2025 saw strong investment performance from balanced and growth asset-tilted portfolios, as equities delivered a third consecutive year of strong performance.

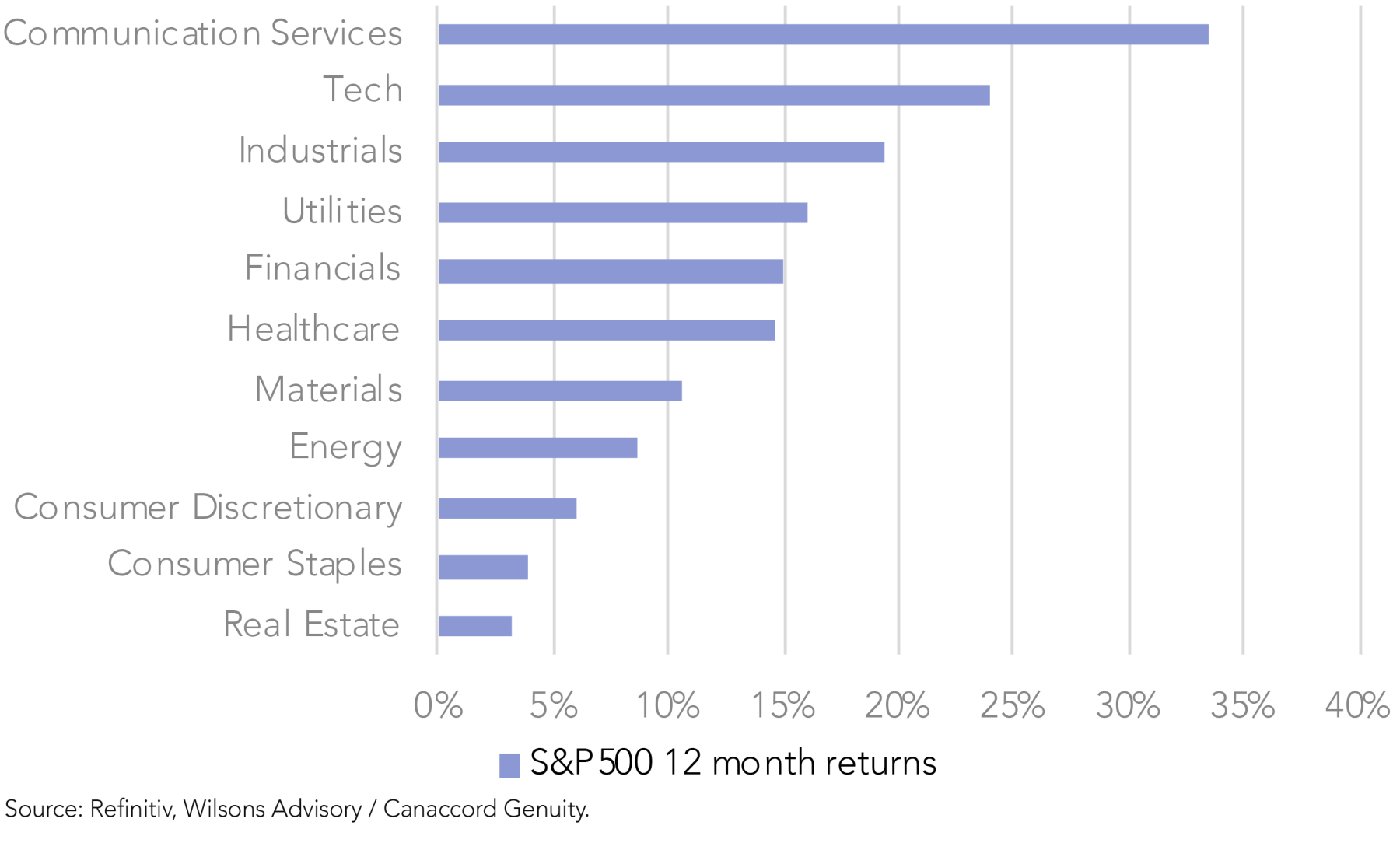

US equities have been the dominant driver of portfolio returns in recent years and delivered another above average year in 2025. However, global equity performance showed some noteworthy broadening in 2025, particularly when the impact of a weakening US$ is considered.

