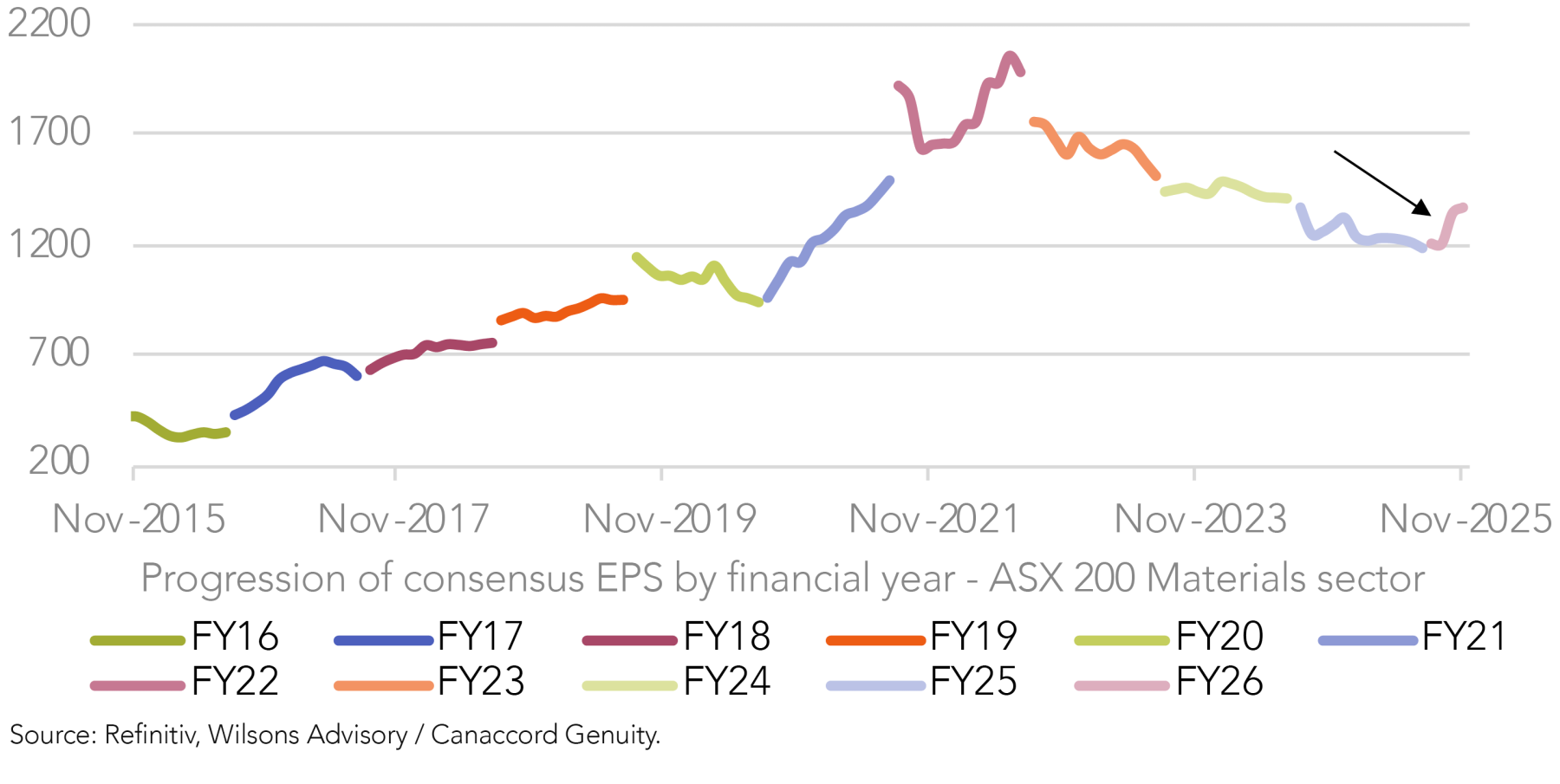

After a three-year downturn, momentum in the Mining sector appears to be turning – with broad-based strength across major commodities now underpinning what could be the early stage of a significant resources upgrade cycle.

The multi-year downtrend in resources (with the notable exception of gold) has been largely driven by pessimism over China’s growth outlook – particularly weakness in its property sector, which remains central to demand for iron ore. While China’s economy may slow further, investor sentiment seems to be improving, supported by easier monetary policy and rising credit availability (what some call the ‘China liquidity rally’).

We also see potential for large-scale stimulus in China in 2026, as greater clarity emerges around the US tariff situation, which would have positive implications for commodity pricing.

More broadly, the macro environment is becoming more supportive for resources: rate cuts in the US should help stimulate global commodity demand; a weaker USD offers a tailwind for dollar-priced commodities; Trump’s ‘Big Beautiful Bill’ will also take effect early next year and is expected to stimulate US manufacturing; and further easing of trade frictions between the US and the rest of world could help improve global growth.

