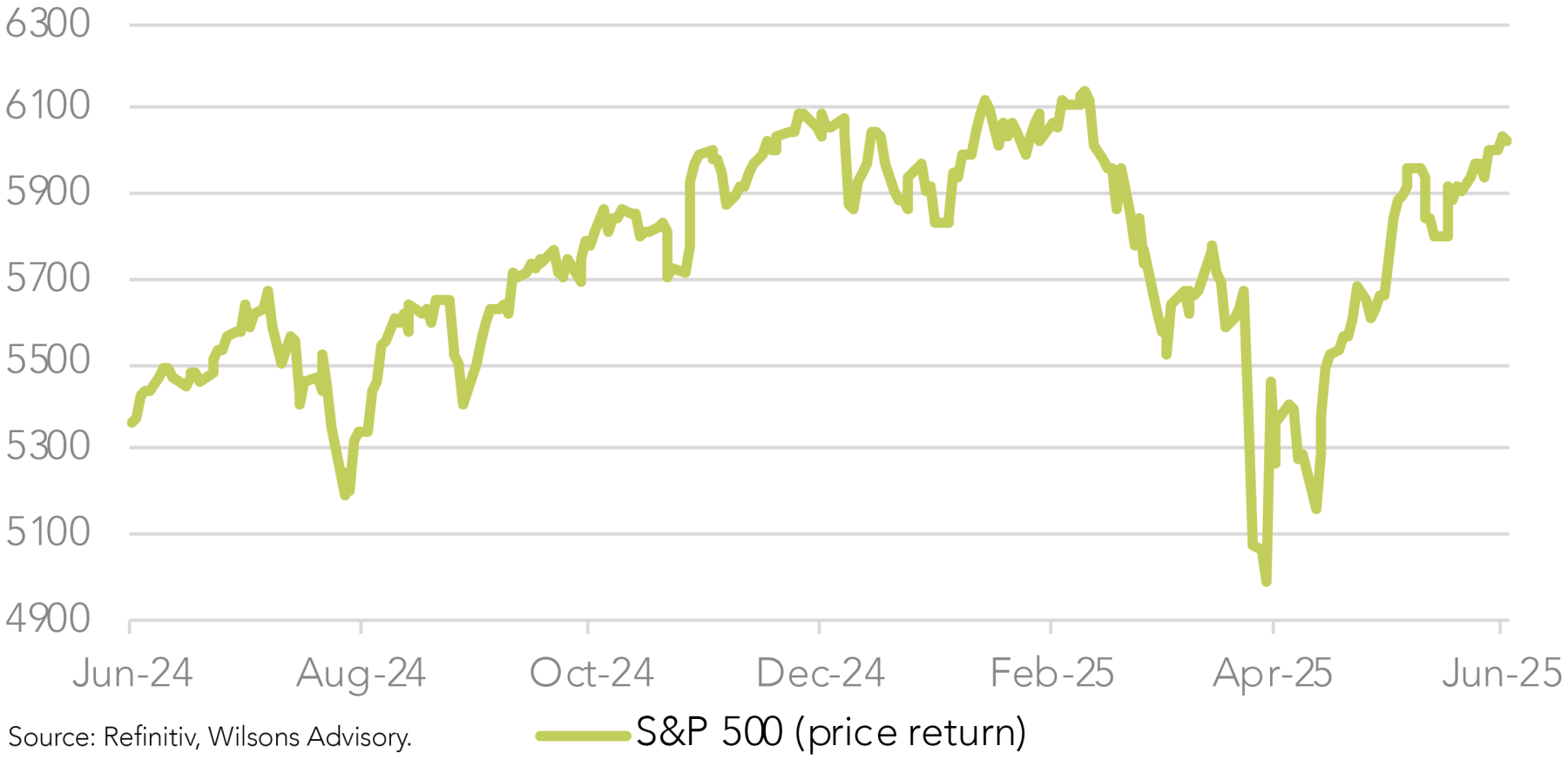

The US stock market continues to defy fears related to the Trump Administration’s volatile approach to economic and foreign policy.

