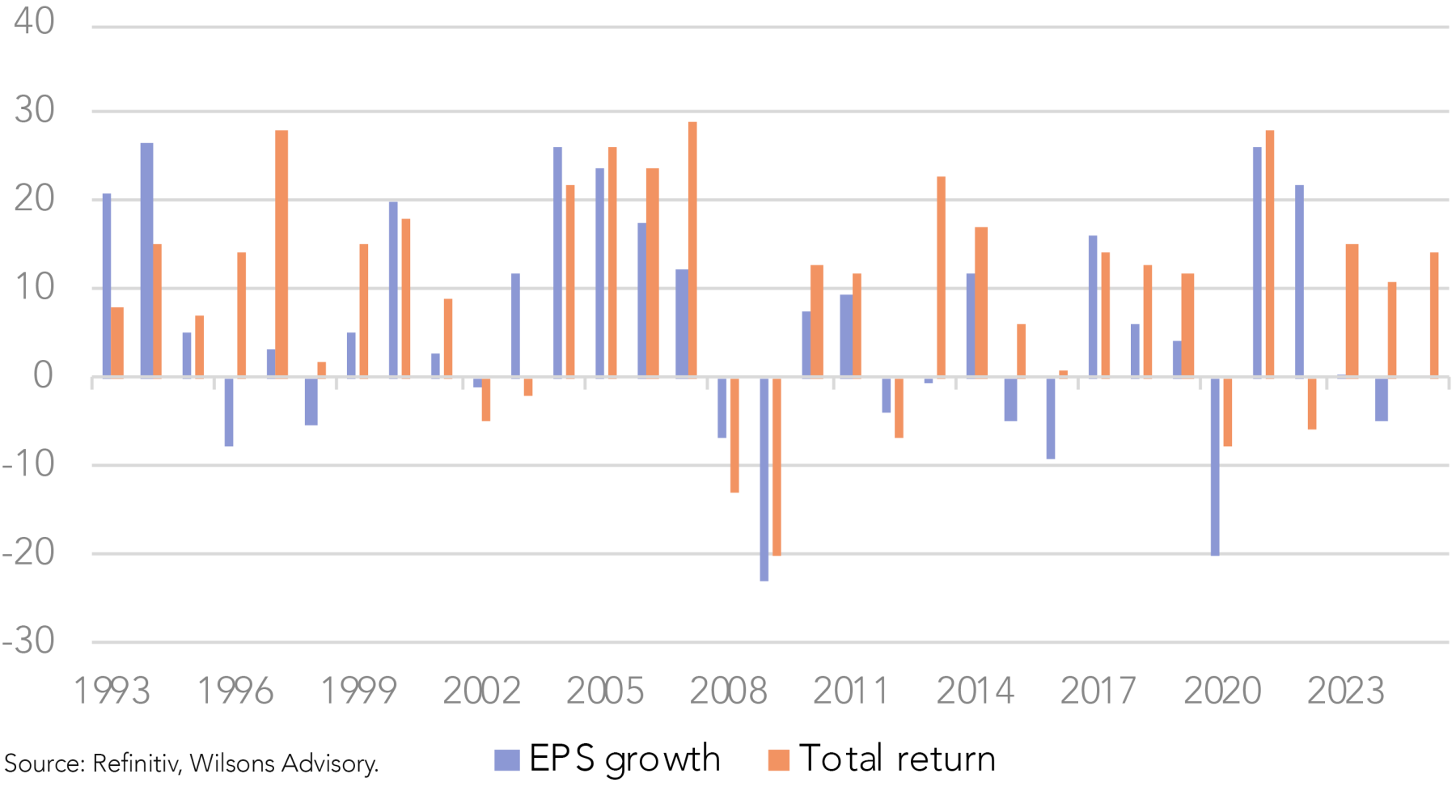

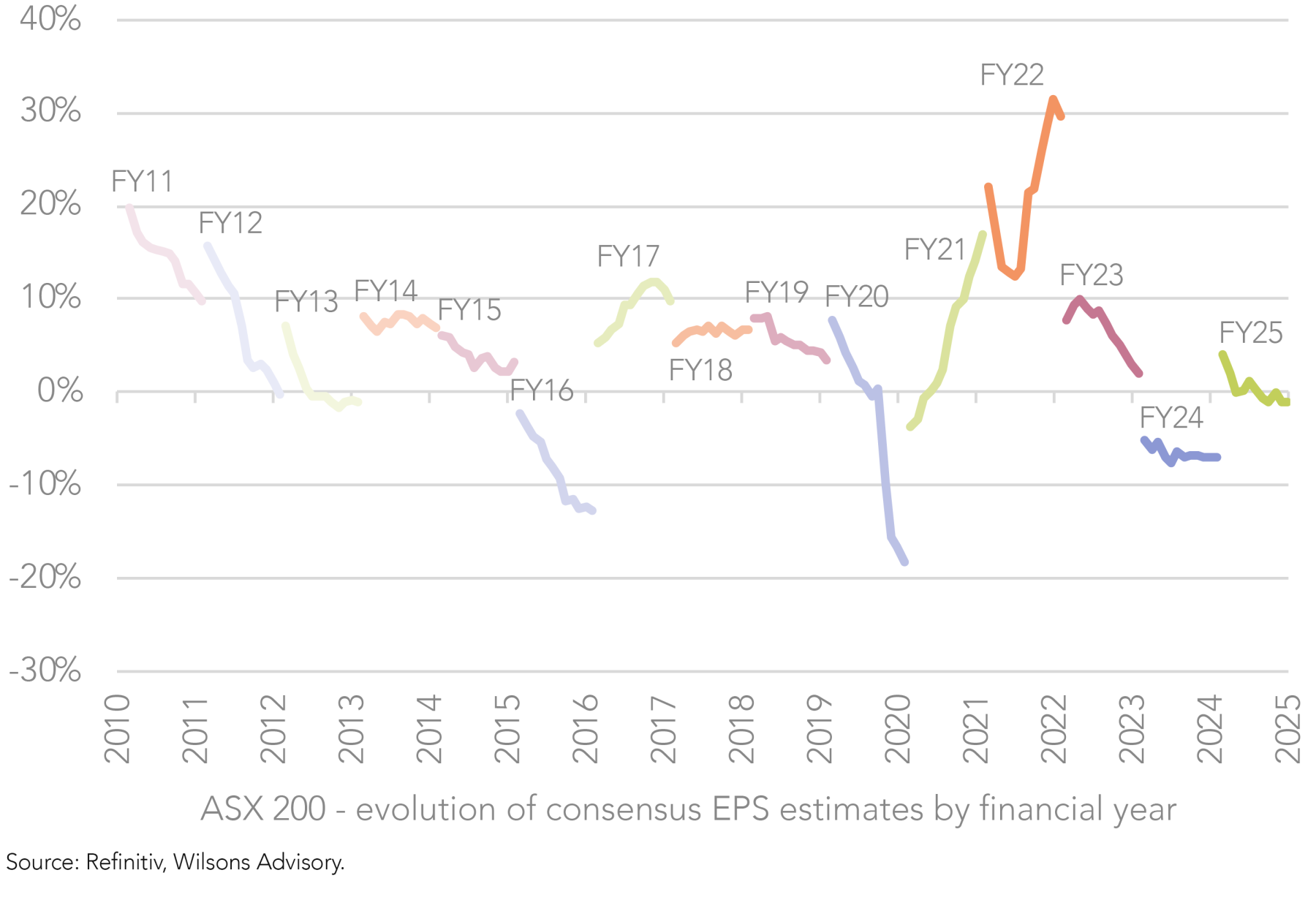

The Australian equity market is set to move into the full year FY25 reporting season next week. This will almost certainly mark the third consecutive year of flat to negative EPS growth at the index level.

