After a year adapting to major policy changes in 2025, the latest Federal Reserve projections anticipate the US economy emerging on track for stronger growth and lower inflation in 2026.

In contrast, the latest assessment from the RBA sees risk of signs of a broad-based inflation pick up and the potential need to raise interest rates again next year.

Here we consider the potential implications for markets before discussing the differing outlooks in more detail.

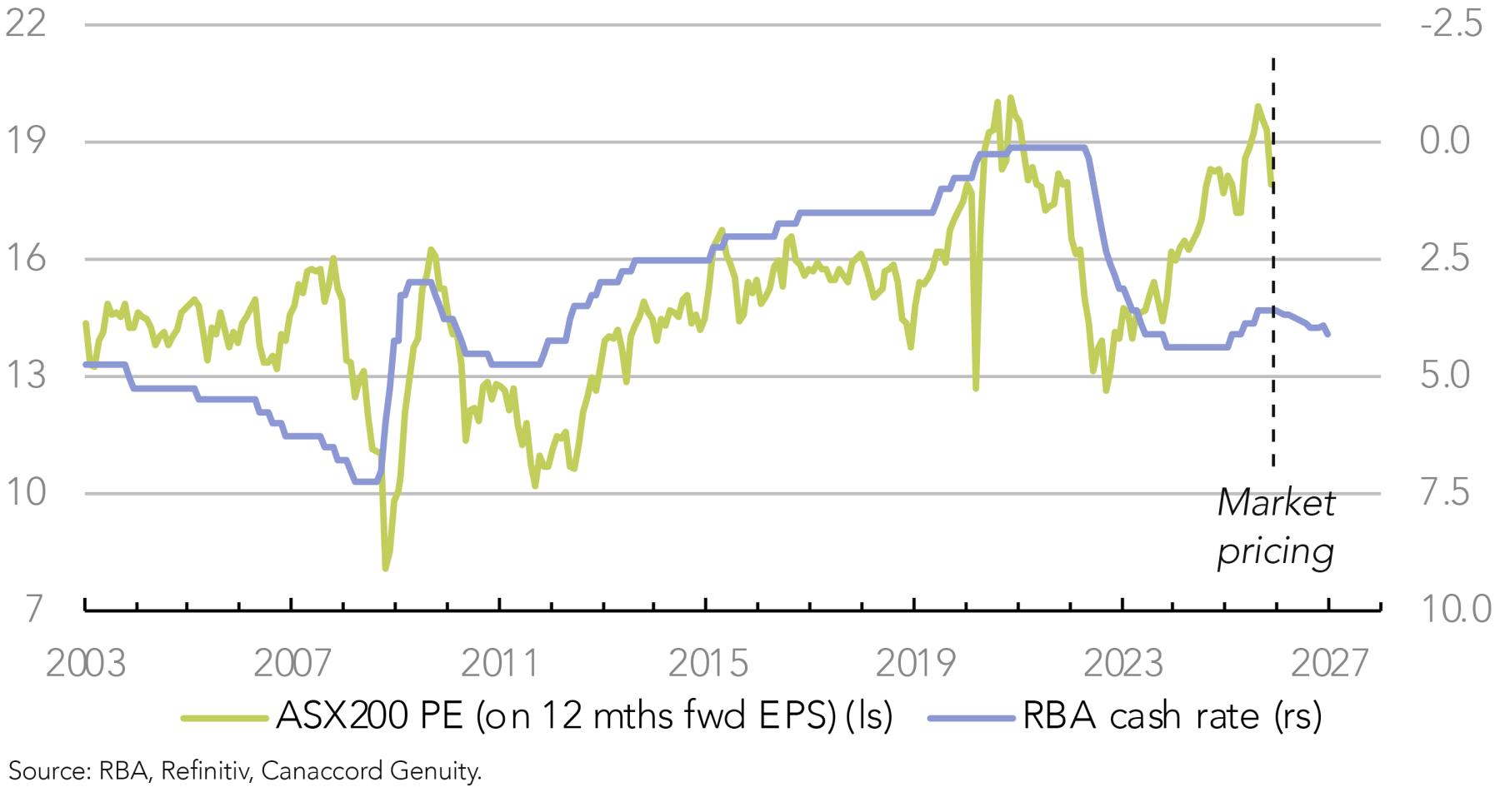

- Recent market performance has factored in some divergence in the outlooks. We have commented in the past few weeks on the sensitivity of markets to shifting interest rate expectations, which have created choppy US markets but left equity indices and bond yields little changed in the past month and half; while generating weaker markets in Australia, with equities down around 5% and bond yields up as much as three-quarters of a percent, as rate expectations have swung around. In the past week, the Fed and the RBA tended to validate these moves, with the Fed cutting again and projecting more easing, but the RBA on hold and discussing conditions that could require a hike next year.