While we view the broadening performance as an important and welcome development, the US market tends to set the broad tone for virtually all equity markets. As such, US market performance in 2026 will once again be crucial. Although valuations are stretched by historical standards, our base case is that the key drivers that have delivered tailwinds for the US market should continue to be supportive in 2026.

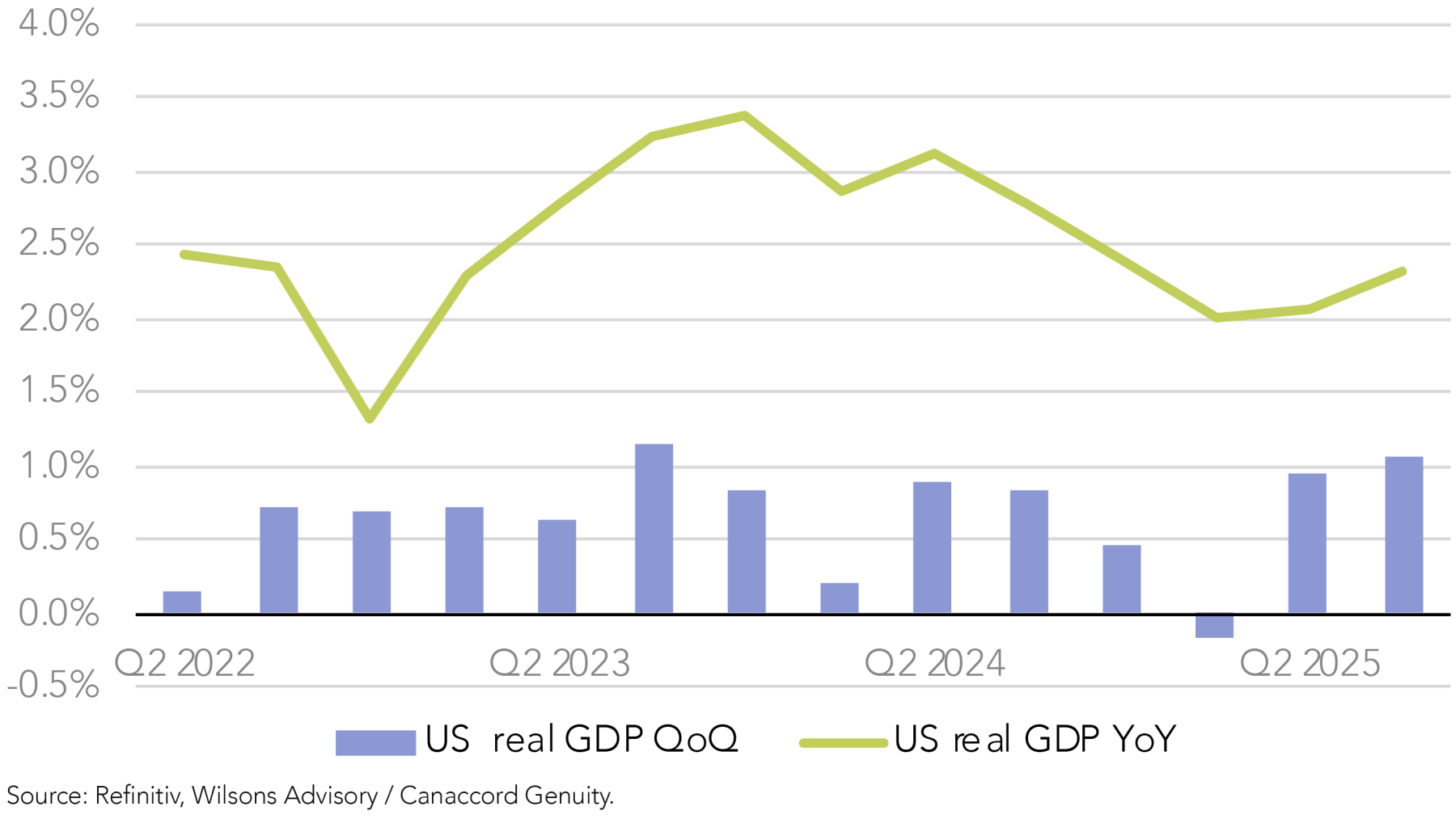

Goldilocks US Macro Looks Likely to Continue

Despite a significant “wall of worry” in 2025 - stemming from US President Trump’s tariff war and an array of geopolitical tensions - US (and global) equities have benefitted from a surprisingly benign macroeconomic backdrop in relative terms.

