Heading into year end, markets are set to finish another solid year, particularly overseas, after significant uncertainty at the start.

The volatility around the introduction of tariffs on “Liberation Day” has been followed by a strong recovery for much of the second half of the year.

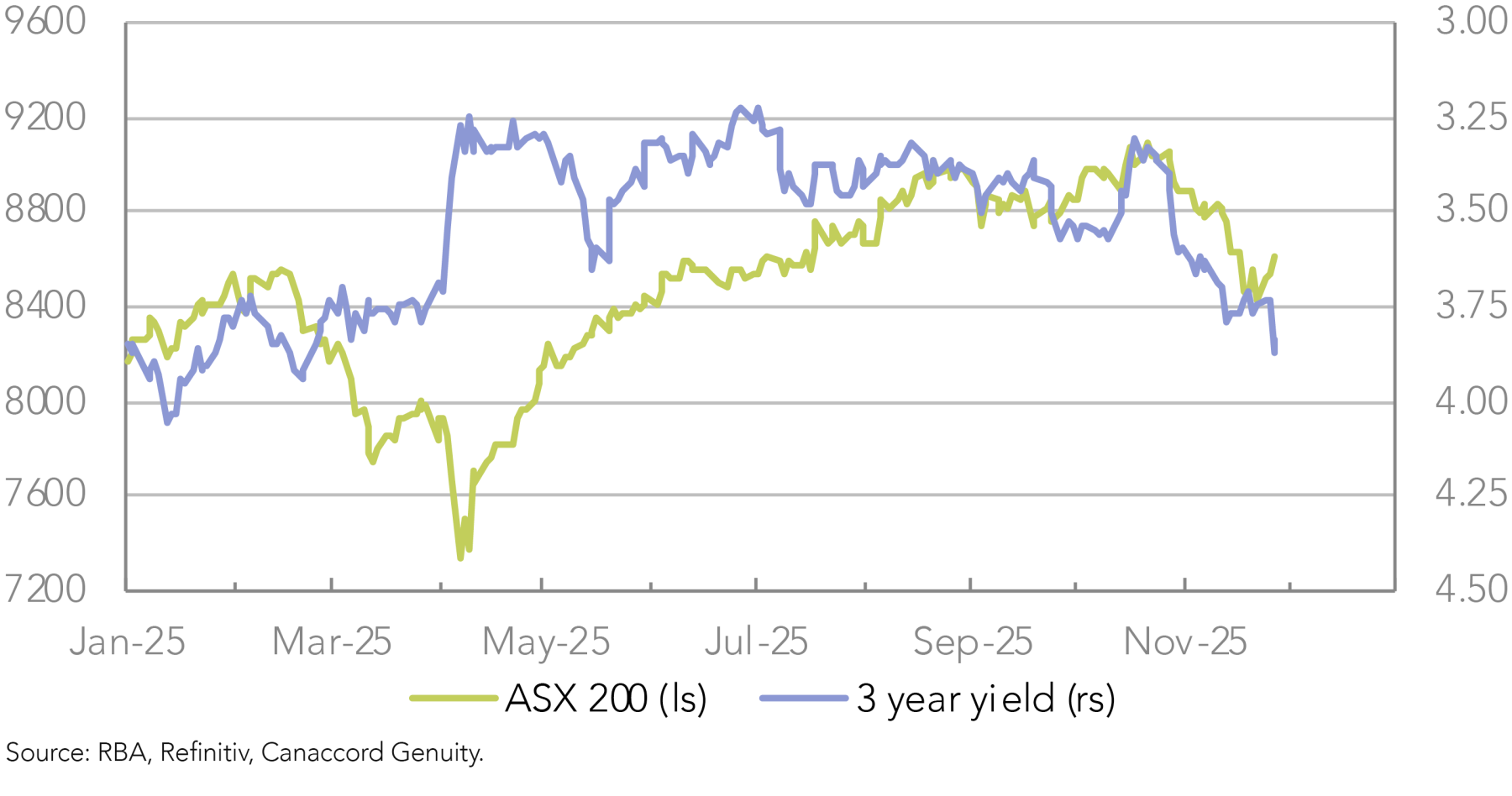

Yet, in the past month there has been some uneasiness as interest rate expectations have fluctuated and shifted, especially in Australia, which has seen a moderate correction retrace some of the year’s gains. Below we take stock of these recent developments and assess near-term prospects.

