For a decade, the large US tech stocks have been producing great returns, underpinned by strong earnings growth, and have outperformed the broader US market most years.

Yet more recently returns have also been solid across a wide range of US stocks, and many are adopting the technological advances being driven by the Mag 7.

Below we take stock of the recent performance and consider some opportunities for diversification in the US beyond the mega caps.

- Stocks have widely participated in the rally and not only the largest ones. With the S&P 500 Index looking on track to produce a return of close to 20% again this year, the average stock in the index has recorded a return of over 10% to date (as indicated by the Equal Weighted Index) for the third year in a row, highlighting the breadth of the rally. In the early months of the year, it might not have seemed likely, with the US Administration’s sweeping policy changes, particularly to tariffs. But some compromises and the adaptability of US companies have continued to enable the strong market earnings growth that has been a feature of recent years.

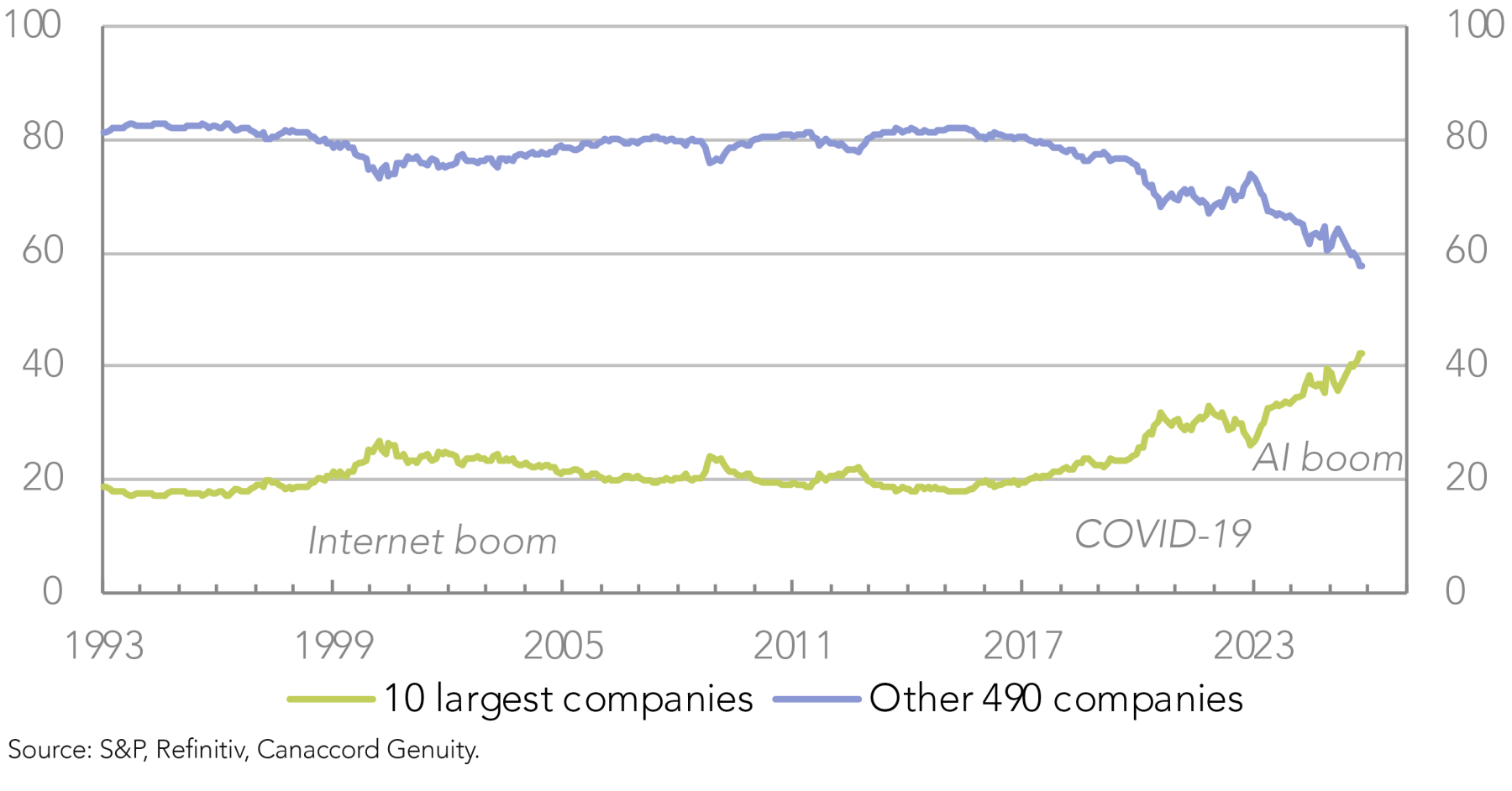

- The large tech stocks have led the way but broader returns indicate a breadth of performers. The “Magnificent Seven” have continued their remarkable run of extraordinary returns this year, extending their domination of the market (Figure 1). And as they upscale investment in artificial intelligence, as a growth driver it may sustain their high valuations and returns again in the coming year. Yet across the wider US market – from industrials and utilities to finance and healthcare – returns have also been solid and growth expectations might be more easily exceeded. And with the broadening adoption of AI and cloud advances, there is a widening range of plays on tech beyond the Mag 7.