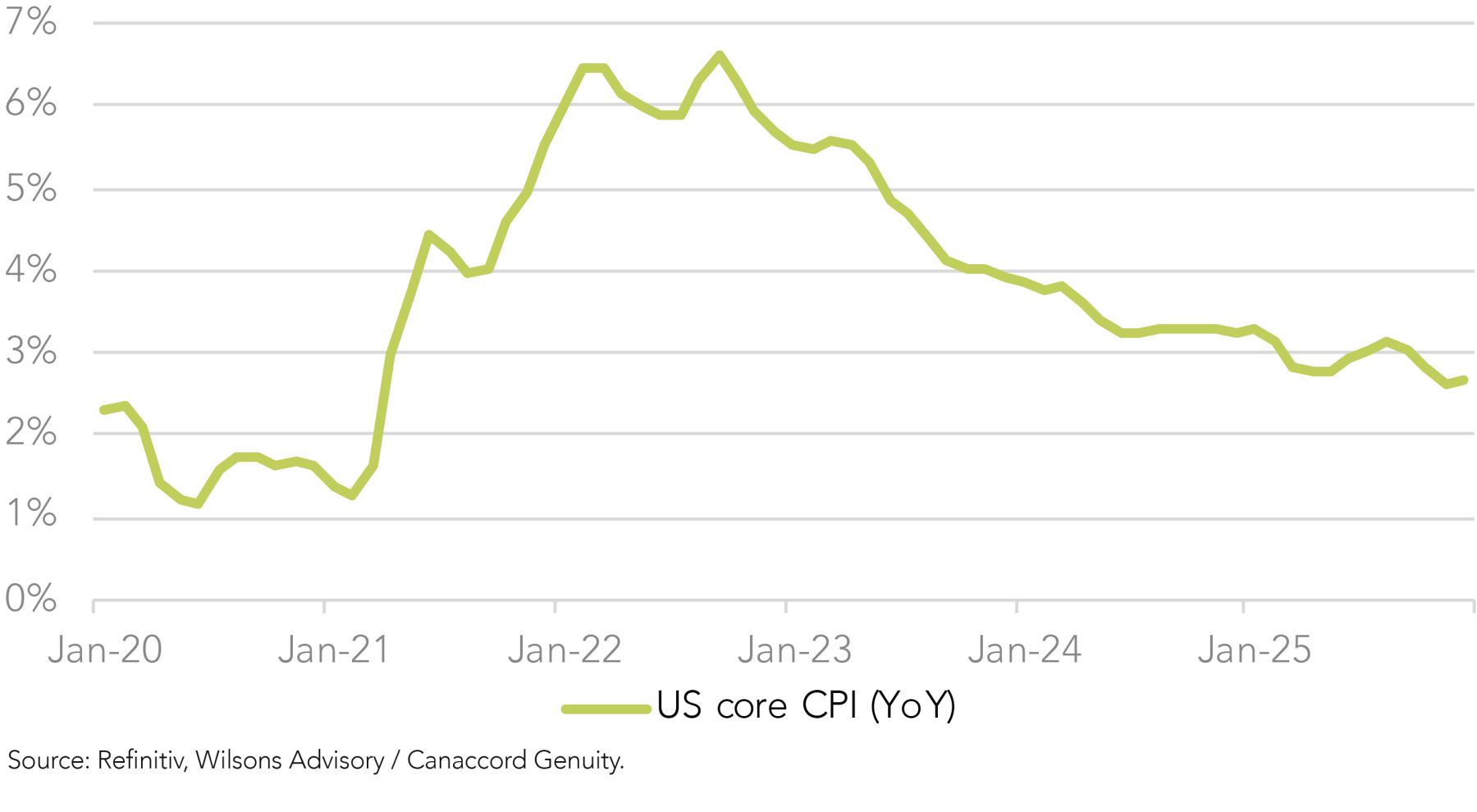

This environment was marked by a continued moderate economic expansion and an inflation trend that remained relatively contained, despite investor concerns of a tariff-driven pick-up in the US inflation rate.

