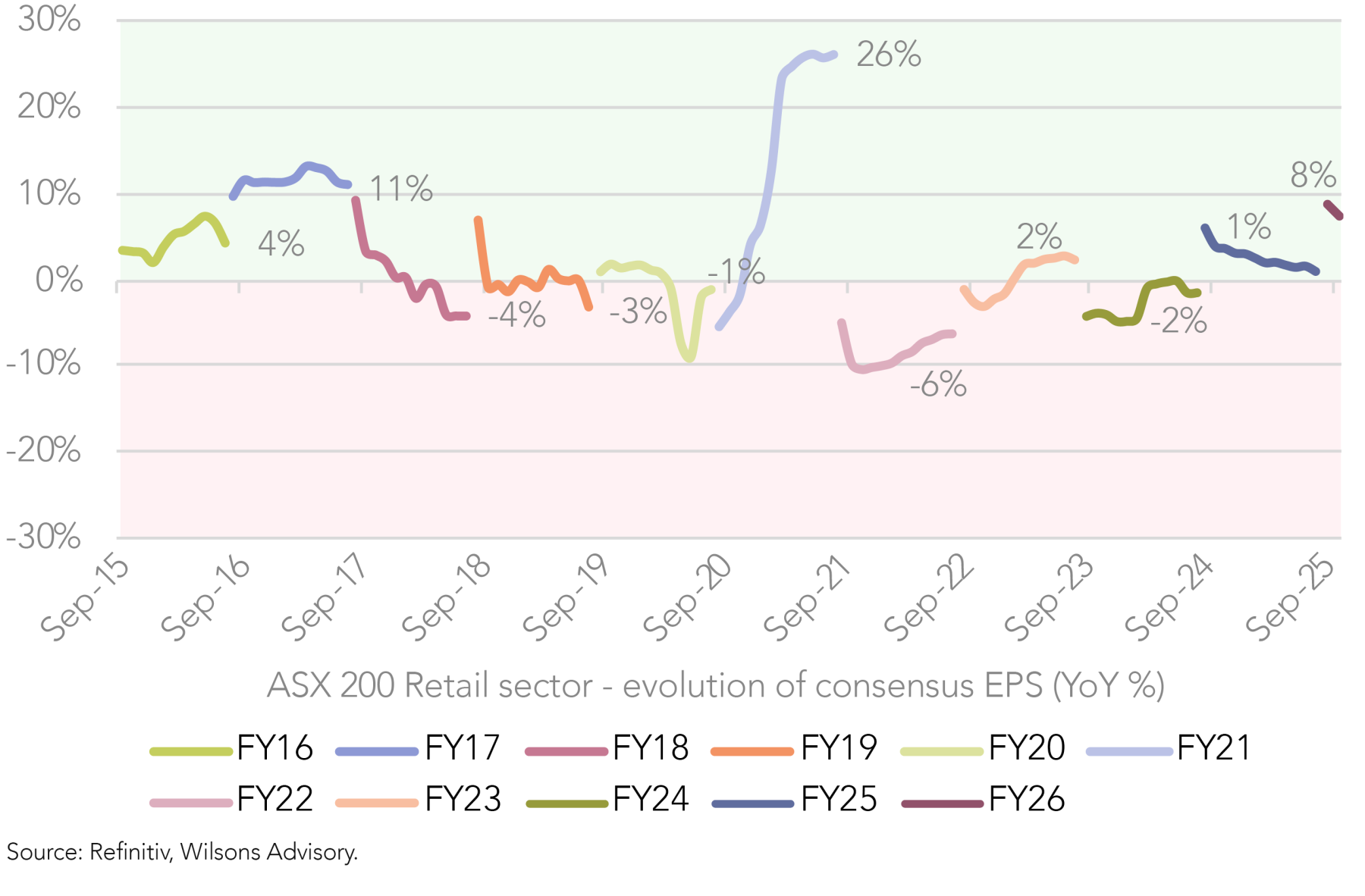

The combination of the start of top line recovery and natural operating leverage associated with the fixed cost based of retailers (particularly brick & mortar stores) have resulted in a positive forward earnings outlook for the sector. After a few years of negative to low single digit EPS growth, the sector is now at an inflection point from an earnings point of view. Consensus is now expecting FY25-28 EPS CAGR of high single digits in Retail and low double digits in Consumer Discretionary.

