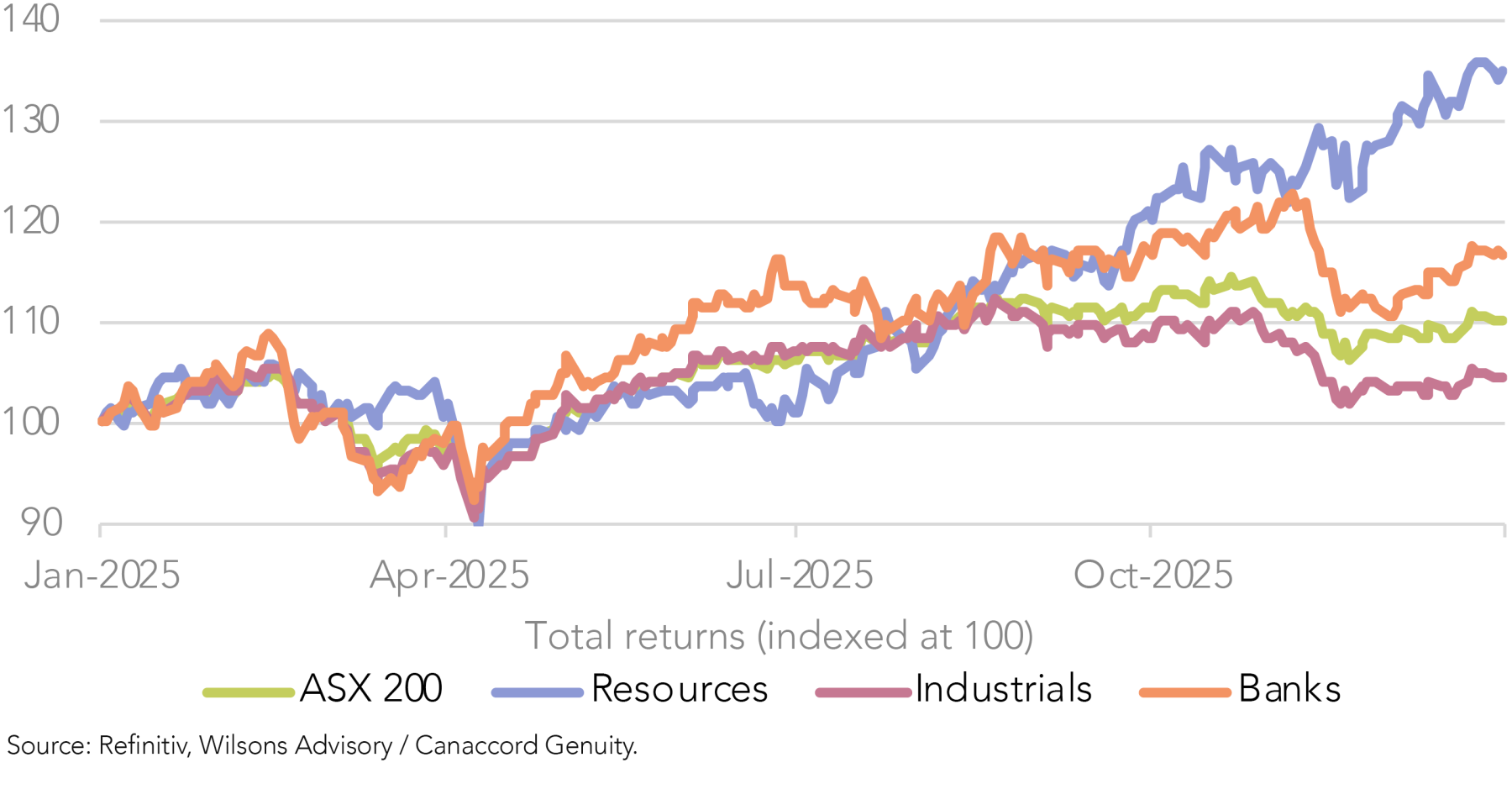

The ASX 200 delivered a solid total return of 10% in 2025, with the strongest contributor being the Materials sector (+36%), as sentiment towards the commodity complex improved in the second half of the year.

The biggest contributor to the strength of the Materials sector was the Gold miners, as the precious metal surged +65% during the year amidst a prevalence of macro and geopolitical risks. There was also impressive strength among miners exposed to base metals, such as Copper and Aluminium, driven by tightening supply/demand dynamics, as well as critical minerals such as Rare Earths and Lithium, as their prices staged a recovery from their respective slumps.

Other sectors that outperformed included Industrials (GICS) (+14%), Utilities (+13%) and Financials (+12%). Notably, within Financials, after demonstrating market leadership throughout 2024 and for much of 2025, the Bank sector began to give back its outperformance towards the end of the year. This was driven by the partial unwinding of CommBank’s extreme valuation premium as the bank failed to deliver against high market expectations of continuing earnings upgrades.