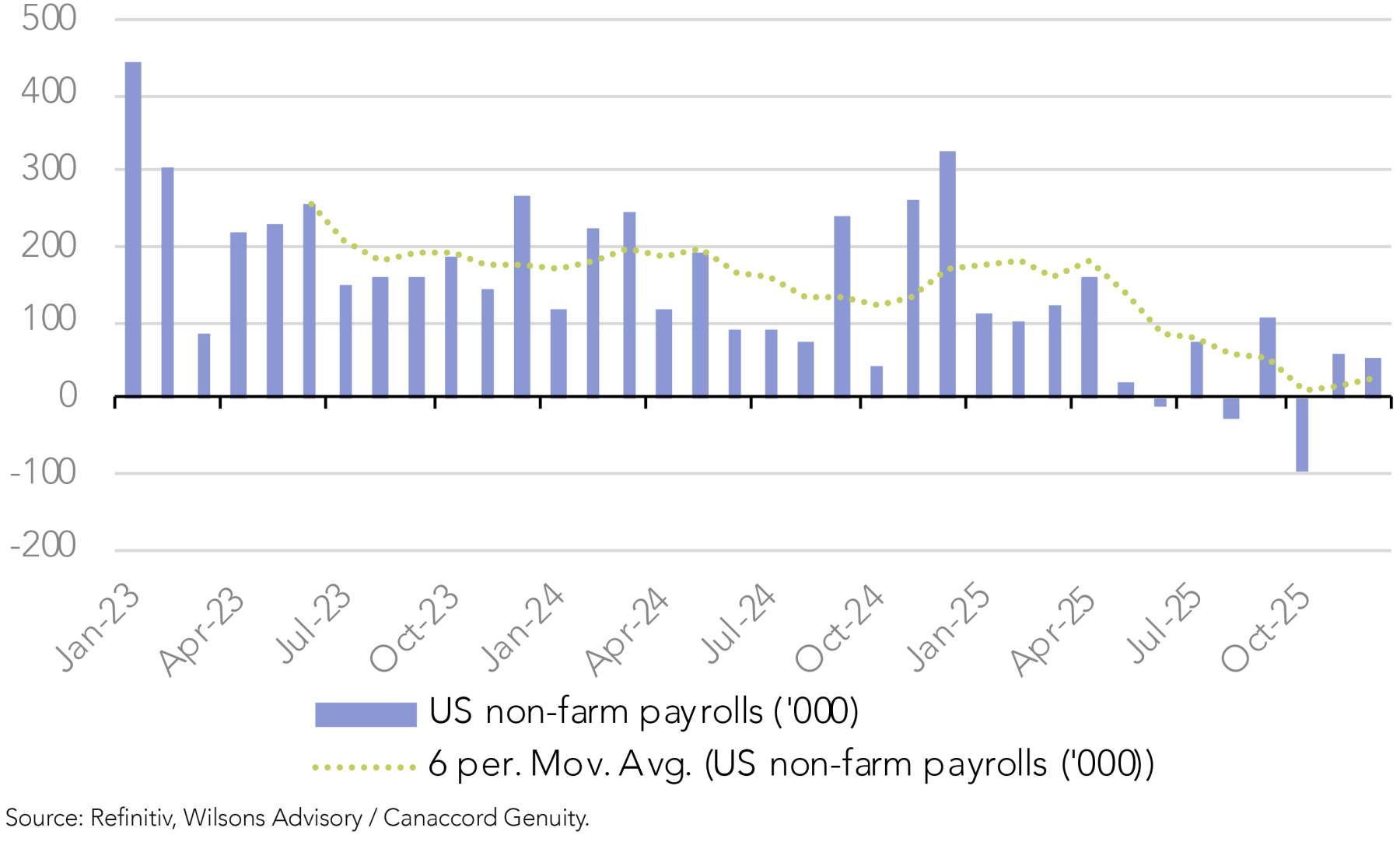

The labour market has been the US economy’s weak spot, with very few jobs added in 2025. However, with immigration slowing sharply, the unemployment rate edged up only marginally.

