Last week we discussed the prospect of a likely US Federal Reserve rate cut at this week’s December 9th/10th meeting.

Market confidence in a Fed cut has continued to firm over the past week with pricing sitting at 89% probability at the time of writing (5 December).

While there are no absolute certainties in central bank crystal ball gazing, it would appear a cut from the Fed is highly likely. Incremental evidence of ongoing labour market softness, a relatively modest inflation uplift from tariffs, alongside some relatively dovish comments from key Fed board members are adding to market confidence that the Fed is set to cut.

As discussed last week, this should continue to be supportive for the US, Rest-of-World, and Australian stock markets. This is particularly the case if the market’s current expectation for two to three more Fed rate cuts next year holds over coming months.

Looking at the empirical relationship between Fed easing cycles and equity market performance shows the US equity market has had a strong tendency to rise when backed by the supportive combination of Fed easing and an economic soft landing.

Indeed, we find no instances (since 1980) of poor US market performance when the Fed is in easing mode, and the US economy achieves a “soft landing”. This keeps us constructive on US equities despite full valuations and lingering concerns around the AI capex boom.

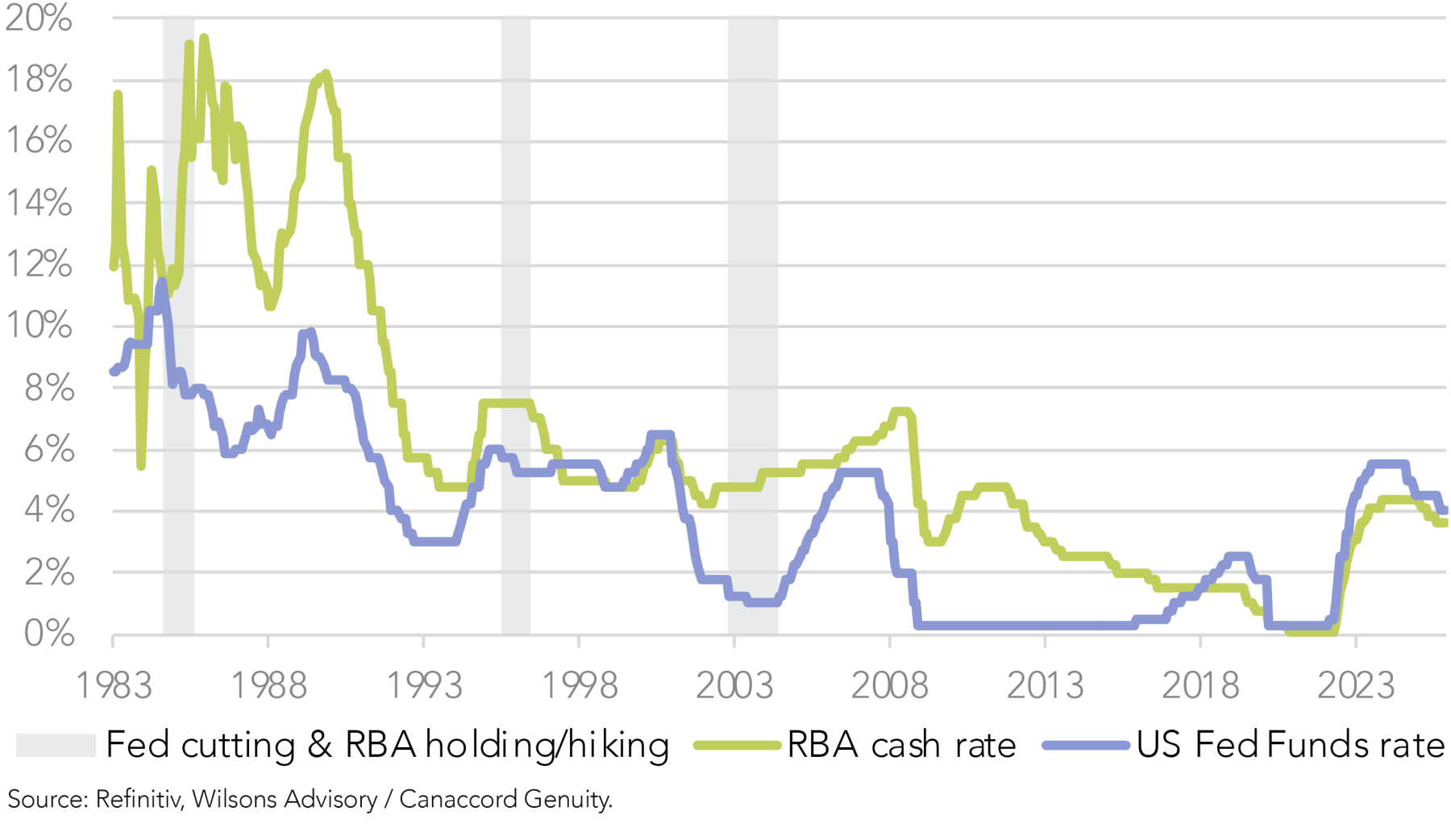

It is interesting that Australian equities also tend to trend higher when the Fed is easing and the US economy continues to grow. This appears to hold regardless of whether the RBA is easing in sync with the Fed or not.

