We take a look at the latest earnings results and outlook for companies across the Wilsons Global Equity Managed Portfolio. All our holdings saw some impact from COVID-19 during the quarter. Beneficiaries were companies like Microsoft and Danone, while Starbucks and Honeywell both saw disruptions. Longer-term, we think most of our portfolio positions will be in a stronger relative position post the crisis vs. pre-crisis.

We remain of the view that a secular bull market in equities is emerging. The rally is being underwritten by a combination of re-openings across the real economy, unlimited central bank support and large fiscal stimulus – all of which provides a backstop for global equities.

In this environment, companies exposed to pervasive growth themes – Cloud computing, Digital Transformation, SaaS Health, and Healthier Eating – all themes in the Wilsons Global Equity Managed Portfolio - should be able to continue to increase revenue and market share. In time, they should be rewarded with higher market capitalization.

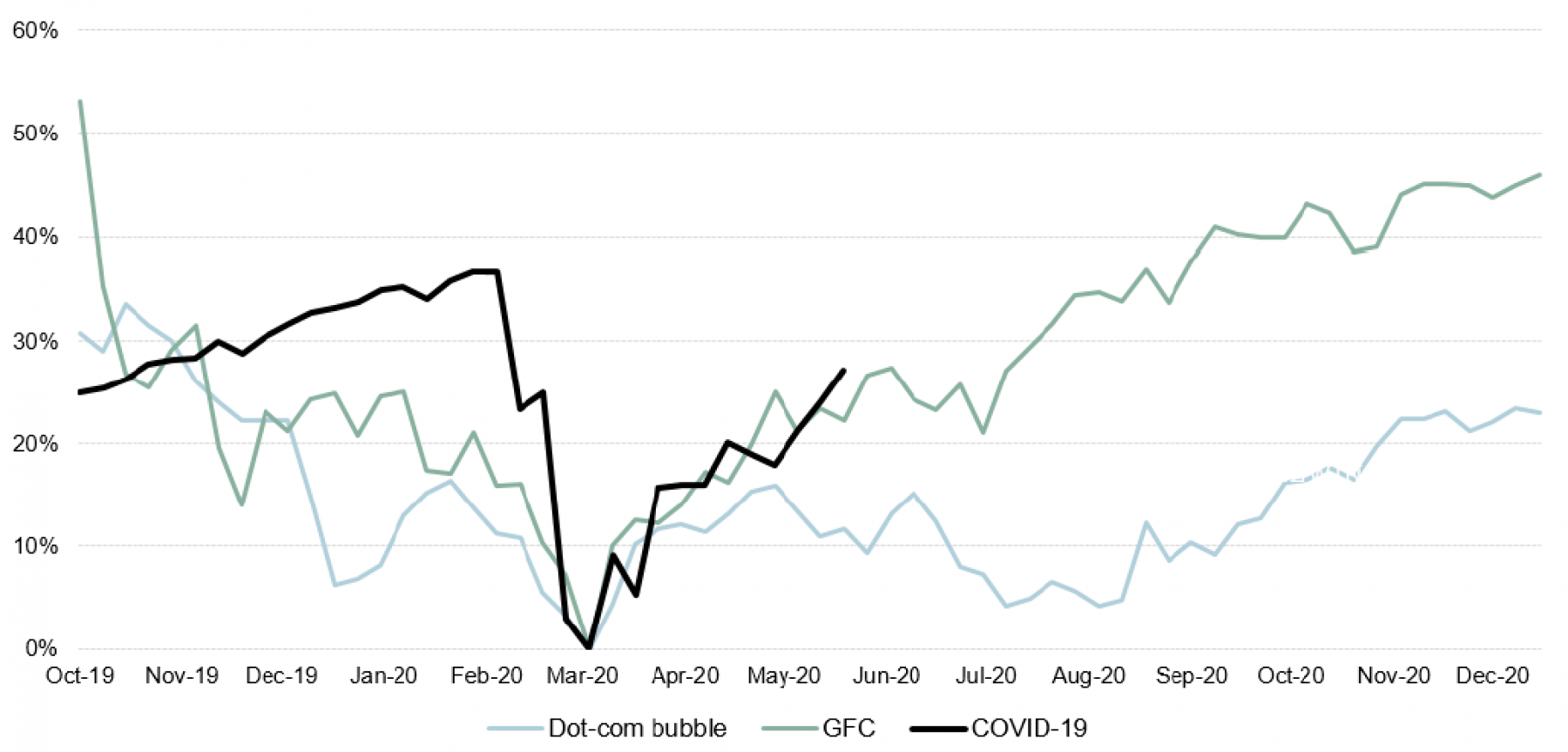

Exhibit 1: S&P500 Reaction: COVID-19* vs. GFC and Tech Crash

Source: Source: S&P500 rebased to 0% at market low. *COVID-19 data up until 3 June 2020.

For more information about Wilsons' Global Managed Equities Portfolio, please email info@wilsonsadvisory.com.au

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.

Written by

John Lockton, Australian Equities

John is a leading investment strategist with 20 years experience.