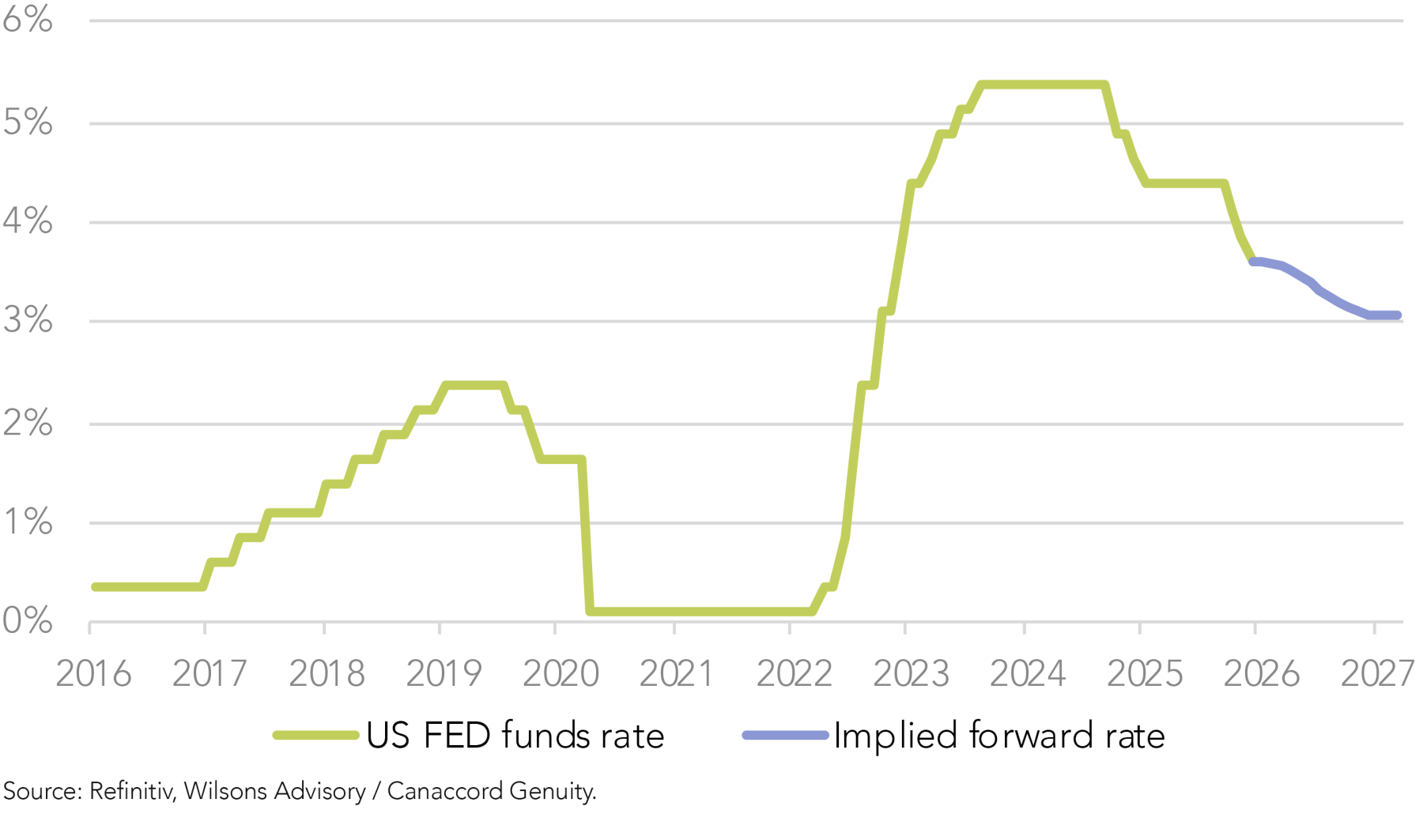

This benign combination of moderate growth, contained inflation, and a soft but relatively stable labour market allowed the Fed to continue to gradually ease policy rates, with expectations for two more cuts in 2026.