- The range of options seems to make the case for maintaining diversification in the US. With the Mag 7 such a large part of the market and driving the technology advances, they will remain a key focus. But other stocks still make up the majority of the S&P 500’s capitalisation, and some sectors other than tech still individually comprise around 10% or more of the market. Like the Mag 7, a lot of these US companies are well known, but many are changing with the rate of innovation, as well as new industry leaders emerging, and in this report, we highlight some that could be attractive for Australian investors and provide diversification in the US market.

More Variety

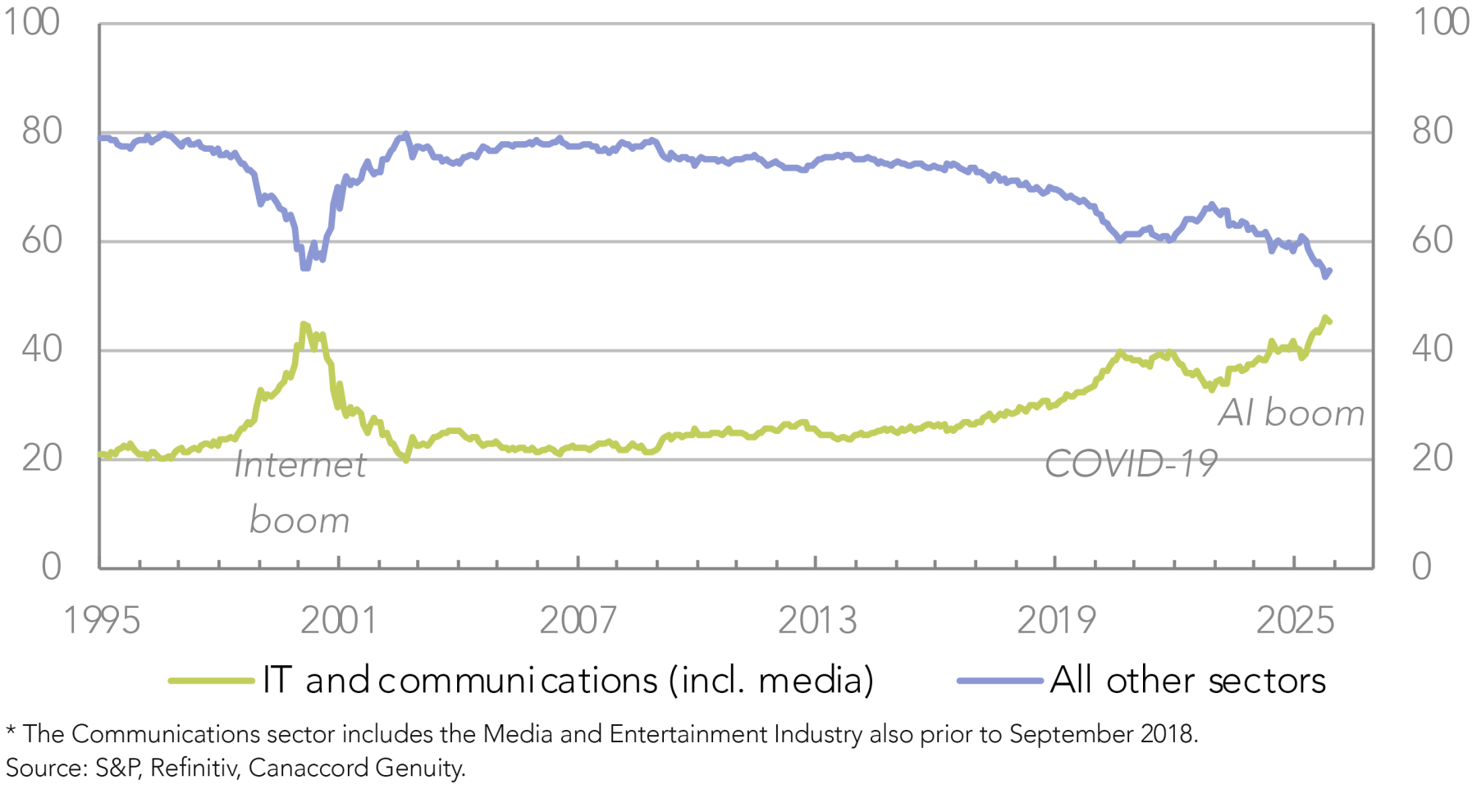

With the US market’s largest stocks mostly tech companies, the concentration of the S&P 500 evident in Figure 1 is also reflected in the large, combined weighting in the index of the IT and Communications sectors, which now comprise around half of the index’s capitalisation, similar to the internet boom a quarter of a century ago (Figure 2). Incidentally, this similarity may be a more meaningful way of considering if the current situation is comparable to the earlier boom, as there are differences between the two periods that may make other comparisons less categoric.

