It’s been an eventful year in global markets, with the Trump Administration’s sweeping policy changes, geopolitical flashpoints, and a record US government shutdown leaving a blackout of data on the US economy of late.

Despite the elevated uncertainty, particularly earlier in the year, equity markets have rallied further and, coming on top of the gains in the past few years, this may have left the US offering less potential now than other markets around the world.

Here we take stock of the position of the US and other markets and elaborate in more detail further below.

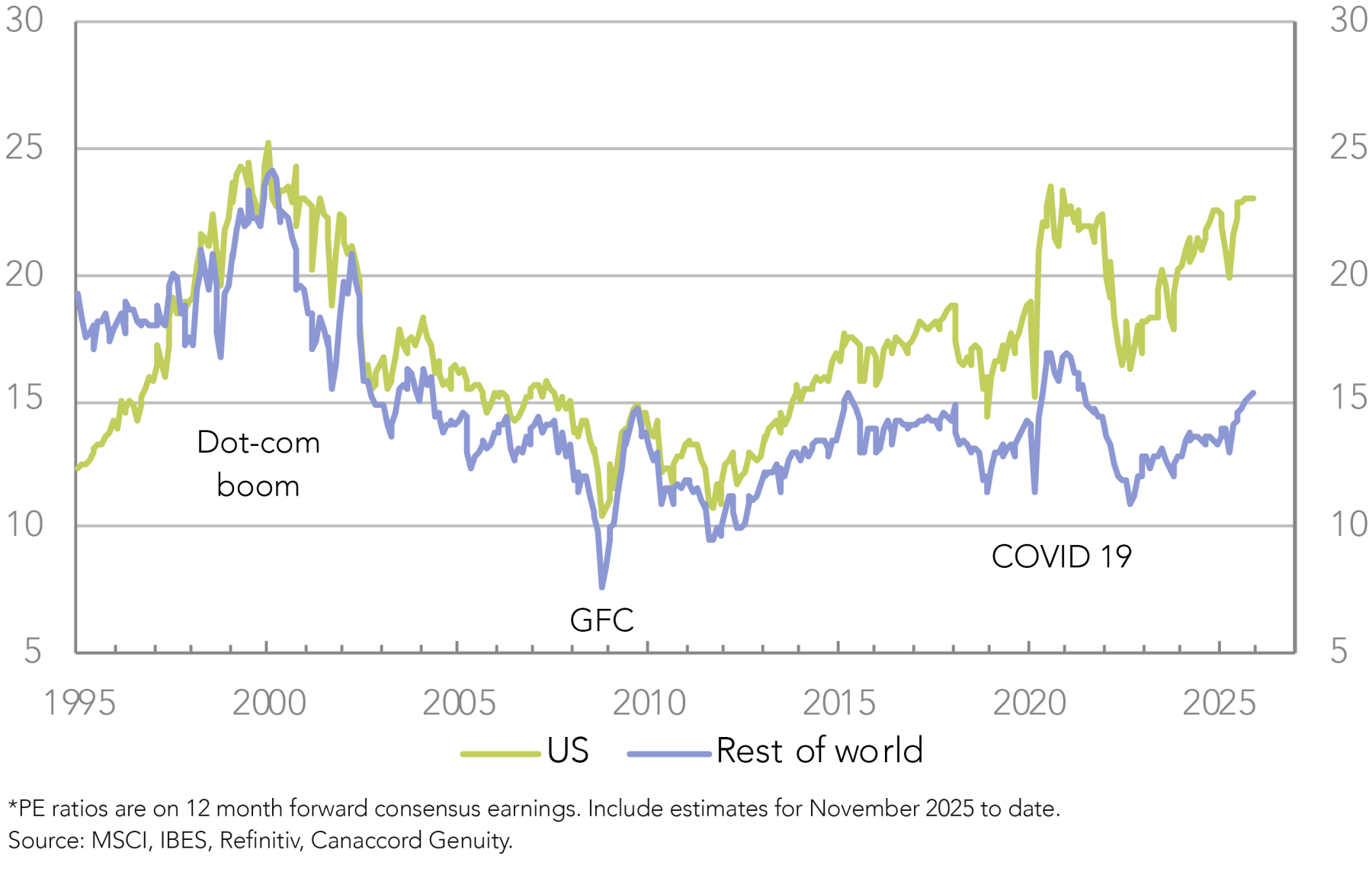

- The US market continues to see strong earnings growth but seems constrained by high valuations. As we’ve recently noted, Q3 earnings results seem on track to deliver 11% growth on the prior year, another strong quarter, but the market has struggled this month, bumping up against a near record PE multiple (Figure 1). The US economy has fared better than feared under higher tariffs but has still slowed down from recent years, and inflation is persisting. Uncertainty has eased substantially and the spectacular AI investment boom is underpinning the economy and the market, but it creates concentration risk if something goes wrong (outlined in depth in our report of 31 October).

- The rest of the world has also shown resilience in the face of the US tariffs and its markets are not as expensive. Europe, Japan and China are all major exporters but have managed to maintain growth, by not retaliating to US tariffs and with some policy stimulus (Germany and China). They have made up ground on US growth as it has slowed and they haven’t added to inflation by retaliating. And while the corporate earnings growth in the rest of the world has remained well below that in the US, market valuations have also, with a wide gap still to the US, and have been providing more upside this year.