Over the same three-year period the market has delivered a total return of 13% pa, including a 15% total return over the last 12 months.

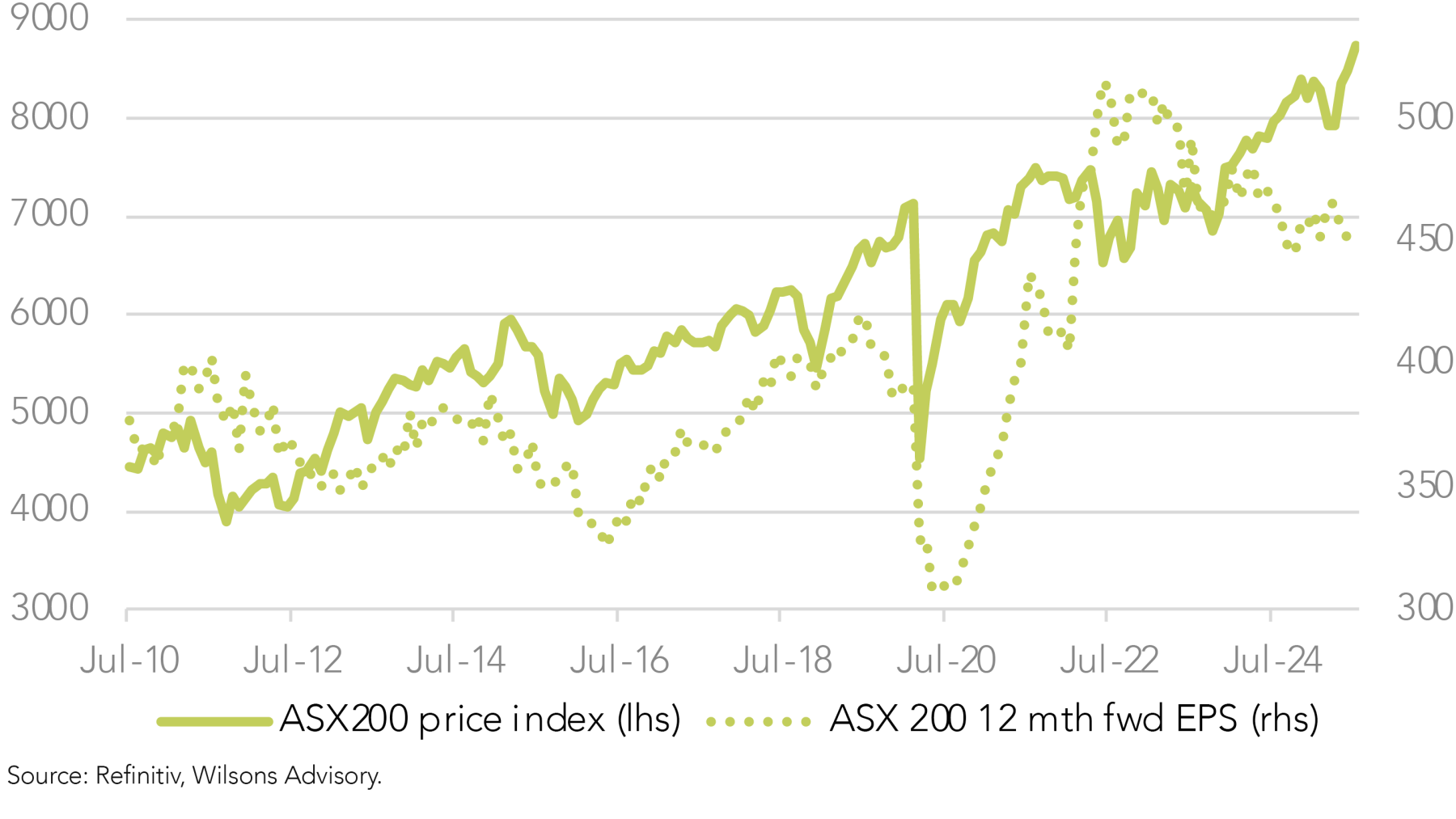

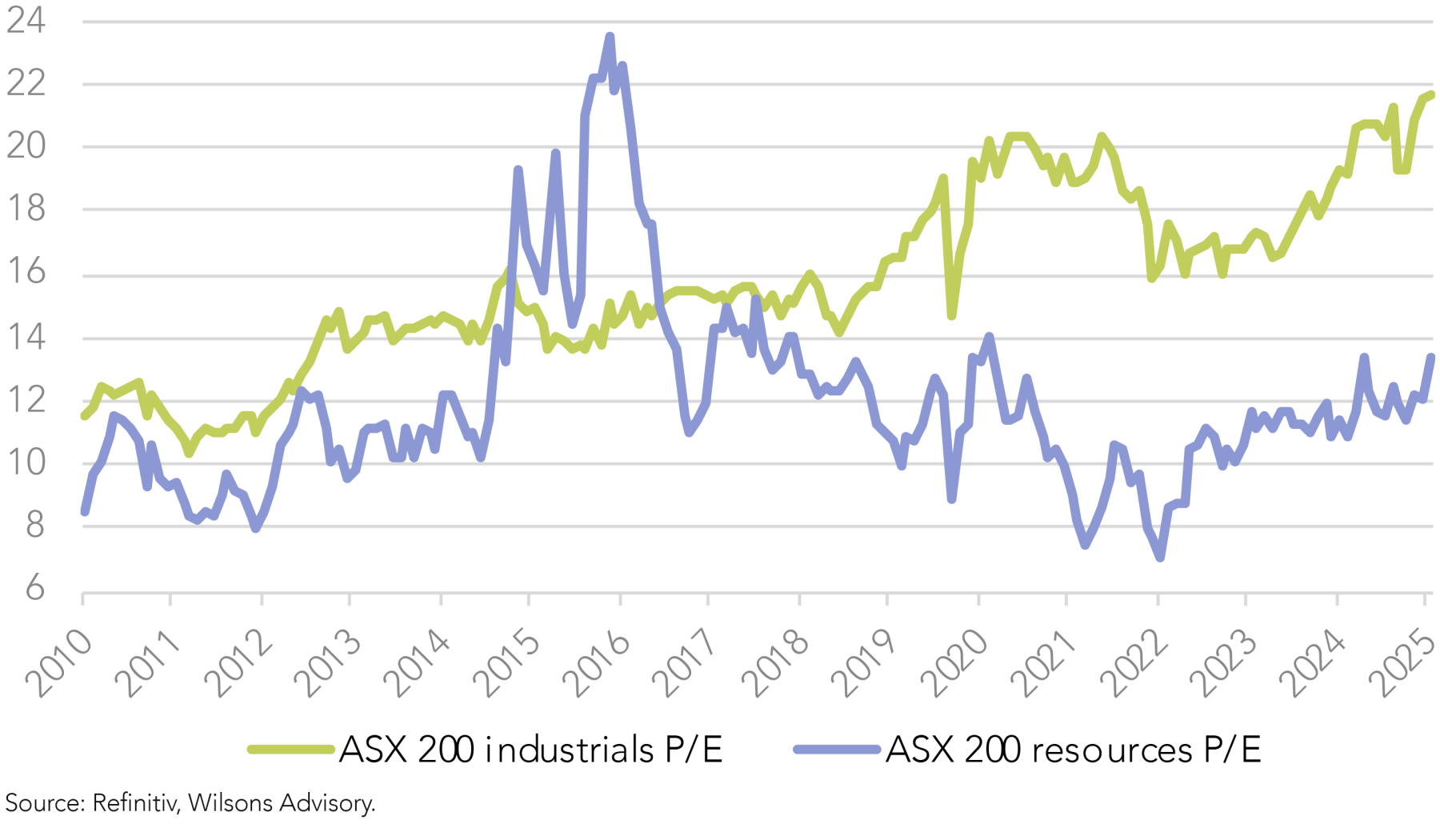

This disconnect between market earnings growth and market performance has seen the market P/E increase from 16.7x to 19.1x over the last year. With the 10-year average multiple of 16.2x, the current ~19x valuation suggests the market is fully priced to say the least.