For example, compared to the Mag 7 that make up much of these tech sectors today, a group of less dominant companies comprised them in the internet boom. Hence, the earnings of the tech sectors in the two periods may not be equivalent and, in turn, the price to earnings (PE) ratios less comparable. Rather, it may be more meaningful to contrast the market capitalisation of the tech sectors across the two periods and the weighting within the index, as in Figure 2, as an indication of the sustainability of the scale in a market and economy that must have other sectors making up a reasonable share.

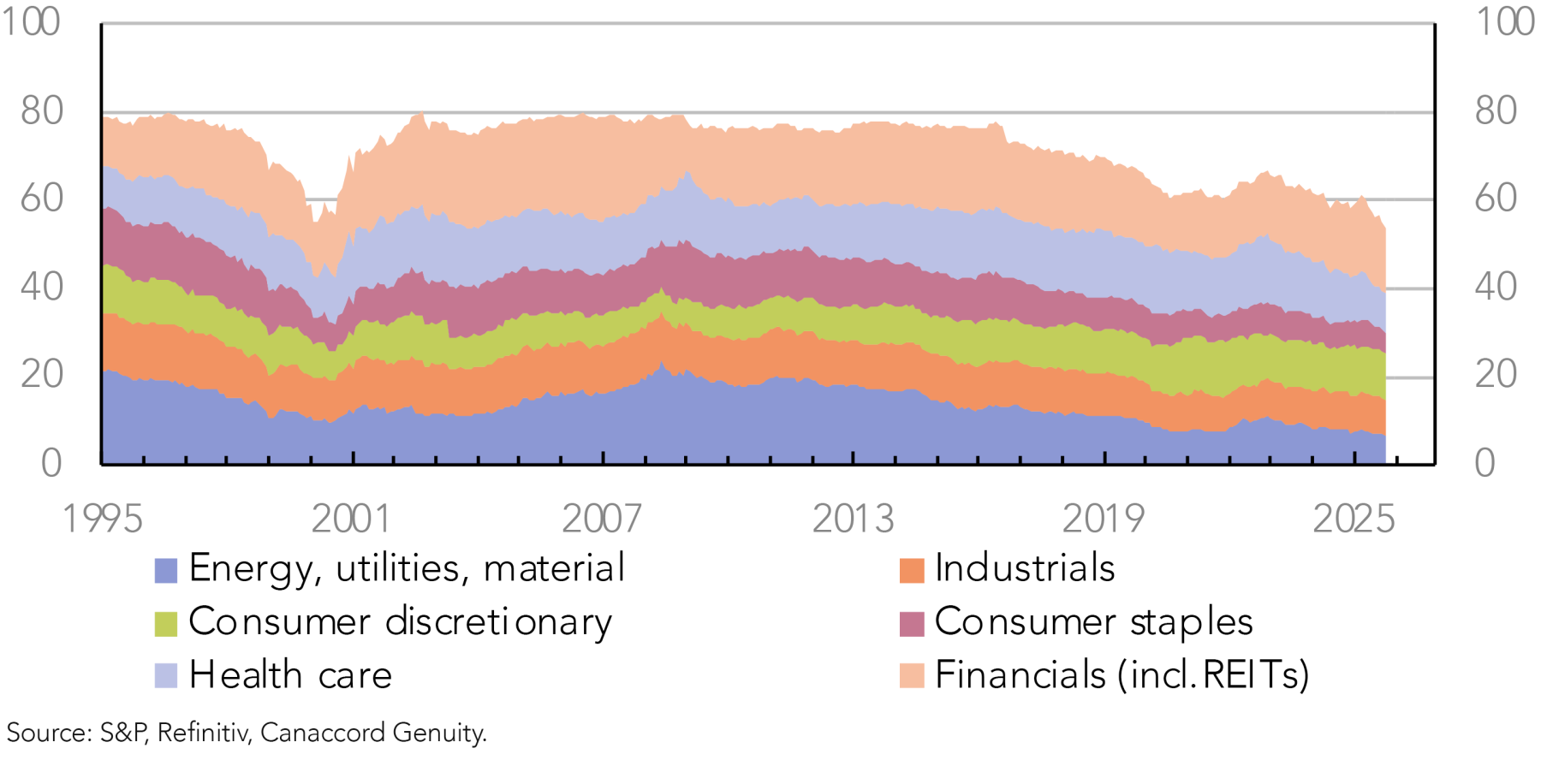

On this basis, the sector weights could be interpreted as indicating the current boom is of a similar scale to the earlier one. Also, like the earlier boom, all other sectors have fallen in weighting and are now comprising only a half of the market, compared to commonly making up three-quarters or more of the market before (Figure 3). These other sectors range from industrials and consumer sectors to finance, health care, and energy, utilities and materials, and are a reminder of the diversity of the market, as well as areas to look to when seeking diversification, even if they are a smaller share today.