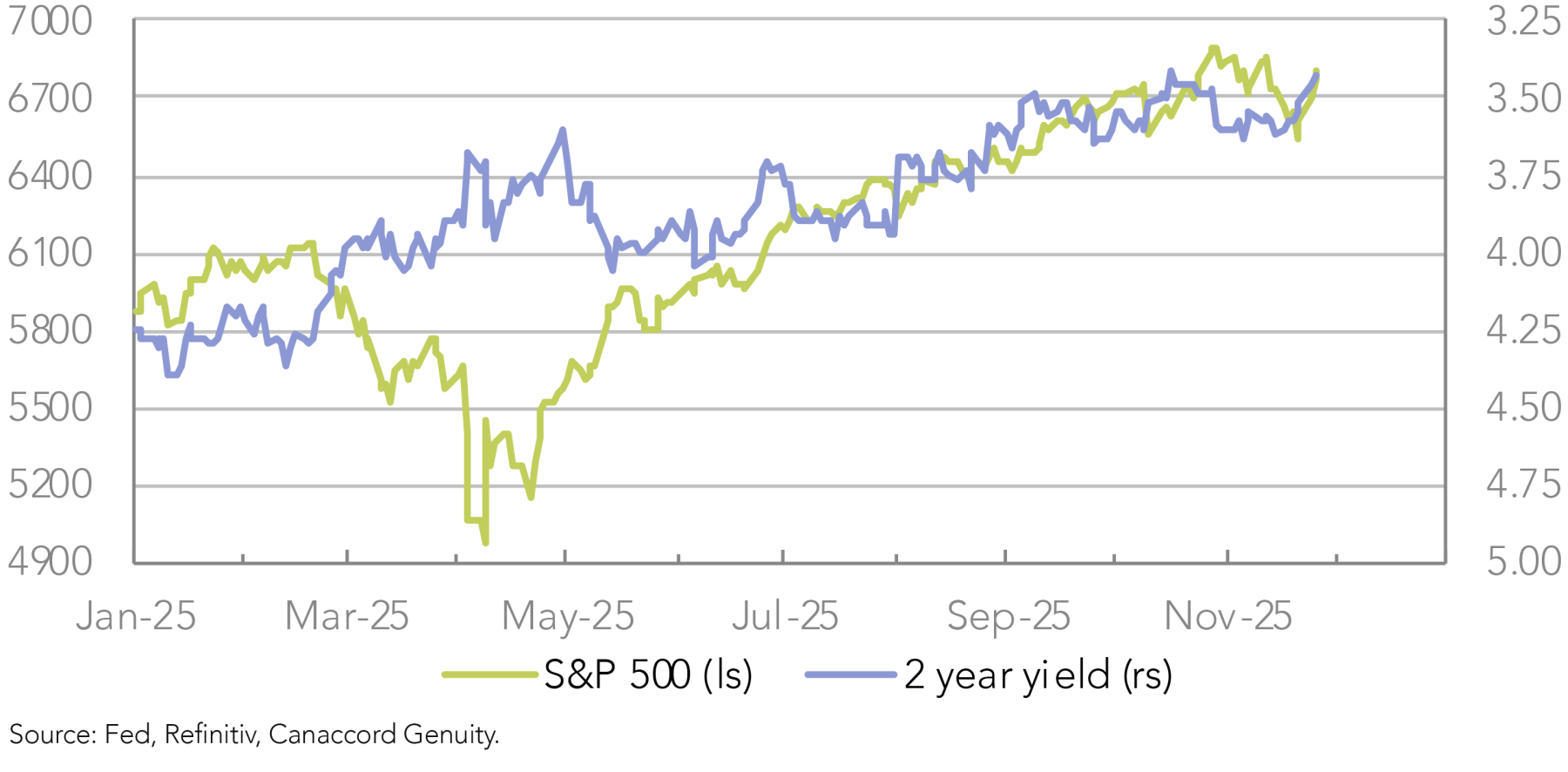

- After another year of good gains, following the earlier volatility, the rally in equity and bond markets has become a bit unsteady. It seems to be reliant on further interest rate cuts, and has reversed on risks of them not materialising. In the US, this has made for choppy conditions, as a further rate cut this year has been thought “off again and on again”, and both the S&P 500 and Treasury bond yields have waxed and waned over the past month (Figure 1). In Australia, it has led to a moderate correction, as the prospect of further cuts has faded, with the ASX200 down around 5% and bond yields rising up to half a percent (as discussed in our report of 24 November).

- In the US, further rate cuts would still seem likely, including next month, potentially keeping conditions supportive in markets. The Fed policy setting committee may be divided on a move in December, but enough members seem likely to be open to a further cut. Although the US government shutdown has delayed official data on the economy, figures starting to get released and those from private surveys have tended to indicate continued weakness in the US labour market and still only moderately higher inflation since the tariffs. The Fed will also update projections for the economy and despite possible differences on timing, recent meeting minutes reported a majority of the committee continue to expect to lower interest rates further.

- In Australia, after higher inflation, markets are already factoring in a slight rise in rates in 12 months, which may limit further near-term weakness, given uncertainty. The uptick in inflation has been more pronounced than expected but the RBA has judged a substantial part of it as likely to be temporary and has also warned that the new comprehensive monthly figures are likely to be volatile for a while. It also considers the economy’s recovery as likely to remain moderate, and September quarter GDP figures this coming Wednesday will shed more light on this. If the Fed were to continue easing and the RBA pause, the AUD could also appreciate, helping reduce inflation and adding to doubts about a possible rate rise.

Risk Management

After the sweeping policy changes ushered in by the US Administration, the absence of official data for over a month following the government shutdown has added to the challenges of interpreting economic conditions in the US going into year end. Yet, monetary policy must continue to be set and Fed officials have to make their best judgements about the appropriate decisions to take, which will be necessary again at the final meeting for the year in December.