The only two sectors that finished 2025 ‘in the red’ were Healthcare (-24%) and IT (-21%). The Healthcare sector’s weakness was led by the underperformance of index heavyweight CSL following successive downgrades. The IT sector de-rated as domestic bond yields surged, disproportionately impacting high P/E growth stocks. The sector was also weighed down by AI-related disruption fears (explored below), as well as a number of stock-specific factors, including scrutiny over large-scale offshore M&A, governance and legal issues, and mixed delivery against consensus expectations.

Key Views for 2026

The outlook for ASX 200 returns in 2026 is somewhat constrained by the risk of RBA rate hikes, as well as still-elevated valuations, with the index trading on a forward P/E of 18.2x – ~1 standard deviation above its five-year average.

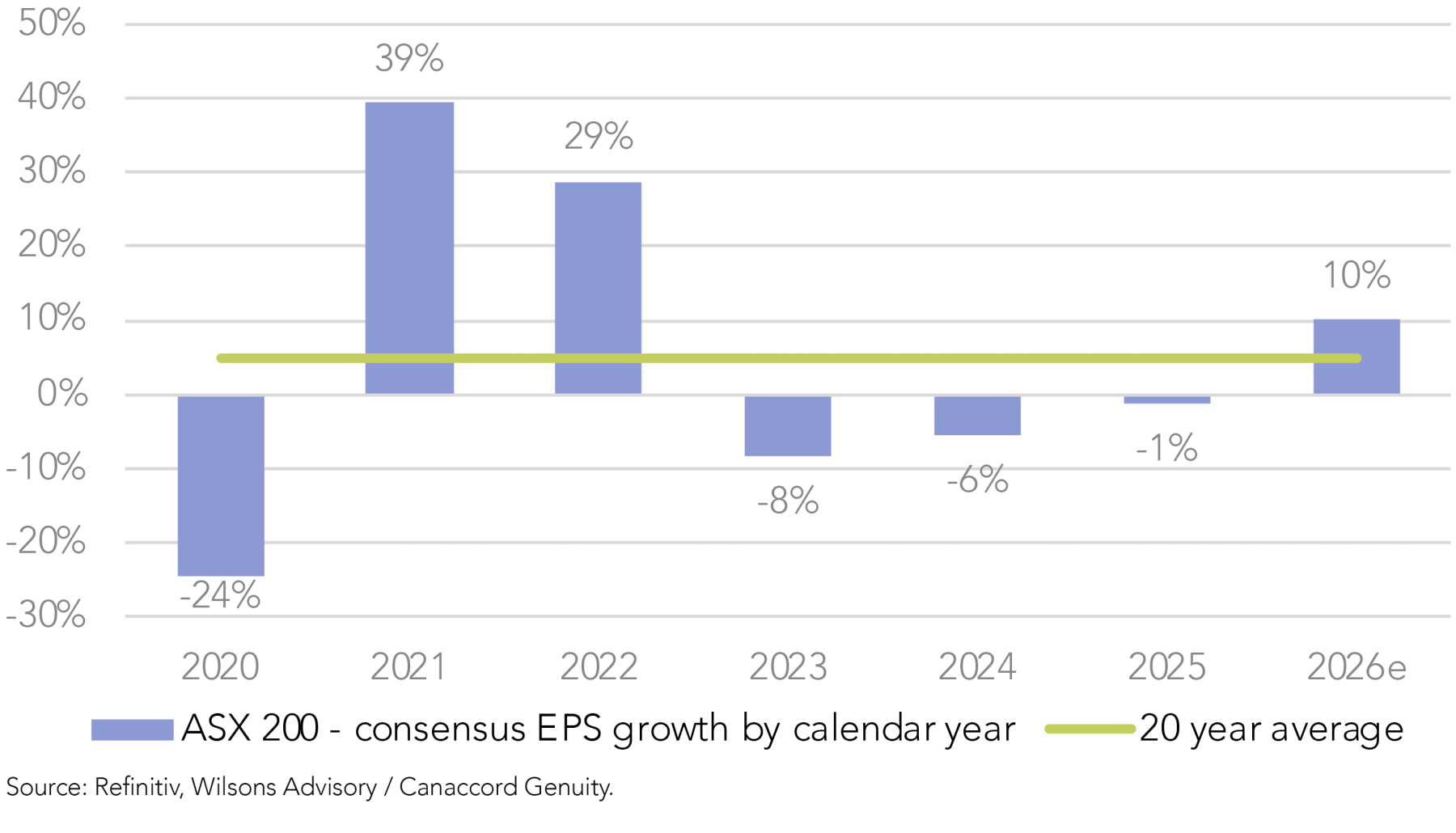

That said, the market now offers a relatively supportive earnings growth backdrop, with consensus pointing to 10% EPS growth for the calendar year, which would represent the strongest rate of earnings growth in four years.

While EPS growth estimates are typically revised lower by analysts as the year progresses, we see scope for 2026 to buck this trend, supported by a continued Resources-led earnings upgrade cycle.