Different Expectations

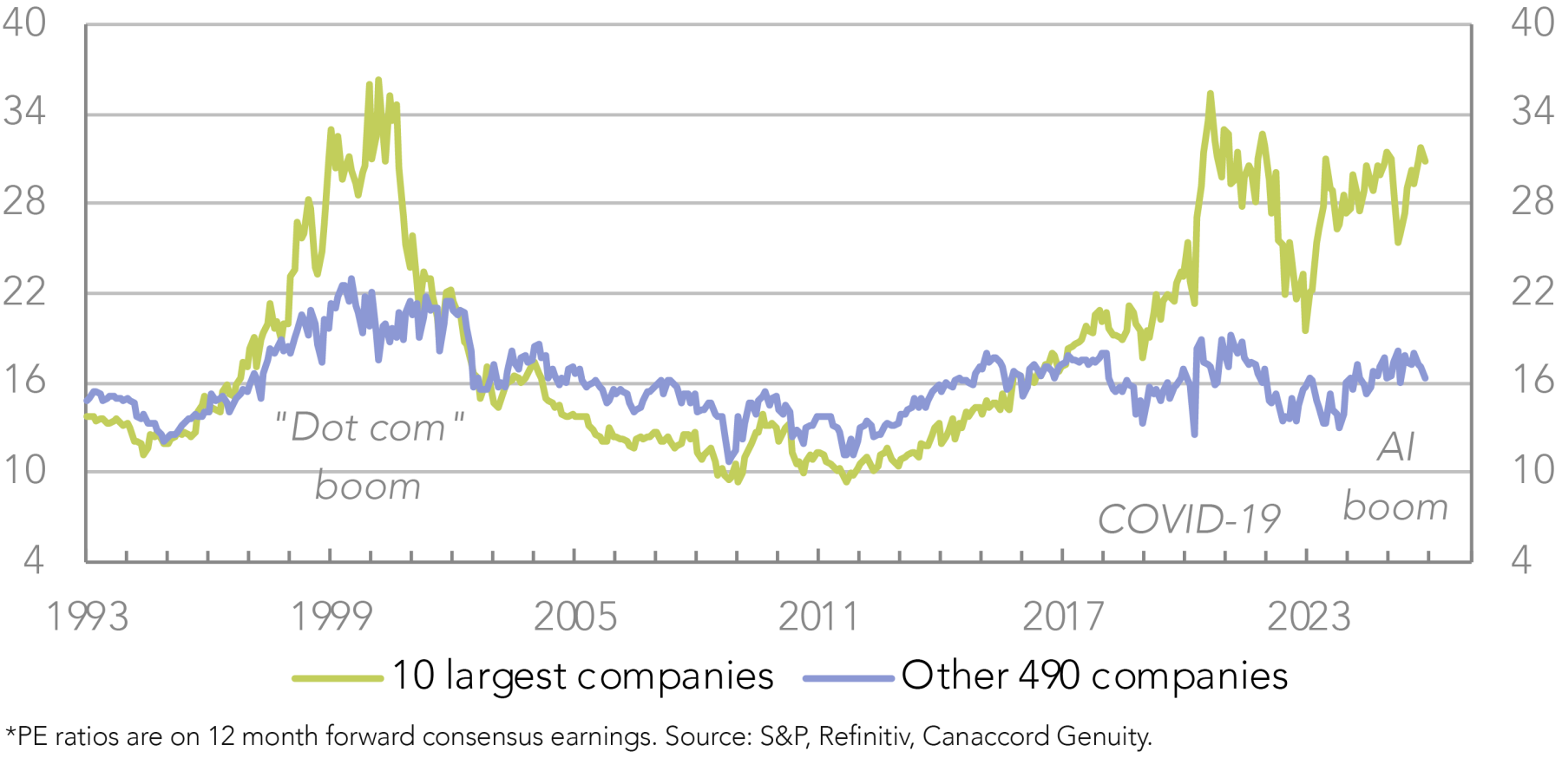

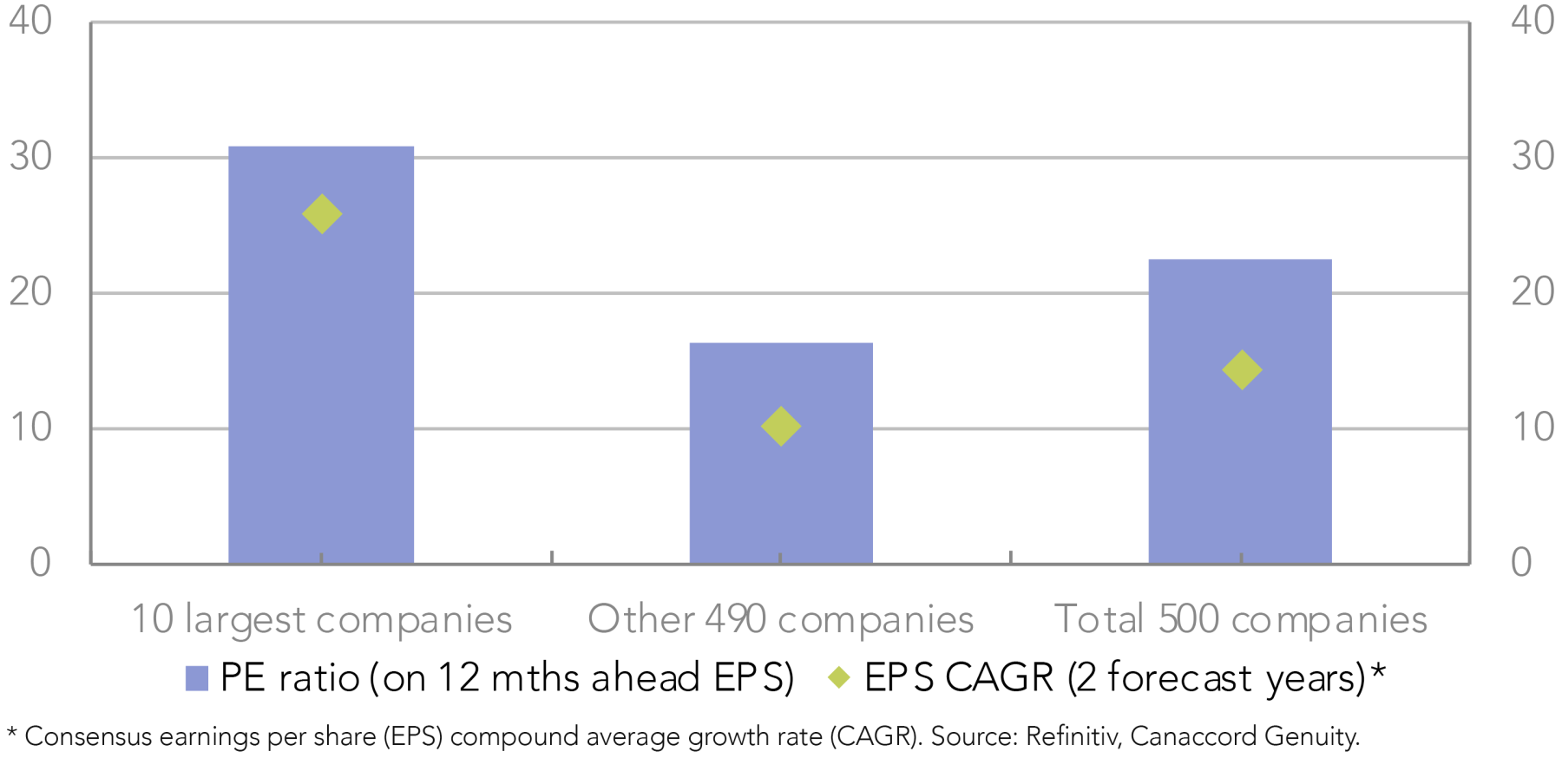

Of course, the recent rise of the large US tech stocks did not happen overnight. It’s been occurring for around a decade or more, and has been underpinned by strong earnings growth. The Mag 7 trade on high PE ratios but this is consistent with their record of strong growth, potentially continuing; while the rest of the market trades at a lower PE ratio after having had more moderate growth, which could also continue (Figure 4).

These differences are in fact forecast to extend in the coming year or so, and strong growth may sustain the high valuations and returns of the tech stocks, relative to more moderate growth in the rest of the market, though with lower valuations, expectations could be favourably exceeded there (Figure 5). For the companies, though many are international, the US is still their predominant market, and the economic outlook still seems solid, after resilience this year through the policy changes, and with interest rate cuts since mid-year potentially continuing.