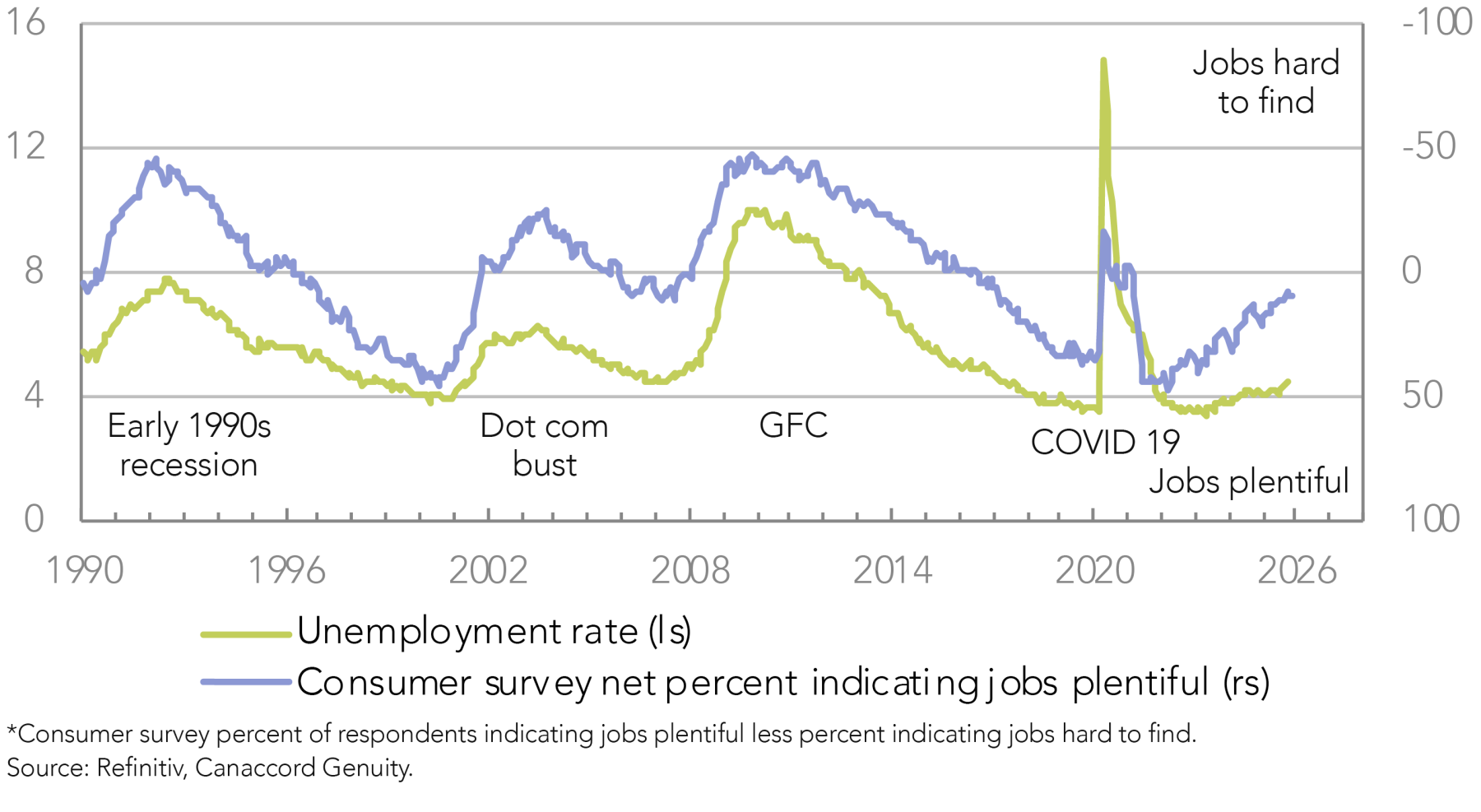

Fortunately, official figures have started to be released again and those from private surveys have continued, and an impression can be formed of underlying conditions, which seems to continue to suggest weakness in the US labour market through recent months and still only moderately higher inflation after the tariffs. Monthly payroll figures for the private sector have recorded only modest growth in employment through to October, and in consumer surveys jobs have been reported as less plentiful in recent months, often associated with higher unemployment (Figure 2).