Valuations Appear Stretched at the Sector Level

While the Consumer Discretionary sector’s earnings outlook has started to materially improve, this needs to be balanced against generally demanding valuations, particularly within the Retail sector.

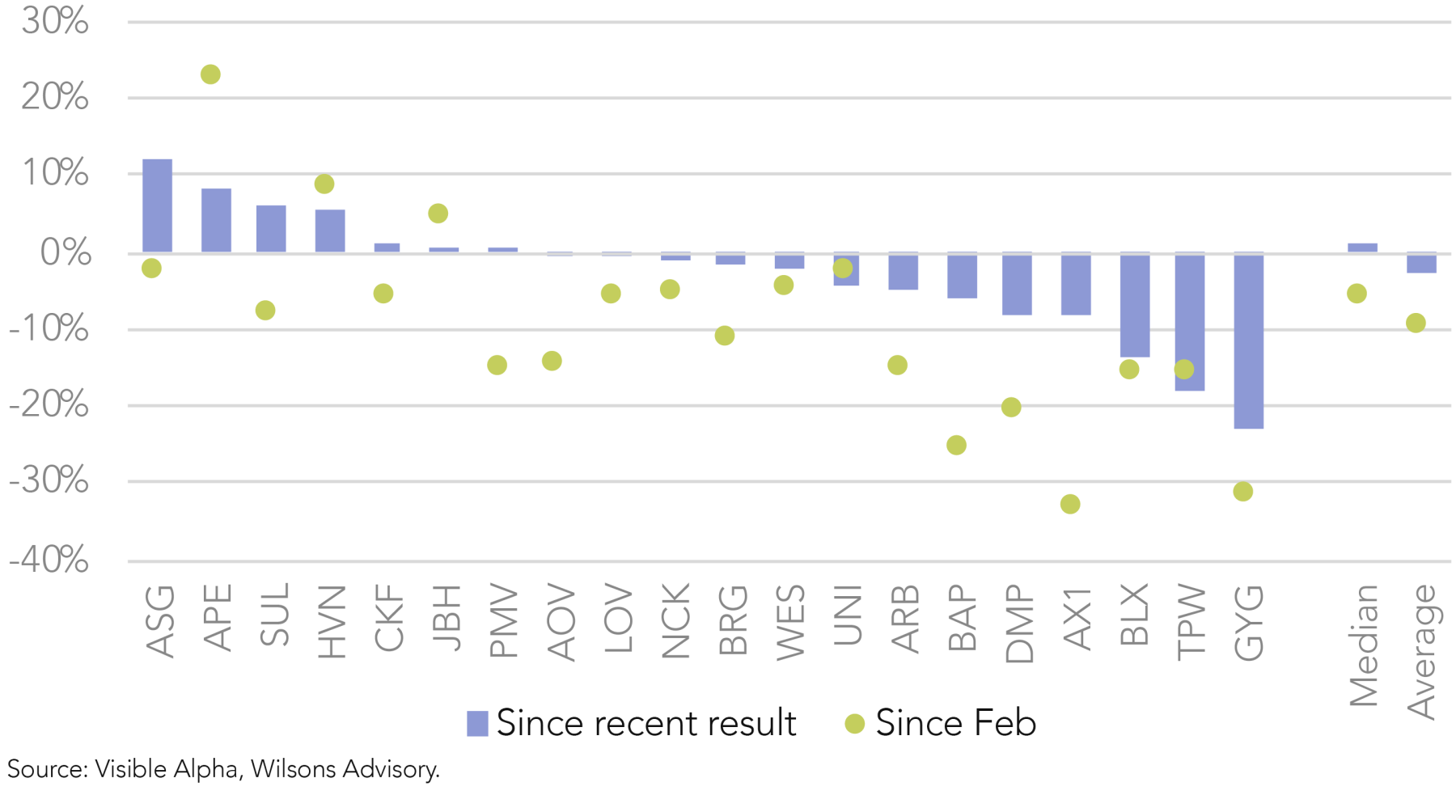

Valuation multiples within the sector have re-rated significantly over the last 12-18 months, well ahead of any improvements in the macro environment and despite relatively broad-based consensus earnings downgrades in this timeframe. This implies the market has been willing to look through near-term macro headwinds and earnings downgrades and has ultimately priced in a consumer recovery for some time now, leaving little value at the sector level.