However, perhaps more important than traditional cyclical demand drivers are the structural forces that – in our view – have been central to the recent strength in commodity prices. These include:

- The on-shoring of supply chains and build-outs of strategic stockpiles, as nations respond to concerns about supply-chain vulnerability (especially for critical minerals).

- Growth in data centre and infrastructure spending to support AI development is boosting demand for base metals.

- Re-armament and renewed defence spending (particularly among NATO and US-aligned nations) is driving greater demand for a wide range of industrial metals.

- The energy transition continues to drive structural demand for critical minerals and metals needed for batteries, renewables and electrification.

At the same time, supply dynamics remain a key differentiator across commodities – with tightening supply conditions supporting the rallies in metals like copper and aluminium, while concerns over a structural oversupply have impacted the relative price movements of iron ore (even though it has been more resilient than expected).

When it comes to precious metals such as gold, demand continues to benefit from meaningful structural drivers – including sustained growth in central-bank purchases, concerns around long-term US fiscal sustainability (and USD debasement), as well as ongoing safe-haven demand amidst global uncertainties.

Overall, more supportive supply/demand fundamentals for most metals are now driving upgrades to consensus commodity price forecasts and, importantly, translating into stronger earnings expectations for the ASX Mining sector.

Positive Towards Resources, But Remaining Selective…

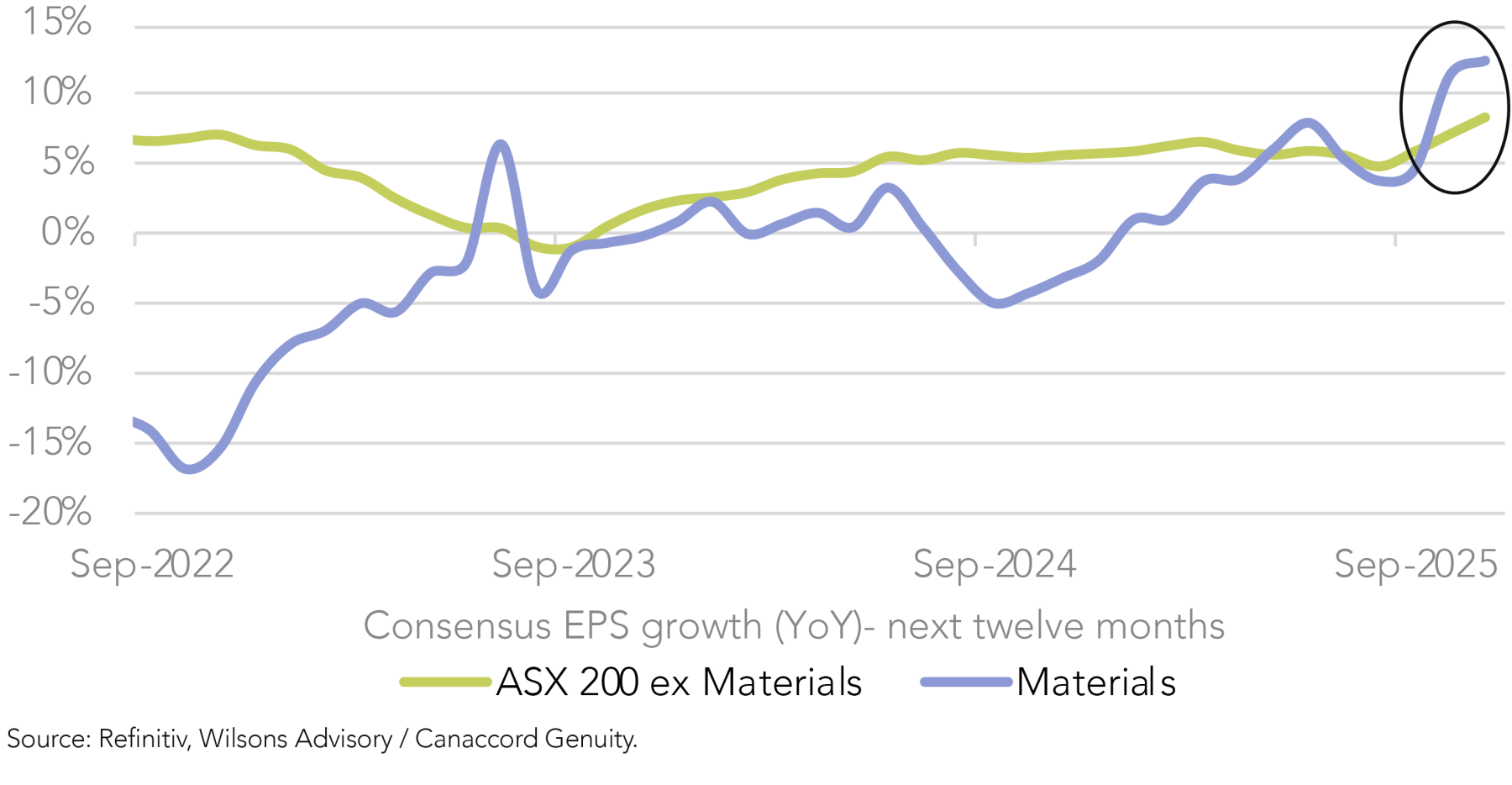

Broadly speaking, with consensus upgrades flowing into the Mining sector, the sector now has stronger 12-month forward earnings growth (YoY) than the ASX All Industrials.