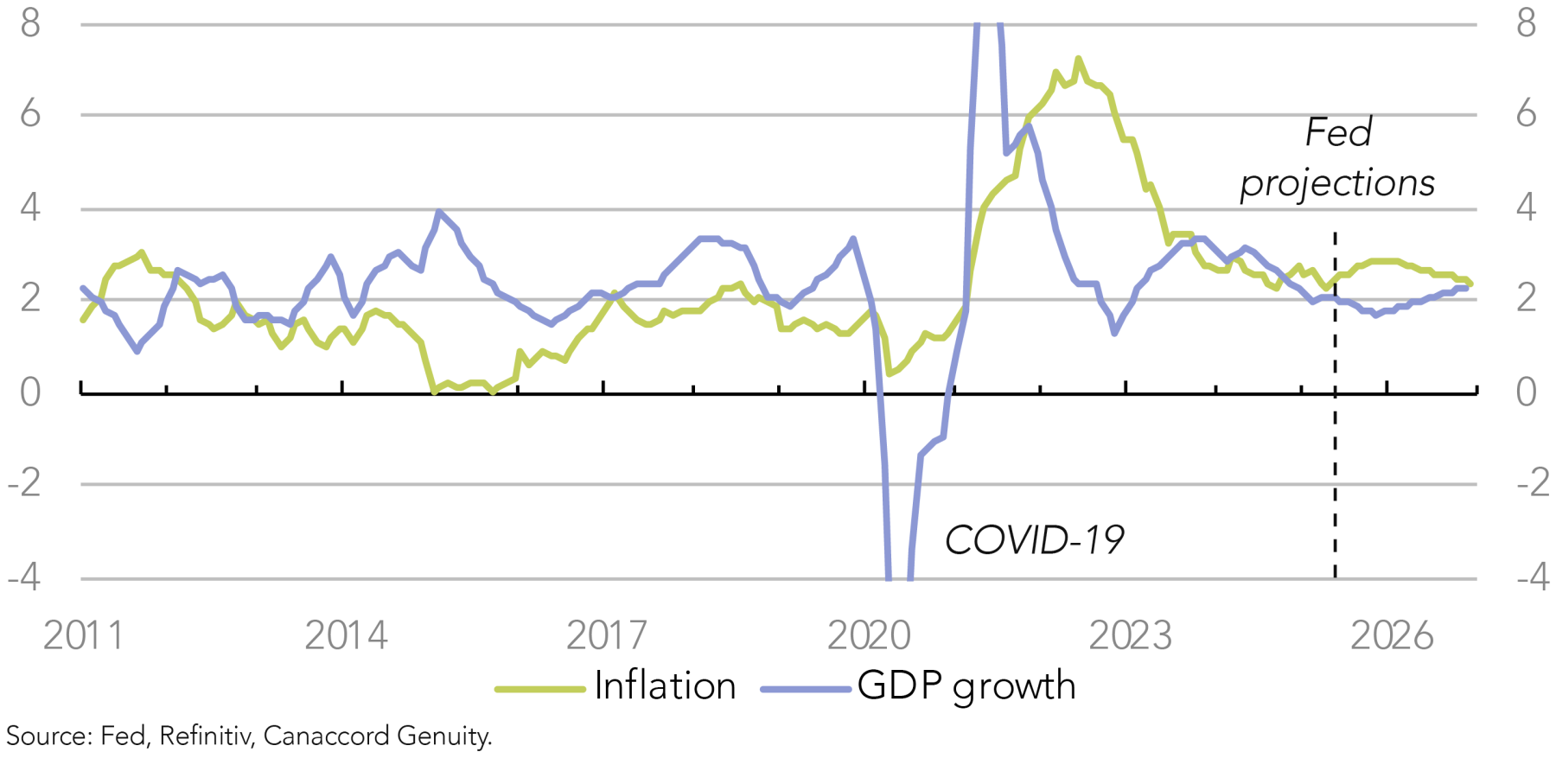

- In reality, the Fed may be close to pausing, though an improving economic outlook could remain supportive of markets. At the past week’s press conference, the Fed Chair noted that, after the three, one quarter percent rate cuts in recent months, policy was now within the range of estimates of neutral, leaving the Fed well placed to “wait and see” how the economy evolves. Moreover, the median projection of committee members was for only one further quarter point cut next year, and there were two dissenters from cutting at the past week’s meeting. But the projections also envisage an easing in inflation and pickup in growth next year, conditions that could continue to support equity and bond markets (Figure 1).