Most notably, index heavyweight Wesfarmers has re-rated to a forward P/E of ~37x, which is comfortably a new all-time high for the business, well above prior cycle highs and its long-run trading range of ~15-20x. The company also trades on a substantial premium to best-in-class offshore retail comps like Home Depot (~27x) and Lowes (~21x). Similarly, JB Hi-Fi’s forward P/E multiple has risen to ~25x, which is a post-GFC high and comfortably above its long-run trading range of ~10-15x.

While both businesses are among Australia’s highest quality retail businesses – as ‘category killers’ in their respective segments with strong competitive advantages supporting continued market leadership – elevated earnings multiples create a balanced risk/reward trade-off at this juncture. Accordingly, notwithstanding their quality and the supportive macro dynamics, the Focus Portfolio has zero exposure to both these names due to valuation concerns.

Screening the Consumer Discretionary Sector

Despite a strong sector re-rating, there are still opportunities available that provide leverage to the consumer rebound, while also offering reasonable entry valuations. These include Collins Foods (Focus Portfolio 3%), Autosports Group and Universal Store.

| Name | Ticker | Market cap ($m) | Current fwd P/E |

5Y avg | +/- vs sector | +/- 5yr avg | FY25-28 EPS CAGR |

PEG ratio | 12M fwd EPS revisions - last 90 days |

| Universal Store | UNI | 677 | 16.5 | 13.64 | -43% | 21% | 28% | 0.6 | -4% |

| Autosports Group | ASG | 668 | 12.5 | 8.36 | -57% | 50% | 22% | 0.6 | 14% |

| Myer | MYR | 1,045 | 13.0 | 11.53 | -55% | 13% | 19% | 0.7 | -4% |

| Collins Foods | CKF | 1,263 | 19.4 | 18.92 | -33% | 3% | 18% | 1.1 | -1% |

| Accent Group | AX1 | 824 | 12.3 | 14.47 | -57% | -15% | 11% | 1.1 | -14% |

| Nick Scali | NCK | 2,068 | 25.0 | 14.25 | -13% | 76% | 21% | 1.2 | -3% |

| Domino's Pizza | DMP | 1,275 | 10.6 | 30.29 | -63% | -65% | 9% | 1.2 | -17% |

| Beacon Lighting | BLX | 732 | 21.3 | 16.76 | -26% | 27% | 15% | 1.5 | -8% |

| Harvey Norman | HVN | 9,096 | 18.4 | 12.8 | -36% | 44% | 12% | 1.5 | 6% |

| Guzman Y Gomez | GYG | 2,551 | 100.6 | 160.99 | 249% | -38% | 59% | 1.7 | -24% |

| Bapcor | BAP | 1,090 | 12.5 | 16.58 | -57% | -25% | 8% | 1.6 | -24% |

| Temple & Webster | TPW | 2,826 | 132.5 | 96.89 | 360% | 37% | 67% | 2 | -18% |

| Lovisa | LOV | 4,297 | 37.8 | 31.2 | 31% | 21% | 21% | 1.8 | -2% |

| Eagers Automotive | APE | 7,221 | 24.7 | 14.77 | -14% | 67% | 12% | 2.1 | 3% |

| Premier Investments | PMV | 3,357 | 18.0 | 18.36 | -38% | -2% | 9% | 2 | -1% |

| Super Retail Group | SUL | 3,783 | 15.5 | 13.31 | -46% | 16% | 7% | 2.2 | 6% |

| ARB | ARB | 3,244 | 29.5 | 27.87 | 2% | 6% | 12% | 2.5 | -6% |

| Breville | BRG | 4,684 | 33.3 | 30.77 | 16% | 8% | 10% | 3.4 | -4% |

| JB Hi-Fi | JBH | 12,906 | 24.8 | 15.87 | -14% | 56% | 8% | 3.3 | 2% |

| Wesfarmers | WES | 105,300 | 36.5 | 26.05 | 27% | 40% | 8% | 4.5 | -4% |

Source: Refinitiv, Wilsons Advisory.