Accordingly, the range of possibilities would seem to argue for maintaining diversification in the US market, and with the large tech companies well known and well held by investors, below we highlight some other US companies that could provide the desired diversification (Figure 6). Some if not all of these companies will also be well known, with many global businesses, and they represent a group of stocks spread across sectors predominantly other than tech, though include a number of innovative technology platforms. They span healthcare innovation, digital platforms, financial infrastructure, and essential services offering a mix of growth momentum and reasonable valuations.

Eli Lilly, Danaher, and Intuitive Surgical provide exposure to transformative healthcare trends including obesity treatments, biological drug manufacturing, and robotic surgery. Shopify, Booking, Intuit, and Uber capture secular digital commerce shifts with AI-powered platforms, with several trading below historical multiples despite accelerating growth. JPMorgan and Mastercard deliver financial services exposure combining franchise quality with reasonable valuations.

Home Depot and Union Pacific offer cyclical recovery opportunities at modest multiples. NextEra Energy positions for surging AI data centre electricity demand through renewable infrastructure.

Below we highlight the features of each in more detail (Figure 7).

| Company | Sector | Market Cap (US$bn) | P/E (12M Fwd) | P/E versus Historical* | Div. Yield (12M Fwd) | EPS Gth (3Y CAGR) |

| Booking Hldgs | Cons. Disc. | 169 | 19.7x | -15% | 0.8% | 18% |

| Danaher | Health Care | 161 | 27.1x | -2% | 0.6% | 7% |

| Eli Lilly | Health Care | 956 | 31.9x | -14% | 0.6% | 45% |

| Home Depot | Cons. Disc. | 355 | 23.4x | 7% | 2.7% | 3% |

| Intuit | IT | 194 | 27.8x | -20% | 0.7% | 14% |

| Intuitive Surgical | Health Care | 209 | 59.8x | 7% | 0.0% | 15% |

| JPMorgan | Financials | 878 | 14.9x | 24% | 2.0% | 8% |

| Mastercard | Financials | 493 | 28.8x | -11% | 0.6% | 15% |

| NextEra | Utilities | 174 | 20.9x | -12% | 3.0% | 8% |

| Shopify | IT | 212 | 90.0x | 29% | 0.0% | 21% |

| Uber | Industrials | 213 | 25.2x | -32% | 0.0% | -1% |

| Union Pacific | Industrials | 140 | 18.7x | -4% | 2.4% | 7% |

* P/E ratios are compared to 5-year historical average, except for Shopify and Uber which are compared to 2-year average. Source: Factset, Canaccord Genuity.

| Company | Ticker | Investment Summary |

Booking Holdings |

BKNG.NAS | Booking Holdings operates the world's leading online travel platform through Booking.com, Priceline, Agoda, KAYAK, and OpenTable, offering 8.6 million accommodation listings and restaurant reservations across 220+ countries. The company's 3Q FY25 results demonstrated strong execution with revenue up 13% and EPS up 19%, driven by room nights reaching 323 million (up 8%), accelerating US growth to high single digits, and the cost-saving program. The investment case centres on Booking capturing the secular shift toward integrated travel platforms. Key drivers include: first, the Connected Trip strategy of bundling services increases customer lifetime value and switching costs; second, Genius loyalty drives customers to return directly eliminating Google and affiliate fees, while processing 68% of payments earns incremental transaction revenue; third, AI tools and cost restructuring are reducing customer service expenses despite 10% higher volumes, supporting management's FY25 guidance of 180bps margin expansion and 20%+ EPS growth. Consensus forecasts 18% EPS CAGR through FY27, with the stock trading at 19x forward P/E versus its 23x five-year average, offering attractive value given expectations for accelerating growth and margin expansion. |

Danaher |

DHR.NYS | Danaher is a leading global life sciences and diagnostics innovator, providing critical instruments, consumables, and services across biotechnology (bioprocessing equipment and reagents), life sciences (research and analytical tools), and diagnostics (molecular diagnostics, clinical analysers, pathology solutions). The investment thesis rests on sustained bioprocessing momentum with Danaher's equipment and consumables supporting over 90% of global antibody-based drug production and high-single-digit growth expected through FY26, margin expansion trajectory with 100bps+ improvement guided for FY26 driven by productivity savings, and diversified exposure providing resilience as China diagnostics headwinds moderate. Consensus forecasts 7% annual EPS growth through FY27, with the stock trading at 27x forward P/E, broadly in line with its 28x five-year average. The company's 3Q FY25 results exceeded expectations with revenue up 4.5% and EPS up 10.5%. |