Against this backdrop, some of our key views for 2026 explored in this report include:

- Remain Overweight Resources

- Stay Underweight Banks

- Retain Exposure to ‘AI Winners’

- Remain Underweight Retail and Overweight Supermarkets

Resources Revival

Remain overweight resources

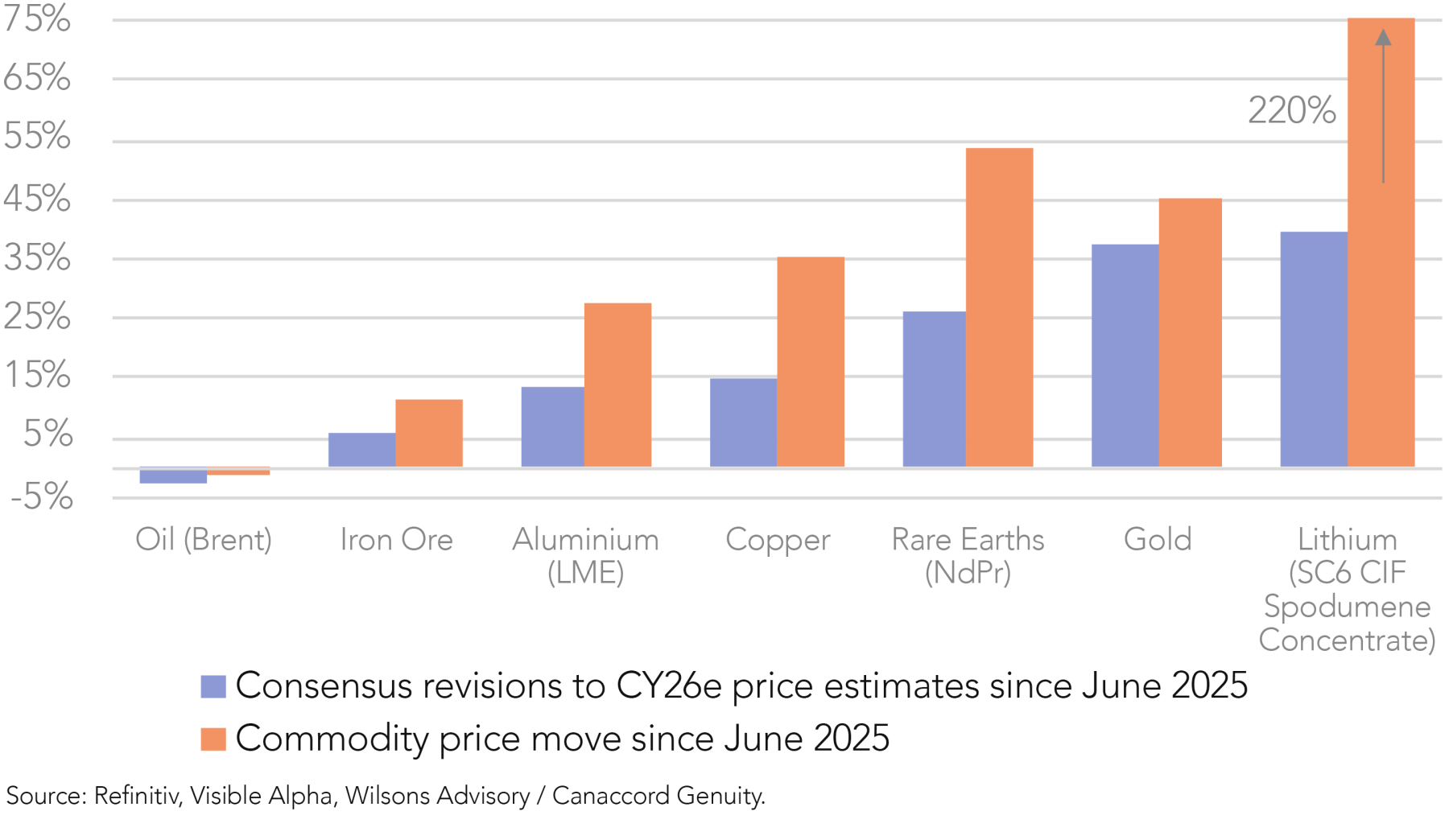

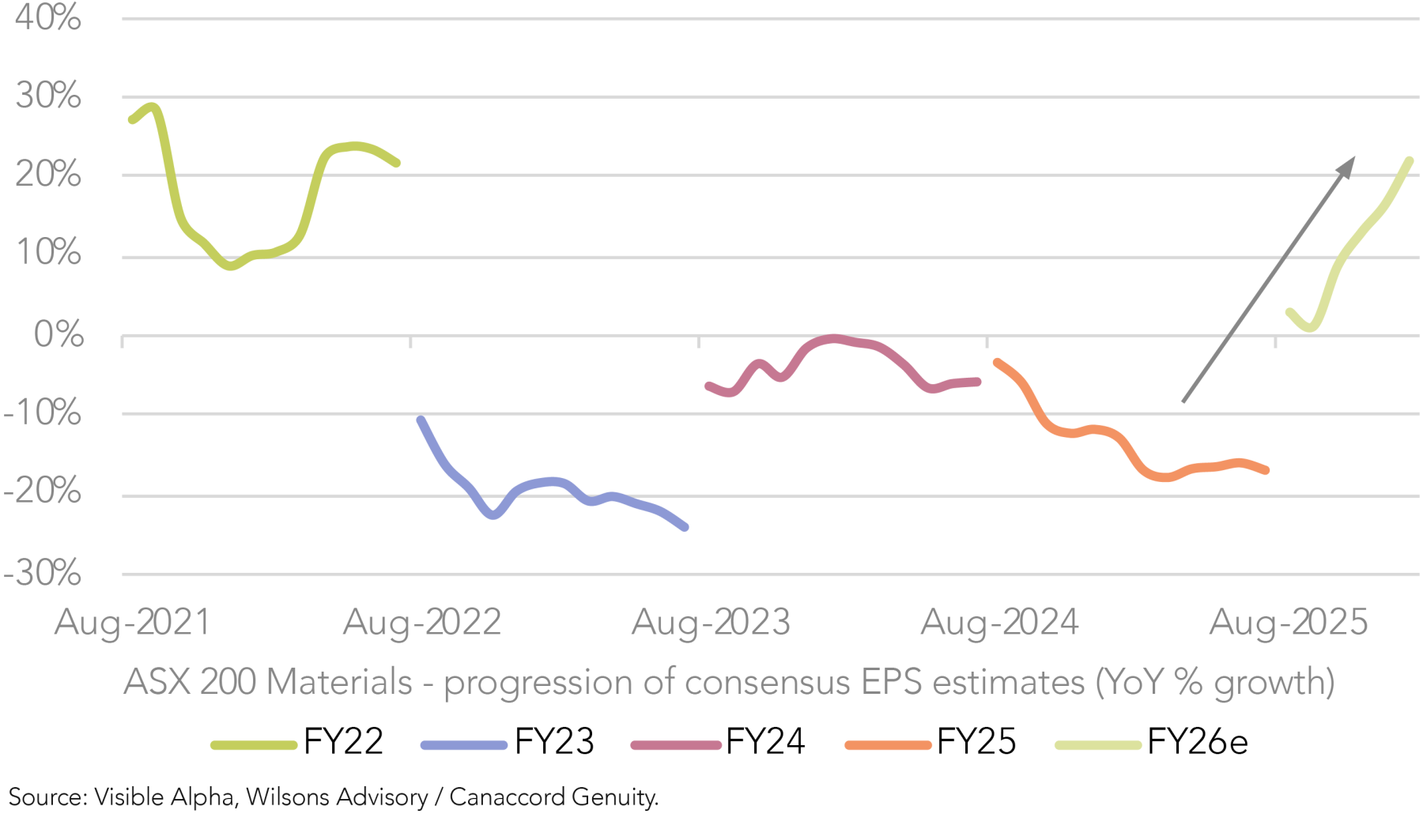

After a multi-year downturn, market sentiment towards the Resources sector has improved materially over the past six months, underpinned by broad-based strength in commodity prices (and forward price expectations), which has resulted in significant consensus earnings momentum. We see scope for a continued metal pricing upgrade cycle and a sustained rotation into the Resources sector in 2026, supported by several key factors:

- Healthy global growth pulse – while macro and geopolitical risks persist, generally positive ‘big picture’ macro trends support expectations of moderate global economic growth and further interest rate cuts from major central banks, including the US Federal Reserve, in 2026. This backdrop is broadly constructive for the commodity demand outlook.

- Weakening USD – we expect the USD to depreciate relative to the AUD over the course of 2026, driven by a widening US-AU interest rate differential, alongside structural concerns over the US government’s fiscal position. This environment should provide a tailwind to commodity prices and, by extension, the Resources sector, which has historically exhibited a strong correlation with the AUD.

- Structural demand tailwinds – a confluence of major thematics – including the energy transition, re-armament, supply chain onshoring, and AI – are driving an uplift in demand for a range of ‘future facing’ metals and minerals.