Collins Foods (CKF) – Original Recipe for Success

CKF is held in the Focus Portfolio at a weight of 3%.

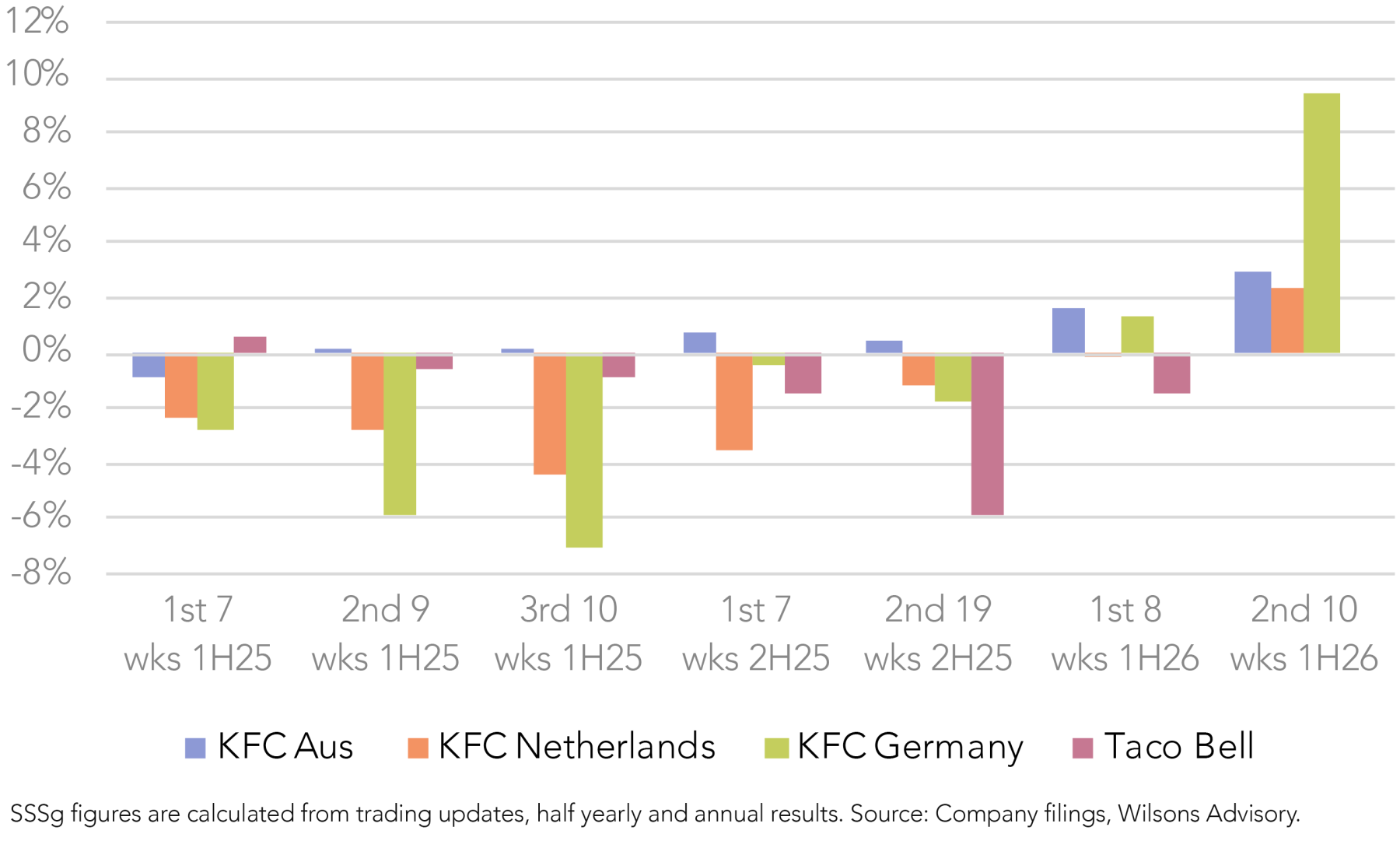

CKF is the largest franchisee of KFC restaurants in Australia with 285 outlets, while also operating a further 74 stores across the Netherlands and Germany. We are attracted to the strength of the KFC brand (particularly in Australia), the company’s strong cash conversion, and significant long-term growth opportunities through store rollout – particularly in Europe.