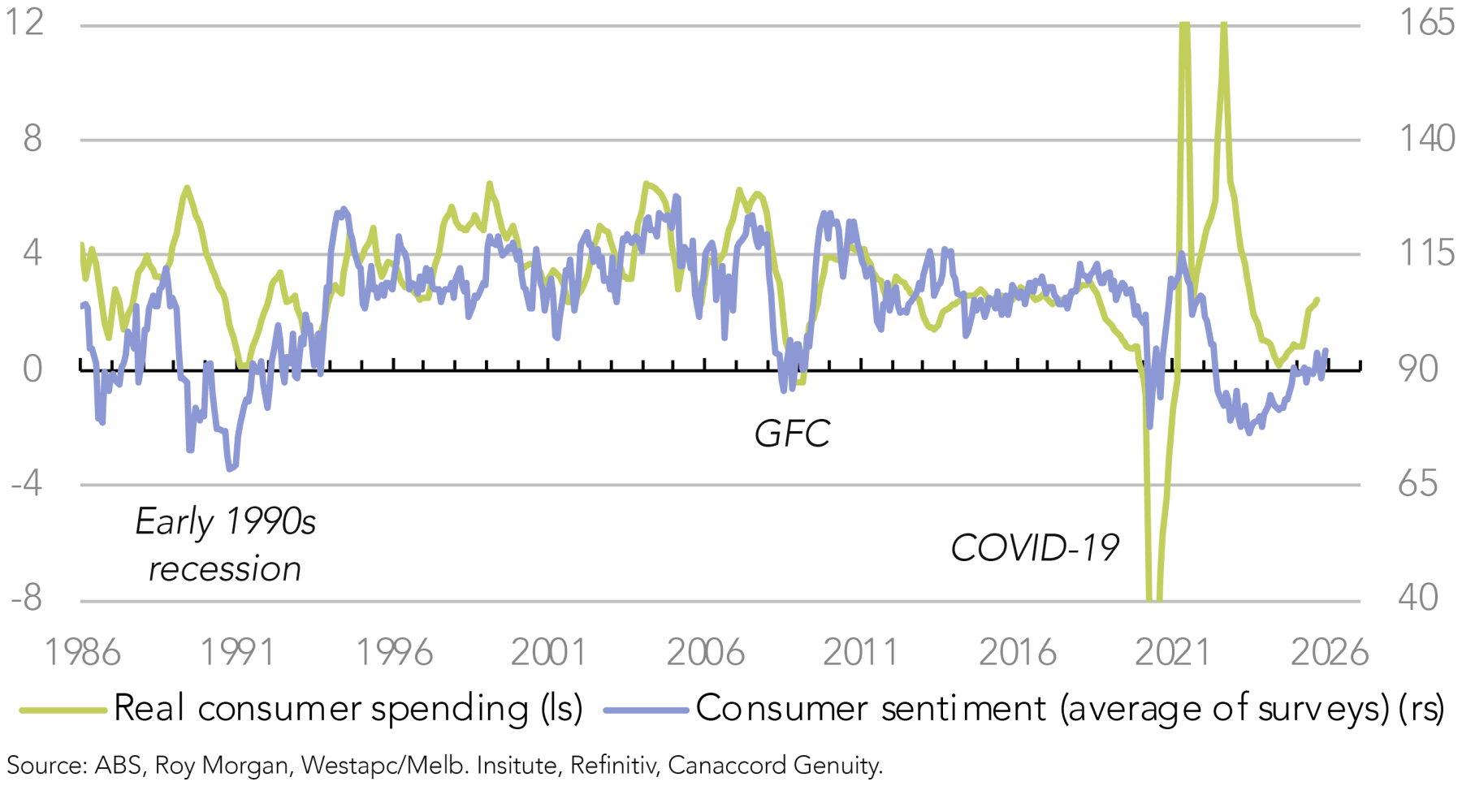

- Domestically, markets have now priced in a significant change in the direction of rates, and the RBA may not need to go beyond that. After the past week’s meeting, the Governor indicated the board is assessing how much of a persistent rise in inflation may have occurred and how restrictive policy may or may not be. On the indications so far, including underlying inflation only at or slightly above the target range, any adjustment in rates might not need to exceed the half a percent rise markets have factored in. Consumers may also be sensitive to the change in outlook for rates, from cuts to hikes, given cost of living pressures, and a stronger AUD could also contribute. Thus, after what’s been priced in, further headwinds to domestic markets could be less, and continued gains in the US could remain a positive backdrop.

Getting Back On Track

The past week’s Fed meeting had the added interest of offering an official view of the US economy after a couple of months of little government data and difficulties judging conditions. The assessment provided turned out to be more positive than expected and projected both a significant easing in inflation and pickup in growth in 2026. It suggested the US economy would emerge from a challenging year of major policy changes in 2025, particularly in relation to trade and immigration, on track for sustainably stronger growth again in 2026.

The median projections of the policy setting committee members anticipated the Fed’s preferred measure of inflation, based on the PCE price index, easing from 2.9% at the end of this year to 2.4% by end next year, and GDP growth picking up from 1.7% this year to 2.3% next year. These favourable projections were founded on, in the case of inflation, continued decline in inflation in services, and a peaking and decline in inflation in goods, the latter as the effects of higher tariffs passed; and in the case of GDP growth, on sustained consumer spending, continued business investment in AI, and fiscal stimulus from the recent federal budget.

Part of the more subdued growth this year and pick up next year was attributed to the disruption of the government shutdown, causing a reduction in growth this quarter and bounce back next quarter. Abstracting from this, GDP growth would have been projected to be 1.9% this year and 2.1% next year, less of an underlying pickup but still one nonetheless.