This is comforting in the face of rising uncertainty as to whether the RBA's next move in domestic rates in 2026 is actually up rather than down. At the time of writing the market has fully priced an RBA hike in the back end of 2026. This is in contrast to the market pricing for two cuts in 2026 a little over six weeks ago.

| Market Return after 1st Fed Rate Cut | |||||

| S&P500 1y Return | S&P500 2y Return | ASX200 1y Return | ASX200 2y Return | Hard or Soft Landing? | |

| 1981 | -14% | 30% | -28% | -14% | HARD |

| 1984 | 15% | 52% | 29% | 64% | SOFT |

| 1989 | 3% | 21% | -6% | -1% | HARD |

| 1995 | 22% | 63% | 11% | 36% | SOFT |

| 1998 | 34% | 53% | 22% | 34% | SOFT |

| 2000 | -14% | -33% | 4% | -6% | HARD |

| 2007 | -14% | -32% | -21% | -28% | HARD |

| 2019 | 13% | 55% | -12% | 13% | SOFT* |

| 2024 | 10% | ? | 7% | ? | ? |

Source: Refinitiv, Wilsons Advisory / Canaccord Genuity.

| Market Return when Fed Cutting & RBA holding | ||||

| ASX200 1y Return | ASX200 2y Return | S&P500 1y Return | S&P500 2y Return | |

| 1984-1985 | 29% | 64% | 15% | 52% |

| 1995-1996 | 11% | 36% | 22% | 63% |

| 2002-2003 | 7% | 28% | 13% | 25% |

Source: Refinitiv, Wilsons Advisory / Canaccord Genuity.

Could It Be Different This Time?

We believe the chance of the Fed disappointing the market this week is relatively low. However, given the divided nature of Fed board member policy views there is still some residual risk around this scenario. Perhaps more of a risk is that the market’s pricing for two or three cuts in 2026 doesn’t come to fruition. Our base case remains for some additional Fed easing in 2026 given President Trump’s “captain’s pick” is due to take the reins when Chair Powell’s term expires in May 2026. In the absence of a significant re-acceleration in growth and/or inflation the markets pricing for a marginally dovish Fed is a supportive central case for 2026.

Hard Landing Risk in 2026?

The risk of a hard landing for the US economy is always worth considering on a 12-month view, however in aggregate the US economy continues to show resilience, despite some soft patches.

With the economy not under any great duress, the Fed in easing mode and with plenty of rate cut headroom (the US cash rate is 3.875%) we see the risk of a hard landing in 2026 as relatively low.

It would probably take an exogenous shock, such as a major dislocation in credit markets, or a sharp and sudden reversal in the AI capex boom to usher in a 2026 recession. As always, we remain vigilant around any cracks in our resilient US economy thesis, but at this stage we don’t see US recession risk as particularly elevated.

US Bond Market Calm Before a Storm?

