The Australian market has pulled back by around 6% in recent weeks, in line with the pullback in US equities.

The local market remains moderately up over the past year in absolute terms (3% in price terms at the time of writing), albeit Australia has once again lagged the performance of global equities over the past year.

Market Re-Rates Into an Earnings Slowdown

For the last two years or so, it is noteworthy that the market’s solid rise has occurred against a backdrop of no underlying earnings growth at the index level. Indeed, earnings growth has been slightly negative at the index level for both FY24 and FY25.

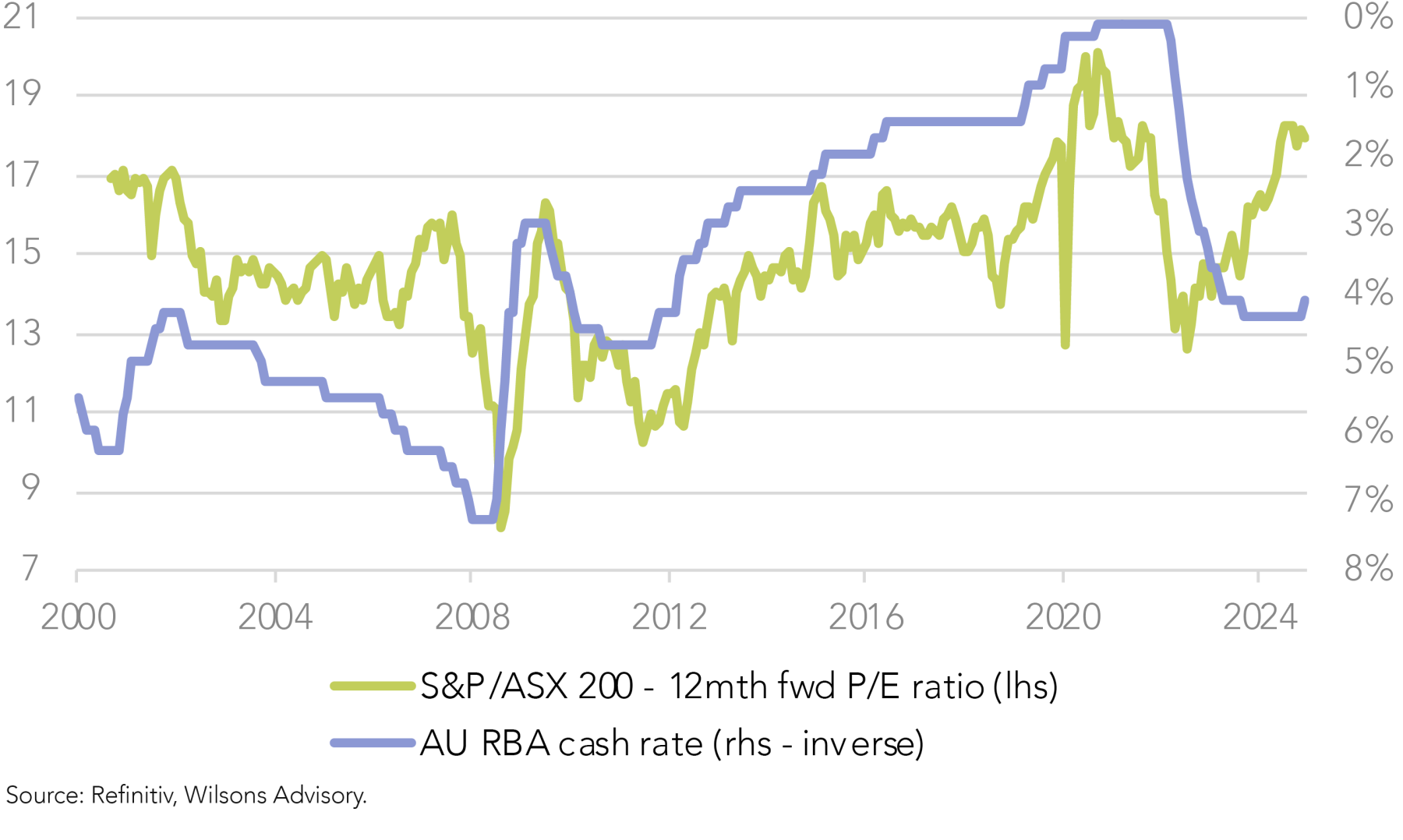

This has seen the market PE move up from lows in late 2022 to sit at just under 18x 1 year forward expected earnings. While valuations have eased from mid-February levels, the market’s aggregate price-to-earnings ratio is well above average levels when measured over the last 25 years (14.8x) or over the last 10 years (16.1x).