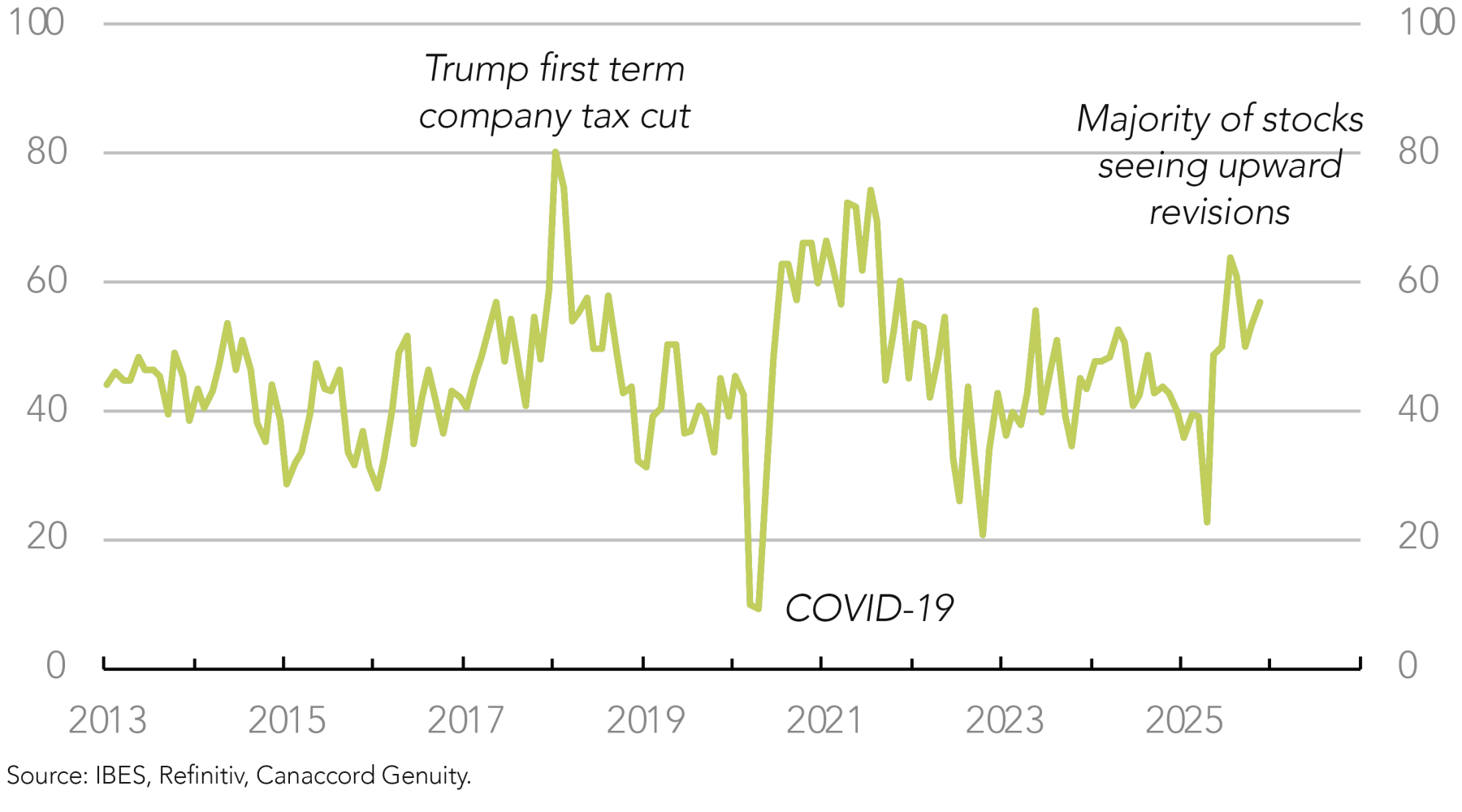

Based on available data, the Fed considered that growth had remained moderate over recent months, though positive corporate earnings guidance and upgrades to earnings forecasts by analysts indicate business conditions have been favourable and the Fed’s economic projections suggest that continuing next year (Figure 2).

Moving A Little Off Course

The RBA meeting also provided an official view on the domestic economy, after the first comprehensive monthly figures for inflation in October and the recent GDP figures for the September quarter. The assessment was a bit more hawkish than after the prior board meeting, reiterating that both temporary and persistent factors could be contributing to the rise in underlying inflation, but noting the risk of signs of a broad-based pickup. The GDP growth of around 2% over the past year was in line with the RBA’s forecasts and close to potential growth, but the pickup in private demand growth to 3% had been stronger than expected.

The board had been left of the view that the risks to the outlook had tilted to the upside, having been judged more to the downside at mid-year, partly due to global developments at the time. And so, while wanting more information to assess how much of a persistent rise in inflation had occurred and how restrictive or not policy is, the Board discussed conditions that might warrant a rate hike next year; and the Governor interpreted the market’s swing from pricing a further half of a percent of cuts only two months ago to half a percent of hikes now, as trying to judge the RBA’s potential reaction to developments, without wanting to comment on the scale of adjustment.