- Supply tightness – several key commodities – including Copper, Aluminium and Lithium – face increasingly tight supply/demand balances in 2026, which should provide support to underlying commodity prices. That said, other commodities – including Oil, Iron Ore and Nickel – face the prospect of a persistent oversupply, suggesting a likely divergence within the commodity complex.

- Strong precious metals demand – we expect Gold and Silver prices to remain supported by safe-haven buying amidst ongoing geopolitical risks, ongoing concerns over US fiscal sustainability, continued structural growth in central bank purchases, and the prospect of US interest rate cuts.

- Consensus upgrade momentum – following the recent broad-based rally in commodity prices, consensus price assumptions for several commodities now appear ‘stale’, sitting below current spot levels. This leaves scope for a continuation of the current earnings upgrade cycle in 2026, as analysts update their forward price assumptions.

Consequently, we remain positive towards the Resources sector and continue to advocate for an overweight exposure. Among the major commodities, our preferred exposures across base metals include Copper (SFR, CSC) and Aluminium (AAI), which are both entering supply deficits. Within precious metals, we remain positive towards Gold (EVN, NST). Meanwhile, we remain cautious towards Iron Ore given expectations of widening oversupply in 2026, however, we see value in BHP as the lowest cost producer with significant copper exposure, noting at spot prices BHP would generate more EBITDA from Copper than Iron Ore in FY26e.