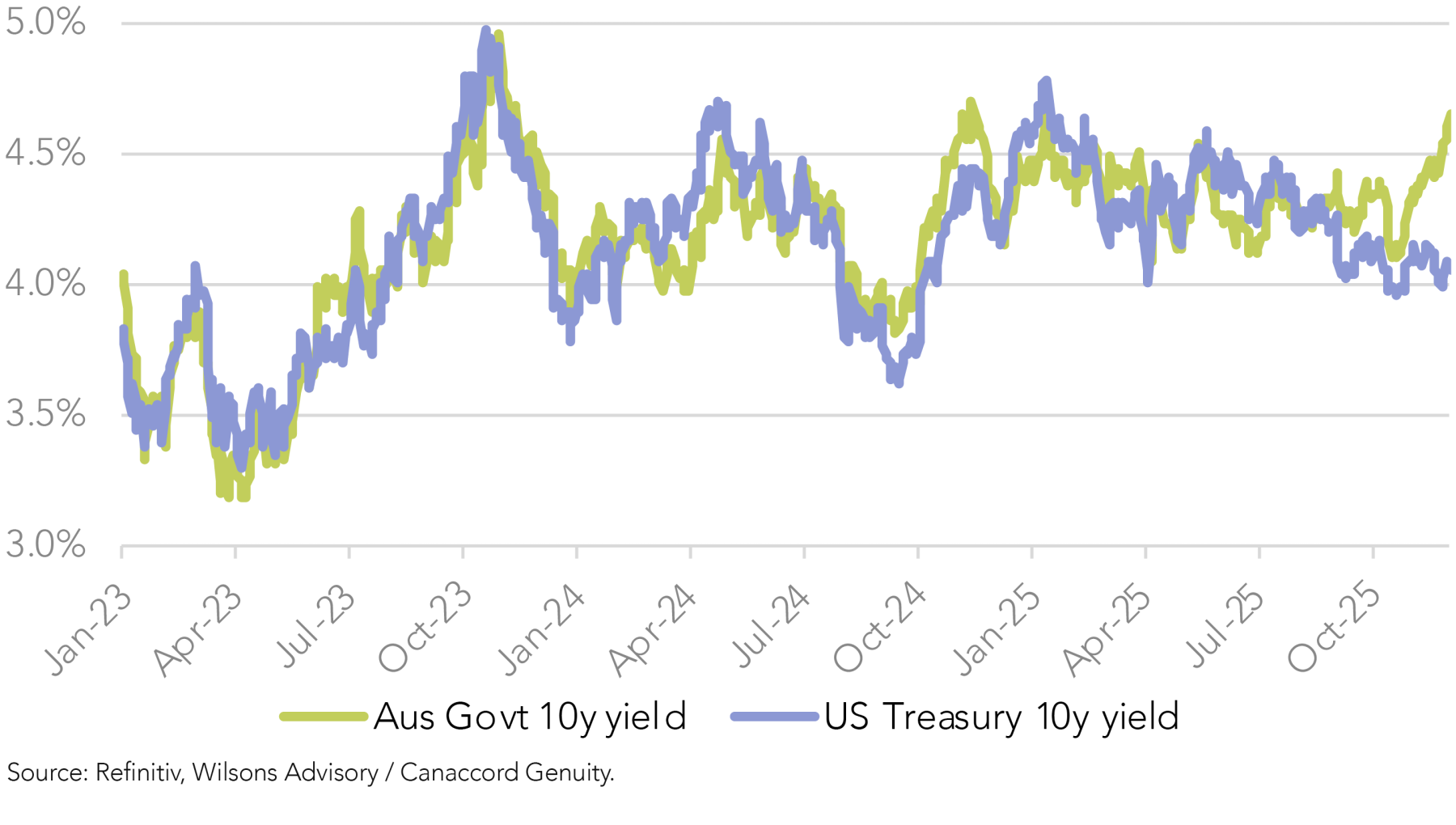

An interesting feature of 2025 has been that the US bond market has been quite well behaved despite a persistent wall of worry stemming from the triple threat of US inflation, the sustainability of the fiscal deficit and the sustainability of foreign demand for US treasuries.

US ten-year yields started 2025 at 4.6% and have rallied to 4.1%, producing solid total returns for US bond investors this year. In-line with our thesis, Fed rate cuts in 2025 combined with continued expectations for more in 2026 have kept the US bond market in check despite the above-mentioned fears.

Our base case for 2026 is that the US bond market once again hangs together but tail risks in respect of US bonds are arguably edging up again as a new (dovish) Fed chair combined with some likely fiscal pump priming into the US (November) mid-terms risks pressuring the long end of the US yield curve. Once again, the chance of a disorderly US bond market is a risk case, but not our base case. However, we can’t rule out bond market jitters developing as we head toward the US mid-terms.

Australia Similar but Different

In contrast to the falling US bond yield trend this year, Australian bond yields have pushed moderately higher in 2025. While they are not materially above their January starting point, they are up decisively from the lows of just six weeks ago. Inflation has been the big surprise for the Australian economy in recent months. This has caused expectations for the cash rate to move from two cuts in 2026 to the market now pricing for a likely hike. This swing in rate expectations played a part in the recent 7% correction in the Australian equity market however renewed expectations for lower US interest rates have helped the local market edge up from its recent lows.

Conclusion. Don’t Fight the Fed

In summary the prospect of more Fed easing is supportive for US, global and domestic equities. More Fed easing versus an on-hold RBA with risks of a hike later in 2026 suggests scope for more outperformance for US/global equities over the local market, however potential for A$ strength is a consideration for relative position sizing as well as some partial hedging of foreign equity portfolios.

Written by

David Cassidy, Head of Investment Strategy

David is one of Australia’s leading investment strategists.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.