The market’s surprisingly sharp bounce-back from its post-Liberation Day slump in early April has been driven by a combination of factors.

These include resilient (hard) economic data, an ongoing constructive corporate profit backdrop, hopes of further de-escalation of trade sanctions and conservative institutional positioning.

Hard Data Yet to Go Soft

The path of the US economy with respect to both growth and inflation is a key focus for investors post-President Trump’s recent chaotic policy announcements.

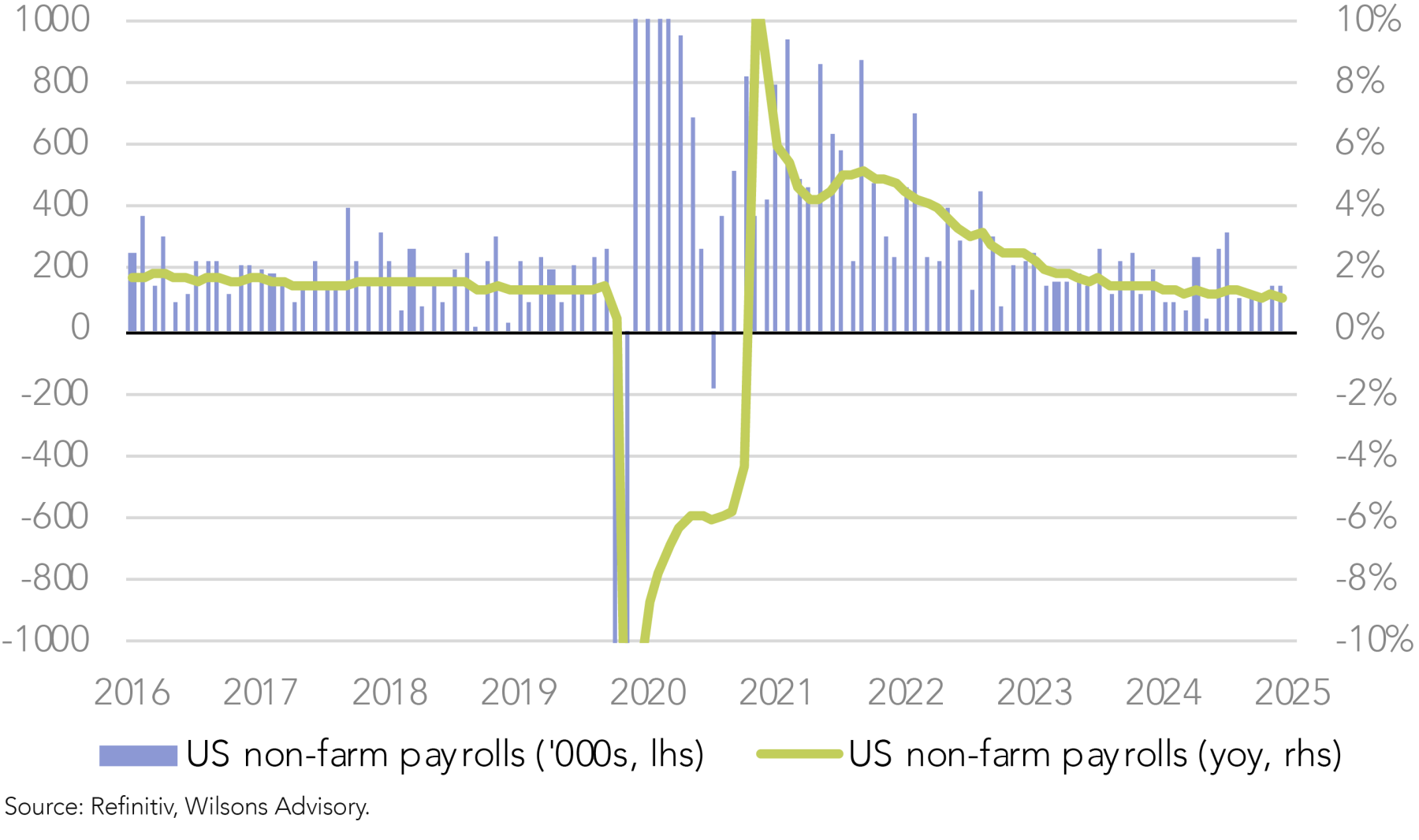

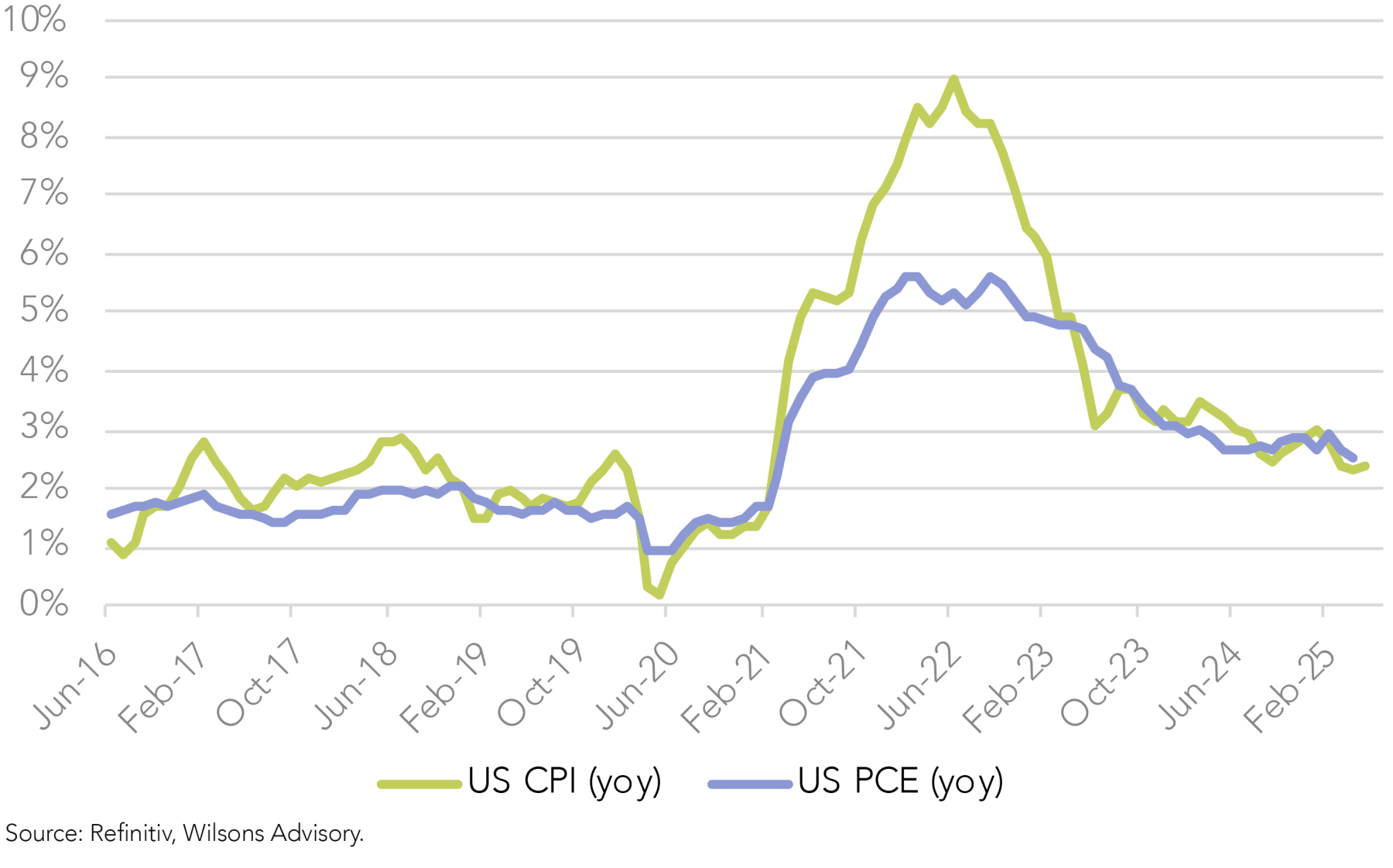

So far, the evidence from hard data continues to be benign. Key recent data points have been a better-than-expected - including the May - non-farm payroll report and last week’s lower than expected May CPI report.