Read Resources Revival

Bank Run

Remain underweight banks

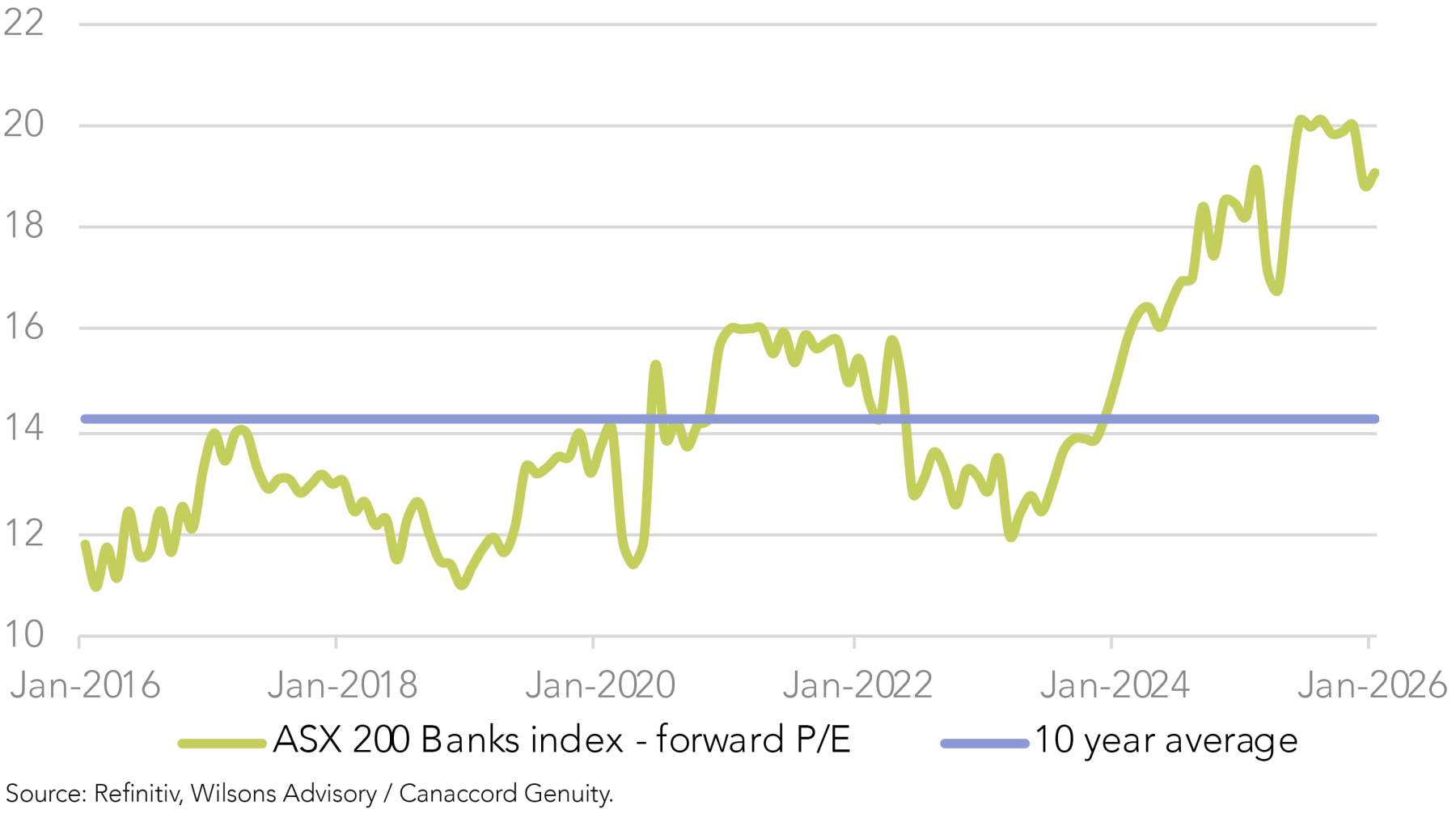

Bank sector fundamentals are likely to remain sound in 2026, with solid credit growth, robust capital buffers and benign bad debt trends. The prospect of higher interest rates could provide a modest tailwind to bank NIMs and, by extension, earnings, while a higher AUD is also typically supportive of the sector. However, valuations remain prohibitively expensive for a sector offering below market, low- to mid-single-digit consensus EPS growth.

On top of this, with sentiment towards the Resources sector improving rapidly (as explored above), we expect investor interest in the Banks to fade. Last year, the sector benefited from a ‘flight to safety’ as investors avoided Resources amidst weakness in the commodity complex and sought out ‘ex-China’ large cap exposures on the ASX. However, with Resources now back in favour, that flow-driven tailwind is likely to fade over 2026.

Accordingly, we continue to advocate an underweight portfolio exposure to the sector. We expect CommBank’s market leadership to erode over 2026: its consensus upgrade cycle appears complete, its valuation premium remains substantial (trading on a forward P/E of 25x, well above its 10-year average of 18x and the peer average of 17x), growth prospects remain unappealing, and key peers – ANZ and Westpac – appear to be entering their own upgrade cycles.