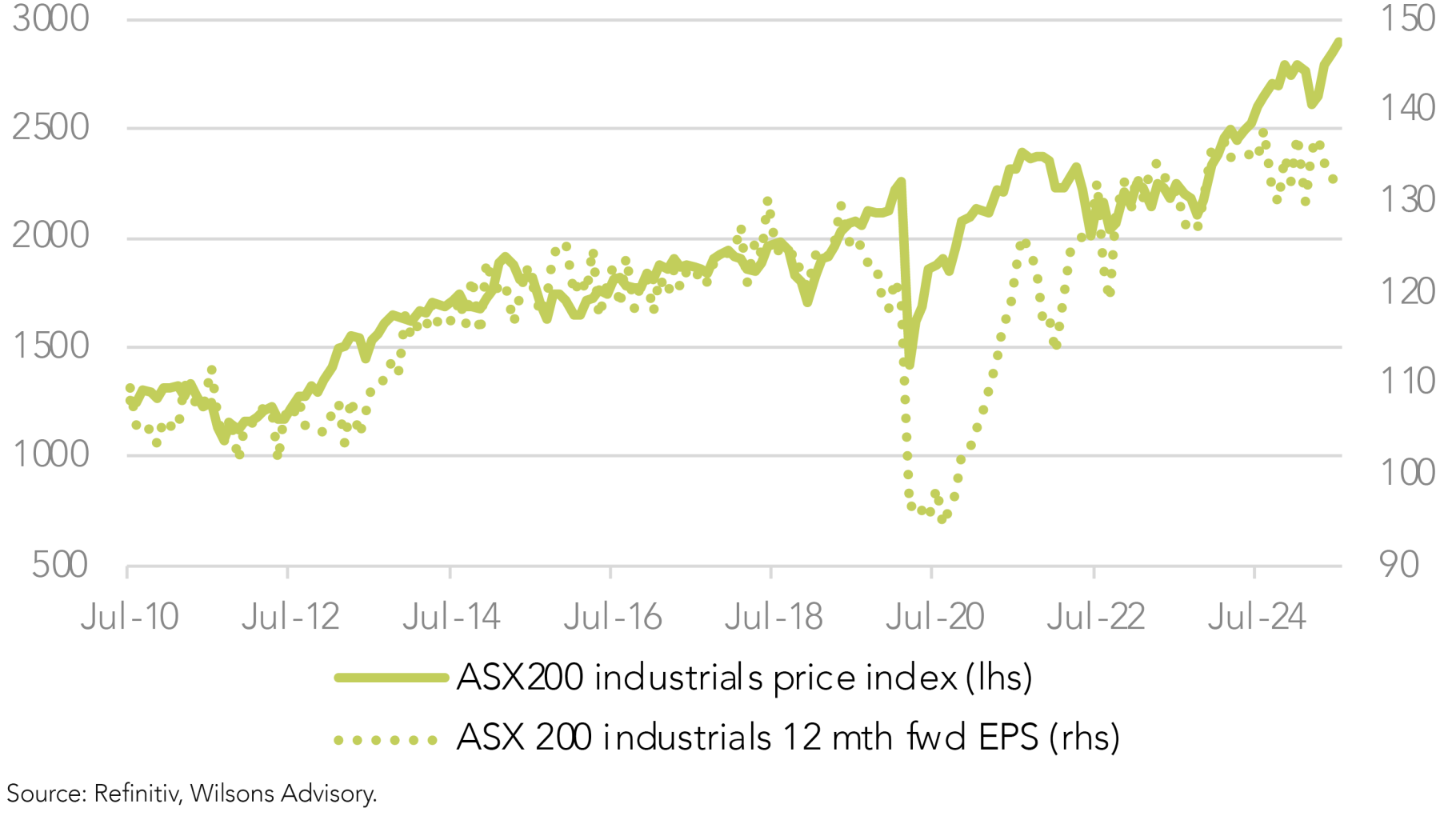

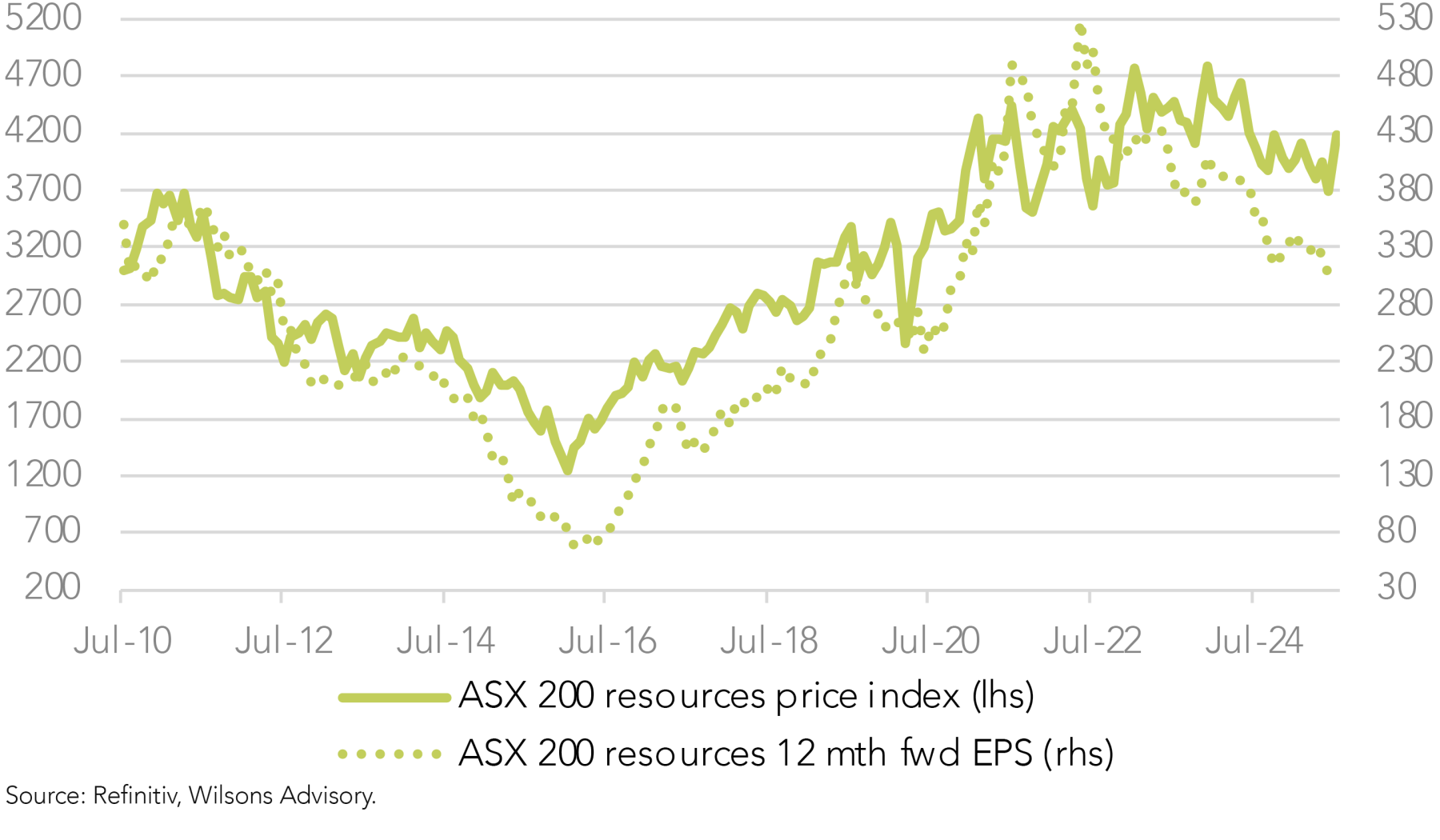

Digging a layer deeper in terms of performance trends, we note a stark difference in performance between the resource sector and the “ex-resources” segment of the market (the All Industrials) in recent years.