A further moderate economic expansion with more Fed easing remains our base case for 2026. While we remain alert to the risks around our central case, the backdrop of a moderately growing economy and Fed easing is typically conducive to stock-market gains.

Recent data points on growth, labour markets, and inflation have displayed a Goldilocks-like quality. Market concerns could emerge from data that prove either “too hot” (higher inflation) or “too cold” (further labour market weakening). However, current trends continue to support our view that core macro conditions should remain relatively benign.

Risks could also bubble up for a number of other tail risks, including challenges to Fed independence, or fiscal largesse into the US mid-term elections. Nonetheless, our base case remains that the 2026 macro backdrop will once again be supportive for equities, as well as fixed income and credit markets.

Importantly, 2025 reminded investors that US equities are not the only game in town. While we will examine rest-of-world prospects in more detail in coming weeks, the foundations set by the US economy should help global growth at least match last year’s pace. The prospect of additional European and Chinese stimulus provides some upside to this scenario and could support an earnings recovery outside the US. We continue to recommend a strategy of diversified exposure to both US and rest-of-world equities.

Weighing Up the Sustainability of the AI Virtuous Circle

Outside of constructive macro foundations underpinning the US economy, the AI trade has been central to the US and the global equity uptrend.

Our view for 2026 remains relatively constructive, albeit increasingly selective. US tech once again outperformed in 2025, although there is plenty of debate around whether too much optimism is priced into the AI trade. At the same time, there is also a growing debate around whether some of the “AI losers” of 2025 have been discounted too aggressively.

Constructive but Diversified

Broadly, we see the AI revolution as closer to early- than late-cycle, but we can’t discount the possibility of some “AI impatience,” as investors question the return on capital from the massive AI capex acceleration of recent years. At this stage, we are handling this risk with diversification rather than an overt tilt away from the US technology sector. We are also increasingly looking at some of the heavily sold down “AI losers” for rebound opportunities in 2026.

In 2025, the market consistently underestimated the capex spend on AI from the US mega cap tech sector while also underestimating profit tailwinds stemming from AI.

The US tech sector continued to deliver more earnings growth and more upgrades than the broader market. We remain constructive on the prospect of an AI tech led profit upswing, as well as the prospect of productivity benefits across the broader corporate sector. We are nonetheless attuned to the risk of some near-term disappointment around AI this year, although this is very difficult to pinpoint. However, we think the risk of an AI capex bust is low, particularly with the Fed still in easing mode.