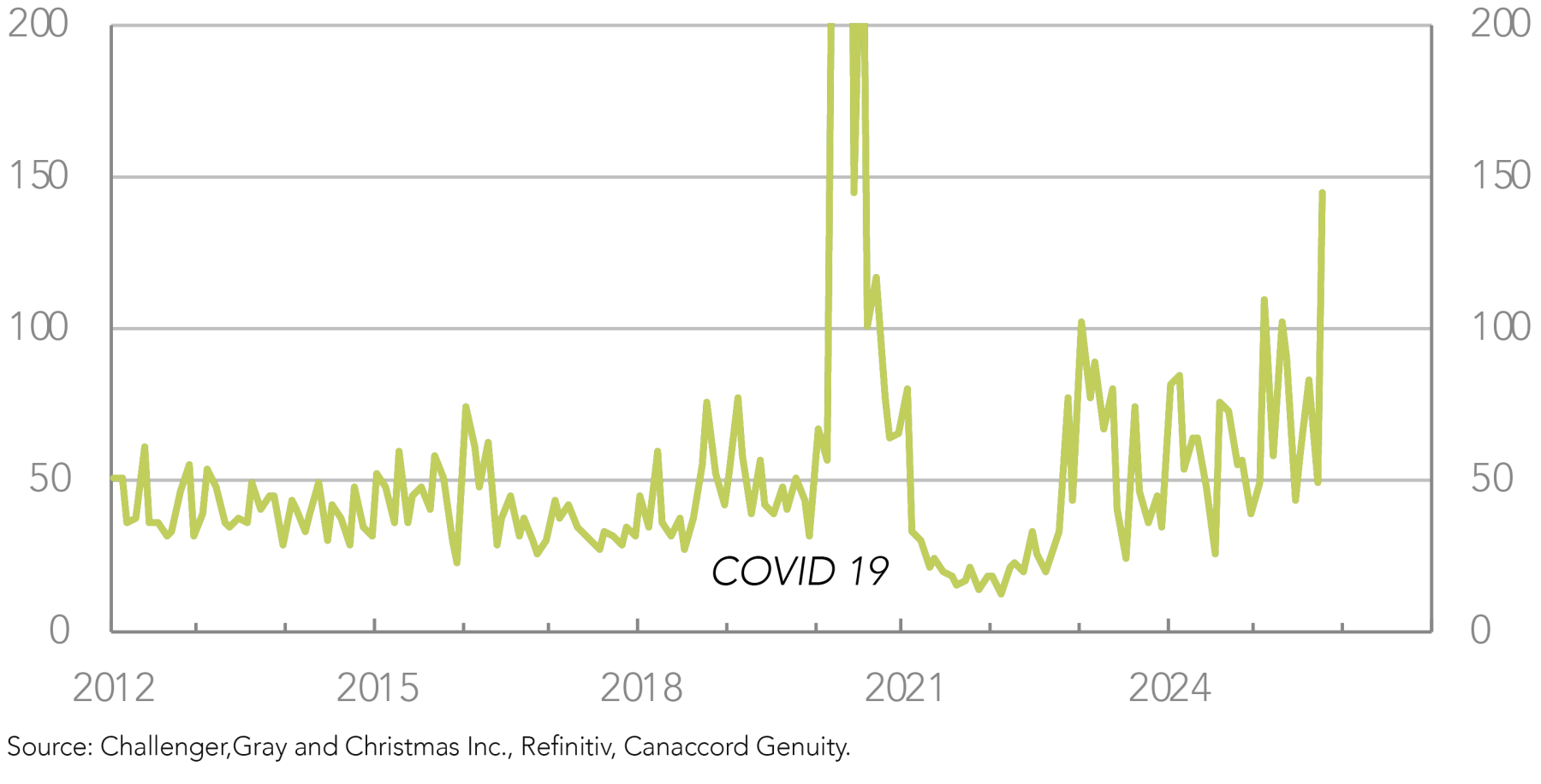

There has been debate whether the weaker job growth is more a reflection of less demand for workers or less supply due to reduced immigration, but a sign that it is due more to less demand for workers is the fact that jobs are being reported as less plentiful, for if it were due to less workers being available, there would be more job vacancies and jobs would be more plentiful. The situation with jobs growth stalling but not collapsing is being described as the “no hiring, no firing” labour market, but widely reported lay offs in October create the risk of further deterioration (Figure 3).

With inflation still only moderately above target and not showing recent signs of increasing further, the “risk management” approach of the Fed to its dual mandated goals of maximum employment and price stability seems to provide a reasonable likelihood of the policy committee erring on the side of caution in regard to risks to employment by cutting rates further at its December meeting. This could potentially keep conditions supportive in equity and bond markets.

Exercising Judgement

In local markets, conditions have been weaker in the past month, as higher inflation has dashed prospects of further rate cuts and seen markets factor in a slight rise in rates in 12 months (Figure 4). But this may limit further near-term weakness, given the uncertainty and the potentially supportive conditions in overseas markets.

The RBA has been surprised by the extent of the rise in inflation but has kept it in perspective, judging two-thirds of the rise evident in the September quarter figures as likely temporary. Its response has been to dampen expectations of any further rate cuts and highlight the uncertainty about the future direction. It has also warned about likely volatility for a while due to evolving seasonal adjustment in the new comprehensive monthly inflation figures released in the past week, which showed a further jump in inflation in October.