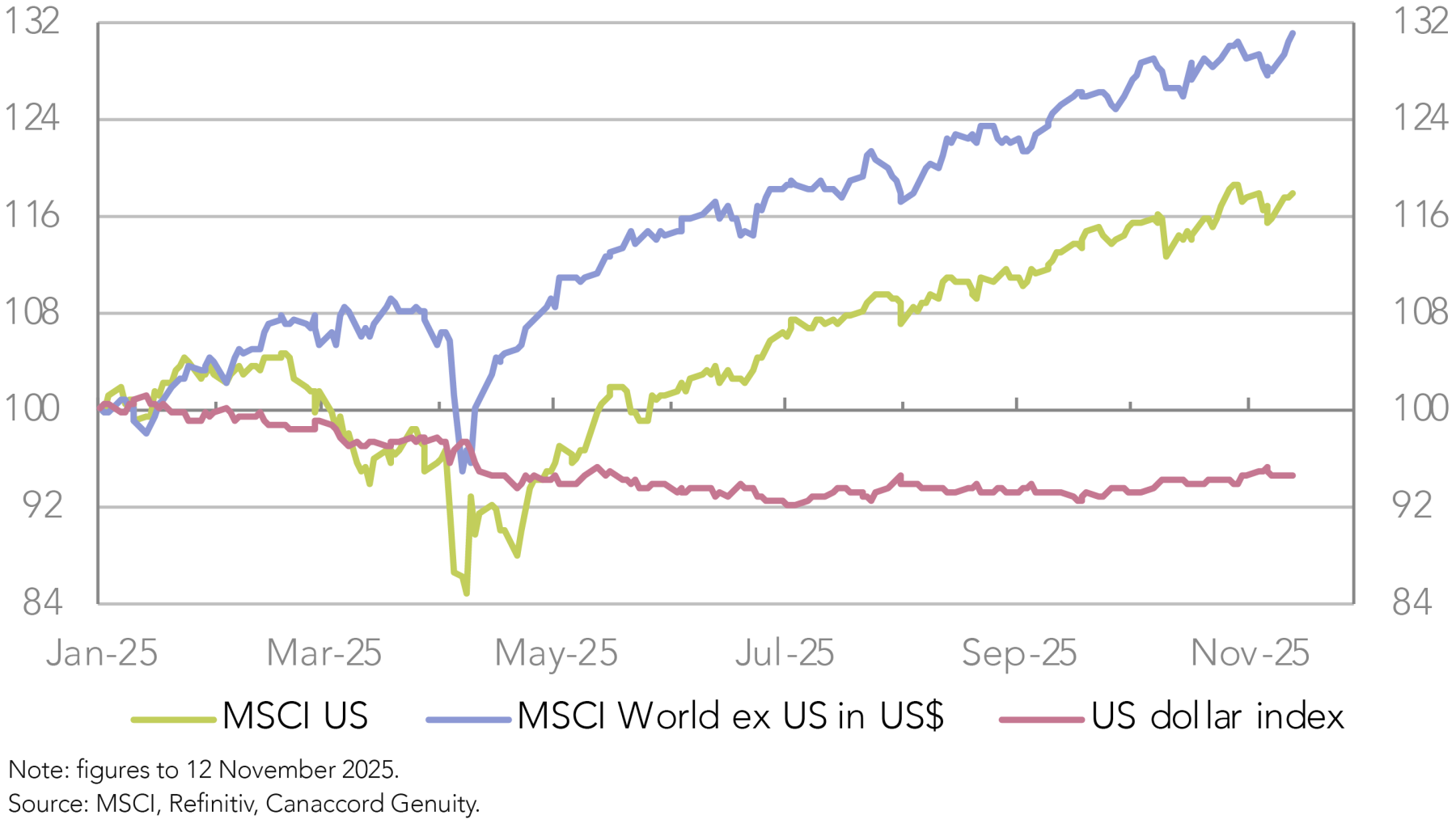

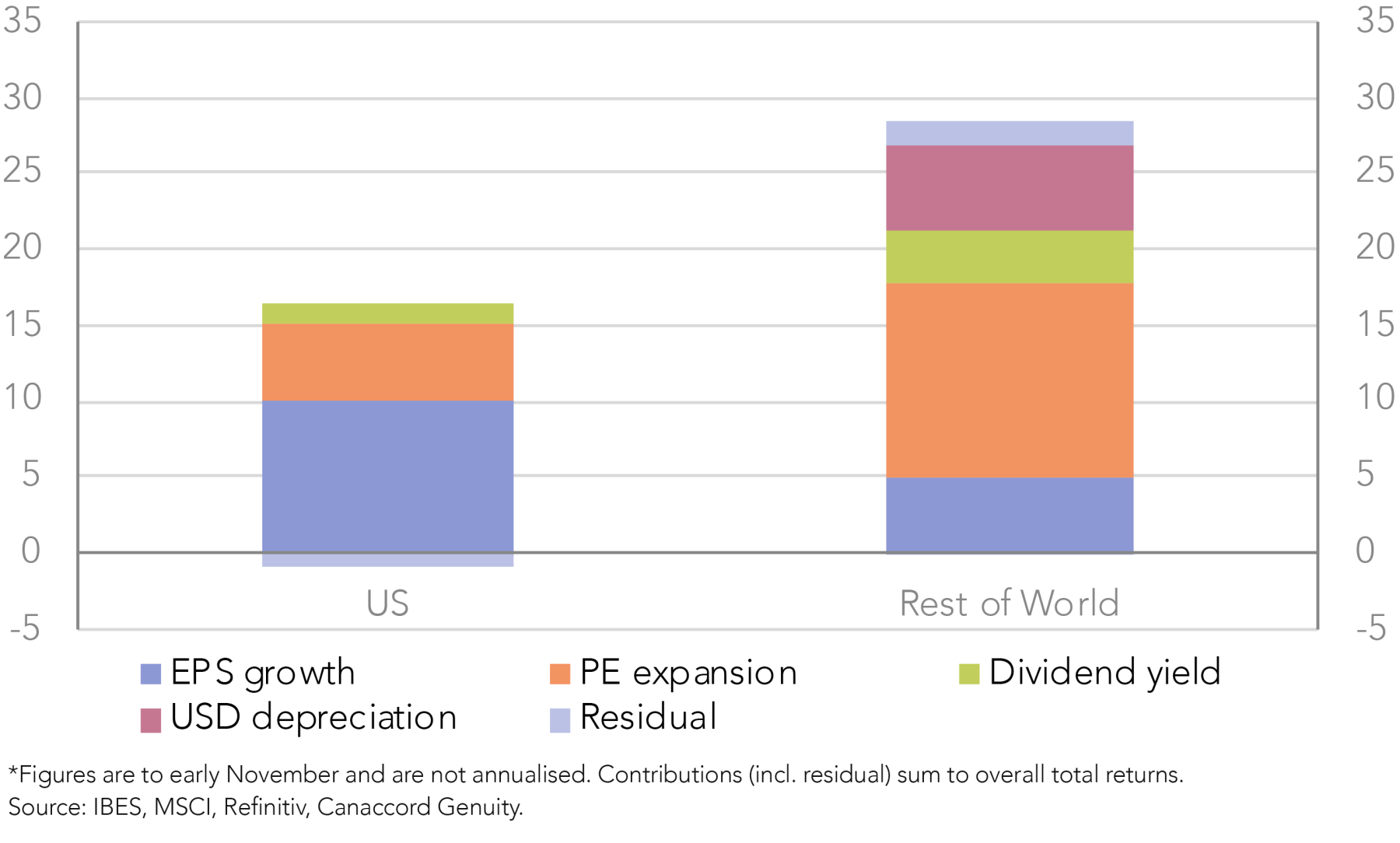

- The US equity market has had another good year, but the rest of the world has matched and even exceeded it. Despite lower earnings growth, there has been more scope for PE expansion in other markets, and there may well be further scope for this. On top, the high US dollar has depreciated and added to the outperformance of the rest of the world, which could also go further, especially given the Fed is projected to cut rates more but not so much the ECB or BOJ. At the very least, diversification across other markets could mitigate US risks, and the MSCI World Index could be a guide, with the rest of the world currently comprising around one-third of its capitalisation and the US two-thirds.

Outperformance Elsewhere

After more than a decade of US market outperformance, which has contributed to the idea of US exceptionalism, the tables have turned this year, with the rest of the world generating better performance than the US (Figure 2). A well appreciated contributor to this has been the depreciation of the US dollar, which has made it easier to account for why the US market has lost ground despite the continued strong earnings growth and the impressive adaptability and innovativeness of US companies.

But the US dollar weakness is only part of the story and not even the main part. What has contributed more to the outperformance of the rest of the world, despite more moderate earnings growth, has been a significant rise in market valuations, or PE expansion as some call it (Figure 3). This has added substantially to the rise of other markets this year and more than made up for the lower earnings growth than in the US.