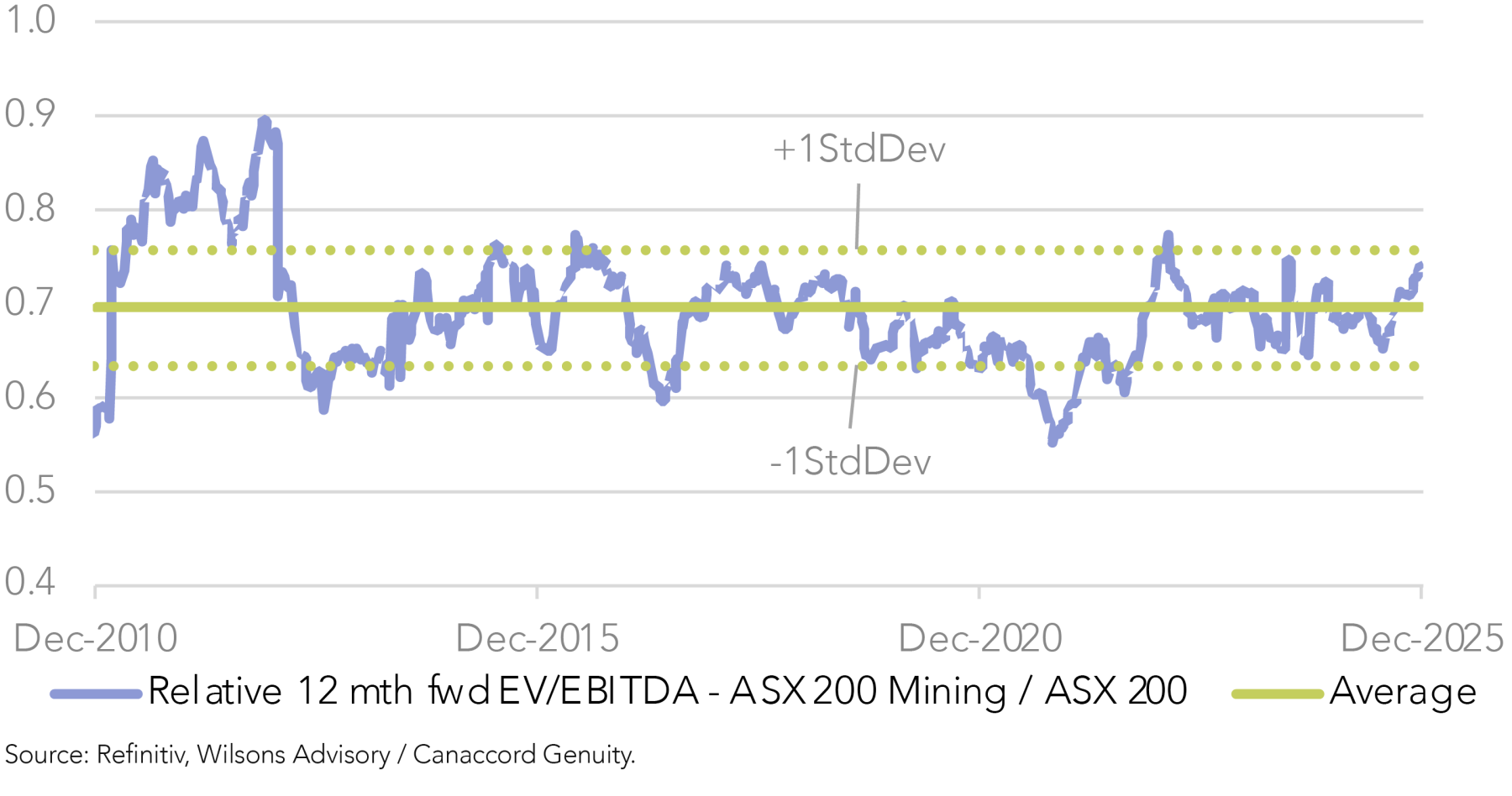

At the same time, the sector remains one of the cheapest on the ASX and trades comfortably within its historical range on a relative forward EV/EBITDA basis versus the ASX 200. This leaves scope for further re-rating if sentiment continues to improve, which we believe is likely.