Australia’s Goldilocks Macro Rudely Interrupted in 2025

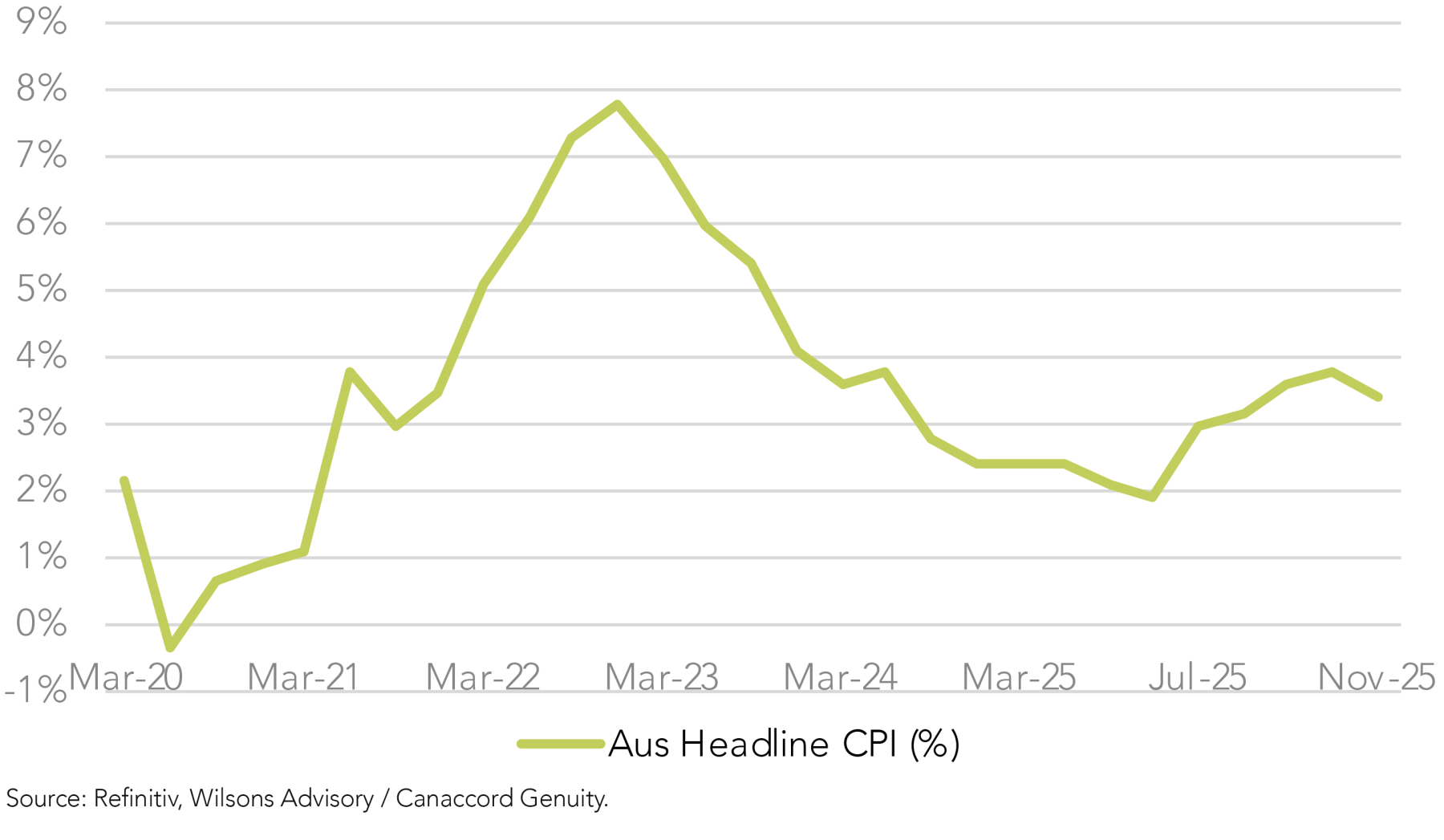

While US and global macro conditions proved surprisingly benign in 2025, Australia’s own Goldilocks economic backdrop was disrupted by a surprising U-turn in domestic inflation during the second half of last year.