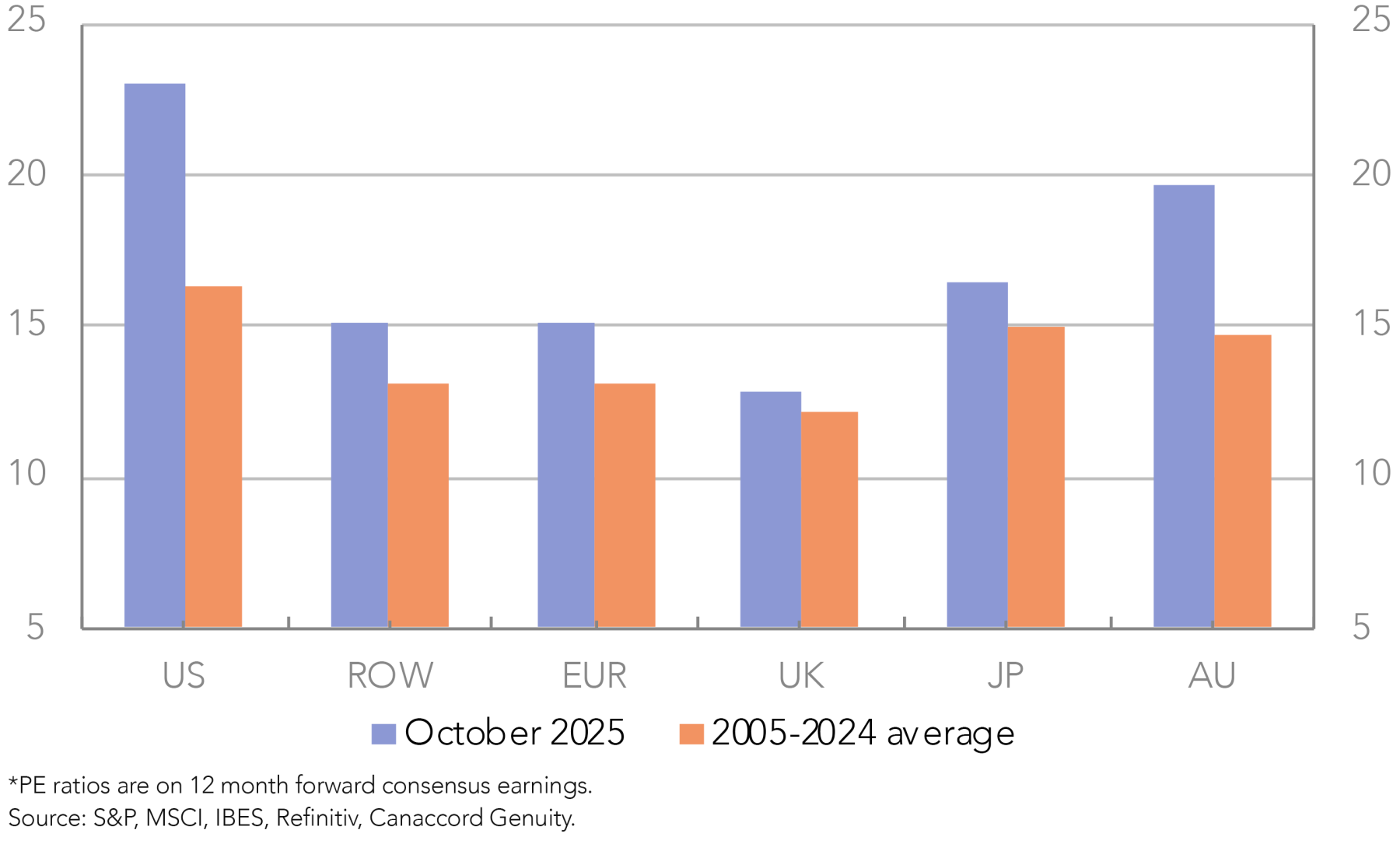

And there would seem scope for this to go further, with the valuation of other markets still not that high and this being a fairly broadly-based feature across major individual markets, interestingly with the Australian market somewhat of an exception, being at a higher valuation (Figure 4). Meanwhile, the US market valuation remains much higher, with this being driven by the mega cap tech stocks, and it could continue to provide a bit of a ceiling for performance, at least shorter term.