Therefore, if earnings upgrades can persist alongside supportive commodity prices, investors stand to benefit from both rising earnings and expanding valuations, which warrants an overweight sector allocation in our view.

That said, we still expect divergence at the commodity level and continue to advocate for a selective approach, focused on commodities with the most favourable supply-demand dynamics. Among the major commodities, our preferred base metals continue to be copper and aluminium. We also maintain a positive view on gold, while staying cautious on iron ore.

The remainder of this report summarises our outlook for these key commodities and our preferred large cap ASX exposures.

Copper – Remaining Positive Despite Record Prices

Copper remains one of our preferred commodities, supported by healthy demand and increasingly constrained supply. Prices recently hit record highs (US$5.10/lb), driven by multiple supply disruptions which have tightened the physical market, however, we continue to see upside to the copper price over the medium-term.

Healthy demand supported by both cyclical and structural tailwinds

The energy transition and electrification continue to underpin the long-term demand outlook, with solar, wind, grid upgrades, batteries and electric vehicles all requiring substantial copper.

Additional demand is also likely to come from re-armament, AI-driven data-centre expansion, and steady traditional end-uses such as durables and capital equipment. At the same time, the broader macro backdrop is becoming incrementally supportive of global growth, reinforcing the near- and medium-term demand outlook when combined with these structural tailwinds.

Fragile supply driven by scarce project starts and disruptions

Supply constraints remain significant and have been the dominant narrative driving the copper price in recent months. Significant operational disruptions at Freeport McMoRan’s Grasberg mine- the world’s second-largest copper mine, along with disruptions at Kamoa-Kakula, Cobre Panama, and QB, have exacerbated market tightness in an already constrained market.

Moreover, declining ore grades, deeper mines, rising costs, the lack of large-scale projects in the pipeline – alongside sovereign risks – are all likely to limit new project delivery and push the cost-curve higher over time.