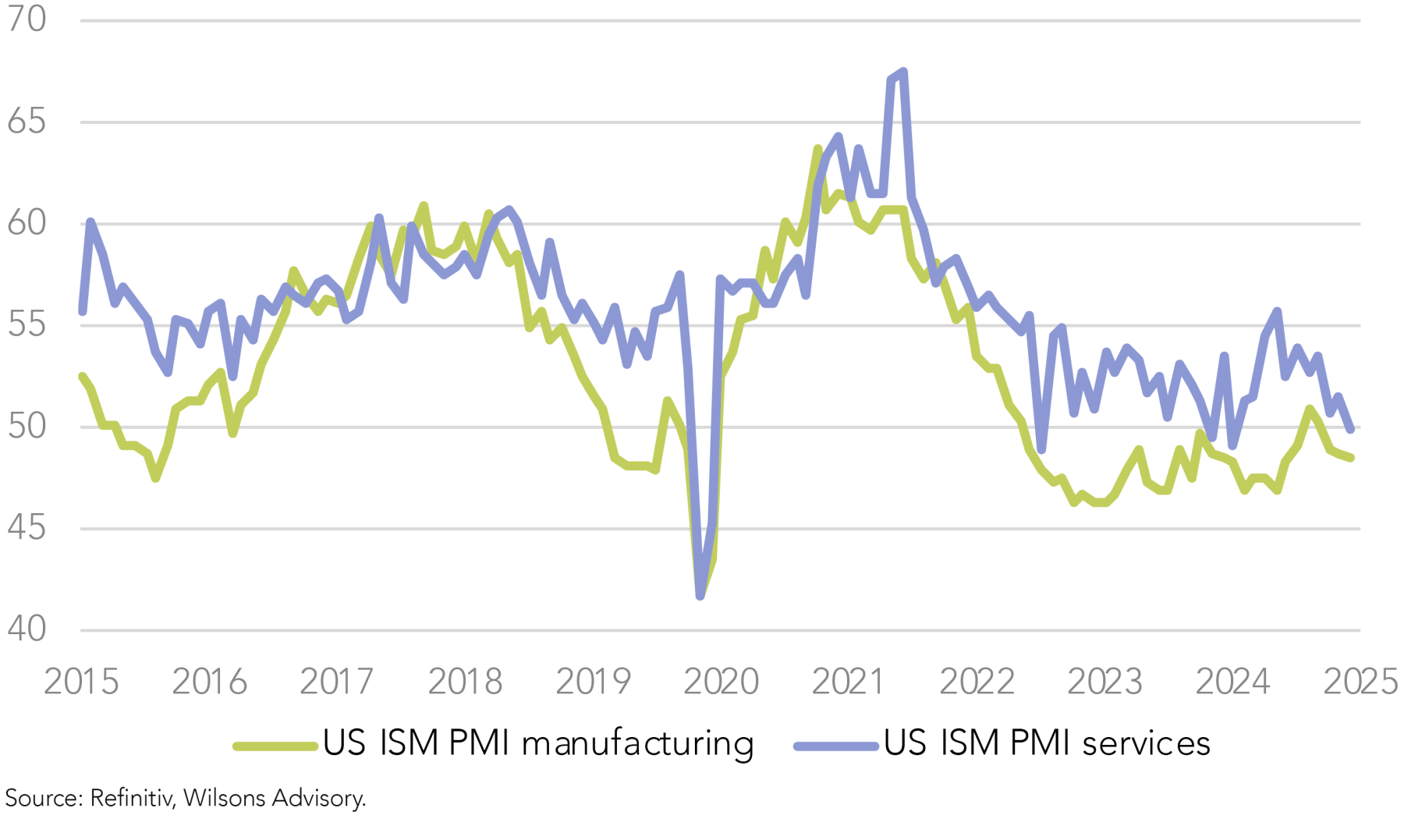

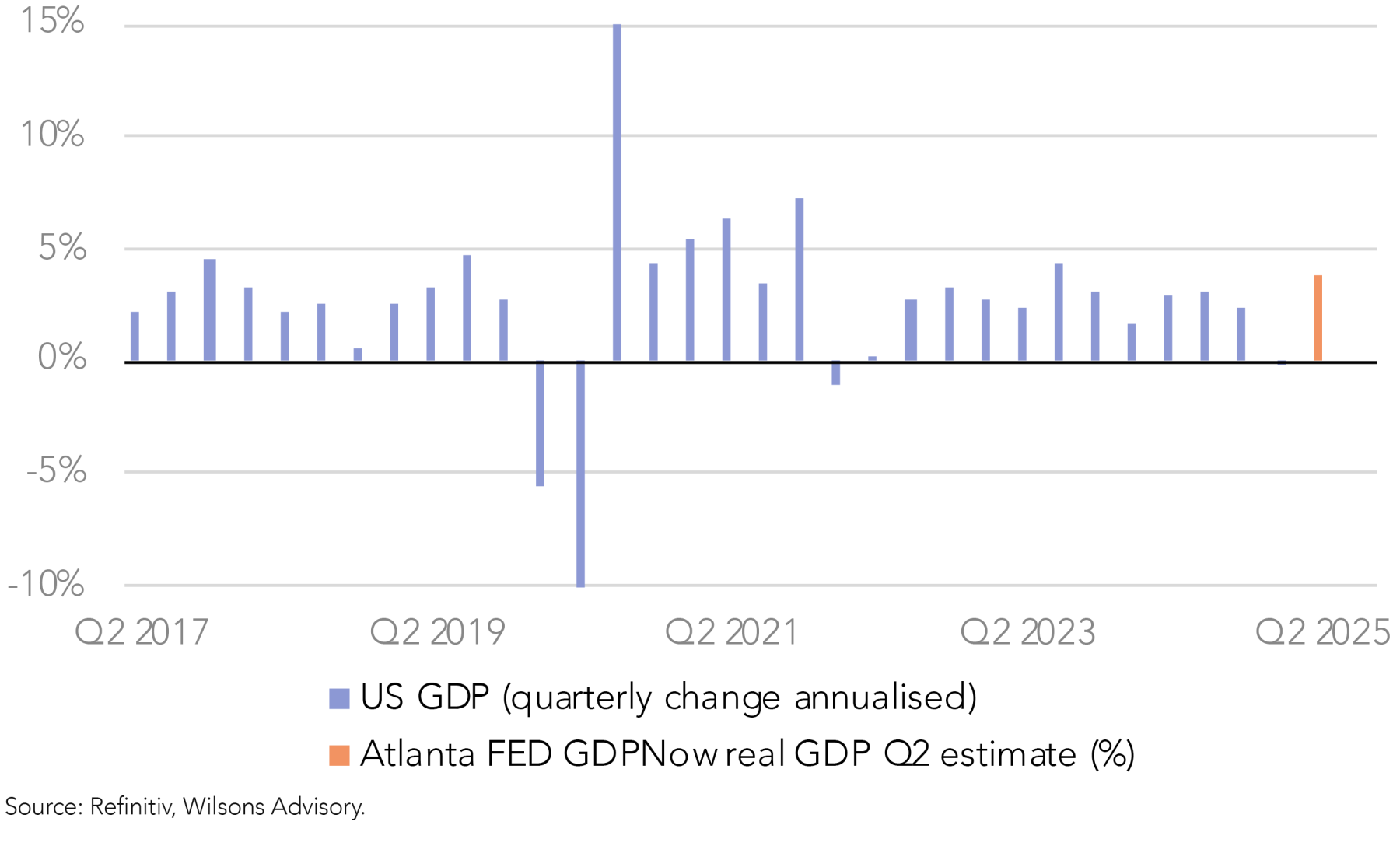

While “soft data” such as consumer confidence and business surveys continue to flag caution, the evidence so far is that the US economy is still tracking reasonably well. Indeed, while the influence of trade flow distortions are undoubtedly a factor, the latest Atlanta Fed Nowcast for US Q2 GDP shows growth rebounding to 3.8% after negative growth in Q1.