Economic Resilience

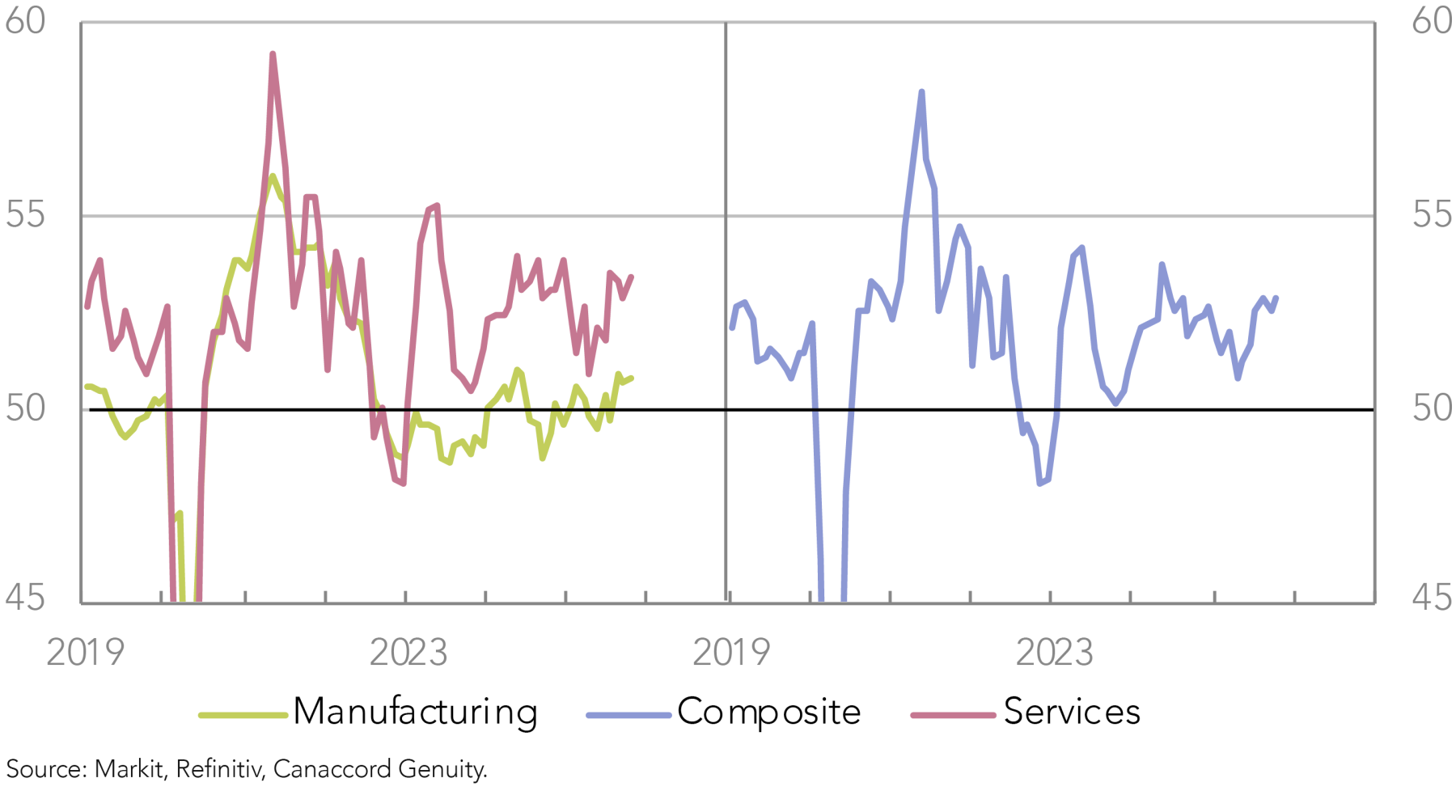

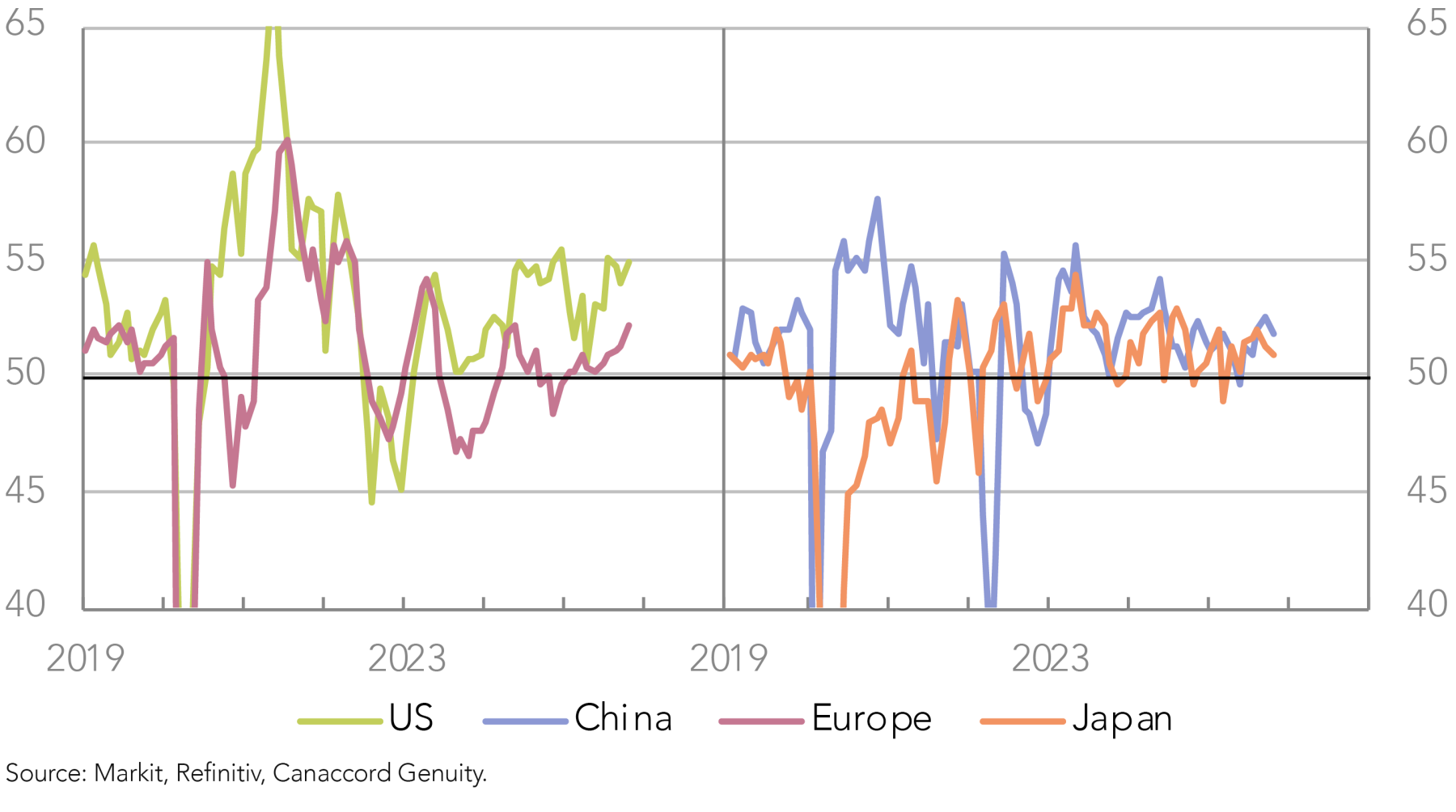

The US economy has also lost ground relative to others this year, facing headwinds from the US administration’s policies, while Europe and Japan have picked up since the bout of global inflation that followed the pandemic. The world experienced a scare earlier this year with the “Liberation Day” tariffs, but sentiment and activity look to have bounced back, with the widely monitored purchasing managers’ indices (PMIs), which track business conditions, suggesting global economic activity remains resilient going into year-end (Figure 5). Moreover, across the major economies, activity looks reasonable and to be potentially strengthening (Figure 6).