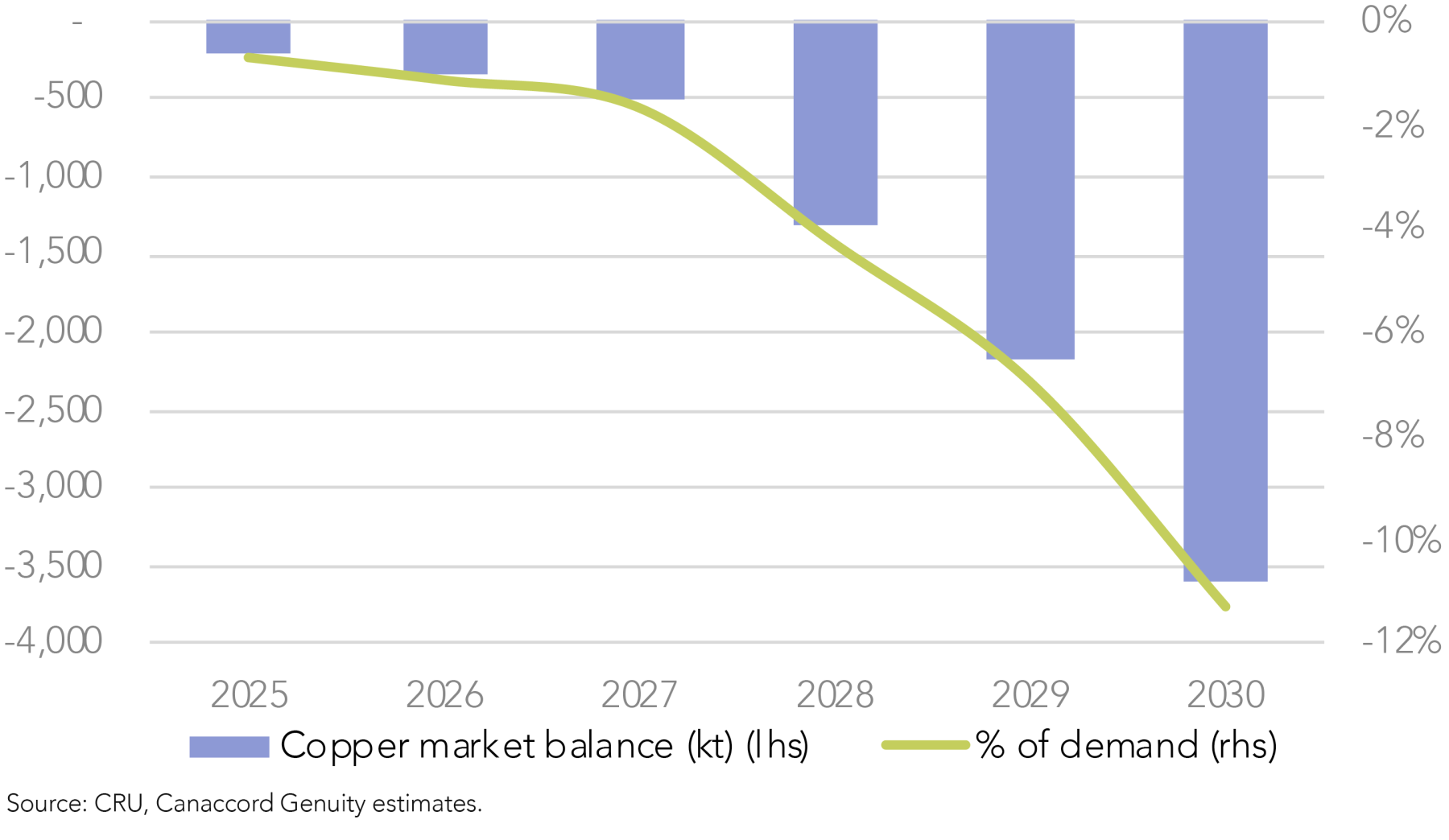

Tightening market dynamics point to an increasing deficit

Given the healthy demand outlook, limited supply pipeline, and the demonstrated fragility of existing and proposed copper projects, we expect the global market to be in a deficit in 2026, with that shortfall widening materially over the medium term. This supports our expectations of higher copper prices over time and leaves room for further consensus upgrades. From a portfolio perspective, this backdrop warrants an overweight exposure to copper.

Our preferred exposure is Sandfire Resources (SFR) (CG price target: $15), despite its somewhat full valuation. As the only pureplay ASX 100 copper producer, SFR has a best-in-class track record of operational delivery, which continues to underpin reliable leverage to the copper price.

Outside of the ASX 100, Canaccord Genuity Research has Buy ratings on Hillgrove Resources (HGO) (price target: $0.05) and Capstone Copper CDI (CSC) (price target: C$14.50), both of which also offer pureplay copper exposure.

Aluminium – An Underappreciated Critical Metal With A Looming Supply Deficit

The aluminium market is entering a period where demand growth is likely to outpace supply, creating tight market conditions. After nearly two decades of persistent oversupply driven by China’s substantial capacity additions, this balance has structurally shifted as new supply appears unlikely to match China’s previous additions to keep up with rising consumption.

Healthy demand outlook supported by structural drivers

The demand outlook is underpinned by both traditional and emerging drivers. Construction, packaging, machinery, electronics, and automotive applications continue to provide a stable base of industrial consumption. On top of this, structural demand drivers are becoming increasingly significant, including the energy transition (electric vehicles, renewables), rising defence spending, growing demand for AI-related infrastructure, and the continued substitution of plastics and copper for aluminium. Together, these factors should support strong and resilient demand for aluminium over the coming years.

New supply will be constrained by China’s capacity cap and high energy costs

Supply growth is likely to remain constrained. China – the world’s dominant producer – is nearing its self-imposed 45Mt smelting capacity cap, meaning most incremental supply will need to come from higher-cost ex-China markets, which appear unlikely to meet rising demand. At the same time, smelting is extremely energy-intensive and new projects require long-term (10+ years) power at around US$40/MWh to be viable.

However, both existing and proposed smelters are increasingly struggling to access affordable power, which is exacerbated by competition from other energy-hungry sectors – most notably Big Tech – who are willing to pay over US$100/MWh to secure capacity to power AI data centres.

This pressure is already evident. Norsk Hydro has recently written down Australia’s largest aluminium smelter – Tomago, and South32 has written down its Mozal operation, both citing difficulties in securing long-term, low-cost renewable power.

Therefore, limited future Chinese supply additions, combined with constrained power availability, will restrict supply and push the global cost curve higher over time.