Earnings are at an inflection point

In addition, CKF’s earnings are at an inflection point, with its earnings leveraged to a cyclical recovery in domestic consumer spending over the near-term. The business is already starting to benefit from a stronger consumer backdrop following successive rate cuts, positioning it for a recovery in top line growth and margins that will underpin strong earnings growth.

CKF’s most recent trading update demonstrated strength in KFC Australia’s same store sales growth (SSSg), which accelerated to +3% in the 10 weeks up to 31 August.

This strength in SSSg, together with continued operational excellence, underpins margin improvement. We expect this will continue as the business sees further cost deflation, operating leverage and eventually, menu price increases.

Valuation remains attractive

Despite its recent rally, CKF still offers compelling value at a forward PE of ~19x, alongside a 3 year EPS CAGR of ~20%, implying an attractive PEG ratio of ~1.1x.

Autosports Group (ASG) – Earnings Are Shifting to a Higher Gear

ASG is represented in Invest Now as one of our highest conviction small and mid cap investment ideas from the Wilsons Advisory Research team’s coverage.

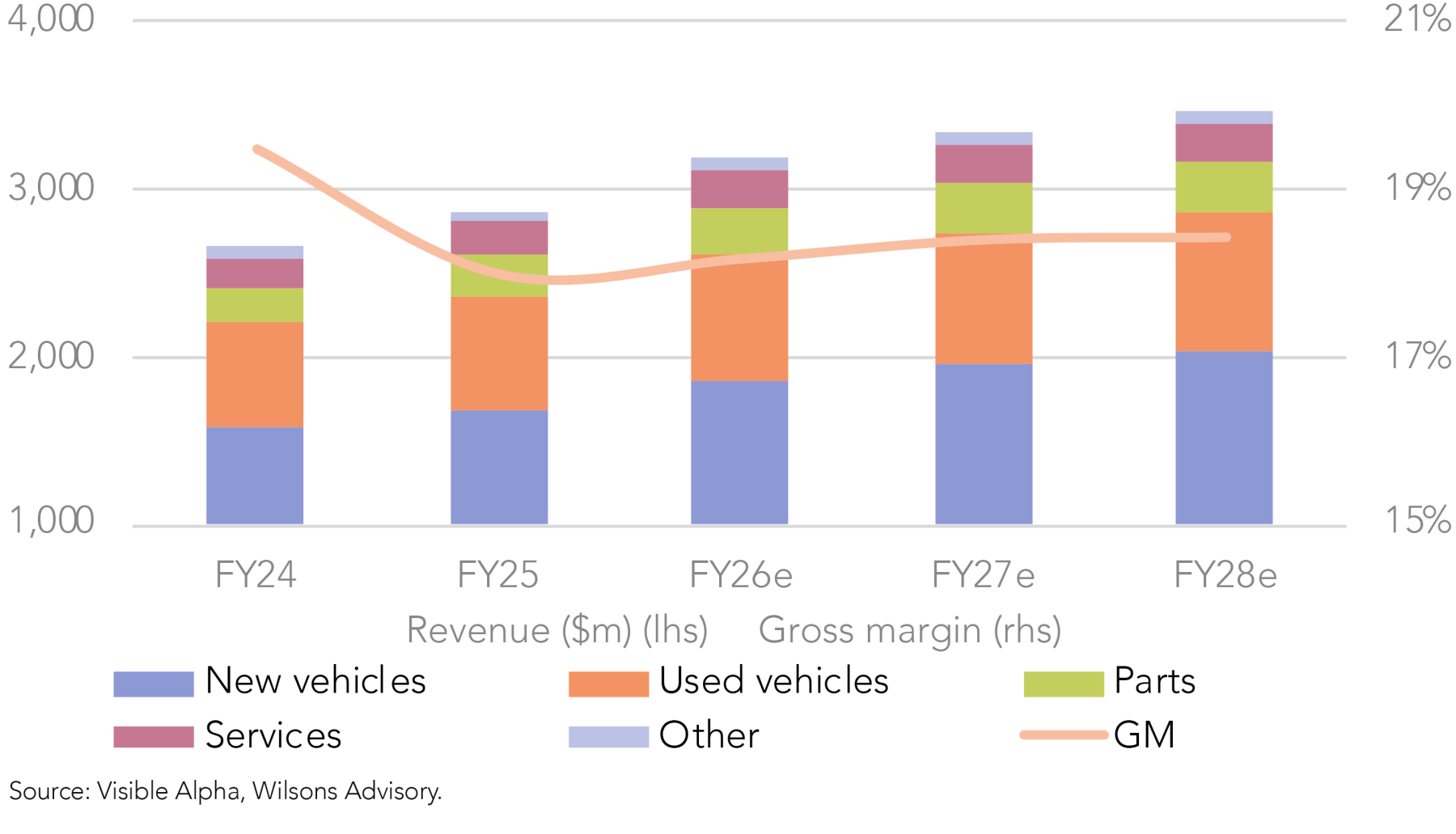

ASG is an Australian automotive dealer that focuses on luxury new vehicle sales, while also selling used vehicles, aftermarket parts and providing services (i.e. repair, distributing finance/insurance products). ASG is well-positioned for growth as industry headwinds start to unwind, it has the balance sheet capacity to fuel growth and still screens attractively valuation-wise.