Over the last three years or so earnings have been falling in resources, while the resource sector P/E has edged up a little. This has seen the sector deliver a lacklustre 3.5% pa total return over the last three years and 4% over the last 12 months, aided by a sharp rally over the past month.

Resources drag on market earnings, but market still lifts

The poor earnings performance of the resources sector has dragged aggregate market earnings growth back to zero. However, it hasn’t dampened overall market performance much, with the market still managing a double-digit total return on a one- and three-year basis. Investor flows have shifted to the “market ex-resources”, where earnings momentum has been better (albeit far from spectacular) resulting in significant P/E expansion across many key “industrial” stocks and major sectors. The All Industrials sector has delivered a 16% total return over the last 12 months despite modest ~3% earnings growth. The market ex-resources now trades on 21.7x expected earnings, versus a 10-year average of 17x.

Looking at the sector drivers of the market’s P/E expansion shows a disproportionate influence from the banks, with the bank sector P/E expanding from 14x to 20x over the past three years.

Stock market or market of stocks?

While banks are not the only area of P/E expansion, the median stock P/E for the ASX200 is only a touch above five- and 10-year averages. Moreover, the median stock is expected to deliver ~6% growth in FY25 and 12% growth in FY26. This suggests opportunities for active stock pickers, despite a headline index that appears both expensive and growth constrained.

Earnings Growth Is Expected to Pick Up in FY26

While FY25 will mark another lacklustre year for market aggregate earnings, growth consensus expectations for FY26 earnings are stronger at ~6%, although FY26 estimates have been edging lower in recent months. Indeed, the trend of most financial years is downgrades over the course of the year. Fig 7 shows FY25 estimates were for +4% growth 12 months ago compared to the current estimate of -1%.

It is interesting that similar to FY25, the consensus for FY26 is showing stronger earnings growth for the median stock (+12%) relative to the index at ~6%. While this suggests that there is more earnings growth on offer at the stock specific level than at the headline level, it does also caution that there is some stock specific risk heading into August, given elevated company specific FY26 estimates.

We expect to see some trimming of numbers in August, but are more comfortable with the earnings outlook as we move through FY26. For both stock specific and market levels estimates, the prospect of better domestic and ultimately global growth as we move through FY26 should lessen the risk of dramatic downgrades, despite near-term risk being to the downside. As always, commodity prices over the coming year will be important to where aggregate market estimates end up.

The Rubber Band Finally Snaps Back

While the All Industrials (particularly the banks) have led the market higher over the last couple of years, there has been quite a noteworthy performance shift in the past month.

The bank sector has eased 6% over the last month, while the resource sector is up 11%. Despite the loss of bank sector leadership (the largest sector in the market), the overall market has still been able to grind higher (+2%). This has been helped by improving performance from some rebounding large cap stocks such as CSL, alongside the resource sector rally. This may be the market sensing some shift in earnings momentum as we move into FY26. Stretched valuations and peaking momentum flows in the bank sector are also likely a factor in the recent sharp reversal.

Market Outlook. The good, the bad and the stock specific

We retain a broadly neutral stance on the Australian market for the next 12 months. Valuations are full, but lower interest rates should be supportive. Prospects for aggregate earnings growth in FY26 are improving, but still likely constrained by index composition. Growth potential looks better at the stock level, suggesting active management should be able to return to form after a tough period. We will discuss our stock specific views ahead of reporting season this coming Wednesday.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.