We still expect evidence of softer growth and higher inflation to emerge over the next few months. This may cause renewed market volatility, but for now the market is taking comfort from the fact that the US economy is still tracking reasonably well.

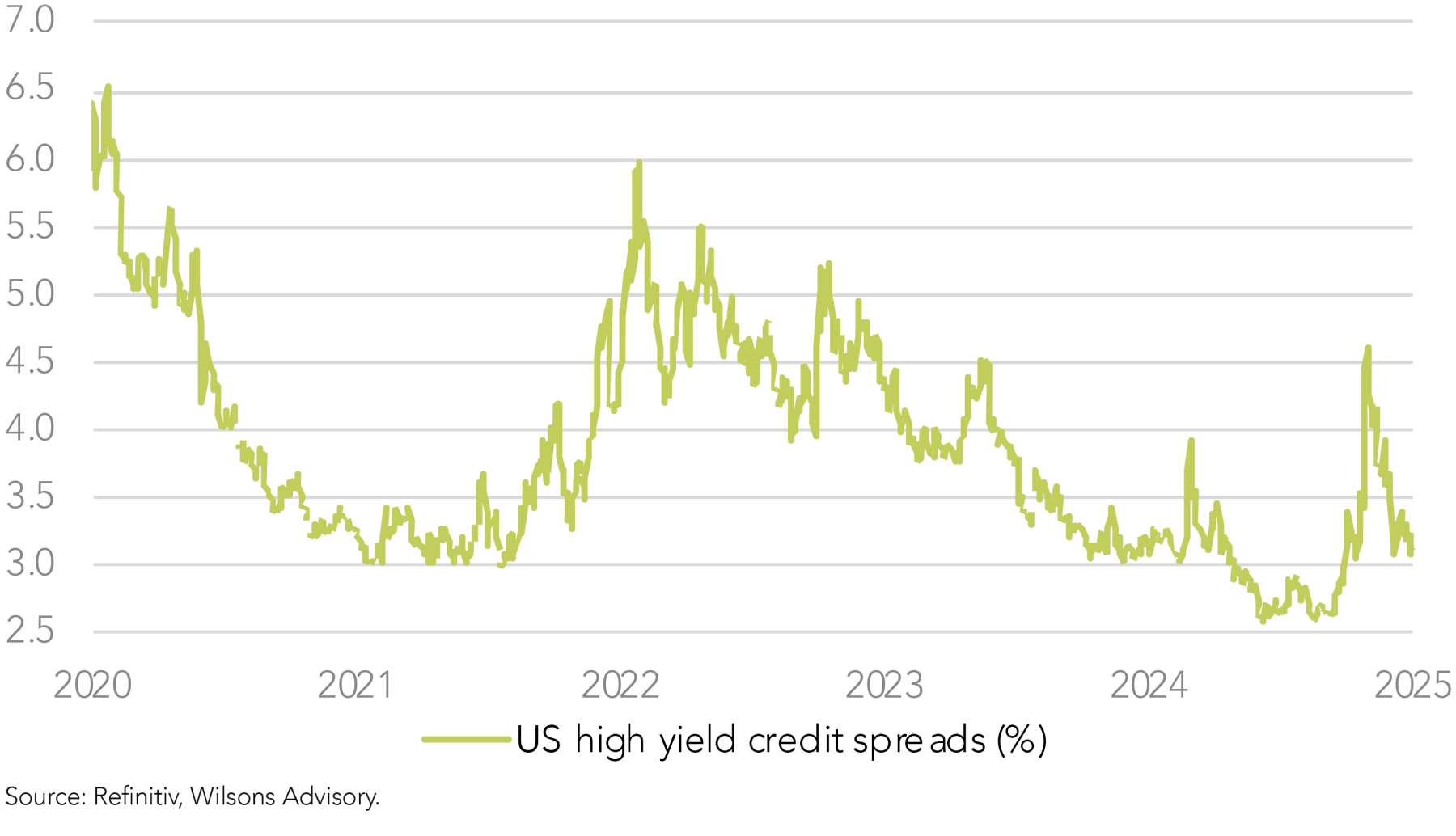

When this economic resilience is combined with ongoing hopes for trade de-escalation, as well as light professional investor positioning, the significant rebound in equities can be rationalised. However, the pace of the rebound combined with full valuations still leaves us a little wary around near term (three-month) market prospects.

Earnings to face some headwinds

The solid Q1 reporting season that played out through April and early May also contributed to the market’s rebound, particularly in relation to the sharp rebound in the US tech sector. The Q2 reporting season due in July/August will likely be a sterner test for the market, particularly with the jump in share-prices over the last 2 months. The market will be watching for evidence of tariff impact on corporate cost bases and supply chains, as well as the broader revenue outlook. We expect earnings growth estimates for CY25 (9%) and CY26 (11%) to be edged back, but at this stage not dramatically.

Trade De-escalation Deadlines Approaching

Hopes of tariff de-escalation have undoubtedly helped equities in recent weeks, with pauses to global reciprocal tariffs and a partial walk-back from the punitive (145%) tariffs on China. However, sustainable and significant de-escalation agreements have not yet been announced.