We are attracted to ASG at this juncture for three key reasons:

- Improving industry dynamics –

the recent FY25 result confirmed that new vehicle order writes and gross margin improved through 2H25. This was evidence that industry conditions have turned, after a period of normalisation following elevated gross margins due to post-Covid supply chain disruptions. Encouragingly, July trading has started on a strong note, with revenue up ~13.5% vs the pcp, and new vehicle order writes are up 20.2% vs the pcp. This further reinforces our positive outlook as the RBA eases monetary policy. Furthermore, the Federal Government is considering scrapping the luxury car tax, which would further support demand. - Industry consolidation tailwinds –

the prospect of further industry consolidation as OEMs rationalise their networks is a positive for ASG. This is because ASG has greater operational scale relative to other dealers and the balance sheet capacity (including a recently announced $350m debt facility) to fund EPS accretive dealership acquisitions. - Attractive valuation –

while stock has re-rated, ASG’s valuation still remains attractive at a forward P/E of 13.5x, which is at a discount to other interest-sensitive consumer names shown in Figure 6. Furthermore, its current discount of 48% to leading auto dealer peer Eagers (APE) (26x) is below its average of 41%, demonstrating that ASG still offers good value, particularly considering a 3 year consensus EPS CAGR of ~22%, implying a PEG ratio of just 0.6x.