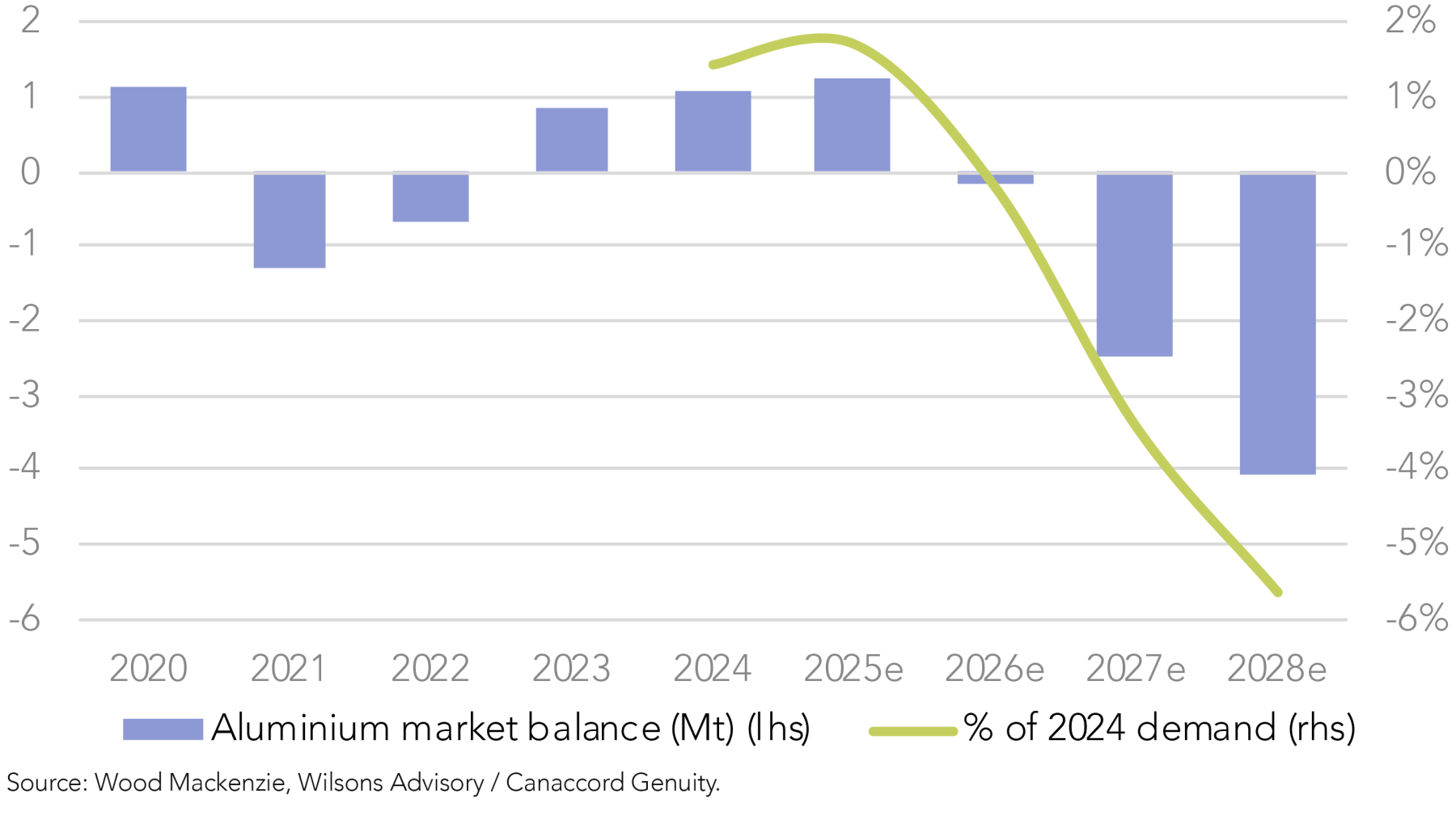

Growing market deficits are supportive of higher aluminium prices

Overall, sustained demand growth and limited new supply additions are expected to widen market deficits and drive the cost curve structurally higher, supporting firmer aluminium prices over the medium to long term. From a portfolio perspective, this backdrop warrants an overweight exposure to aluminium.

Our preferred aluminium exposure is Alcoa (AAI), the only pure-play aluminium company listed on the ASX, thereby offering the greatest leverage to aluminium prices. AAI boasts a high-quality, vertically integrated portfolio and a proven track record of operational excellence.