Our preferred exposures are ANZ and Westpac, which both have reasonable valuation support, benefit from sector-leading capital positions, and offer the most consensus earnings upside from internal ‘self-help’ initiatives such as technology upgrades, process simplification, and cost-out programs.

GenAI Tailwinds to Continue

Retain exposure to ‘AI Winners’

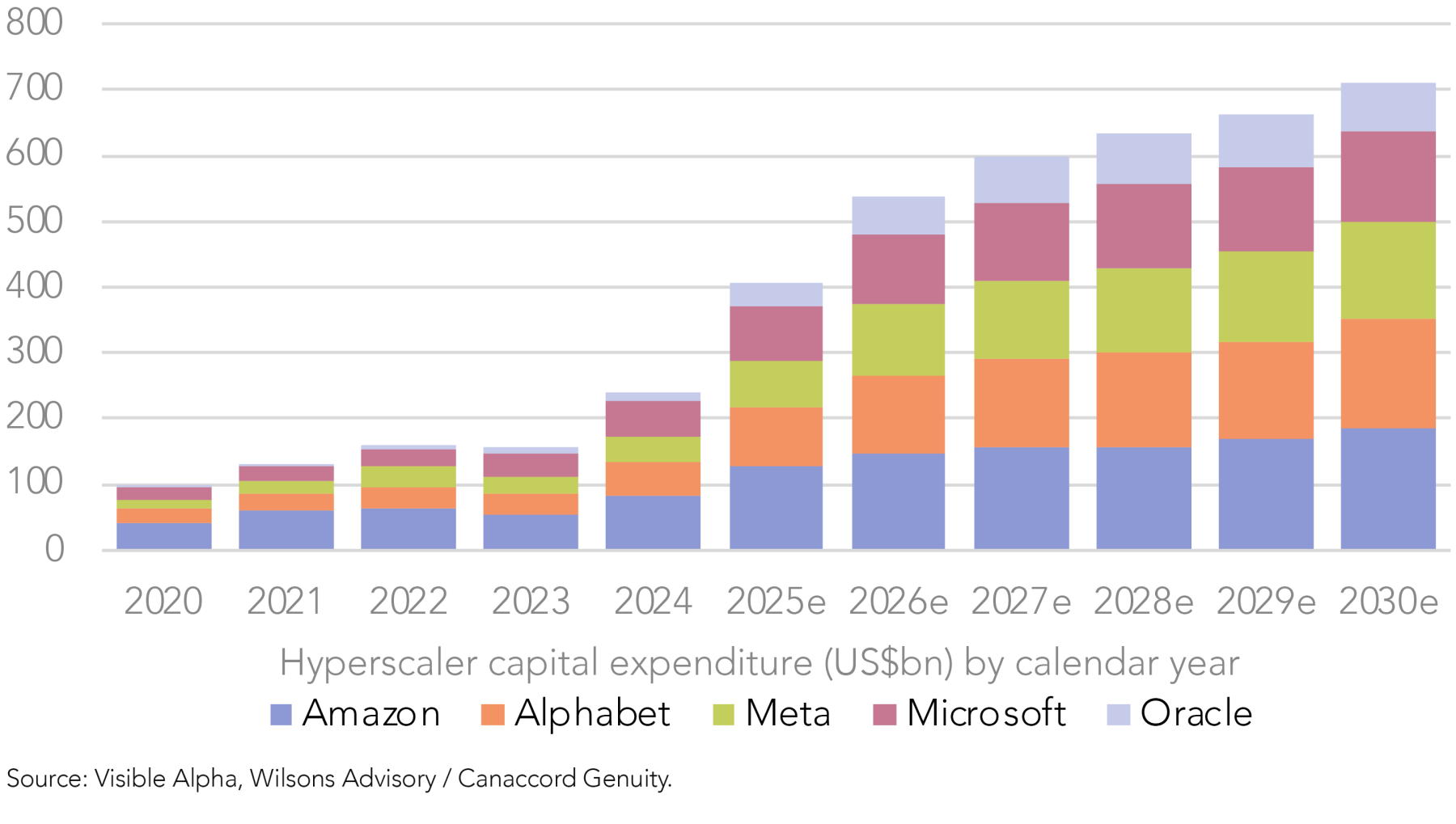

The Generative AI (GenAI) CAPEX supercycle remains an incredibly strong and important market theme in 2026.

Broadly, we see the AI revolution as a genuine megatrend that is closer to early than late cycle and is supported by continued upgrades in Hyperscaler CAPEX forecasts. That said, we acknowledge the risk of some ‘AI impatience,’ as investors scrutinise the return on capital from the acceleration in Big Tech AI CAPEX in recent years.

This thematic has produced a number of ‘AI winners’ and perceived ‘AI losers’ on the ASX. The first wave of AI winners comprises the ‘picks and shovels’ businesses that provide the digital infrastructure required for AI deployment, and are therefore directly leveraged to the ongoing investment cycle. Most notably this group includes data centre owners/developers such as NextDC and Goodman Group.