They may well be delivered in coming weeks, but deadlines are approaching (the global reciprocal tariff deadline is July 9) raising the risk of renewed market angst. The tariff impost as it stands is lower than feared in April, but is still a significant lift from the previous status quo.

Despite the benign inflation print last week, consensus estimates suggest US core inflation will ultimately tick up to 3.5% in the second half of this year, from its current level of 2.8%. The tariff-driven inflation pick-up is set to be a drag on consumption, and makes life difficult for the Fed in terms of delivering further policy easing. The market continues to see the Fed as being in wait-and-see mode, with the next cut expected in September and only two cuts forecast for this year.

From a fiscal policy perspective, the exact approval timing and ultimate content of the US fiscal bill (the "big, beautiful bill") is also being closely watched by investors - particularly bond investors. The equity market seems encouraged by the prospect of at least some modest incremental stimulus. However, bond investors are nervous around the sustainability of the US debt and deficit burden.

This likely deterioration in the US deficit is not huge in the context of the already sizeable debt burden. However, a 6.4% deficit-to-GDP ratio in 2025 is not a great starting point for even a moderate further deterioration, particularly in the context of an economy that has been at full employment for some time.

The US bond market. Debt clock ticking

US bond yields have edged lower in recent weeks, but tail risks are still significant. Slower growth should keep a lid on bond yields in the second half of this year. The clock is ticking on US fiscal sustainability, however, it is difficult to predict if and when this becomes a genuine flashpoint.