Universal Store – A Thrilling Set-up

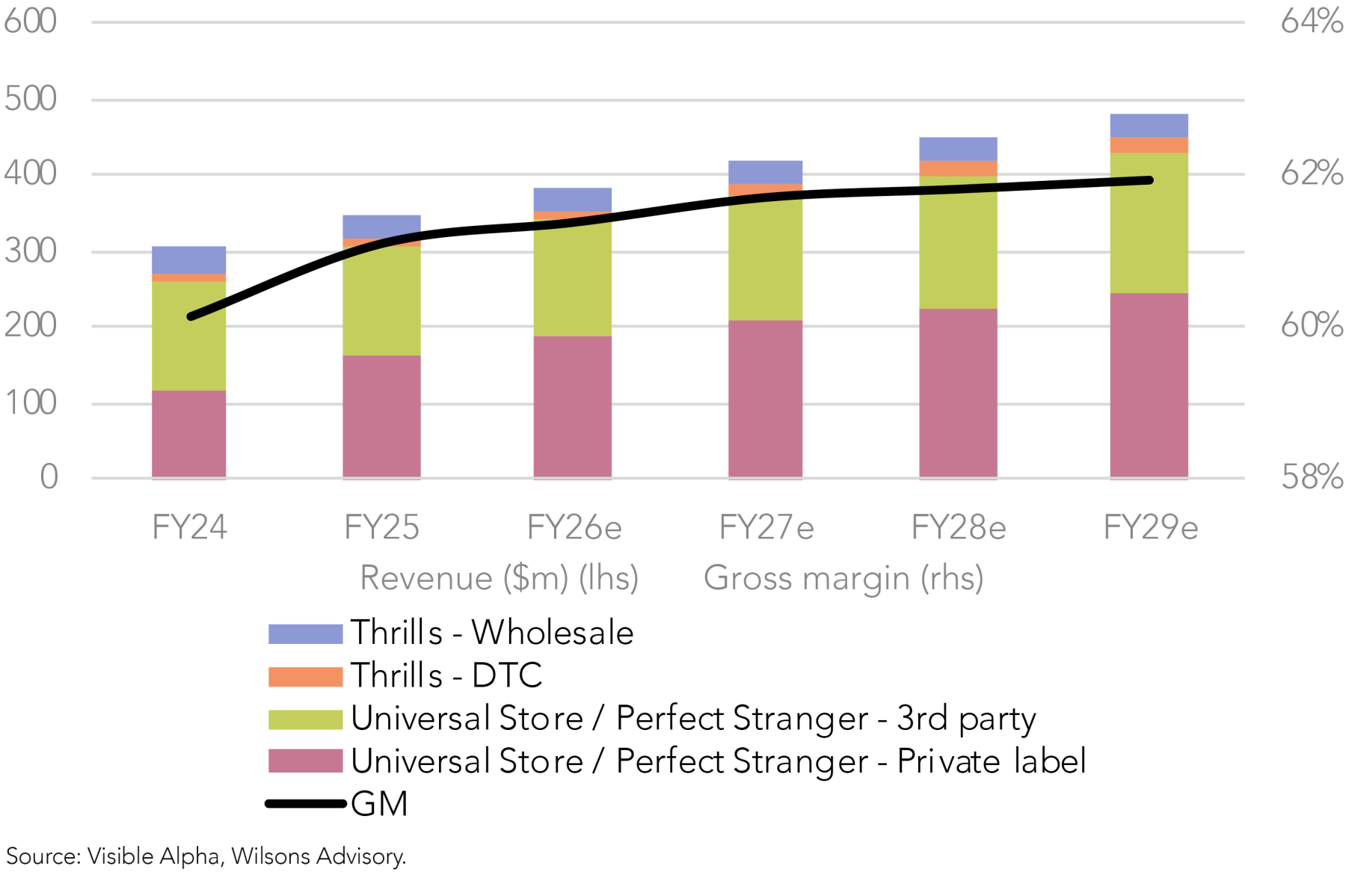

Universal Store (UNI) is a specialty retailer of casual and youth (15–35) apparel with a fast-growing brand portfolio: Universal Store (US), Perfect Stranger (PS) and Cheap Thrills Clothing (CTC). We suggest UNI for the following reasons:

Private brand penetration is driving margins

UNI is expanding private label penetration across its portfolio, delivering higher gross margins. This is predominantly due to:

- Direct sourcing – UNI cuts out third parties and buys directly from manufacturers, lowering per-unit costs. This has expanded from 18% of private label goods in FY20 to 76% recently.

- Pricing power and exclusivity – Its sought-after private brands are exclusive to UNI stores, giving them pricing power.