The next wave of AI winners is likely to emerge through the adoption and implementation of AI within companies’ operations to improve productivity, alongside the embedding of AI into product suites to enhance functionality, strengthen customer value propositions and expand addressable markets. On the ASX, this opportunity is most evident among the major software providers.

TechnologyOne recently launched its maiden agentic-AI product, ‘Plus’, a virtual assistant for its local council, state government and higher-education customers. Management expects Plus to contribute to earnings from FY26e, with 10–15% take-up in year one and 75% by year four, underpinning a >$70m incremental ARR opportunity by 1H30e and supporting sustained >115% net revenue retention.

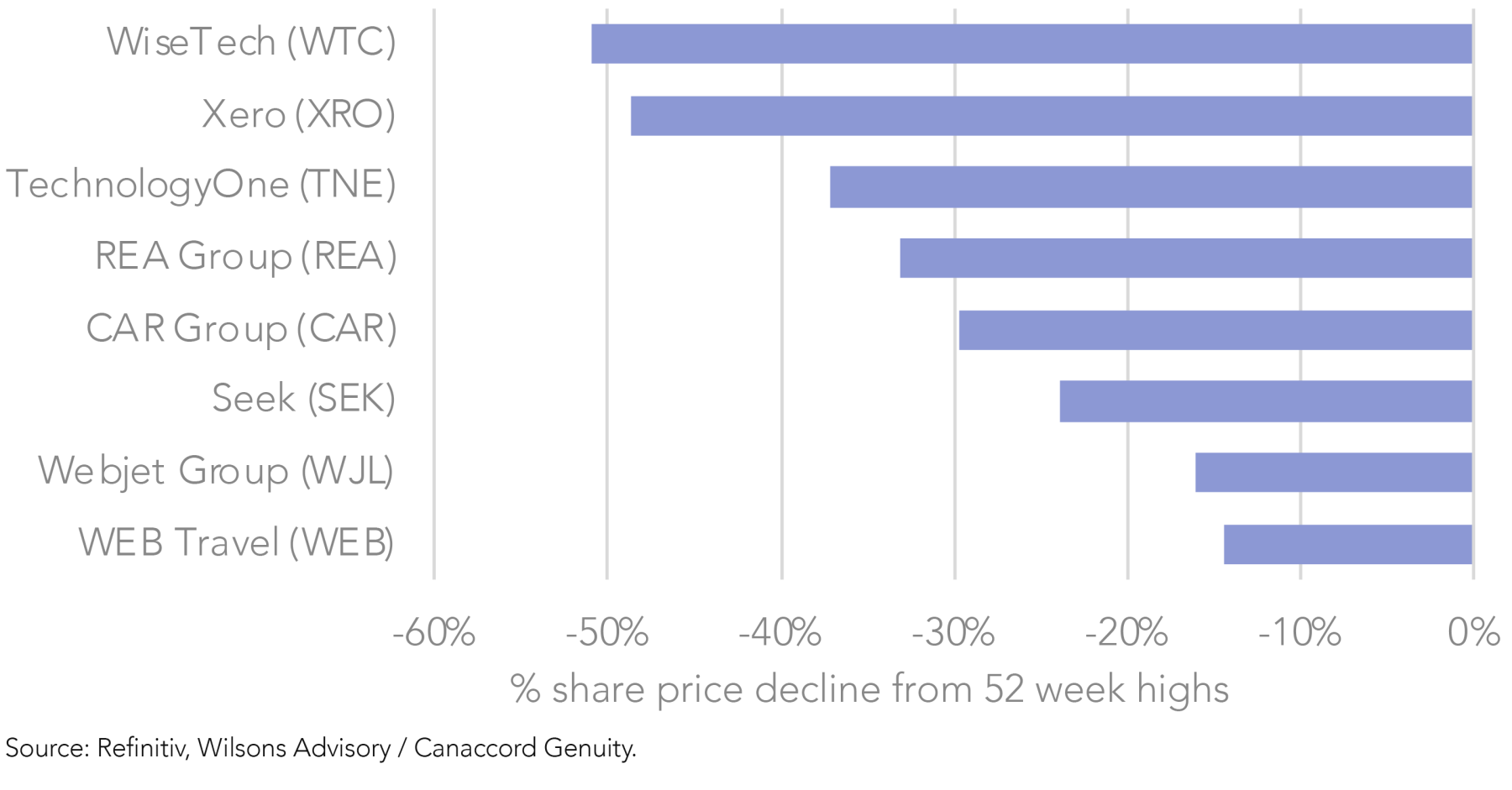

Attractive buying opportunities among perceived ‘AI losers’

Paradoxically, some market participants have (unfairly, in our view) grouped the major software businesses – as well as the major online classifieds (e.g., CAR Group, REA Group) – as potential ‘AI losers’. This reflects concerns that the democratisation of AI has lowered barriers to entry, increasing the threat of new entrants and calling into question the durability of competitive moats.