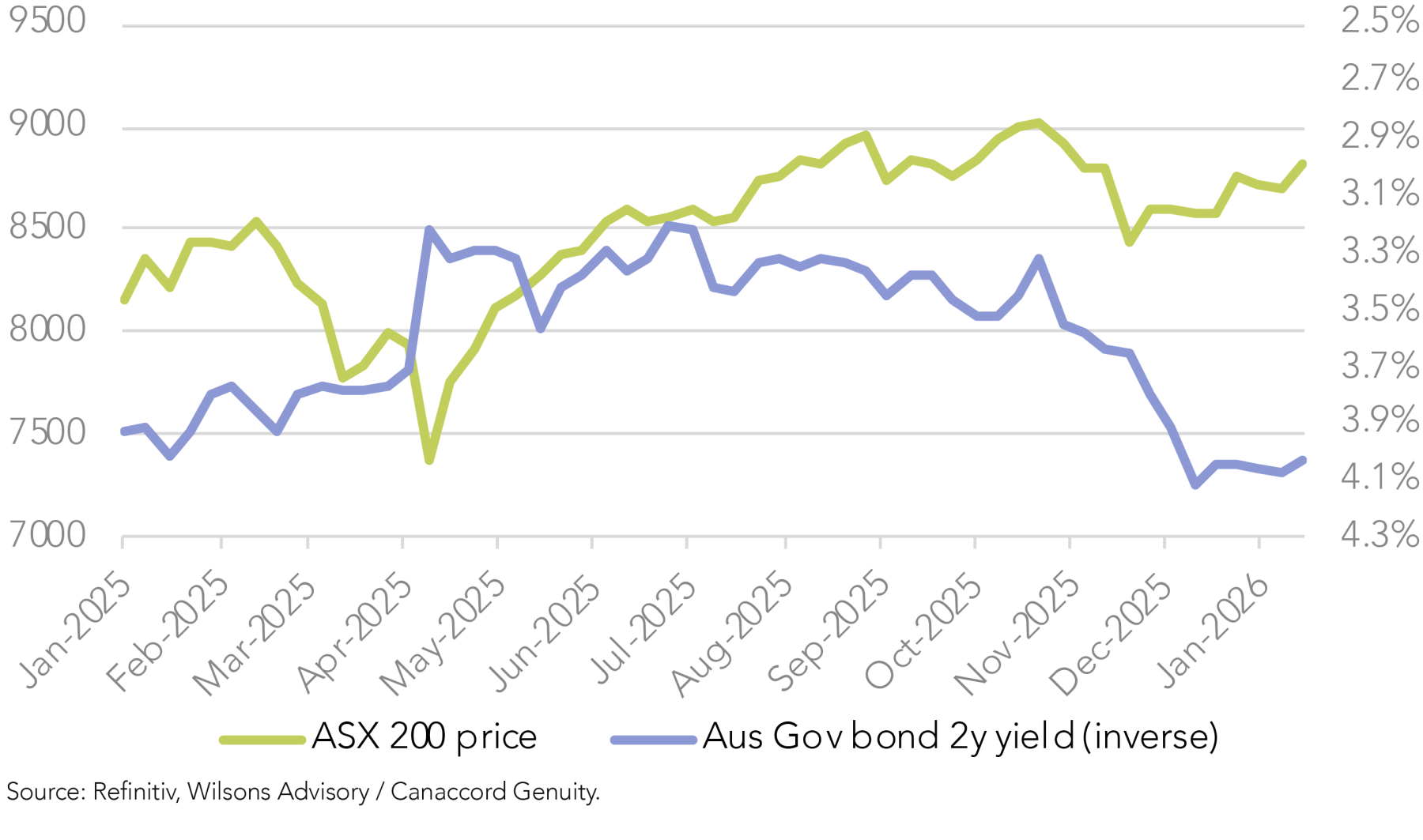

This caused a decent pullback in equities around October/November, alongside a sharp selloff in the local bond market as investors recalibrated their expectations for RBA policy.

Moving into 2026 investors, don’t see risk in the inflation and interest rate backdrop as presenting a genuine stagflation risk, but higher inflation and higher interest rates have taken the gloss off domestic fixed interest and equity returns. We saw both underperform against global fixed interest and global equities by the end of 2025.

2026 has so far brought some somewhat better news on inflation, with a lower-than-expected November monthly print. However, it is premature to call this a new trend and Australia’s underlying rate of inflation is still too high. The December quarterly print, due in late January, will be key to near-term expectations with the market currently fully pricing a rate hike (somewhere between May and August). This compares to last September, when the market was still pricing two to three additional cuts for the cycle. The RBA has suggested recently that it is prepared to look beyond the current near-term inflation pickup. This hint at patience suggests an on-hold RBA is quite a plausible outcome for 2026. This would help Australian equities to follow the likely positive global equity lead, although the late January inflation read will be important despite the RBA’s inclination towards patience.

Despite the potential for an on-hold RBA in coming months, the risk of a rate rise over the next six months looks more likely than a cut. From this perspective - as well as due to still full valuations - Australian equities do not look as attractive as global, although an improving trend in the A$ and the market’s building enthusiasm for commodity plays will likely keep Australia in touch with global markets from a performance perspective.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.