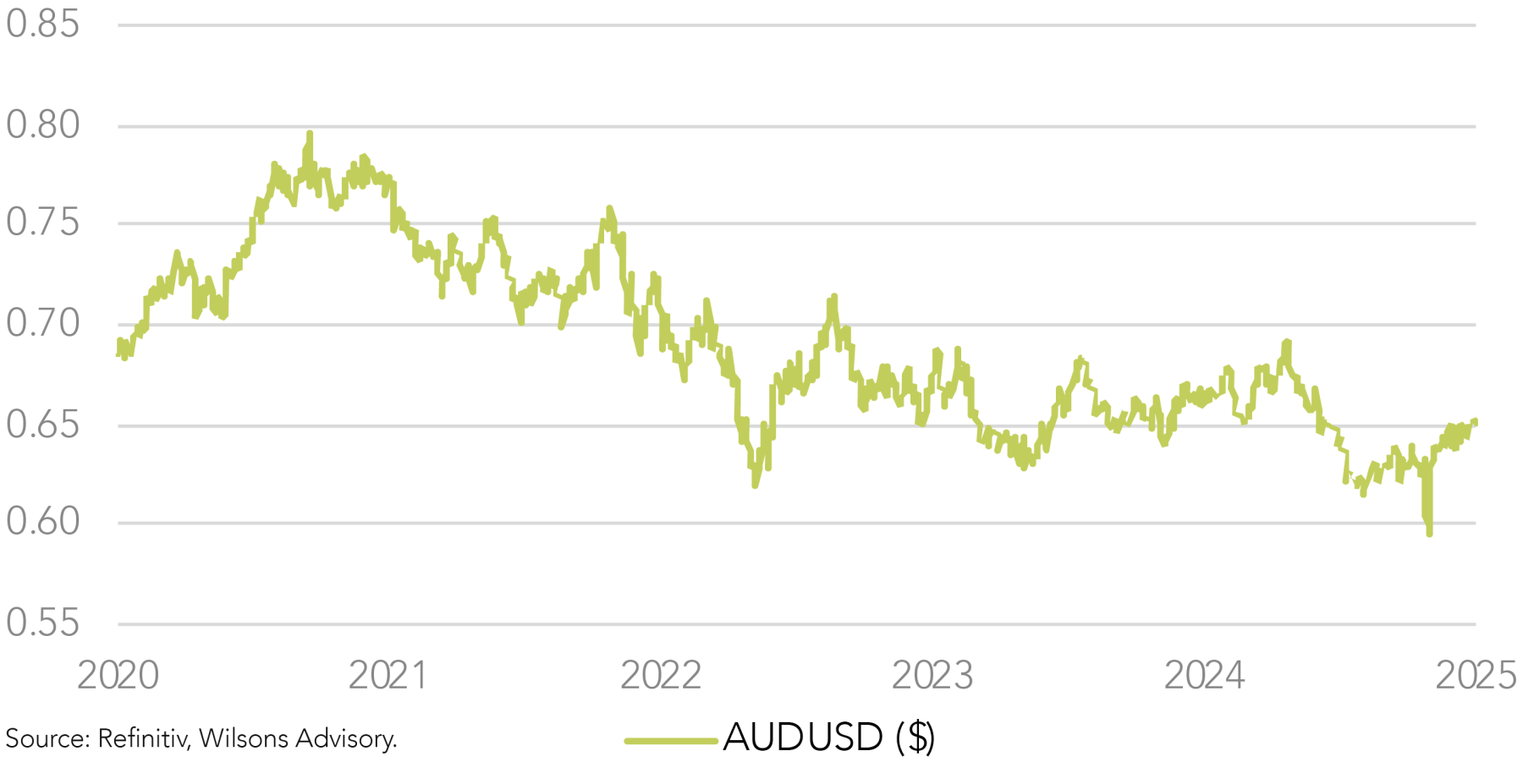

While the US stockmarket still appears to be receiving support, the US dollar is not receiving as strong an endorsement from foreign investors. This is likely to be a function of concern around the US deficit and bond market, alongside general US policy chaos. For now, the decline in the US dollar looks to be an orderly adjustment. The adjustment likely has further to run, with the US$ still looking overvalued against the major currencies, including the A$.

Some Tactical Caution but US Stocks Not in a Bubble

In summary, resilient data, hopes of further trade de-escalation and conservative institutional positioning have combined to push the US share market into a rapid recovery from its April swoon. This has supported a strong bounce in equities across the globe, including the Australian market.

While a strong bounce is justified, the pace and size of the rebound suggests some complacency around a number of risks. These include the ability to successfully de-escalate Trump’s trade war, the ability of the US economy to withstand tariffs and general uncertainty, as well as the US deficit position. The US stock market still appeals for its long-term growth potential, particularly via the US tech sector. However, we retain some tactical caution with an eye on the aforementioned risk factors.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.