Read Aluminium: Bright Prospects for a Critical Metal

Remaining Positive on Gold

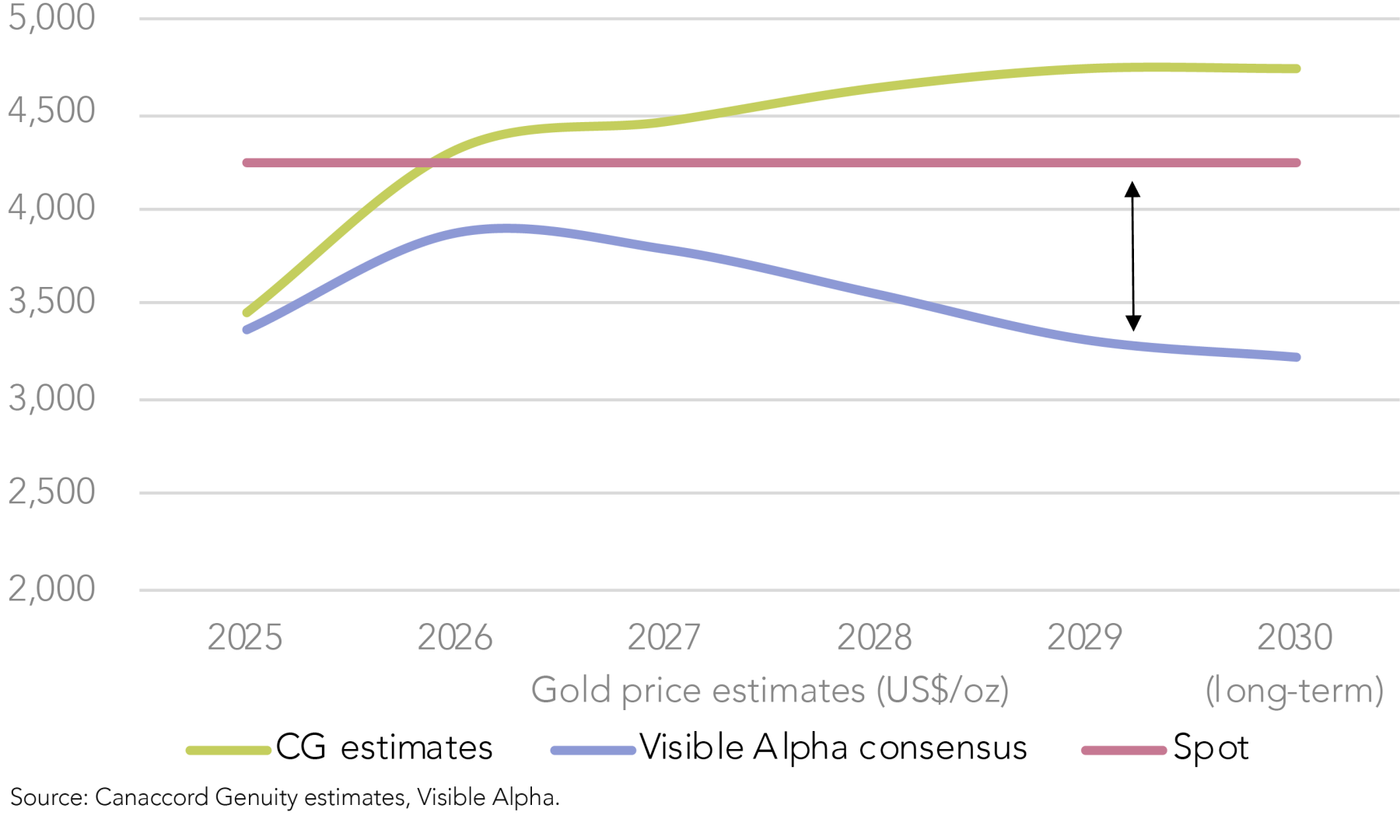

Gold has rallied to record highs this year, and currently trades around US$4,240/oz, yet we remain constructive and see further potential for gains over the medium-term. This is because the key drivers behind the gold rally remain firmly in place, including persistent geopolitical risks, strong growth in central bank gold purchases, rising US debt and fiscal sustainability concerns, and the expectation of US interest rate cuts.

Therefore, we see no compelling reason to change our bullish stance. Moreover, consensus gold price estimates remain below current spot levels, meaning if the gold price holds current levels or rises further – which is our base case – this is likely to drive significant earnings upgrades for ASX gold miners over time.

ASX Gold Mining valuations also remain attractive, particularly in light of potential consensus upgrades. ASX 100 producers currently offer an average CY27 free cash flow (FCF) yield of ~8%, which are likely to rise into the double digits range if upgrades materialise as we expect.

From a portfolio perspective, this backdrop warrants an overweight exposure to gold. Our preferred large cap exposures are Evolution Mining (EVN) (CG price target: $12.45) and Northern Star Resources (NST) (CG price target: $34.50). EVN offers the cleanest gold leverage over the near-term in our view, as it has demonstrated best-in-class operational delivery and offers an attractive FCF yield over the next couple years, while NST offers the greatest medium-term upside in our view, driven by its strong production growth outlook, its relatively attractive valuation, and the rolling off of its hedging profile.

Read Gold Rush

Iron Ore – Glut of New Supply to Widen Market Surplus

Iron ore prices have held around US$100/t this year despite weak steel demand and strong supply additions, particularly from Brazil. Nonetheless, we remain cautious, and see risks as skewed to the downside over the medium term given a weakening supply/demand backdrop.

Iron ore demand faces structural headwinds

We expect steel production to remain constrained by China’s struggling property and construction sectors, alongside slower infrastructure spending elsewhere, anti-dumping actions, and regulatory efforts to rationalise capacity. The US-China trade war adds further downside risk. While potential Chinese stimulus in 2026 could offer short-term support, it is unlikely to address the deep-rooted structural issues within the property sector in our view.