Eli Lilly |

LLY.NYS | Eli Lilly develops medicines treating diabetes, obesity, cancer, and Alzheimer's disease, with leading products including Mounjaro and Zepbound (incretin therapies for diabetes and weight management), Verzenio (breast cancer), and Kisunla (Alzheimer's). The company's 3Q FY25 results demonstrated strong momentum with revenue surging 54%, driven by Mounjaro and Zepbound sales more than doubling, while gross margin expanded to 83.6%. Key investment drivers include Lilly's dominant position in the rapidly expanding obesity and diabetes markets with Mounjaro launched in 55 countries, orforglipron (once-daily oral GLP-1) completing Phase 3 trials positioning for potential 2026 US launch to meaningfully expand market reach, and retatrutide (triple-agonist) delivering deeper weight loss for high-need patients, supported by raised FY25 guidance. At 33x forward P/E (below the 37x 5-year average), the valuation appears reasonable with consensus forecasting 45% annual EPS growth through FY27 as manufacturing expansion and pipeline execution underpin multi-year volume and margin opportunities. |

Home Depot |

HD.NYS | Home Depot is the world's largest home improvement retailer with over 2,300 stores and 780 SRS locations across North America, serving do-it-yourself customers and professional contractors through an integrated omnichannel platform offering building materials, tools, and installation services. The opportunity is underpinned by Home Depot's strategic focus on the professional customer segment, with the recent acquisitions of SRS Distribution and GMS positioning the company to capture share in the fragmented specialty trade distribution market, alongside a 5-year program to open 80 new stores. At 23x forward P/E (versus 22x 5-year average), the valuation remains reasonable given consensus forecasts of 7% annual EPS growth over FY27-28. The company's 3Q FY25 results delivered revenue growth of 3% while EPS declined 1%, with management noting the quarter was impacted by the absence of storm-related demand alongside continued consumer uncertainty and housing market pressures weighing on near-term spending. |

Intuit |

INTU.NAS | Intuit operates as a global accounting and financial technology platform serving approximately 100 million customers through TurboTax, QuickBooks, Credit Karma, and Mailchimp, delivering AI-driven done-for-you experiences that automate financial workflows for consumers and businesses. The company's 1Q FY26 results demonstrated exceptional momentum with revenue up 18% and operating income surging 97%, driven by QuickBooks Online accounting revenue growth of 25%, online payment volume growth of 29%, and QuickBooks Live customer growth of 61% as customers adopt assisted offerings. The investment case centres on Intuit's AI-driven expert platform advantage with 625,000 customer data points per business, powering automated workflows and predictive insights, mid-market disruption with Intuit Enterprise Suite and QBO Advanced growing 40% serving larger complex customers, and meaningful runway with only 6% penetration of an estimated US$300 billion addressable market. Consensus forecasts 14% annual EPS growth through FY28, with the stock trading at 26x forward P/E, below the 32x 5-year average despite improving fundamentals. |

Intuitive Surgical |

ISRG.NAS | Intuitive Surgical is the global leader in robotic-assisted surgery, operating the da Vinci and Ion systems that enable minimally invasive procedures across urology, general surgery, gynaecology, and thoracic specialties. The investment thesis rests on da Vinci 5 driving a powerful upgrade cycle, with 141 trade-in transactions in 3Q FY25 versus 38 a year ago and 18 of the largest 20 US hospital networks already adopting the platform. This supports an 85% recurring revenue mix providing visibility, while digital tools including Case Insights deepen customer lock-in and expand the competitive moat in robotic surgery. Consensus forecasts 15% annual EPS growth through FY27, with the stock trading at 59x forward P/E, a modest premium to its 56x 5-year average, reflecting the company's strengthening competitive position and durable recurring revenue model. The company's 3Q FY25 results demonstrated robust momentum with revenue up 23%, EPS up 30%, and worldwide procedure growth of 20%, with management raising FY25 procedure guidance to 17-17.5%. |

JPMorgan Chase |

JPM.NYS | JPMorgan Chase is one of the world's largest diversified financial services firms operating across Consumer & Community Banking, the Commercial & Investment Bank, and Asset & Wealth Management, with US$4.6 trillion in total assets. The 3Q FY25 result delivered strong momentum with revenue up 9% and EPS up 16%, driven by Investment Banking fees growing 16% as activity accelerated, Markets revenue surging 25% with Fixed Income up 21% and Equities up 33%, and the company retaining its #1 U.S. retail deposit position. Key drivers include franchise diversification across multiple high-quality businesses, strong capital generation enabling US$8 billion of quarterly buybacks, and market-leading positions across consumer banking, investment banking (#1 global wallet share), and wealth management. Consensus forecasts 8% annual EPS growth through FY27, with the stock trading at 15x forward P/E, a premium to the 12x 5-year average reflecting the franchise's quality and diversification. |