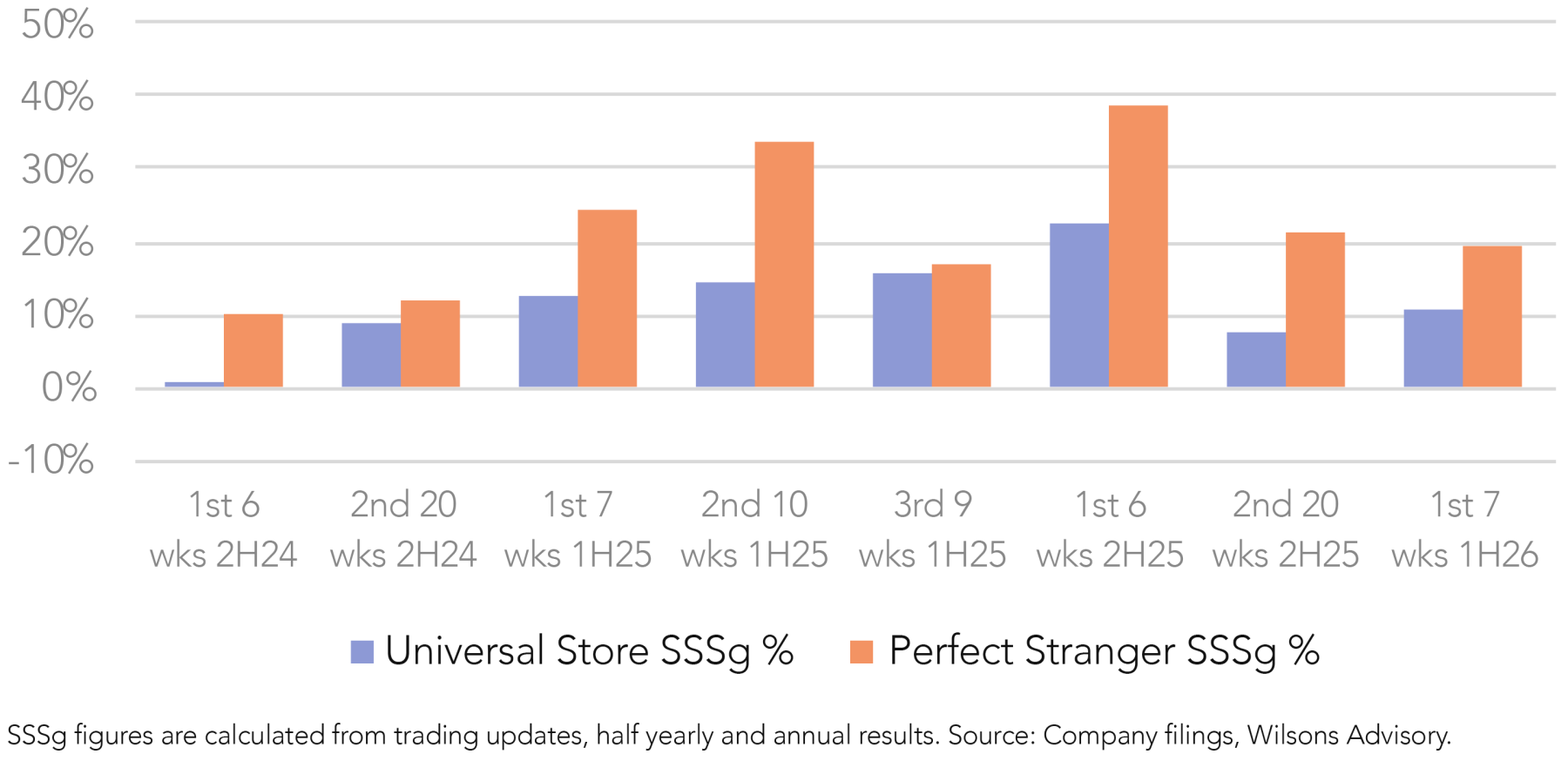

Its most successful private label, Perfect Stranger, now has standalone stores, which are group margin drivers as they overwhelmingly sell private brands. Due to the success of in-house brands such as Perfect Stranger and Neovision, UNI's private label penetration has increased from 30% to 55% in the past five years, with further scope to increase.

Operational excellence catered to a resilient customer base

Despite cost-of-living pressures, UNI’s youth customer base has been resilient, prioritising discretionary apparel spending, with UNI’s brand positioning resonating strongly with its base. Recent CBA data has shown that general discretionary spending among this demographic has been materially boosted by rate cuts, which positions UNI well.

Management continues to operate with excellence despite the backdrop, and is currently focused on: targeted discounts to move slow moving categories; expanding in-demand products and using data to quickly replenish winners; improving store layouts to advertise in-demand products prominently; and increasing cross-merchandising to expand basket sizes.

Good value for its growth prospects

Despite having a strong share price run, UNI still offers compelling value given its strong outlook. At a forward P/E of ~16x, it trades at over a 40% discount to the sector, while offering one of the strongest medium-term EPS growth rates of 28% from FY25-28. This gives it a PEG of just 0.6, one of the most attractive in the sector, as seen in Figure 6. Despite strong comps, UNI is continuing its impressive streak in same store sales, demonstrating its attractive growth story.

Written by

Greg Burke, Equity Strategist

Greg is an Equity Strategist in the Investment Strategy team at Wilsons Advisory. He is the lead portfolio manager of the Wilsons Advisory Australian Equity Focus Portfolio and is responsible for the ongoing management of the Global Equity Opportunities List.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.