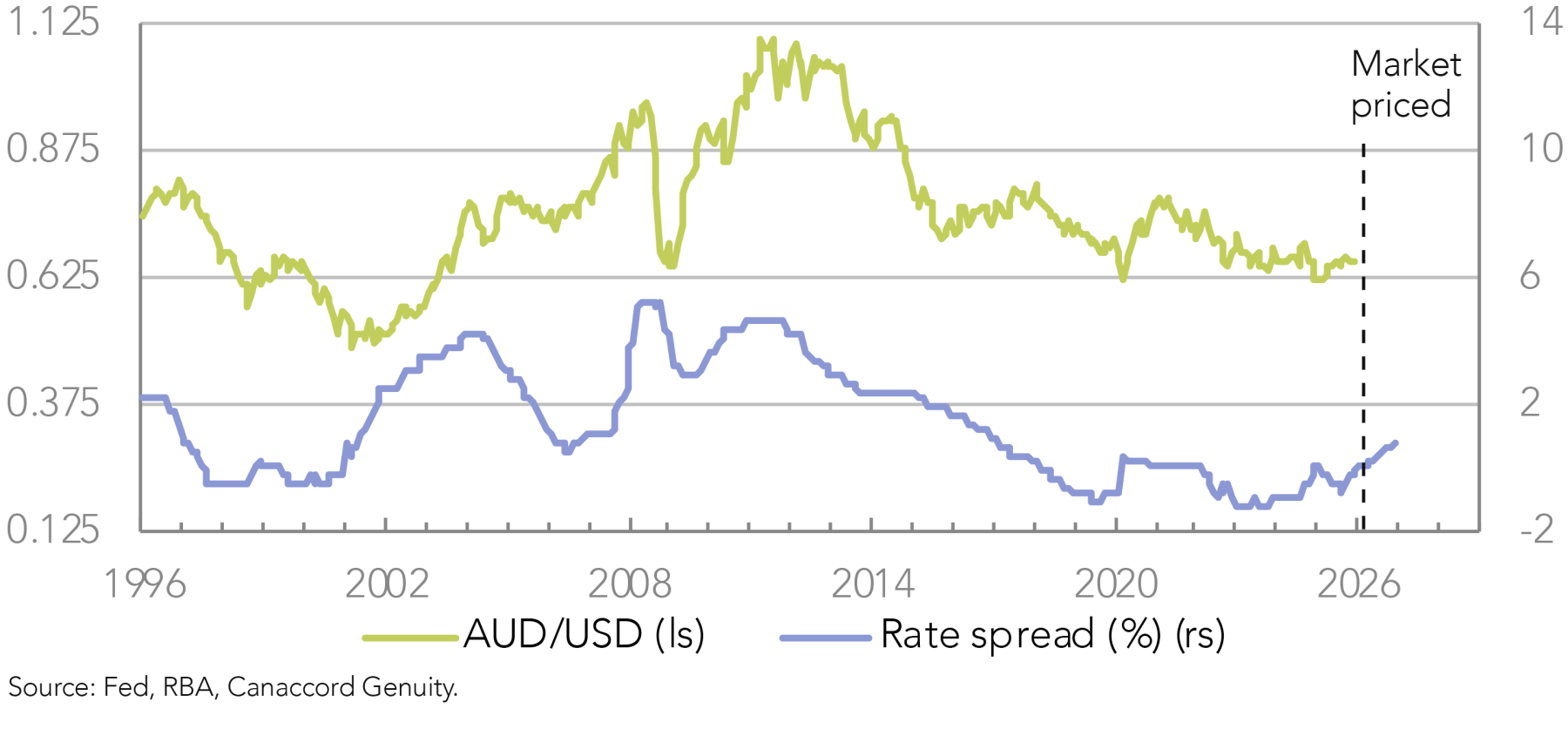

In the coming months, were the RBA to hold rates steady while the Fed continued to ease, appreciation of the AUD could also help reduce inflation and add to the uncertainty about the need for a rise in rates, potentially limiting additional market weakness in the near term (Figure 5).

Written by

Tony Brennan, Chief Investment Strategist

Tony Brennan is Canaccord Australia's Co-CIO, and brings over three decades of investment strategy experience from global investment banks including Citi, Deutsche, and Merrill Lynch in Australia, and UBS in New York, London and Sydney.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.