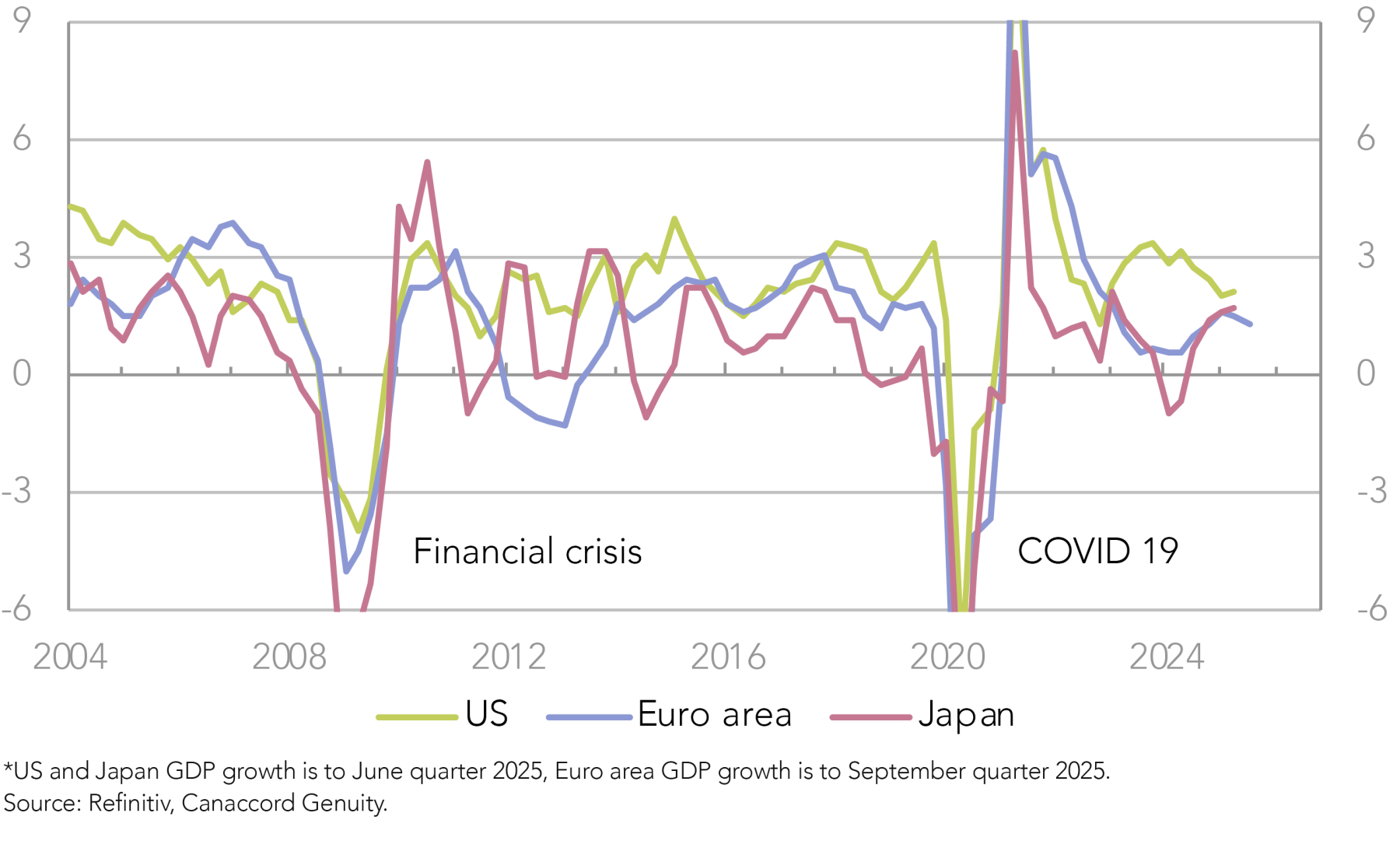

The US is indicated to be registering the strongest activity, but Europe, Japan and China are all recording activity above typical “stall speed” or sub-trend growth (which would be a reading of 50 or less on these indices). These timely and higher frequency PMIs generally concur with estimated GDP growth, albeit it is showing more convergence, with GDP growth slowing in the US and picking up in Europe and Japan in the past 18 months (Figure 7). Though the US government shutdown has delayed US GDP figures for the September quarter this year, while figures for the September quarter for Japan are scheduled for release next Monday.

The economic resilience of the rest of the world in the face of the high US tariffs this year, in contrast to the slowdown in the US from the exceptional growth of prior years; and the still moderate valuations of other markets and the gap to the US, would seem to provide potential for further outperformance from the rest of the world in the period ahead, and grounds for diversification across global markets.

Written by

Tony Brennan, Chief Investment Strategist

Tony Brennan is Canaccord Australia's Co-CIO, and brings over three decades of investment strategy experience from global investment banks including Citi, Deutsche, and Merrill Lynch in Australia, and UBS in New York, London and Sydney.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.