Mastercard |

MA.NYS | Mastercard operates the world's leading global payments network connecting consumers, financial institutions, merchants, and governments across 220 countries, processing transactions while providing value-added services including security solutions, consumer engagement, and business insights leveraging proprietary network data. The opportunity is underpinned by Mastercard's virtuous cycle where payment volume generates proprietary data that powers differentiated services (one-third now AI-powered) driving market share wins that increase transaction activity, with significant secular runway across consumer and commercial payment flows and services penetrating just 7% of serviceable markets. With consensus forecasting 15% annual EPS growth through FY27, the stock trades at 29x forward P/E, below its 32x 5-year average despite improving fundamentals. The company's 3Q FY25 results showed strong execution with net revenue up 17% and EPS up 13%, driven by processed volumes growing 9% and cross-border volumes growing 15%, while value-added services accelerated 25%, and operating margin expanded 50bps. |

NextEra Energy |

NEE.NYS | NextEra Energy operates America's largest electric utility (Florida Power & Light serving 12 million customers) and one of the nation's largest energy infrastructure developers (NextEra Energy Resources), building and operating renewables, storage, gas, nuclear, and transmission assets across the United States. The company's 3Q FY25 results demonstrated strong execution with EPS growing 10%, driven by FPL's regulatory capital employed growth of 8% and Energy Resources adding 3GW to its backlog including a record 1.9GW of battery storage origination, while announcing a landmark 25-year agreement with Google to restart the 615MW Duane Arnold nuclear plant. The investment case centres on NextEra's comprehensive development capabilities and national footprint positioning it to capture surging AI and data centre electricity demand. Consensus forecasts 8% annual EPS growth through FY27, while at 21x forward P/E (versus 24x 5-year average), the valuation remains attractive given the demand backdrop. |

Shopify |

SHOP.NAS | Shopify provides cloud-based software that enables businesses to create and operate online stores, process payments through integrated checkout systems, and manage inventory across websites, physical retail locations, social media, and B2B marketplaces, serving millions of merchants from first-time entrepreneurs to major brands like Estée Lauder. The investment thesis rests on Shopify's position to capture global e-commerce growth. Shopify is positioning itself for AI-powered commerce through its merchant assistant (Sidekick) and strategic integrations with major AI platforms. In addition, the company is expanding its addressable market through geographic growth, enterprise adoption, and merchant services (includes payment processing). Consensus forecasts 22% annual EPS growth through FY27, with the stock trading at 89x forward P/E (above its 70x 2-year average), reflecting market expectations for sustained execution across multiple growth initiatives. The company's 3Q FY25 results demonstrated strong momentum with revenue and gross merchandise value both accelerating to 32% (highest growth rate since 2021). |

Uber Technologies |

UBER.NYS | Uber operates a leading global mobility and delivery platform, connecting 189 million monthly consumers across 70 countries with rides, food delivery, and grocery & retail. The 3Q FY25 result demonstrated accelerating growth with Gross Bookings growing 21% (largest trip volume increase post-COVID), Mobility (rides) trips accelerating 21% and Delivery Gross Bookings up 24%, while EBITDA margin expanded 40bps. Key investment drivers include cross-platform monetisation with only 20% of consumers using both Mobility and Delivery (these users have 35% higher retention and spend 3x more), Uber One's (membership program) 36 million members increasing order frequency, autonomous vehicles targeted to be deployed across 10+ cities by end-2026, and grocery & retail approaching US$12 billion run-rate. With consensus forecasting 28% annual EBITDA growth through FY27, the stock trades at 25x forward P/E, below its 37x 2-year average, reflecting market uncertainty around autonomous investments despite platform advantages in aggregating demand across human and autonomous driver supply. |

Union Pacific |

UNP.NYS | Union Pacific operates North America's premier western railroad franchise, serving 23 states as the only railroad connecting all six US-Mexico gateways while transporting bulk commodities, industrial products, and premium freight across its 32,000-mile network. The opportunity is supported by Union Pacific's proposed merger with Norfolk Southern to create America's first modern transcontinental railroad eliminating interchange points and accelerating transit times, as well as operational improvement with consensus forecasting 7% annual EPS growth through FY27 targeting industry-leading margins, and management reaffirming multi-year targets despite near-term headwinds. Trading at 19x forward P/E (versus a 20x 5-year average), the valuation appears reasonable given strong execution, 2.6x debt-to-EBITDA, and the merger opportunity positioning the combined entity to capture trucking market share. The company's 3Q FY25 results demonstrated solid execution with EPS up 12% and operating margin expanding, driven by core pricing gains of 3.5% and record workforce productivity despite flat volumes. |

Source: Refinitiv, Wilsons Advisory / Canaccord Genuity.

Written by

Tony Brennan, Chief Investment Strategist

Tony Brennan is Canaccord Australia's Co-CIO, and brings over three decades of investment strategy experience from global investment banks including Citi, Deutsche, and Merrill Lynch in Australia, and UBS in New York, London and Sydney.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.