While AI disruption risks warrant monitoring, they have also spun up attractive buying opportunities in the broader tech sector in our view, with a number of high-quality growth businesses now appearing materially oversold. For instance, Xero has now fallen ~50% since mid-2025 amidst AI-related fears, alongside scrutiny around recent M&A and the valuation impact of rising bond yields.

However, the business itself remains in strong shape. Xero holds a dominant domestic market position among SMEs, with robust user growth, a sticky customer base, and pricing power that provides scope to further monetise its products over time. Like TechnologyOne, we view Xero as an AI winner, not a loser, and believe it is well positioned to leverage AI through new tools built on its rich data set, such as its AI assistant, JAX (‘Just Ask Xero’. Over time, JAX and other AI tools should help improve Xero's value proposition, drive higher ARPU and expand its market reach.

Consumer Rotation – Policy Risks Favour Staples over Retail

Remain underweight retailers, overweight supermarkets

The domestic monetary policy outlook presents an incrementally more challenging environment for the Cyclical Retail sector in 2026. The market is now fully pricing a rate hike this year (most likely between May and August), which represents a material shift from September 2025, when two to three additional rate cuts were still priced.

While an ‘on-hold’ RBA remains a plausible outcome for 2026, the balance of risks over the next six months appears skewed towards a rate rise rather than a cut. This environment presents risks to retailer earnings and valuations, with our analysis showing that the sector typically underperforms in the lead-up to rate hikes as the market anticipates softer macro conditions for consumers.

Importantly, the market tends to price changes in the monetary policy outlook well in advance. For instance, the Retail sector started to re-rate sharply in early 2023, more than 12 months ahead of the first cut in the most recent RBA easing cycle. This highlights the importance of positioning ahead of material shifts in forward rate expectations.

Read An ASX Road Map for the RBA’s Path Ahead

Accordingly, we remain cautious on the Retail sector, particularly given still full valuations in high-quality large cap exposures (notwithstanding the recent sell-off) and limited apparent consensus upgrade potential.

In contrast, Consumer Staples appear well positioned in the current environment. Unlike the broader Retail sector, the Supermarket sector has outperformed ahead of the past three RBA hiking cycles as capital typically rotates into more defensive exposures in anticipation of a tougher consumer backdrop.

Moreover, supermarket valuations are compelling on a relative basis despite offering similar medium-term (low teens) consensus EPS growth and a greater degree of resilience against interest rate hikes. Together, these factors underpin an attractive risk/reward for Consumer Staples in 2026 in our view.

Accordingly, we remain broadly positive towards the supermarkets, with a slight preference towards Woolworths over Coles on early signs of improvements in its operational performance, as well as valuation grounds – with the stock trading at a relative P/E of 1.08x compared to Coles, versus its historical average of 1.15x.

Written by

Greg Burke, Equity Strategist

Greg is an Equity Strategist in the Investment Strategy team at Wilsons Advisory. He is the lead portfolio manager of the Wilsons Advisory Australian Equity Focus Portfolio and is responsible for the ongoing management of the Global Equity Opportunities List.

About Wilsons Advisory: Wilsons Advisory is a financial advisory firm focused on delivering strategic and investment advice for people with ambition – whether they be a private investor, corporate, fund manager or global institution. Its client-first, whole of firm approach allows Wilsons Advisory to partner with clients for the long-term and provide the wide range of financial and advisory services they may require throughout their financial future. Wilsons Advisory is staff-owned and has offices across Australia.

Disclaimer: This communication has been prepared by Wilsons Advisory and Stockbroking Limited (ACN 010 529 665; AFSL 238375) and/or Wilsons Corporate Finance Limited (ACN 057 547 323; AFSL 238383) (collectively “Wilsons Advisory”). It is being supplied to you solely for your information and no action should be taken on the basis of or in reliance on this communication. To the extent that any information prepared by Wilsons Advisory contains a financial product advice, it is general advice only and has been prepared by Wilsons Advisory without reference to your objectives, financial situation or needs. You should consider the appropriateness of the advice in light of your own objectives, financial situation and needs before following or relying on the advice. You should also obtain a copy of, and consider, any relevant disclosure document before making any decision to acquire or dispose of a financial product. Wilsons Advisory's Financial Services Guide is available at wilsonsadvisory.com.au/disclosures.

All investments carry risk. Different investment strategies can carry different levels of risk, depending on the assets that make up that strategy. The value of investments and the level of returns will vary. Future returns may differ from past returns and past performance is not a reliable guide to future performance. On that basis, any advice should not be relied on to make any investment decisions without first consulting with your financial adviser. If you do not currently have an adviser, please contact us and we would be happy to connect you with a Wilsons Advisory representative.

To the extent that any specific documents or products are referred to, please also ensure that you obtain the relevant disclosure documents such as Product Disclosure Statement(s), Prospectus(es) and Investment Program(s) before considering any related investments.

Wilsons Advisory and their associates may have received and may continue to receive fees from any company or companies referred to in this communication (the “Companies”) in relation to corporate advisory, underwriting or other professional investment services. Please see relevant Wilsons Advisory disclosures at www.wilsonsadvisory.com.au/disclosures.