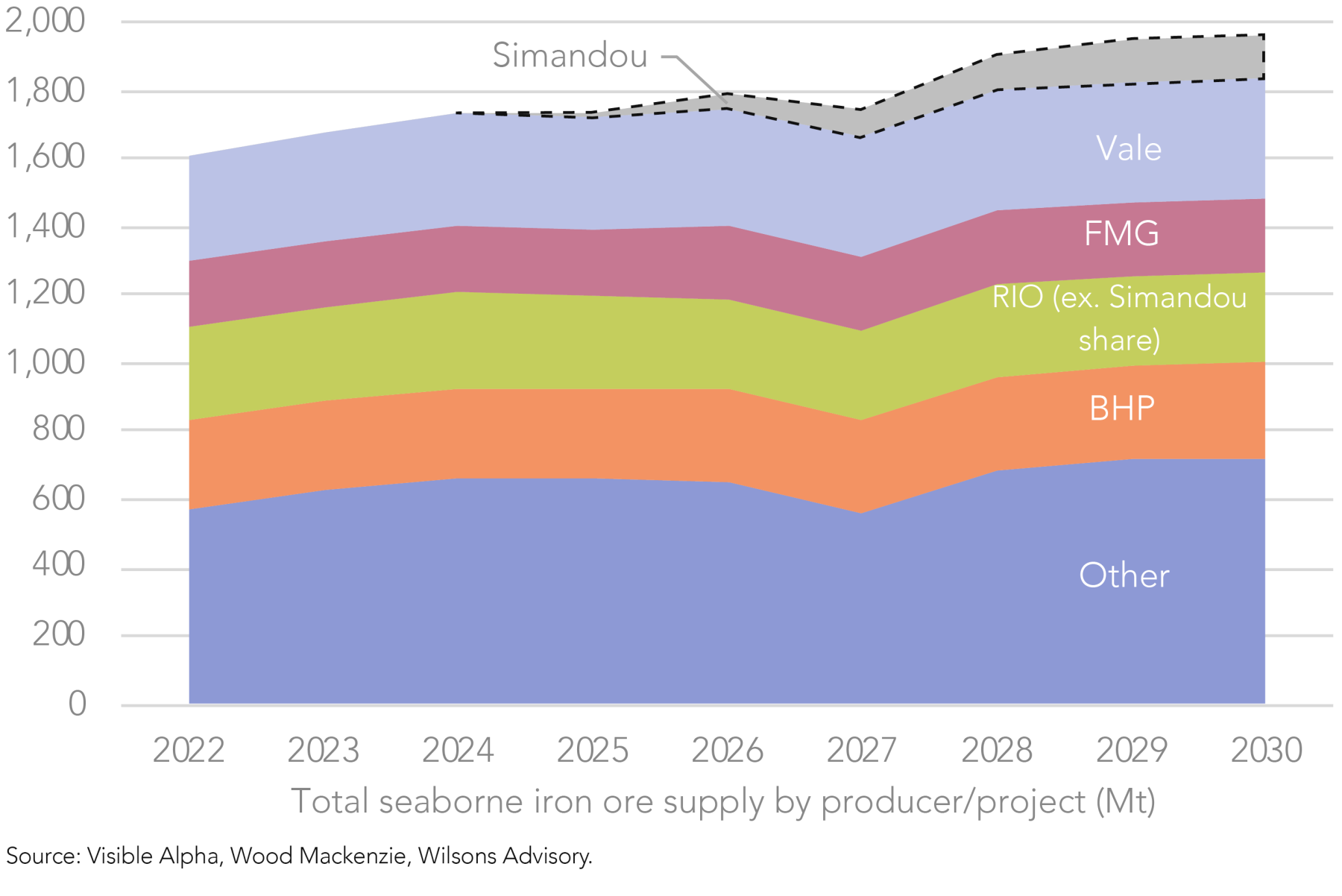

A glut of low-cost supply is on the horizon

New low-cost supply is coming online. The Simandou project in Guinea – the world’s largest undeveloped high-grade iron ore deposit – is ramping up and is expected to account for 6–7% of global seaborne supply by 2030.

With costs potentially competitive with Australia’s Pilbara mines, Simandou will add meaningful supply to an already oversupplied market and threatens to displace higher-cost output from marginal producers, thereby lowering the global iron ore cost curve and reducing the price floor.

Oversupply to widen over time

On balance, soft demand and rising supply underpin our expectation of a growing market surplus over time. We see this driving iron ore prices lower over the medium term, broadly in line with consensus forecasts, which point to prices in the ‘high 80s’ over FY28–30. From a portfolio perspective, this supports a modest underweight exposure to iron ore.

Our preferred iron ore exposure is BHP (BHP), the lowest-cost producer globally with a strong track record of operational delivery and disciplined management. Its commodity mix is relatively attractive compared to the other majors, with ~45% of FY26 EBITDA expected to come from copper (where we have a more favourable view), providing valuable diversification beyond iron ore.

Read Iron Ore: Awaiting the ‘Pilbara Killer’

Written by

Greg Burke, Equity Strategist

Greg is an Equity Strategist in the Investment Strategy team at Wilsons Advisory. He is the lead portfolio manager of the Wilsons Advisory Australian Equity Focus Portfolio and is responsible for the ongoing management of the Global Equity Opportunities List.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.