PE expansion in the All Industrials (the market excluding the resources sector) has been the main driver, with the PE moving up from 15.7x to 20.4x over the last decade. Within this segment of the market, the heavyweight bank sector has made a significant contribution by re-rating from a 10-year average of 13.8x to the current 18x.

Apart from the banks, the largest PE re-rating has come from the local IT sector. This in part stems from the emergence of relatively new (high growth) entrants to the IT index. The re-rating of the sector has nonetheless been substantial. In contrast, the previously high flying Australian healthcare sector has experienced a moderate de-rating in recent years.

The combination of lacklustre growth but a significantly higher multiple is an interesting one, particularly as interest rates have actually moved higher over the last couple of years. It is possible the market is discounting the prospect of lower interest rates in the future; however, the market looks to have re-rated well ahead of the (likely modest) interest rate downshift in this particular cycle.

Market Looking to an Improved Earnings Cycle

While earnings growth over financial years FY24 and FY25e has been negative at the index level, the market is expecting a pick-up in earnings growth of 8% in FY26.

The materials sector (dominated by mining stocks) is making a fairly large contribution to this assumed rebound. However, the expected pick up is relatively broad-based. In our view, this hints at the usual analyst over-optimism, as we head towards a new financial year. On a positive note, it does appear that the domestic economy is set to improve over the next 12 to 18 months. Last week’s national accounts showed the economy posted moderately better growth even before interest rates began to come down. Conversely, this good news on the economy might cap the degree of interest rate relief we are likely to see from the RBA over the coming six to 12 months.

We are working with a base case where market earnings growth eases back closer to 5% growth over the course of the next 12 months. At the moment, market earnings revisions trends are mildly negative. However, the addition of some monetary stimulus should support the earnings cycle and keep any future downward earnings revisions relatively orderly.

Australia Starting to Look Oversold, but Earnings Still Constrained

Our base case of 5% earnings growth should help the market push higher over the coming year, though the relatively elevated market PE suggests that index (price) returns are likely to be constrained. We assume the most likely path for the market multiple is sideways to moderately down.

Of course, the influence of the US market in providing either a global tailwind or headwind for equity market performance will be critical. As discussed last week, our base is to expect a more constrained and volatile performance from the US over the coming year, but still positive returns underpinned by healthy corporate earnings growth.

Back home, an improving domestic economy and - by association - an improving earnings cycle should help the Australian market keep up with what has been a runaway (tech-driven) US market over the last two years.

Longer term, we still see the local market as having a slower long-term earnings growth potential relative to the US market. It is arguably a more level playing field when comparing our market to the world ex-US, although valuations outside the US appear relatively undemanding.

It would be remiss to not mention that the path of the global economy and the global commodity cycle as another key wildcard for the performance of the Australian market, in both absolute and relative terms. Our base case is for some further easing in iron ore prices, but flat to higher prices for other key commodities, such as gold, copper, and aluminium.

This suggest consensus forecasts are plausible. However, the standard error around resource earnings forecasts can be quite large. We remain comfortable with our underweight to the large iron ore miners with a preference to be overweight to gold, copper and aluminium linked stocks.

Near-term risk-reward more balanced but local market has some structural headwinds

The 5-6% pullback in Australian equities in recent weeks prompts us to remove our modest underweight in Australian equities to a neutral tactical position. Positives include an economy that appears to be improving ahead of what should be at least some modest monetary stimulus. Factors keeping us from becoming more positive include the high degree of policy uncertainty into Trump's April 2 tariff announcement, as well as full valuations, and Australia’s longer term issue that the index is growth constrained in terms of aggregate earnings growth potential.

As discussed previously, we believe an active approach will be required against a backdrop of modest earnings growth & constrained returns at the index level.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.