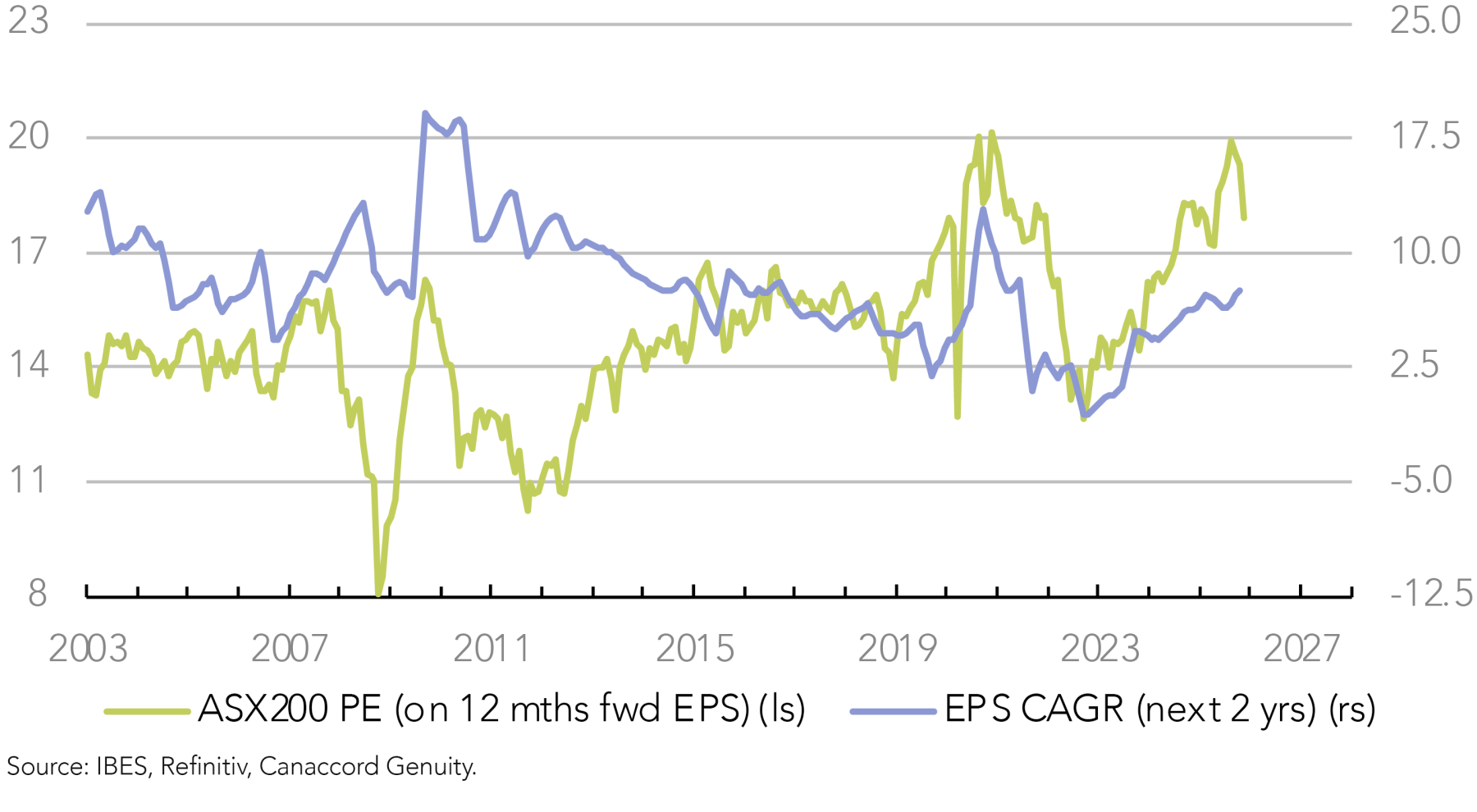

However, on the indications so far, including underlying inflation only at or slightly above the target range and policy appearing little if at all easier than neutral, and with consumers likely sensitive to the change in rate expectations given cost of living pressures, as reflected in still relatively low consumer sentiment, any policy tightening by the RBA might not go beyond that now priced into markets (Figure 3). This might limit further market weakness, as a significant change in rate expectations seems to have been absorbed in the equity market’s recent de-rating, particularly given earnings growth forecasts have still been rising (Figures 4 and 5); and gains in the US market could still provide a positive backdrop in the coming year.

Written by

Tony Brennan, Chief Investment Strategist

Tony Brennan is Canaccord Australia's Co-CIO, and brings over three decades of investment strategy experience from global investment banks including Citi, Deutsche, and Merrill Lynch in Australia, and UBS in New York, London and Sydney.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.